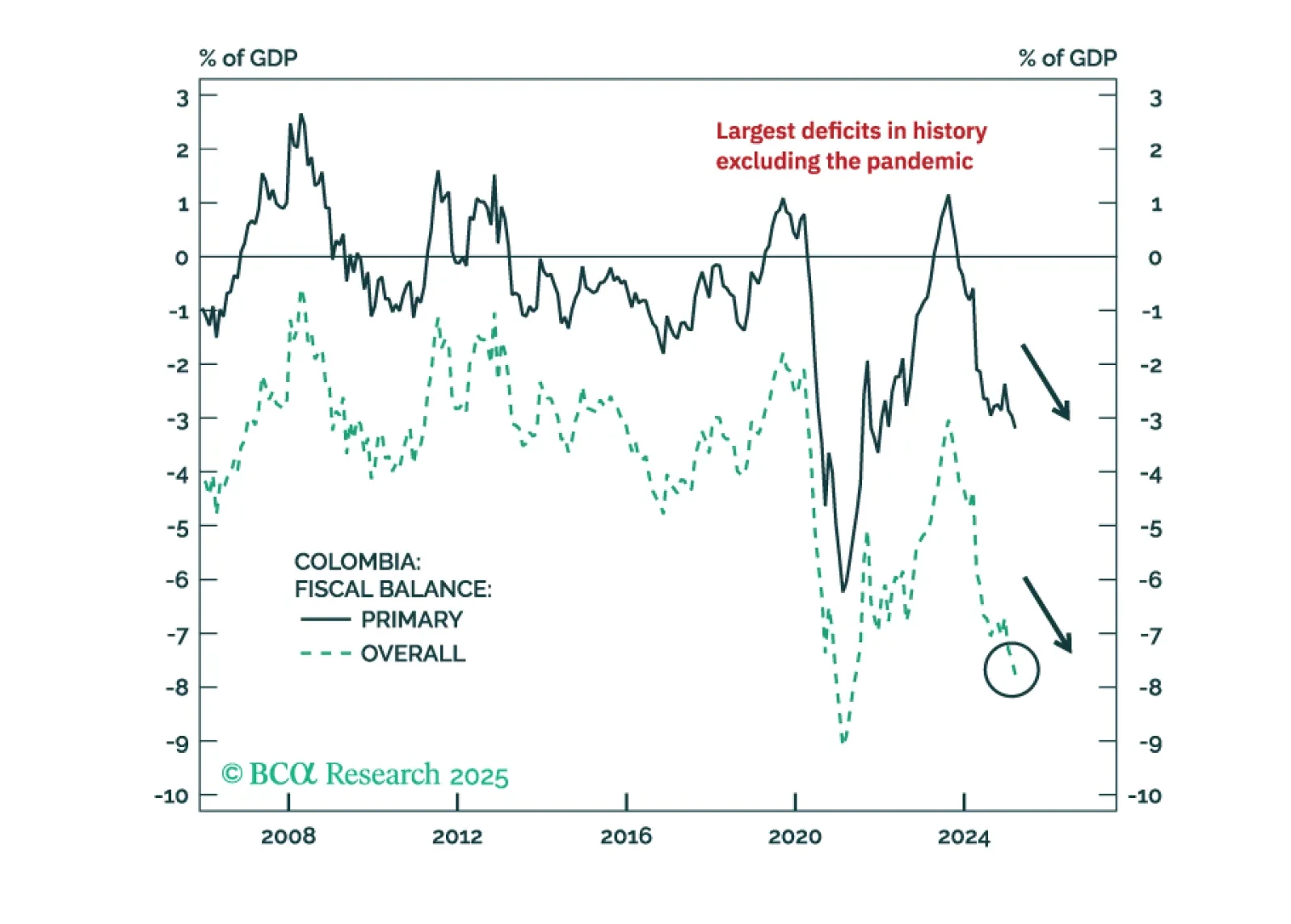

Colombian markets will be torn between expectations of future orthodox policies and the reality of a worsening macro backdrop in the next 12 months. To balance risks, we are upgrading Colombian equities, local bonds, and sovereign…

