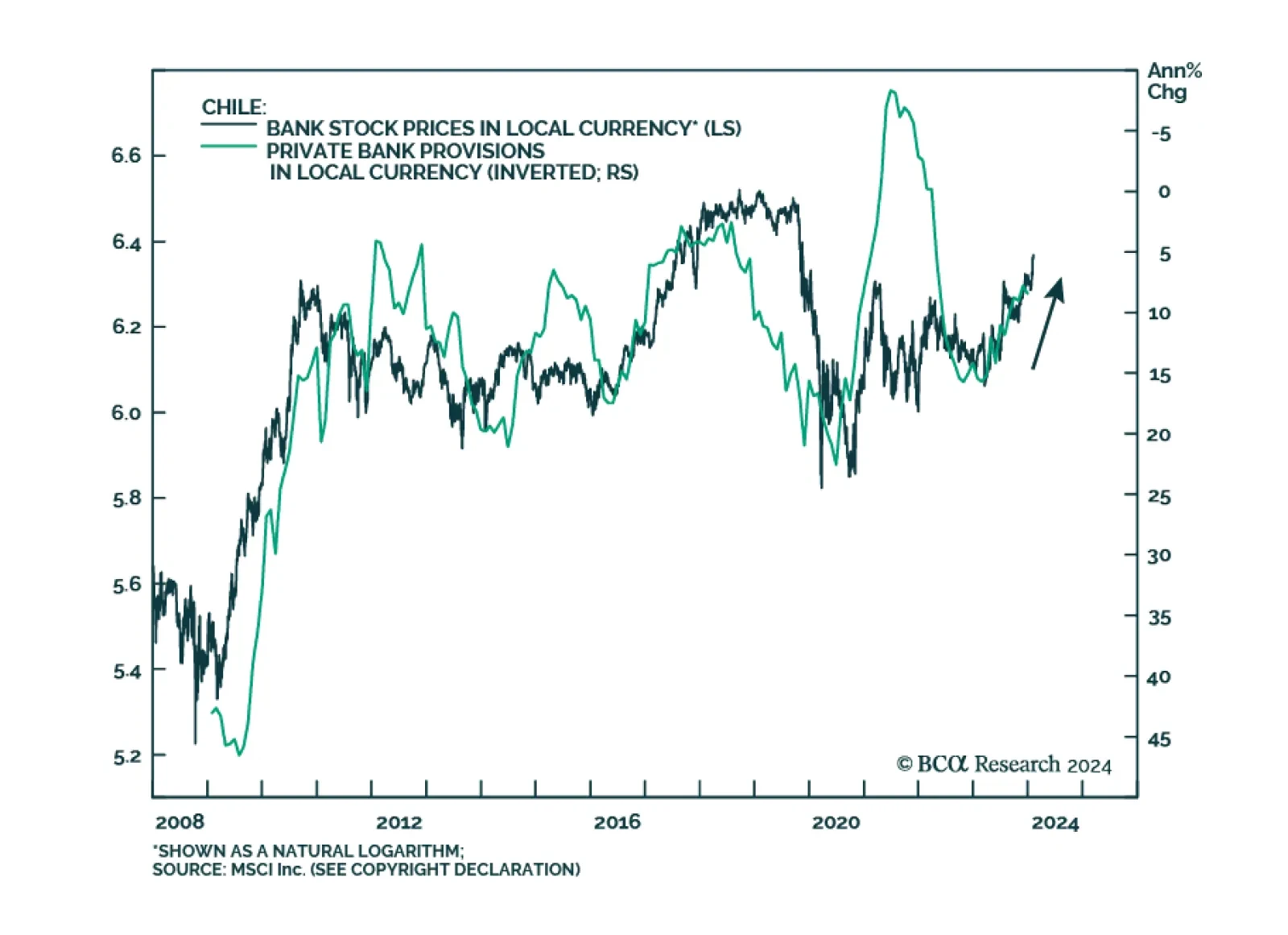

According to BCA Research’s Emerging Markets Strategy service, Chilean bank stocks offer great value and are poised to outperform the EM equity benchmark. Chilean bank share prices are well-positioned to outperform due…

