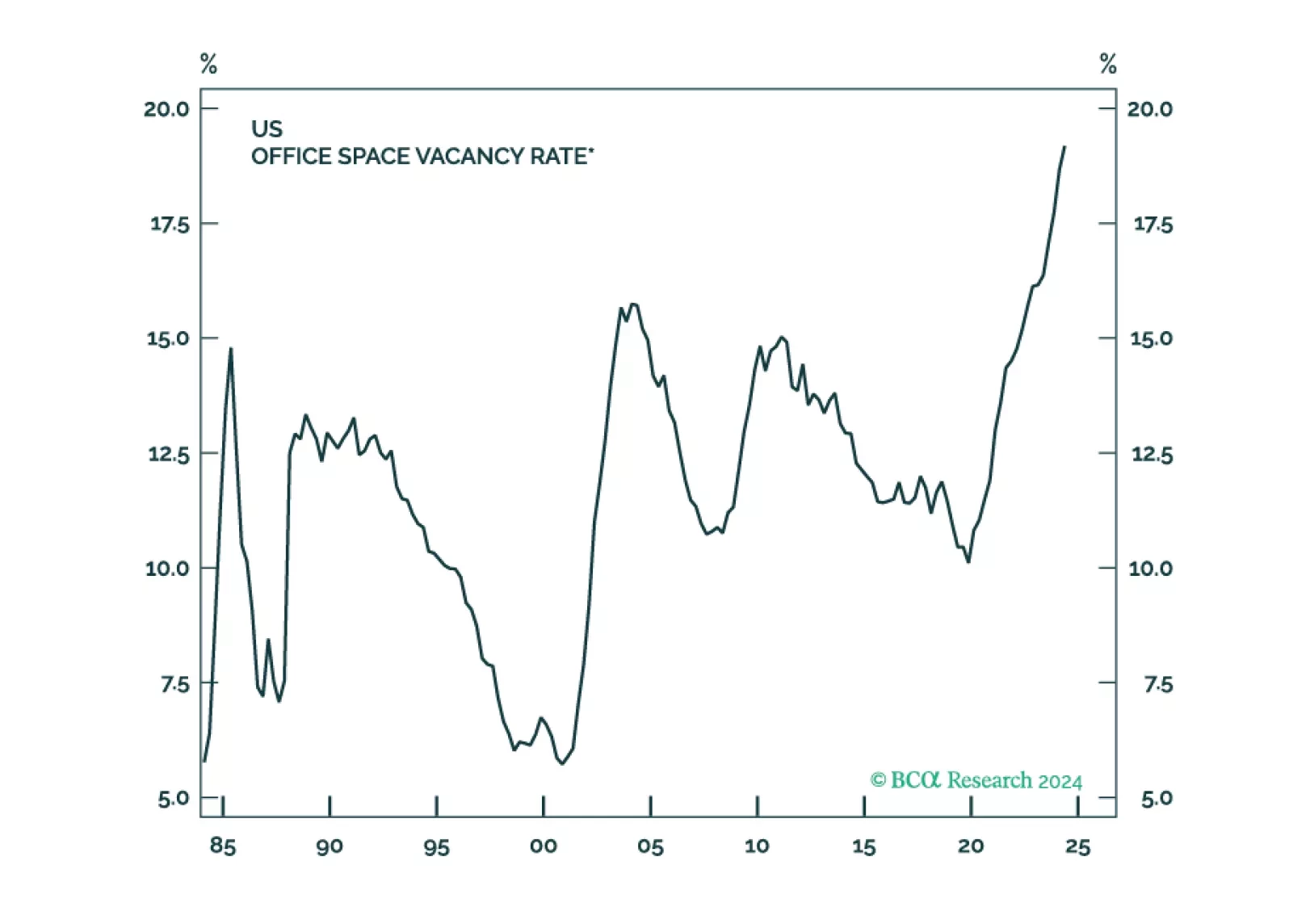

The US suffers from enough imbalances to produce a mild recession. Unfortunately, such a recession could lead to a significant bear market in stocks, just as it did during the very mild 2001 recession.

