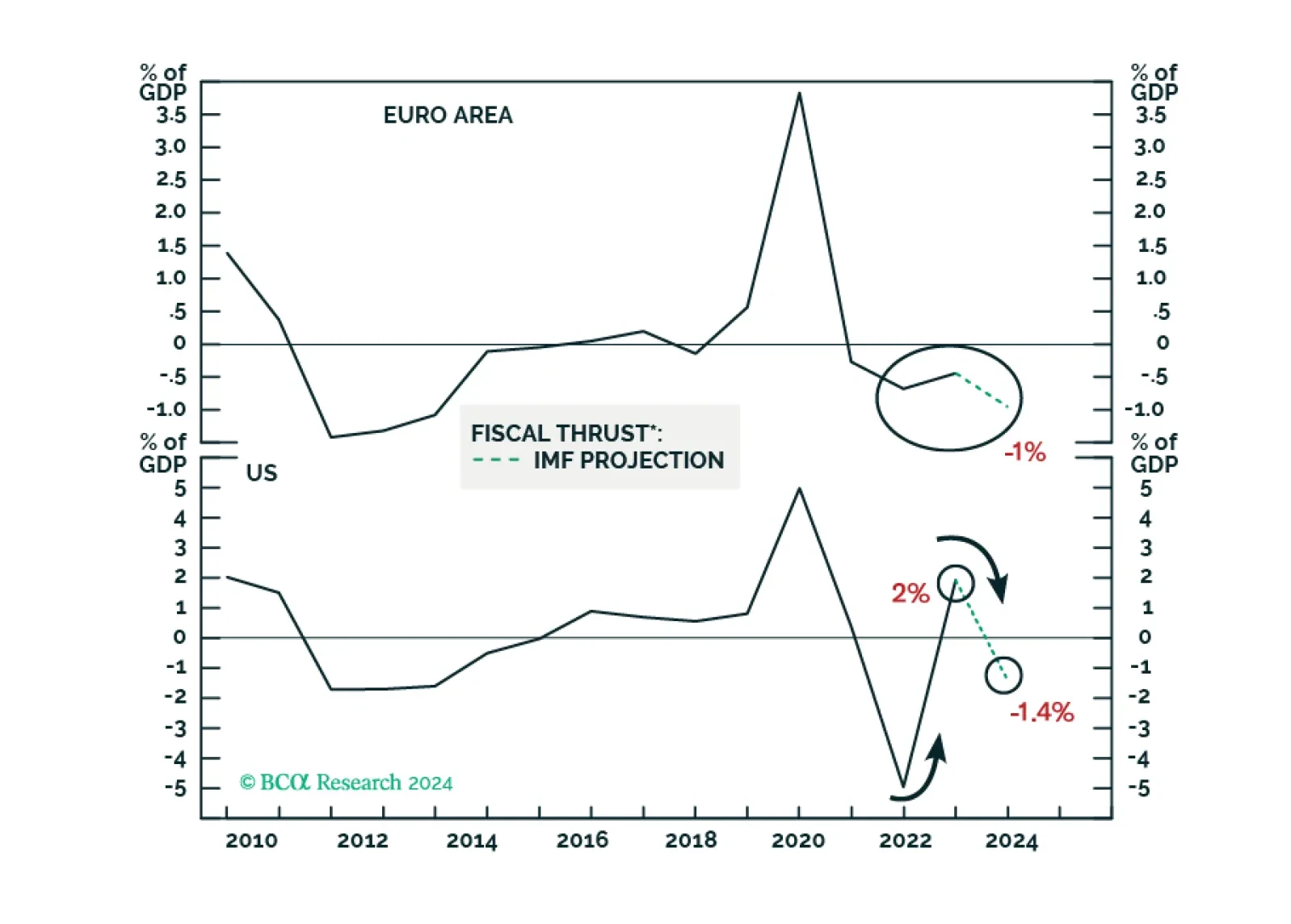

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

