This week I have been holding client calls and roundtables with clients located in the EMEA region. In next week’s report we will share our answers to the most common client questions. In the meantime, this week we are sending you a…

Highlights US crude oil output will continue its sharp recovery before leveling off by mid-2022, in our latest forecast (Chart of the Week). The recovery in US production is led by higher Permian shale-oil production, which is quietly…

Highlights Going into the new crop year, we expect the course of the broad trade-weighted USD to dictate the path taken by grain and bean prices (Chart of the Week). Higher corn stocks in the coming crop year, flat wheat stocks and…

Highlights The rapid spread of the COVID-19 delta variant in Asia will re-focus precious metals markets anew on the possibility of another round of lockdowns and the implications for demand, particularly in Greater China and India,…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

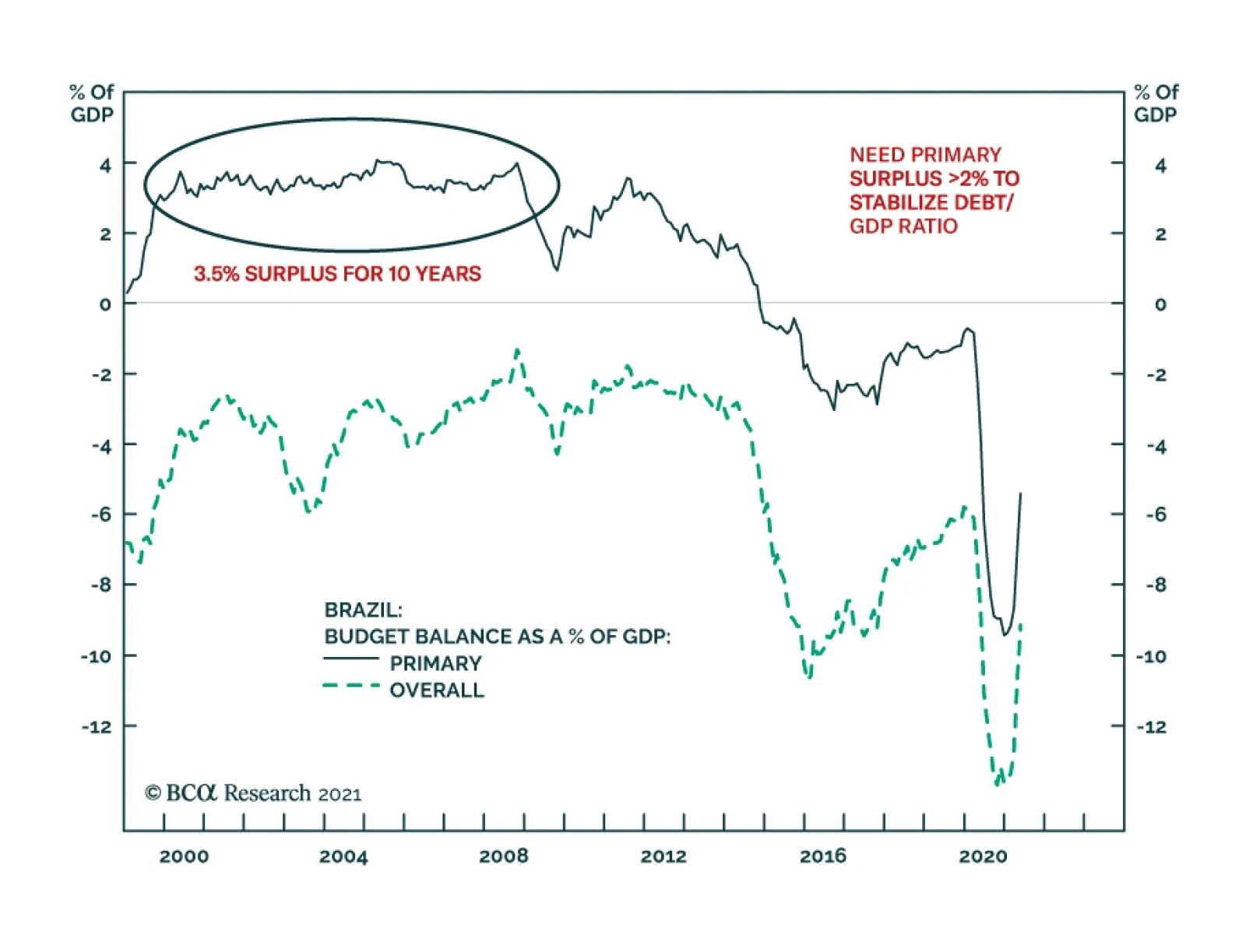

One of the structural challenges Brazil faces is its public debt overhang. The authorities have responded by periodically embarking on fiscal and monetary austerity. Yet, such austerity depresses nominal growth and has in fact…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

