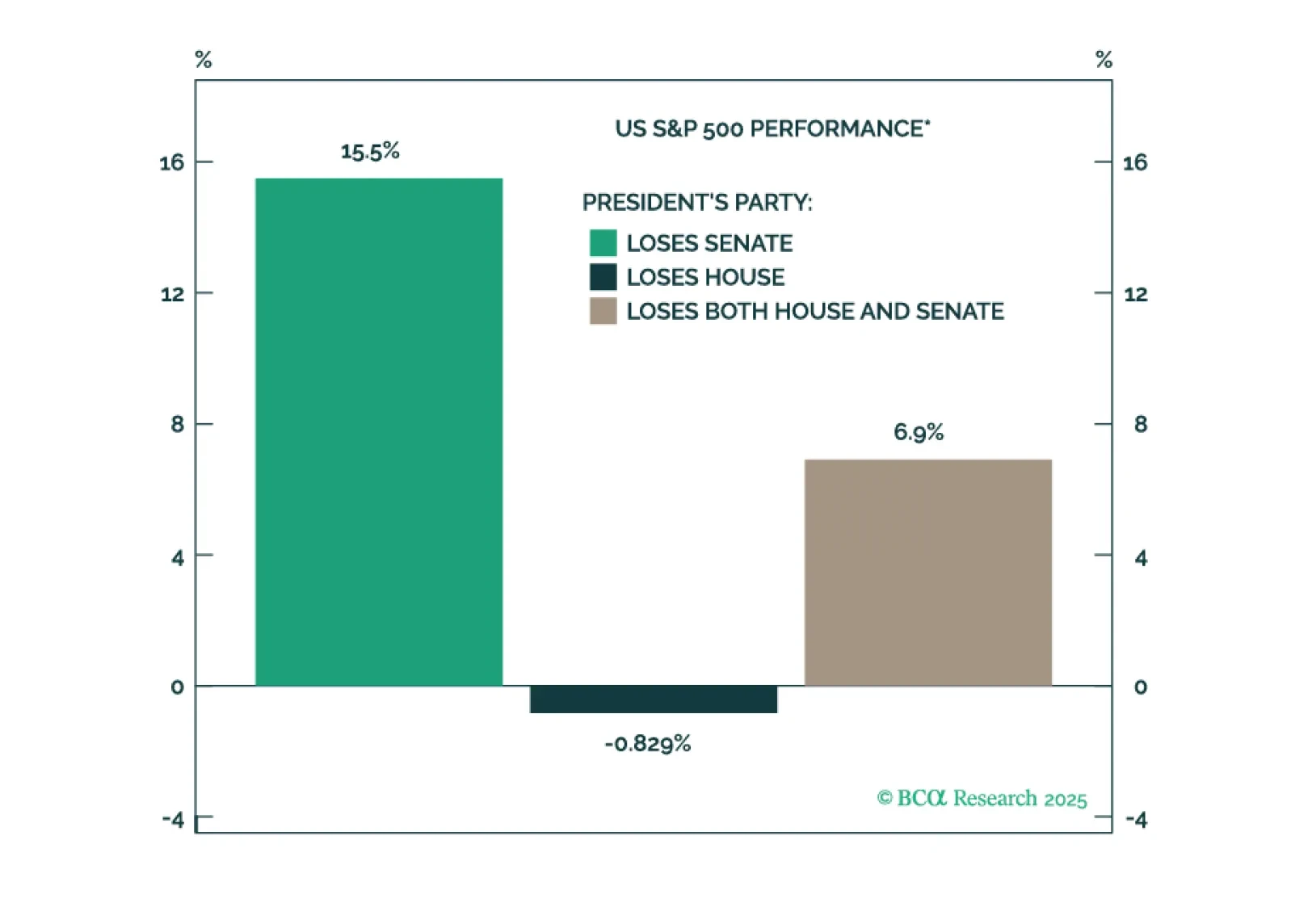

Partisan redrawing of congressional districts will not prevent Democrats from retaking the House in the 2026 midterms. Neither will the Supreme Court's look at the Voting Rights Act.