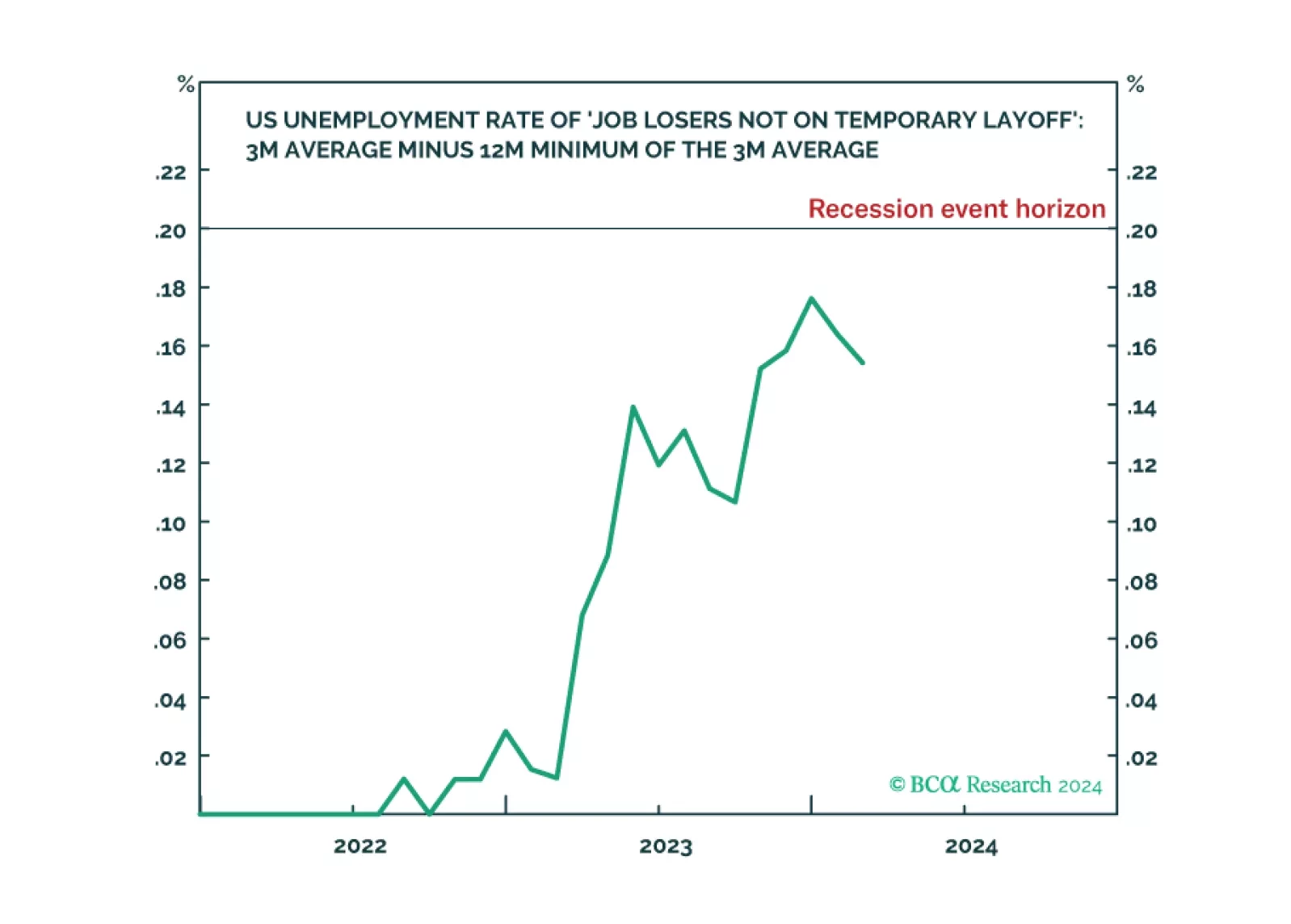

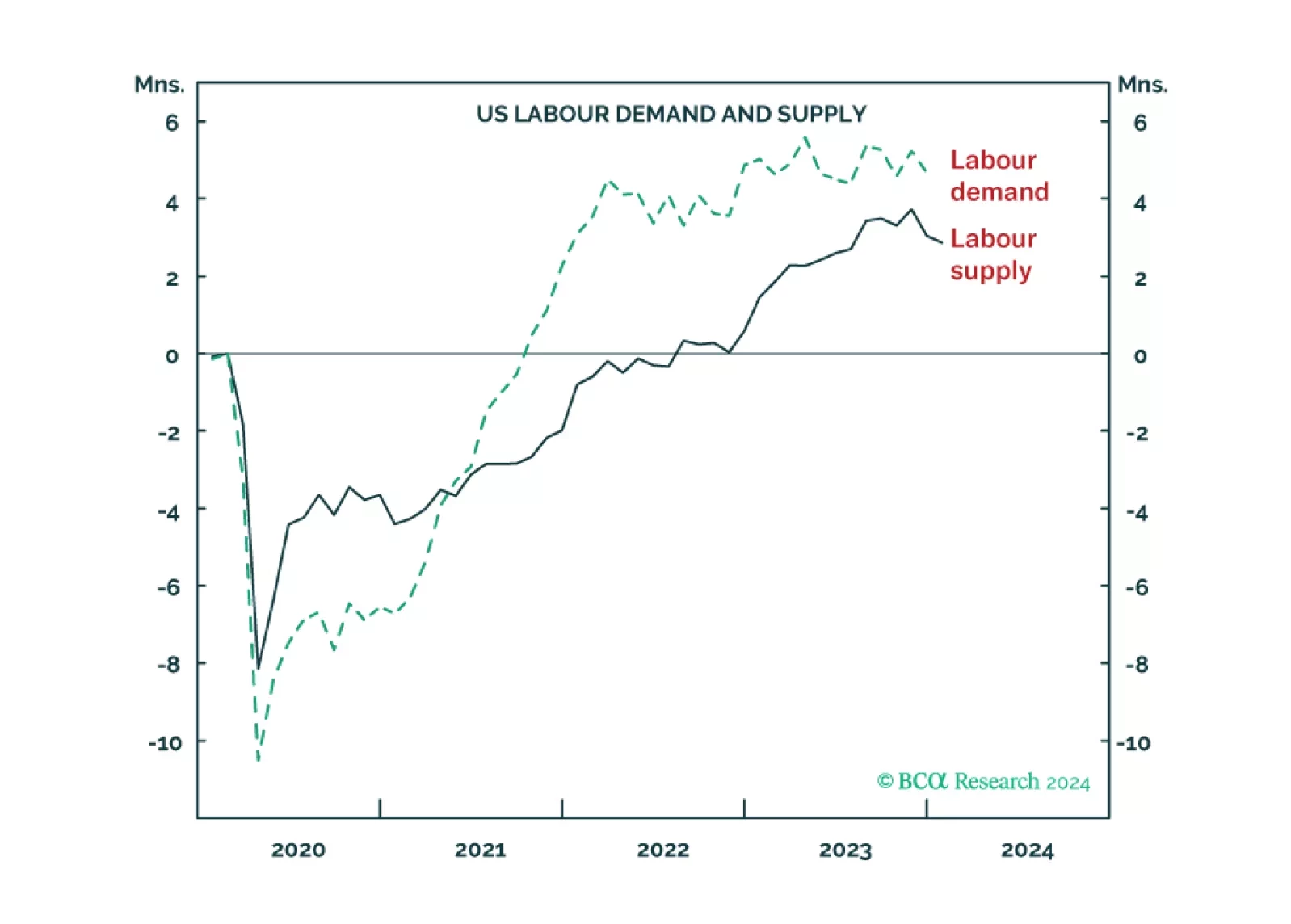

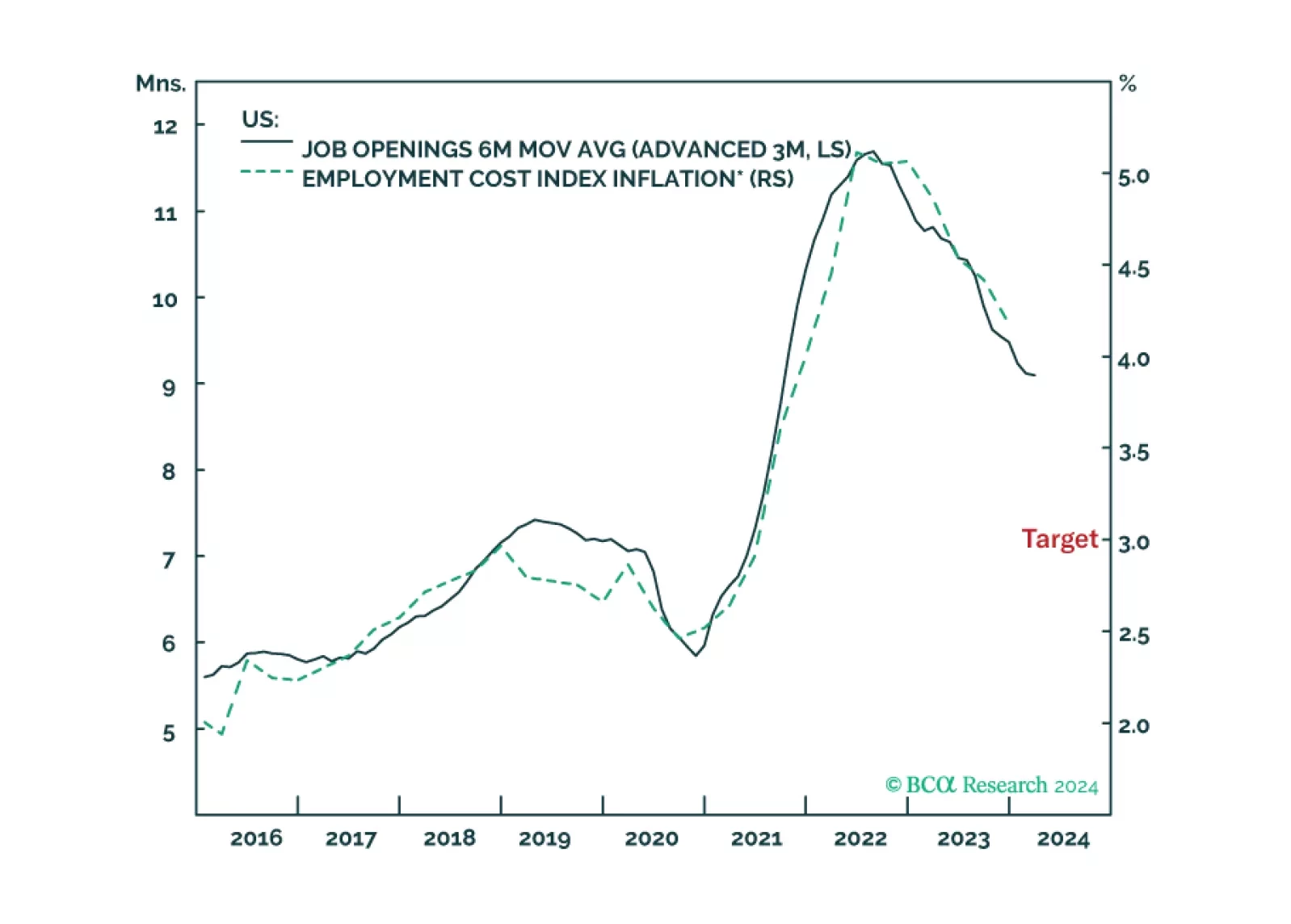

The Joshi rule real-time US recession indicator remains at an elevated 0.154 versus its recession event horizon of 0.200, indicating weakening US labour demand. With the last mile of US disinflation requiring labour demand to ‘catch…

