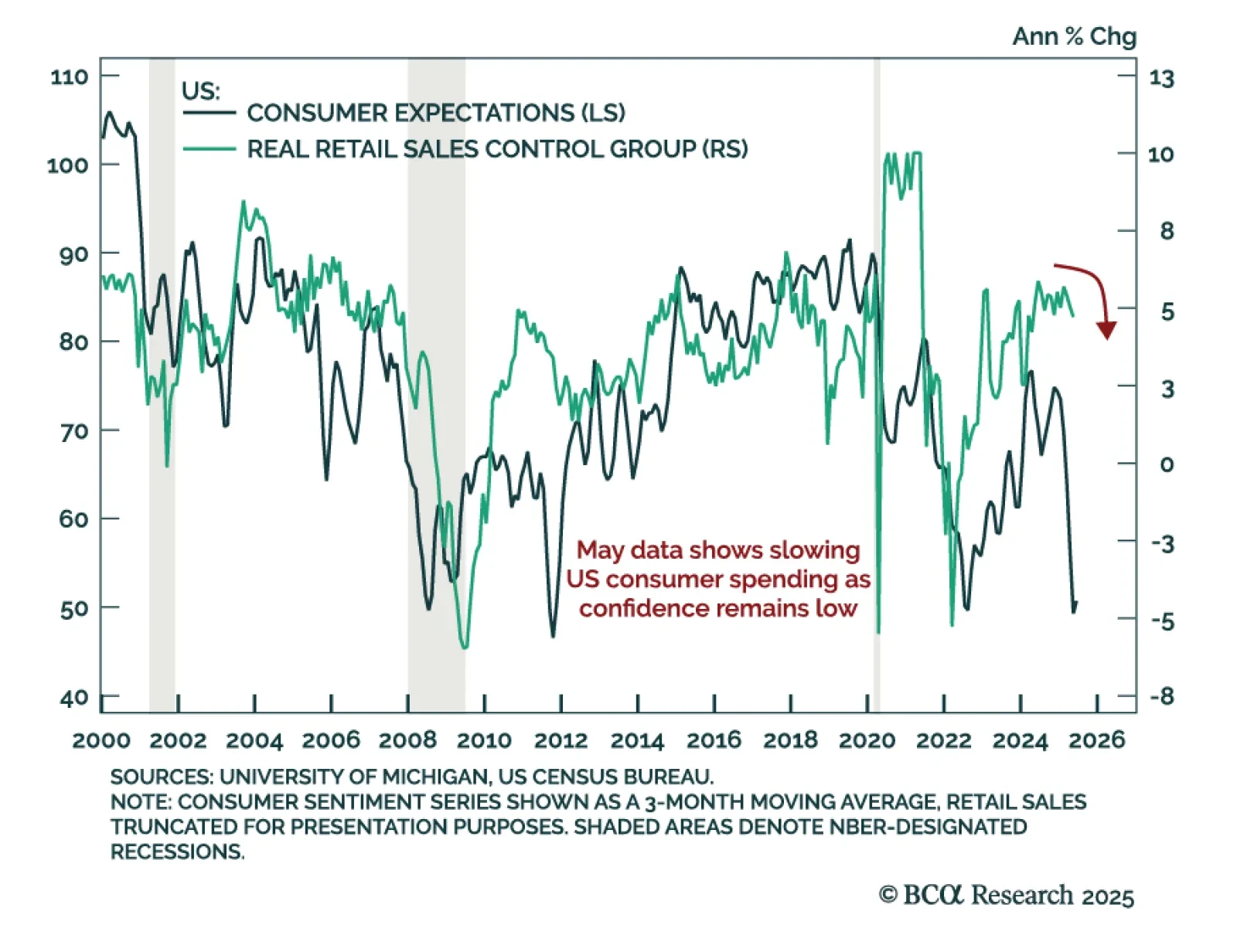

Weakening consumer confidence and fading labor momentum support a long duration stance as inflation fears recede. The June Conference Board Consumer Confidence index dropped 5 points to 93.0, missing expectations. Both present…

