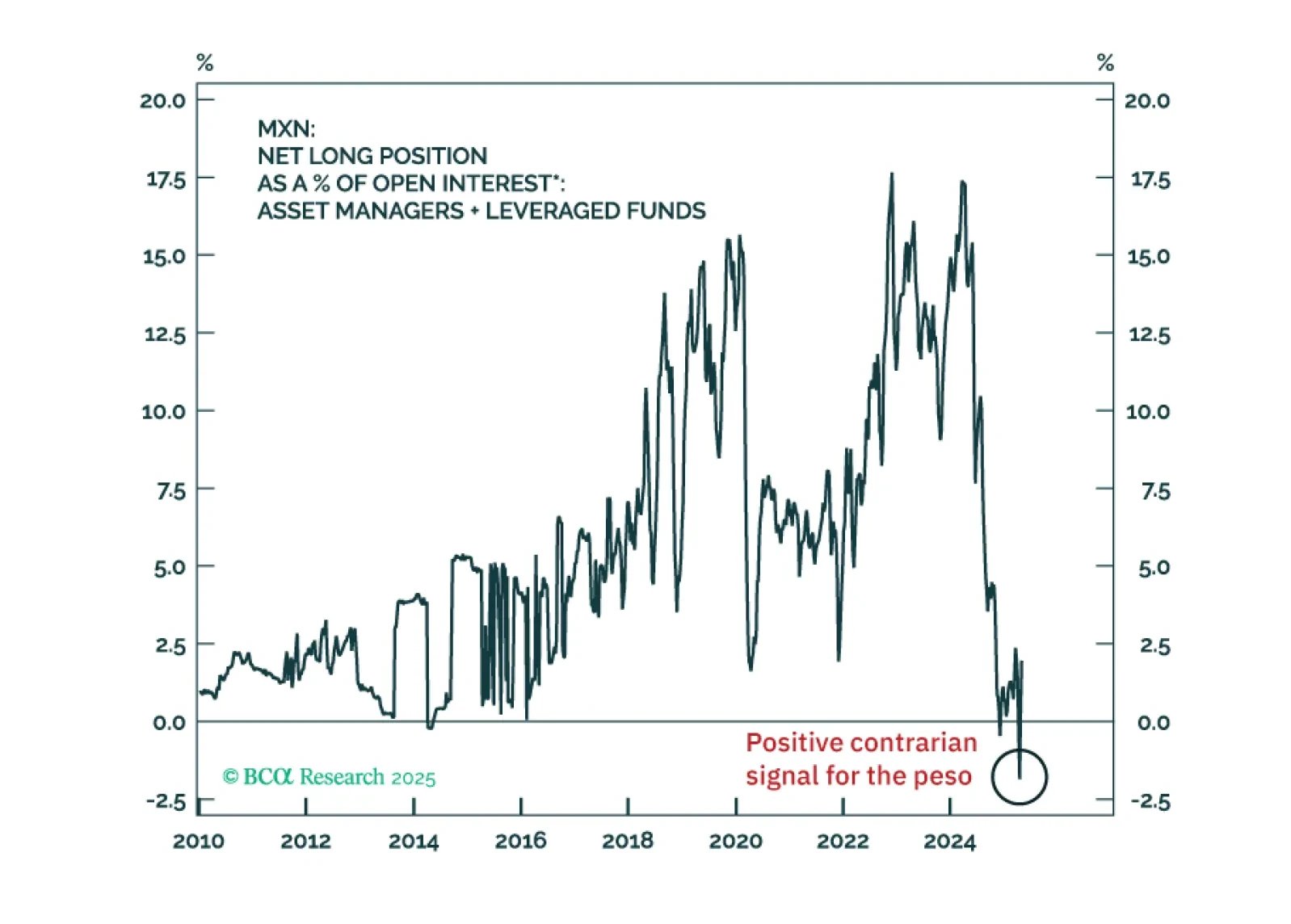

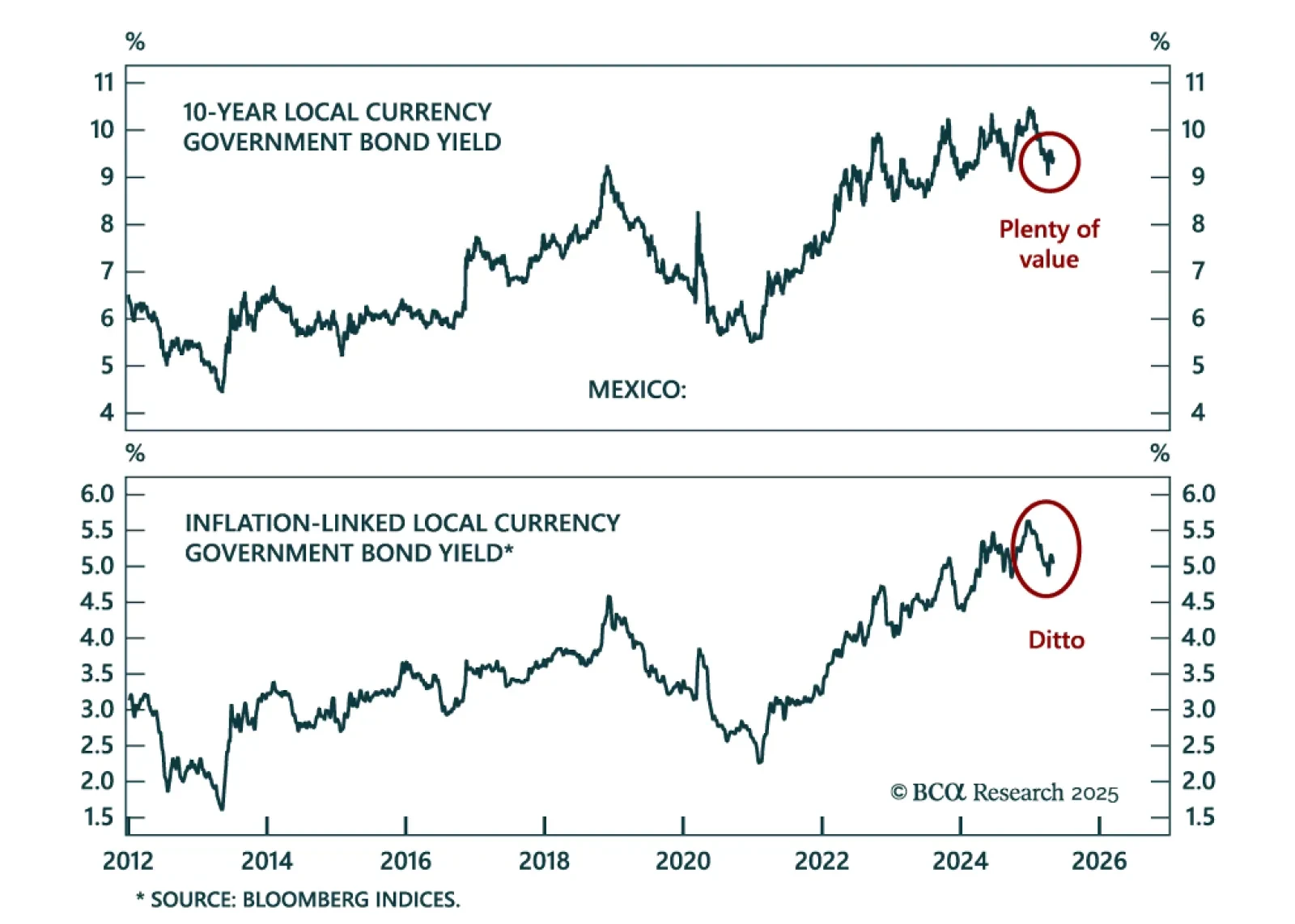

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…

In the long run, Mexico will emerge as one of the biggest winners of US tariffs as the US diversifies supply chains away from China. In the medium term, however, a US growth slowdown and tariffs will push Mexico into recession. In EM…