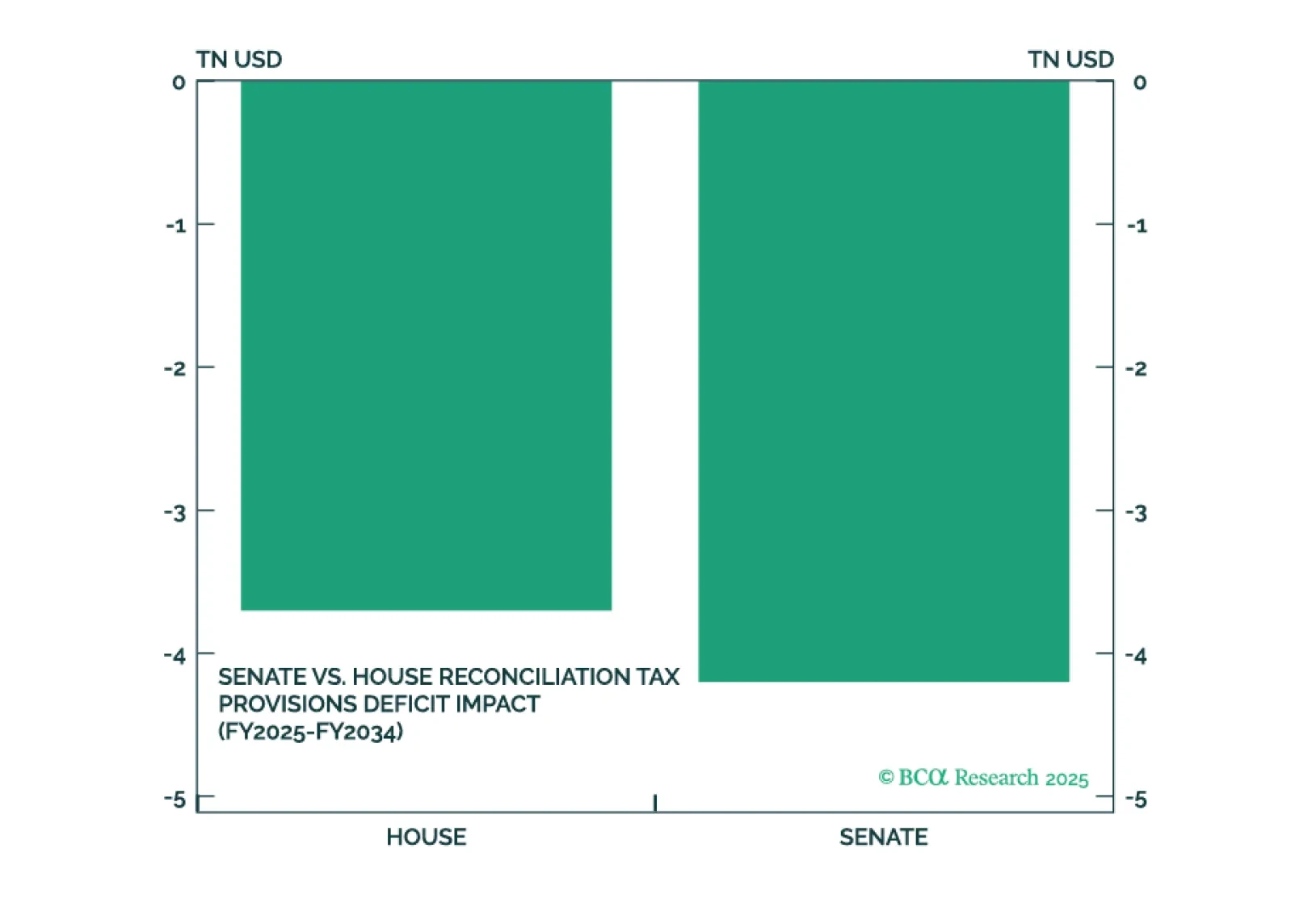

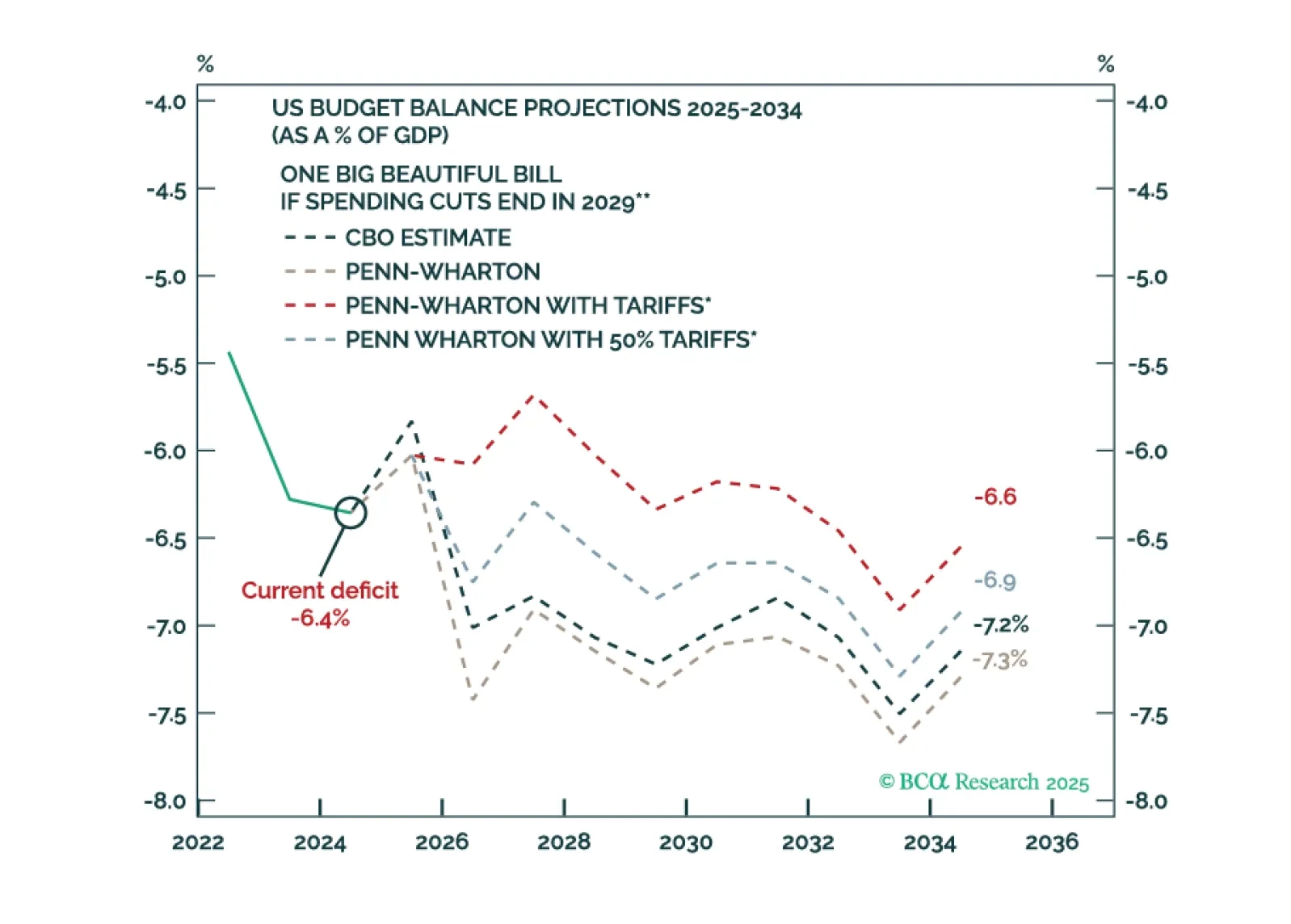