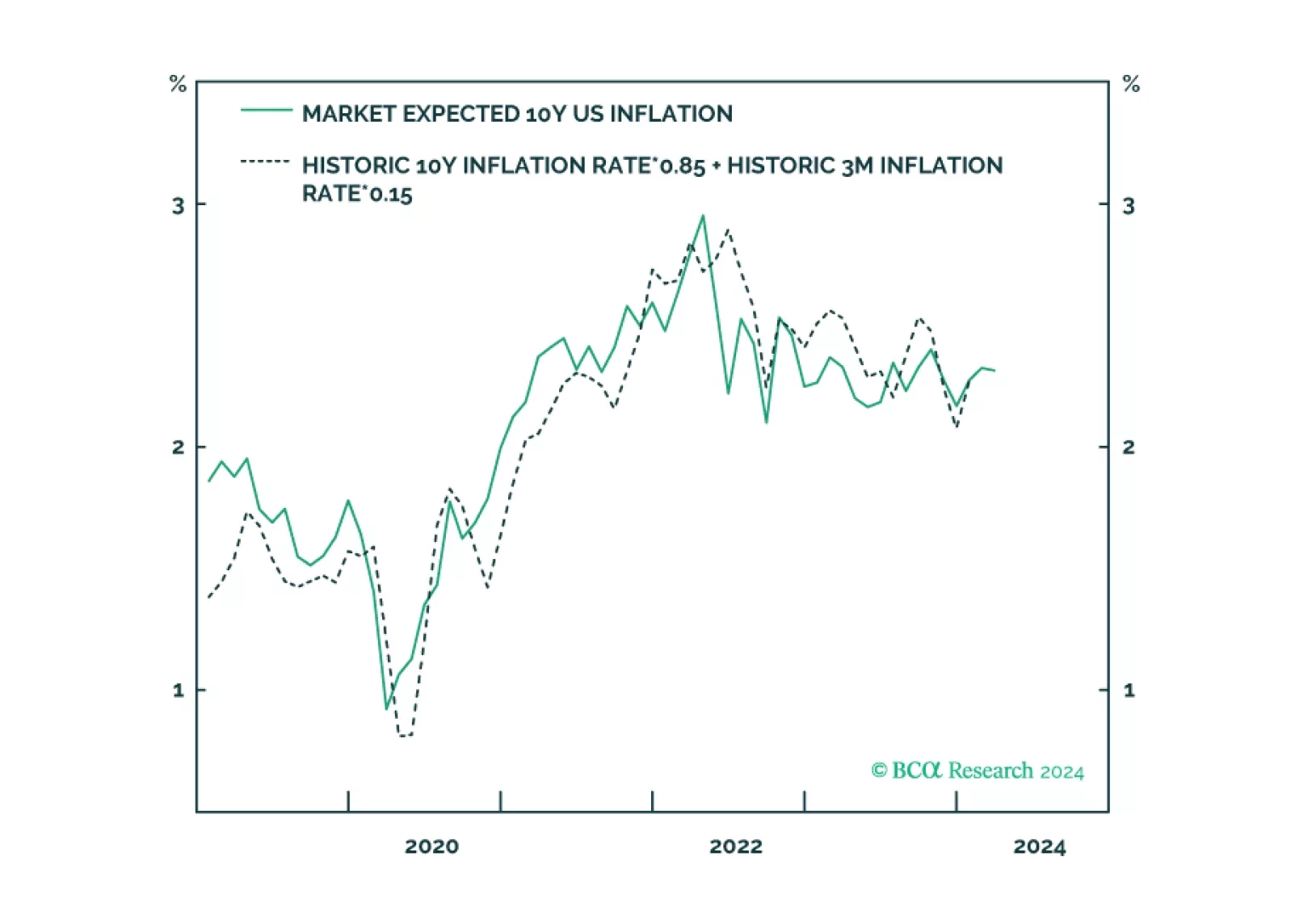

Expected inflation has surged to its highest level in a year. This has surprised many people, but expected inflation is behaving just as expected. Expected inflation is not a prophecy, it is just a mathematical function of delivered…

The US ‘immaculate disinflation’ has run its course, given that labour force participation is topping out. This leaves the Fed with a dilemma. Settle for price inflation stabilising at 3 percent, and cut rates early to avoid higher…

