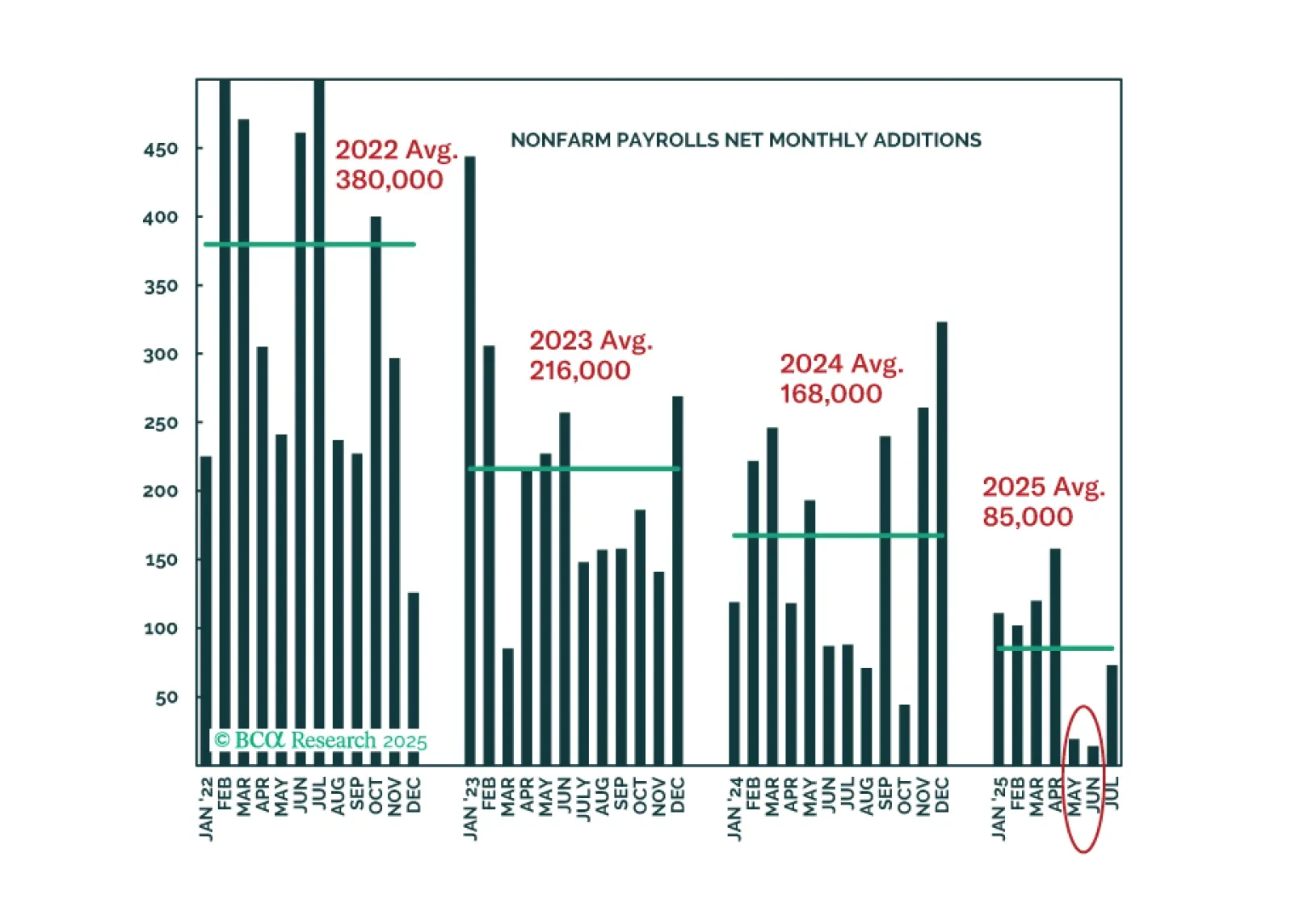

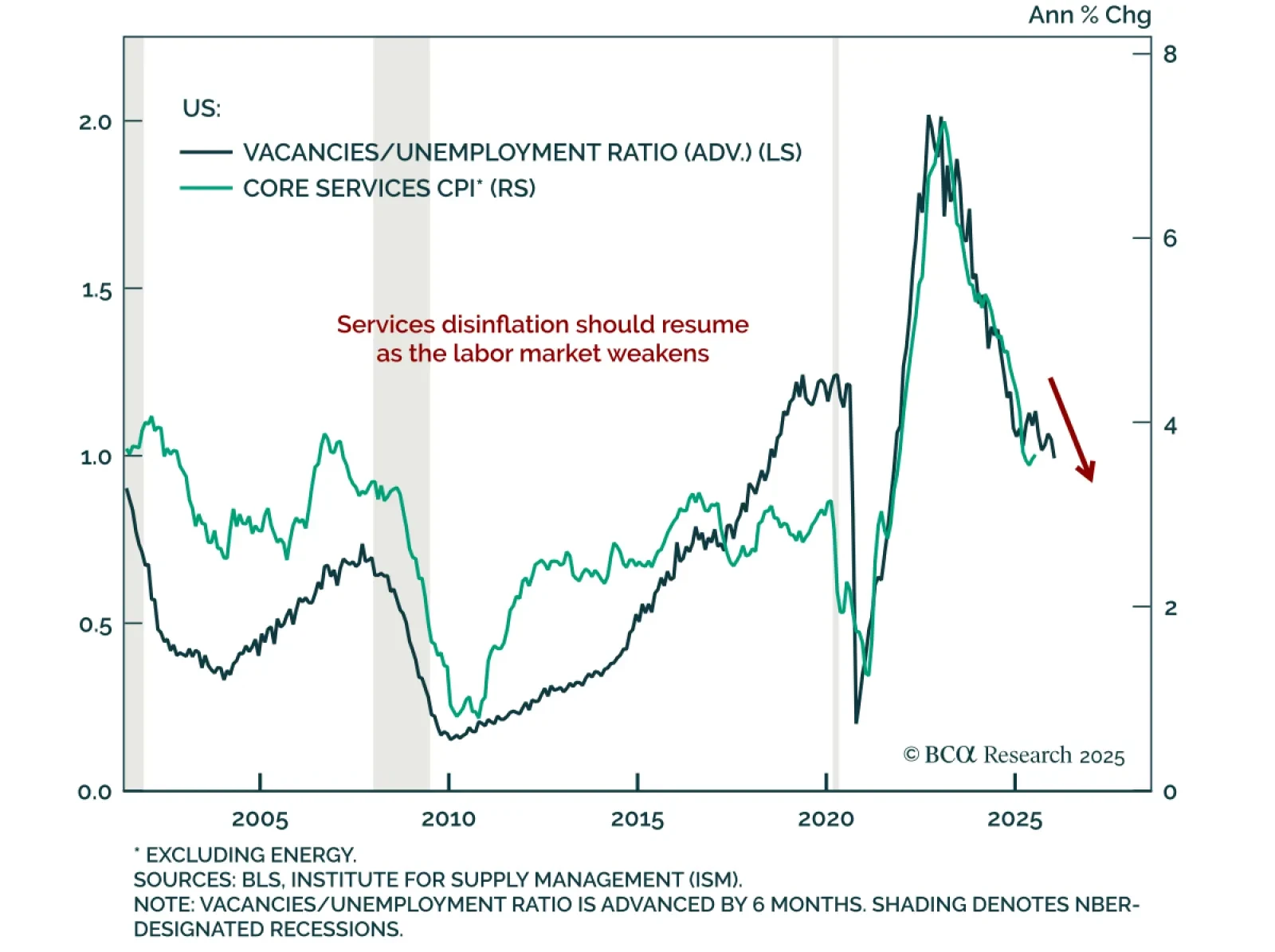

US job openings fell to a 10-month low in July, underscoring continued labor market weakening. Openings declined to 7.18m from 7.36m. The decline was led by non-cyclical sectors such as education and health services, which had…

Our Portfolio Allocation Summary for September 2025.

