The resiliency of consumers through 2023 has surprised investors. However, consumer strength will fade into yearend as factors supporting growth in income and spending are waning. i.e., job gains are slowing, wage growth is…

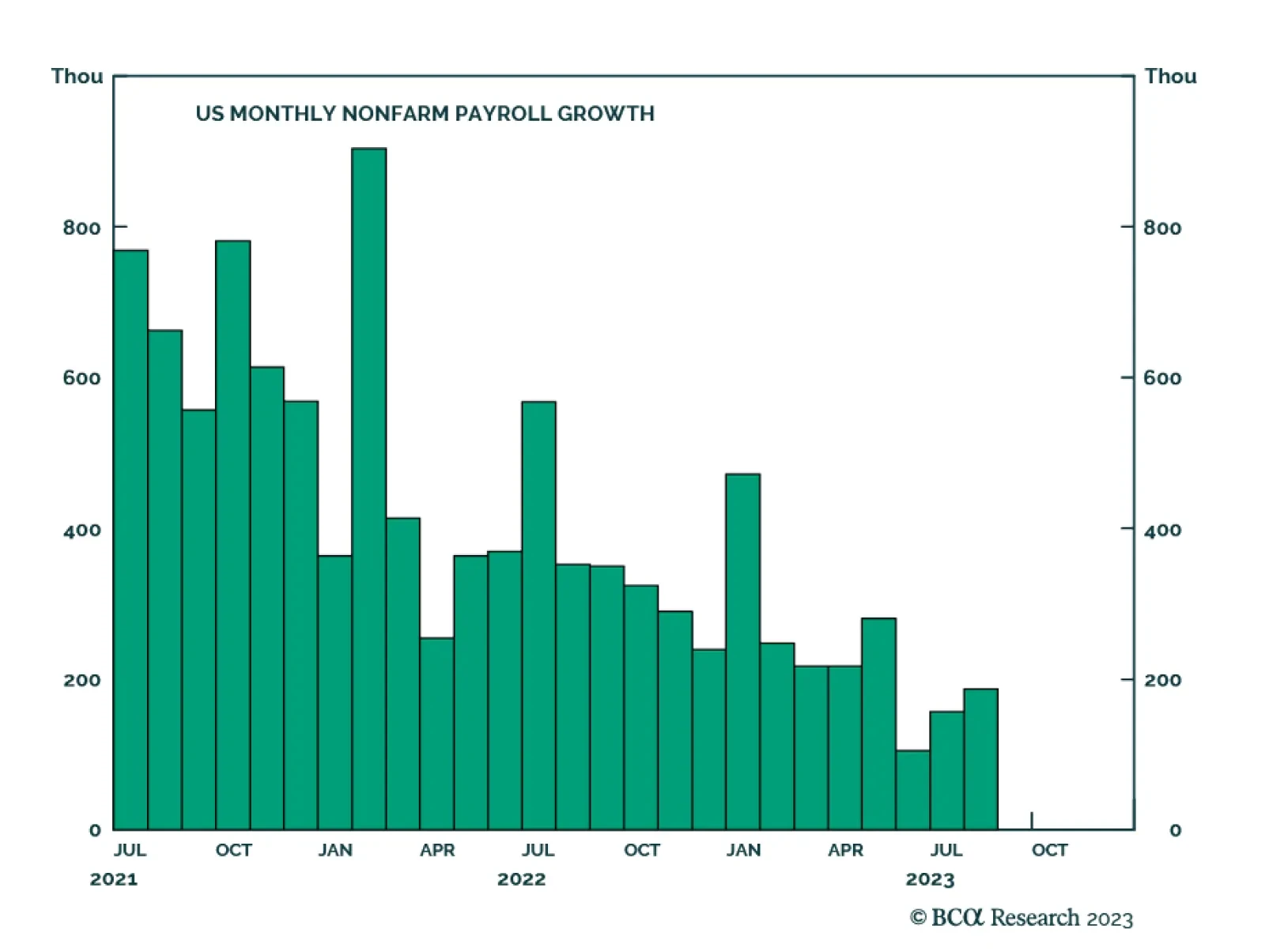

Friday’s US employment report suggests that the softening of the labor market is continuing at a steady pace. Although nonfarm payroll employment in June and July was revised down by 110 thousand, the 187 thousand increase…

US bond investment takeaways from this week’s PCE and employment releases.

