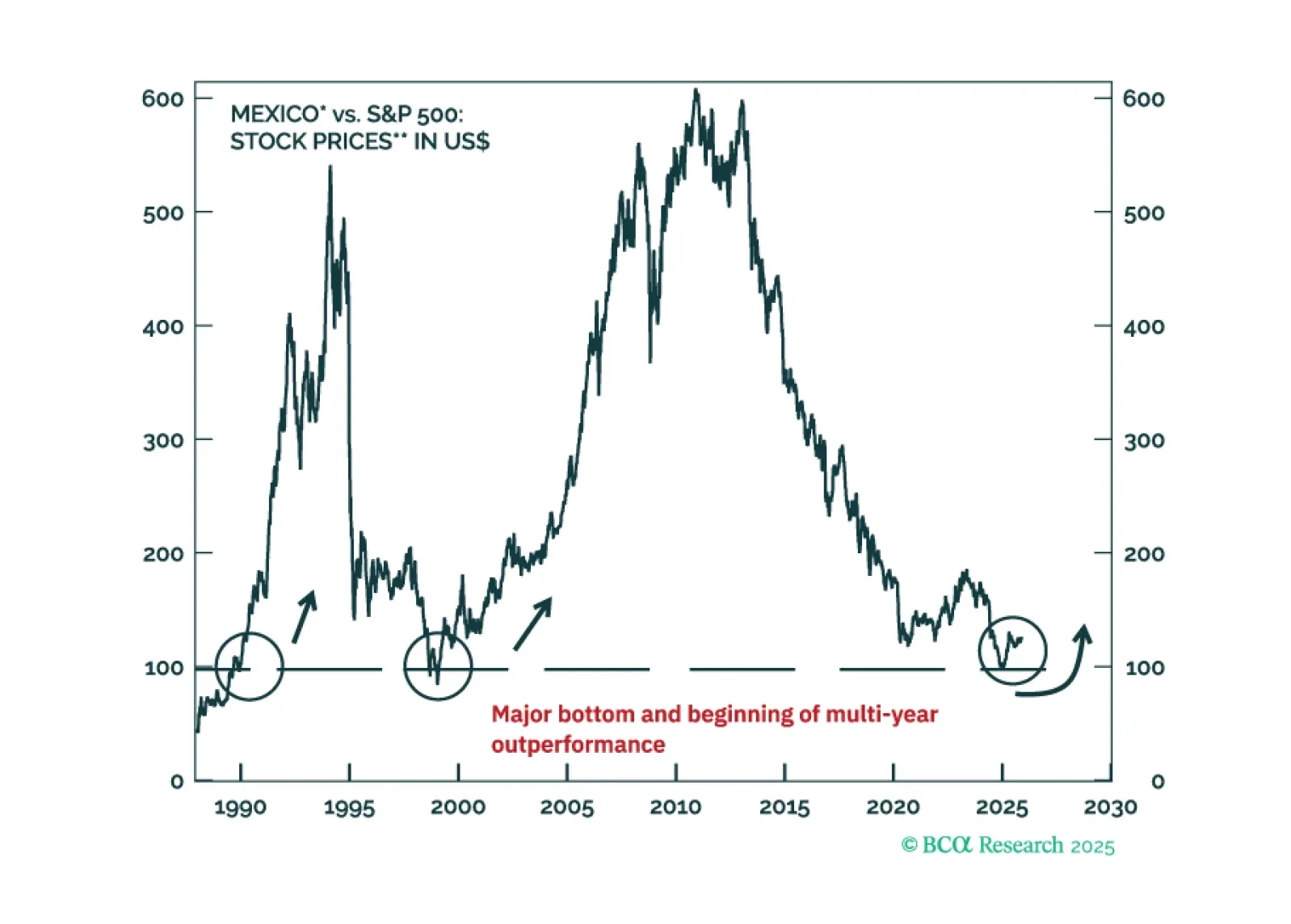

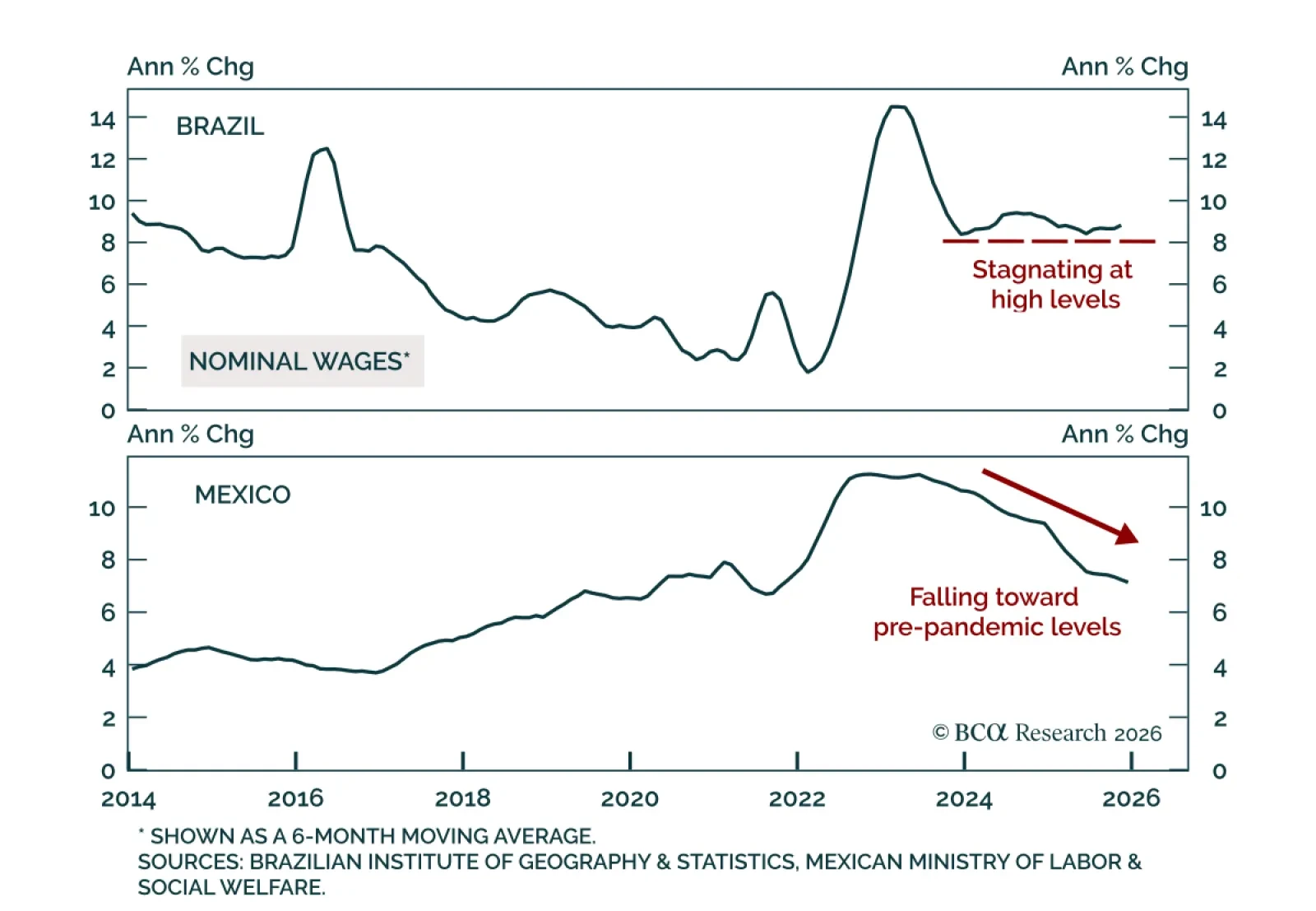

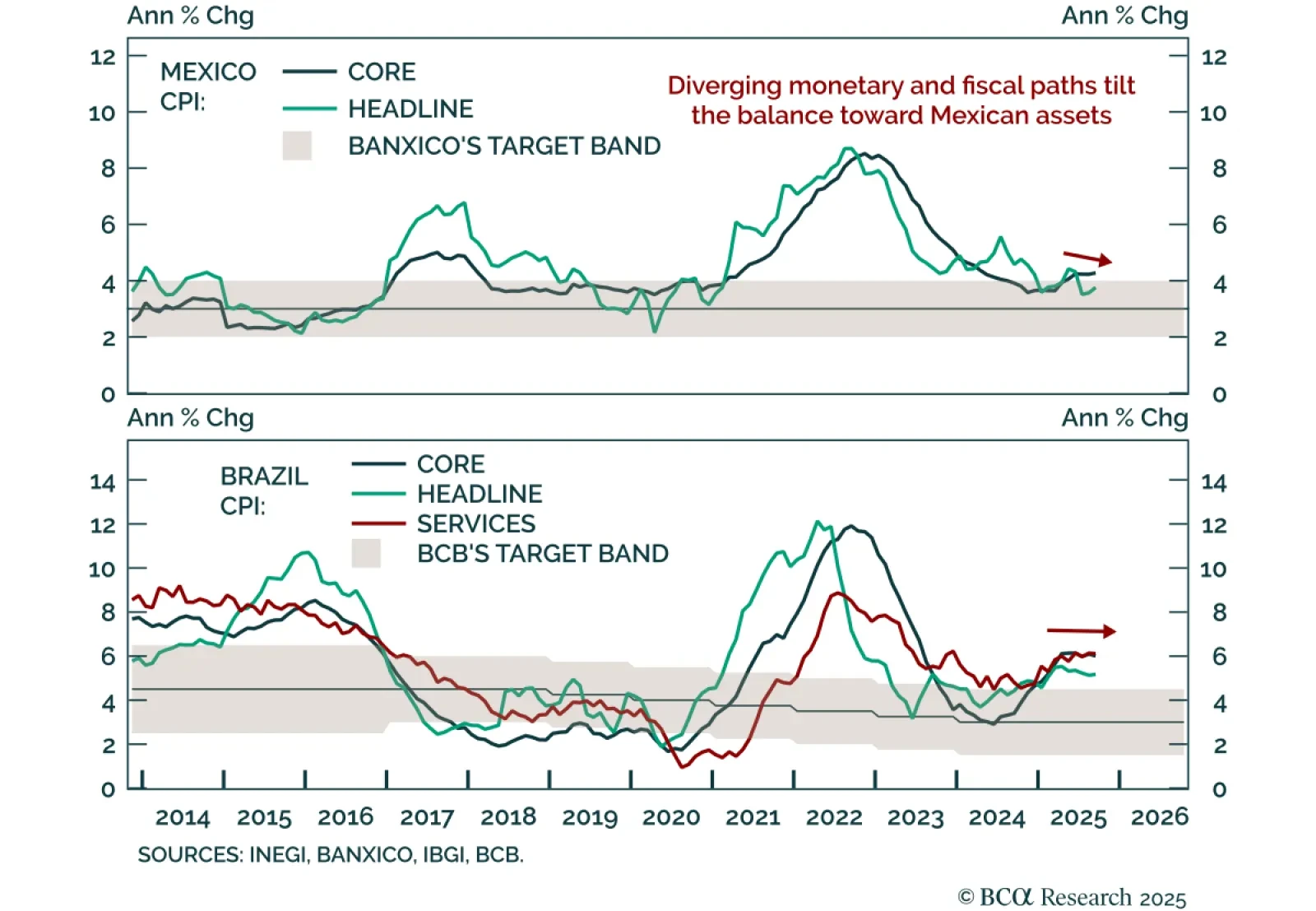

Although inflation has fallen within the upper end of the target range in both of LatAm’s largest economies, our EM strategists are more constructive on monetary easing and financial markets in Mexico than in Brazil. Mexico’s latest…

