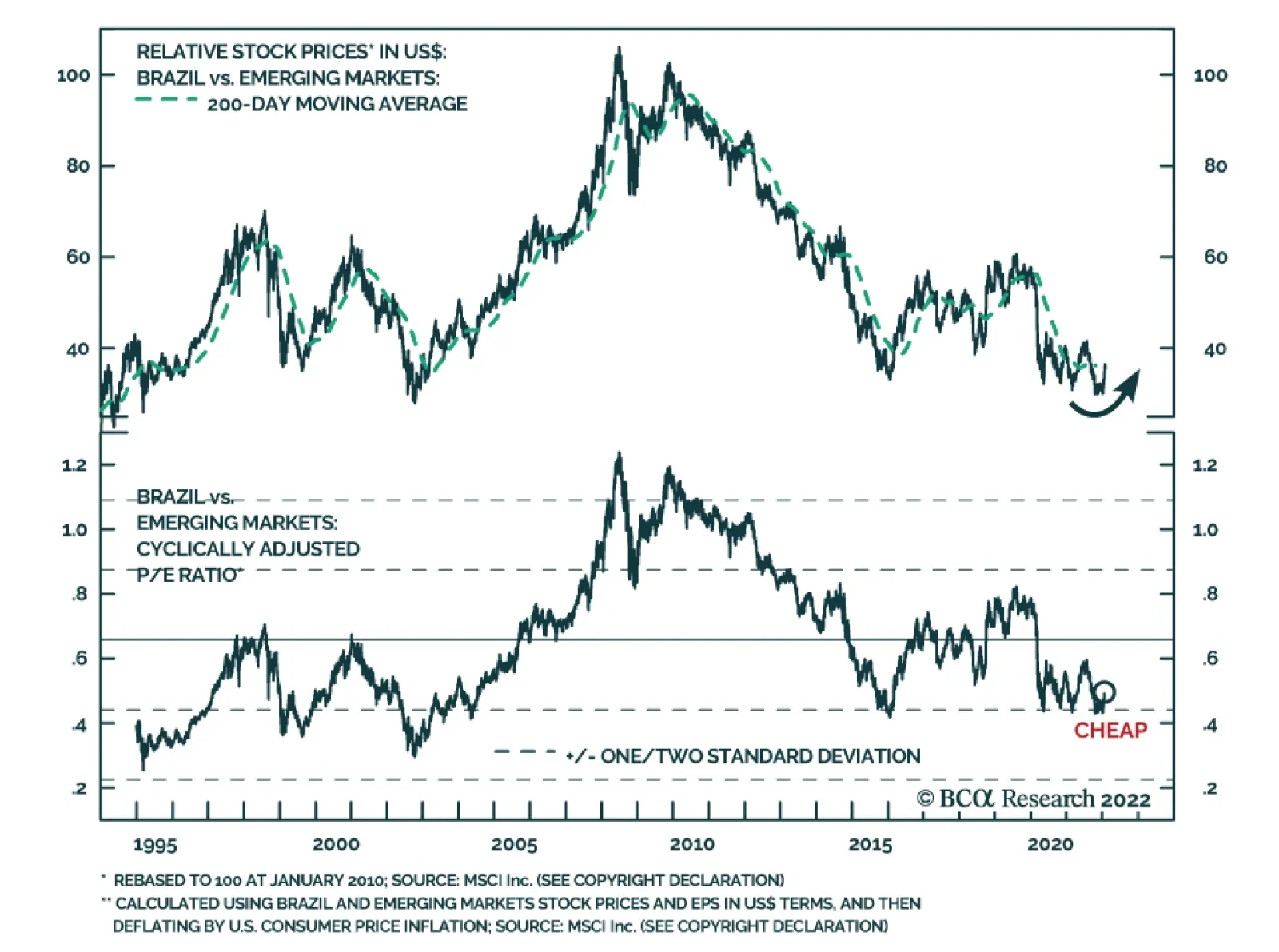

Brazilian risk assets have started the year on a positive note. After falling 23.5% in 2021 – and underperforming emerging market and global equities by 18.9% and 40.3%, respectively – Brazilian equities are up 14.3%…

Executive Summary Upgrading Brazil Within An EM Equity Portfolio Brazilian risk assets are cheap and will get a positive impetus from the rising odds of ex-president Lula winning this year's election. As we have…

