The consumption outlook remains solid thanks to households’ sizable excess savings, incomes that will be boosted by a tight labor market and ample capacity to add debt to augment their buying power.

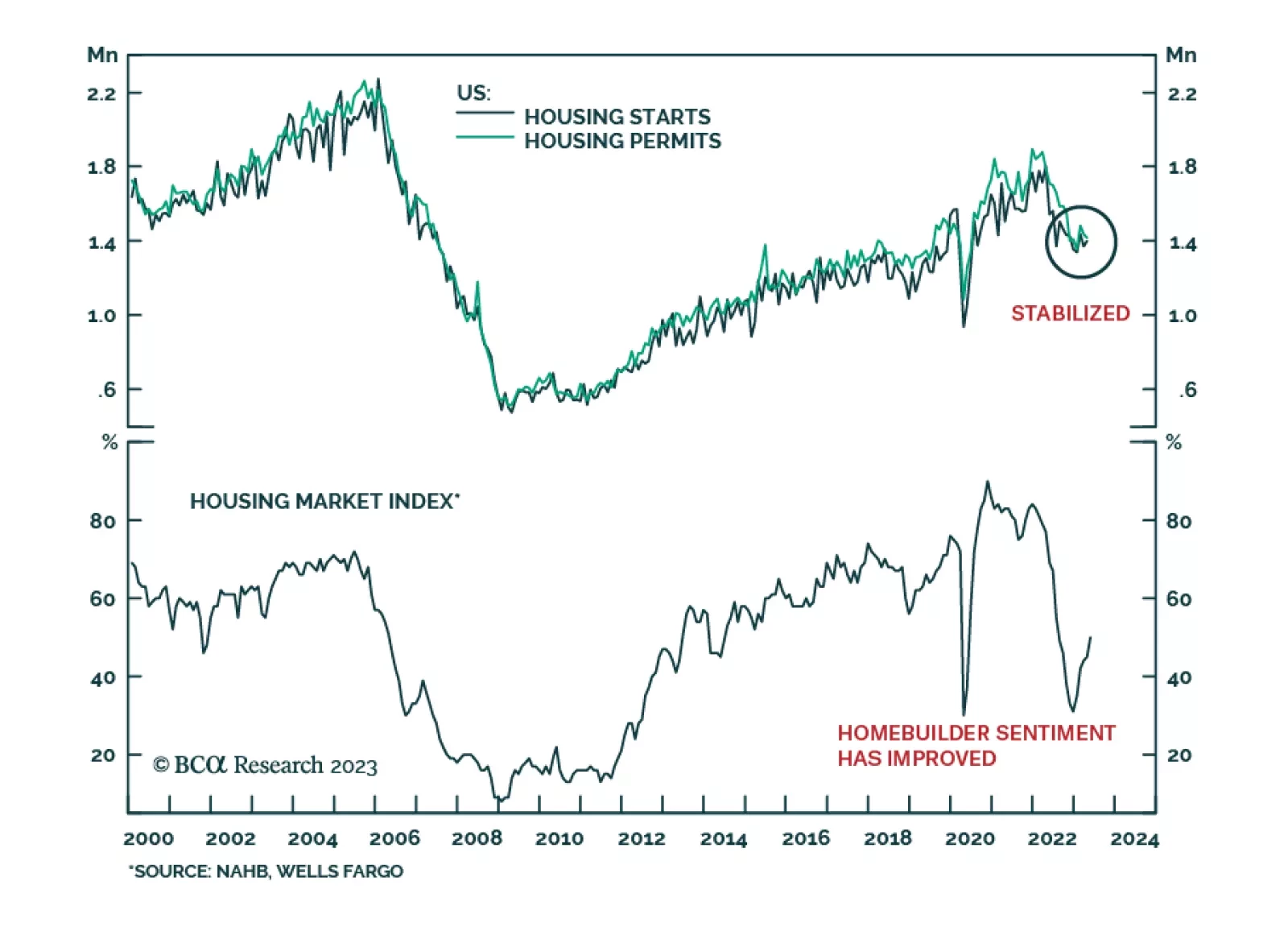

US housing starts unexpectedly increased by 2.2% m/m in April – beating consensus estimates of a 1.4% m/m decline. The upside surprise follows Tuesday’s unanticipated 5-point jump in the NAHB homebuilder sentiment…

The ECB continues to focus on lagging indicators and risks once again to cause a policy error that unduly hurts European growth. What does it mean for investors?

If the recession begins this year, it is unlikely to be mild, because inflation will not have fallen by enough to allow the Fed to cut rates aggressively. In contrast, if the recession starts in 2024 or later, when inflation is…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

The Fed hiked 25 basis points at yesterday’s FOMC meeting while also signaling that the tightening cycle is now on hold. We discuss the short-run and long-run implications for Treasury yields.

Pent-up demand for services is keeping the global economy going, but we still expect recession over the next 12 months. Investors should keep a cautious portfolio stance.

The latest round of earnings calls from the systemically important banks was encouraging on balance. Households are still flush and still spending and consumer and business delinquencies remain remarkably low. Though a recession is…

A benign disinflation is probable during the remainder of 2023. Unfortunately, just when most people become convinced that a recession has been avoided, a recession will begin.