Highlights In this report, we take a close look at corporate margins by analyzing their key drivers: The general level of economic activity, trends in labor costs and productivity, borrowing costs, tax rates, depreciation charges, the…

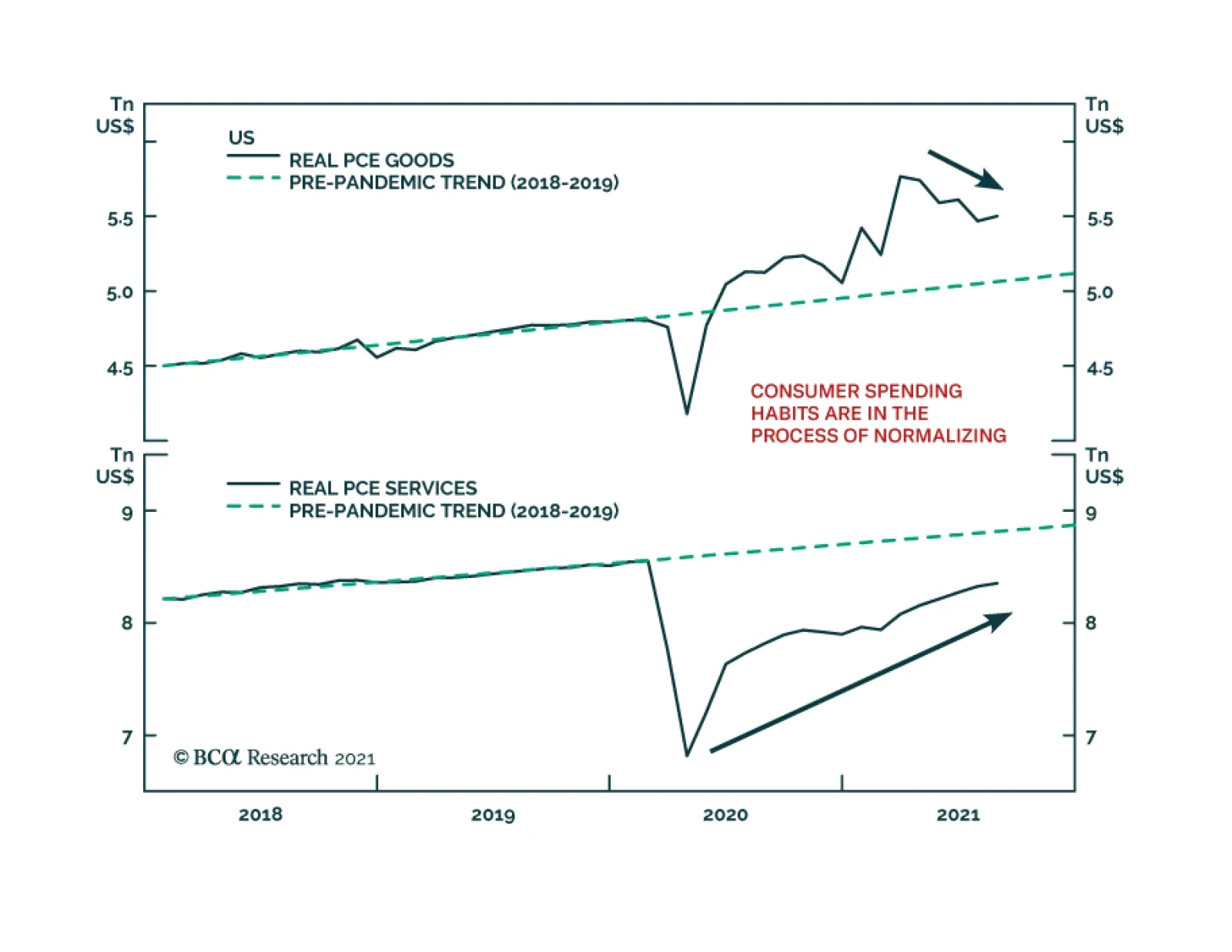

The August US Personal Income and Outlays report was broadly in line with expectations. Personal income rose 0.2% m/m following the prior month’s 1.1% m/m increase. Meanwhile, real personal spending grew 0.4% m/m after a…