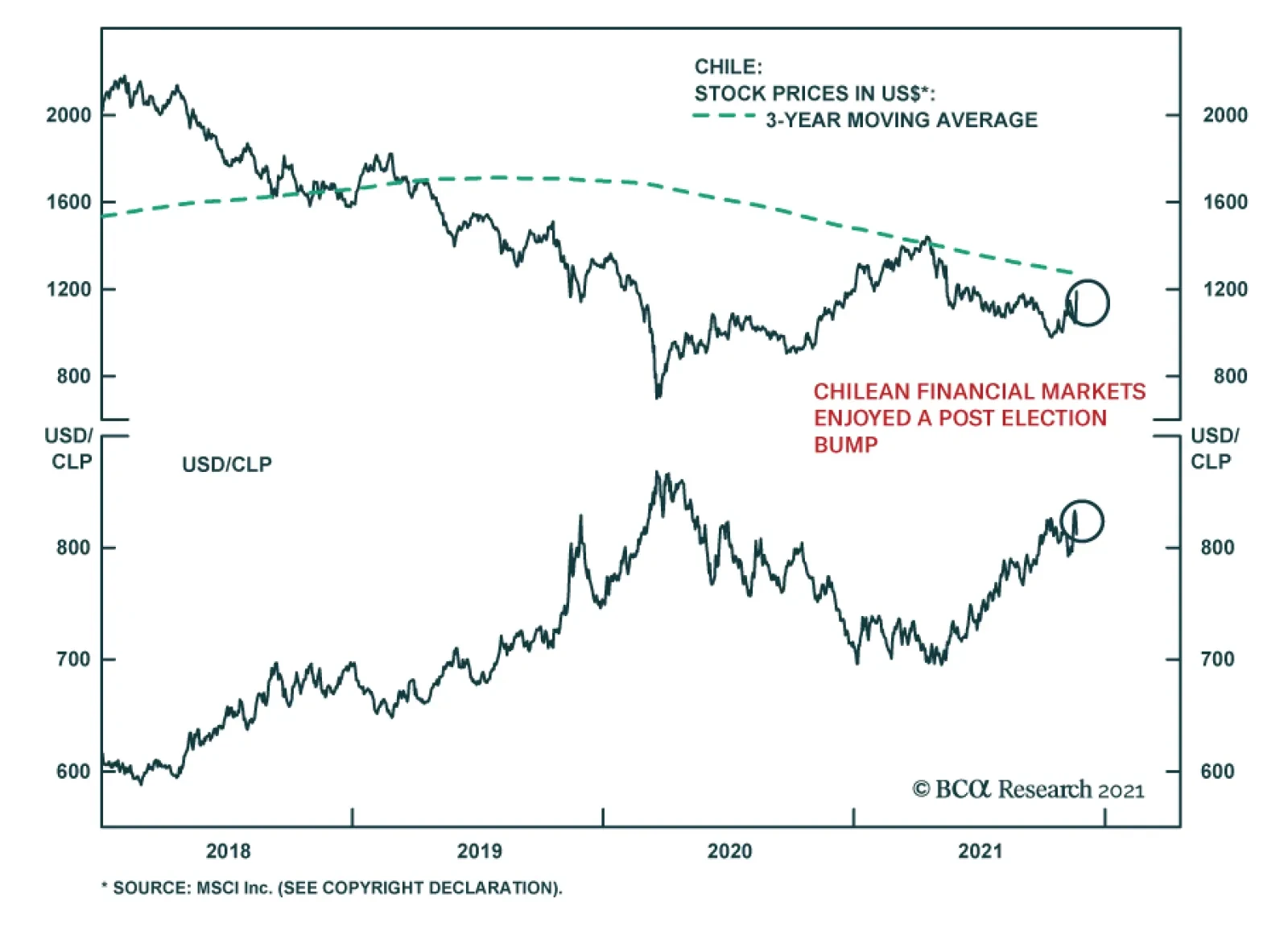

Highlights Odds favor left-wing candidate Gabriel Boric to win the second round of this weekend’s presidential elections. If this scenario takes place, Chilean equities and the currency will sell off considerably. Nevertheless…

