Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

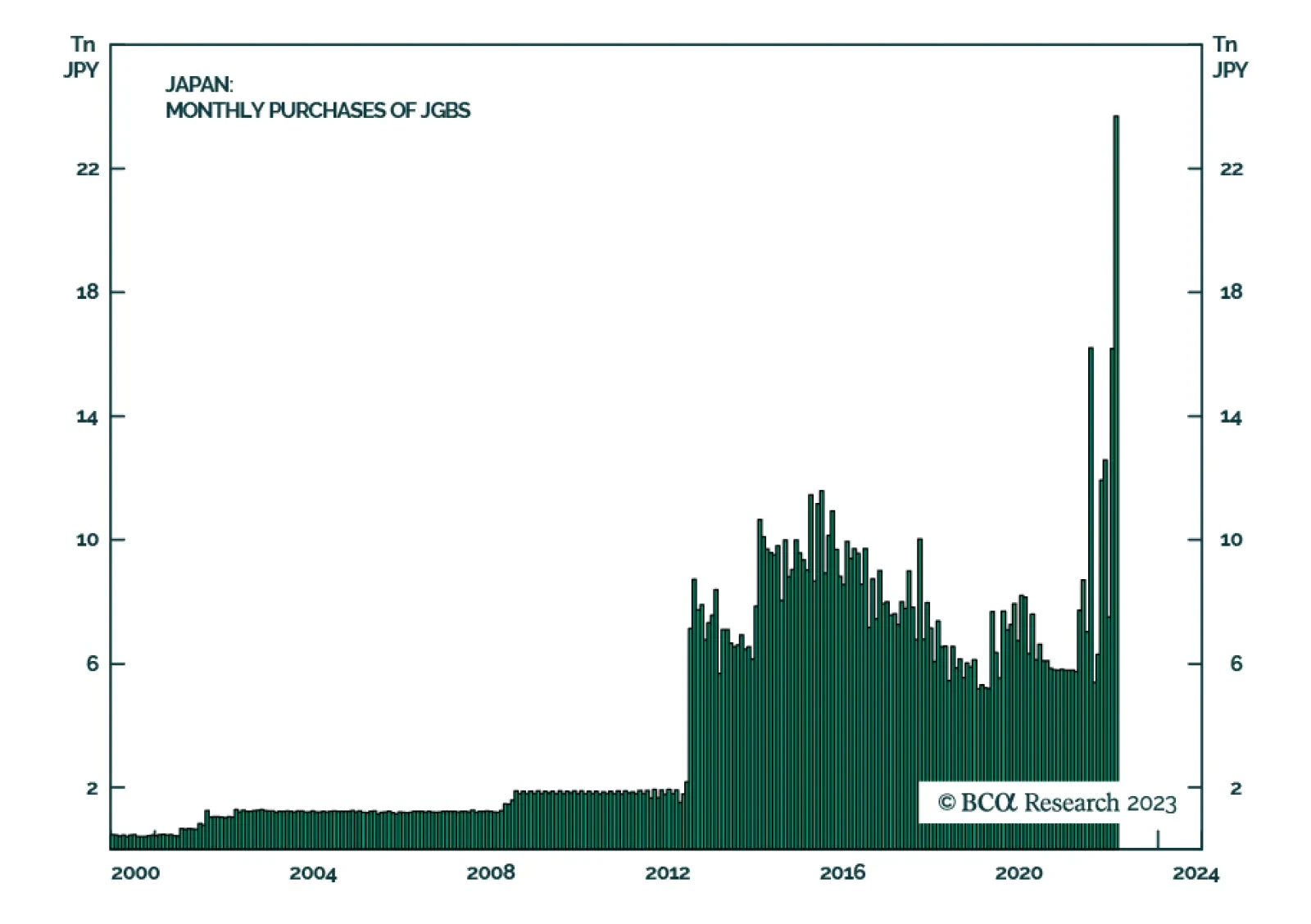

Since the start of the year, the Bank of Japan (BOJ) has bought JPY22 trillion of JGBs, equal to 4% of GDP. Early this week it was forced to conduct further emergency bond buying to keep the yield on 10-yield JGBs below its…

The risk of a recession in 2023 is being supplanted by the risk of another inflation wave. We will turn more defensive on equities if it continues to look like inflation is making a comeback.

