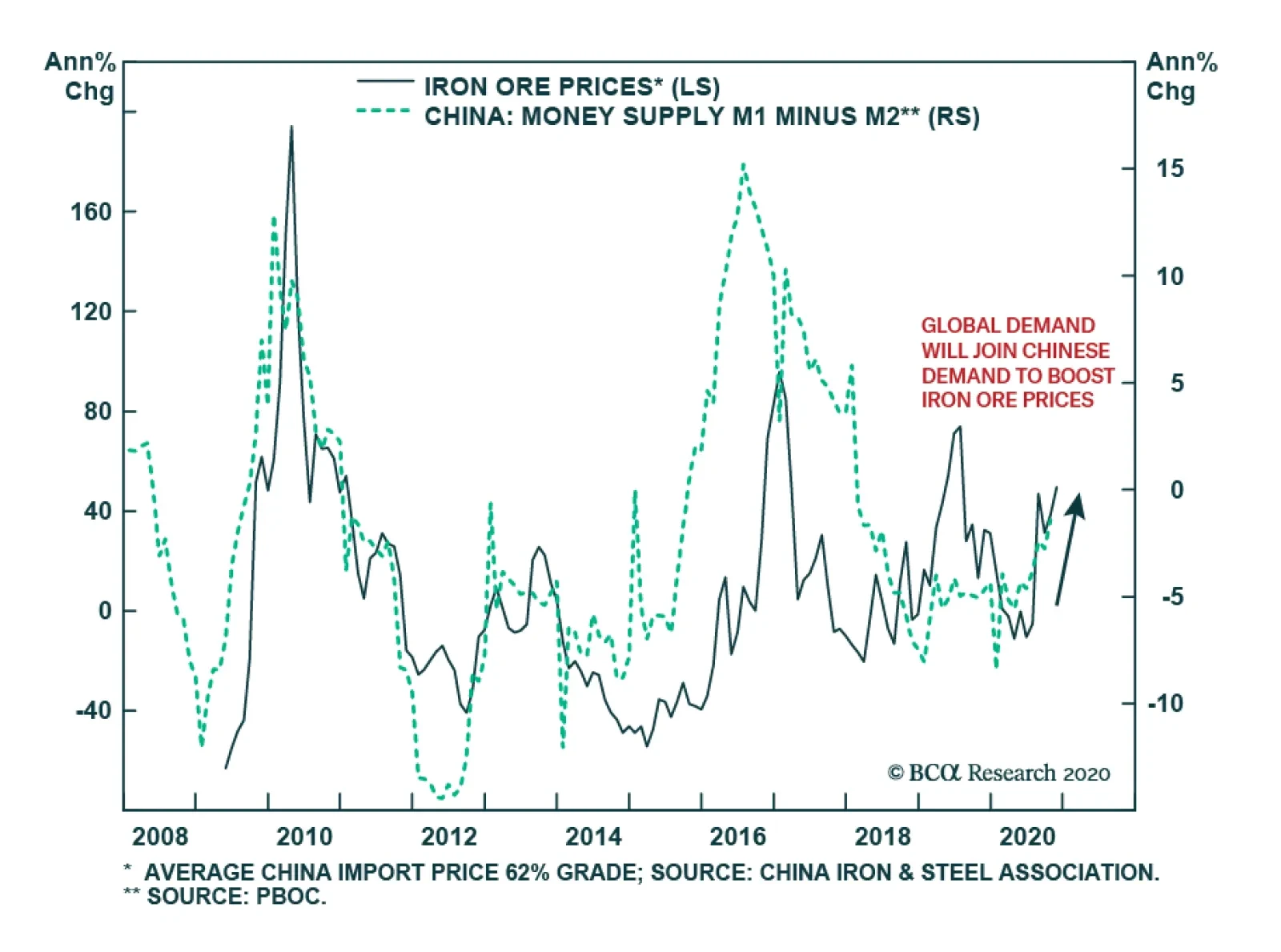

Iron ore prices just hit a 7-year high on the back of both stimulus from China, which has spurred demand from steel-making, and supply disruptions in Brazil. While a near-term pullback is likely, the dominant trend for iron…

Highlights Yesterday we published a Special Report titled EM: Foreign Currency Debt Strains. We are upgrading our stance on EM local currency bonds from negative to neutral. Before upgrading to a bullish stance, we would first need…

Highlights Bulk commodity markets – chiefly iron ore and steel – could see sharp rallies once Chinese authorities give the all-clear on COVID-19 (the WHO’s official name for the coronavirus). These markets rallied…

