Highlights China’s slowdown will deepen, and US bond yields will likely rise. This augurs well for the US dollar but will produce a toxic cocktail for EM. The recent weakness in the commodity complex will continue. EM markets…

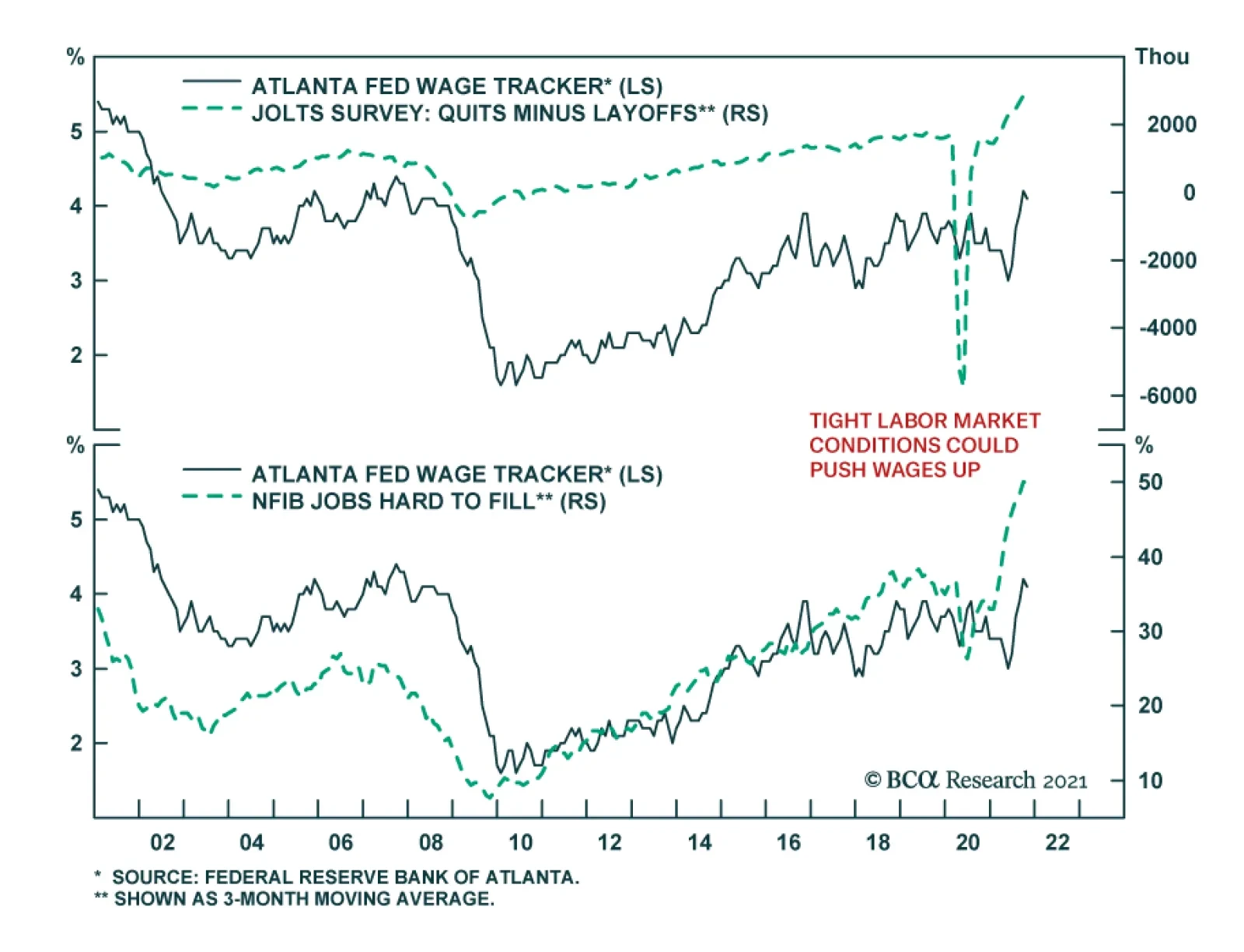

The September Job Openings and Labor Turnover Survey highlights that US labor market conditions are in favor of workers. The share of Americans quitting their jobs hit a fresh series high of 3%. Meanwhile, the job openings rate…

