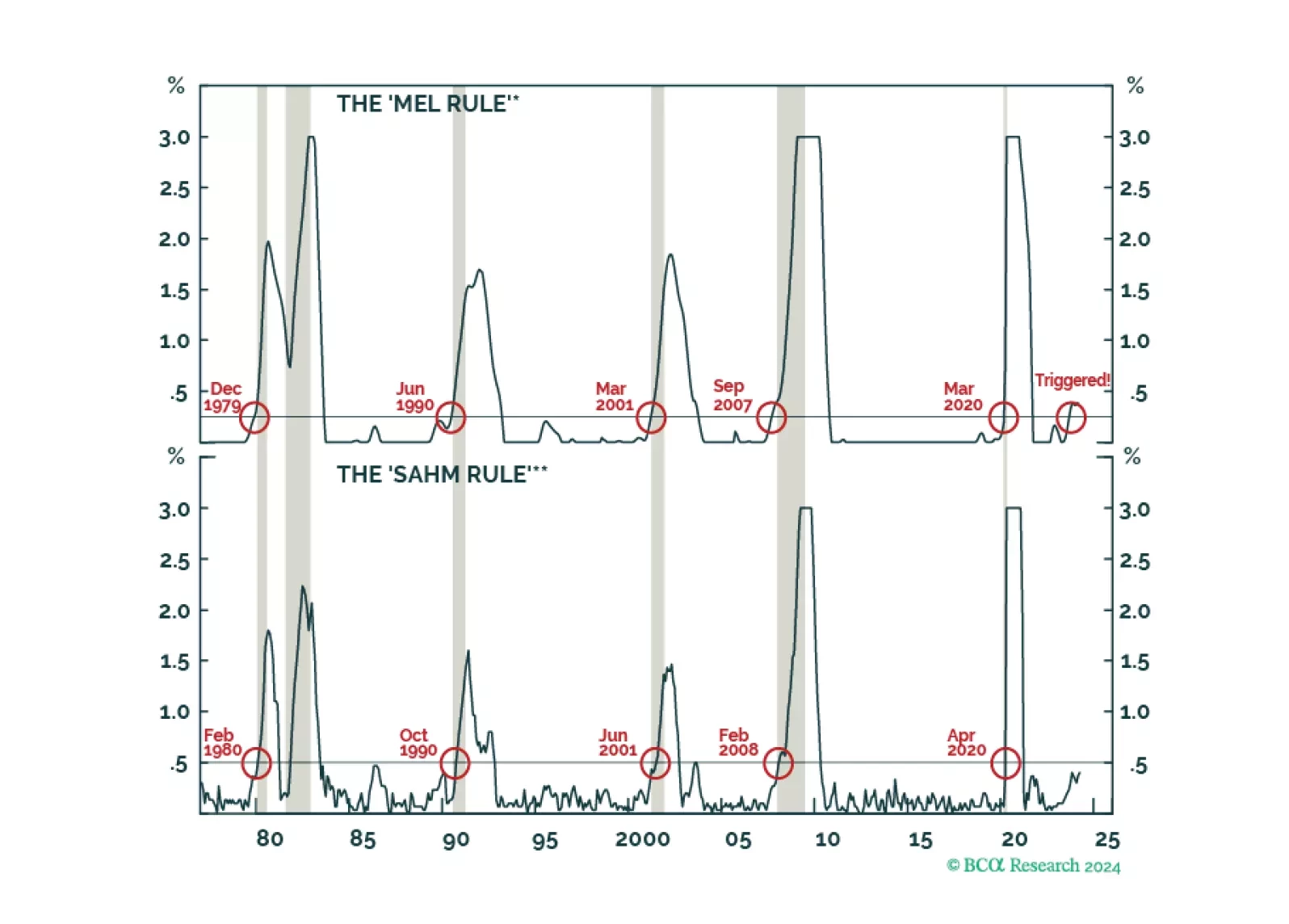

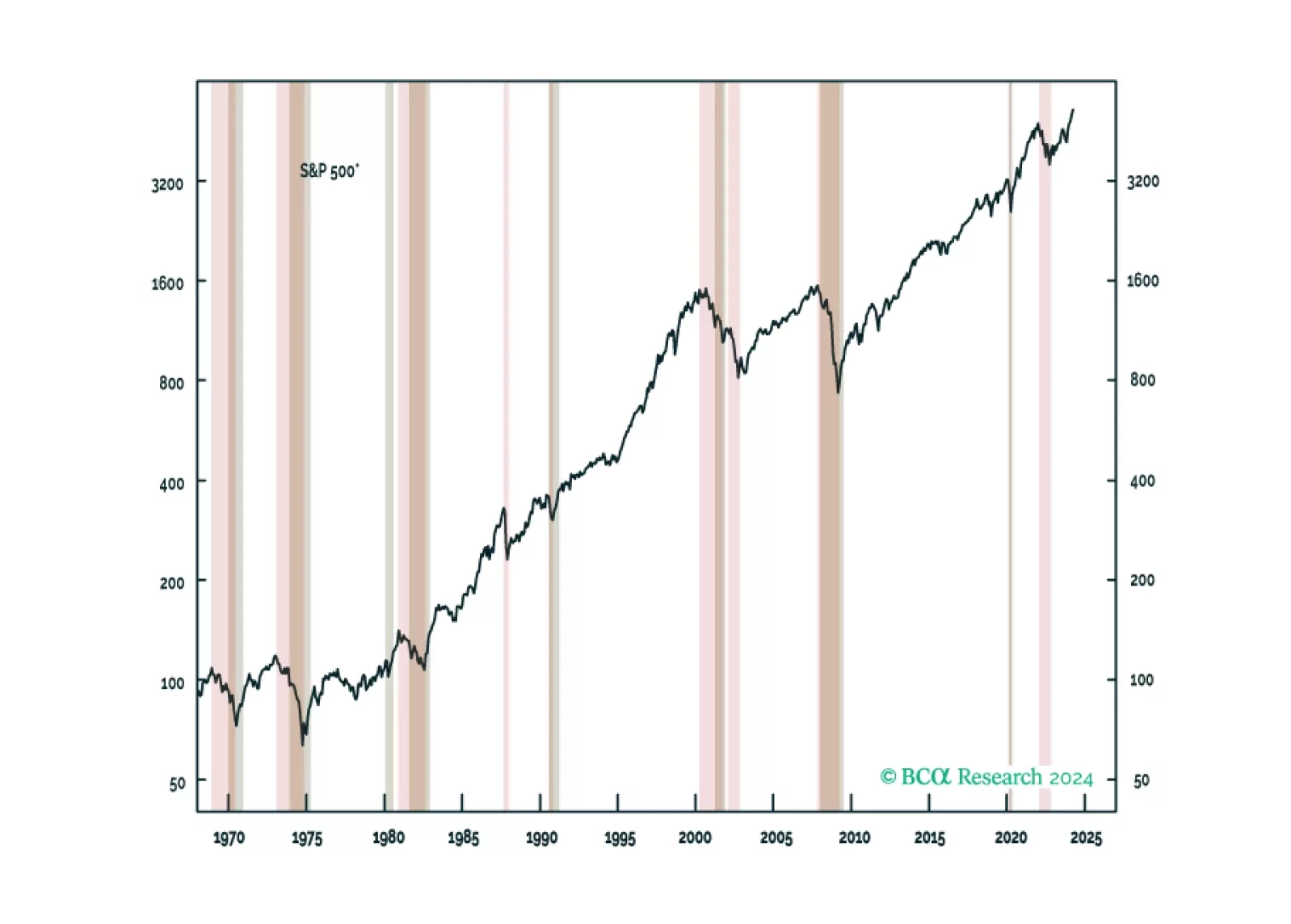