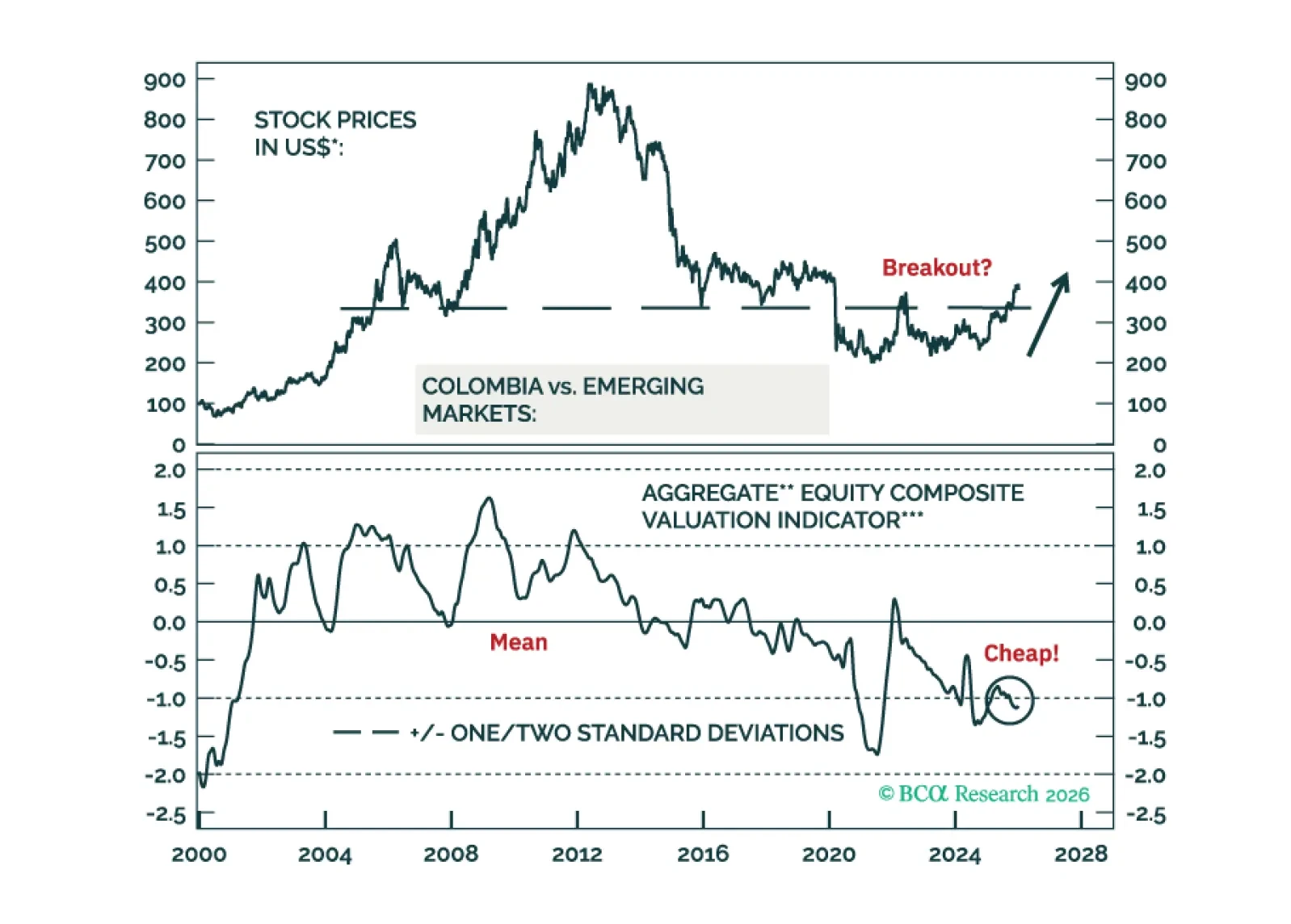

There will be little market and macro implications from the US intervention in Venezuela. Fade away any near-term moves in global oil markets. However, Colombian and Peruvian assets will benefit from lower political risk premiums.…

