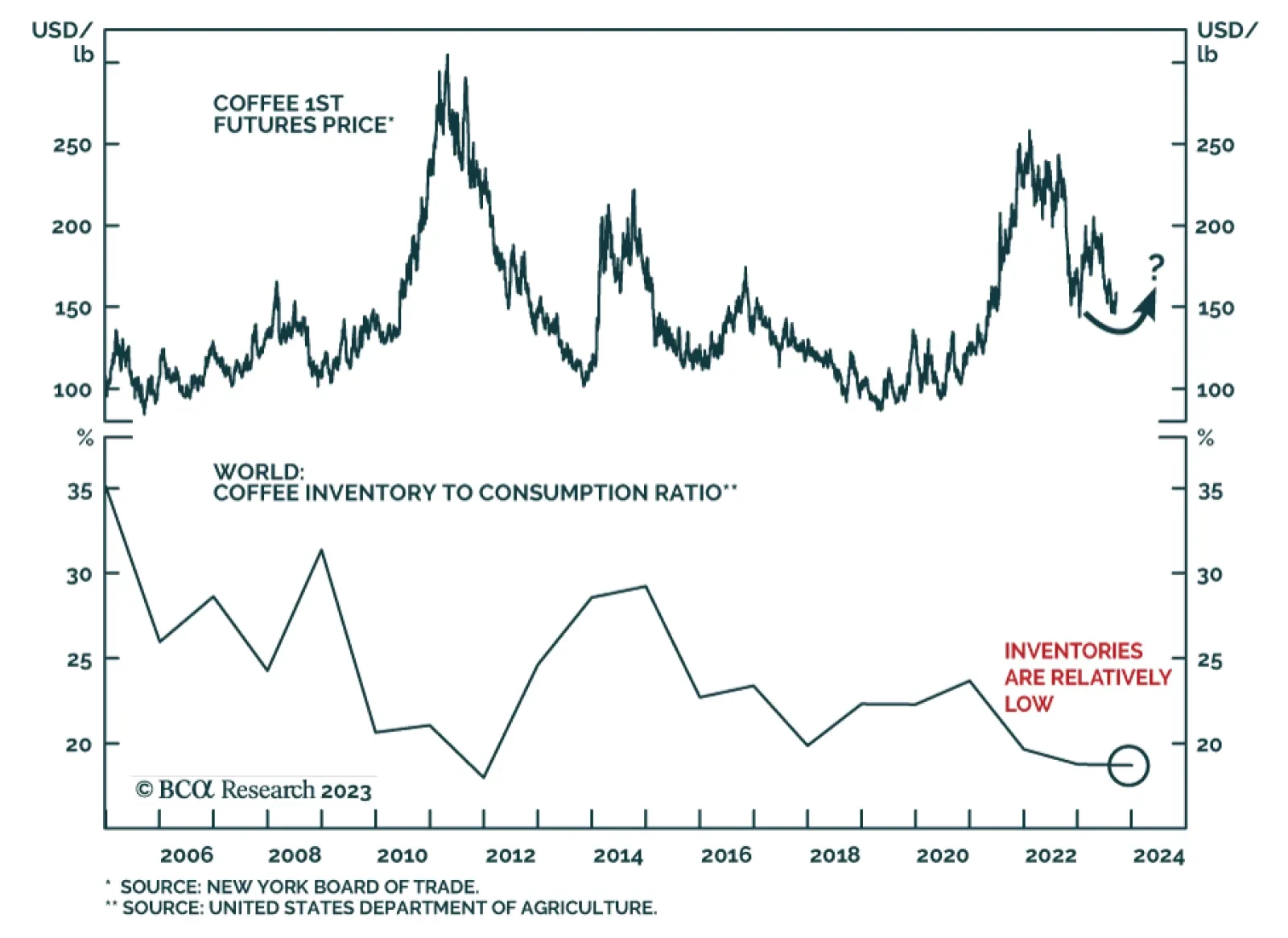

Coffee prices have surged in recent days and have now gained 8.5% over the past week. Two main forces are behind this rally. First, the recent pause in the US dollar strength is a tailwind for coffee prices. In particular, the…