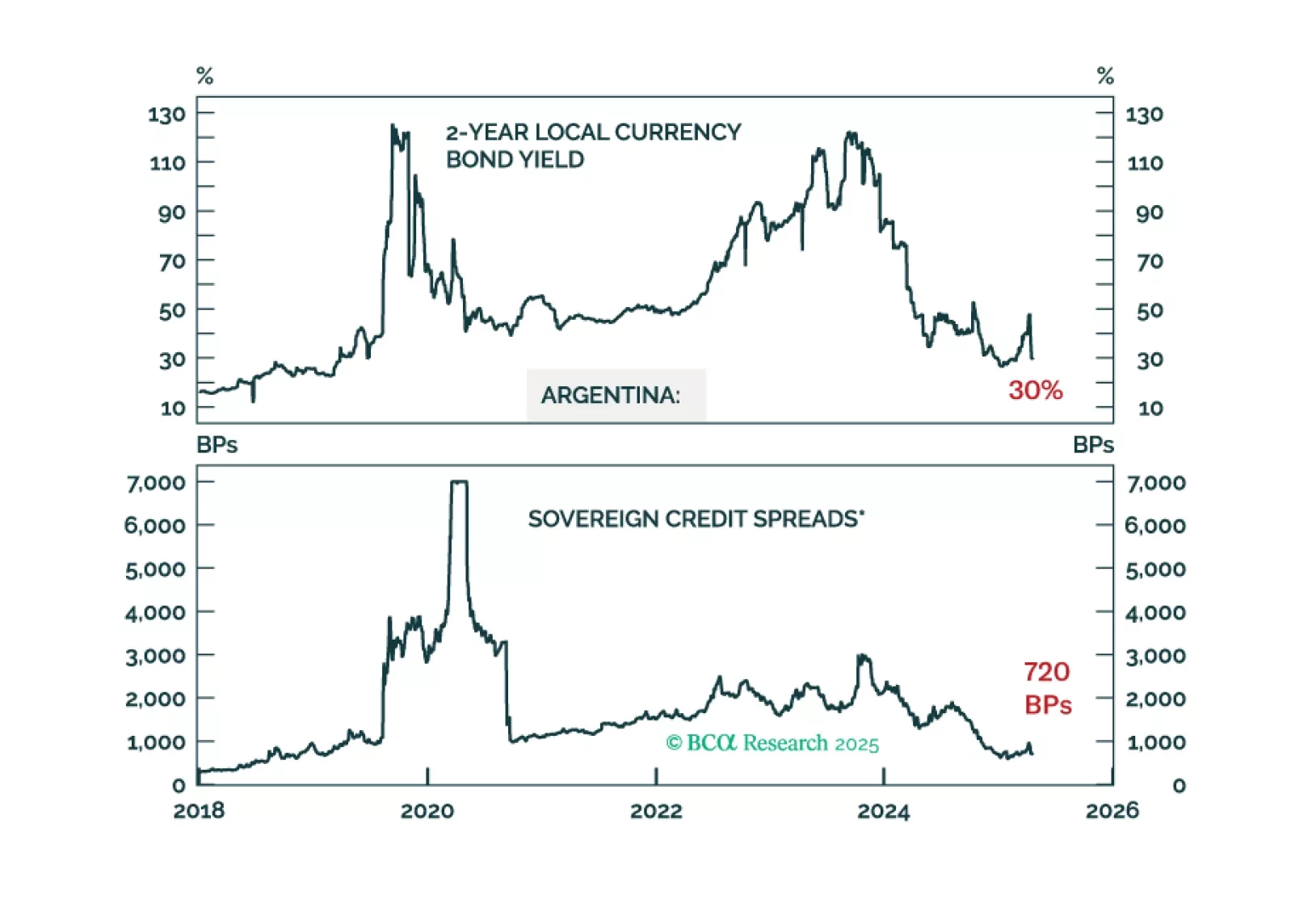

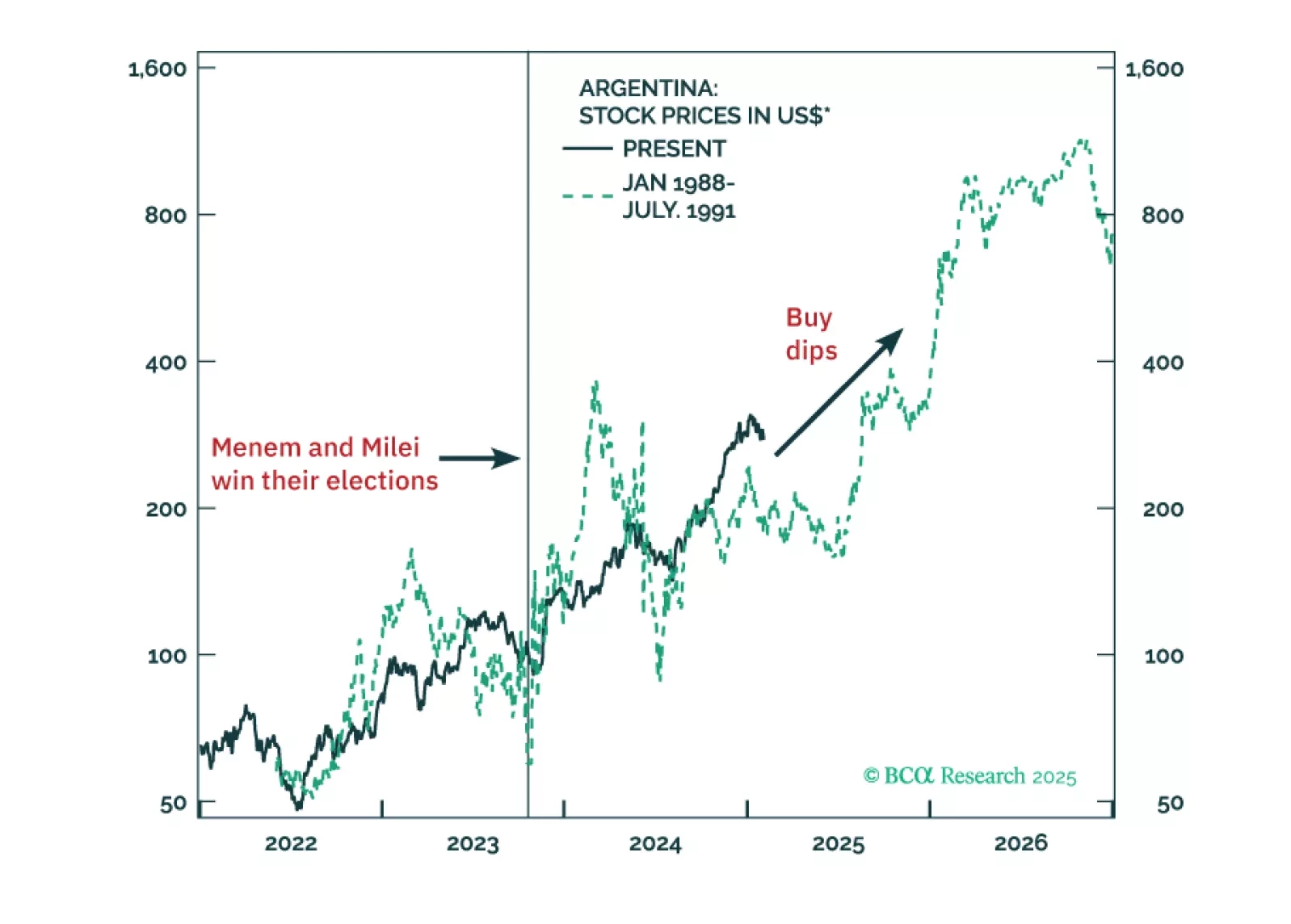

Amid the storm of global financial uncertainty, Argentina stands out as a free-market safe haven. The lifting of currency controls was the last step taken by this country to embrace market mechanisms. We recommend that investors buy…