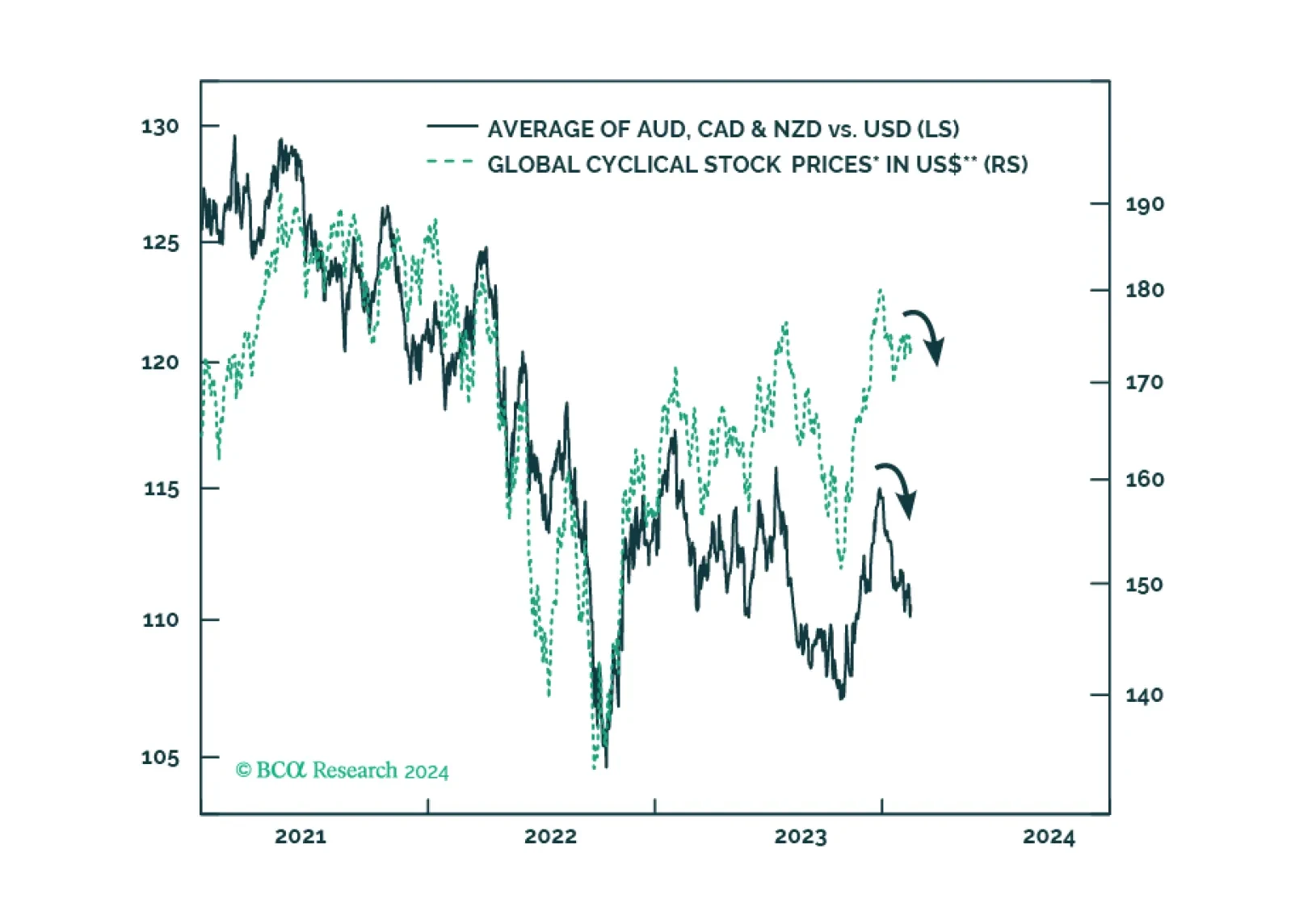

Over the next six months, the deterioration in non-US growth will occur earlier and be more pronounced than in the US. This expectation reinforces our confidence to bet on the strength of the US dollar. As usual, the flip side of the…

