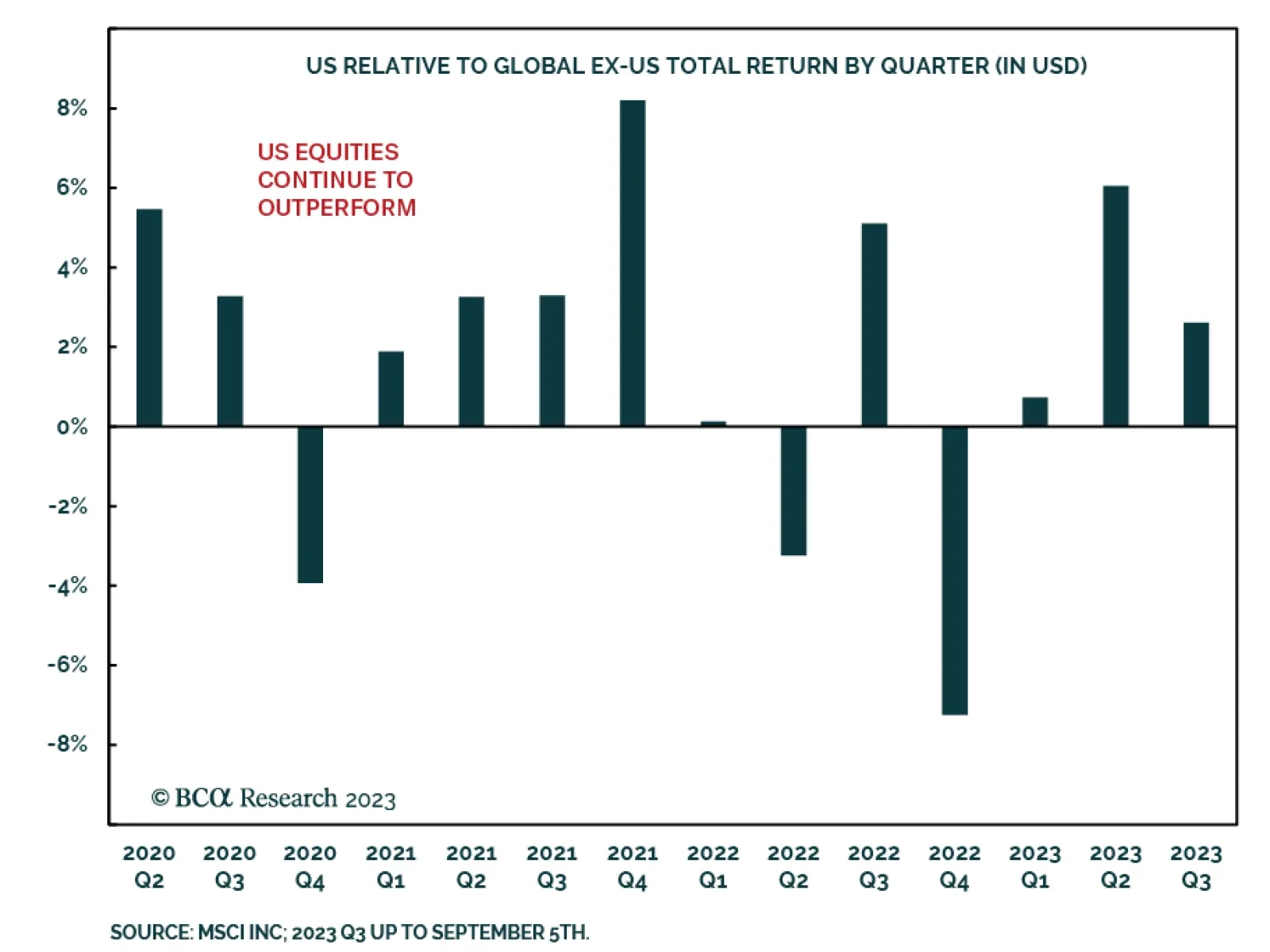

Strategists arguing for an end of the outperformance of US equities over international stocks have pointed to the lofty valuations of American stocks vis-à-vis their global counterparts. Moreover, they have highlighted…