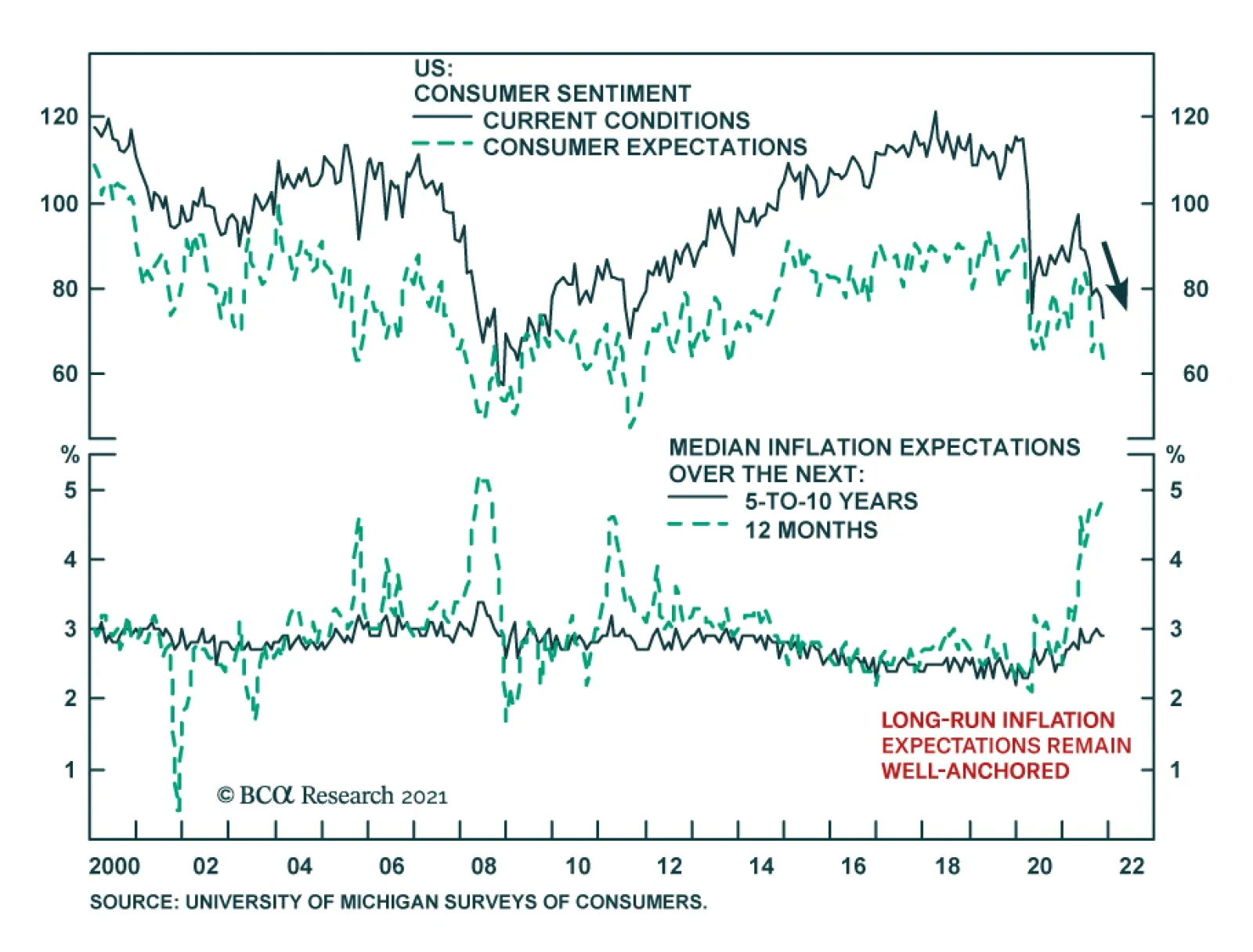

Concerns about inflation are continuing to dent US consumer confidence. The University of Michigan consumer sentiment survey’s headline index fell nearly 5 points in November to a decade low of 66.8, disappointing…

Highlights Geopolitical conflicts point to energy price spikes and could add to inflation surprises in the near term. However, US fiscal drag and China’s economic slowdown are both disinflationary risks to be aware of. …

