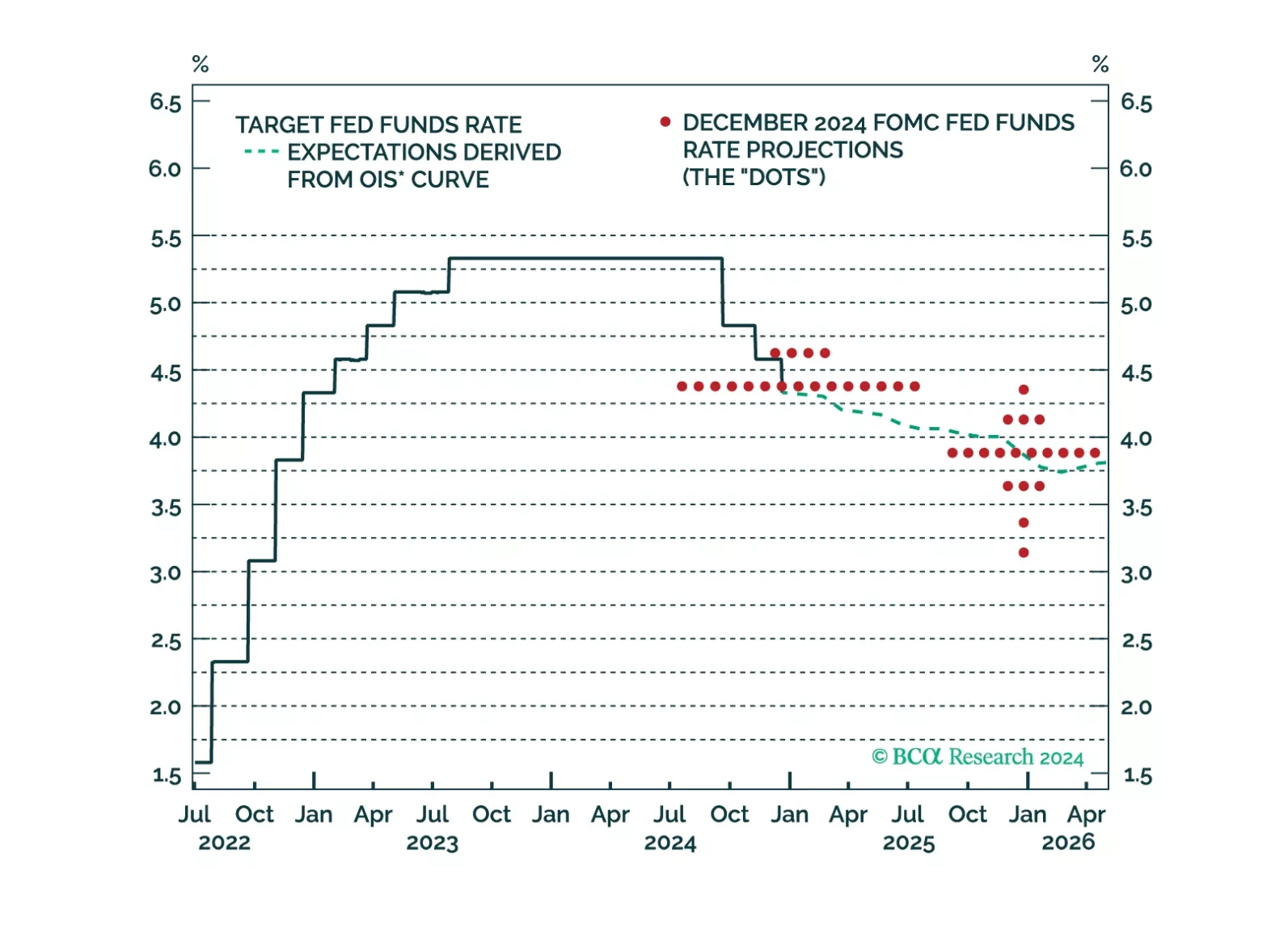

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

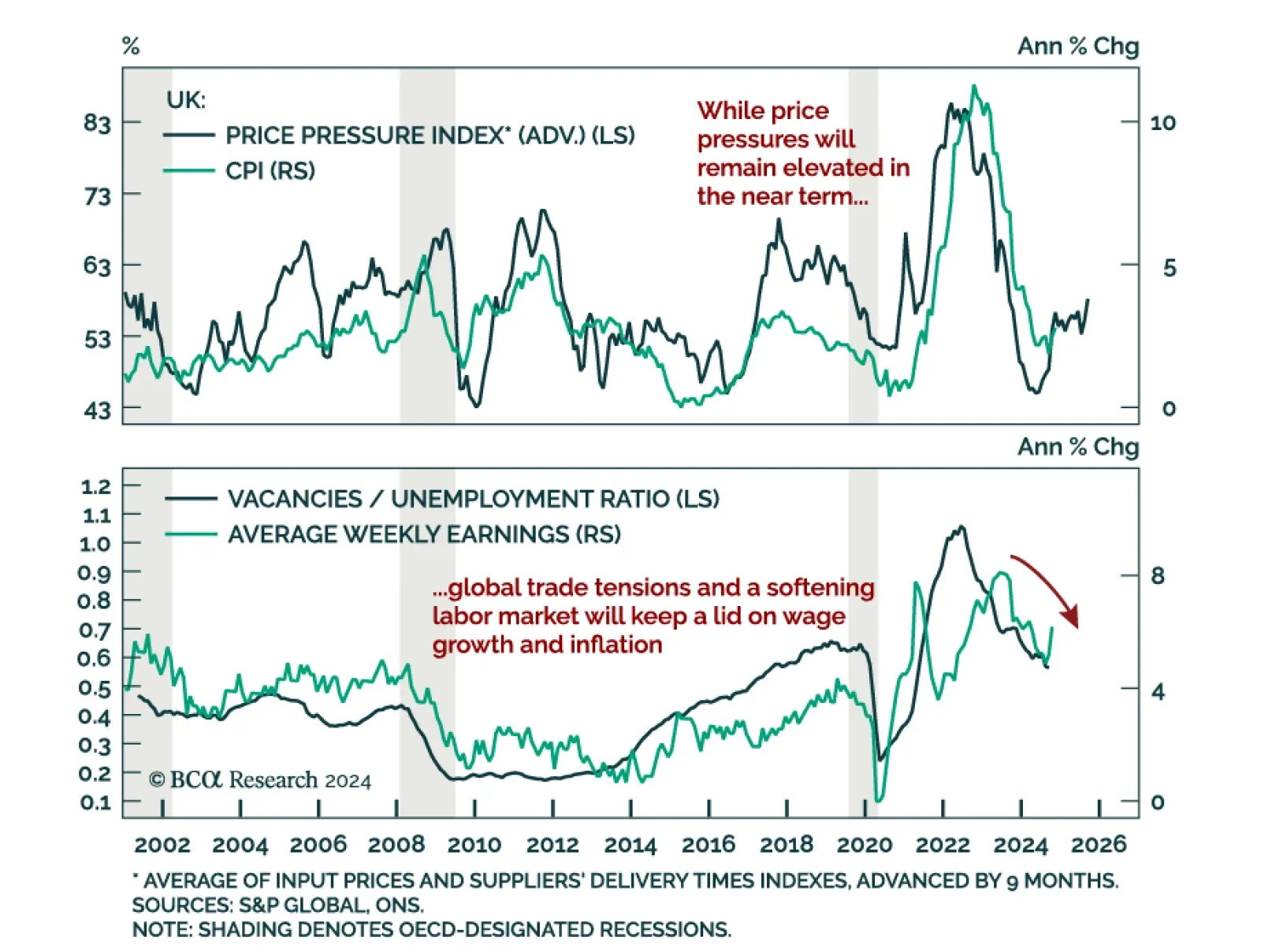