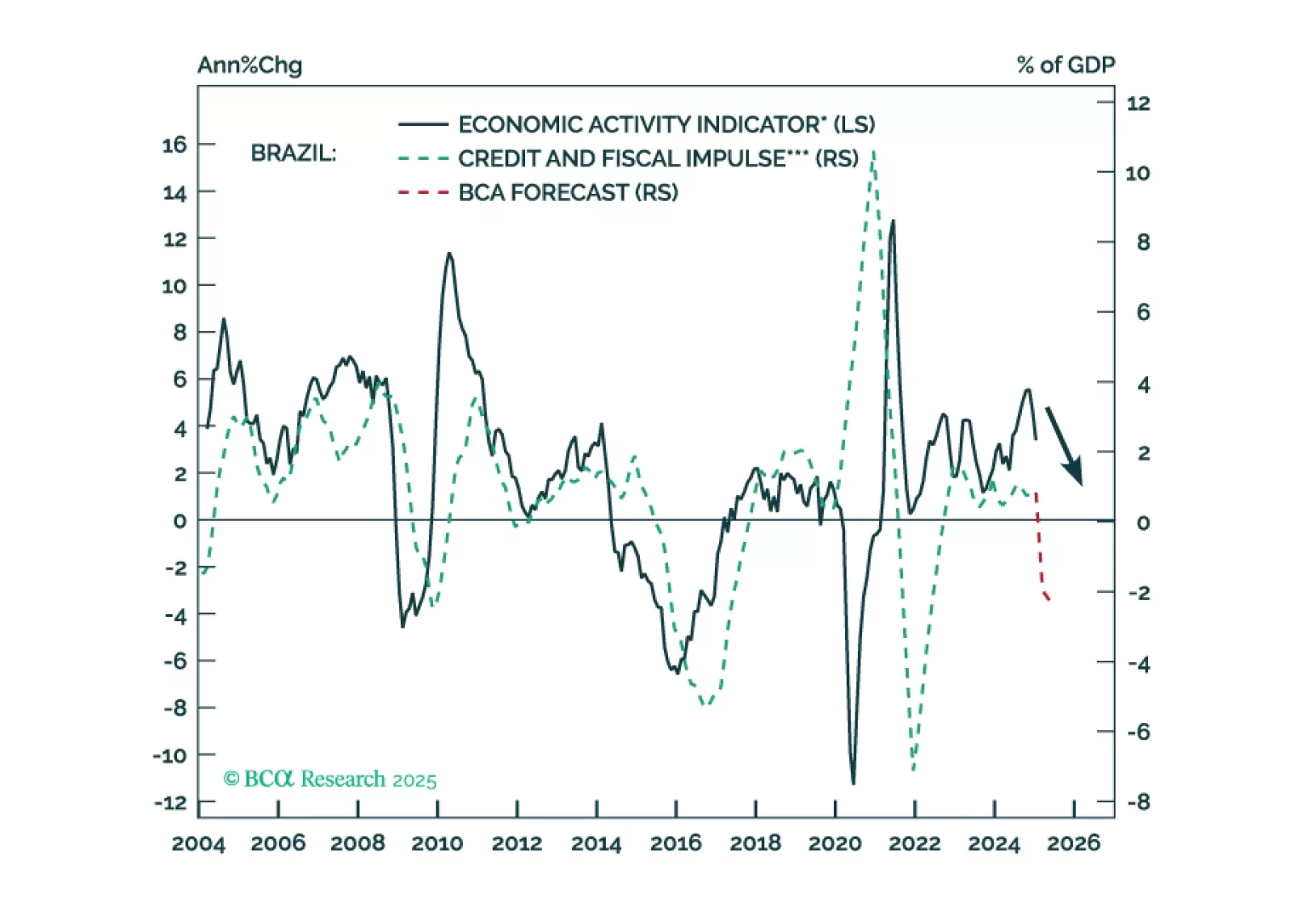

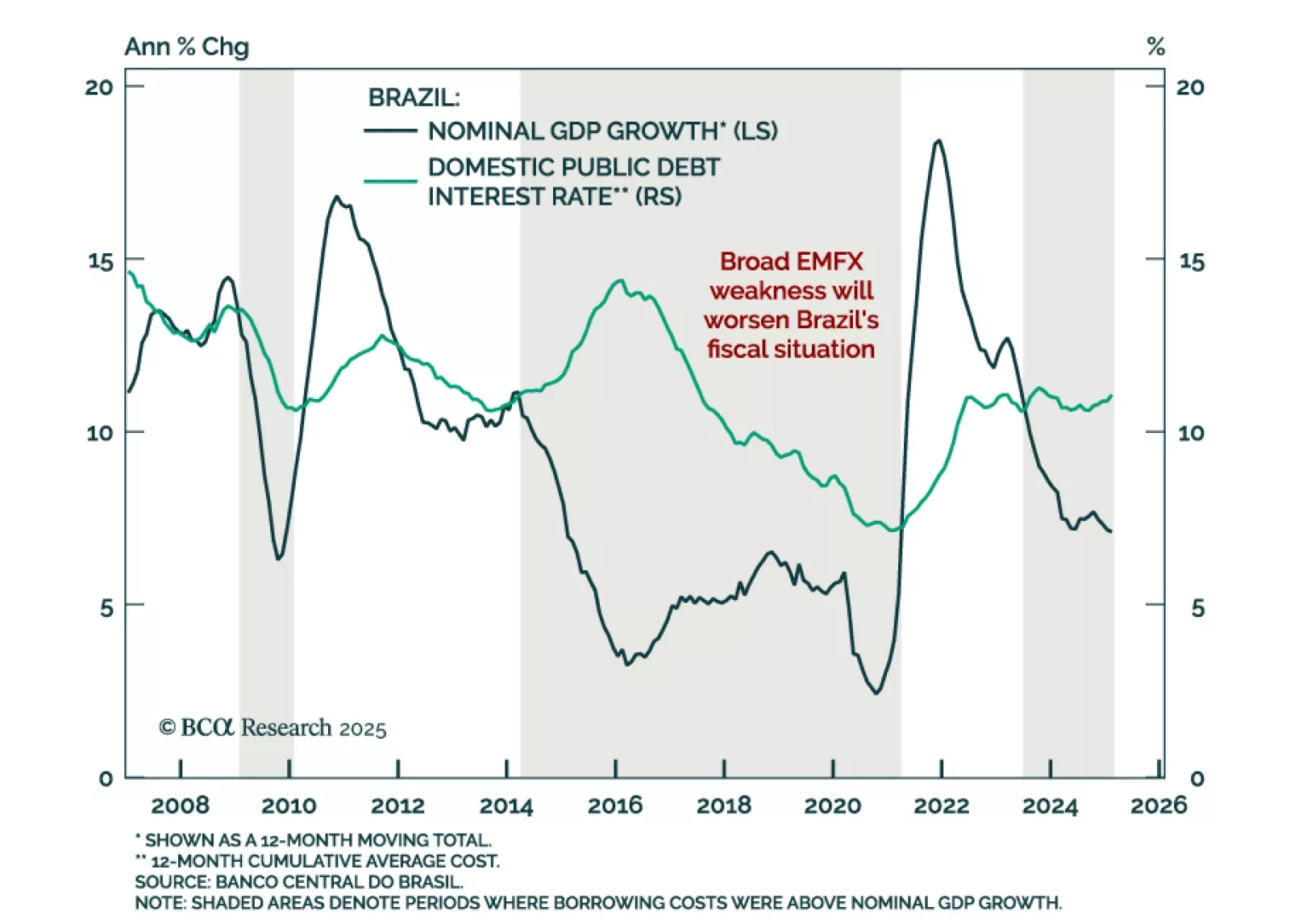

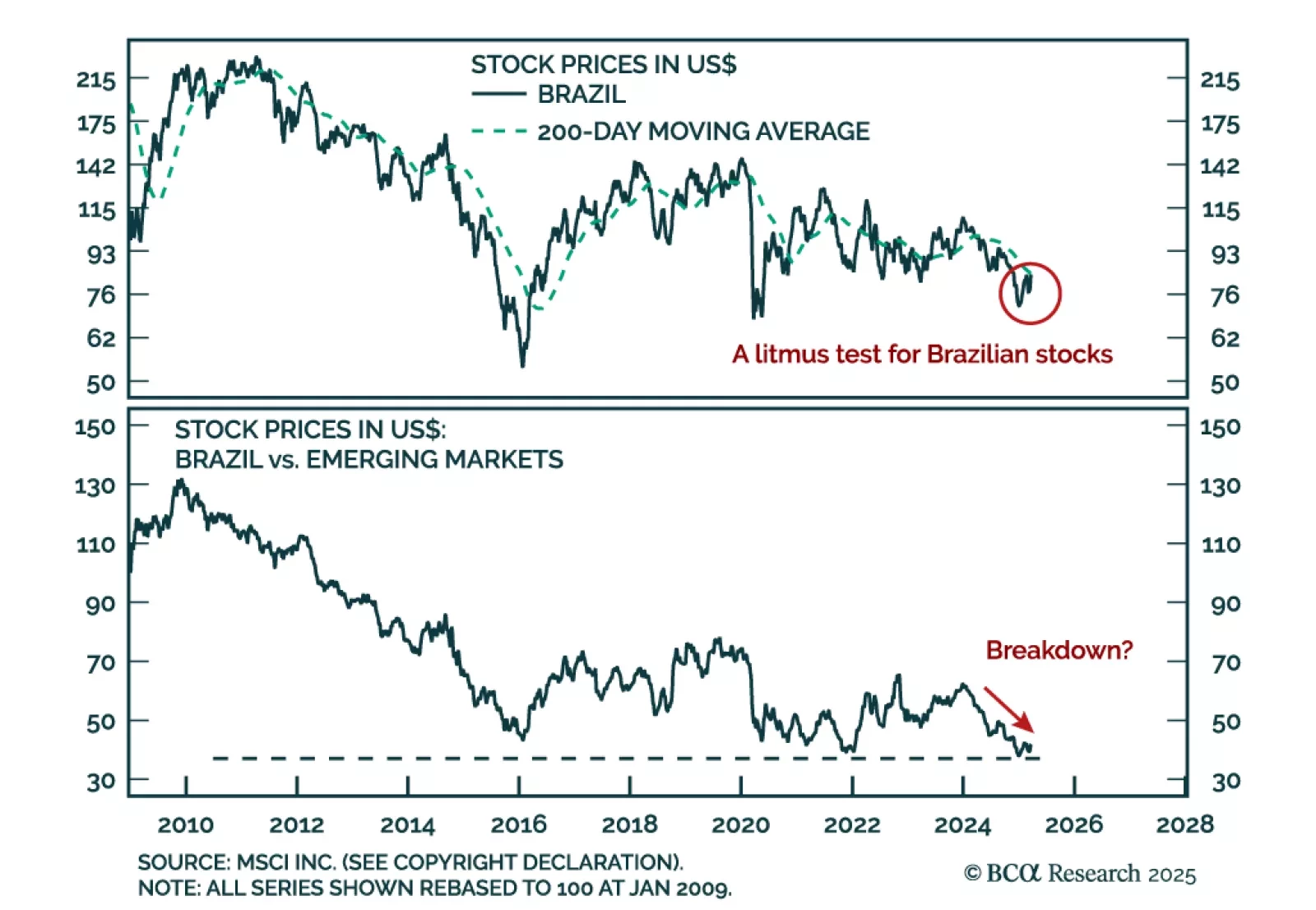

Brazil’s deteriorating fiscal dynamics and rising stagflation risks reinforce our negative stance on Brazilian assets, both outright and relative to EM peers. The latest global financial turmoil, combined with President Trump’s…