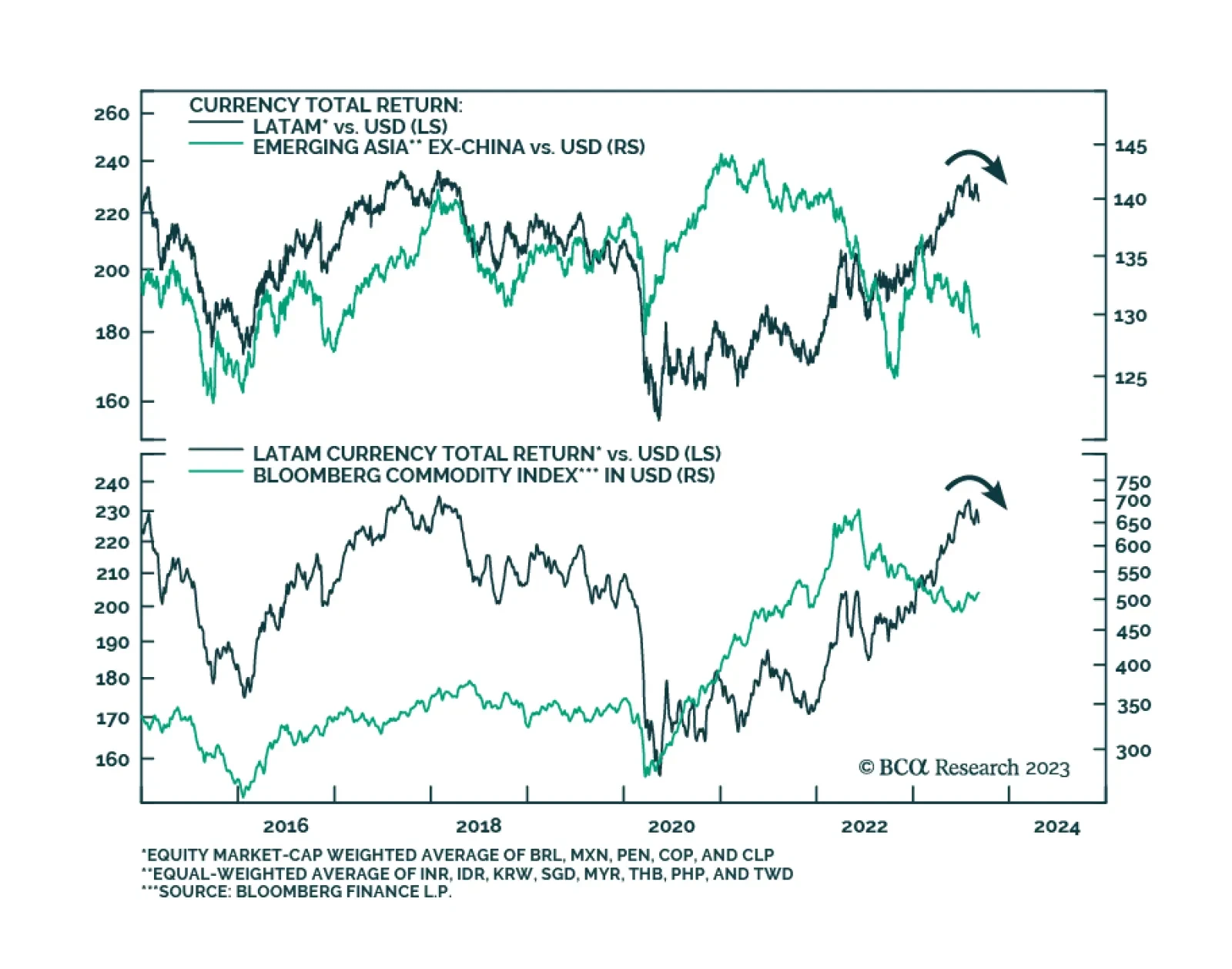

Earlier this year, our Emerging Markets strategists highlighted that the divergence between Latin American and Emerging Asian currencies was unsustainable. While Latam currencies – including the COP, MXN, BRL, PEN, and CLP…