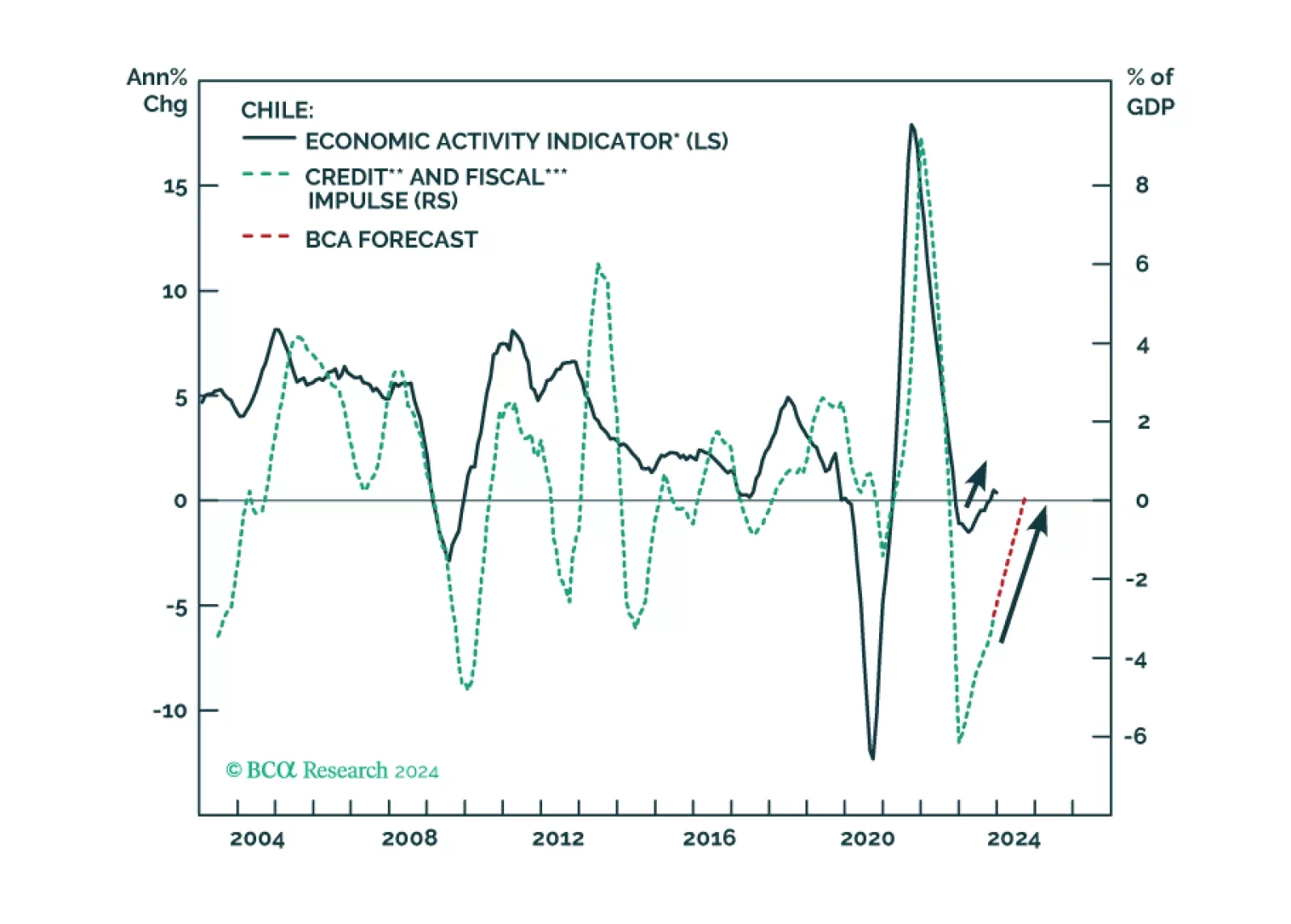

The stars have aligned for a major outperformance of Chilean stocks versus the EM equity benchmark. Plummeting inflation in Chile will push monetary authorities to continue their aggressive rate cuts, engineering a quick economic…

The Central Bank of Brazil (BCB) has cut the Selic rate by 50 basis points in each of the past four meetings and has alluded to maintaining this size of cuts for the coming meetings. Governor Roberto Campos Neto stated last month…