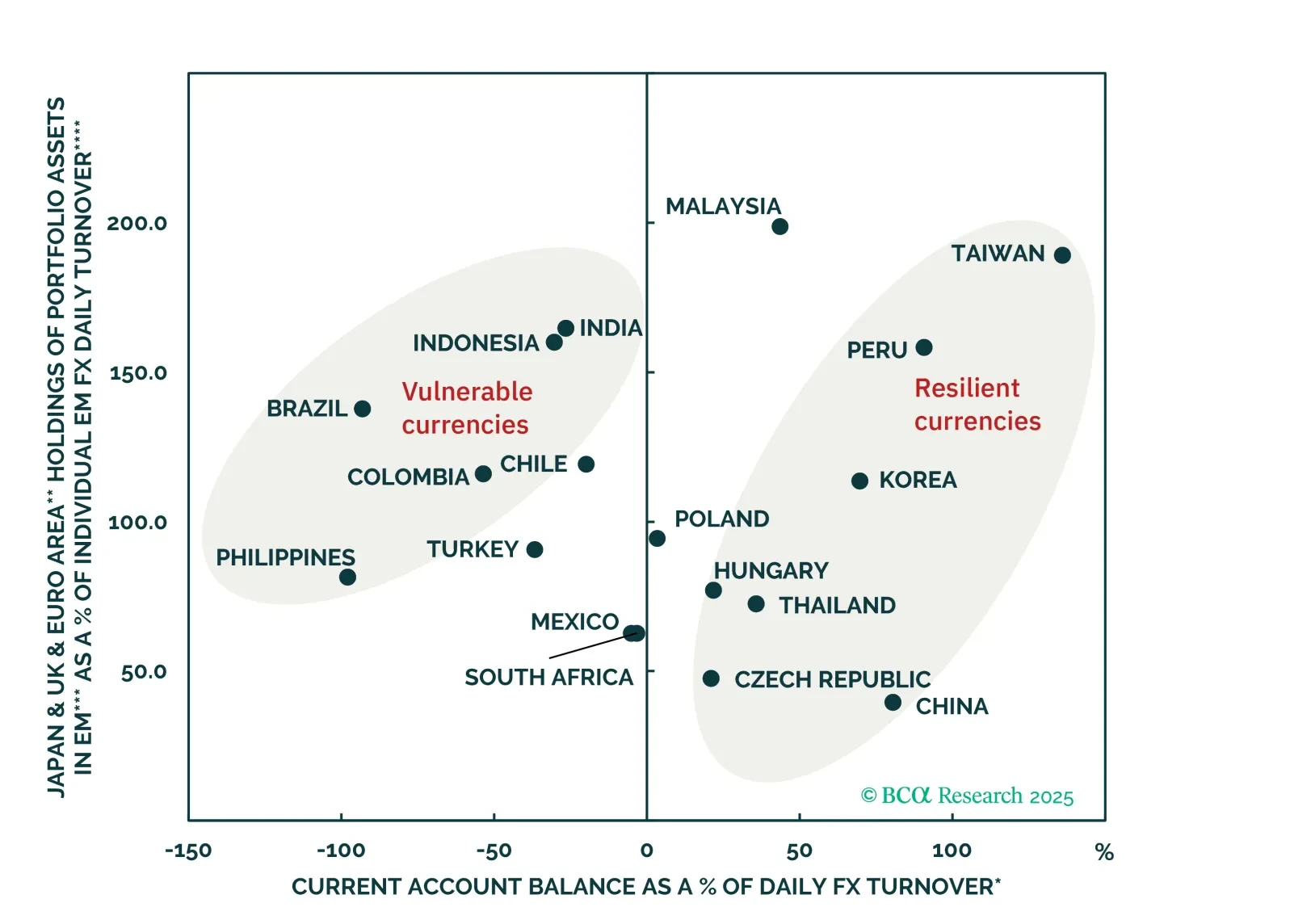

Despite widespread investor optimism Brazil’s currency outlook is challenged by a toxic mix of poor external, fiscal, and macro fundamentals. Expect BRL to underperform most EM peers.