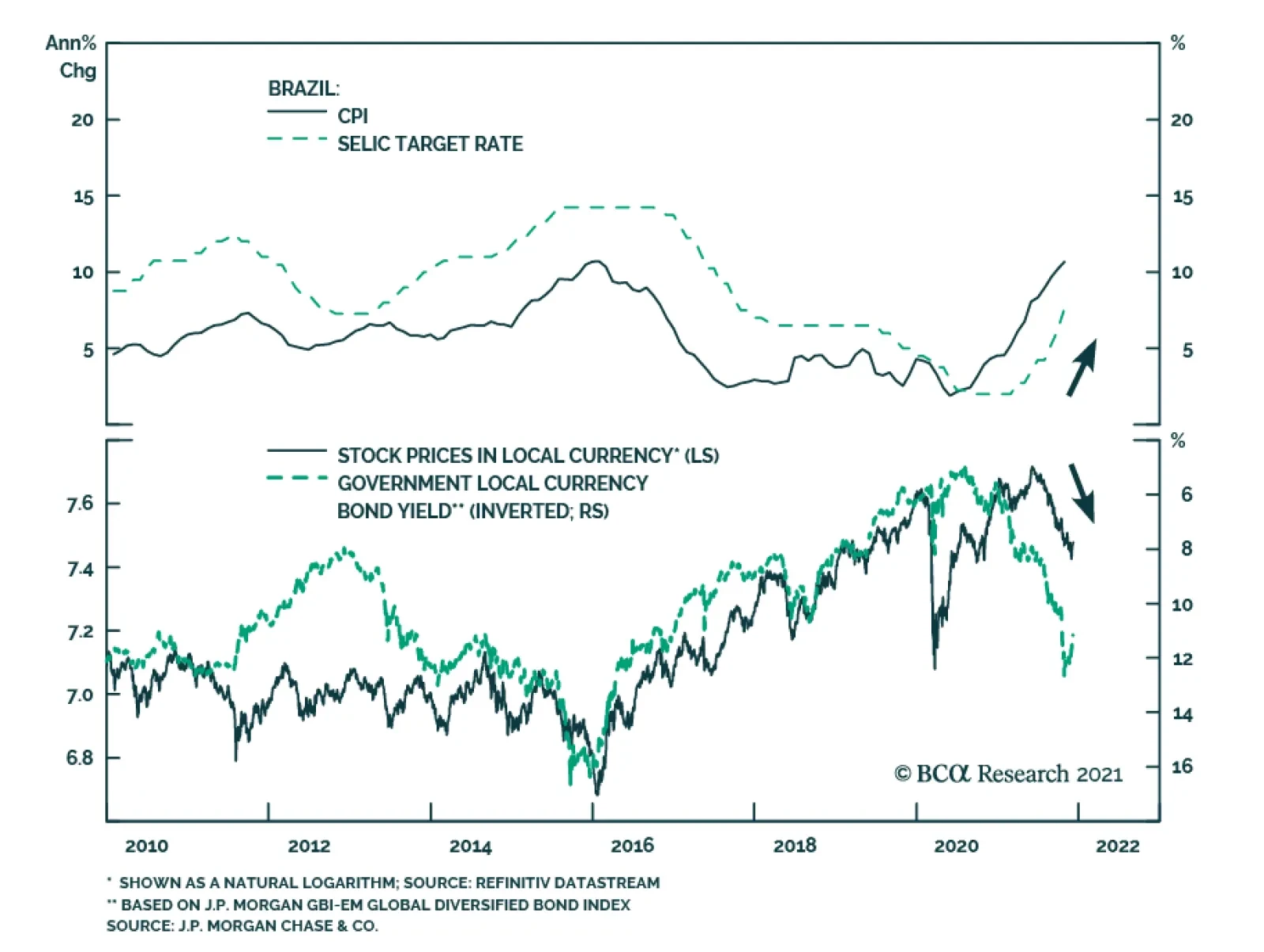

As expected, Brazil’s Central Bank lifted the benchmark Selic rate by 150 bps to 9.25% on Wednesday. This move brings the total increase since the beginning of the year to 725 bps. Policymakers also signaled that another…

Dear Client, Next week, we will be sending you BCA Research’s Annual Outlook, featuring long-time BCA client Mr. X, who visits towards the end of each year to discuss the economic, financial and commodity market outlook for the…