Highlights Recommended Allocation The global economy will continue to grow at an above-trend rate over the next 12 months and central banks will remove accommodation only slowly.But the second year of a bull market is often…

Highlights The fourth quarter will be volatile as China still poses a risk of overtightening policy and undermining the global recovery. US political risks are also elevated. A debt default is likely to be averted in the end. Fiscal…

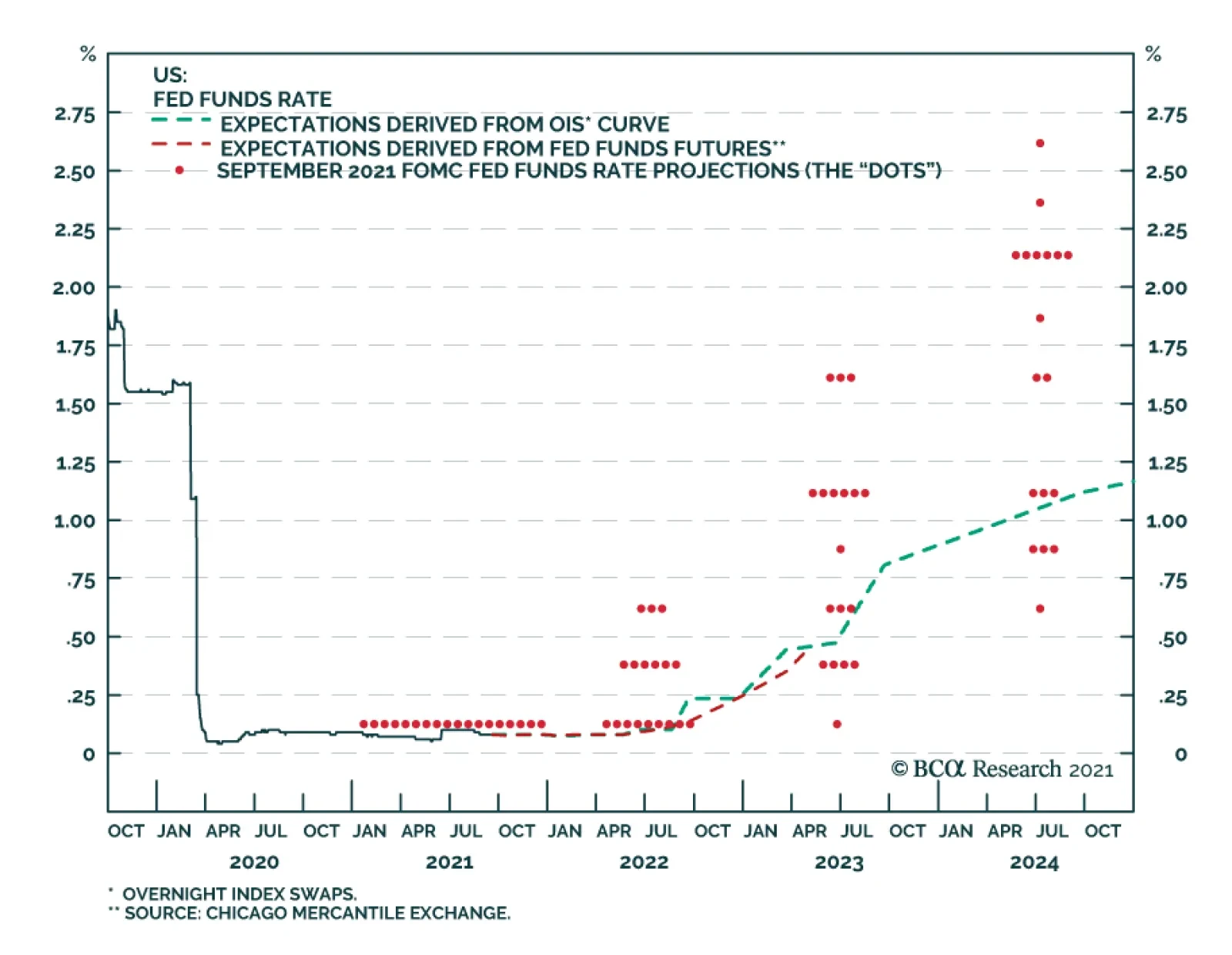

Highlights Monetary Policy: It’s all but certain that tapering will begin next month and conclude by the middle of next year, but the FOMC is currently split right down the middle on whether it will be appropriate to lift rates…