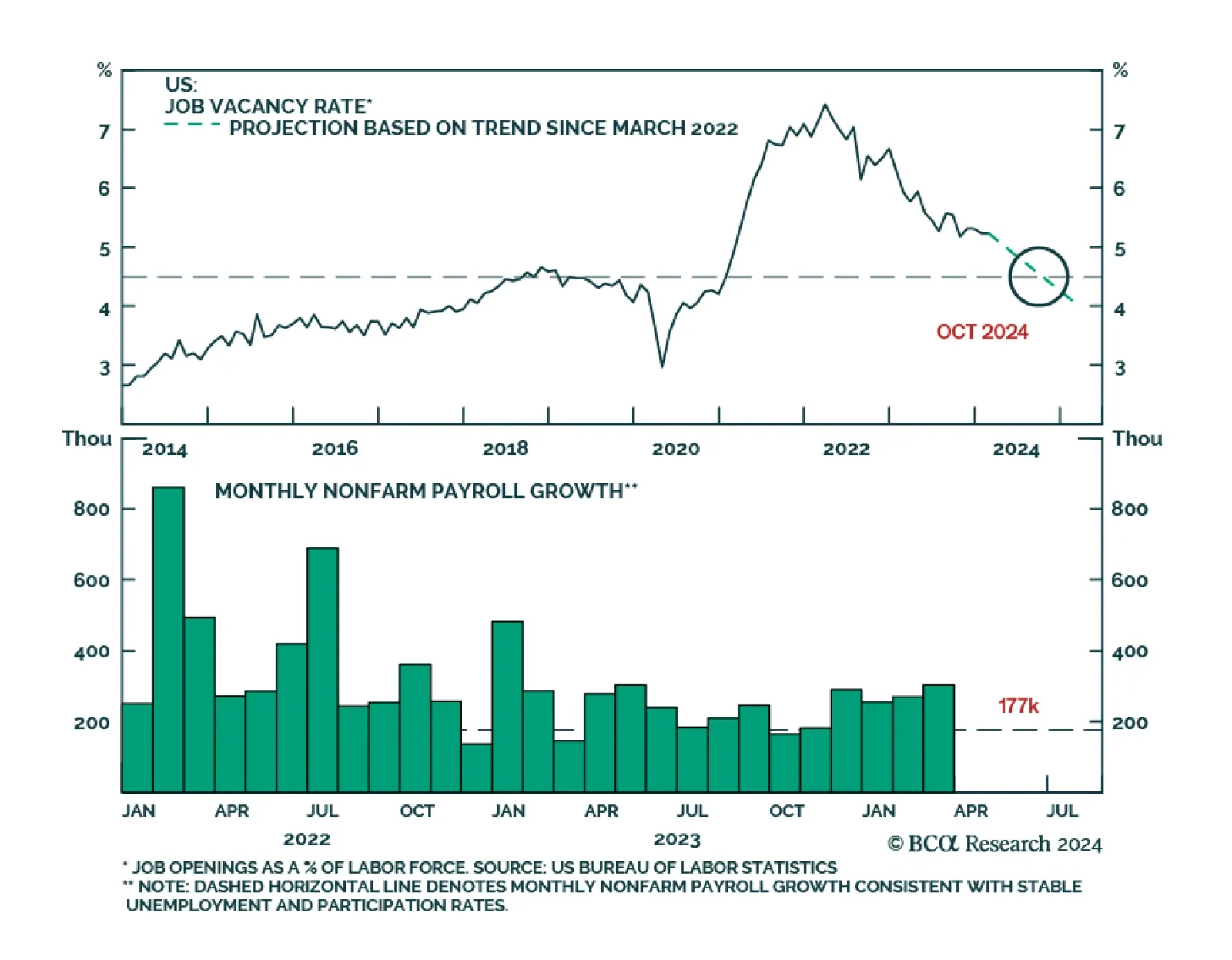

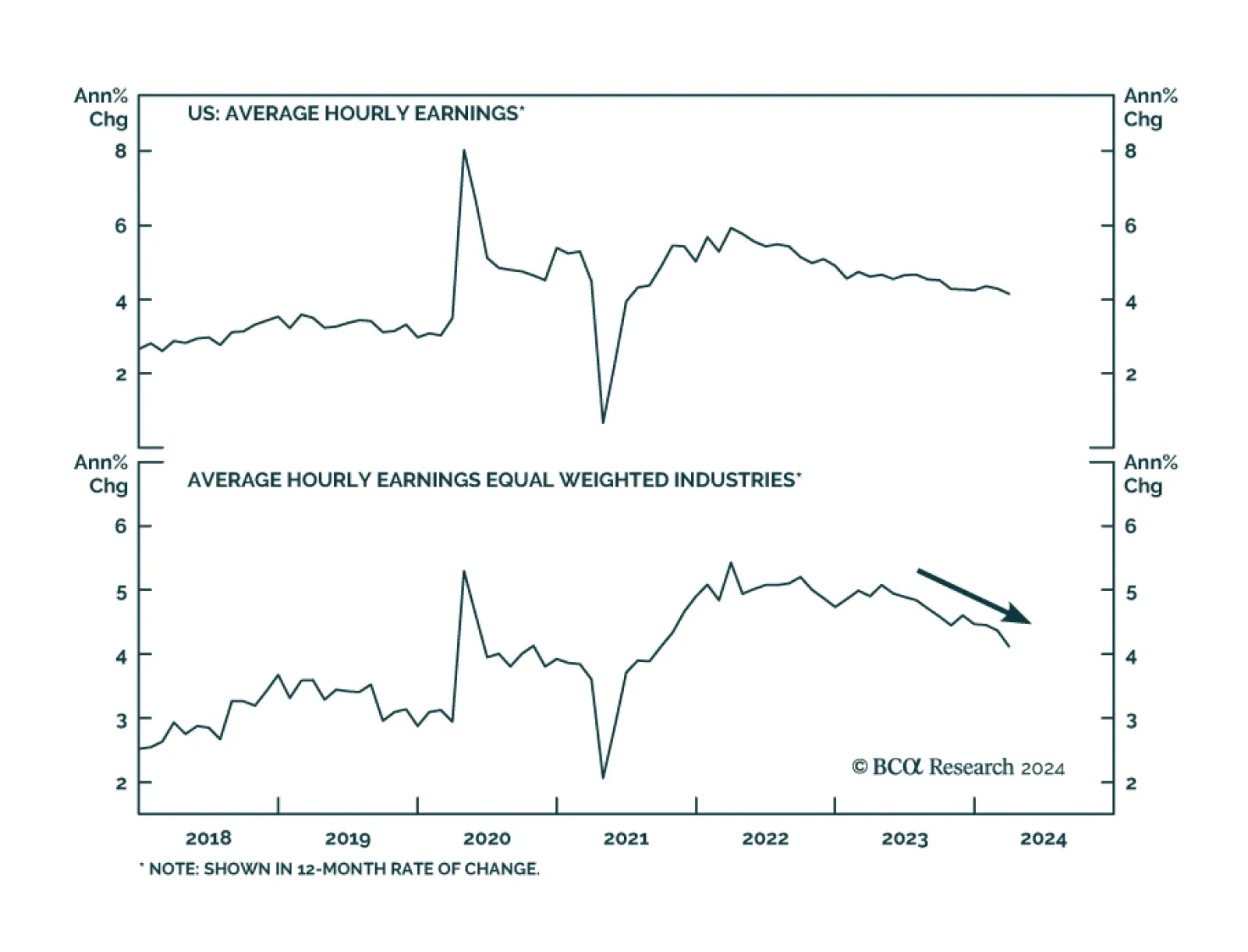

Contrary to conventional wisdom, most leading indicators suggest that the US labor market is weakening, including our very own “Mel rule.” After being overweight stocks last year, we moved to neutral at the start of 2024, and are now…