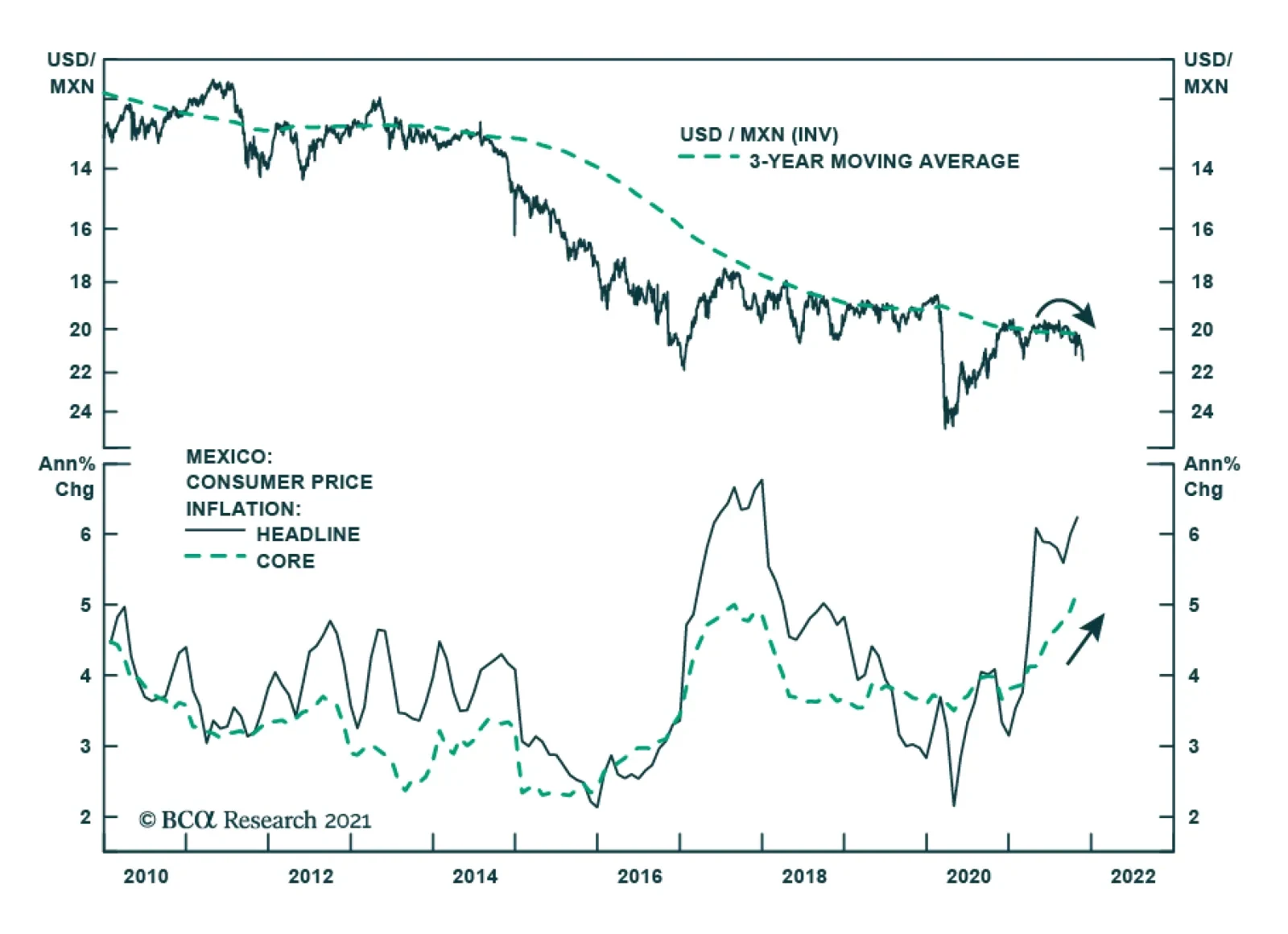

The Mexican peso has weakened sharply vis-à-vis the USD over the past three weeks, dropping to its lowest level since early March. It was the second worst performing emerging market currency on Wednesday, falling nearly 1…

Chilean financial markets rallied following the first round of the presidential elections which ended in favor of conservative candidate José Antonio Kast. Kast secured 27.9% of the votes and came in slightly ahead of his…

Highlights Remain neutral on the US dollar. A breakout of the dollar would cause a shift in strategy. Russia’s conflict with the West is heating up now that Germany has delayed the certification of the Nord Stream II pipeline.…