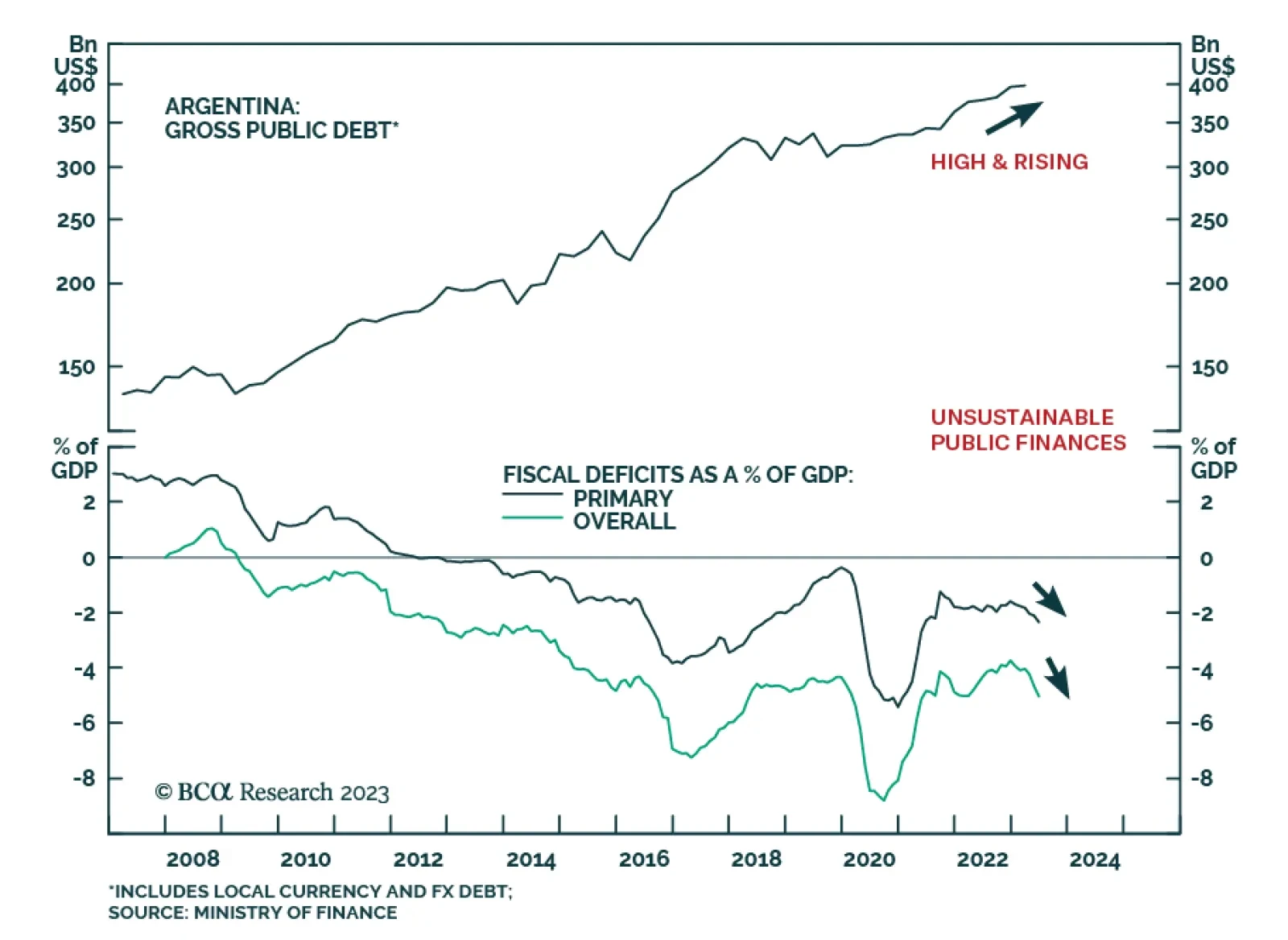

According to BCA Research’s Emerging Markets Strategy service, while it may be tempting to bottom fish, the team advises that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election…

While it may be tempting to bottom fish, we advise that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election of a right-wing candidate in the coming months may boost investor sentiment, the…