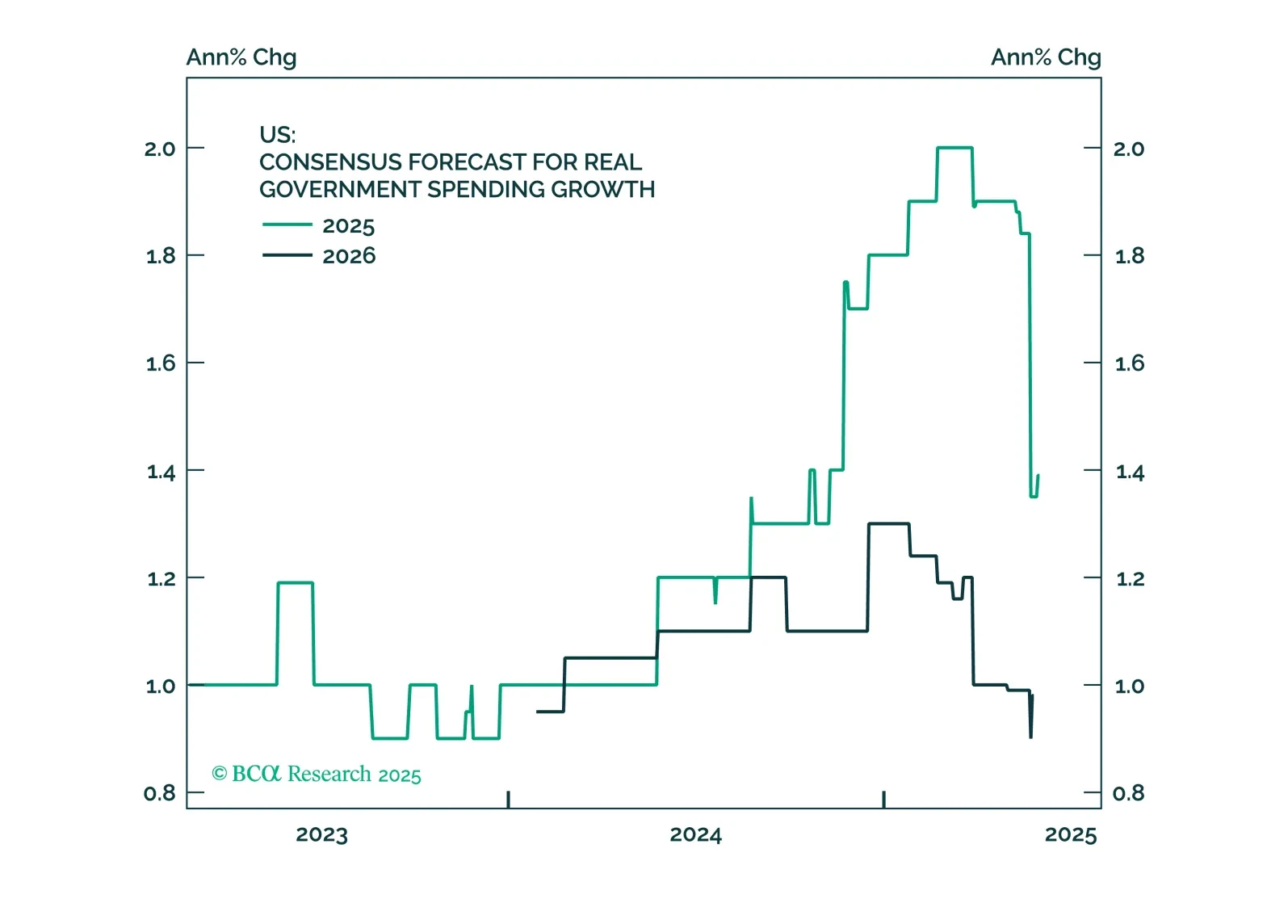