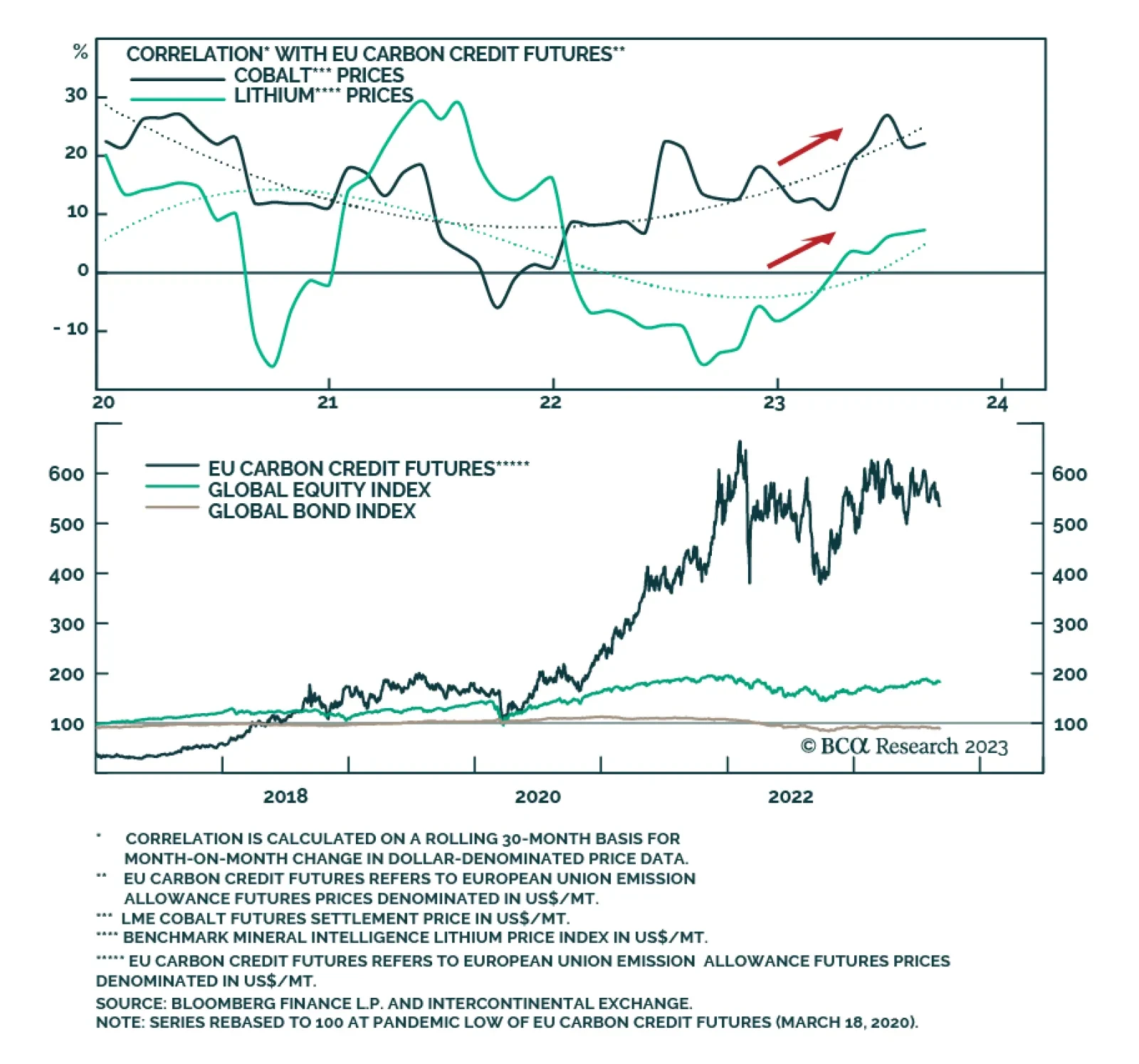

According to BCA Research’s Global Investment Strategy service, the structural bull case for carbon credits remains compelling. However, tactical investors should brace for prices to plateau or even correct over the next 12…