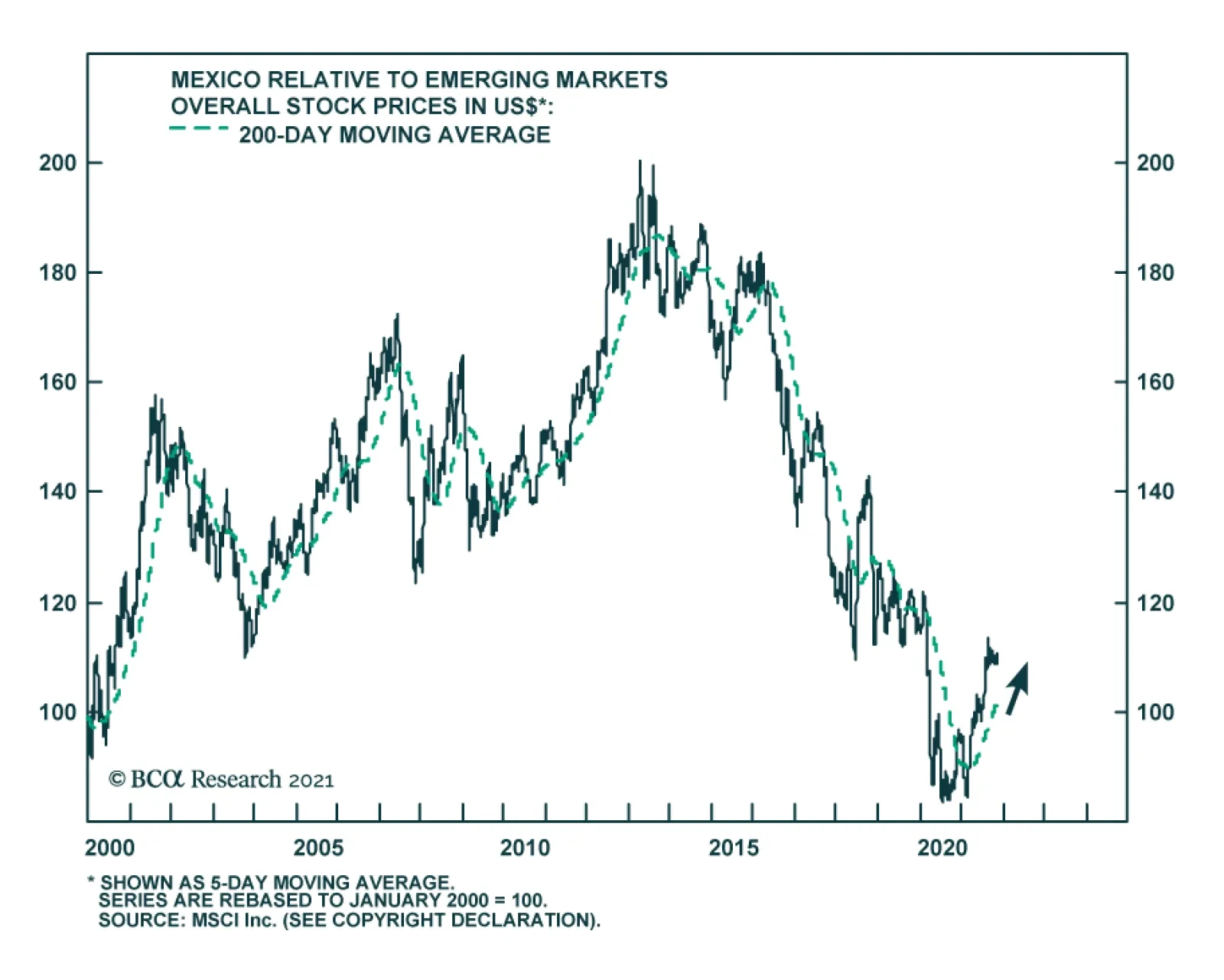

Highlights Mexico has been experiencing stagflation: core inflation has risen sharply while the level of domestic demand in real terms is well below its pre-pandemic level. Going forward, tight fiscal and monetary policies will put a…

The Bank of Mexico raised rates by 25 bps on Thursday, marking the fourth consecutive rate increase this year and bringing the benchmark rate to 5%. These hikes come as the central bank attempts to temper rising inflation. At 6.…