The Life and Health Insurance industry offers downside protection and portfolio diversification in the event of a market correction, surging inflation, or stubbornly high interest rates.

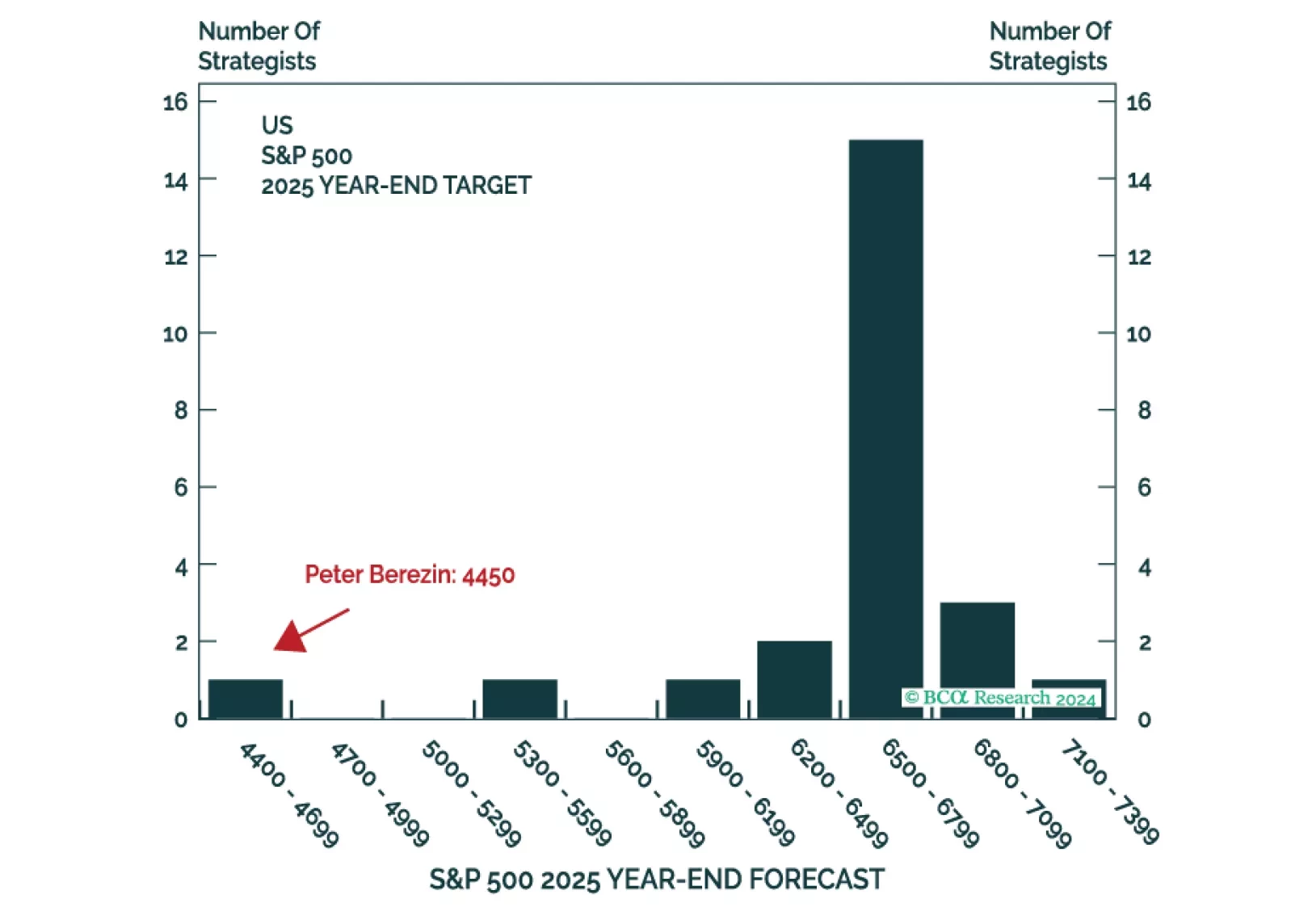

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

Executive Summary The structural downtrend in Chinese bond yields has a lot further to go, because it is helping to let the air out gently of stratospheric valuations in the real estate sector, and thereby preventing a hard landing for…