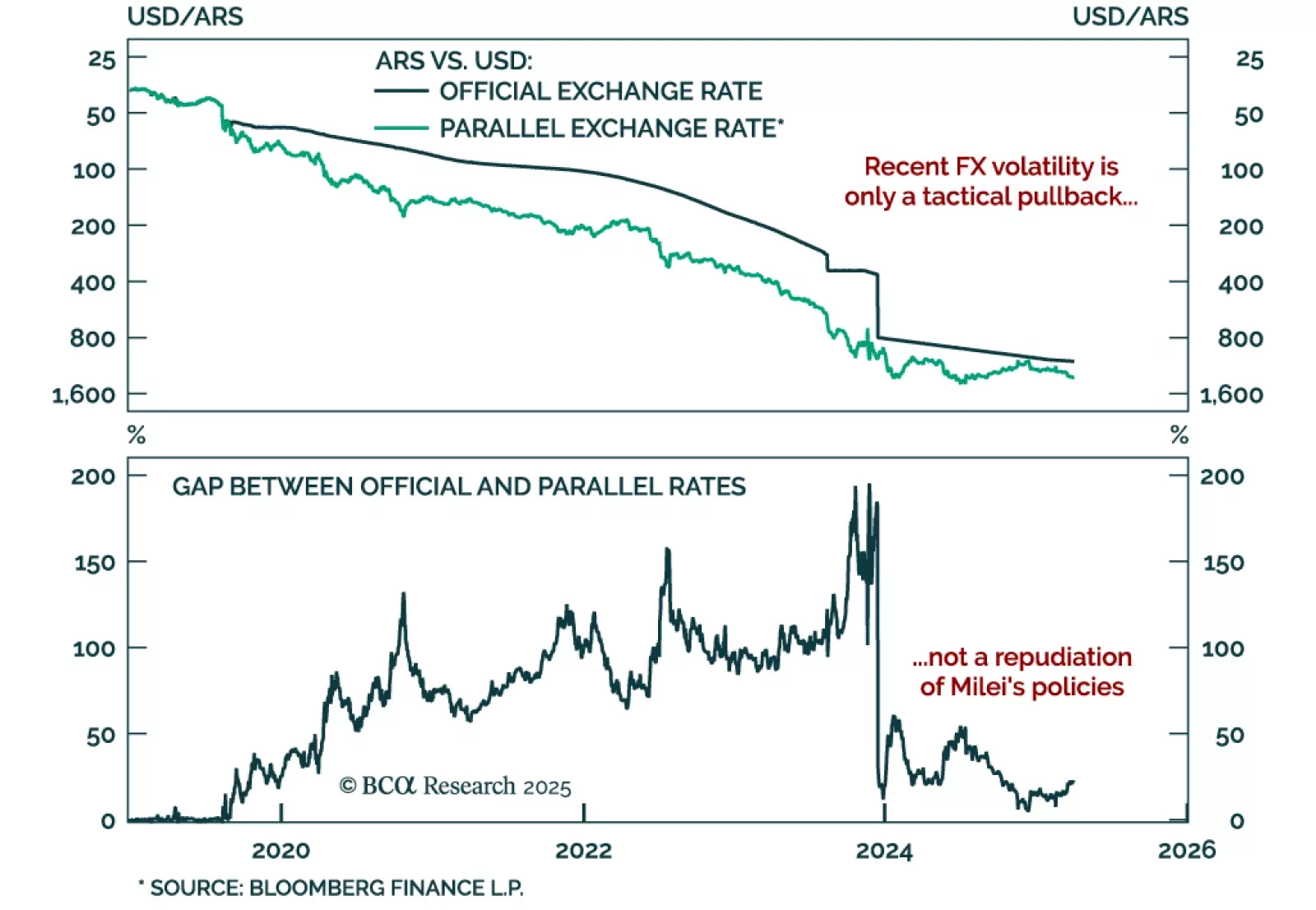

Remain constructive on Argentine assets as recent market moves are a tactical pullback, not a loss of confidence. The gap between official and parallel exchange rates has widened, prompting concerns that markets are questioning…