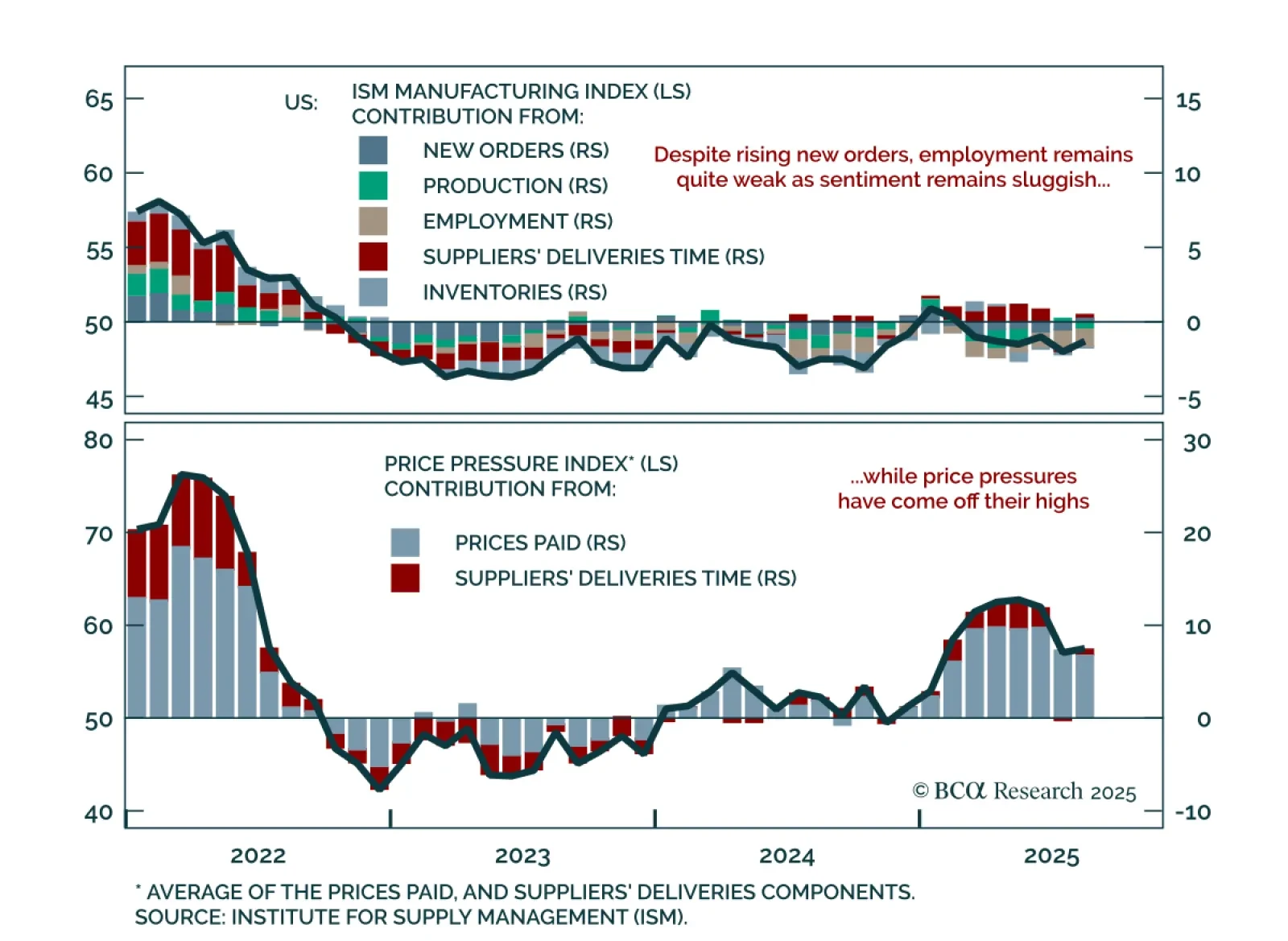

August ISM Manufacturing was mixed, with stronger orders offset by weak production and employment. The headline rose to 48.7 from 48.0, missing expectations. New orders beat estimates, rising into expansion at 51.4 and lifting…