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

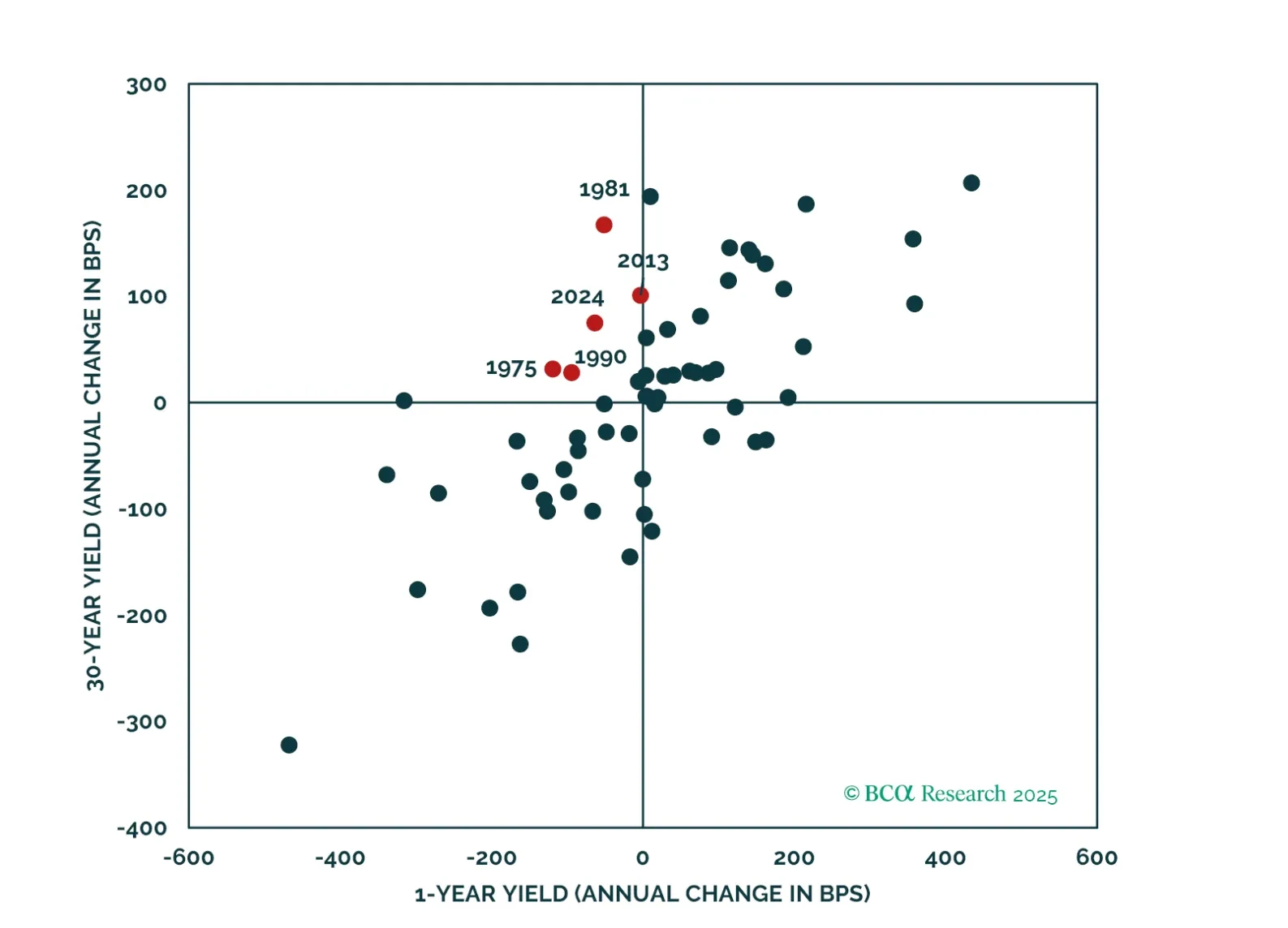

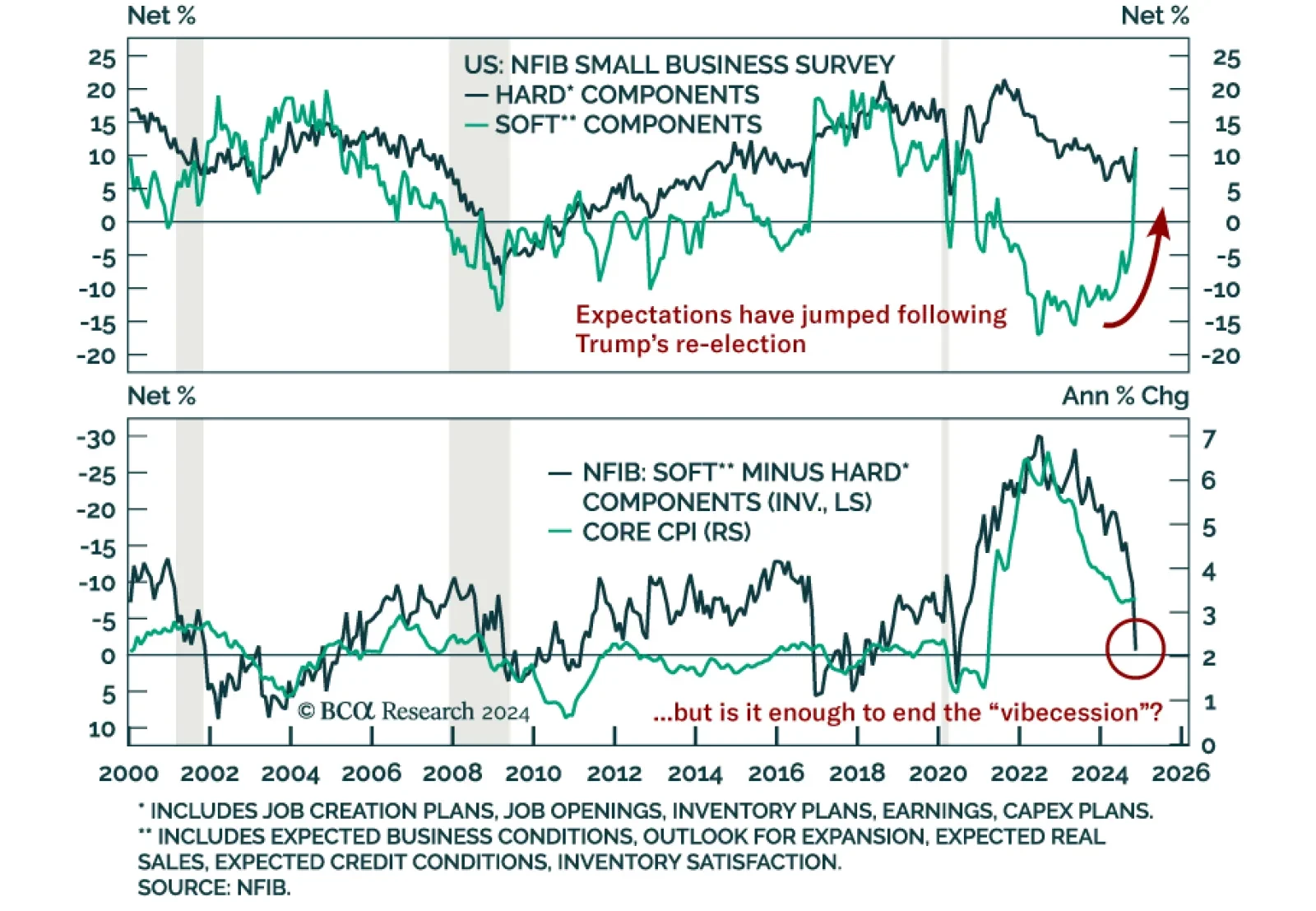

The post-COVID US recovery was different from previous cycles. Despite an ebullient economy, US consumers and firms have just not been feeling it, as reflected by the depressed signals from so-called soft, survey-based indicators…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