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

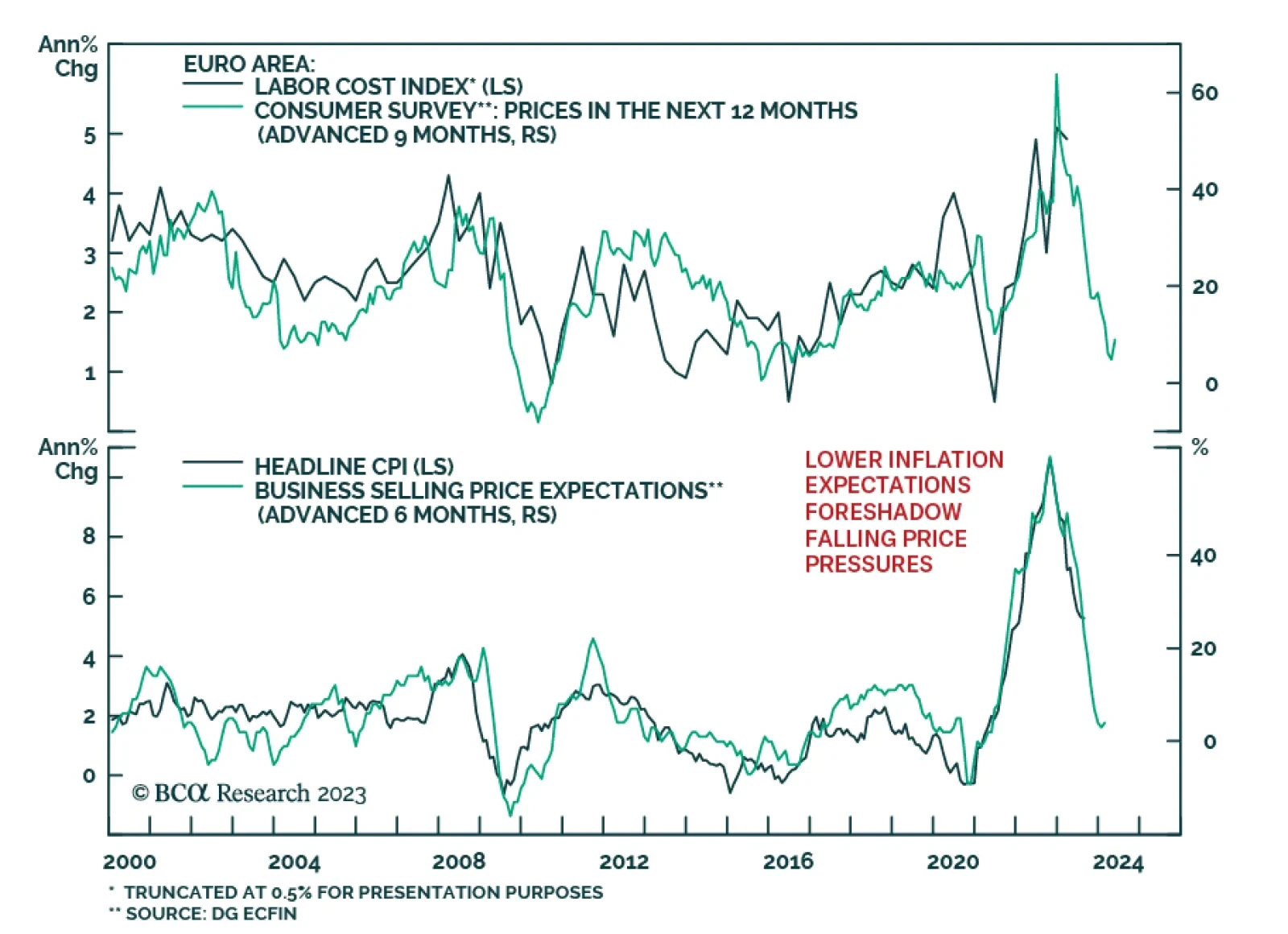

Eurozone headline inflation surprised to the upside in August, confirming the signal from the preliminary German and Spanish releases. The year-on-year gauge was unchanged at 5.3% – surprising expectations of a deceleration…

Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

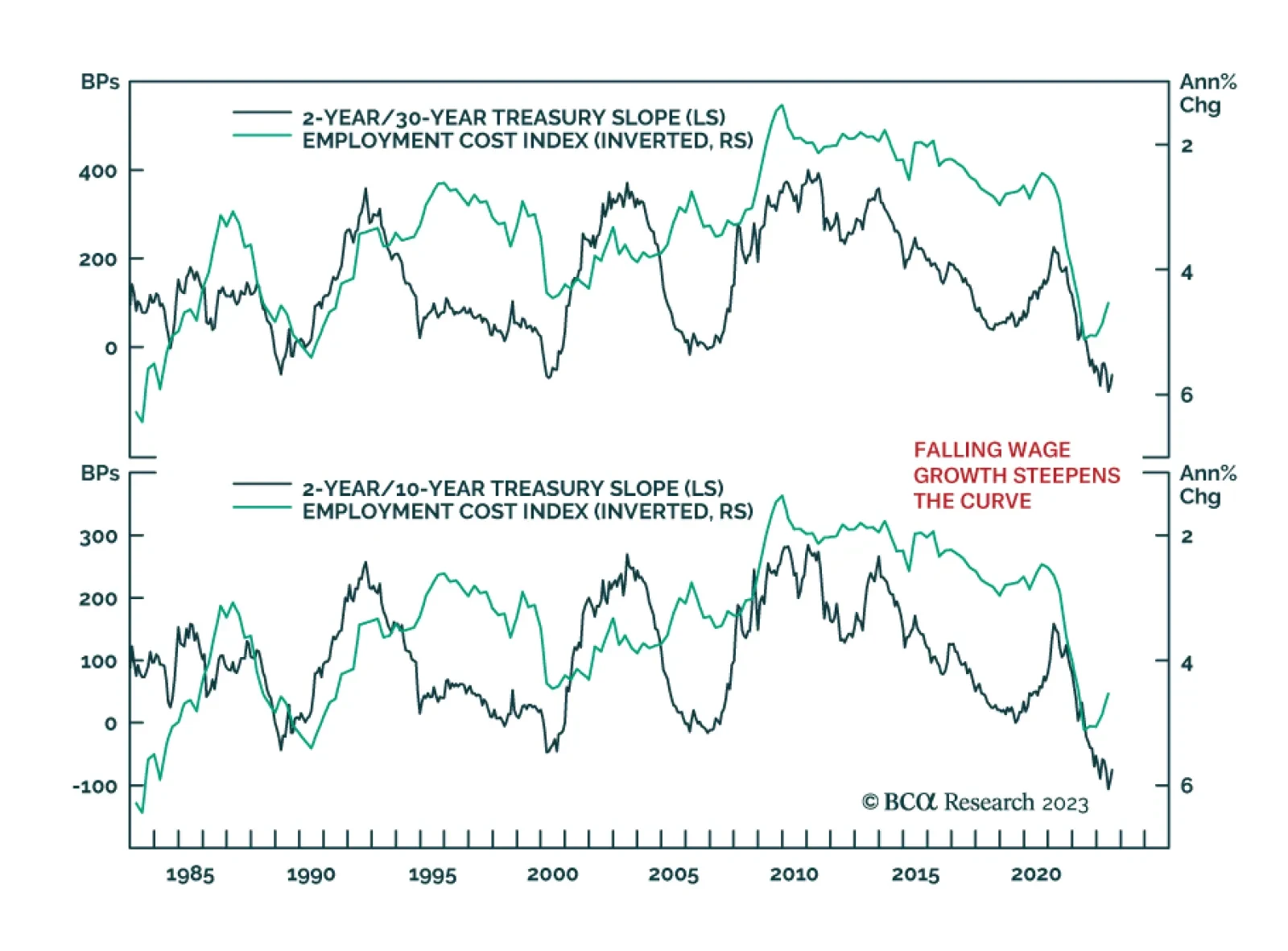

BCA Research’s US Bond Strategy service’s base case outlook calls for a modest curve steepening as wage growth and inflation fall. Odds are that the next big yield curve move will be a bull-steepening that…