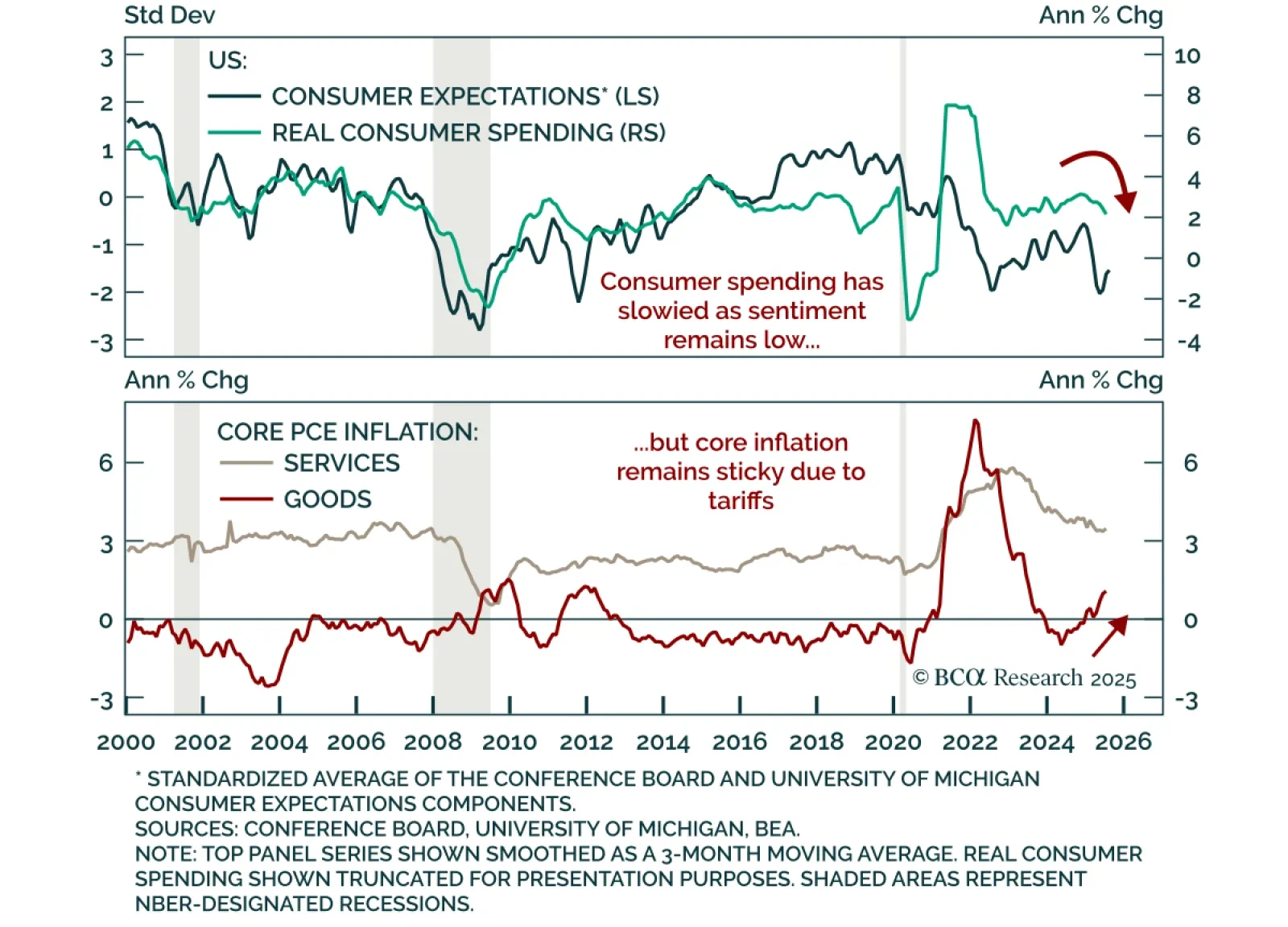

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

In Section I, Doug notes that a negative stance toward stocks will require a meaningful and imminent deterioration in the US macro data given the ongoing impact of AI optimism on the global equity market. In Section II, Chester…