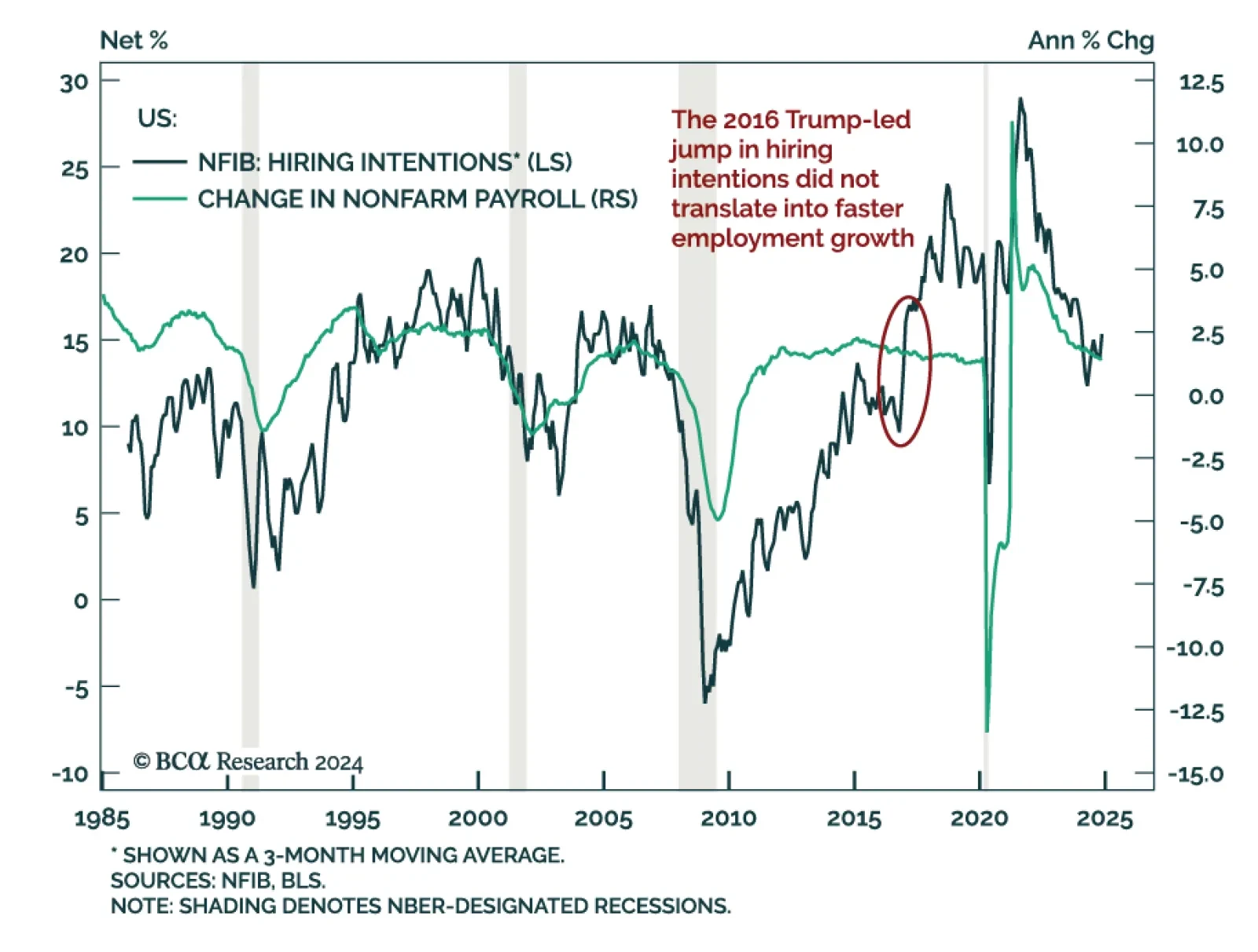

The November NFIB Small Business Optimism index beat expectations, jumping to 101.7 from 93.7 in October. Outside of inventory satisfaction, which was flat, all index subcomponents increased, led by measures of expectations. The…