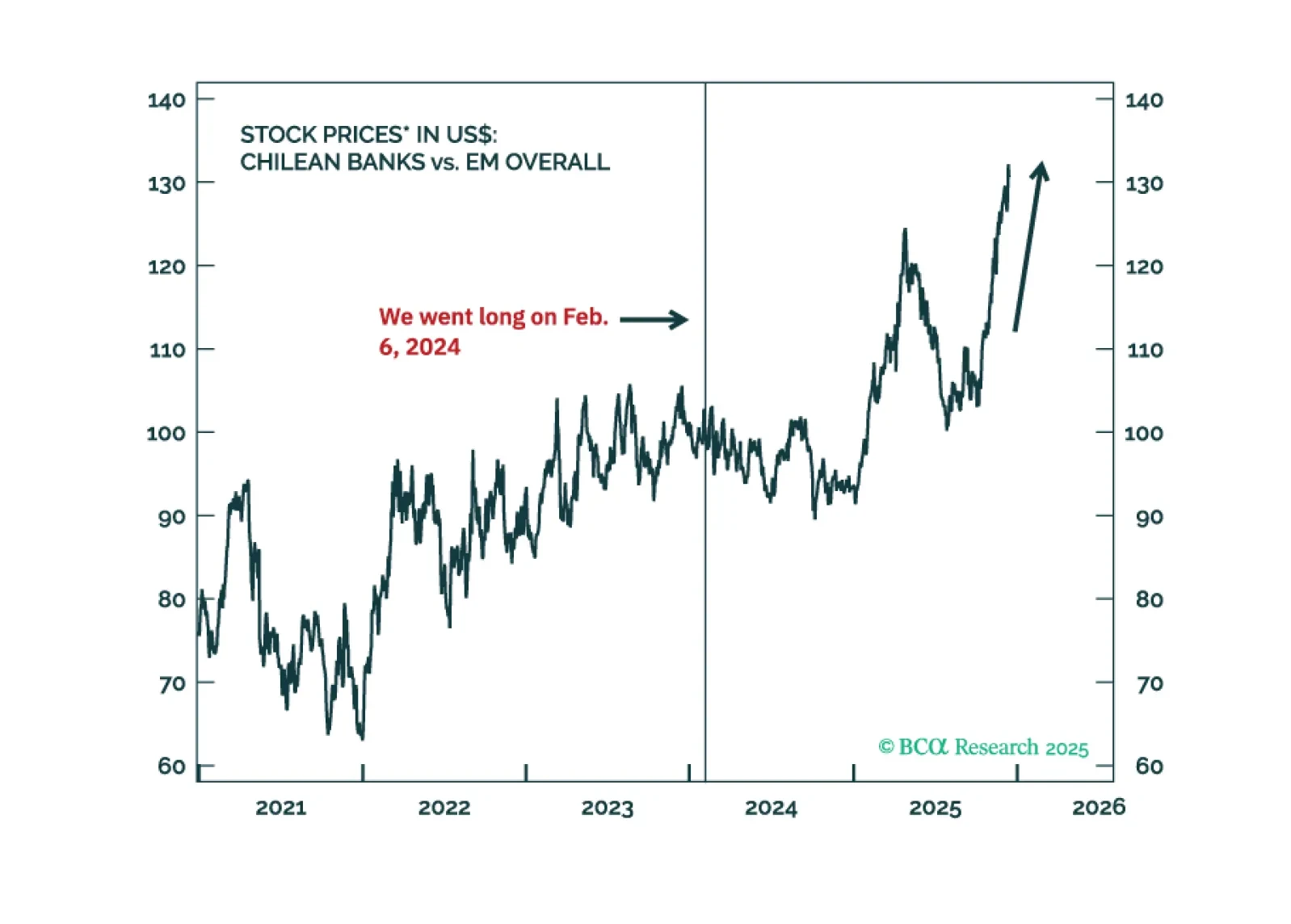

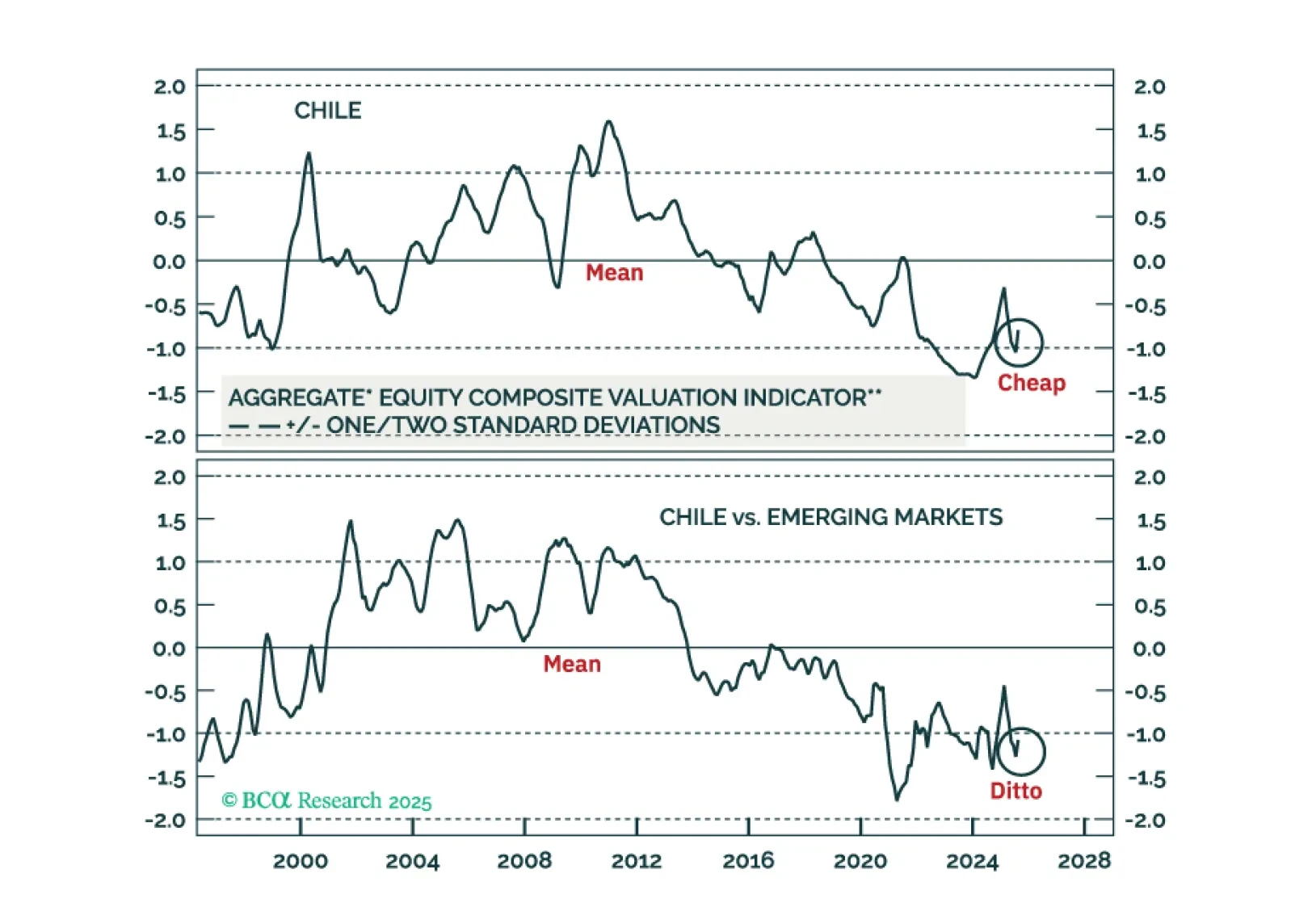

Following this weekend's election, we reiterate an overweight stance across Chilean risk assets relative to EM benchmarks and advise buying local currency government bonds (currency unhedged).

Mexican equity and fixed-income markets will continue outperforming their EM counterparts, regardless of whether global risk assets sell off or not. Also, we recommend a new trade: long Mexican stocks / short the S&P 500.