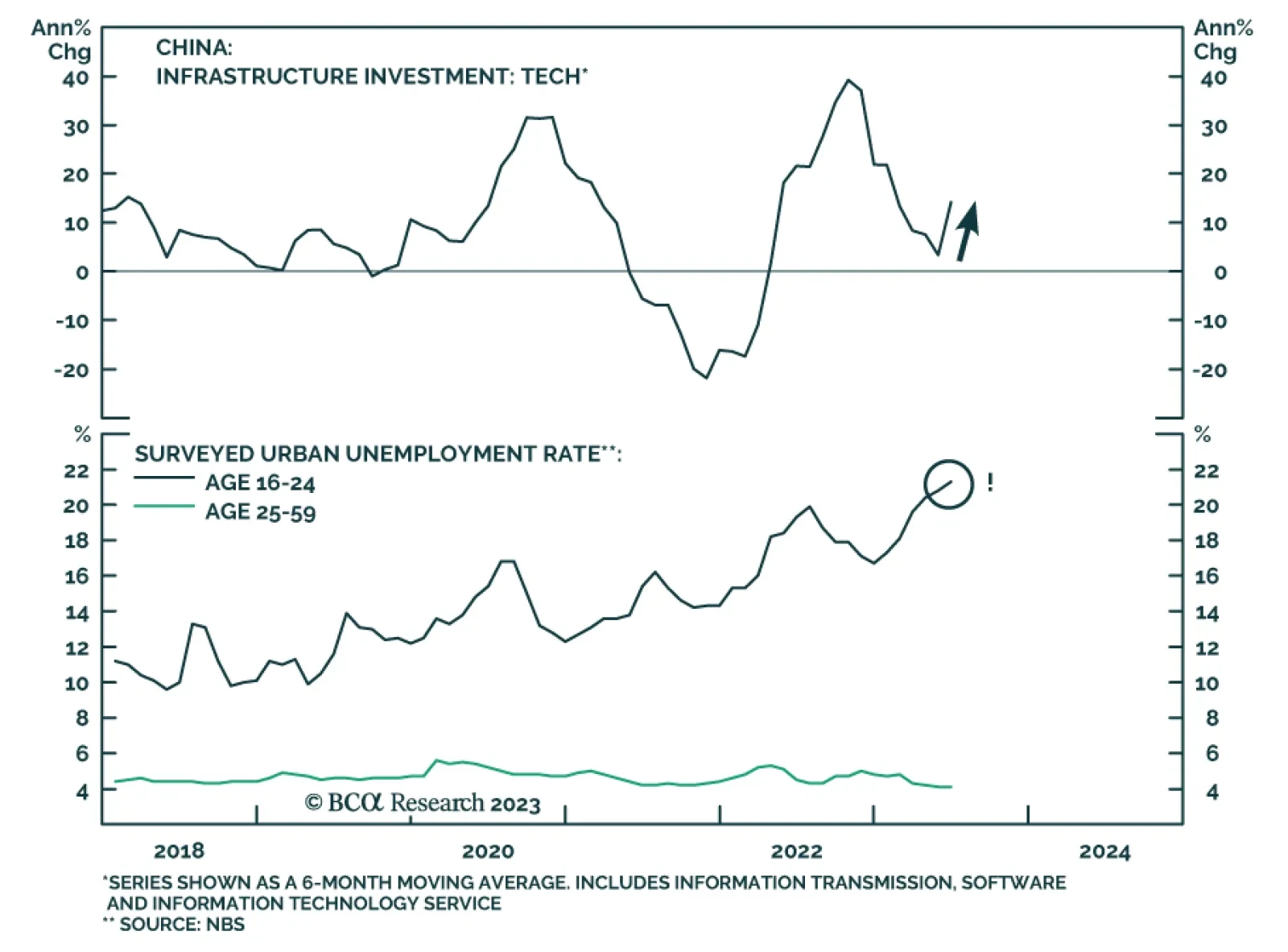

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

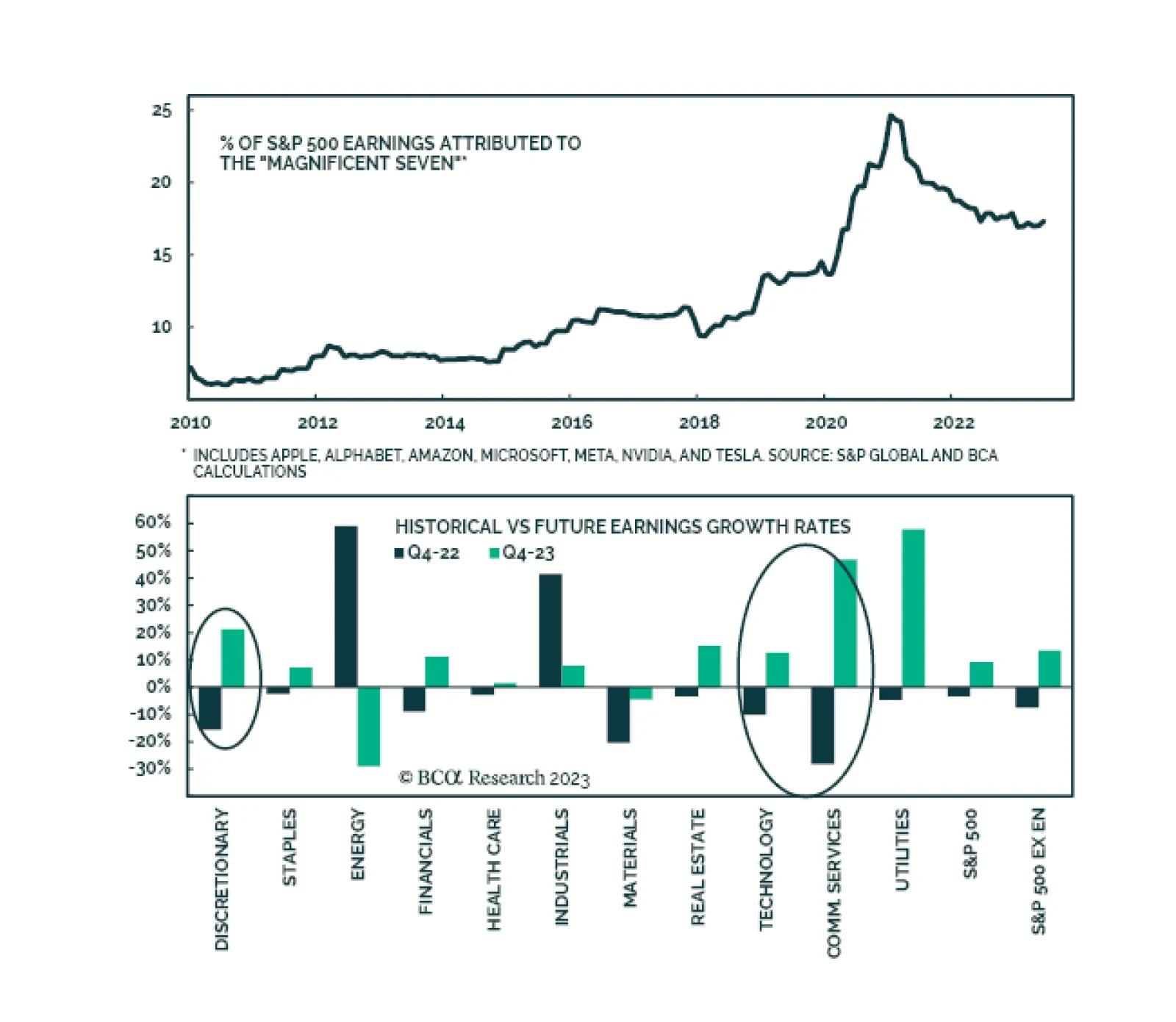

It is widely expected by consensus that earnings growth will rebound into the year-end and into 2024. Multiple factors will drive the reacceleration in earnings growth. Sales growth will pick up: In the remainder of the year,…