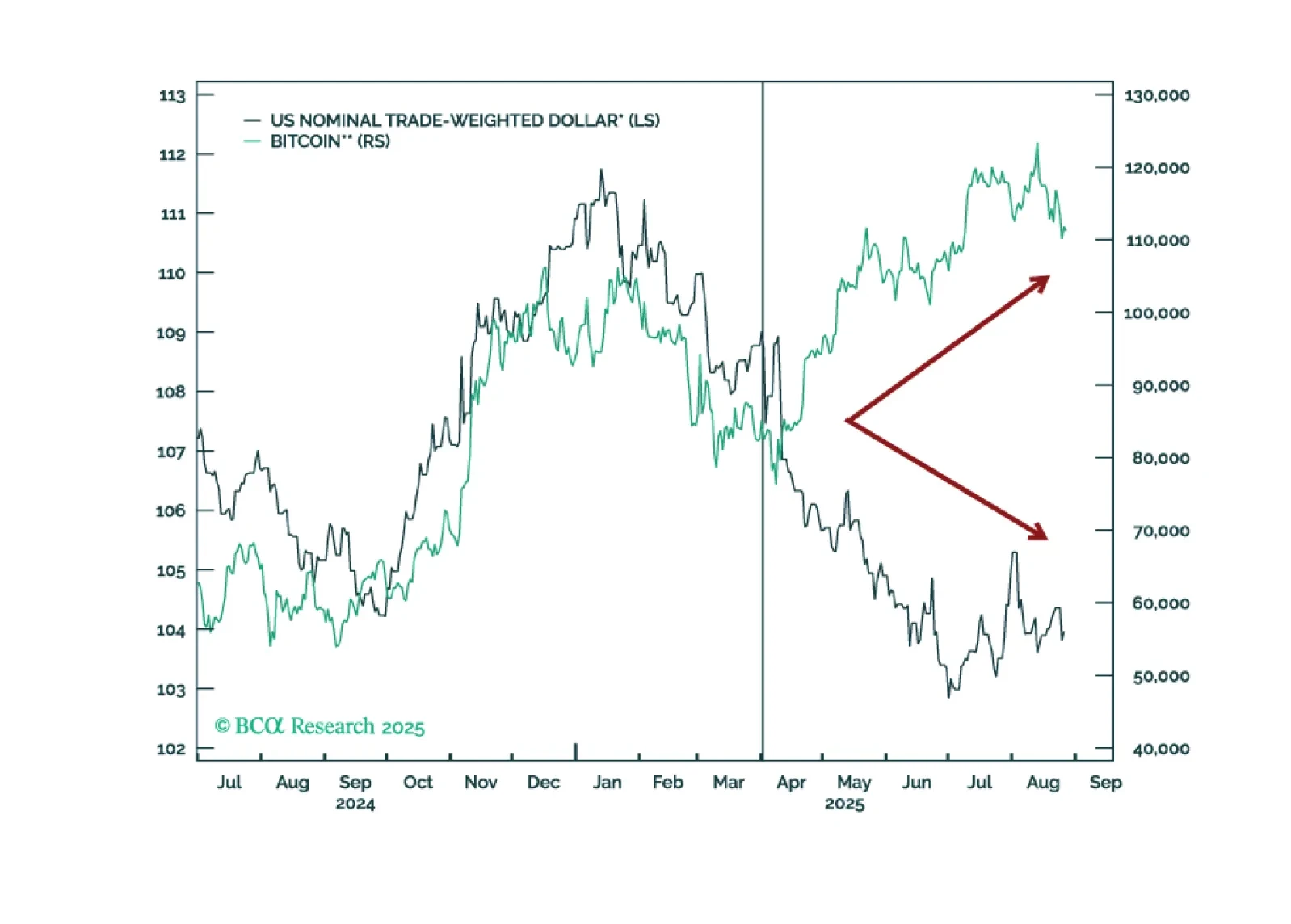

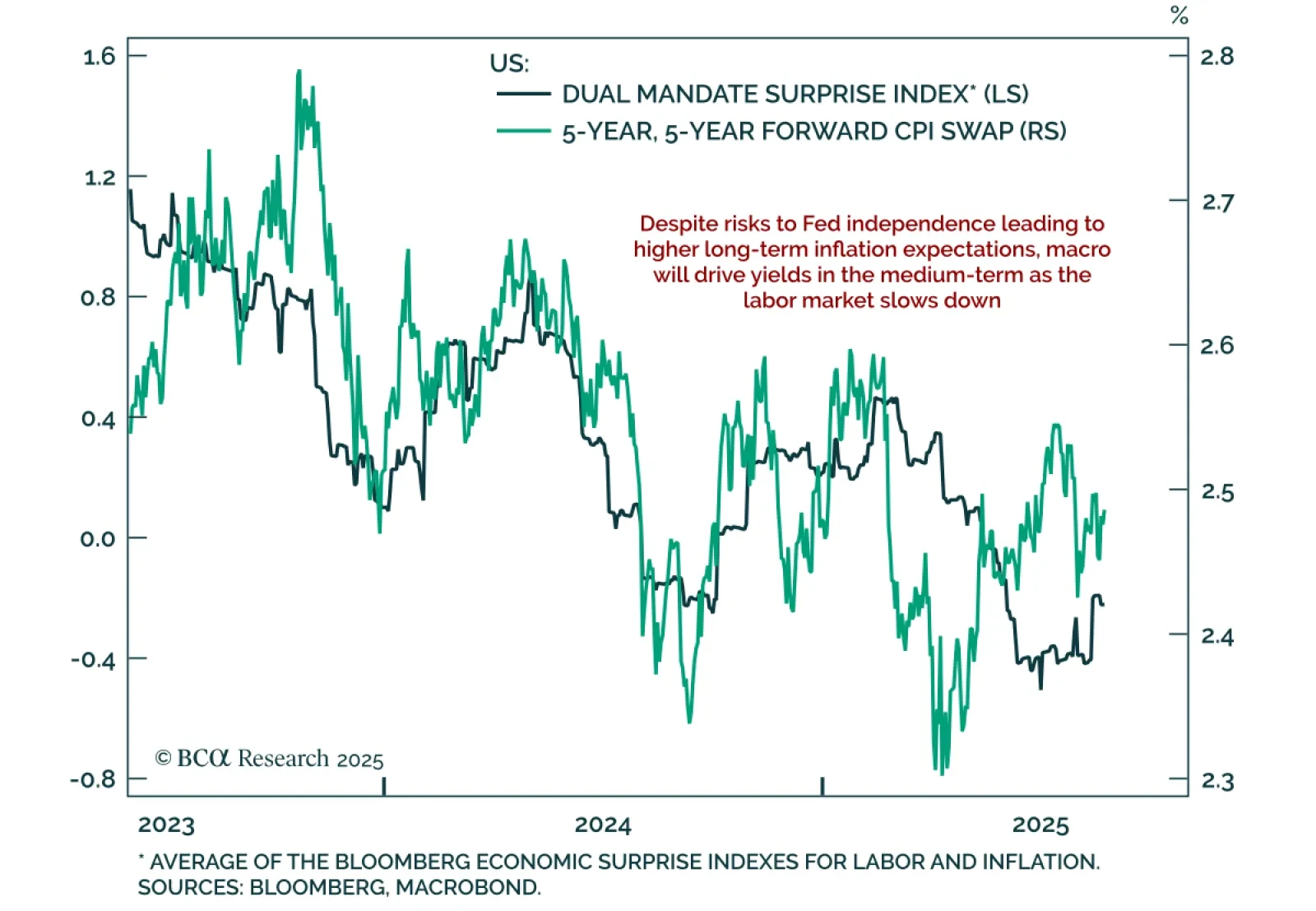

Trump’s firing of Fed Governor Cook raises Fed-independence risks, reinforcing steepener trades. The announcement, aimed at expanding presidential control over the central bank, saw equities fall and bonds initially rally on the…