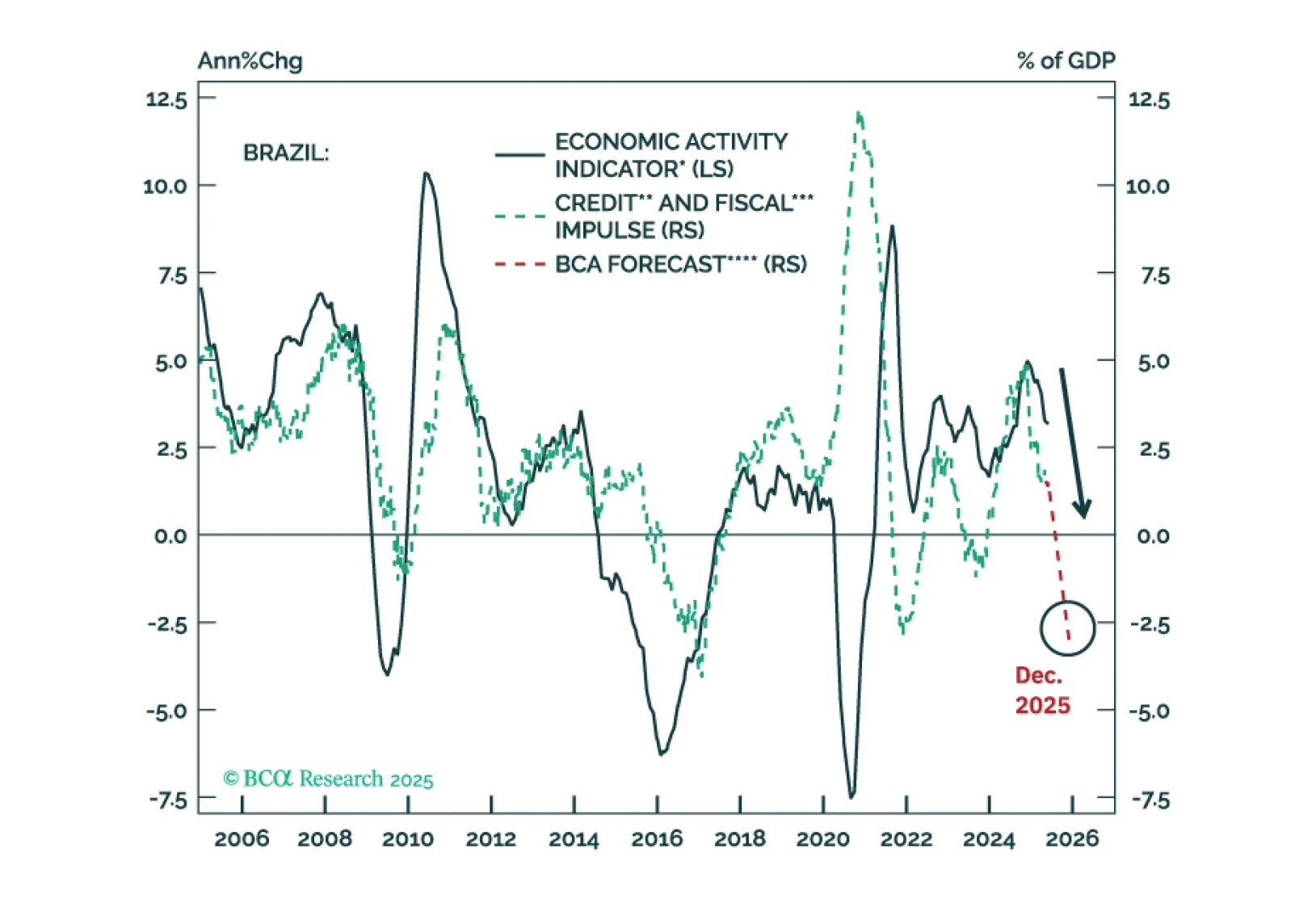

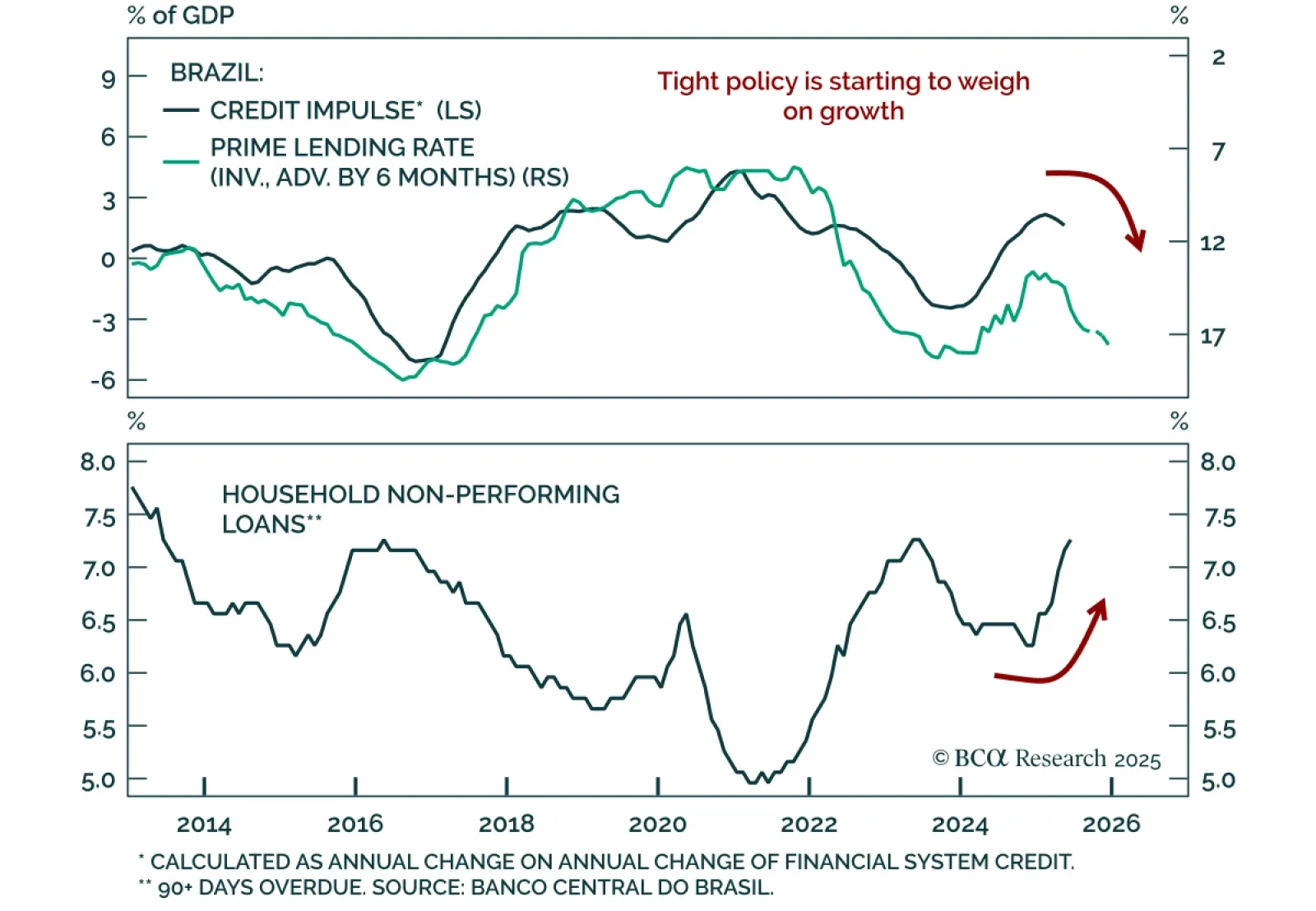

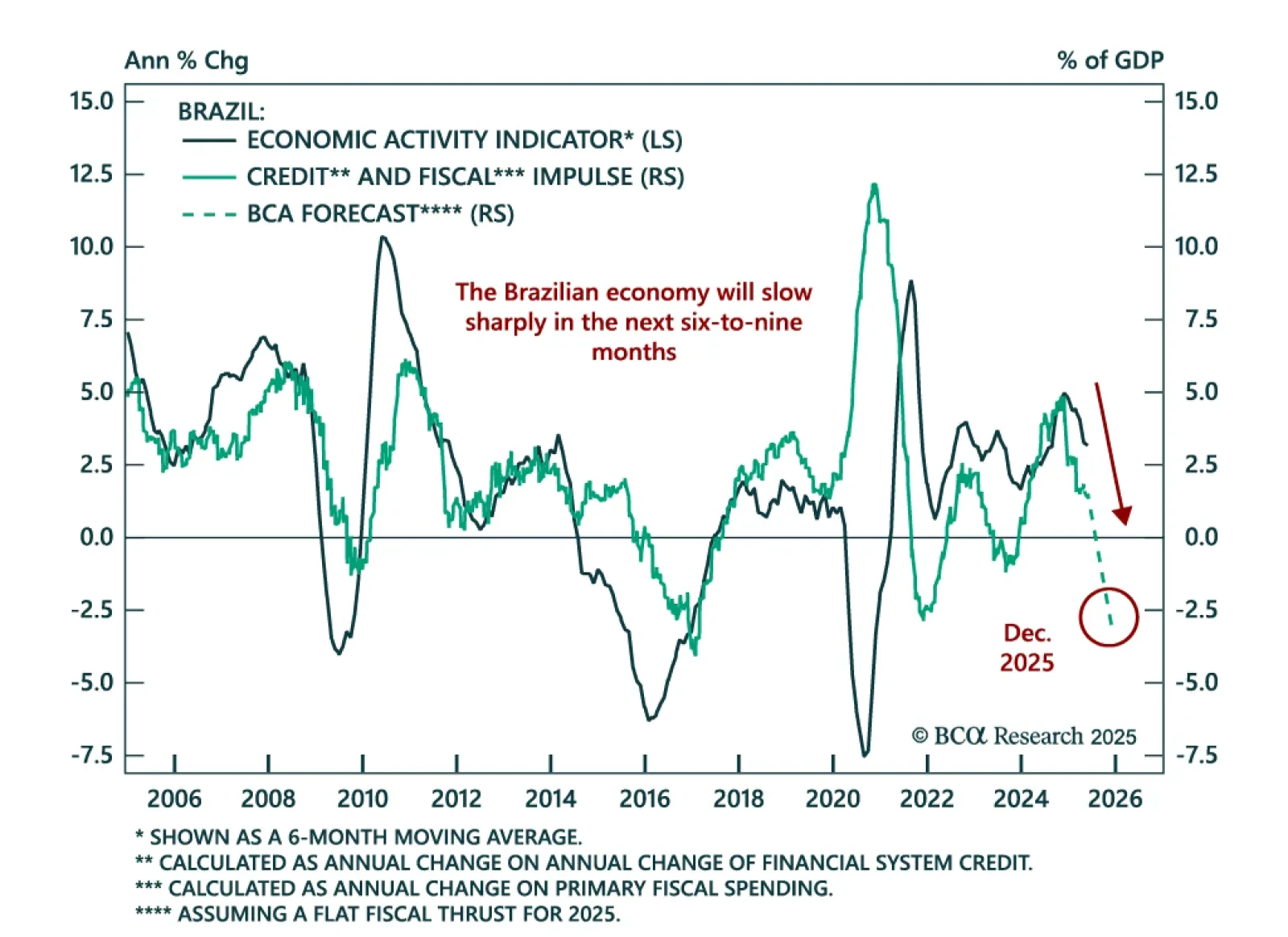

The Central Bank of Brazil (BCB) held rates at 15%, guaranteeing a sharp growth slowdown and reinforcing our underweight stance on Brazilian equities versus EM. All Copom board members voted to maintain an ultra-hawkish policy…

BCA’s Emerging Markets strategists continue to underweight Brazilian equities, local bonds, and sovereign credit, and initiated a receiver position in 2-year swap rates. Brazil’s public debt remains on an unsustainable trajectory,…

A potential right-wing government in 2027 will not stabilize the trajectory of the public debt-to-GDP ratio. Unsustainable public debt, a large current account deficit, and a sharp growth slowdown will lead Brazilian markets to…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