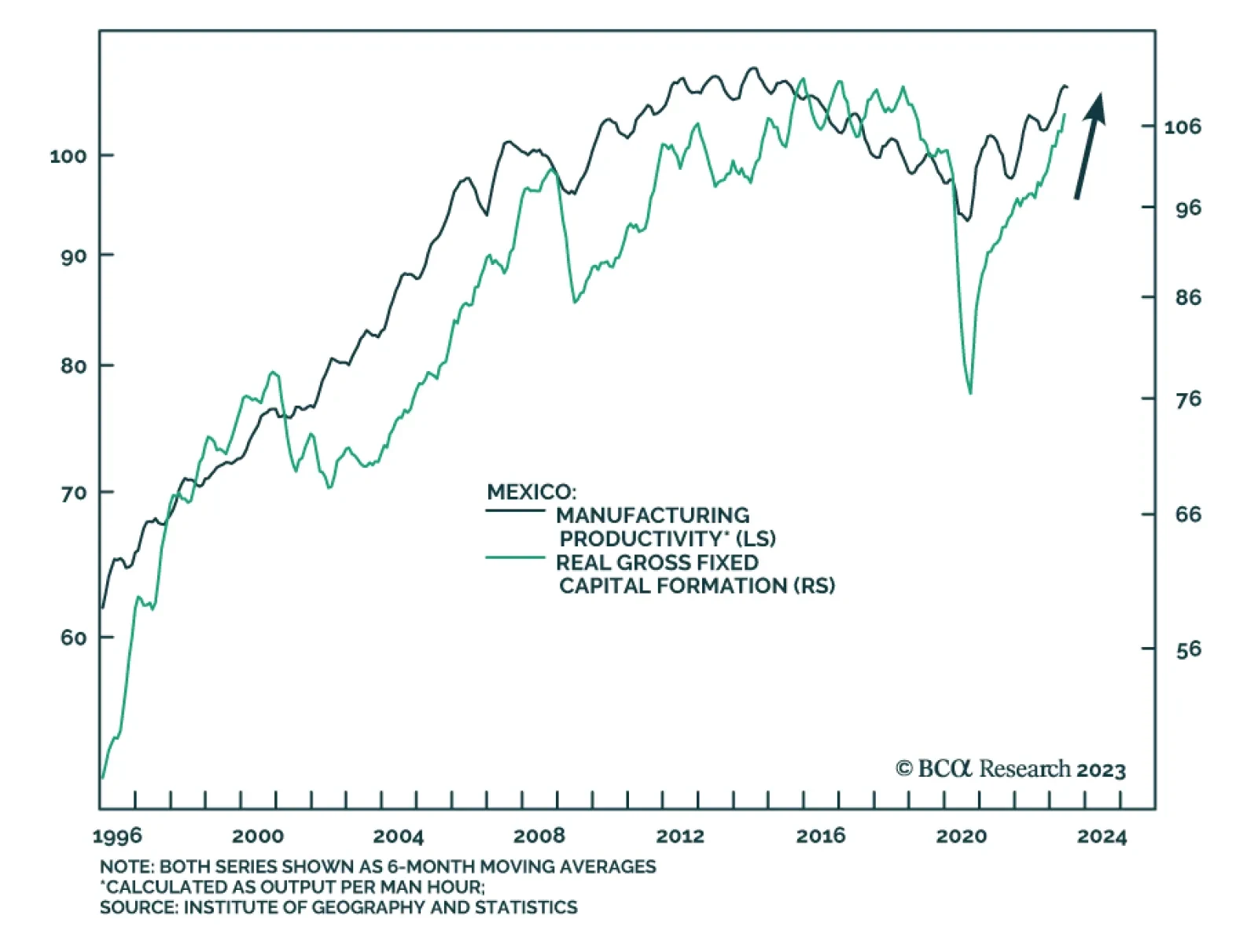

Mexican financial markets have been this year’s stellar outperformers, both in absolute terms and relative to their EM peers. Naturally, the question arises: how sustainable is this rally? According to our Emerging…