The Brazilian government and the central bank will be prioritizing growth over curbing the fiscal deficit and inflation. The outcome of an easy policy mix is that growth and inflation will be higher relative to market expectations,…

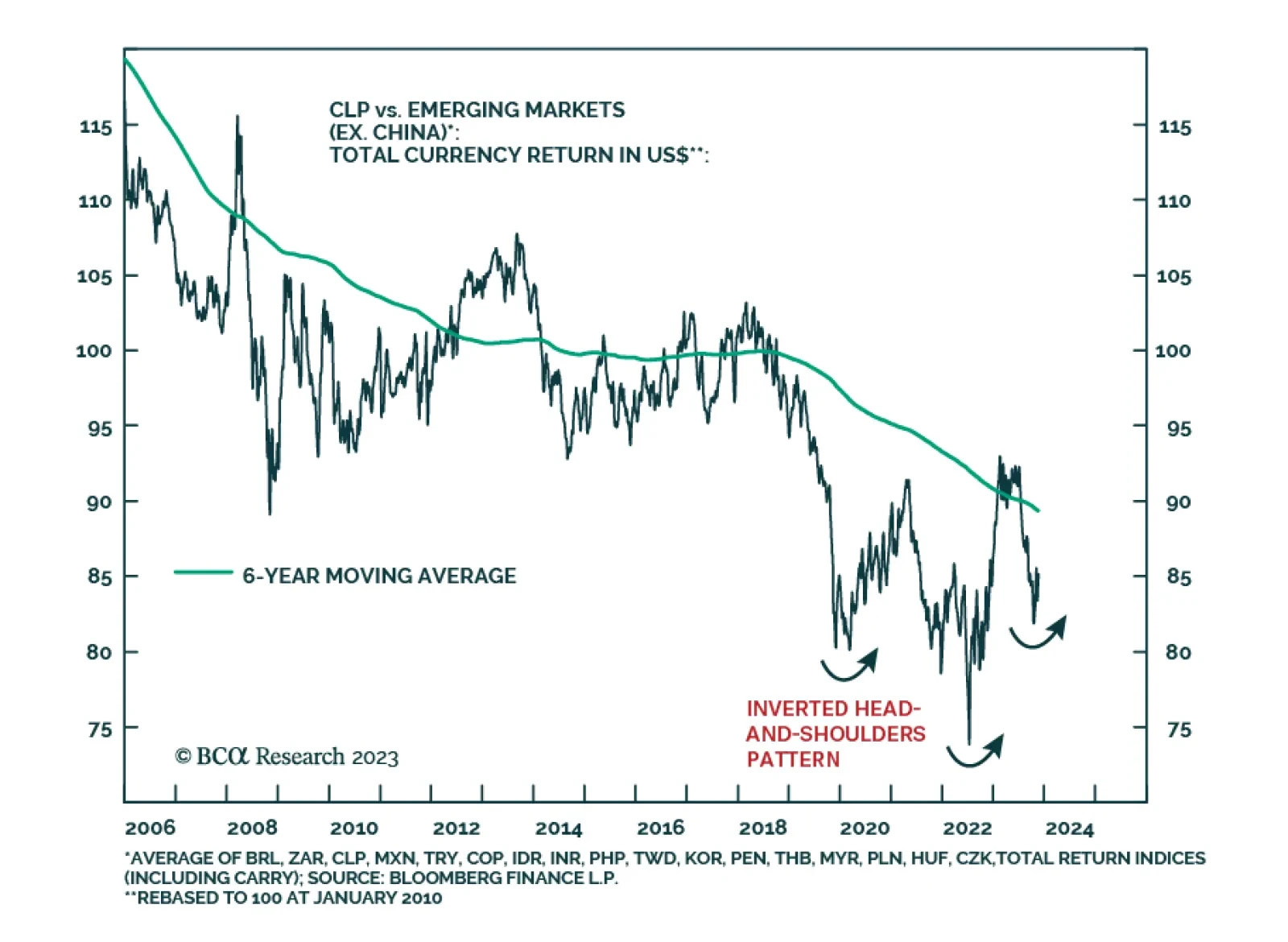

According to BCA Research's Emerging Markets Strategy service, the Chilean peso’s depreciation is already quite advanced. Over the next few months, the CLP will remain under downward pressure due to a likely…