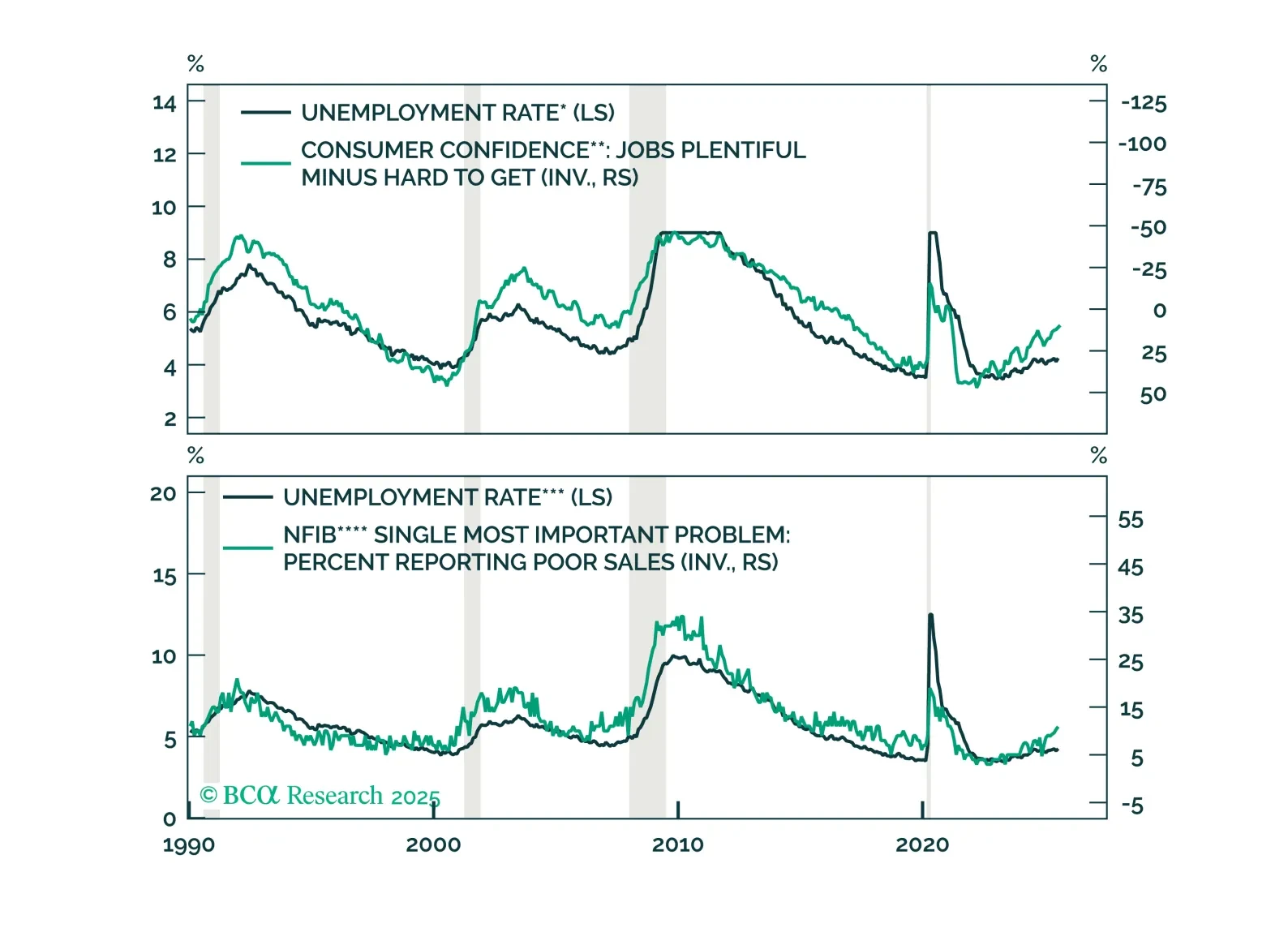

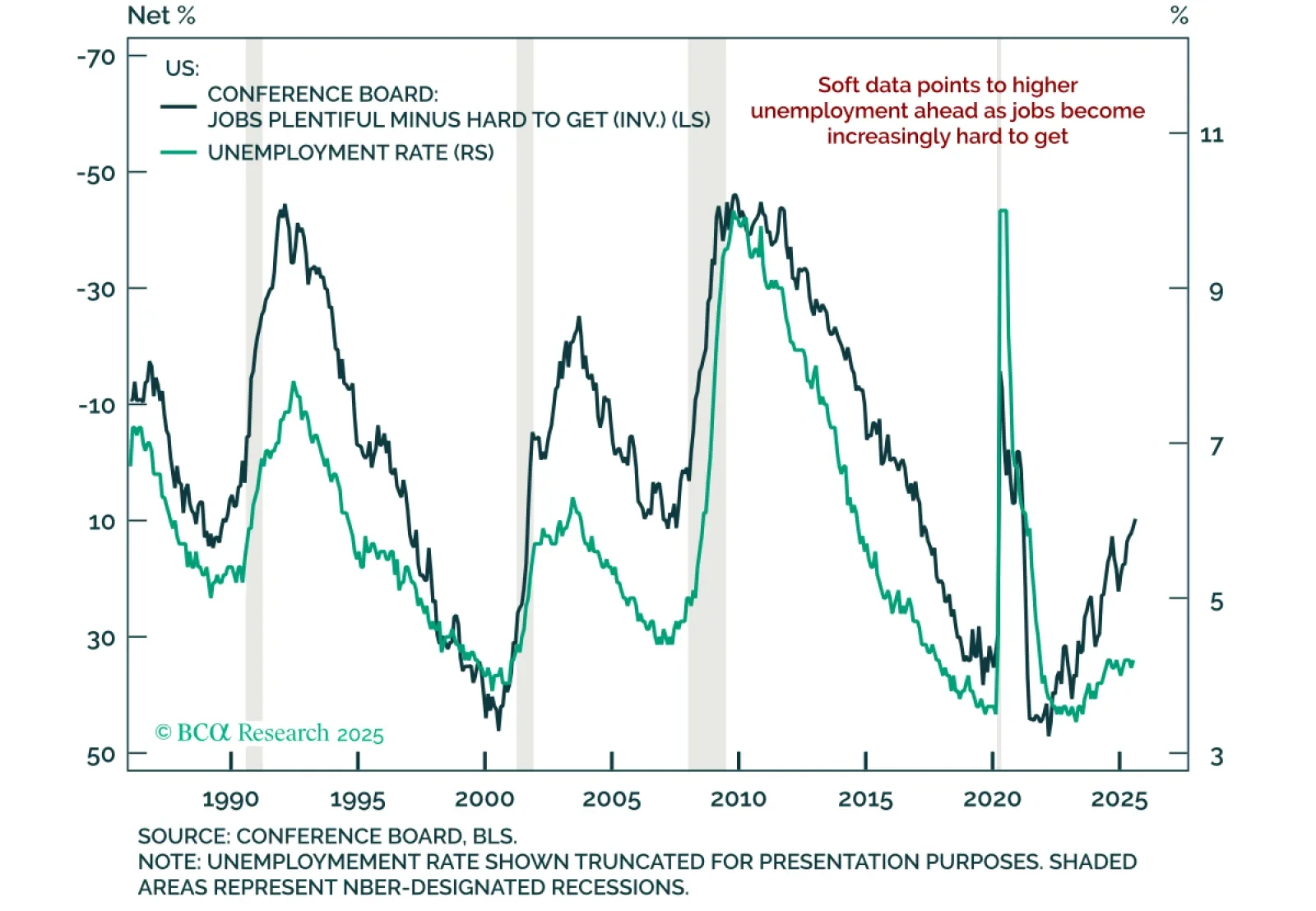

Mixed consumer confidence data and weakening labor signals argue for a modestly defensive stance. The August Conference Board Consumer Confidence Index beat expectations but fell from an upwardly revised 98.7. The present situation…

