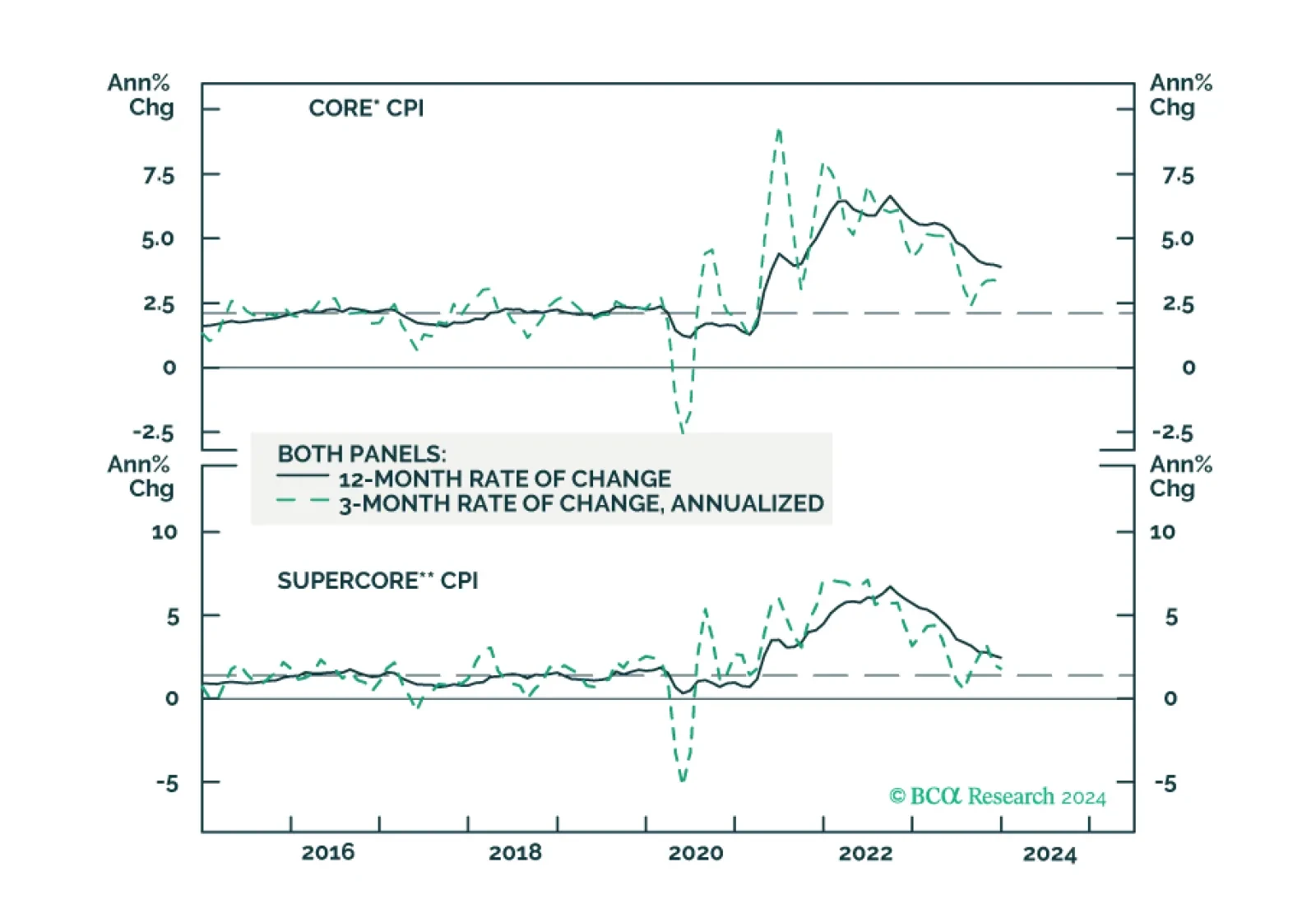

We update our inflation forecast following this morning’s CPI report.