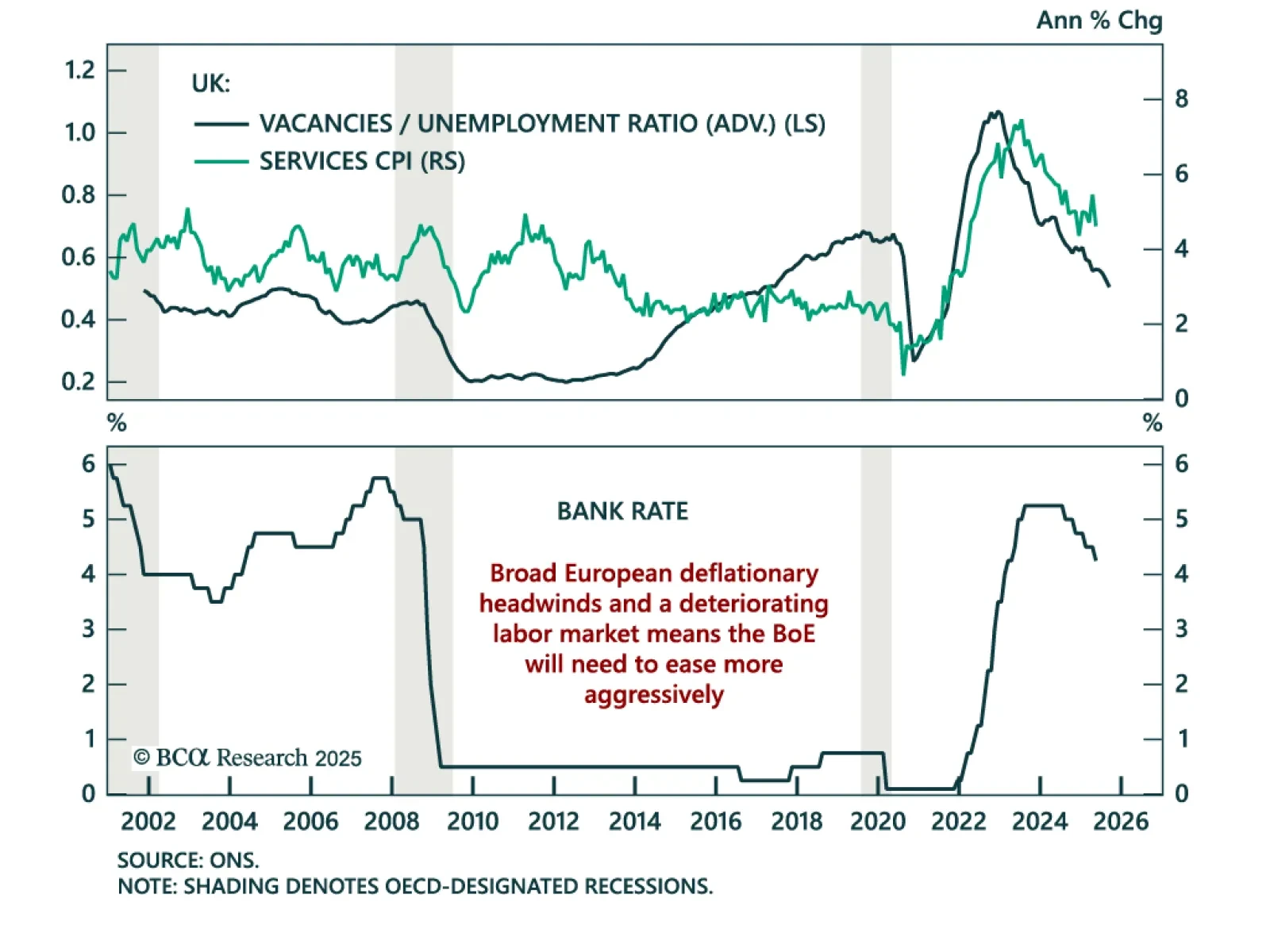

European central banks are pivoting quickly amid deflationary pressure, reinforcing our long UK Gilts and short GBP trades. The Norges Bank surprised with a 25 bps cut to 4.25%, abandoning its hawkish stance. The Swiss National Bank…