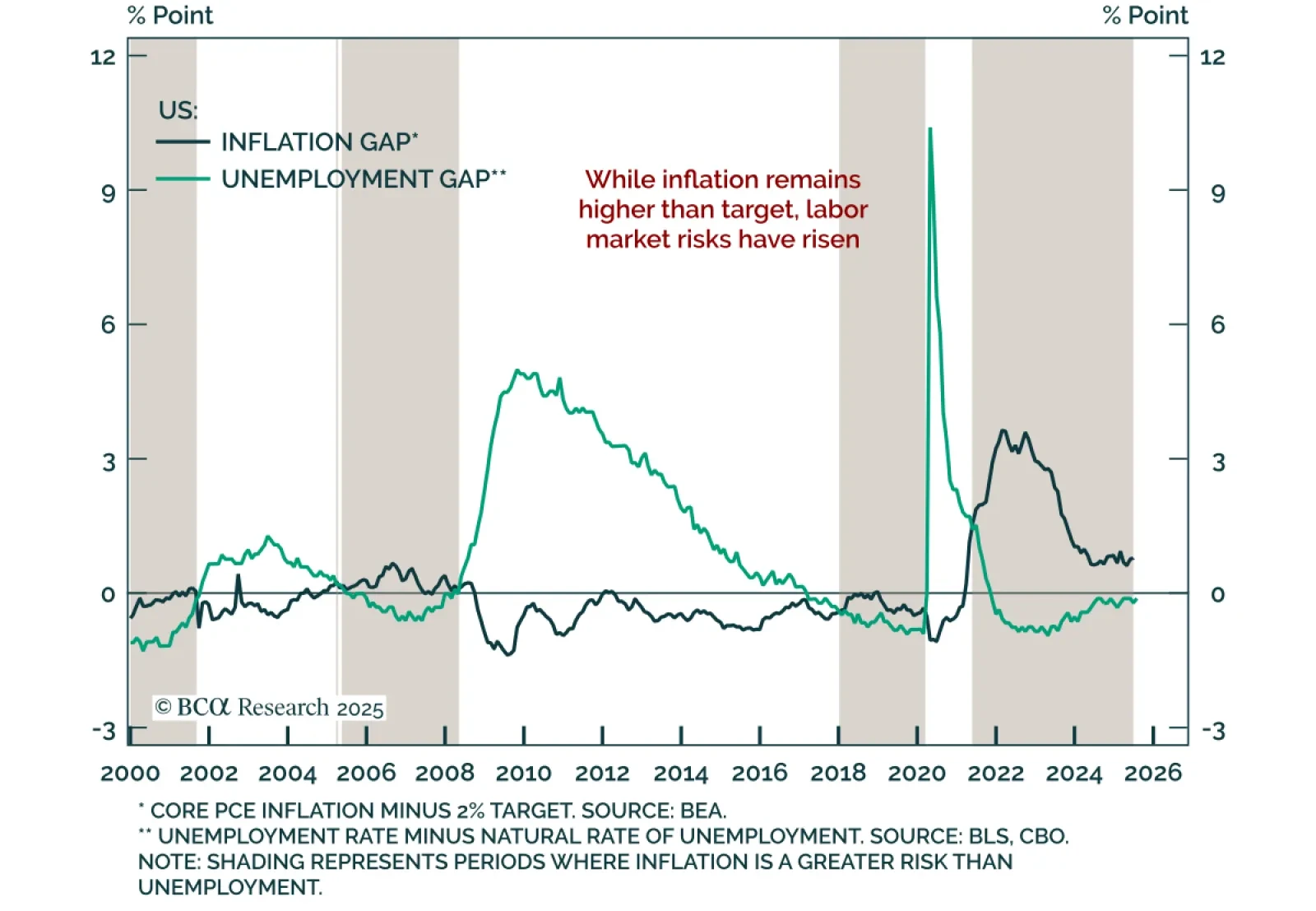

Powell’s Jackson Hole speech was misread, and points to cautious dovishness. Some commentators called it hawkish, others suggested the Fed abandoned its 2% target. Neither is accurate. Central bank communication is rarely…