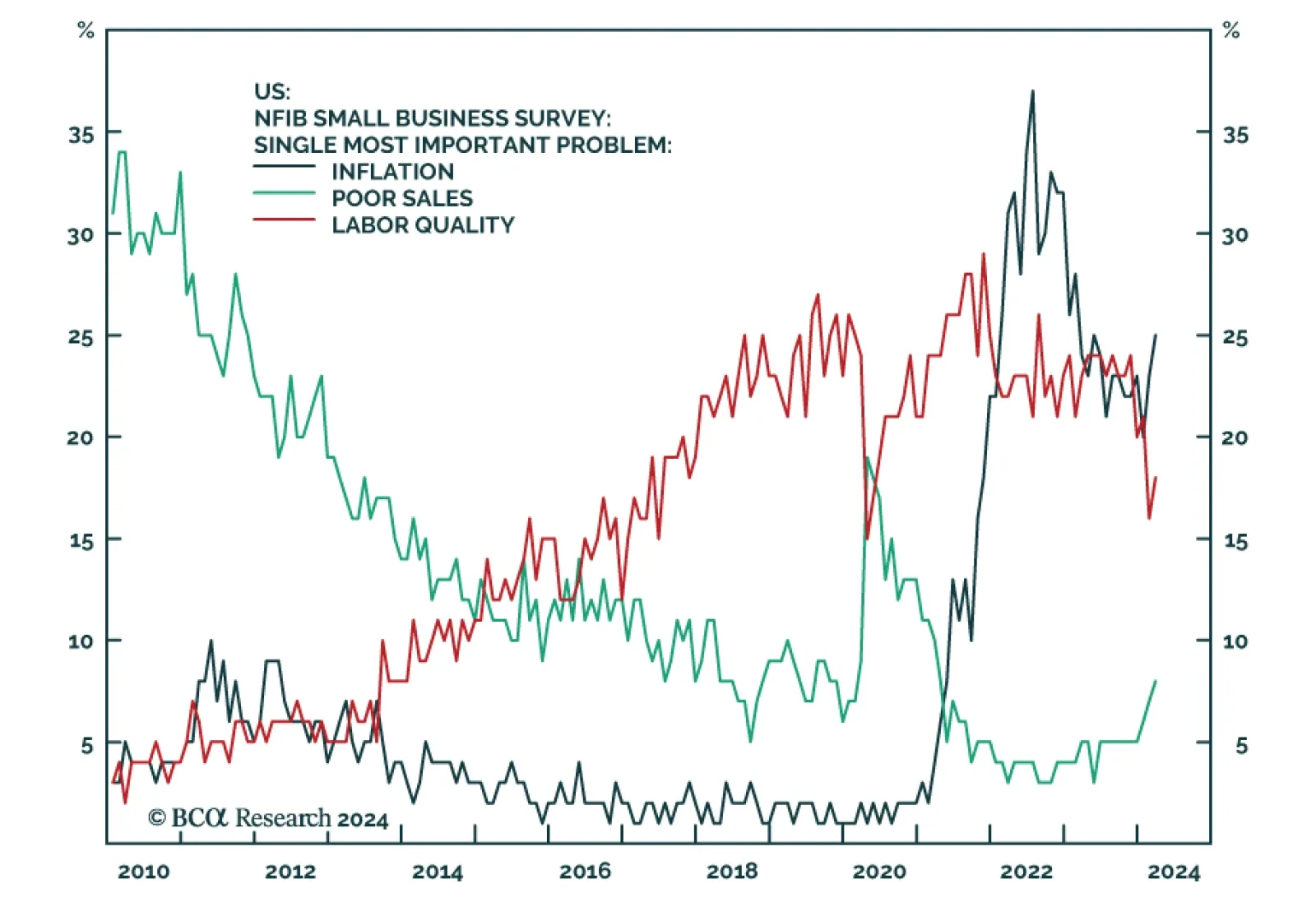

The NFIB’s small business optimism index decreased by 0.9 points to 88.5 in March, missing expectations of 89.9, and reaching its lowest level since 2012. A few things stood out from the report: Labor market…