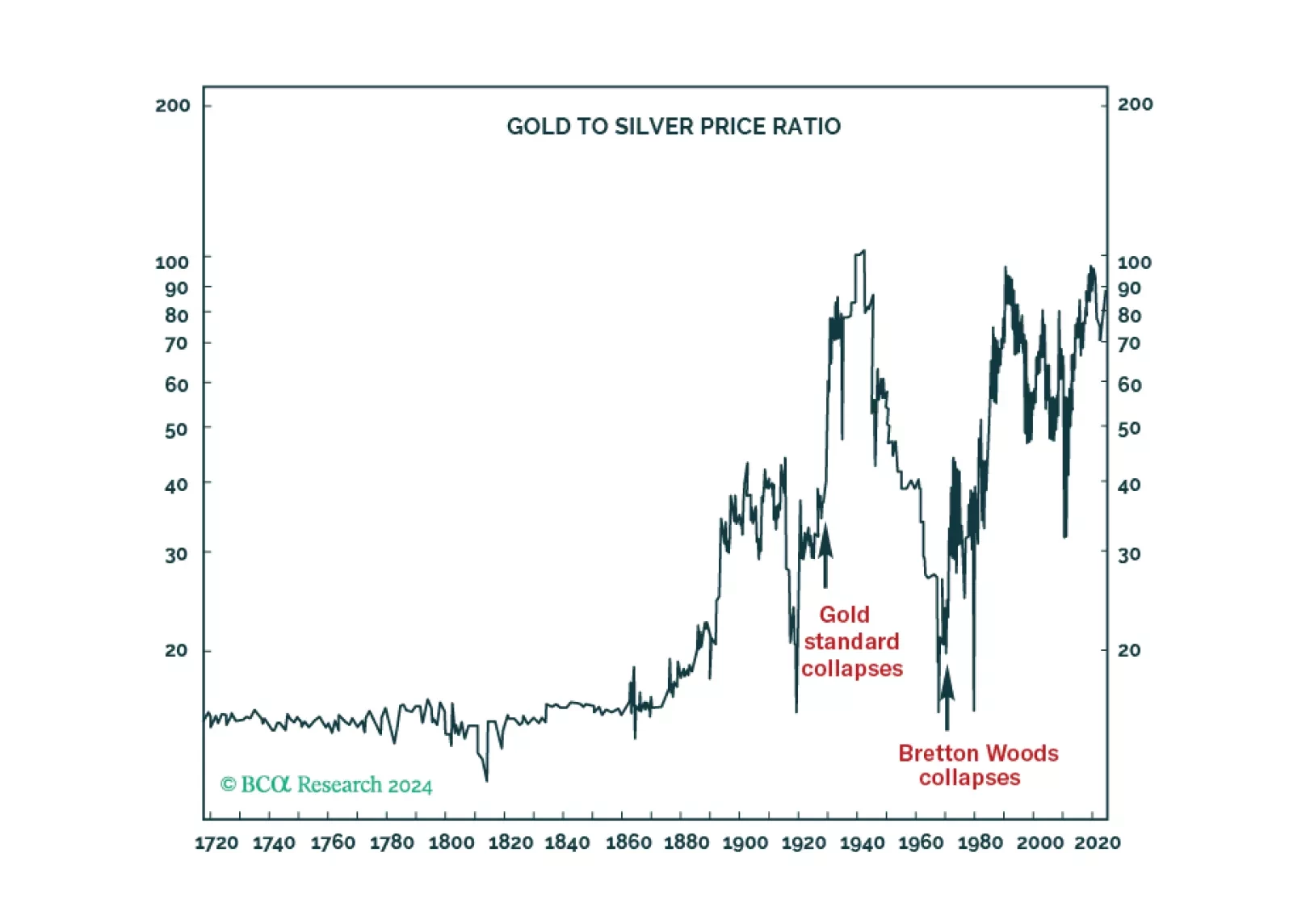

Increasing gray-zone confrontations and another round of tariff and non-tariff barriers to trade are not being reflected in commodity