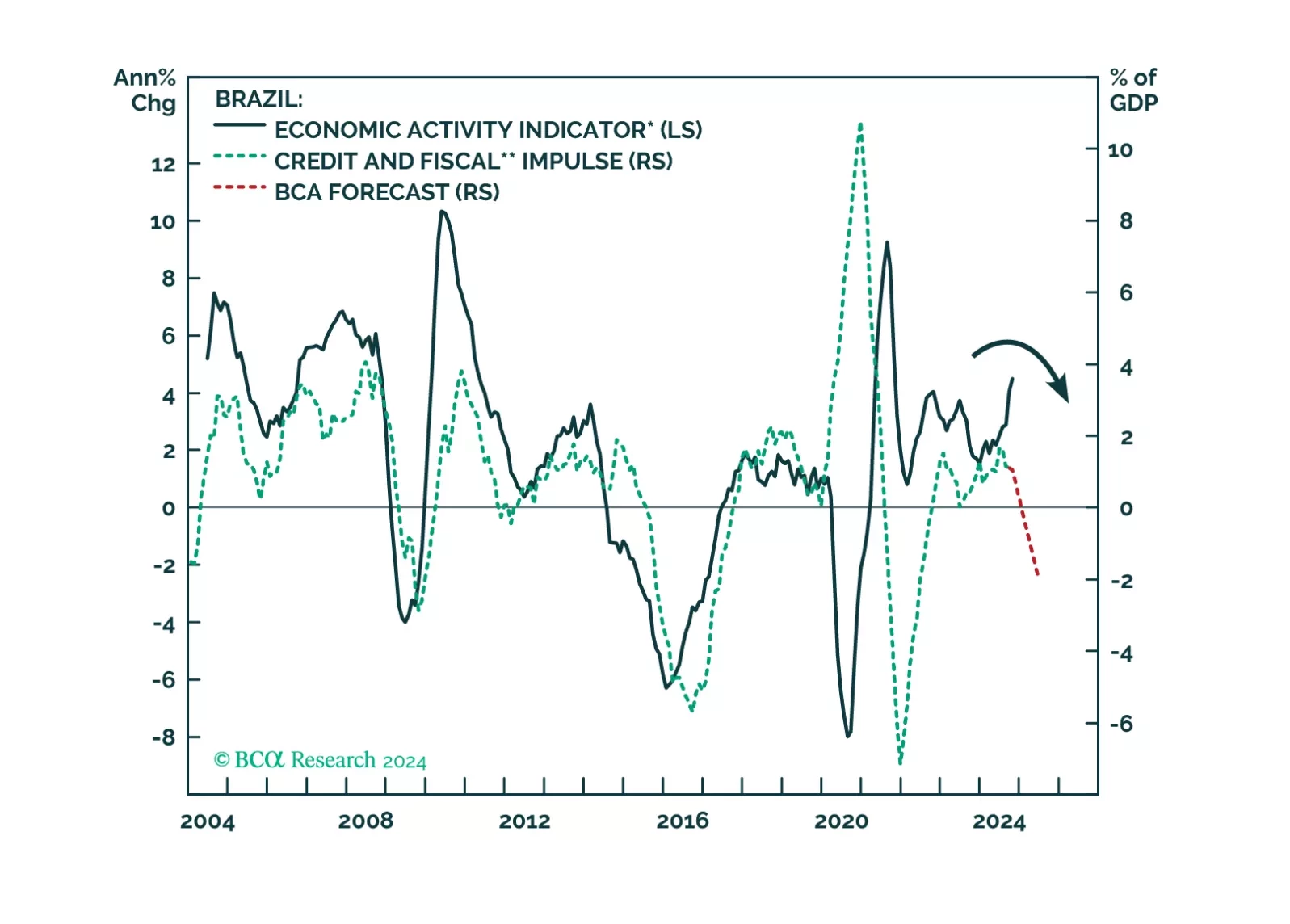

Our Emerging Market strategists downgraded Brazilian equities as public debt dynamics deteriorate and macro fundamentals weaken. While they previously maintained a neutral stance despite being bearish on the Bovespa, the risks have…

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…