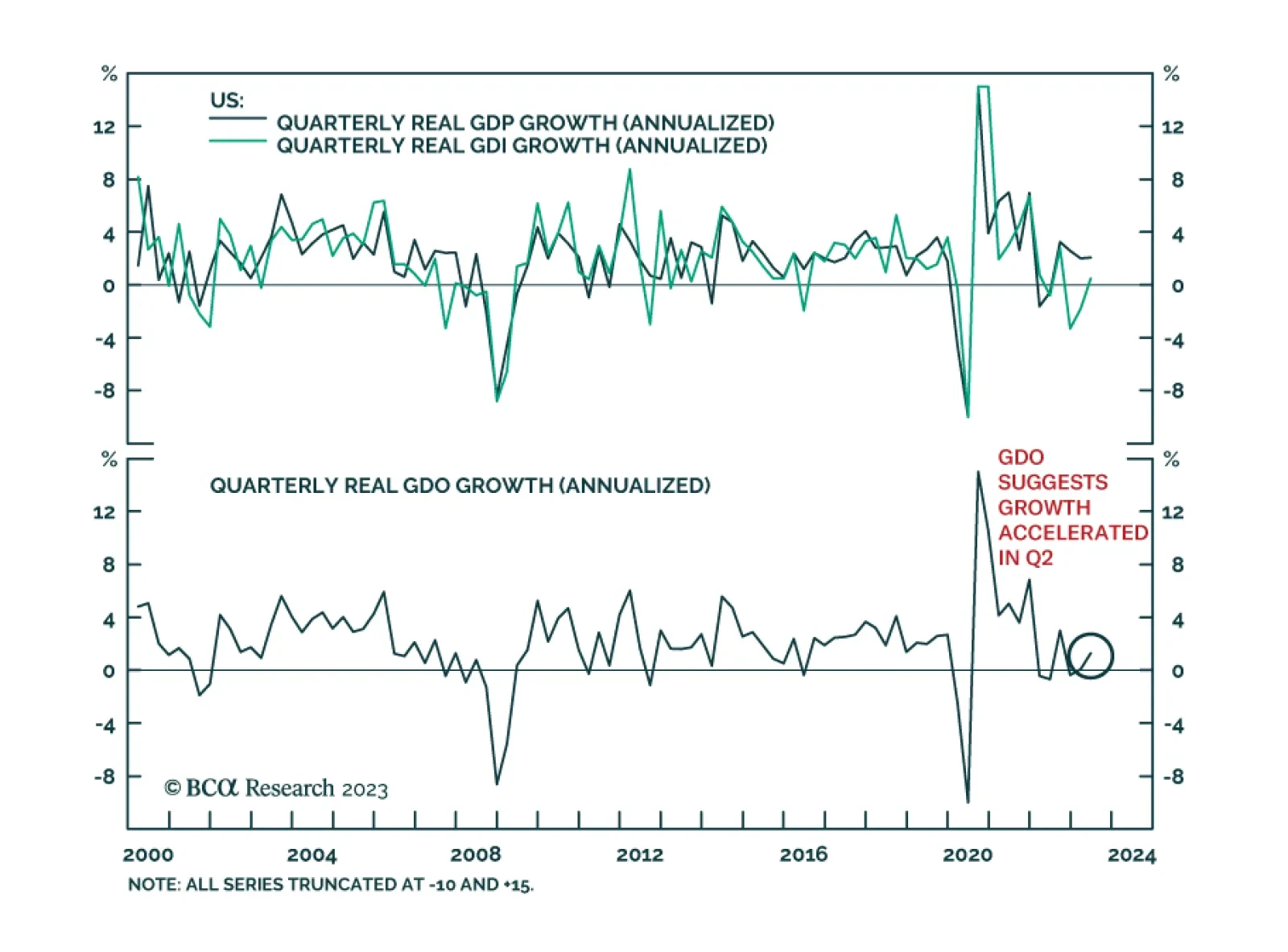

US Q2 GDP growth was revised down from 2.4% to 2.1% on a quarterly annualized basis, only slightly above Q1 growth of 2.0%. Although consumption was revised up by 0.1 percentage points to 1.7%, business spending grew at a slower…

We comment on Jay Powell’s Jackson Hole speech and recommend shifting to a barbelled allocation along the Treasury curve.