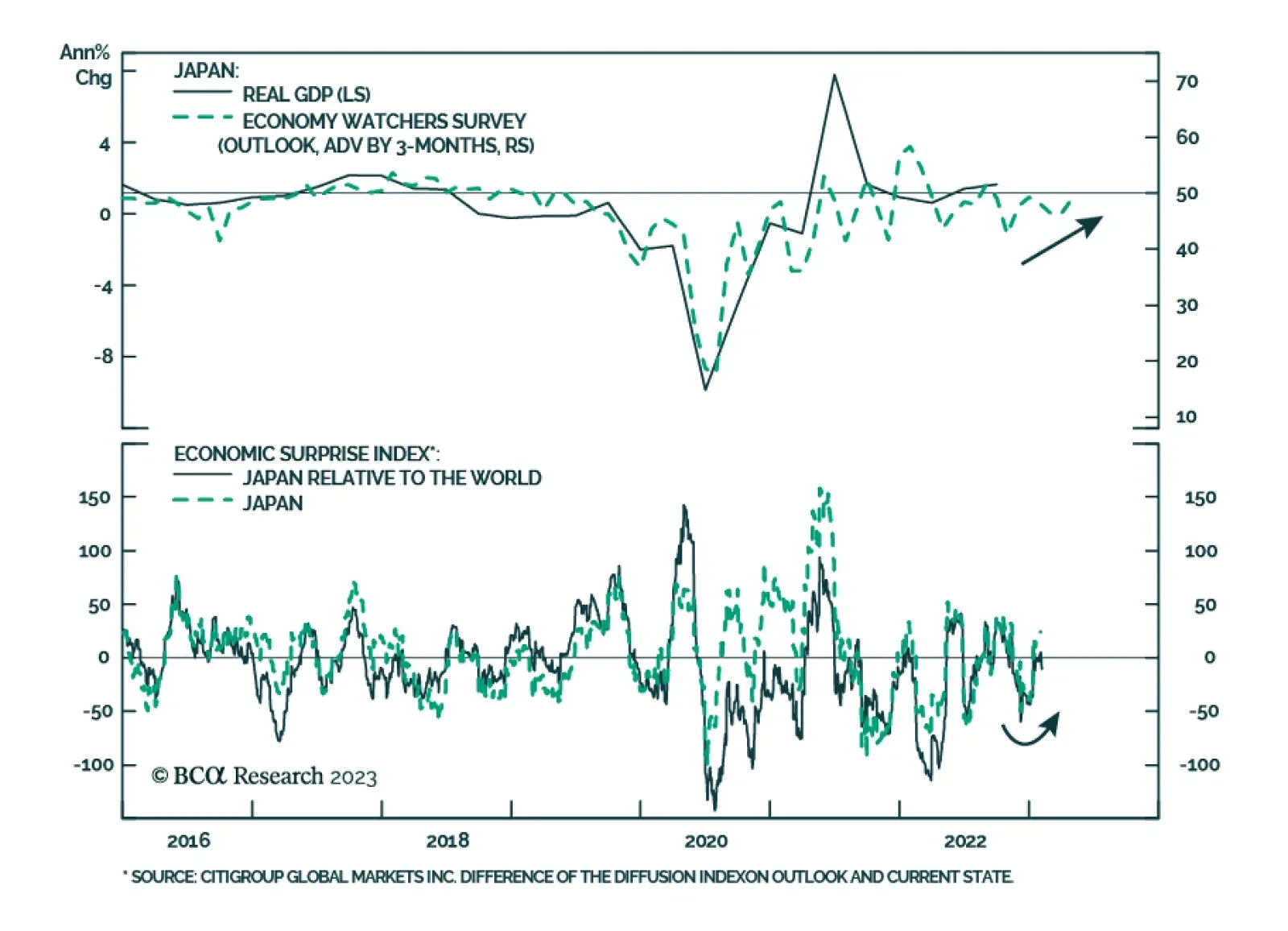

Japan’s Economy Watchers Survey – which is based on responses from over 2,000 workers from a variety of sectors that are sensitive to domestic economic conditions – suggests that businesses are becoming less…

This week, we articulate what the actions of the three major central banks that met (Fed, ECB and BoE) mean for currency markets. This is within the context of our analysis of the latest data releases in the G10, that allows us to…

When does rising unemployment become a bigger problem than inflation? The Fed won't cut rates until that happens, probably thwarting market hopes of big cuts in 2H.