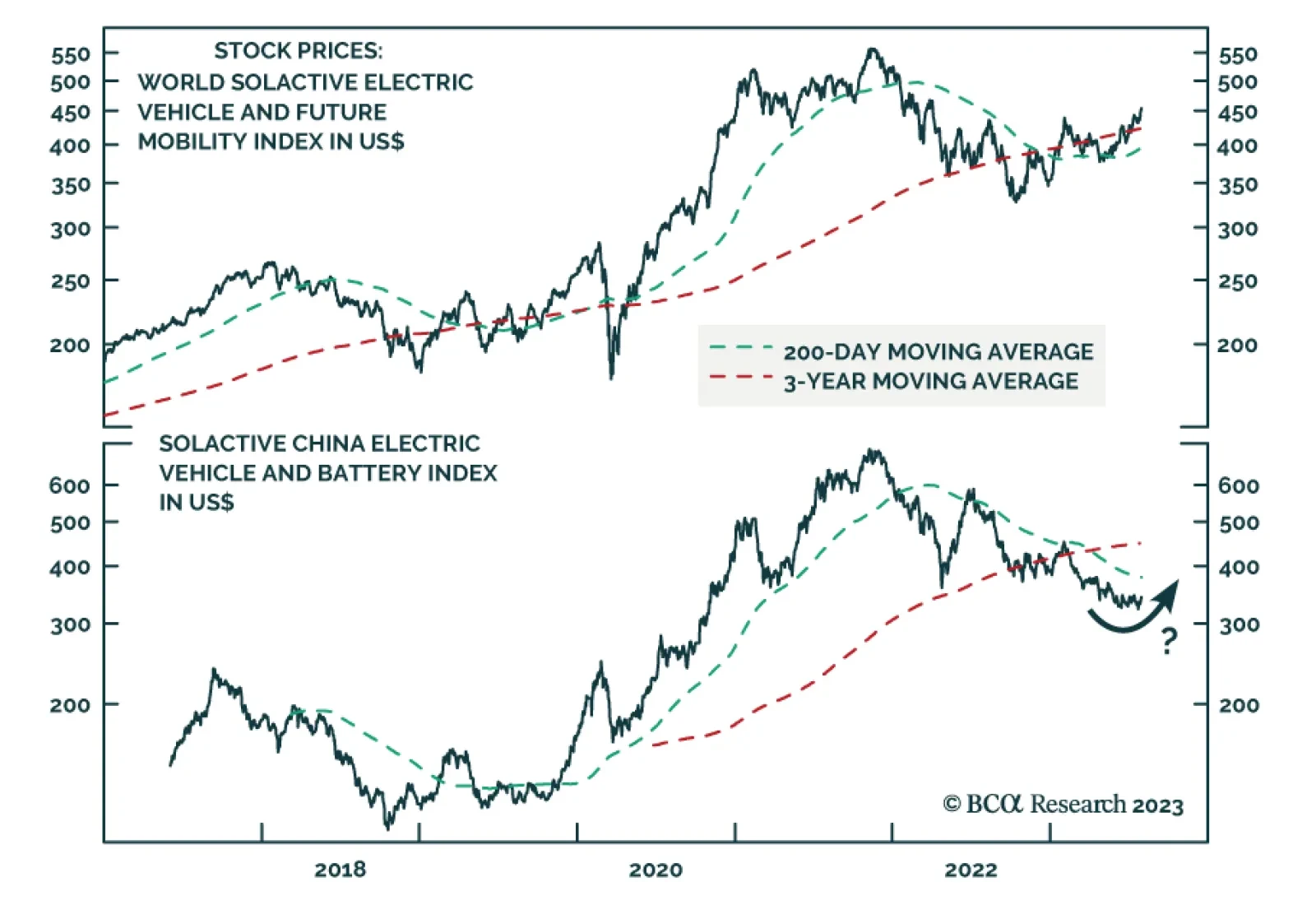

According to BCA Research’s China Investment Strategy service, Beijing’s investment focus is shifting from traditional infrastructure to new economy infrastructure, which includes clean energy and high-tech sectors…