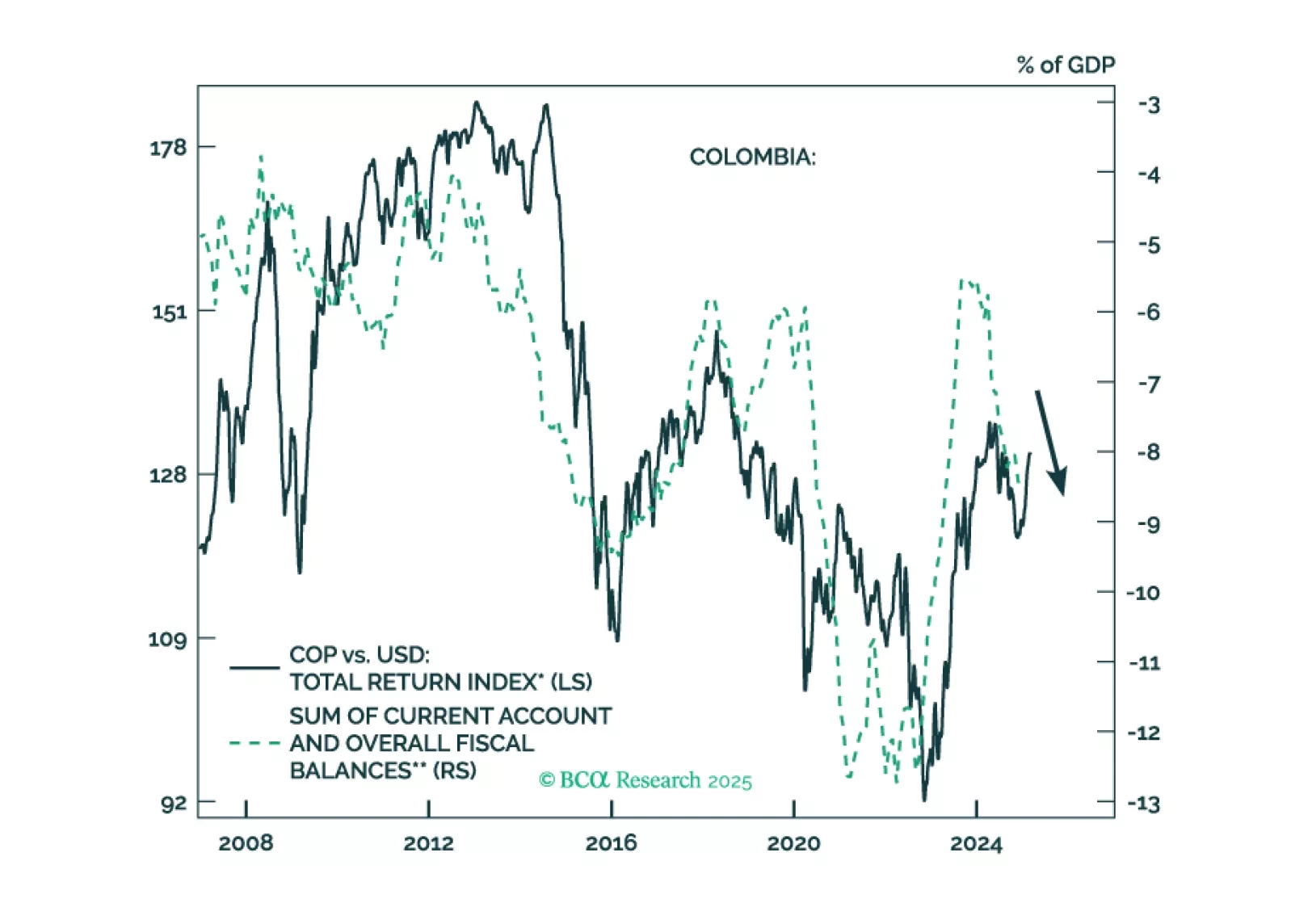

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

Any additional fiscal tightening and further rate hikes might serve as a band-aid, but not a cure, to Brazilian markets. The country’s risk assets and the currency will continue to face headwinds from an impending recession, a…