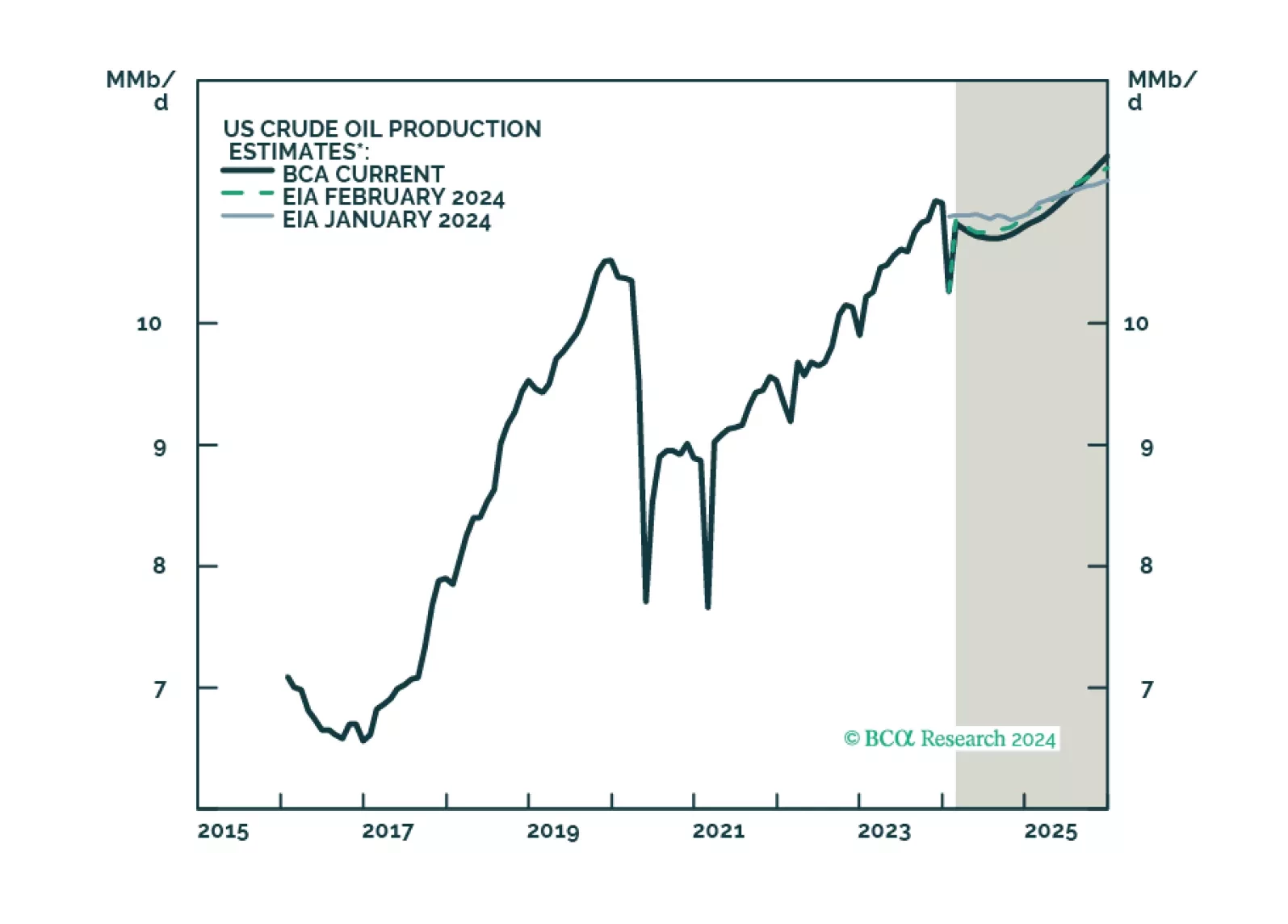

Energy markets are balanced in the short run, which keeps our Brent price forecasts at $95/bbl and $105/bbl in 2024 and 2025. Structurally, we see an upward bias to inflation, as geoeconomic fragmentation fundamentally alters supply…