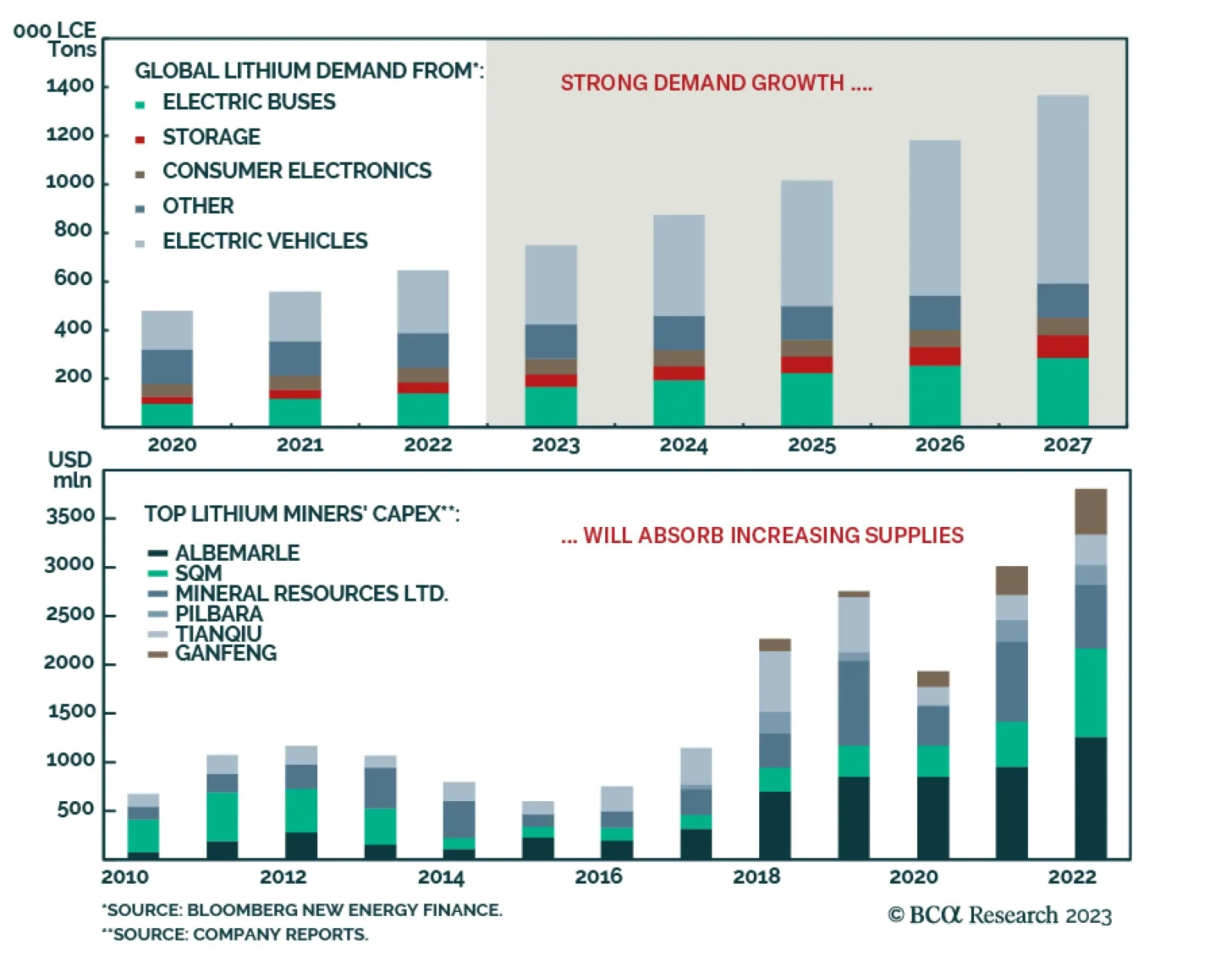

BCA Research’s Commodity & Energy Strategy service expects steady demand for EVs will be able to absorb increasing lithium supplies in the short-to-medium term. The team is getting long the LIT ETF at tonight’s…