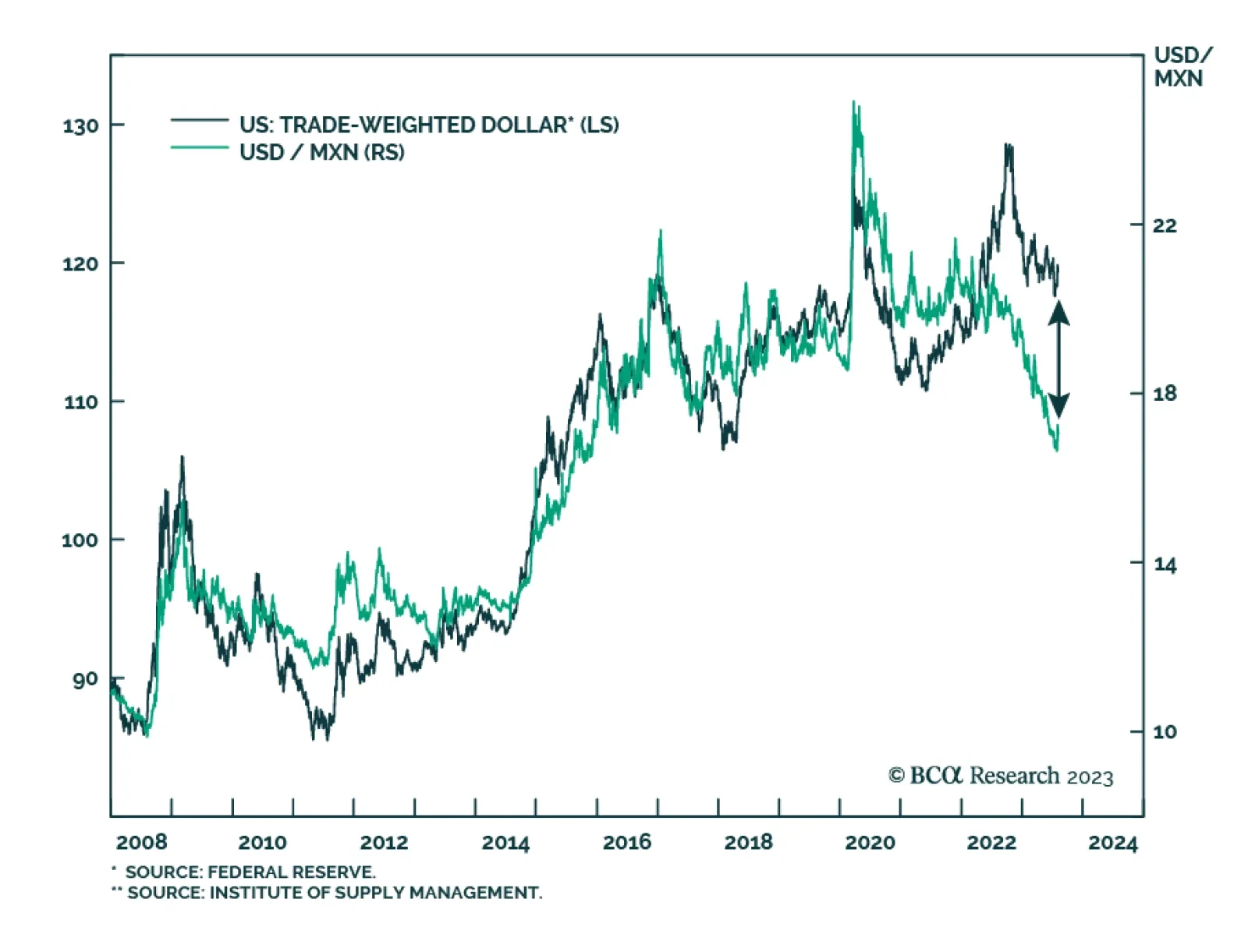

The Mexican peso is the best performing major currency so far this year, gaining 14% vis-à-vis the greenback over this period. Even during the latest bout of dollar strength since mid-July, MXN has weakened by the least…

In absolute terms, Mexican markets may correct given their impressive rally and an impending EM risk-off move. Relative to EM however, Mexico will continue to outperform given its unique cyclical and structural macro fundamentals, as…