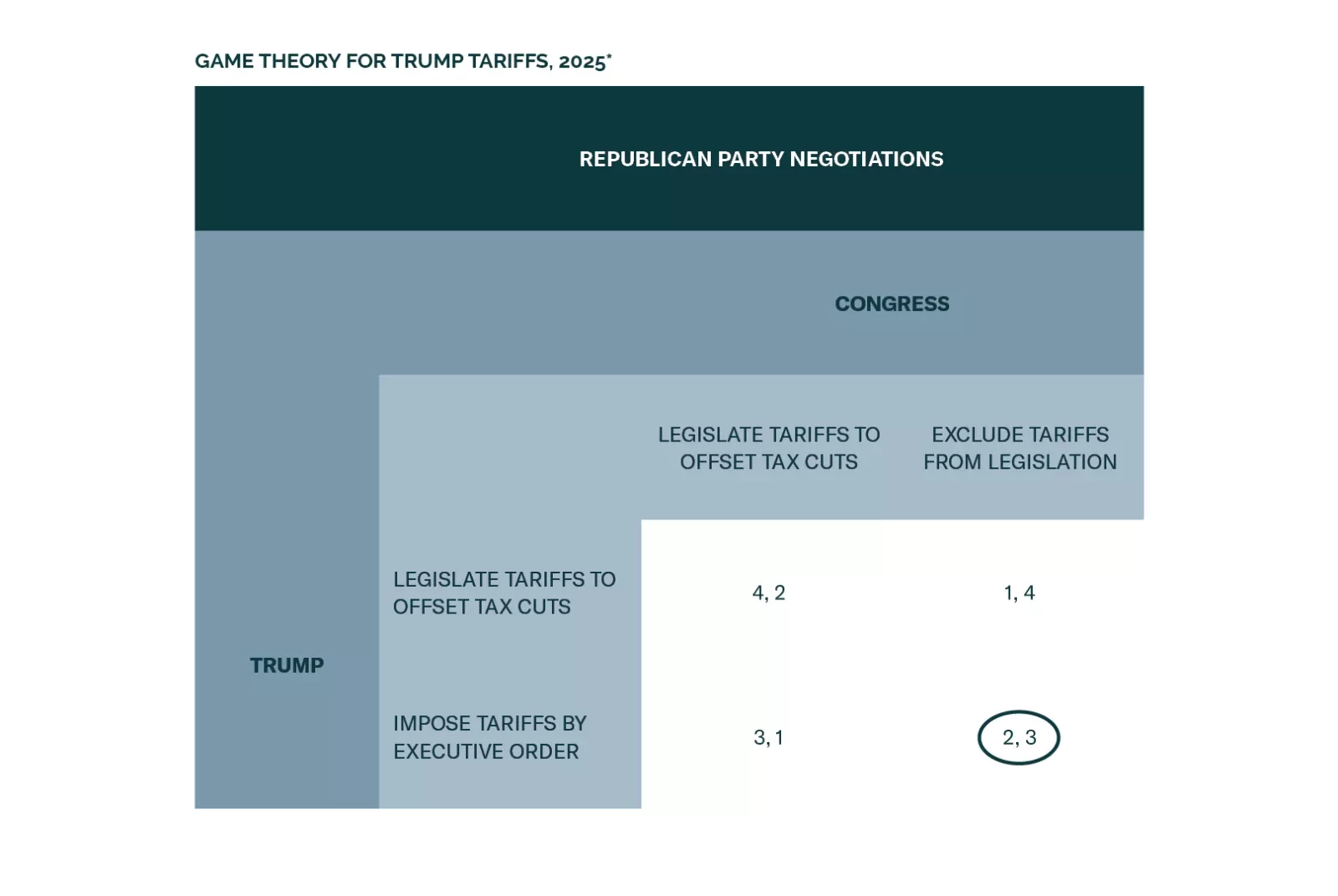

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