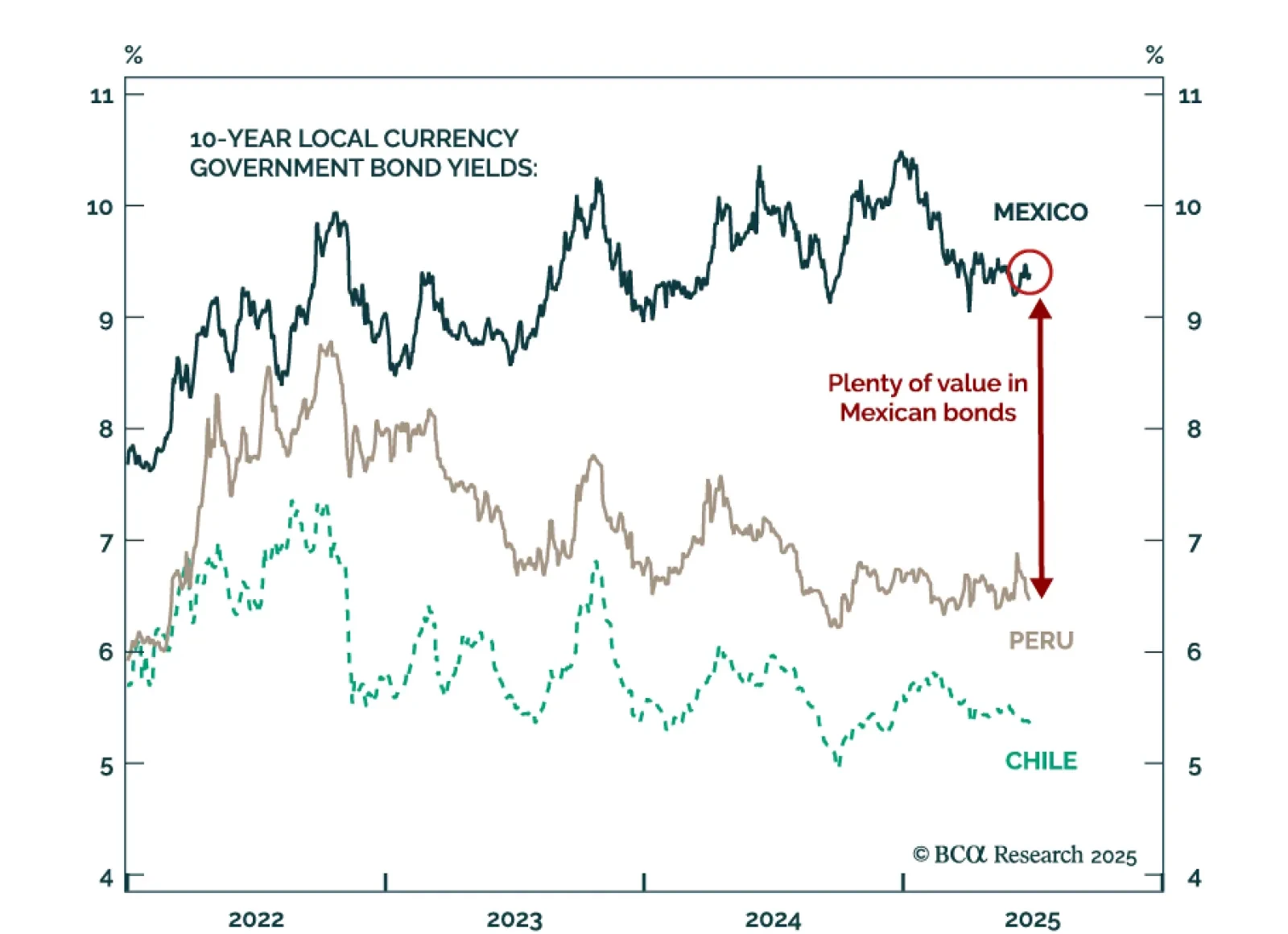

Banxico’s dovish stance reinforces our bullish view on Mexican local currency debt. The Mexican central bank cut interest rates by another 50 basis points to 8%. The central bank will continue easing monetary policy well…