US May retail sales missed expectations, reinforcing our defensive allocation stance. Headline sales fell 0.9% m/m from a downwardly revised -0.1%. Core sales dropped 0.1%, while the control group rose 0.4%, beating estimates. Auto…

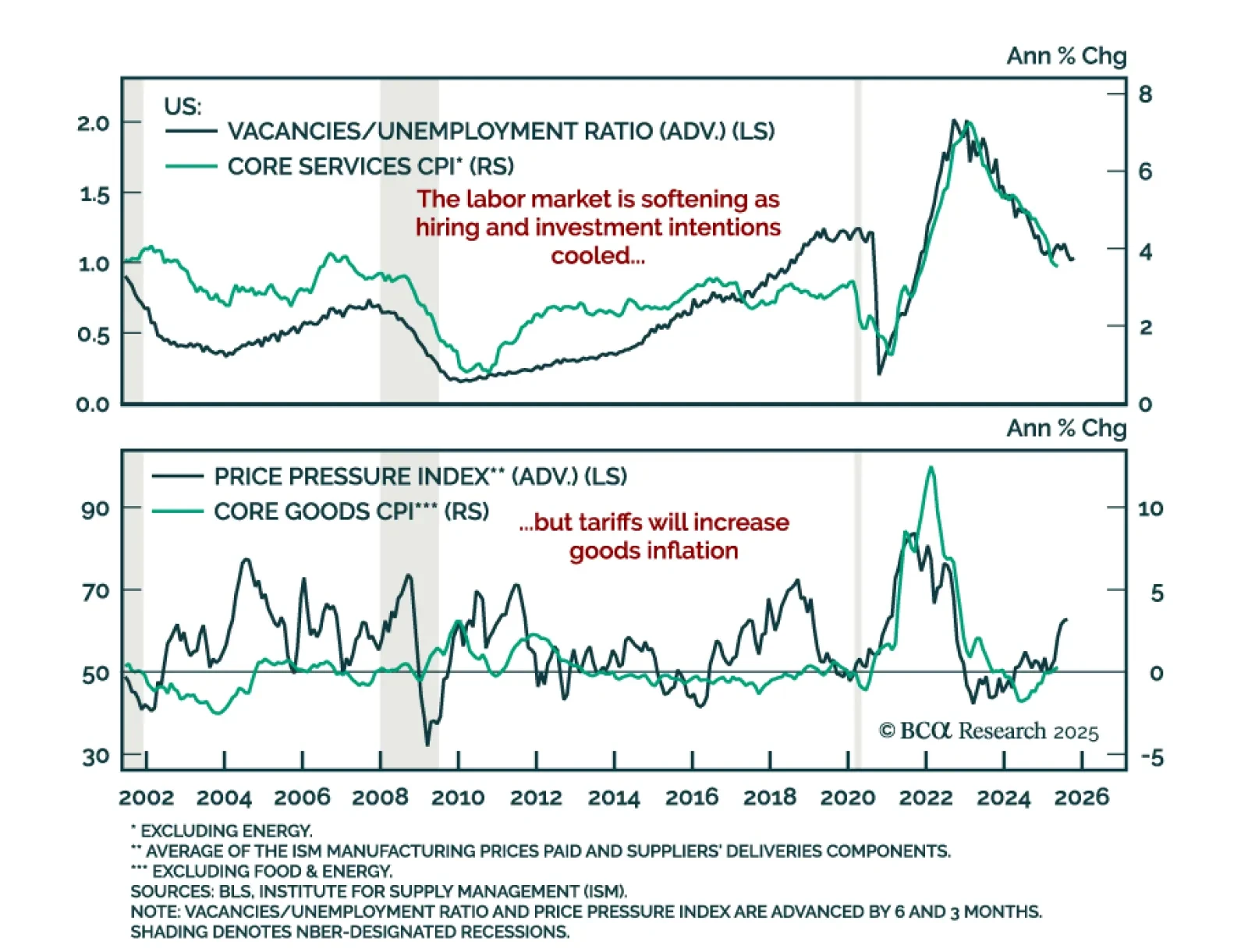

Following a rapid-fire review of issues related to household balance sheets, durable goods demand, the impact of tariffs, DOGE’s capacity to move the budget needle and the labor market’s ongoing cooling, we reiterate our defensive…