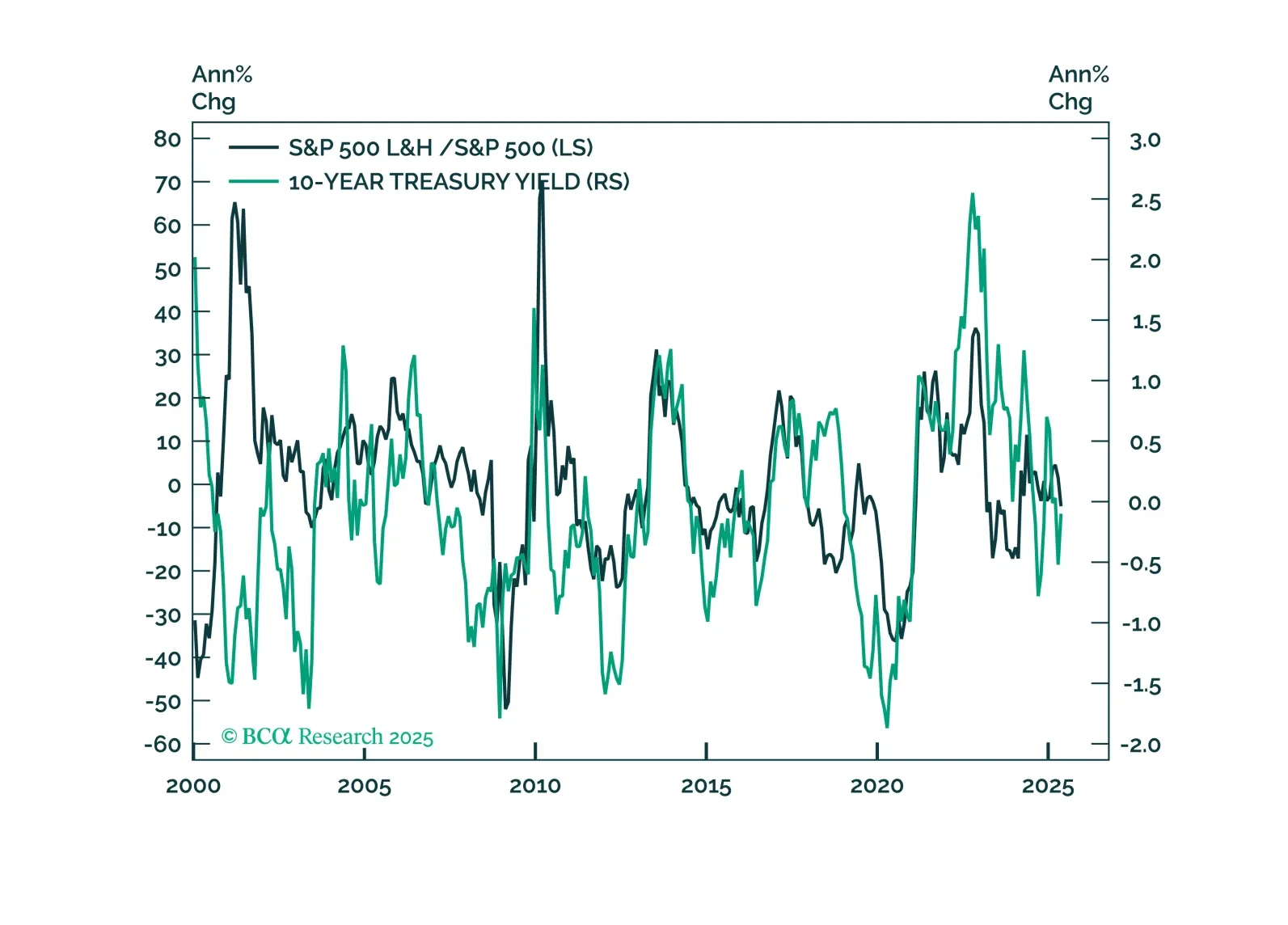

The BCA house view is that the US Treasury rates will move higher this year. Monetary tightening has been one of our core investment themes, and a reason for overweighing banks back in September 2021, which outperformed the S&P 500 by…