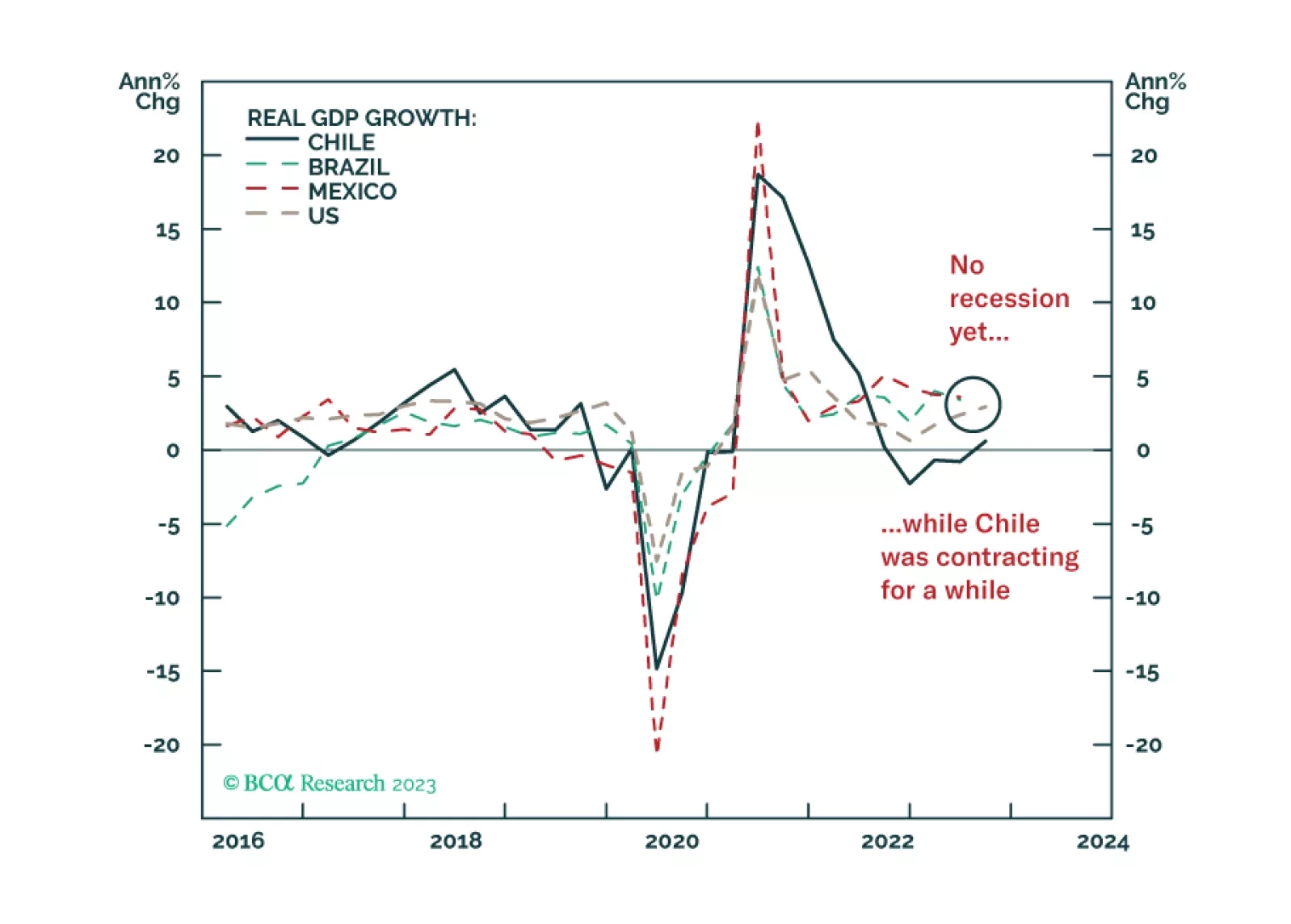

The Chilean economy is in a unique position worldwide: as it is the first to enter a recession, it will be the first to recover. Together with historically cheap valuations, this will lead to a sustained outperformance of Chilean…