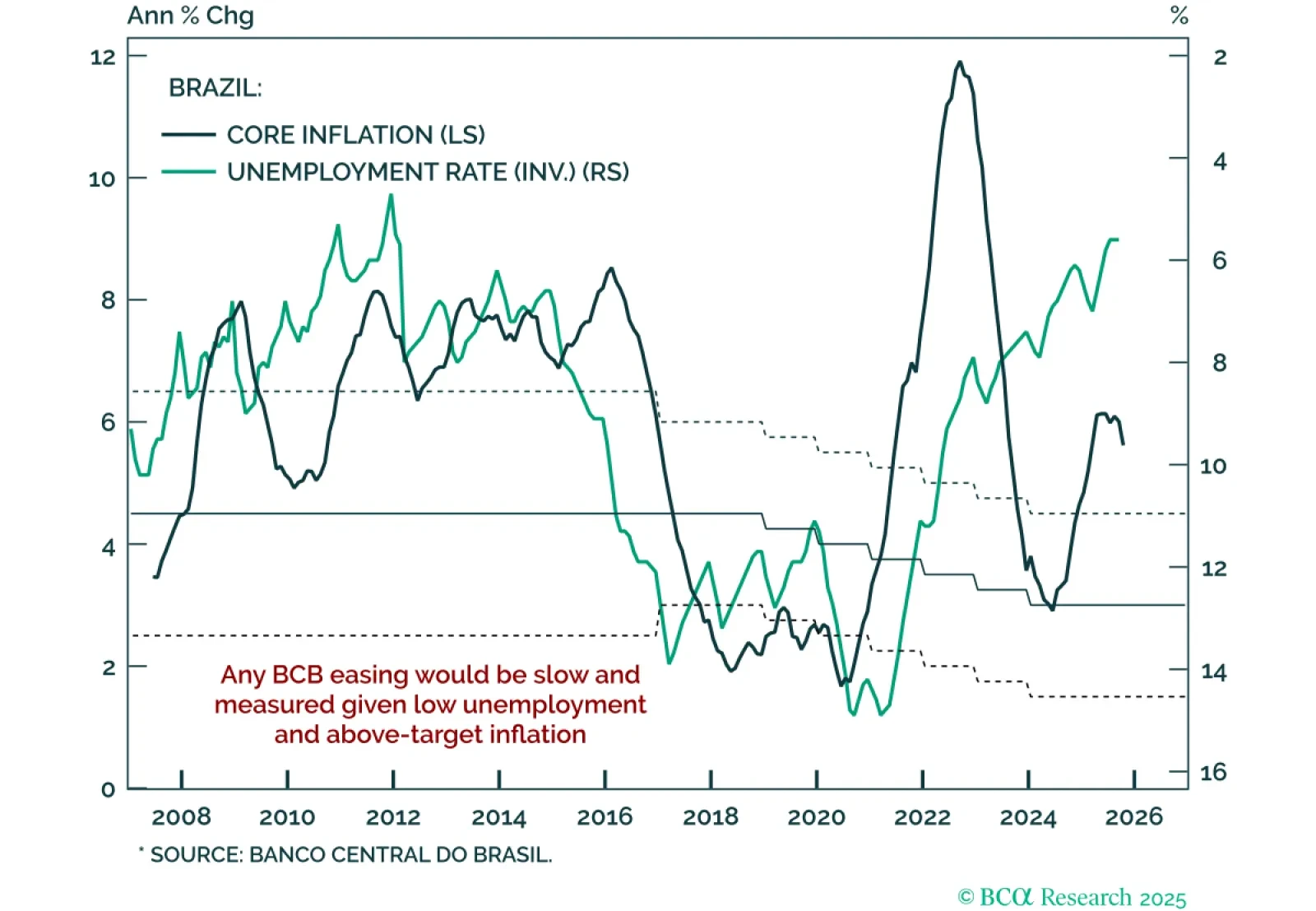

Despite a shift toward an easing bias, a December cut remains unlikely in Brazil. A BCB committee member stated the tightening cycle has ended and the next move could be a cut, shifting the bias from tightening to easing. But a…