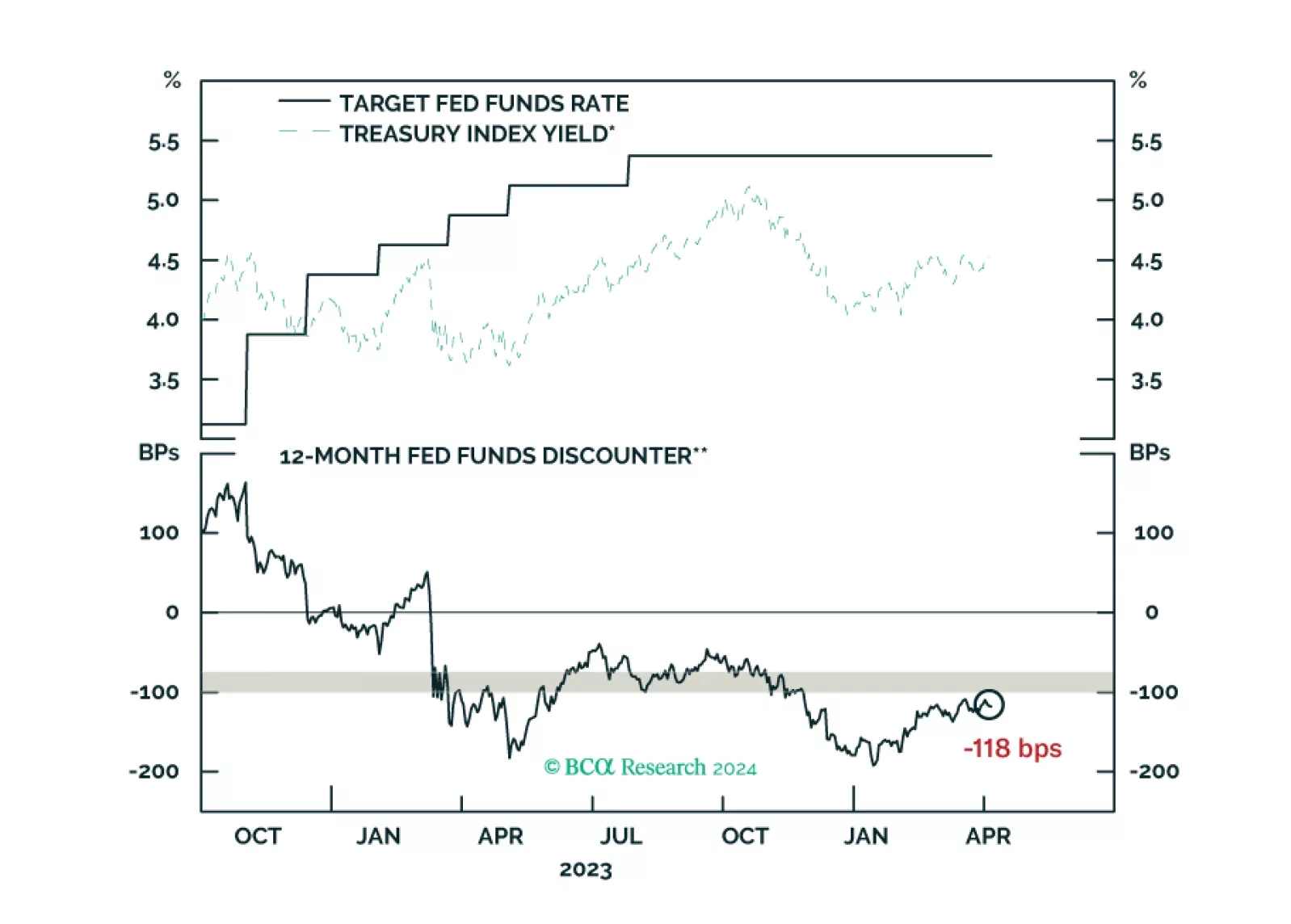

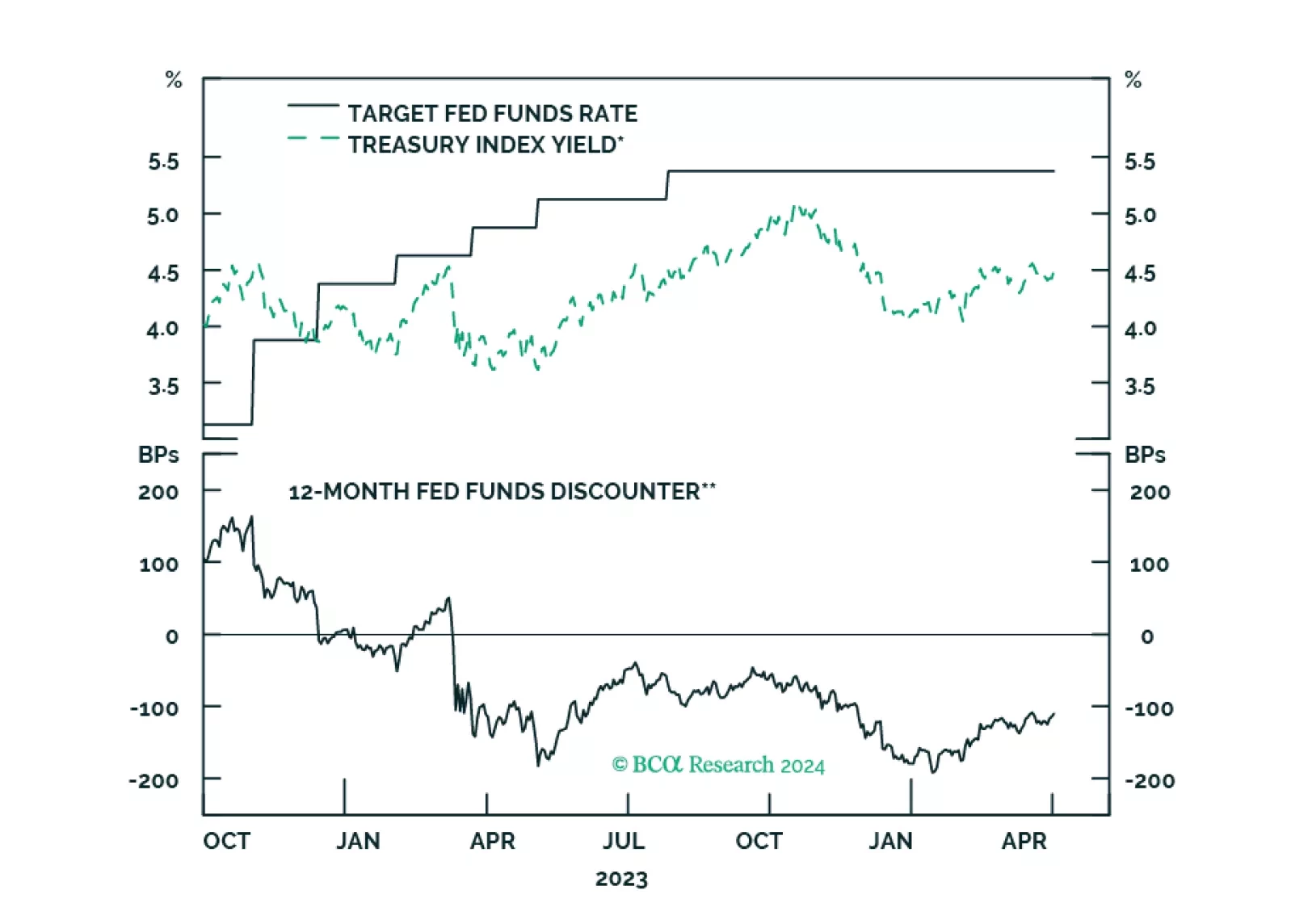

According to BCA Research’s US Bond Strategy service, until labor market cracks emerge, the path of least resistance for bond yields is probably higher, but the potential near-term upside in yields is limited. The team…

The 303-thousand increase in nonfarm payrolls in March came in well above consensus expectations of a moderation from 270 thousand to 214 thousand. Healthcare, the public sector and construction were the top contributors to…

Our reaction to this morning’s employment report and bond market moves.