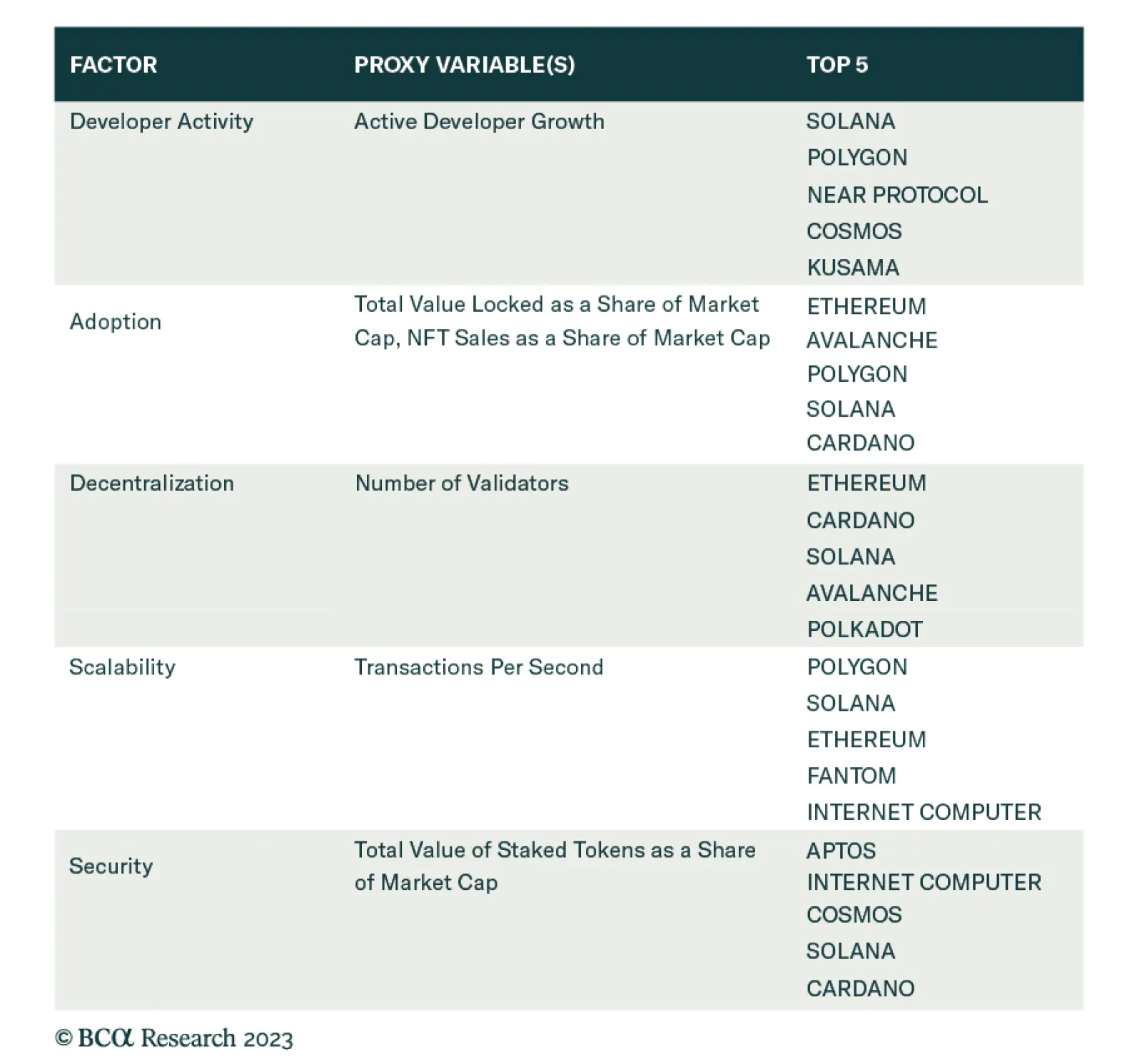

According to BCA Research’s Counterpoint service, the top five blockchains are Solana (SOL), Ethereum (ETH), Polygon (MATIC), Cardano (ADA), and Avalanche (AVAX). Investors should have a small (up to 5 percent)…