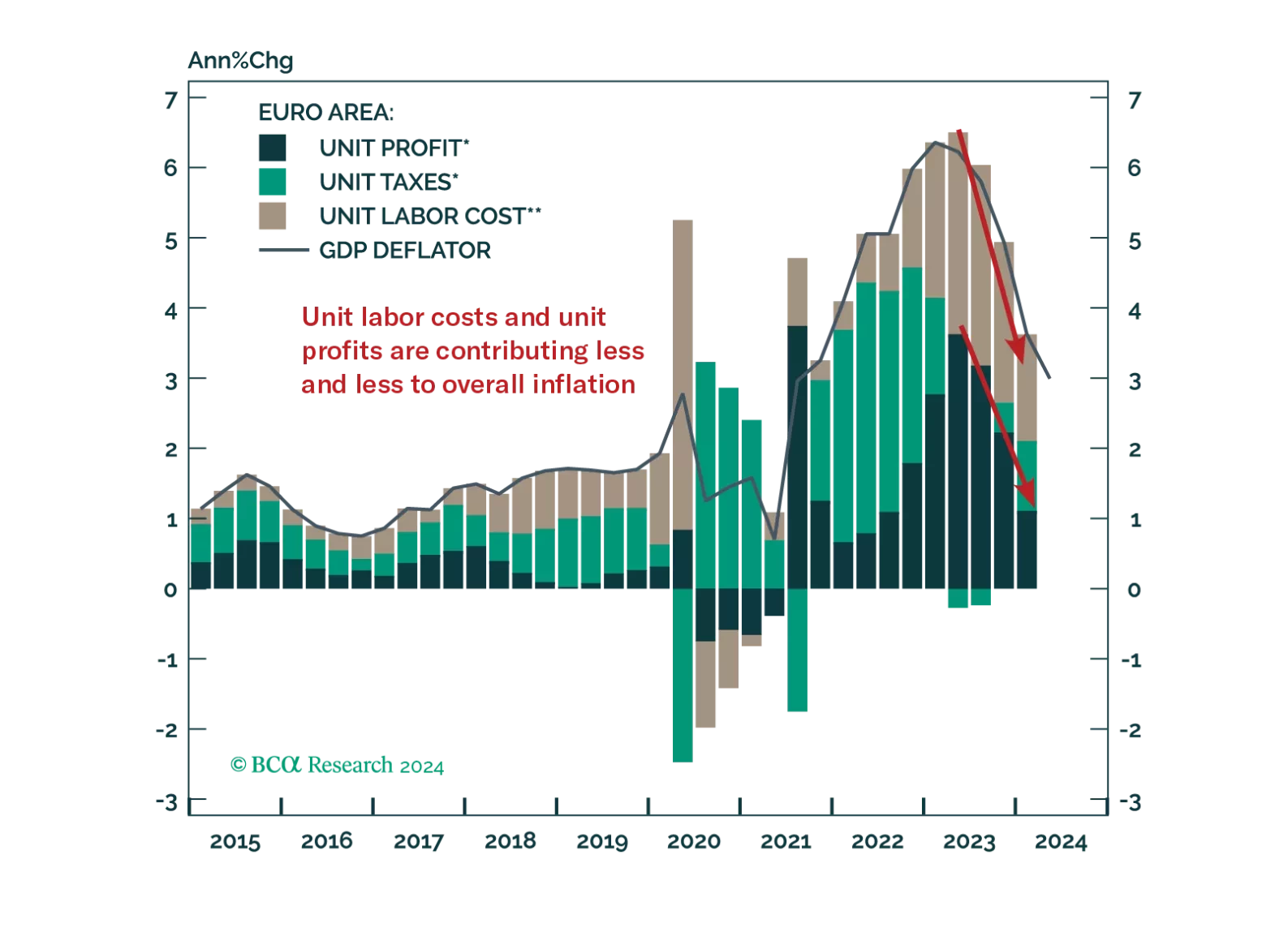

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.