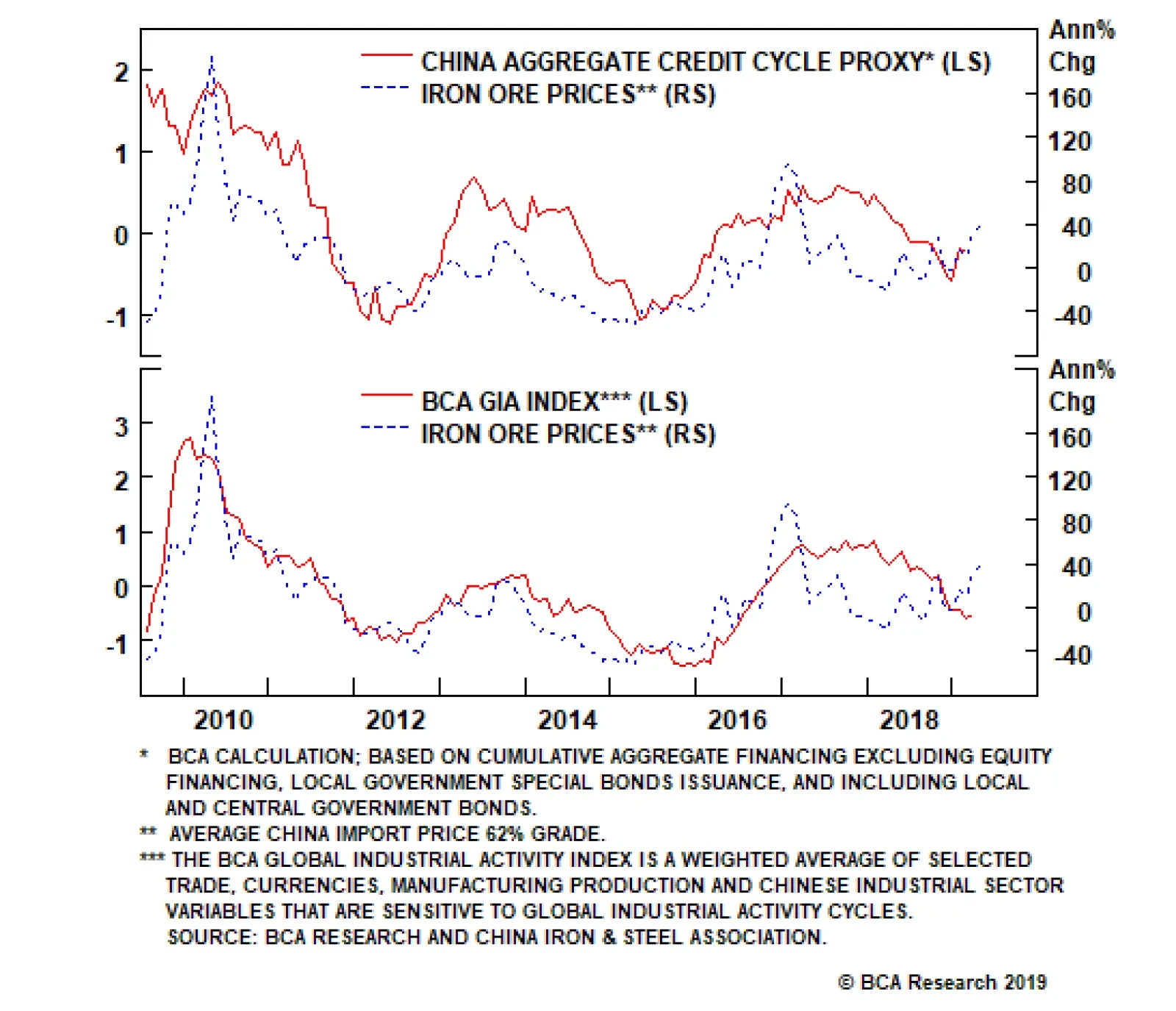

Highlights The slowdown in global industrial activity appears to have bottomed. This, along with an apparent shared desire for a ceasefire in the Sino-US trade war, points toward a measured recovery in manufacturing and global trade,…

Away from the Sino-U.S. trade-war headlines – and the remarkable commodity price volatility they produce – apparent steel consumption in China is up 9.5% y/y in the first seven months of this year. This is being spurred by…

Chart II-1Is Deflation In Steel And Coal Back? Unlike 2015 when steel, iron ore and coal prices collapsed, in the current downturn they have so far held up reasonably well. They have begun falling only recently (Chart II-1).…

Highlights The current global trade downtrend has primarily been due to a contraction in Chinese imports. The latter reflects weakness in China's domestic demand in general and capital spending in particular. The current global…