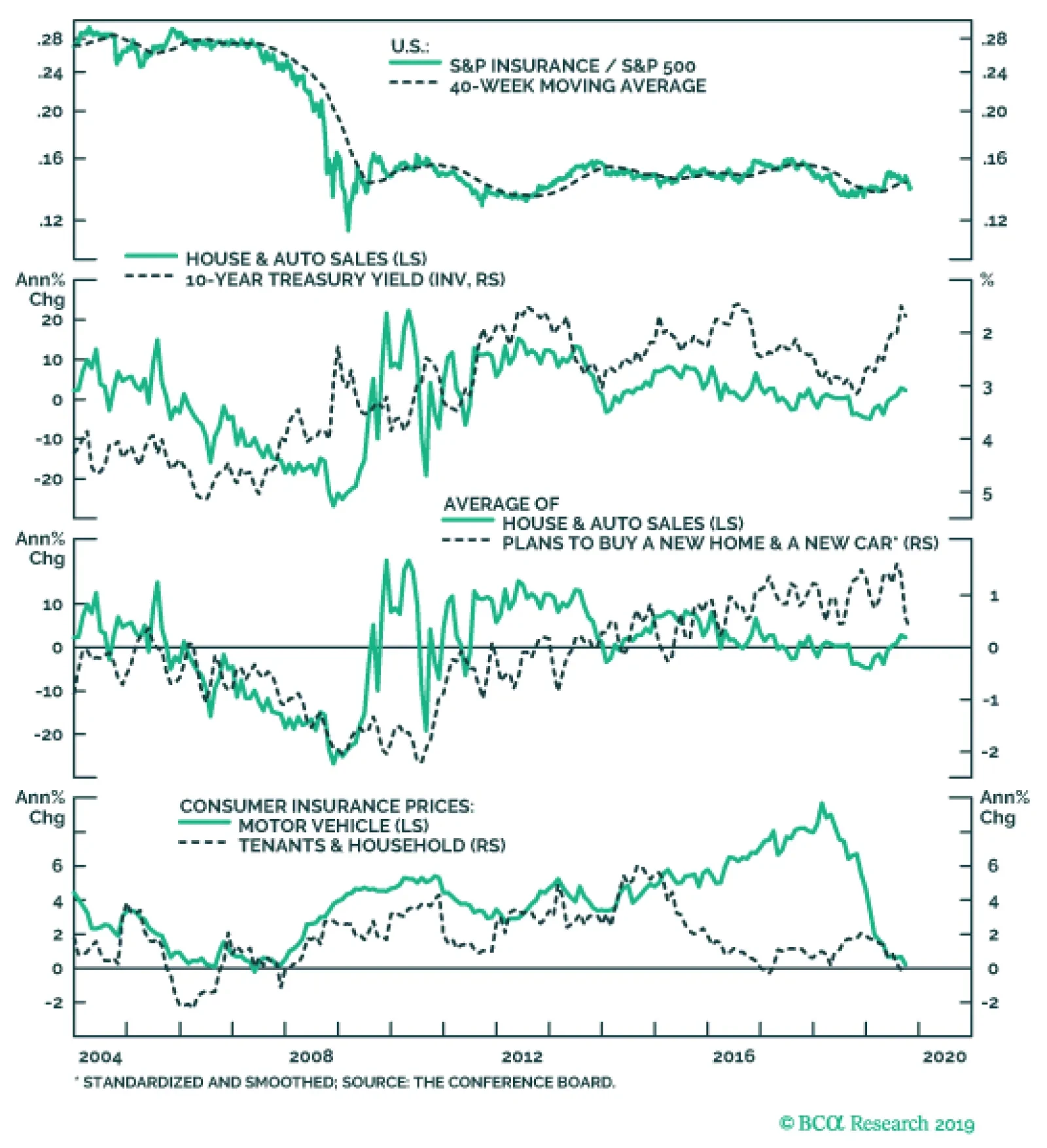

This week we removed the S&P insurance index from our underweight list capitalizing gains of 38% since inception. The underweight served its hedging purpose and softened the blow from our previous exposure to banks.…

Highlights Portfolio Strategy The hardening insurance market on the back of firming demand for insurance services especially in residential real estate and automobile markets compel us to lift insurers to a benchmark allocation. A…

Underweight The S&P insurance index is our sole underweight within the financials universe. The broad macro picture remains unwelcoming and compels us to keep the index at a below benchmark allocation. Falling yields…

While we remain overweight S&P banks and the broad financials sector, we continue to recommend an underweight stance in the S&P insurance index. This early cyclical subgroup continues to underperform the broad equity…

Underweight While we remain overweight the S&P banks and the broad financials sector, we continue to recommend an underweight stance in the S&P insurance index. This early cyclical subgroup continues to…