prices. This is keeping inflationary pressures emanating from the real economy subdued. That said,…

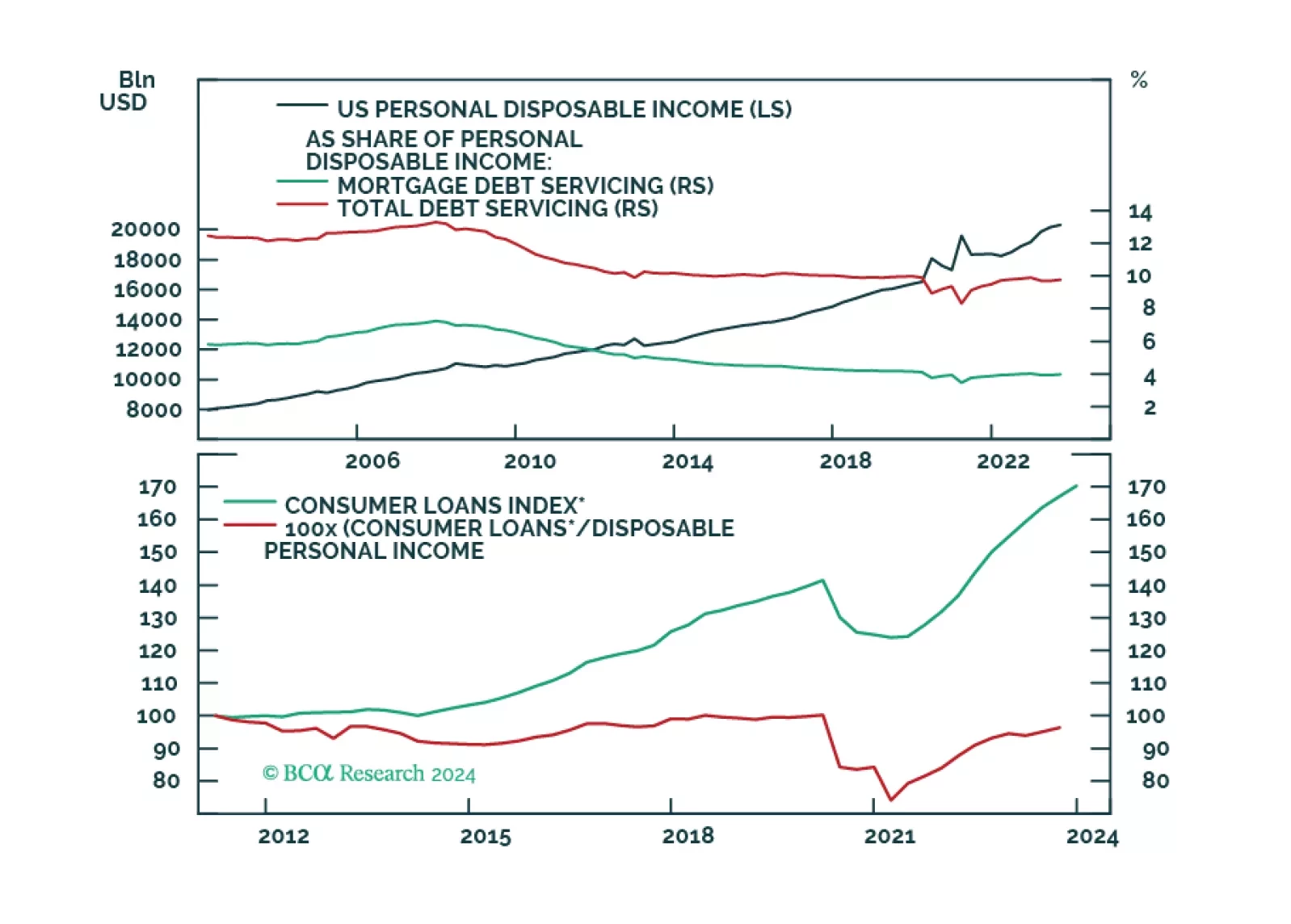

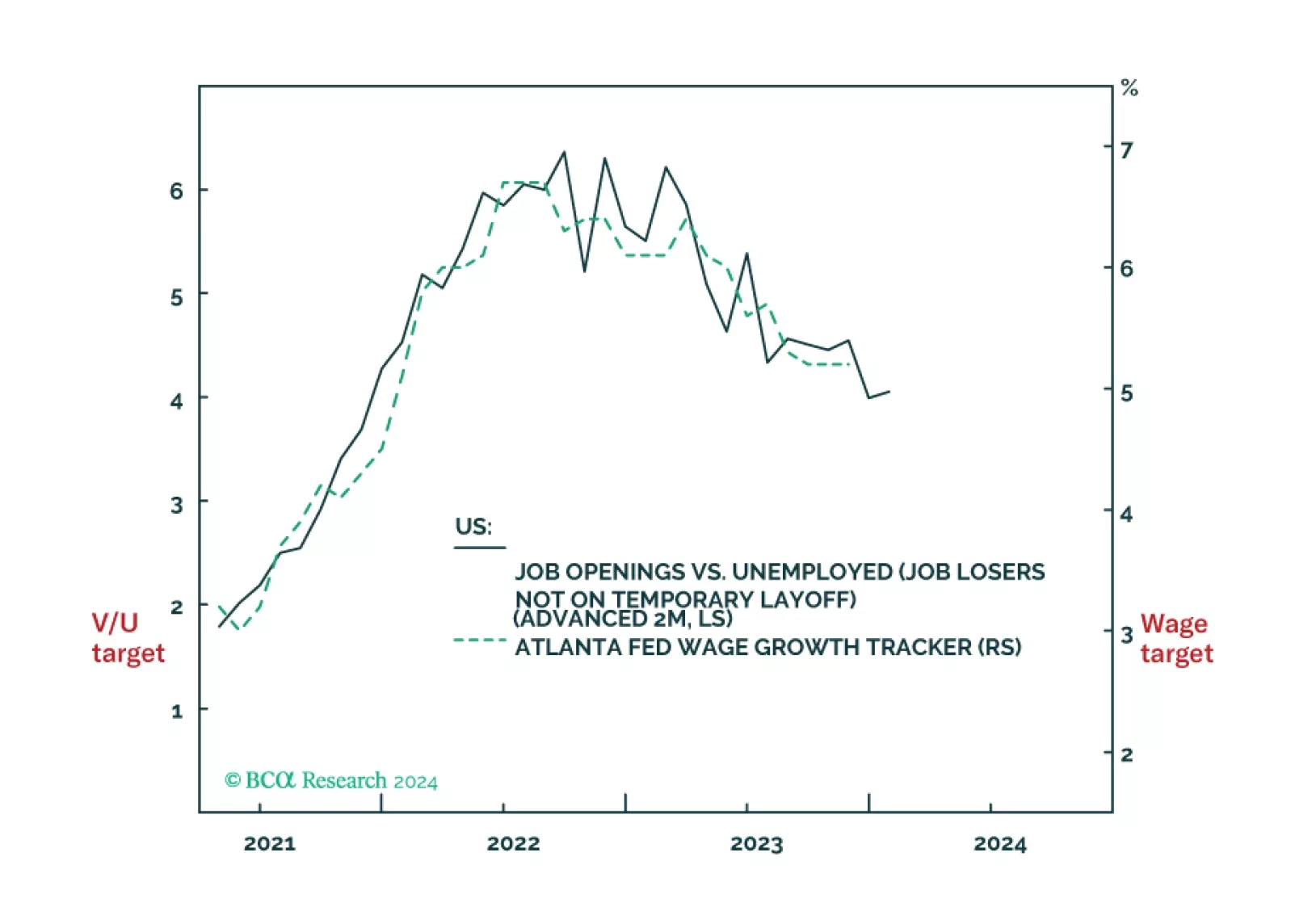