The reversal in China’s credit cycle and in the Fed’s monetary policy stance will be supportive of steel and iron ore prices going forward. In fact, our Commodity & Energy Strategy team’s credit cycle proxy…

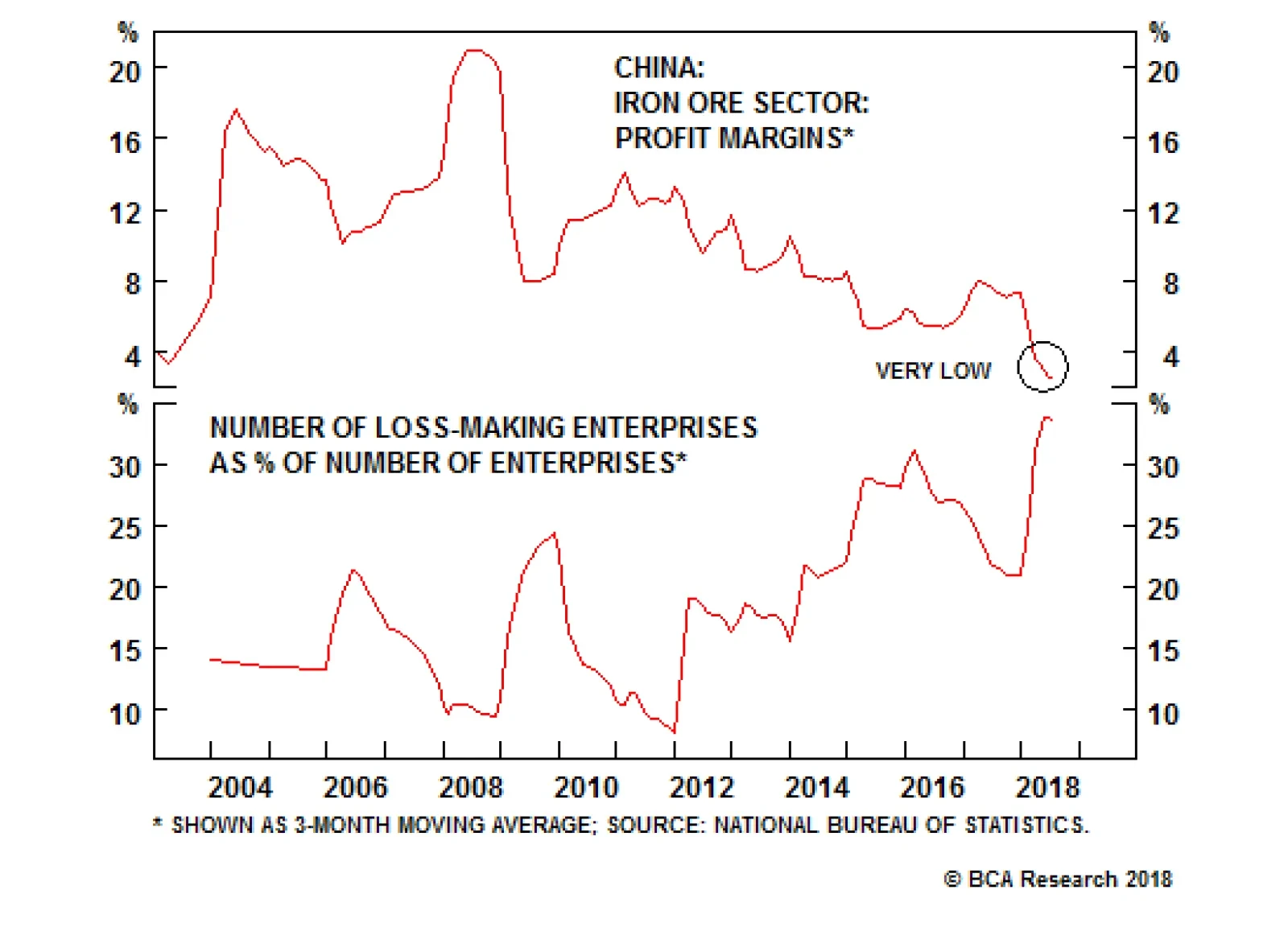

Highlights As long as Chinese policymakers remain committed to their anti-pollution campaign, we believe high-grade iron ore prices will remain supported by demand from newer steelmaking technologies. A continuation of the much-needed…

Iron ore prices may have limited downside and could outperform steel prices over the next 12-15 months. This is primarily due to increasing shutdowns of mainland China iron ore mines. Government data show that Chinese domestic…