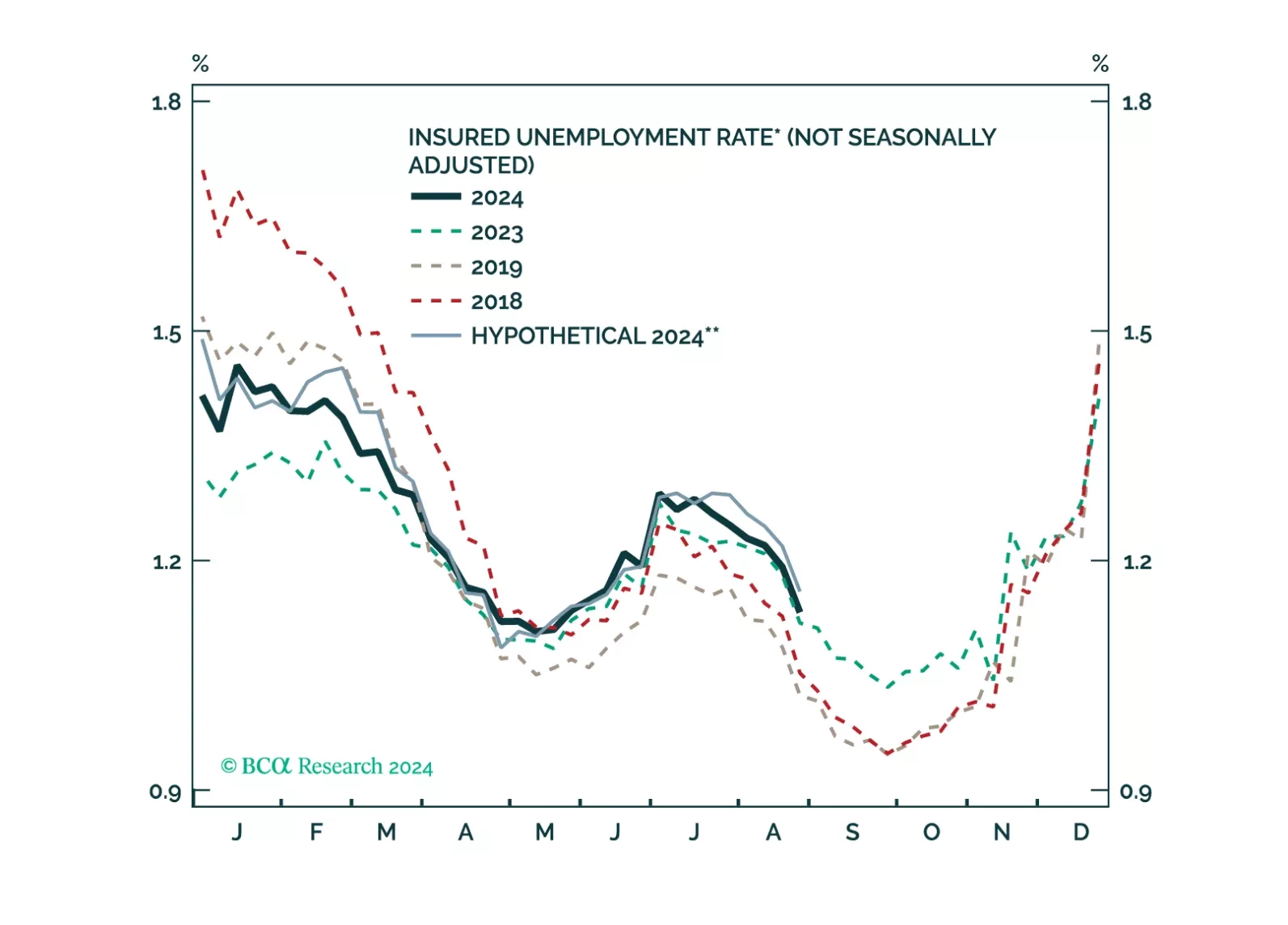

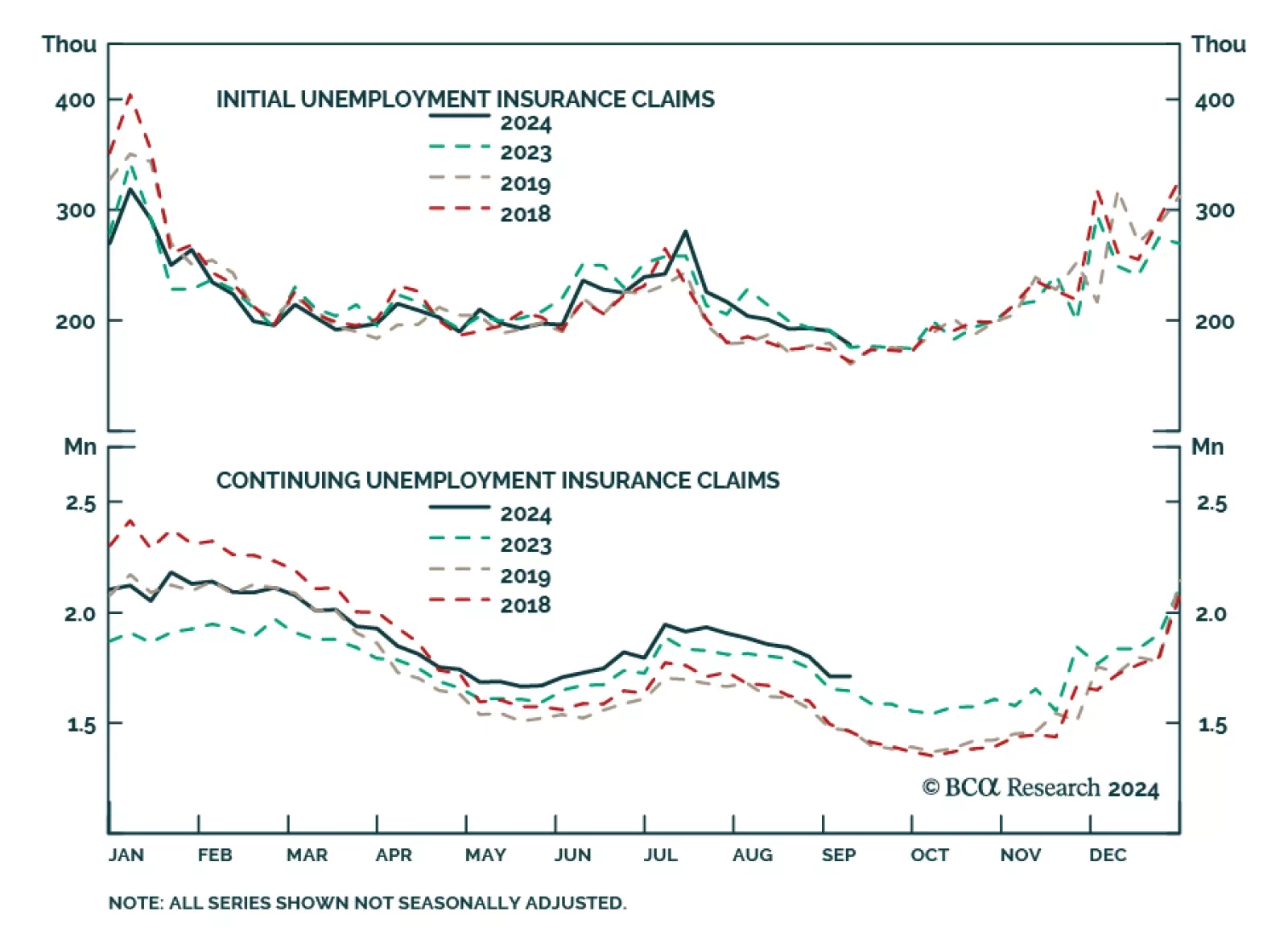

Continued deterioration in labor demand underpins our expectation for a US recession, as it will lead to slower compensation growth, hobbling consumption spending’s main driver. We also previously highlighted that the…

Some thoughts on this morning’s US claims report and a preview of next week’s FOMC meeting.

Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

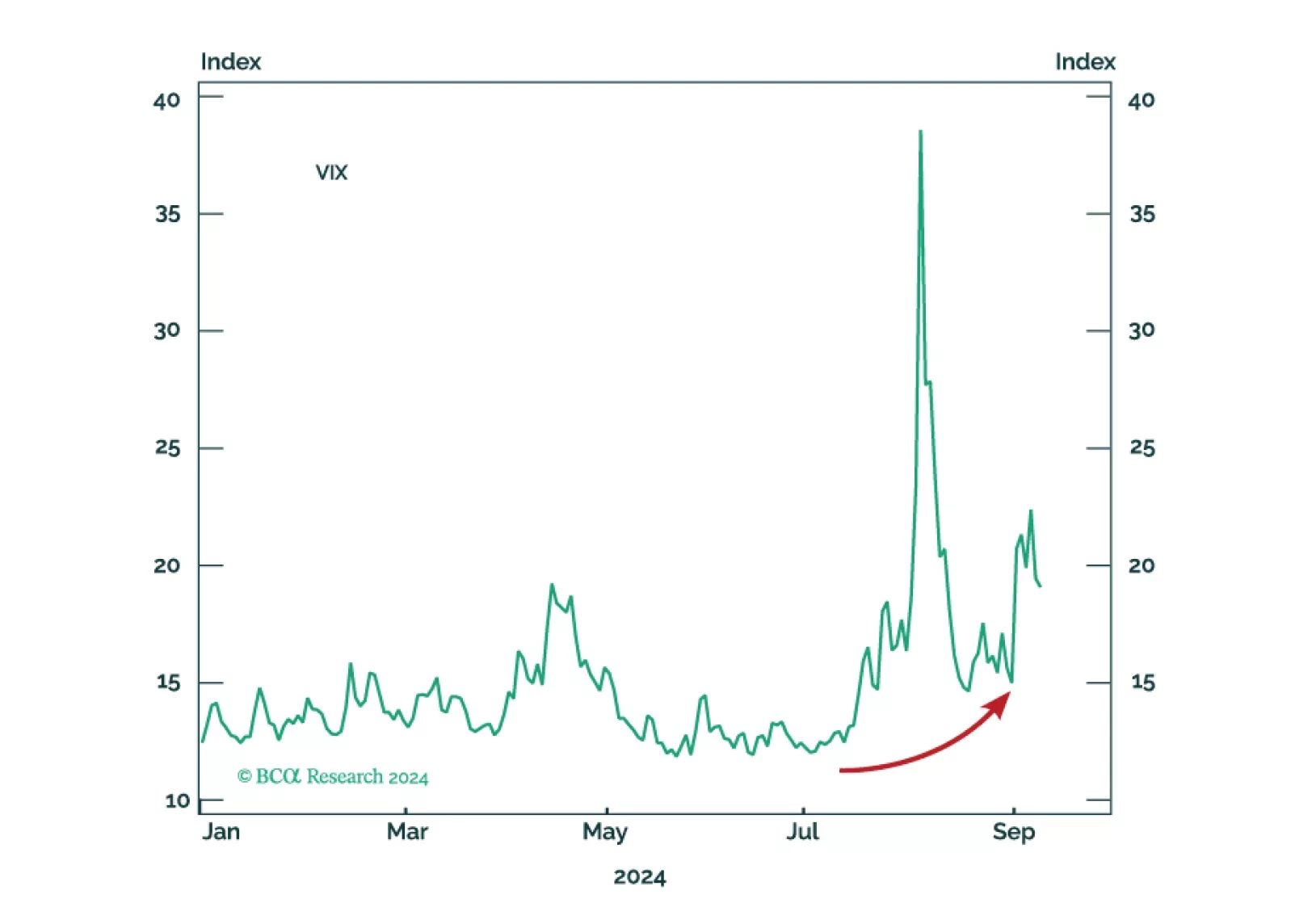

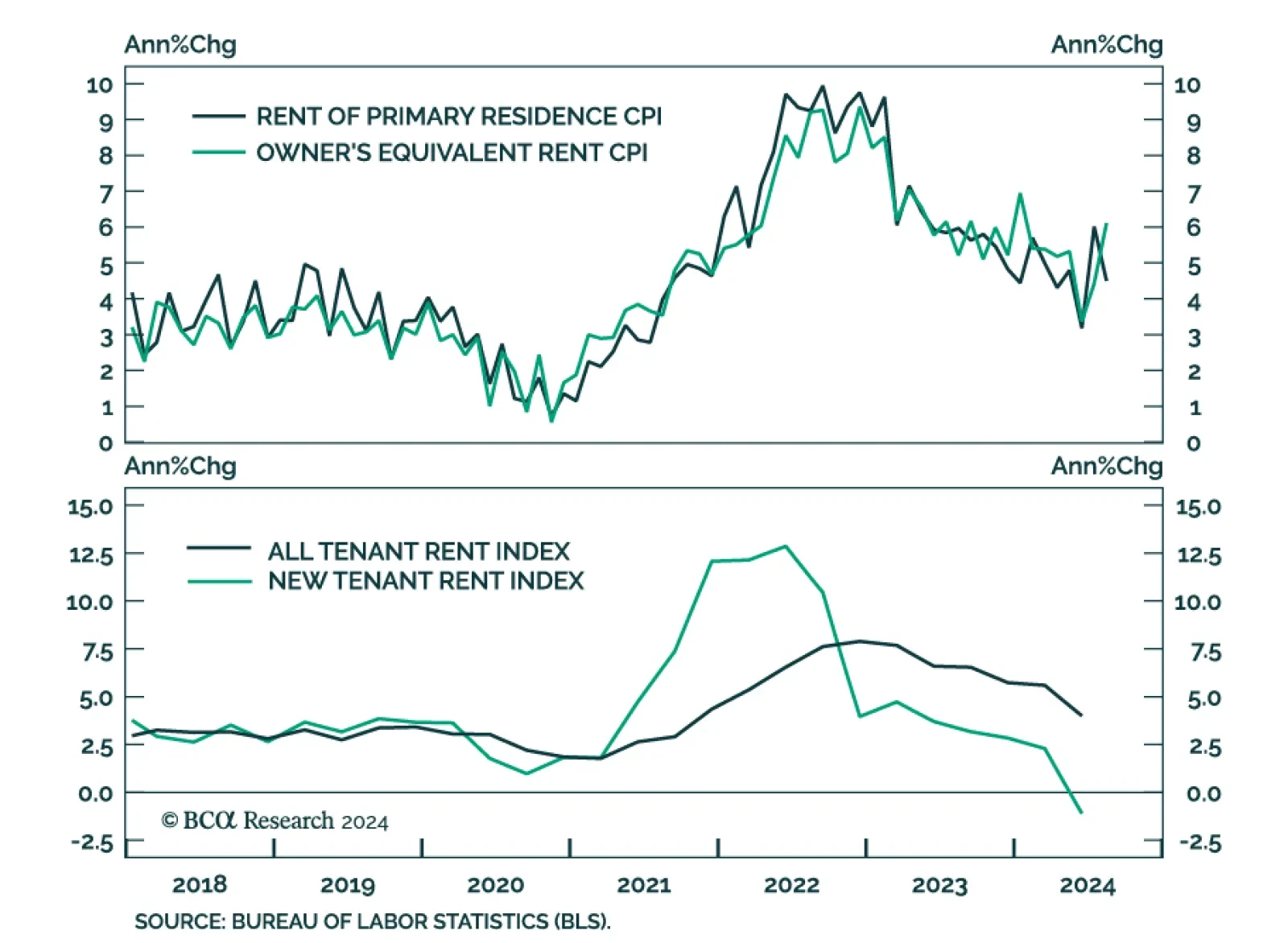

US headline CPI eased from 2.9% y/y to 2.5% in August in line with consensus predictions. However, core CPI unexpectedly accelerated from 0.2% m/m to 0.3%. Aside from airfares -- a highly volatile series which is likely to…