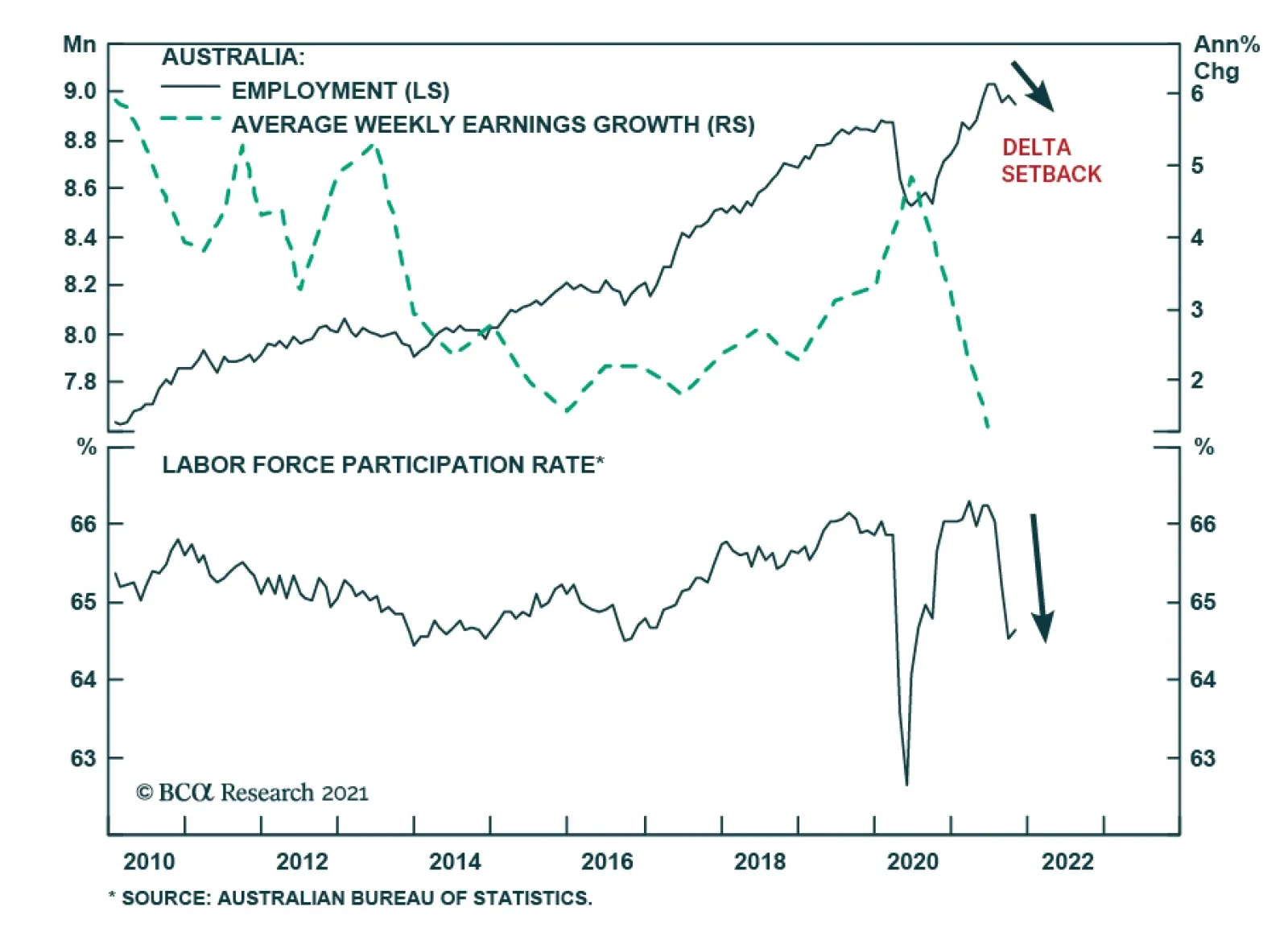

Rising inflationary pressures are seeping into Aussie inflation expectations which according to the Melbourne Institute reached 4.6% in November. Nevertheless, the RBA pushed back against market rate hike expectations at last…

Highlights Fed: Chair Powell’s remarks after the November FOMC meeting suggest that the Fed will not panic and move quickly toward tightening in the face of high inflation. Rather, the Fed will stay the course and will only lift…

We will be holding our quarterly webcasts next Monday, November 15th at 10:00 a.m. Eastern time and Tuesday, November 16th at 8:00 a.m. Hong Kong time in lieu of publishing a Weekly Report. Please join us with your questions to make it a…

Highlights Supply-side pressures should abate over the coming months as semiconductor availability improves, transportation bottlenecks ease, energy prices recede, and more workers enter the labor force. The respite from inflation…