The number of job openings in the US in February (8.76 million) was little changed from the downwardly revised 8.75 million in January, keeping the job openings rate stable at 5.3%. Similarly, the hiring rate was little changed…

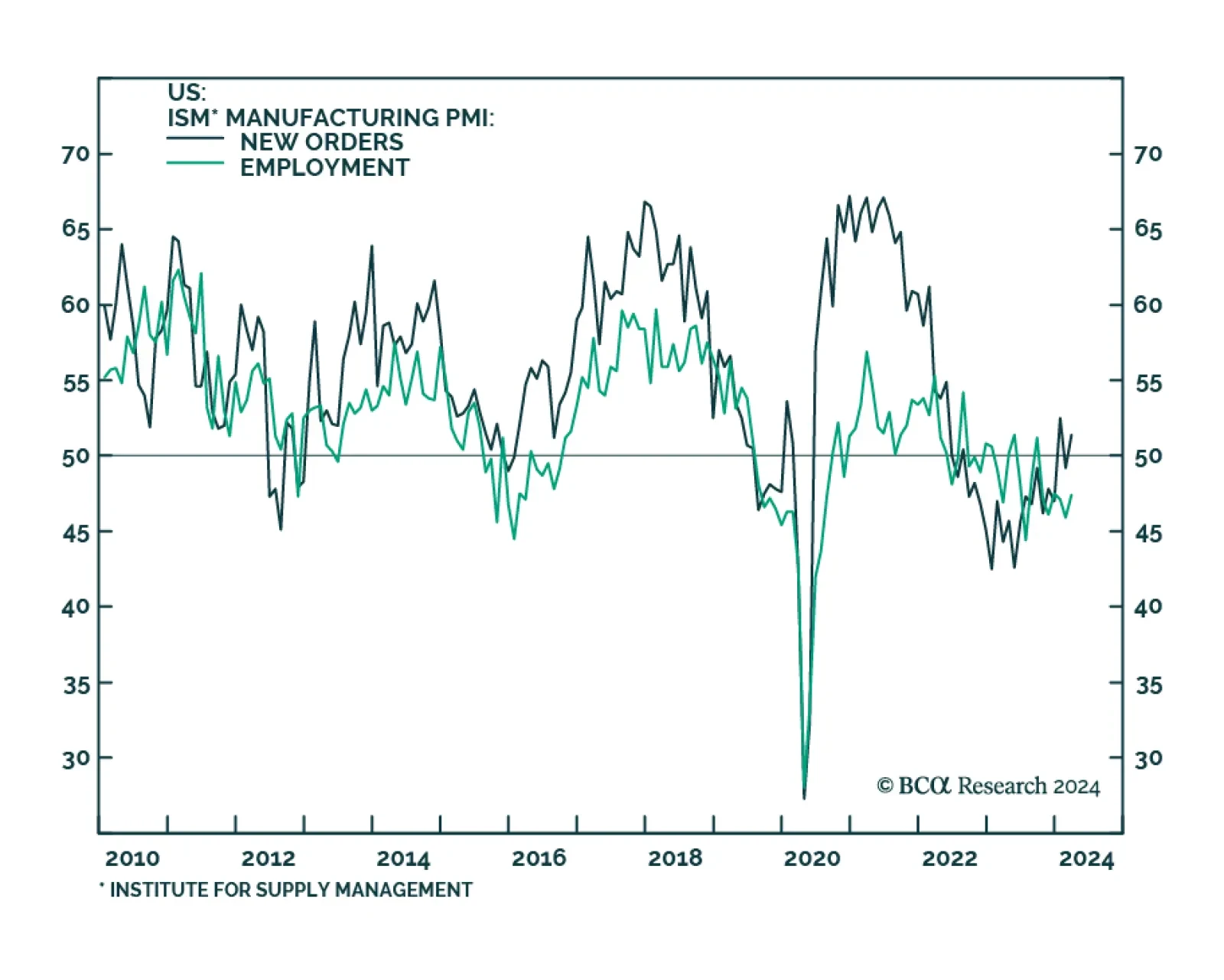

The ISM Manufacturing PMI came in at 50.3 in March, better than expectations of 48.4 and breaking above the 50 boom-bust line for the first time since September 2022. Notably the new orders component rebounded to 51.4, marking…

Our Portfolio Allocation Summary for April 2024.

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.