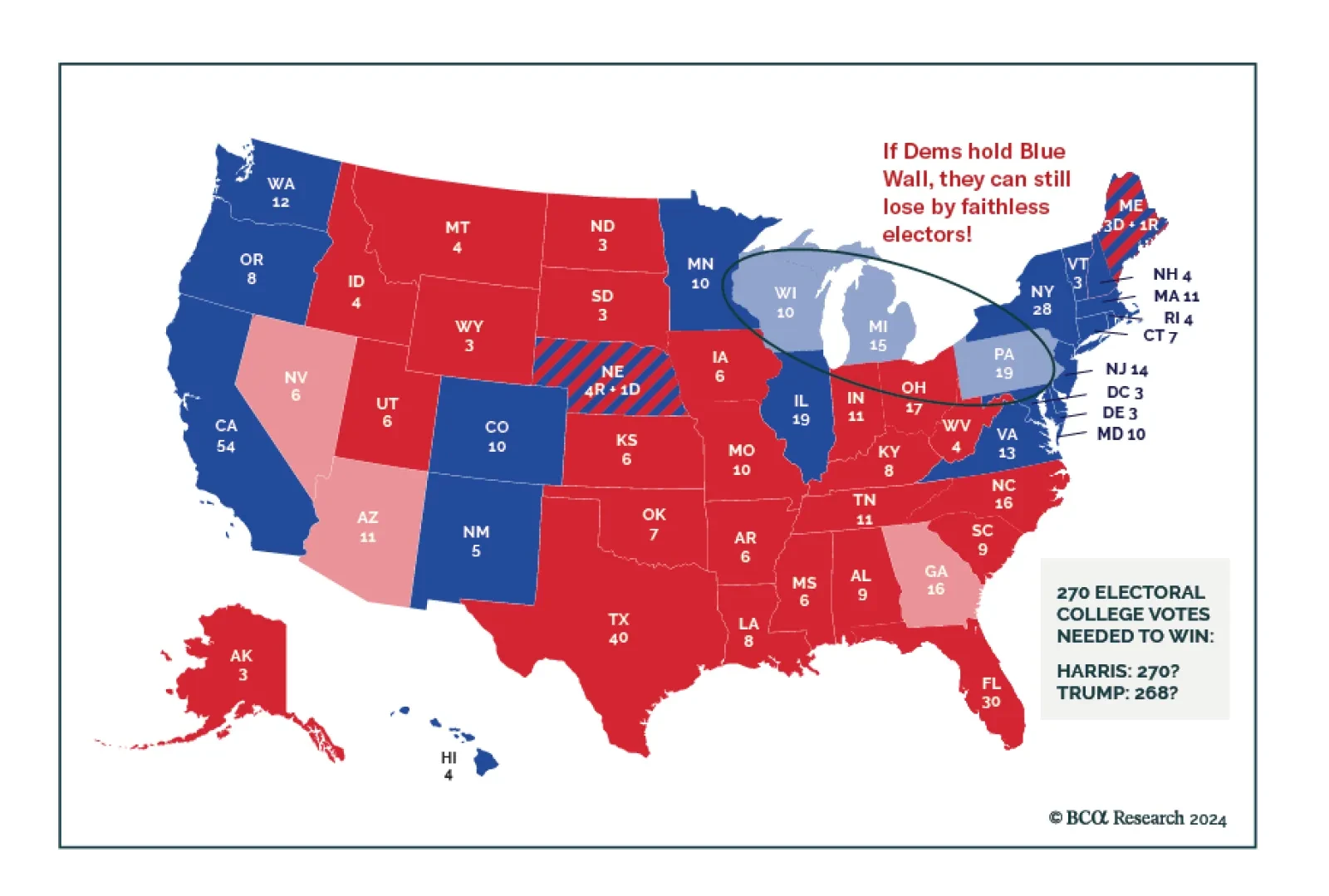

According to BCA Research’s US Political Strategy service, former President Trump still has a path to come back to power, despite his disastrous performance in the debate with Vice President Kamala Harris on September 10…

Despite the disastrous performance by former President Trump in the debate with Vice President Kamala Harris, there are