The Fed faces a dilemma. Cut rates early to avoid a recession, but at the risk of not slaying wage inflation. Or, not cut rates early to ensure that wage inflation is slayed, but at the risk of a downturn. Faced with such a dilemma,…

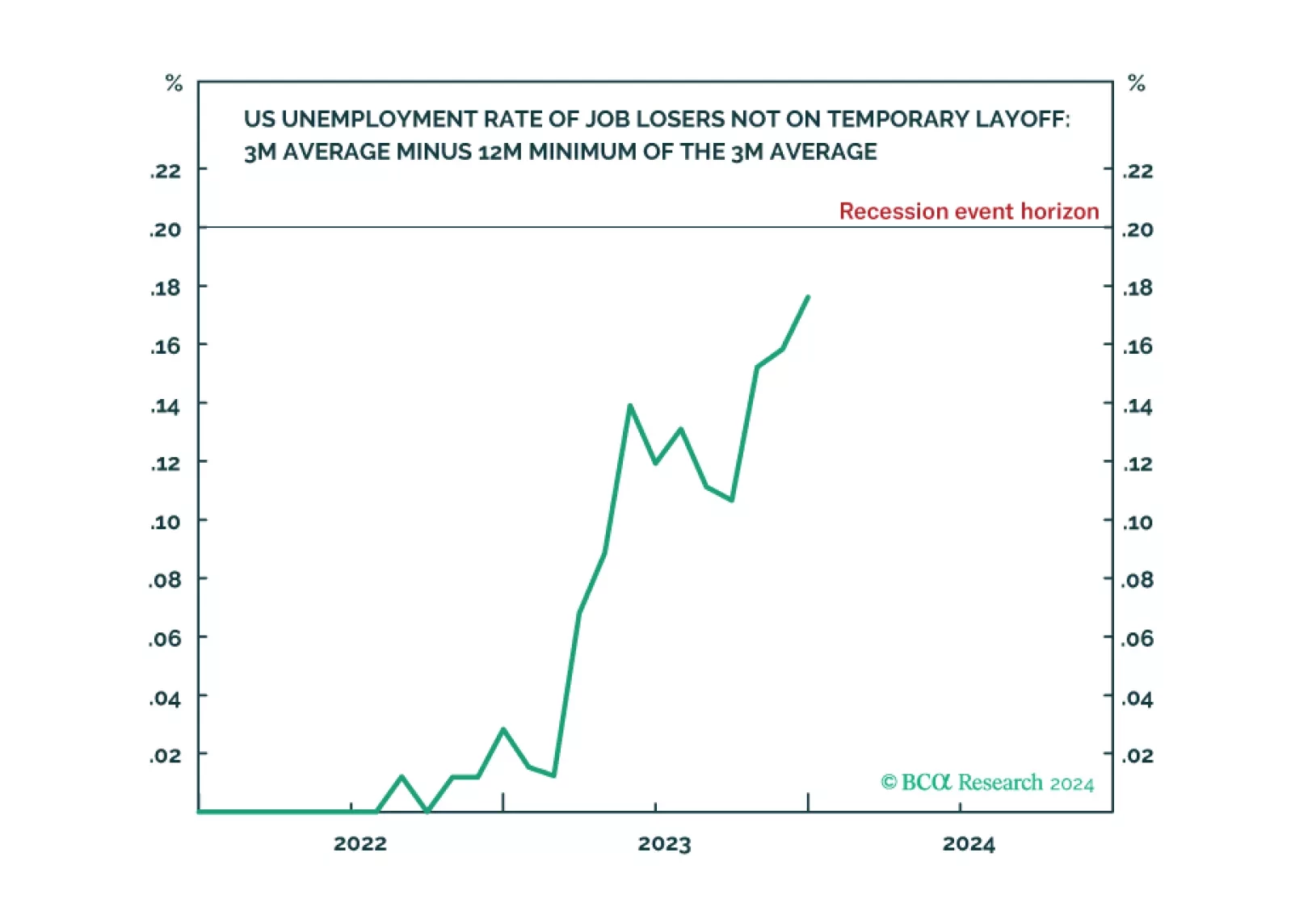

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.