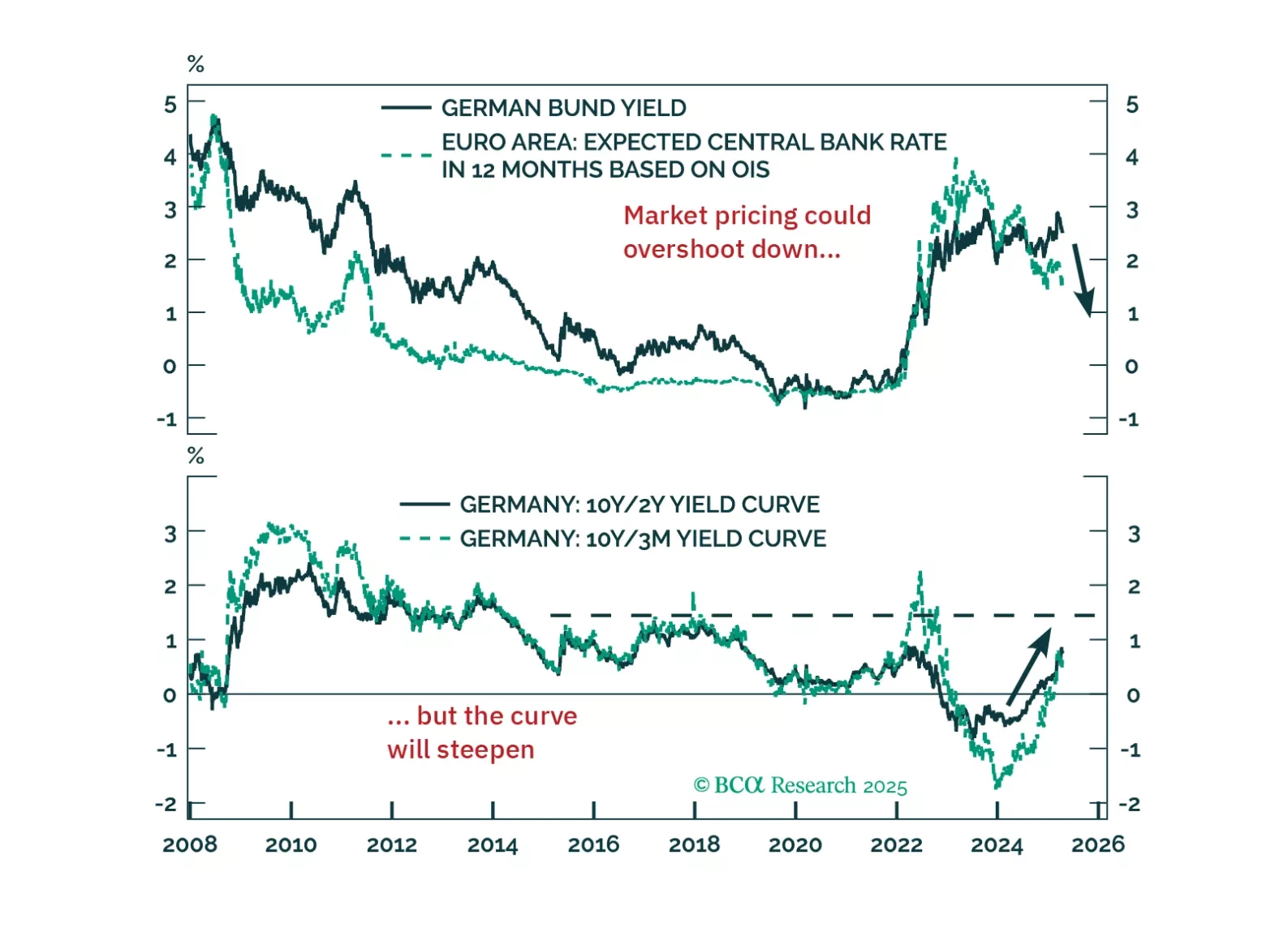