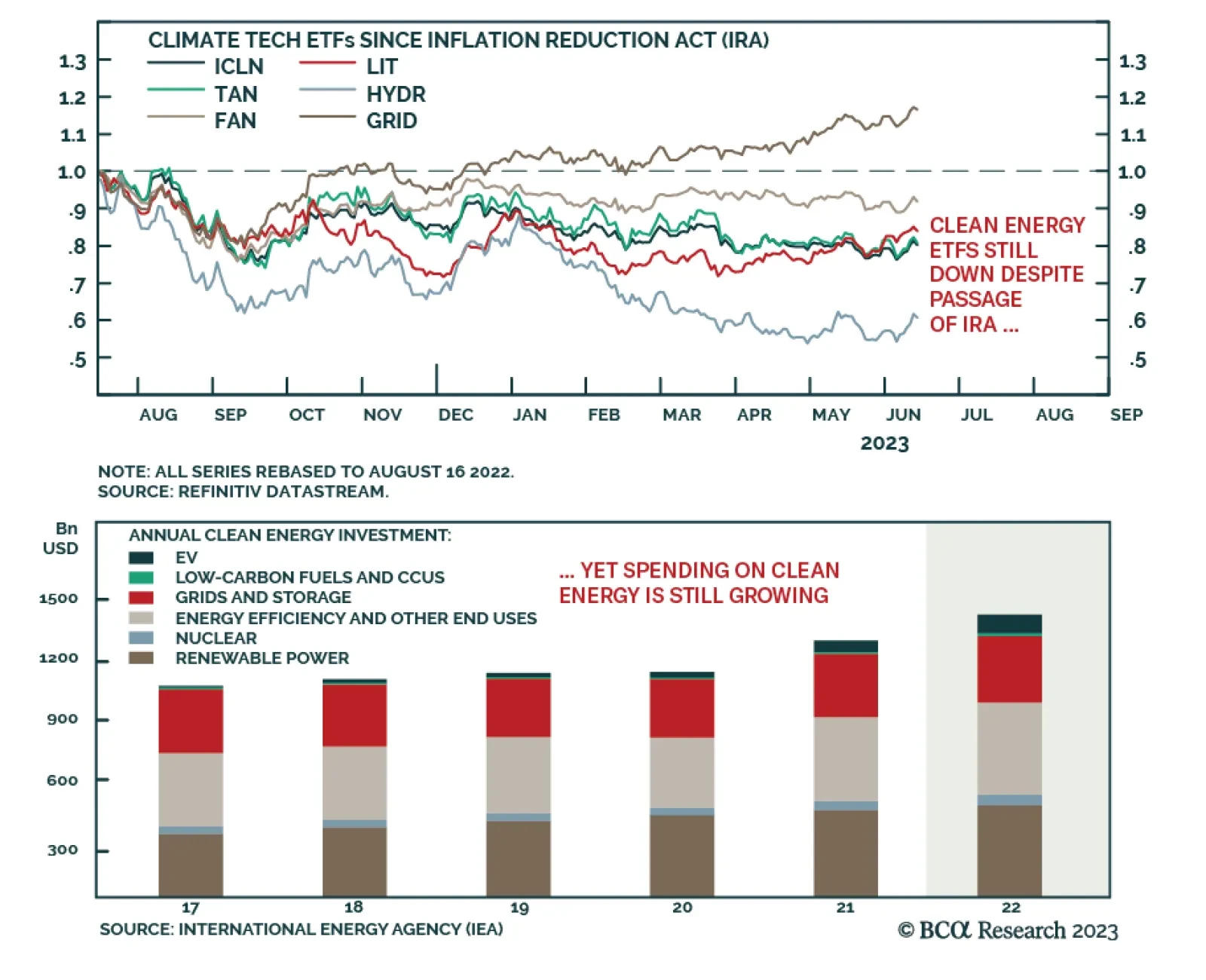

According to BCA Research’s US Equity Strategy, clean energy is well poised for a sustained bull market over the long term. Governments around the world are enthusiastically lending their support to the clean energy…