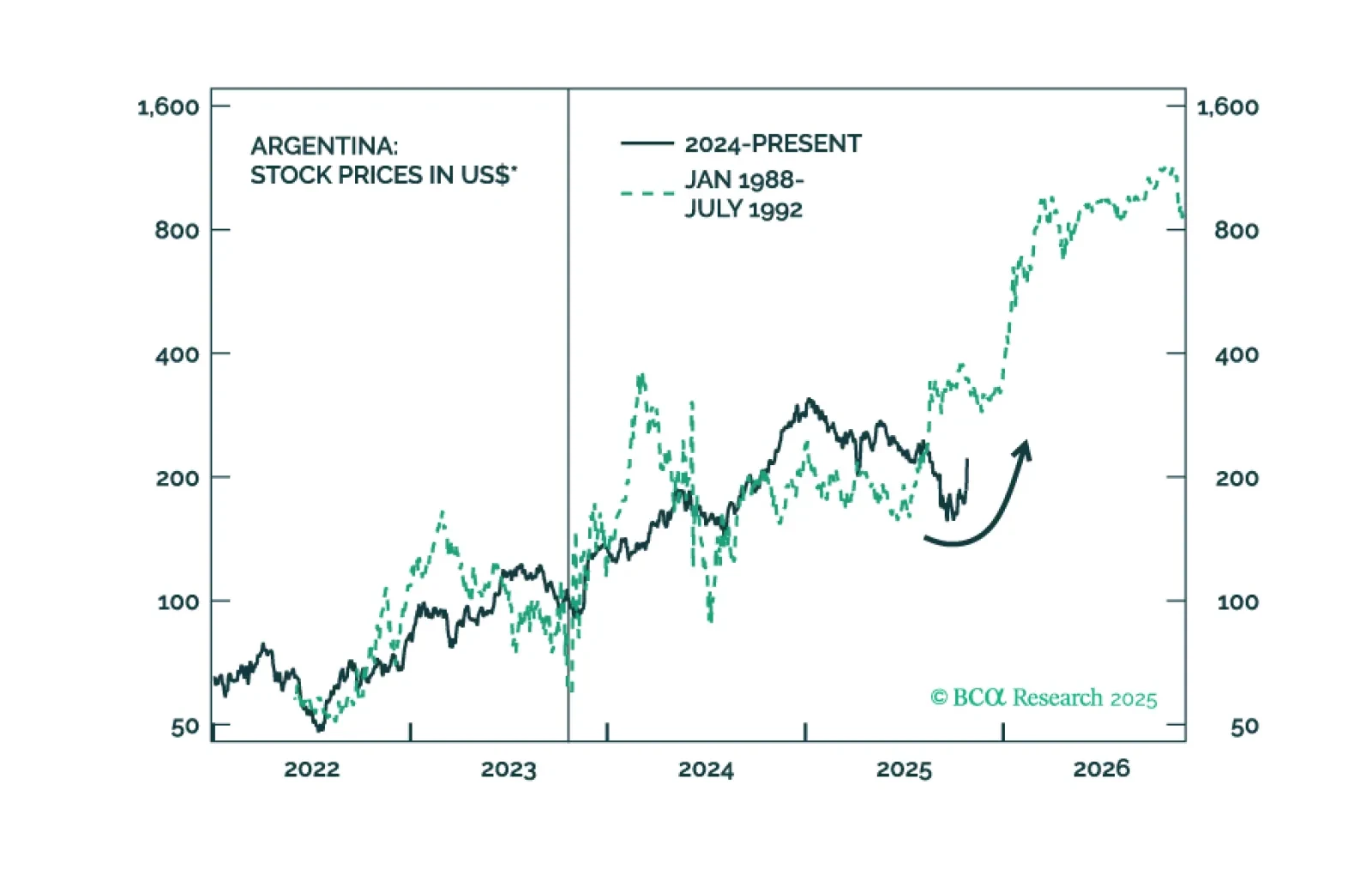

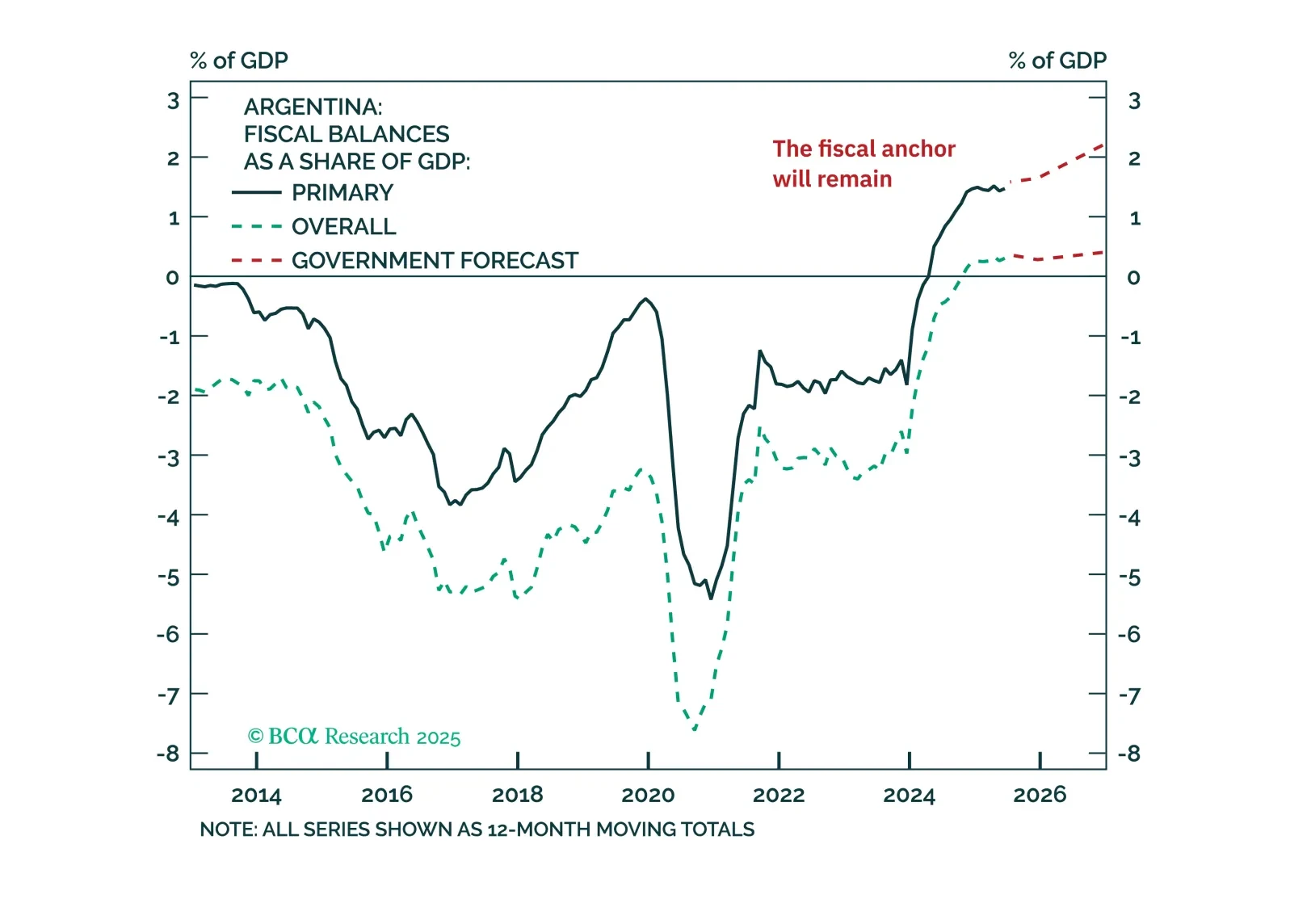

President Javier Milei’s electoral win has massively outperformed expectations. Meaningful legislative support and renewed market confidence will revitalize his liberalizing economic program. Our recommendation not to sell Argentine…

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

Chilean equities are undergoing a structural re-rating. A political swing back to a