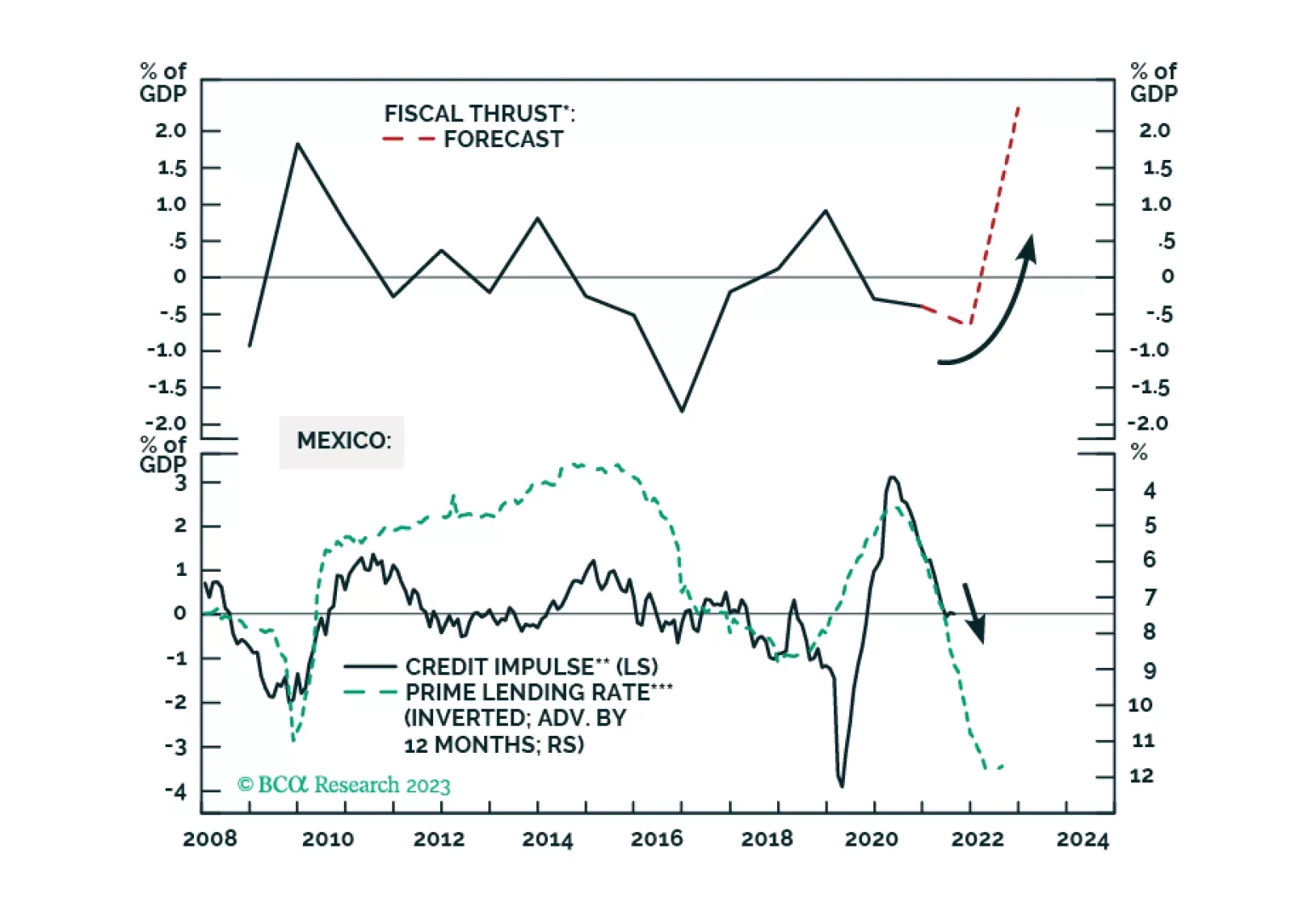

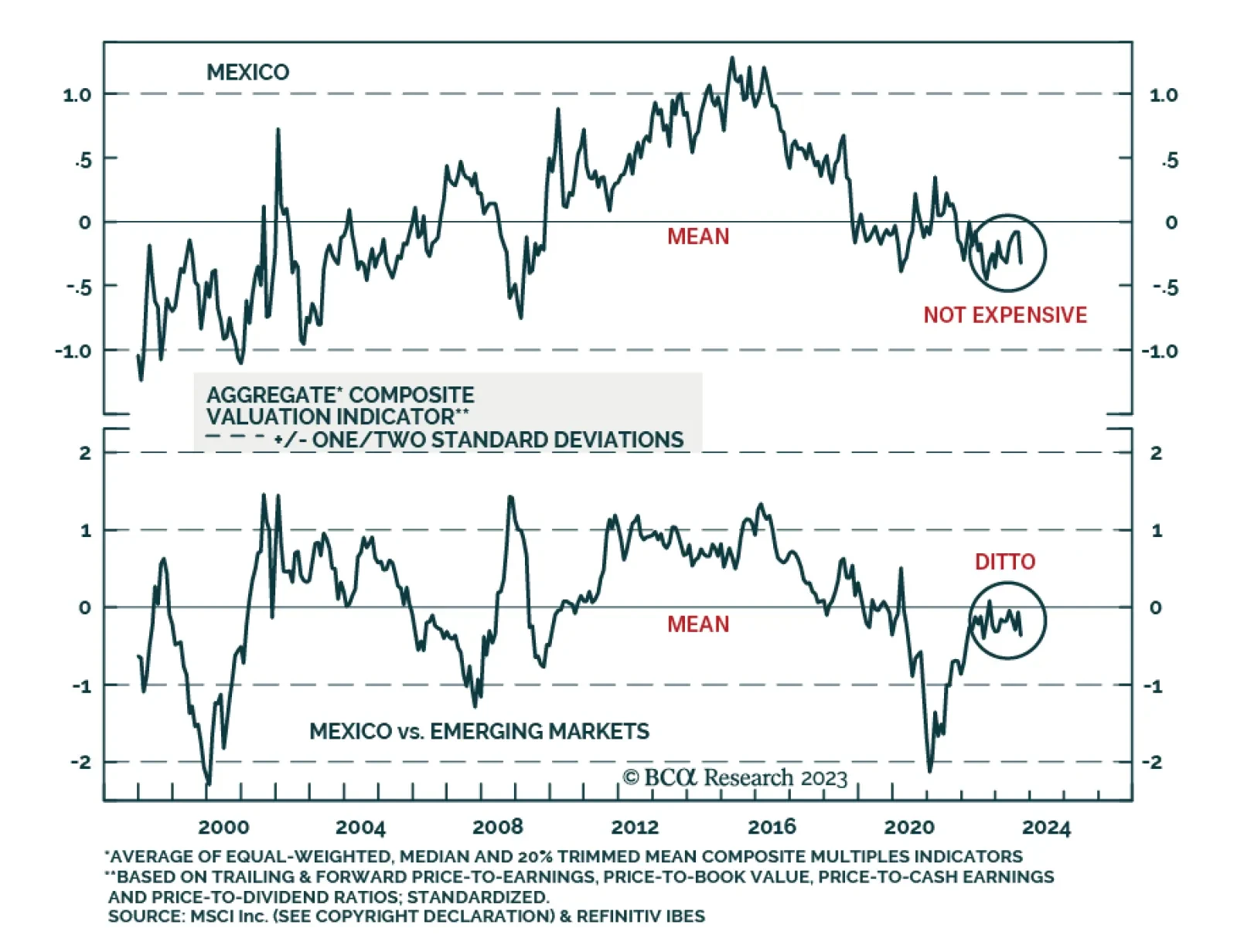

BCA Research’s Emerging Markets Strategy service remains overweight Mexican financial markets relative to their EM counterparts on a cyclical and structural basis. While Mexican markets will suffer in absolute terms with…

While Mexican markets will continue selling off in absolute terms, their recent underperformance versus their EM peers is a temporary setback in a cyclical and structural bull market. Domestic politics are evolving from stable to…

Despite higher oil prices, Colombian risk assets will underperform their EM peers in the months ahead. The domestic economy is evolving from stagflation into recession, and fiscal and political risks will raise the risk premium of…