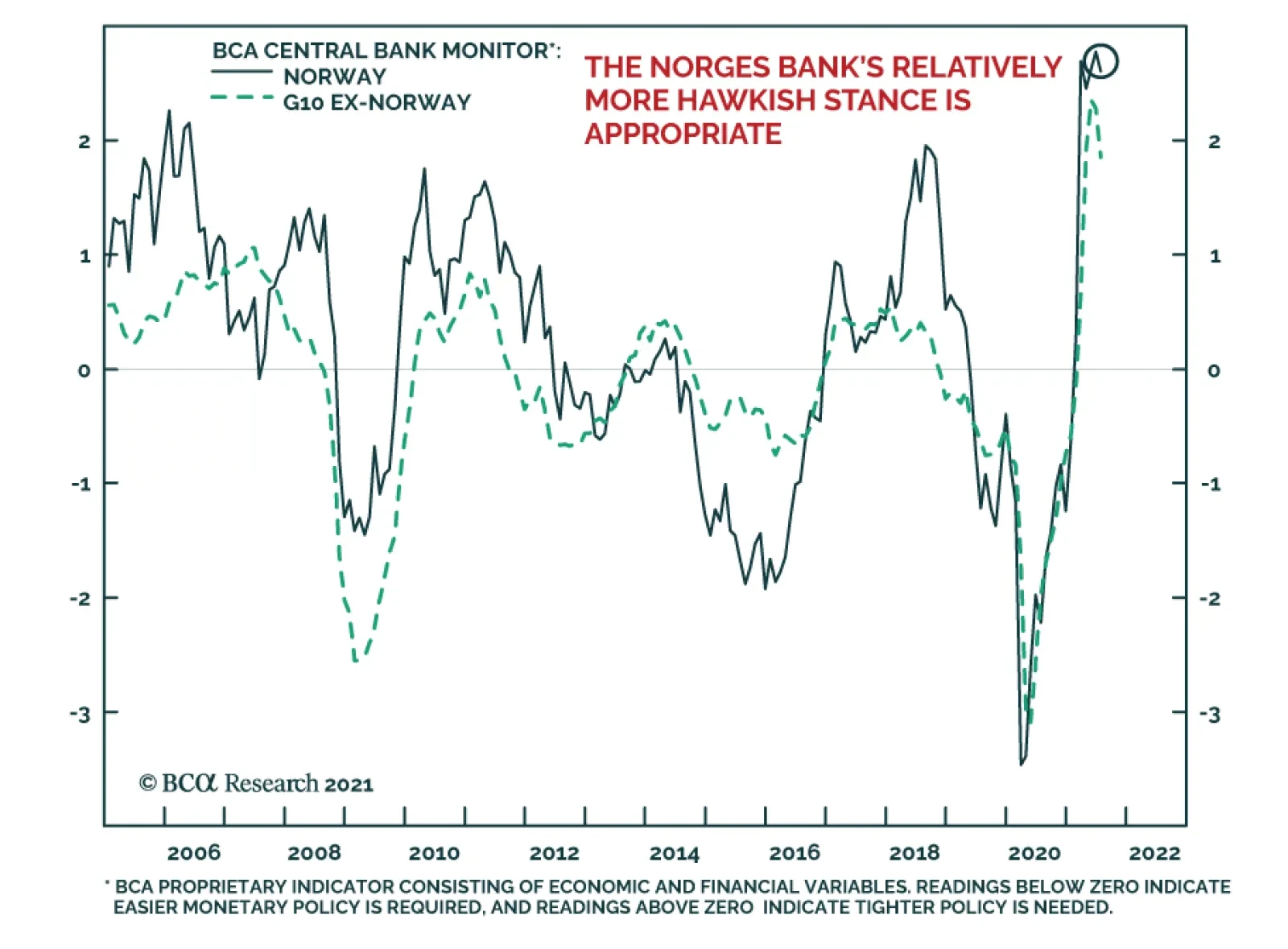

As expected, the Norges Bank delivered its first rate hike on Thursday, bringing its benchmark policy rate to 0.25%. It is the first developed market central bank to raise rates in the post-COVID-19 crisis period. The central…