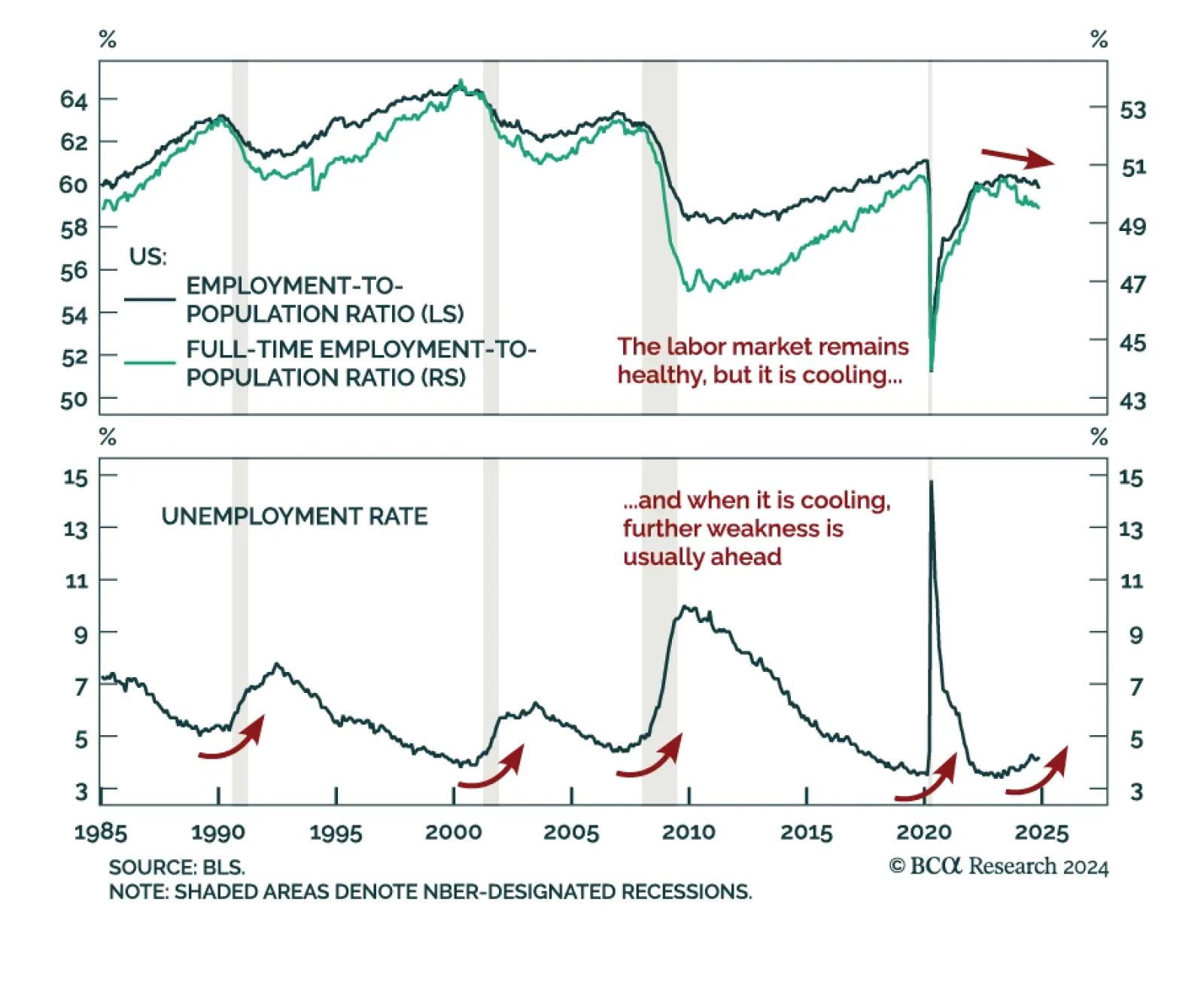

The US November jobs report was mixed. Payrolls rose by 227k vs. an upwardly revised 36k in October, leaving the 3-month moving average at 173k. The unemployment and underemployment rates however rose 0.1% to 4.2% and 7.8%,…

Job openings beat expectations in October, increasing to 7.74m from 7.44m in September. The details of the JOLTS report were mixed, however. Hires ticked down, driven by interest rate-sensitive sectors. Outside of hires, the rest…