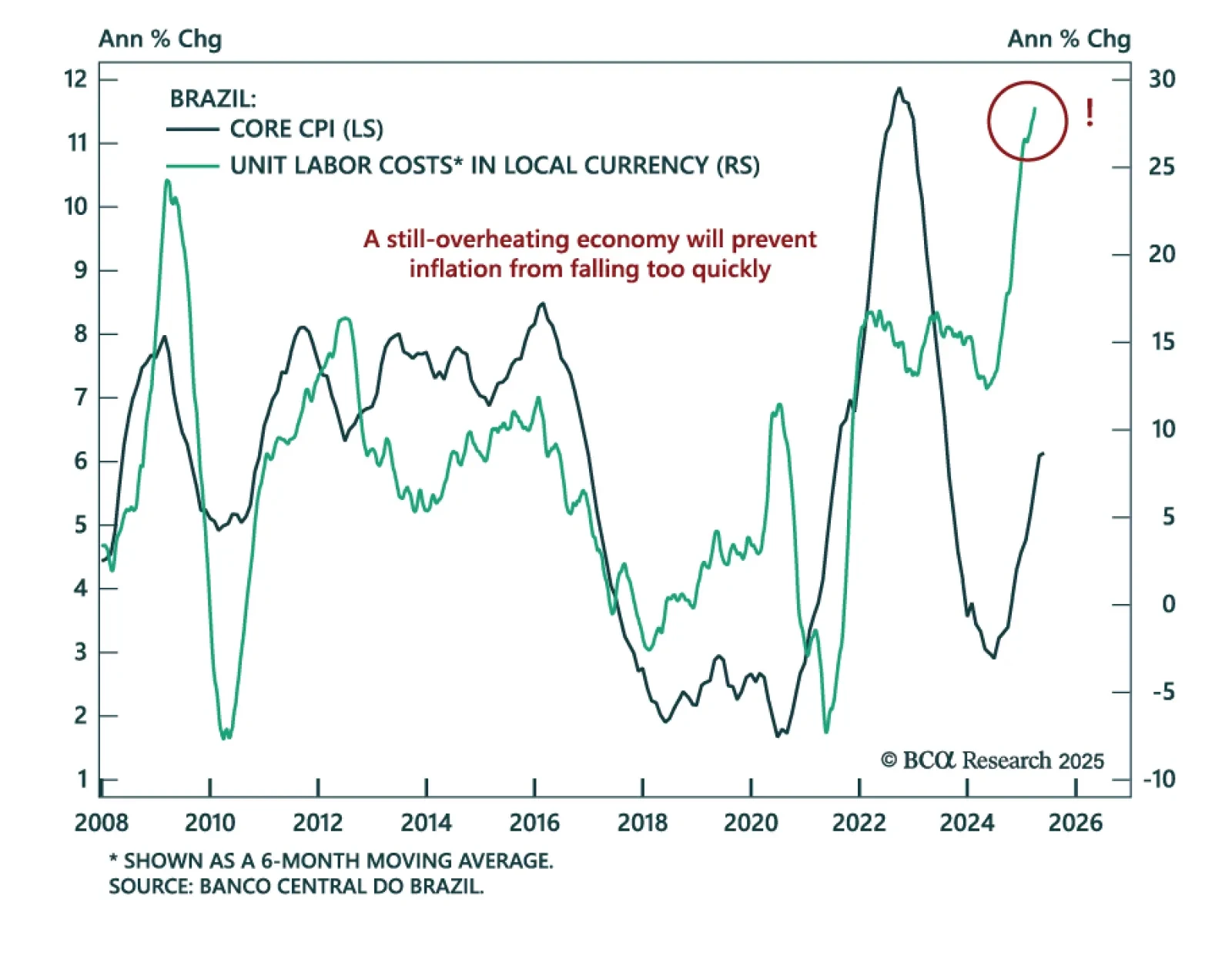

The May Brazilian CPI suggests that price pressures may have reached a peak, but do not expect immediate monetary easing to support fixed income markets. Headline CPI slowed to 5.3% y/y from 5.5% April, but core CPI remained flat at…