The disinflation to date has been benign because it has come almost entirely from improving supply. But the supply-side tailwind has exhausted, so the last mile of the journey to 2 percent inflation will be the hardest, especially in…

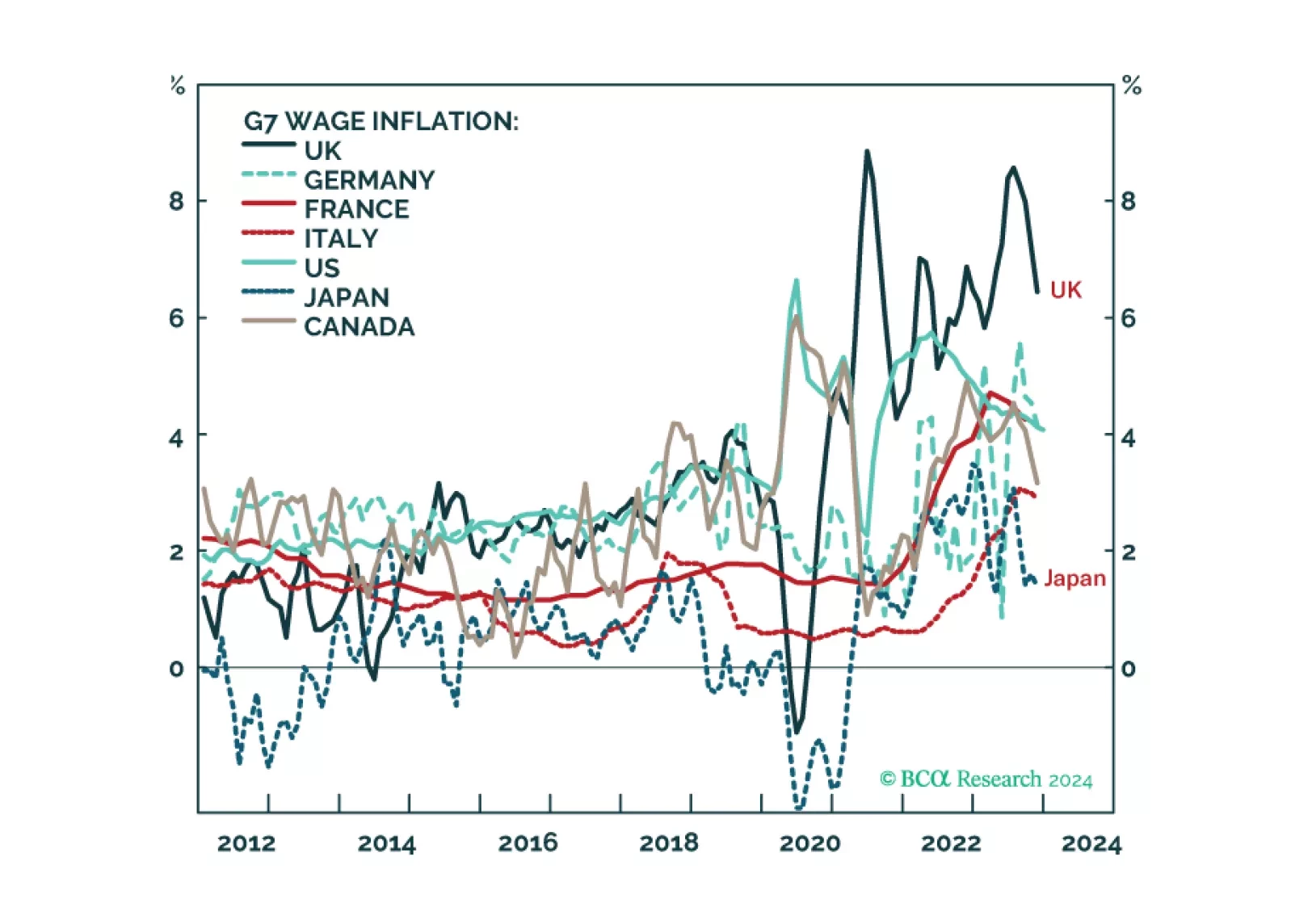

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…