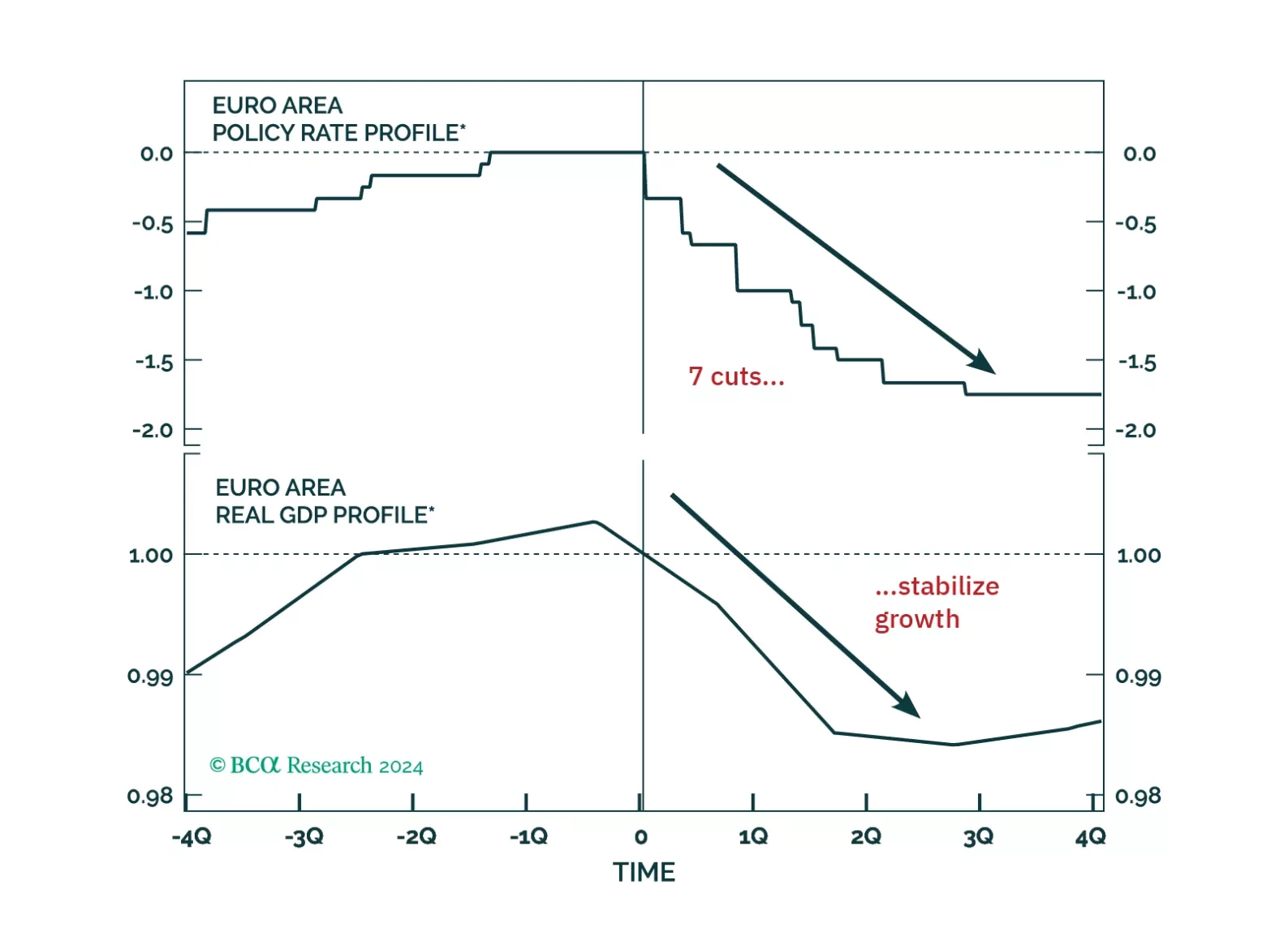

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…