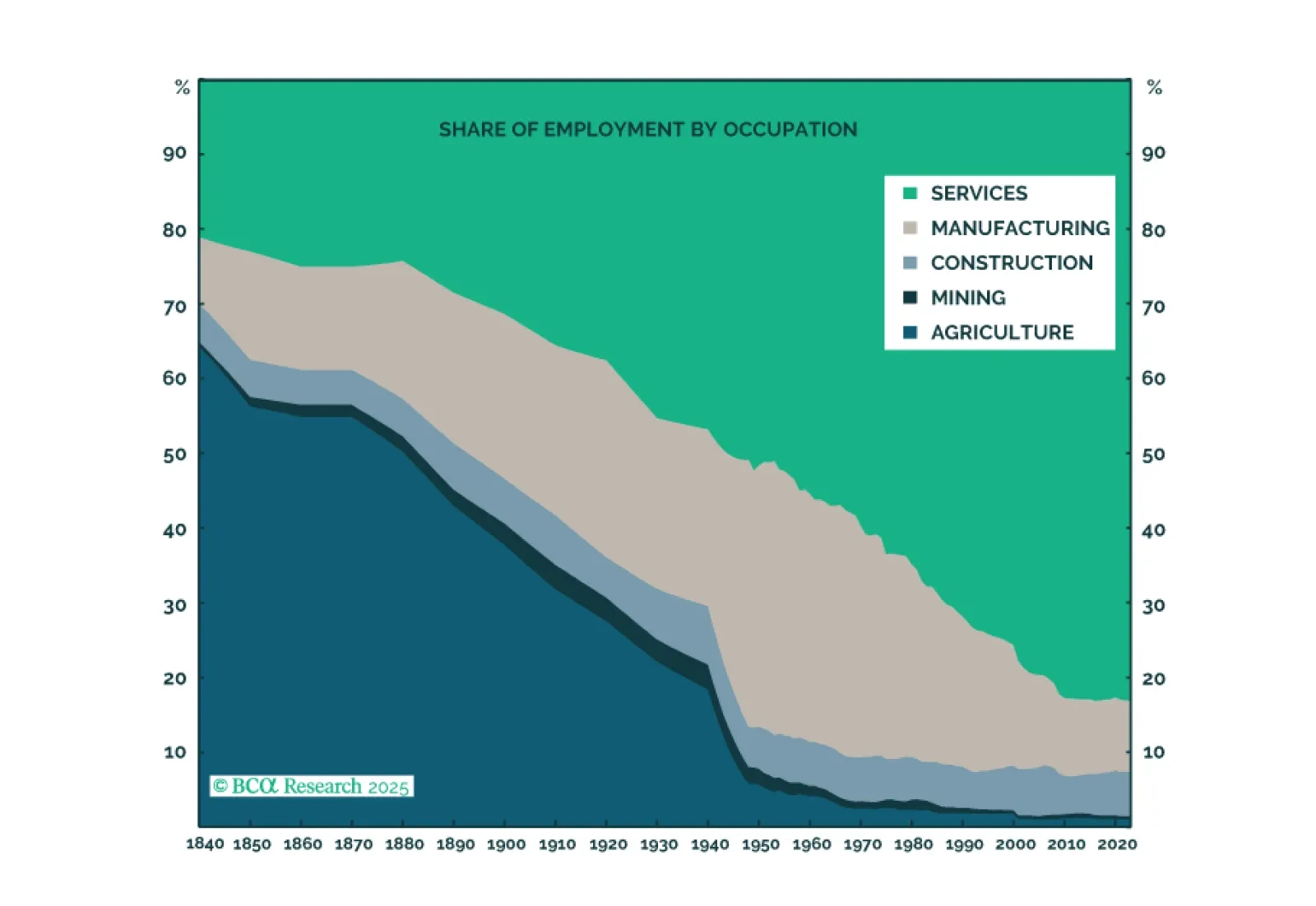

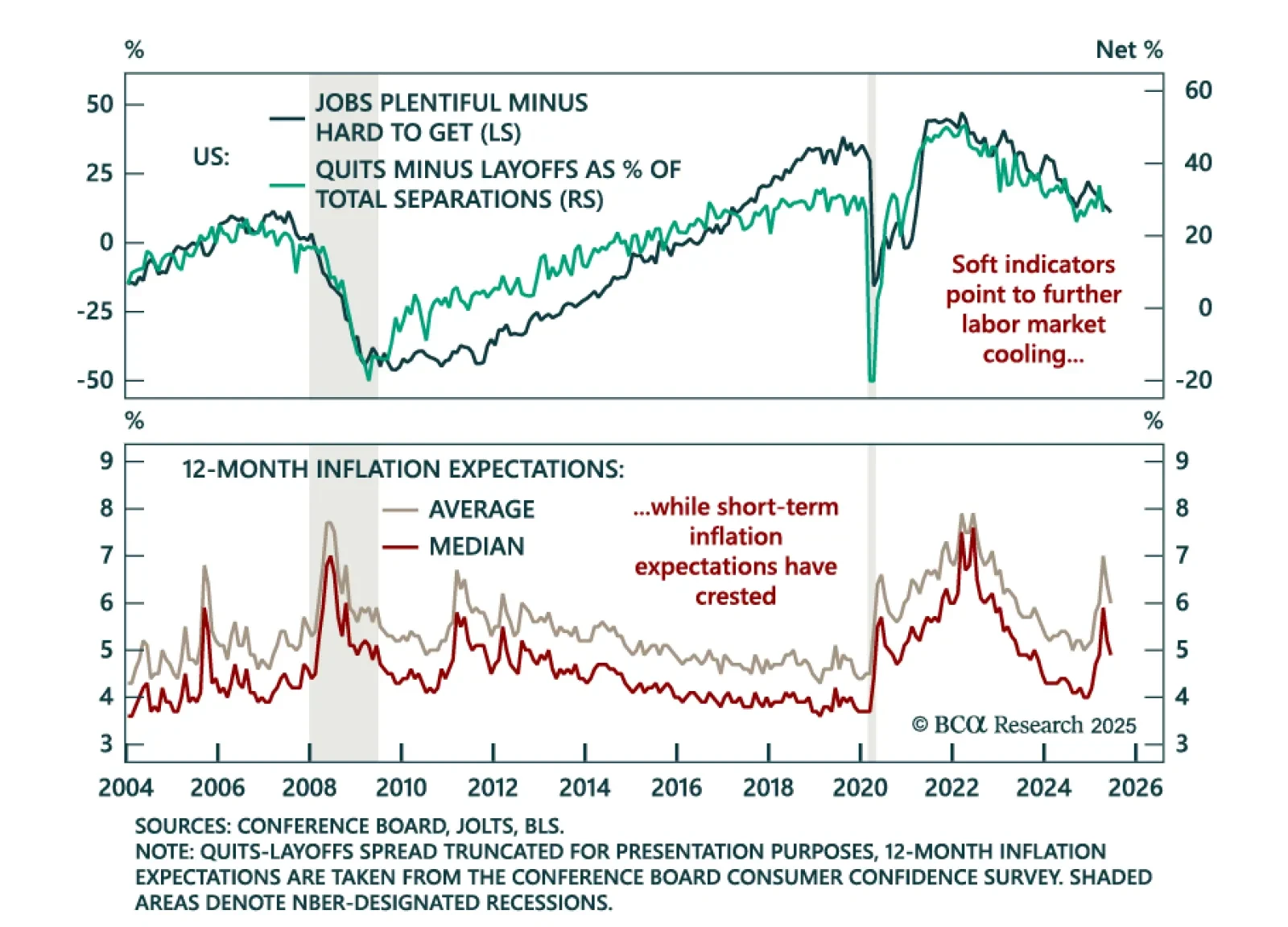

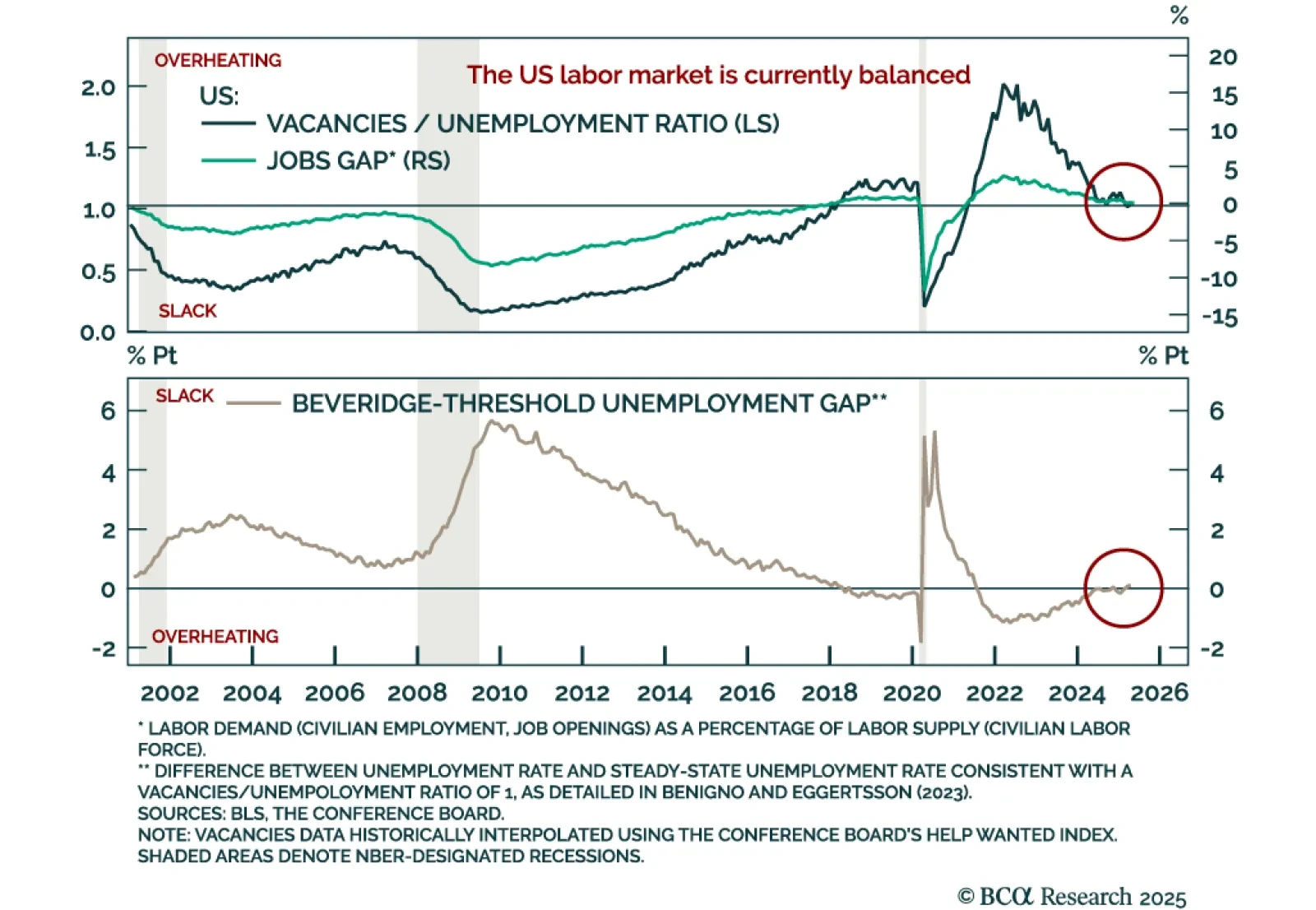

The US labor market appears balanced but at a pivotal point, with further weakness likely to prompt a shift to maximum defensiveness. After running the hottest since the 1960s, the labor market has gradually cooled. That rebalancing…

Further labor market deterioration would trigger a shift to maximum underweight in equities. While soft indicators have markedly deteriorated, hard labor data remains relatively resilient, though it has clearly weakened.…