Hopes of a soft landing for the US economy will intensify over the coming months, allowing equities to rally. However, even if an equilibrium of high employment and low inflation is reached, it will be difficult to keep the economy…

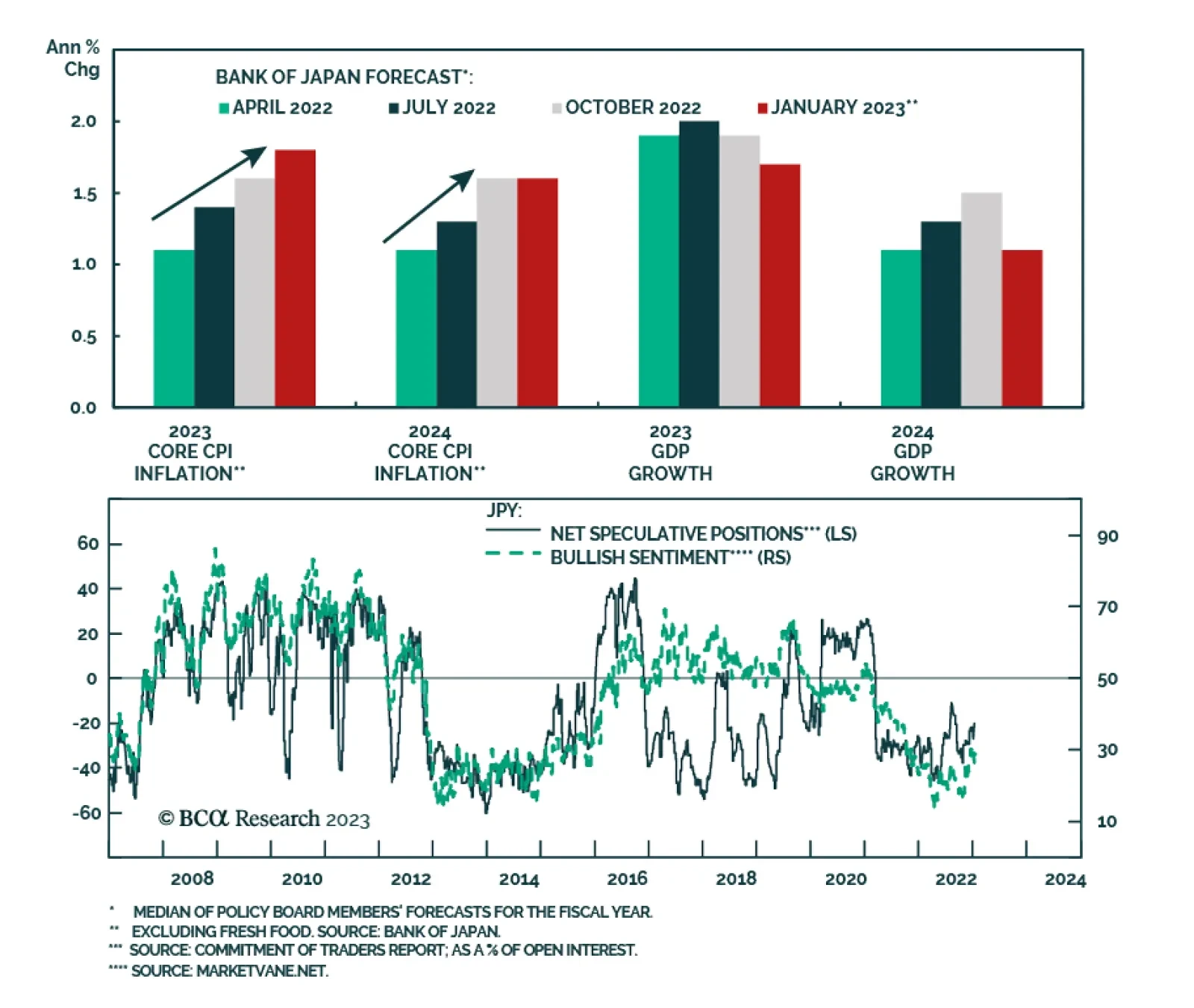

After having unexpectedly doubled its Yield Curve Control (YCC) cap on 10-year government bond yields from 0.25% to 0.5% at its December meeting, the Bank of Japan (BoJ) did not adjust its policy further in January. Instead, the…

We remain bullish the yen, despite the BoJ maintaining yield curve control. In this report, we outline a few reasons for this stance.

We remain bullish the yen, despite the BoJ maintaining yield curve control. In this report, we outline a few reasons for this stance.