still paths for him to come back to power. The economy and global instability could flare up anytime between now…

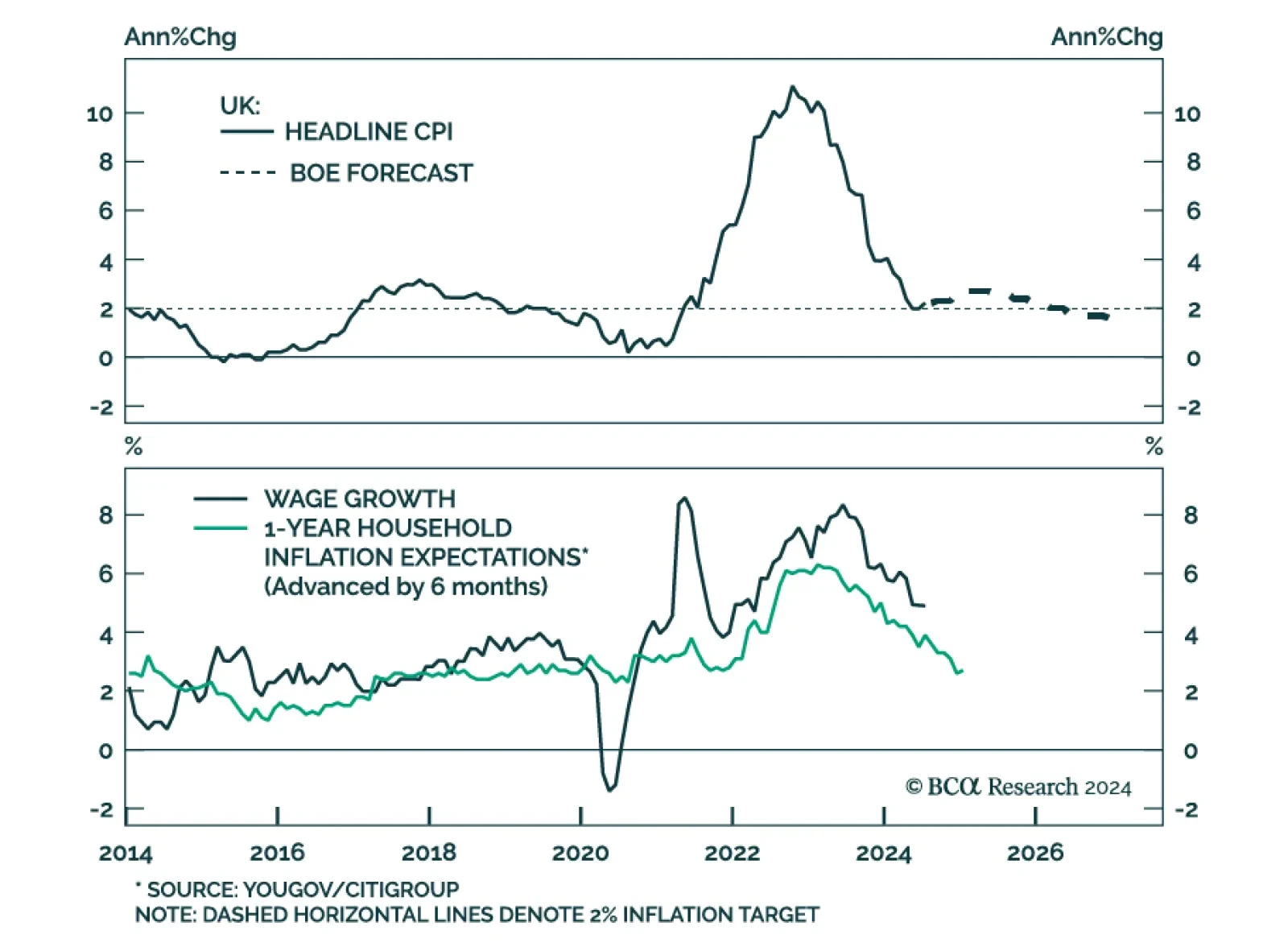

The BoE embarked on its easing cycle in August, delivering its first 25 bps rate cut. The decision was nowhere near unanimous, with 5 MPCs out of 9 voting in favor of lowering policy rates. Indeed, while headline inflation is…