As expected, the FOMC did not make any changes to its policy rate or pace of asset purchases at its meeting on Wednesday. However, the Fed sent a strong signal that tapering is on the horizon. The statement indicated that “if…

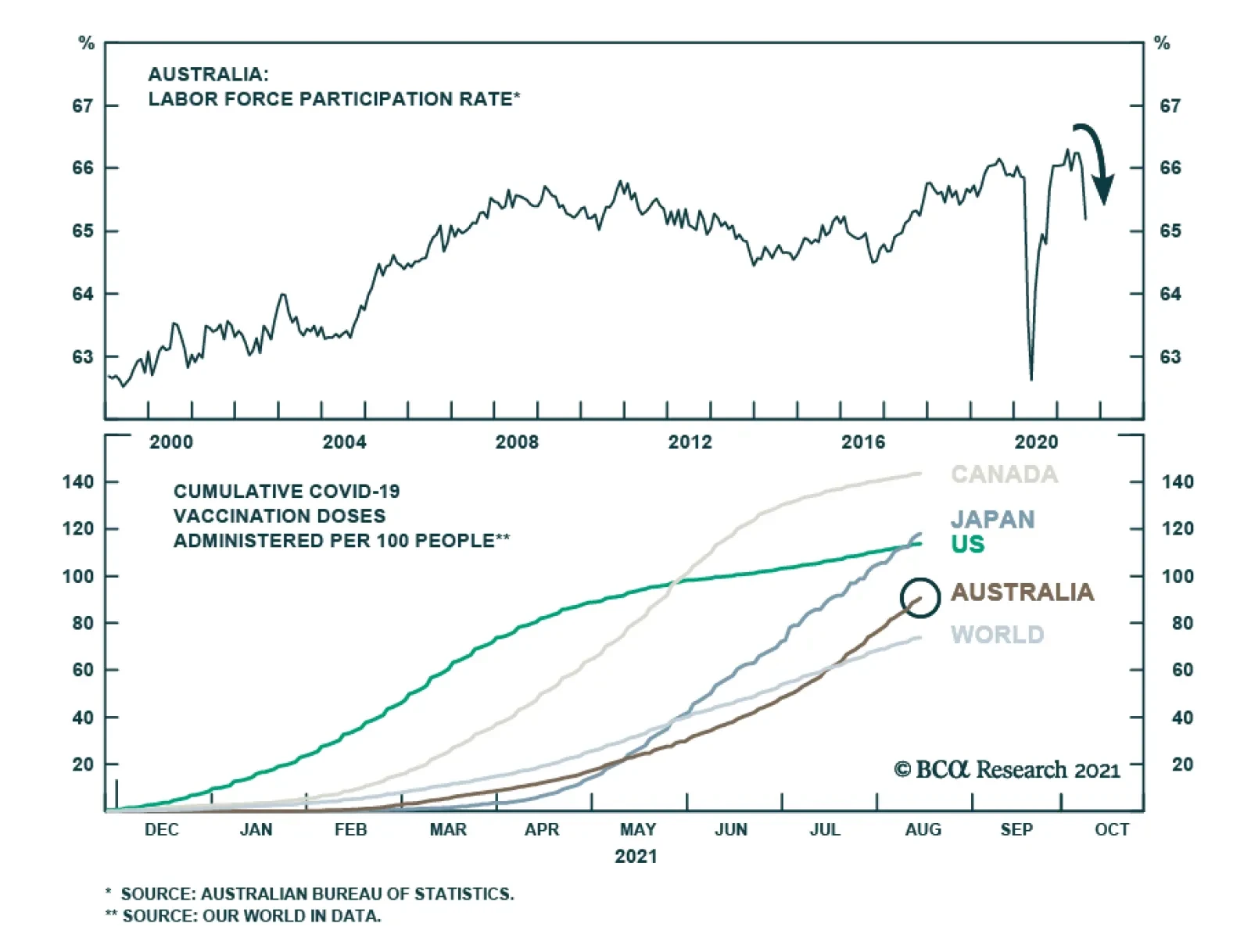

At first blush, Australia’s labor market recovery appears to have accelerated in August. The unemployment rate fell to a 13-year low of 4.5% versus expectations it would rise 0.4 percentage points to 5.0%. However, the lower…