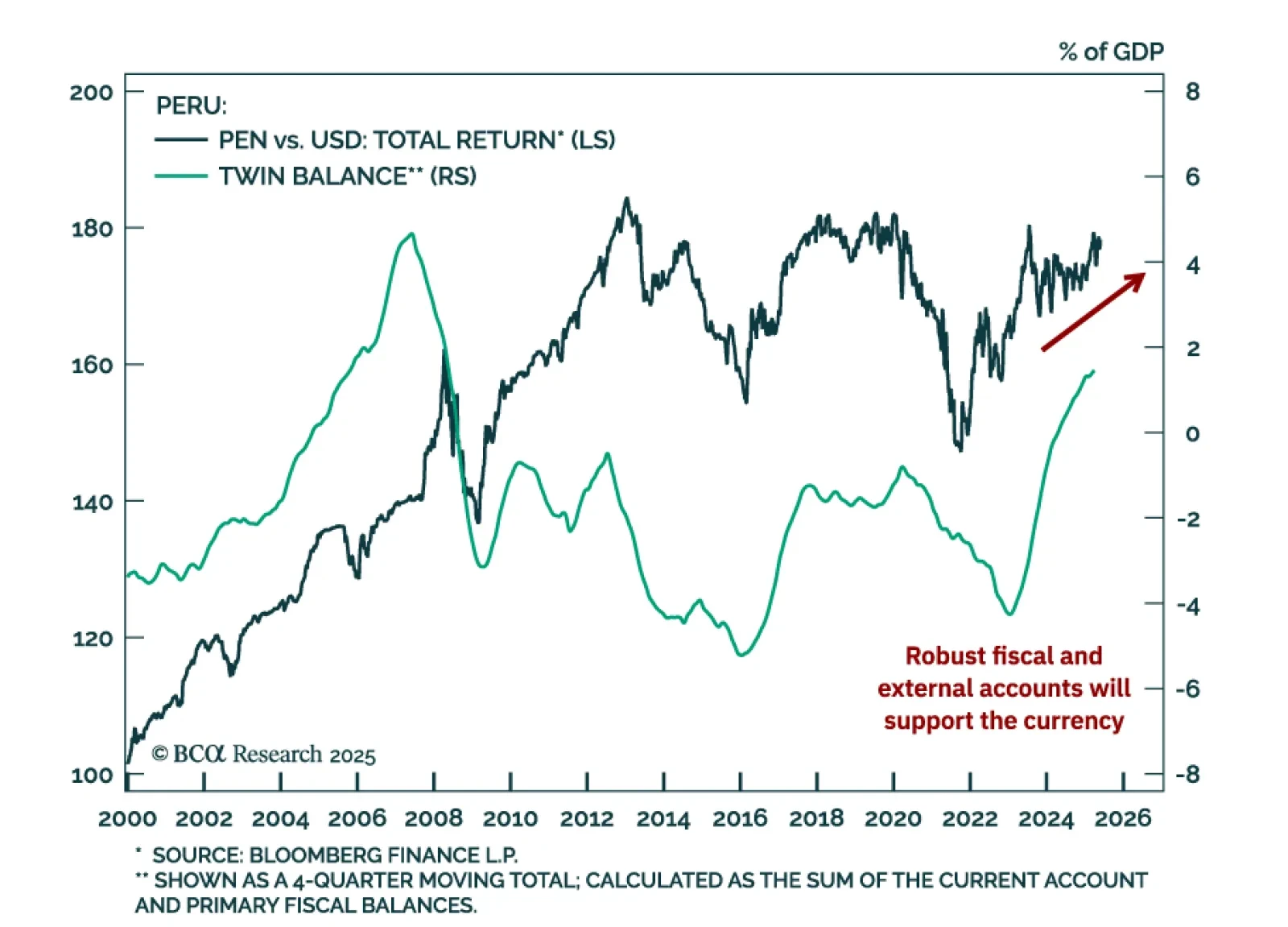

Peru’s economic resilience will help its markets outperform their EM peers. A global growth downturn will weigh on EM assets in absolute terms, but Peruvian markets offer attractive tradeable opportunities. The Andean…