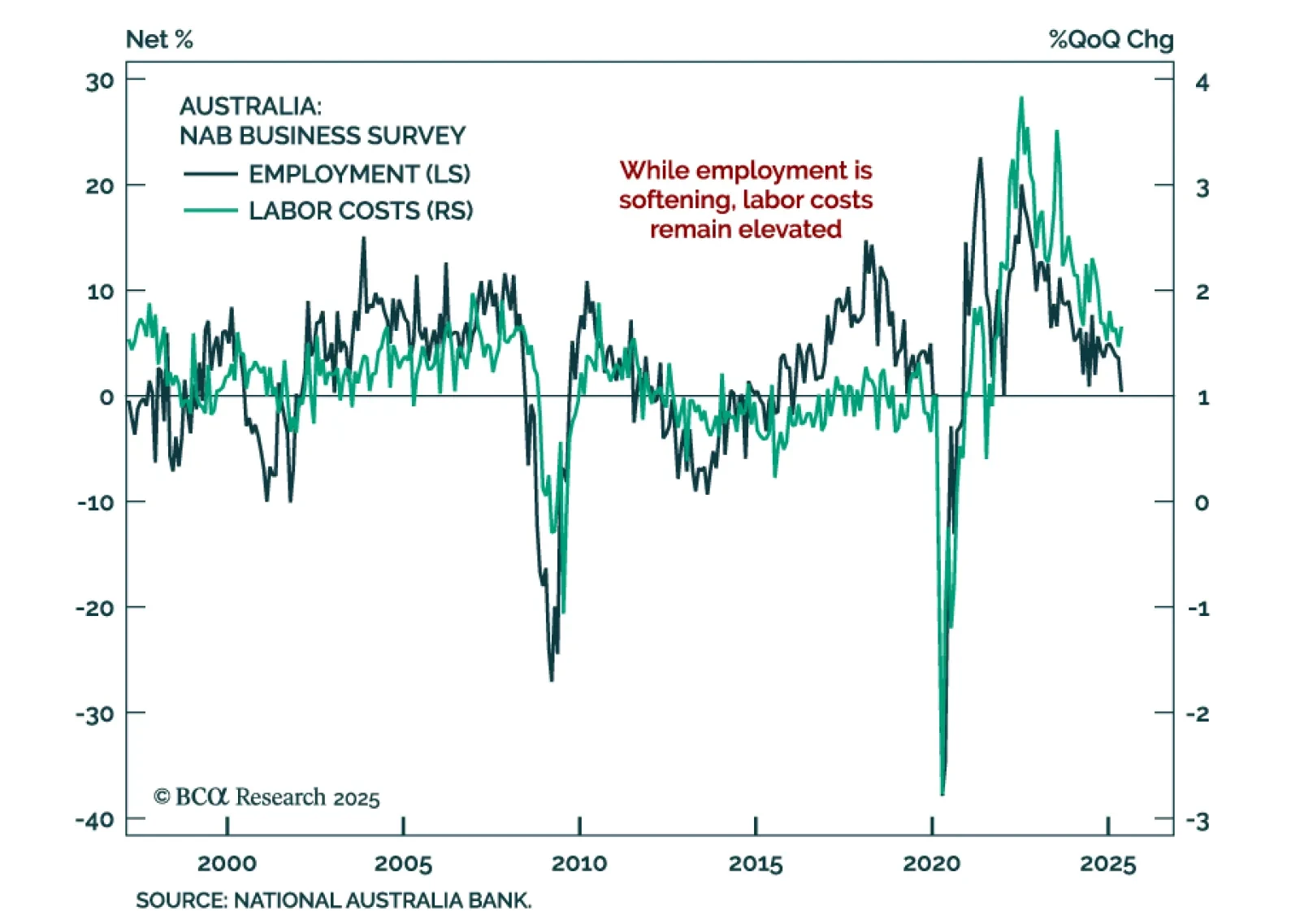

Mixed signals from the NAB Business Survey reinforce our underweight in Australian government bonds and long AUD exposure. In May, business confidence rebounded slightly, rising to 2 from -1, but current conditions dipped to 0 from 2…

Colder May CPI reinforces our overweight in government bonds and tactical steepener trades as growth slows and the Fed stays cautious. Headline inflation rose 0.1% (2.4% y/y), below expectations, as did core CPI (2.8% y/y). Goods…