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

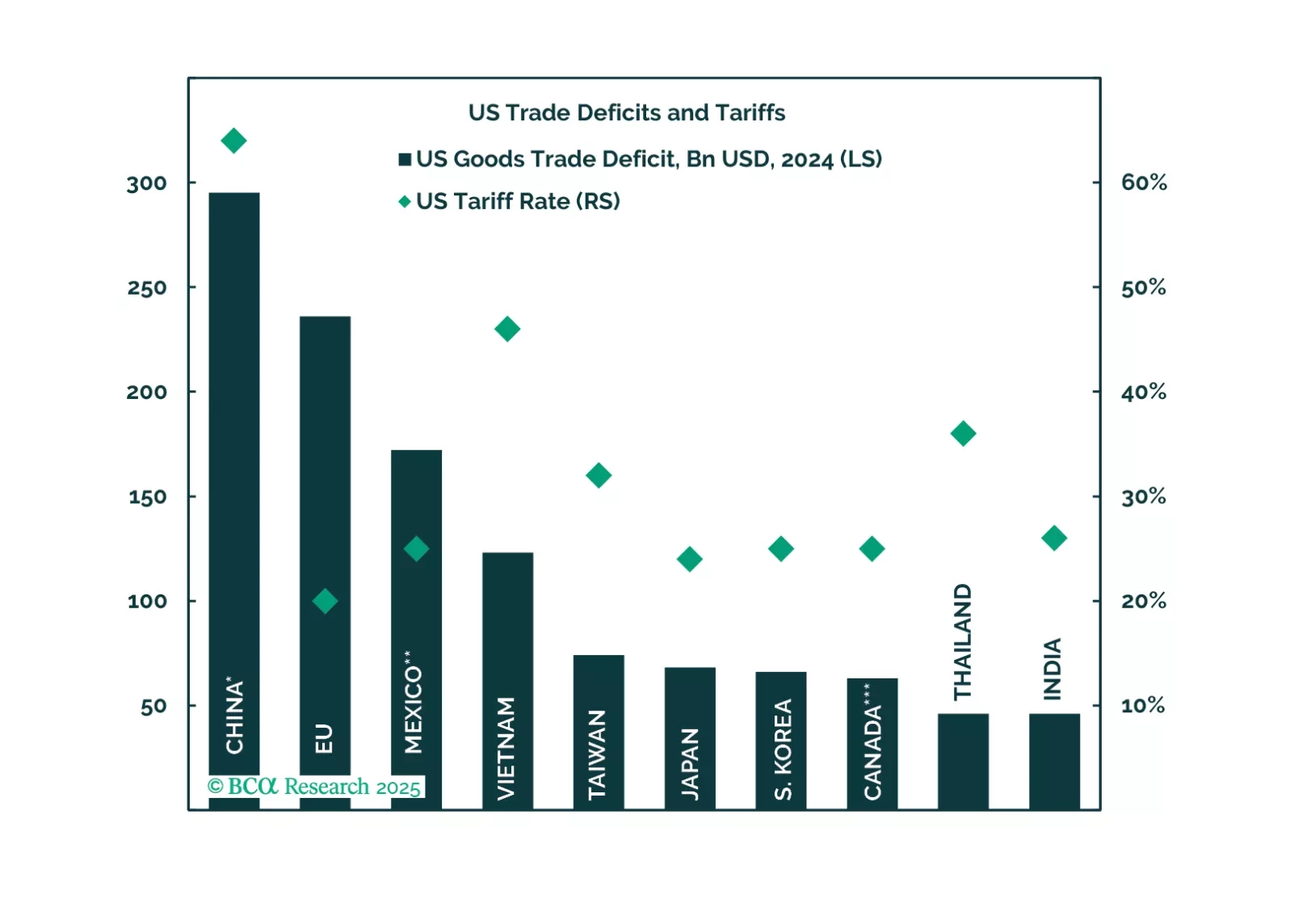

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…