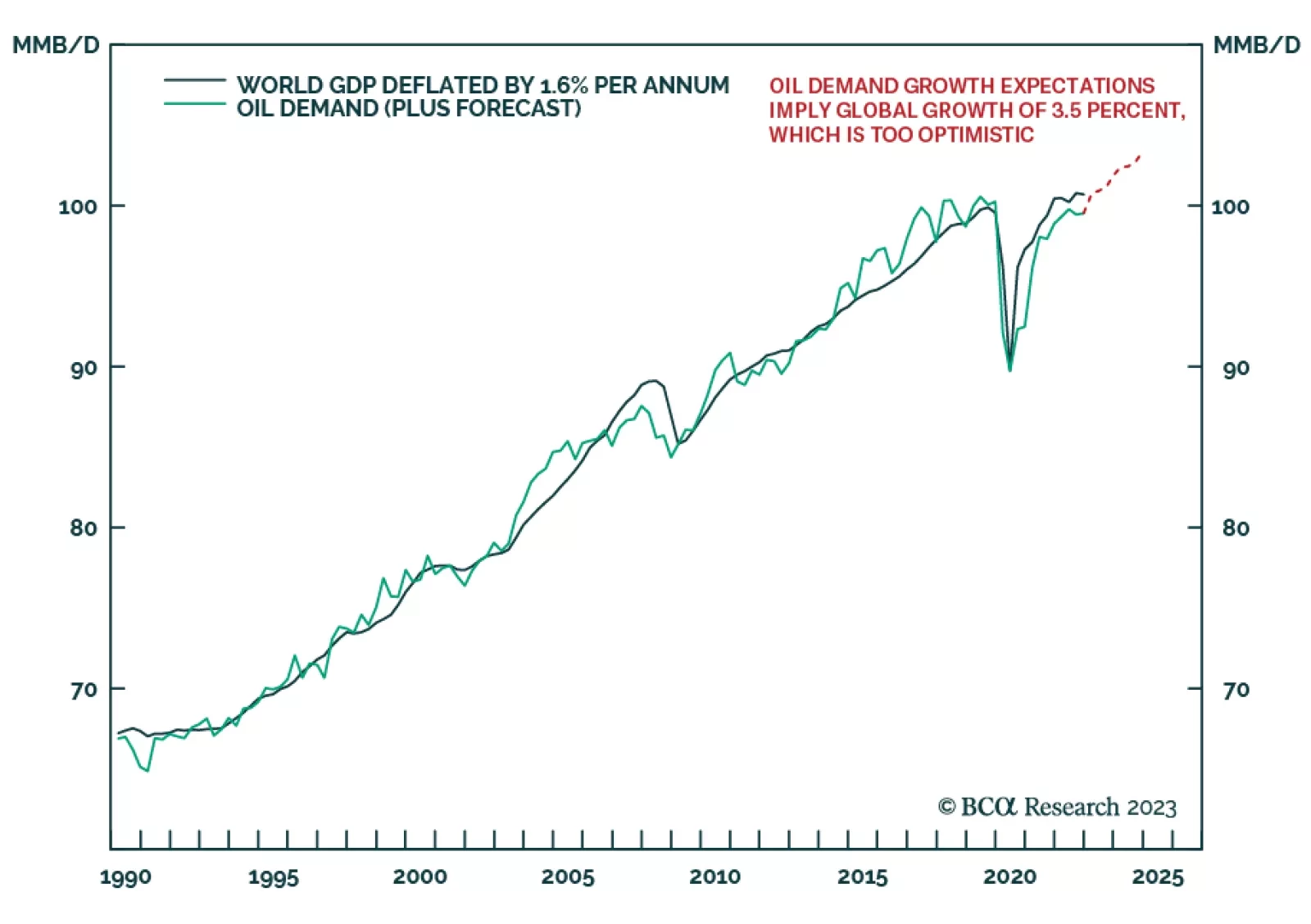

Our Counterpoint strategists believe that that the oil price has further downside, likely to a cycle low of $55 – because expectations for oil demand growth through 2023-24 are much too optimistic. Oil demand tracks…