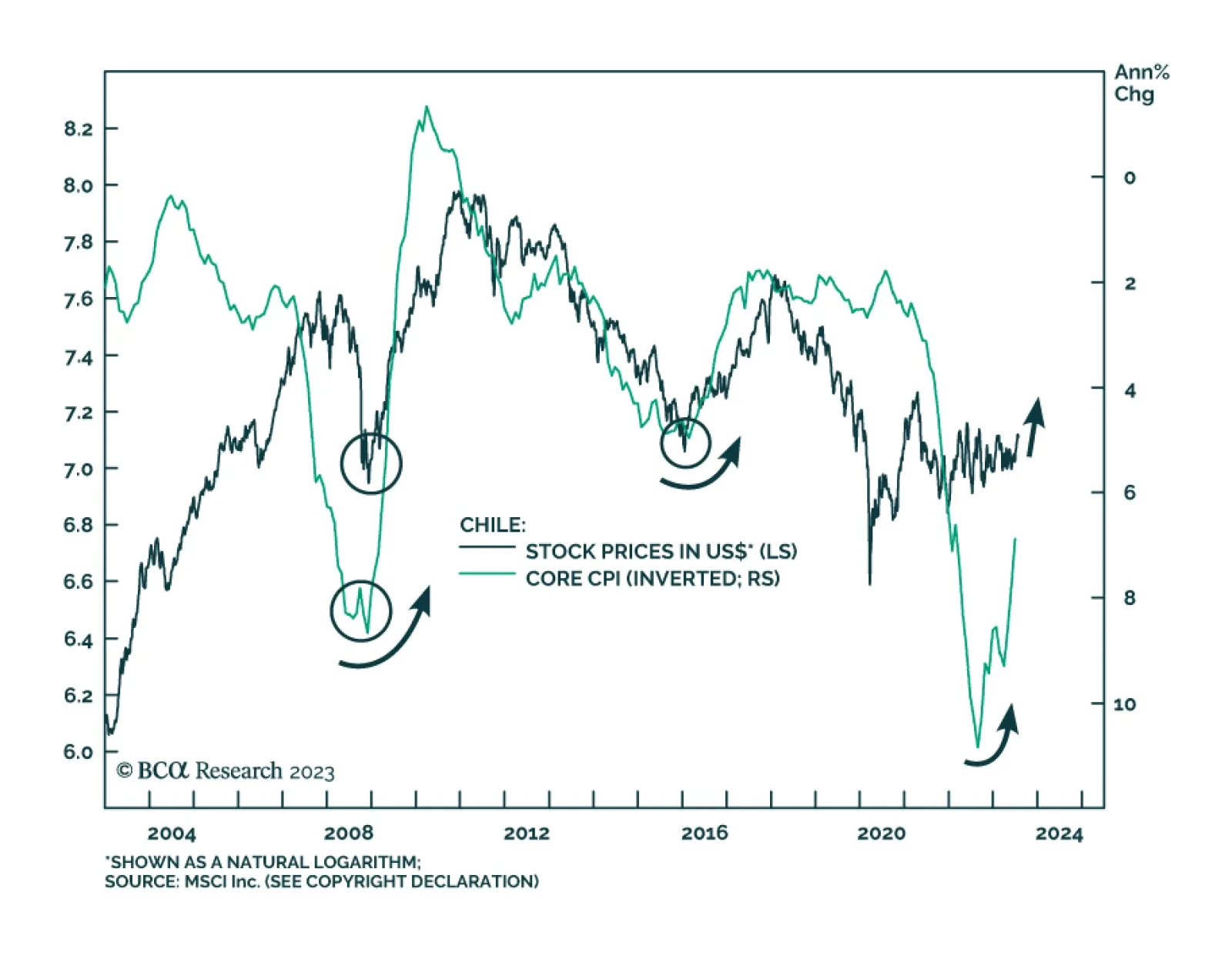

Last Friday, the Central Bank of Chile became the first major Latin American monetary authority to cut rates, thereby beginning the EM monetary easing cycle. In its latest meeting, board members decided to reduce the policy…

In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Investors’ positioning in the USD is not homogenous: they are short some currencies but long others versus the greenback. Market commentators often refer to the US dollar. They implicitly mean the US currency is moving…