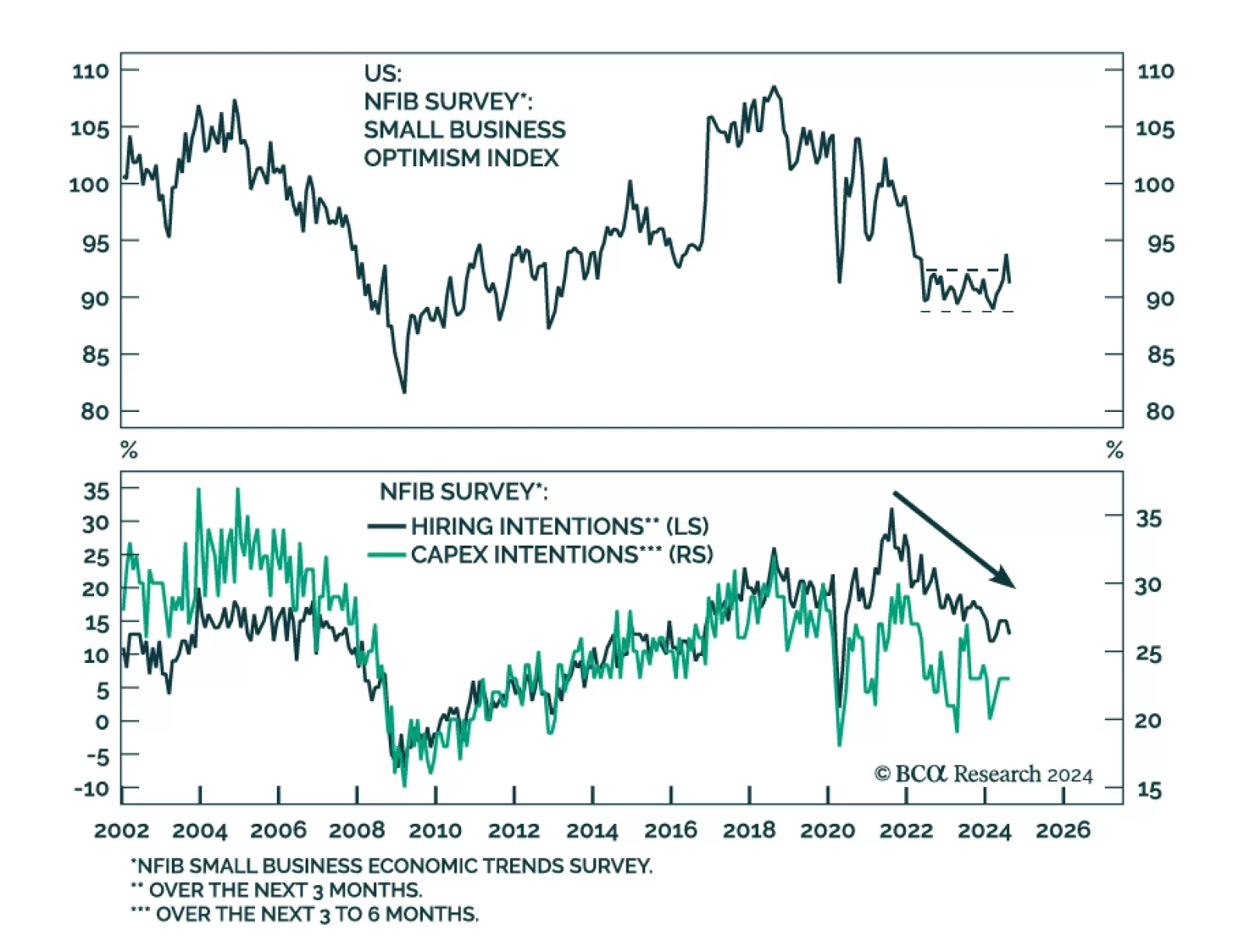

US small business optimism unexpectedly shed 2.5 points to 91.2 in August, the largest monthly decline since 2022, retracing nearly half of the index’s advance since March. The NFIB Small Business Optimism has oscillated in…