pro-business administration, a benign macro backdrop, and a resilient exchange rate will drive Chilean markets’ outperformance versus EM peers.…

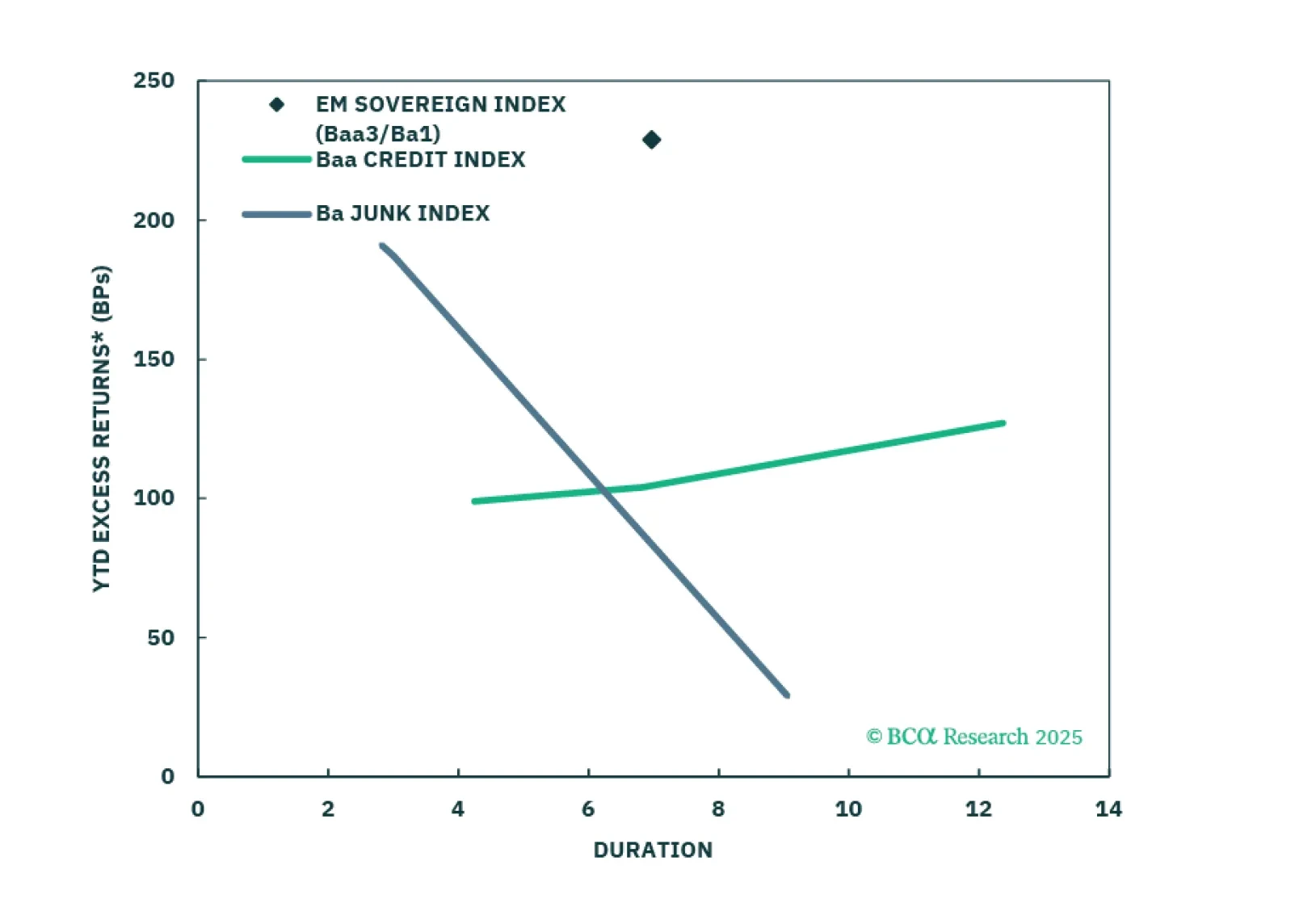

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

The Buenos Aires election results are a setback for the government's political momentum, but not the endgame. Our long-term bullish view remains in place, but short-term investors should stay on the sidelines in the near run.