Please note: There will be no Strategy Report next week, July 15. Our next publication will be a Thematic: Charts That Matter, on July 22. Highlights For any country with local currency public debt, the ultimate constraints to lower…

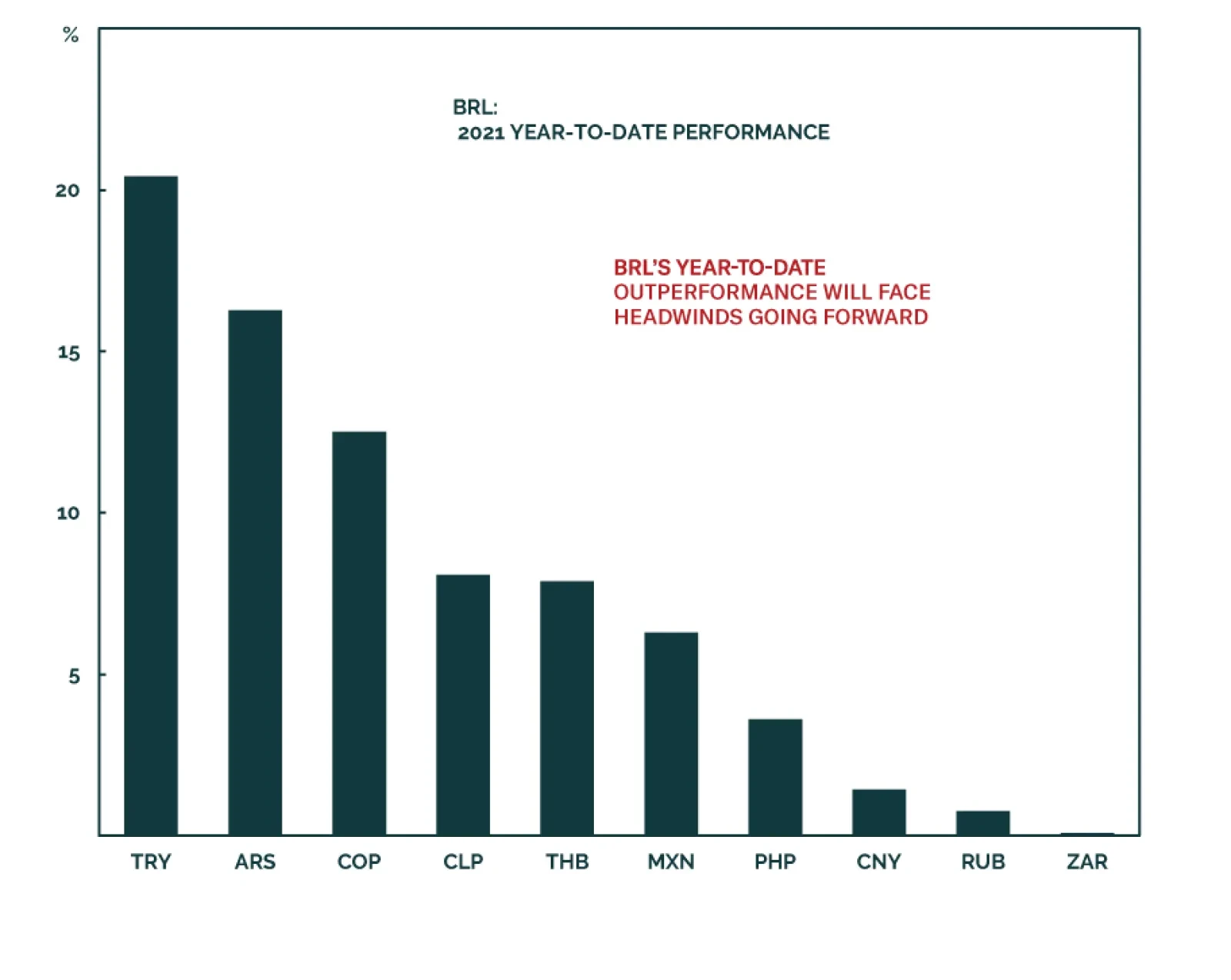

The Brazilian real was up 1.4% versus the dollar on Thursday – a day of broad dollar strength. The gain comes on the back of the Central Bank of Brazil’s decision to hike rates by 75 bps for the third consecutive time…