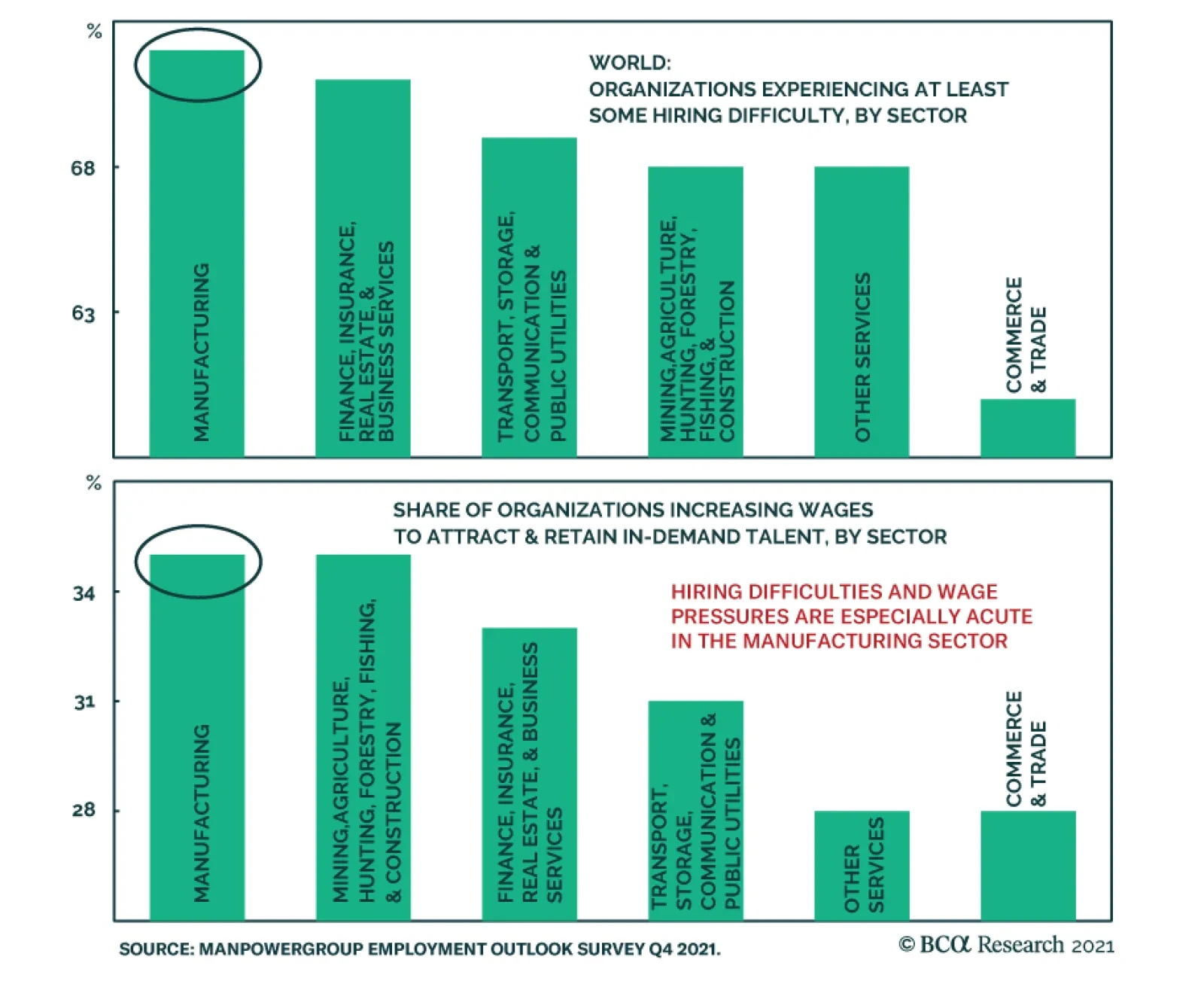

The results of ManpowerGroup's Q4 2021 global employment outlook survey - released earlier this week - provide further evidence that labor markets are tight globally. The share of global employers reporting difficulty…