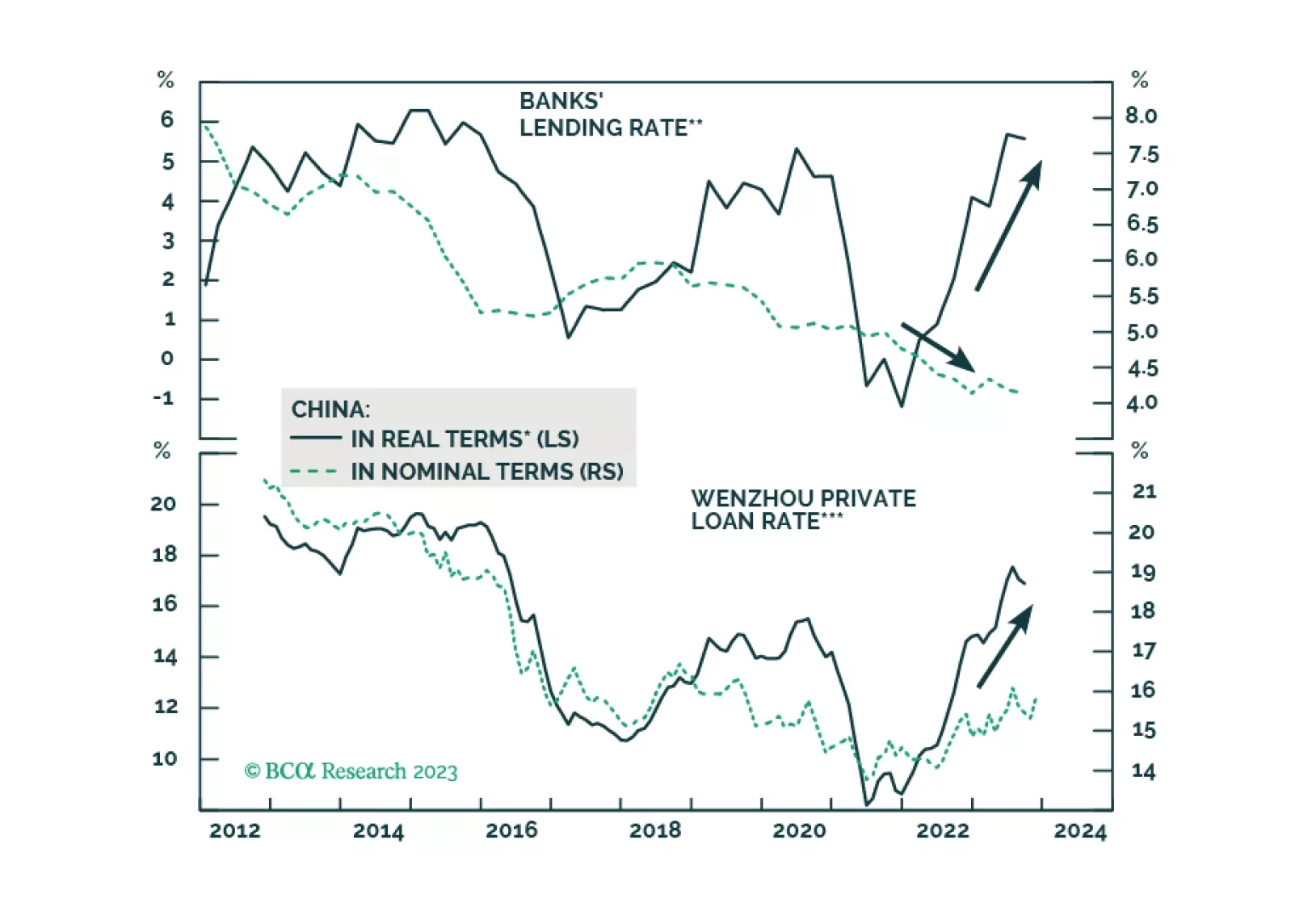

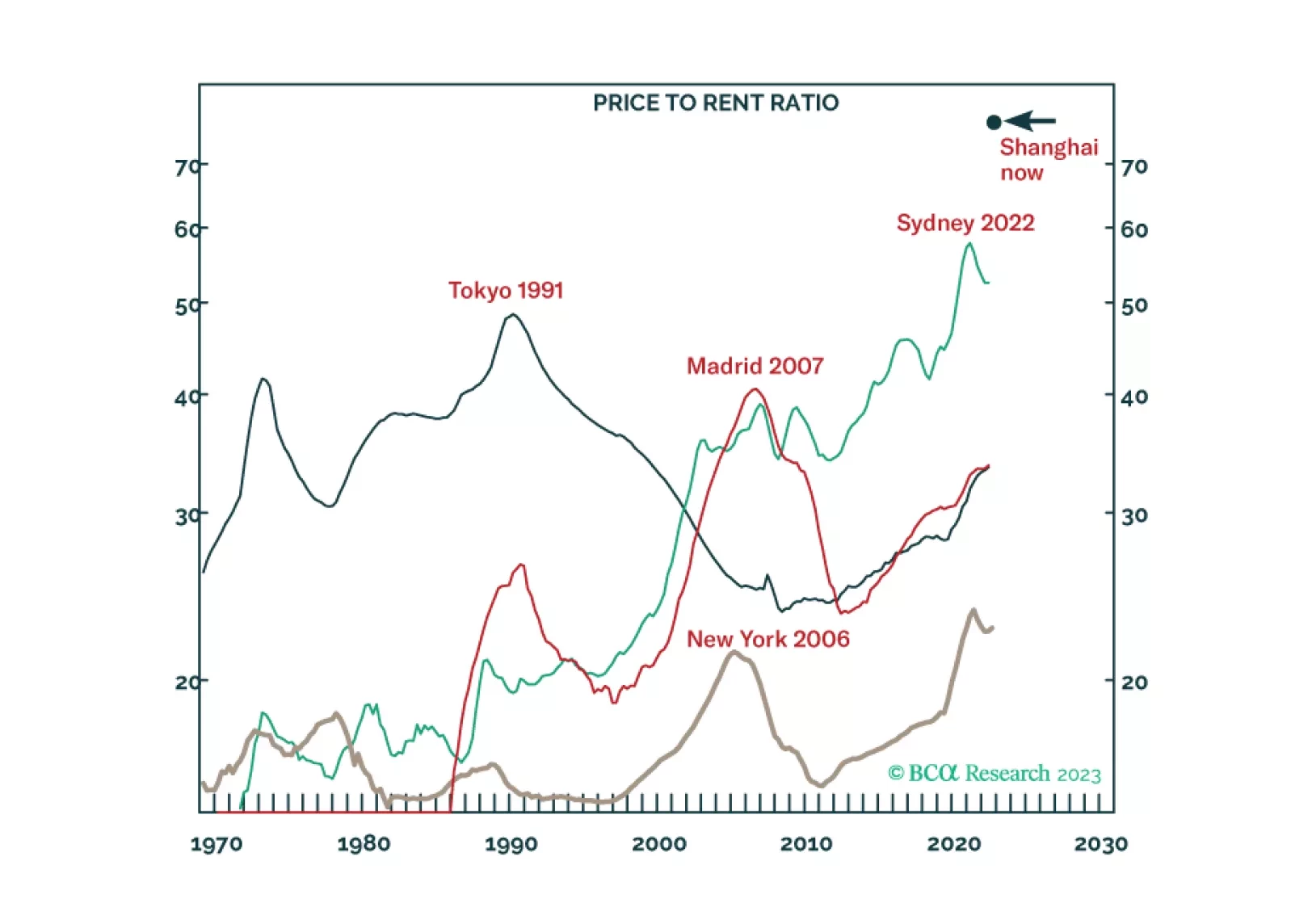

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

Our US bond team’s thoughts on this afternoon’s FOMC meeting and yesterday’s CPI release.