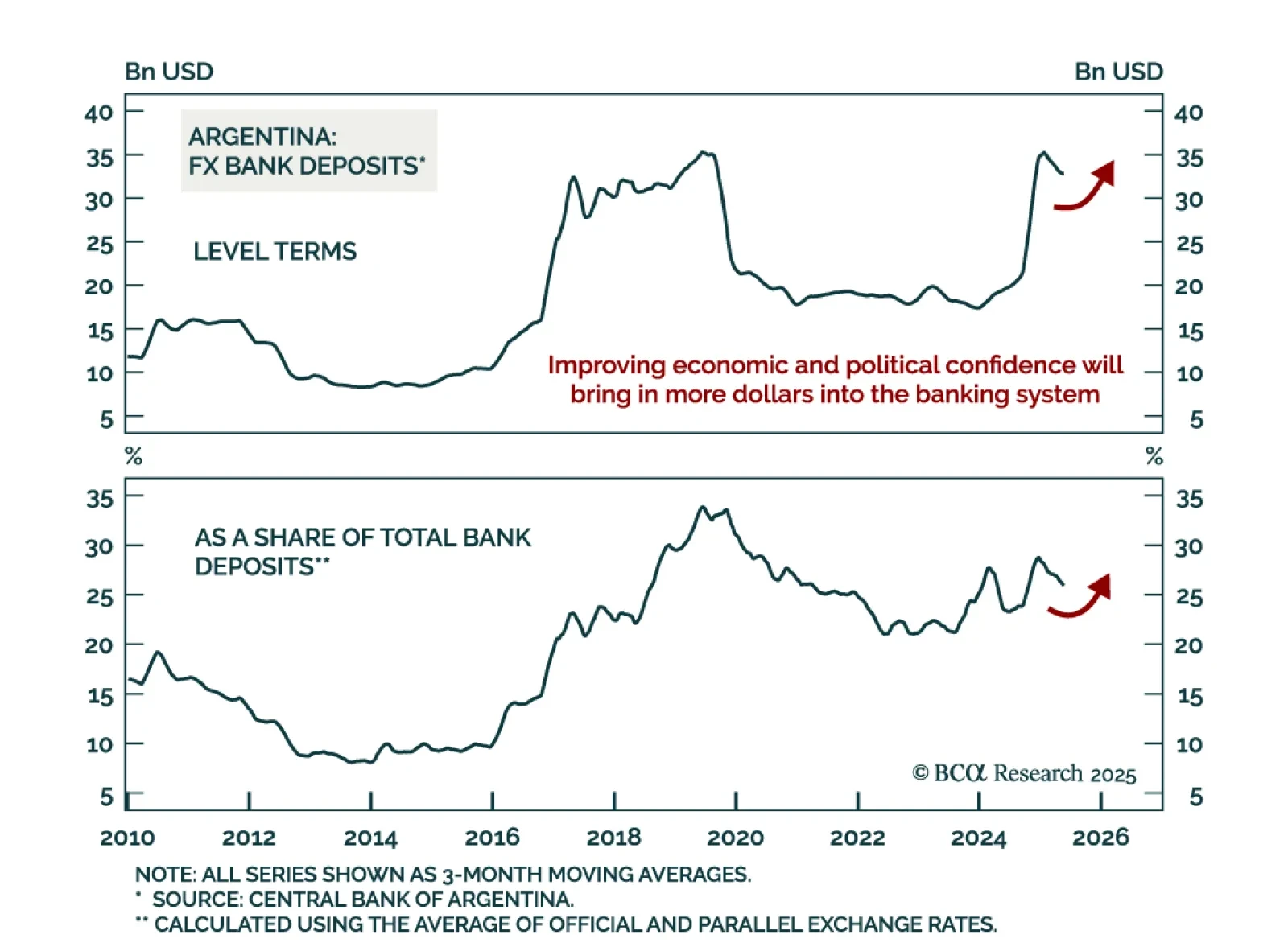

The latest political developments in Argentina increase the odds of further liberalizing reforms and solidify the economy’s structural upside. First, the libertarian governing party came out on top in Buenos Aires’ legislative…