Global stocks fell and sovereign bond yields surged on Thursday following the release of stronger-than-anticipated US labor market data. Data released by Challenger, Gray, & Christmas showed job cuts declined to 40,709…

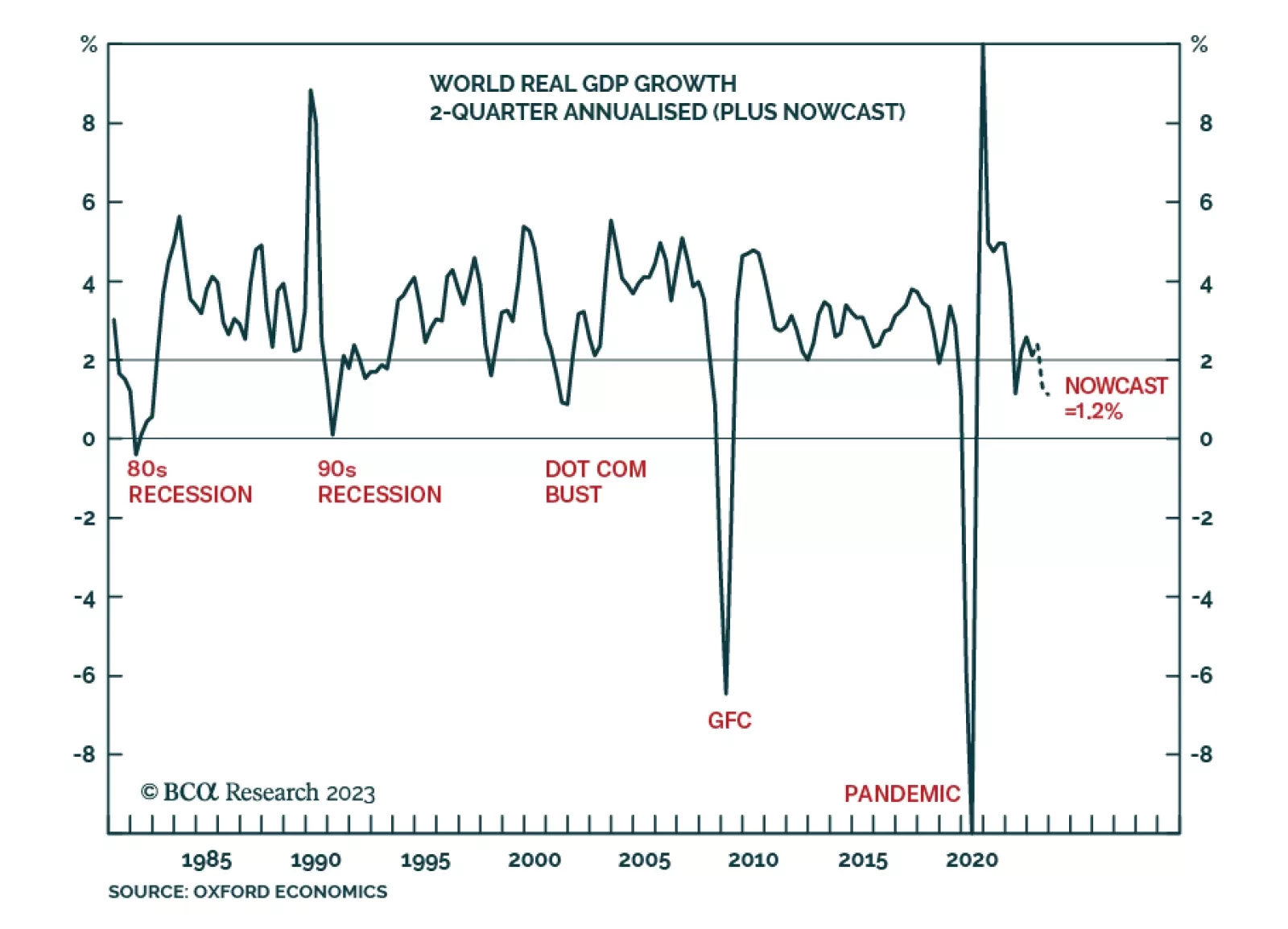

According to our Counterpoint strategy service, latest nowcasts indicate that world growth has likely slowed to sub-2 percent, thereby passing the threshold of a typical world recession as experienced in the early 1970s, early…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

Markets continue to be tossed to and fro by central-bank policy, and risks of higher commodity prices. These are due to fiscal stimulus and exogenous weather and war-related risk, which could send food and energy prices higher this…

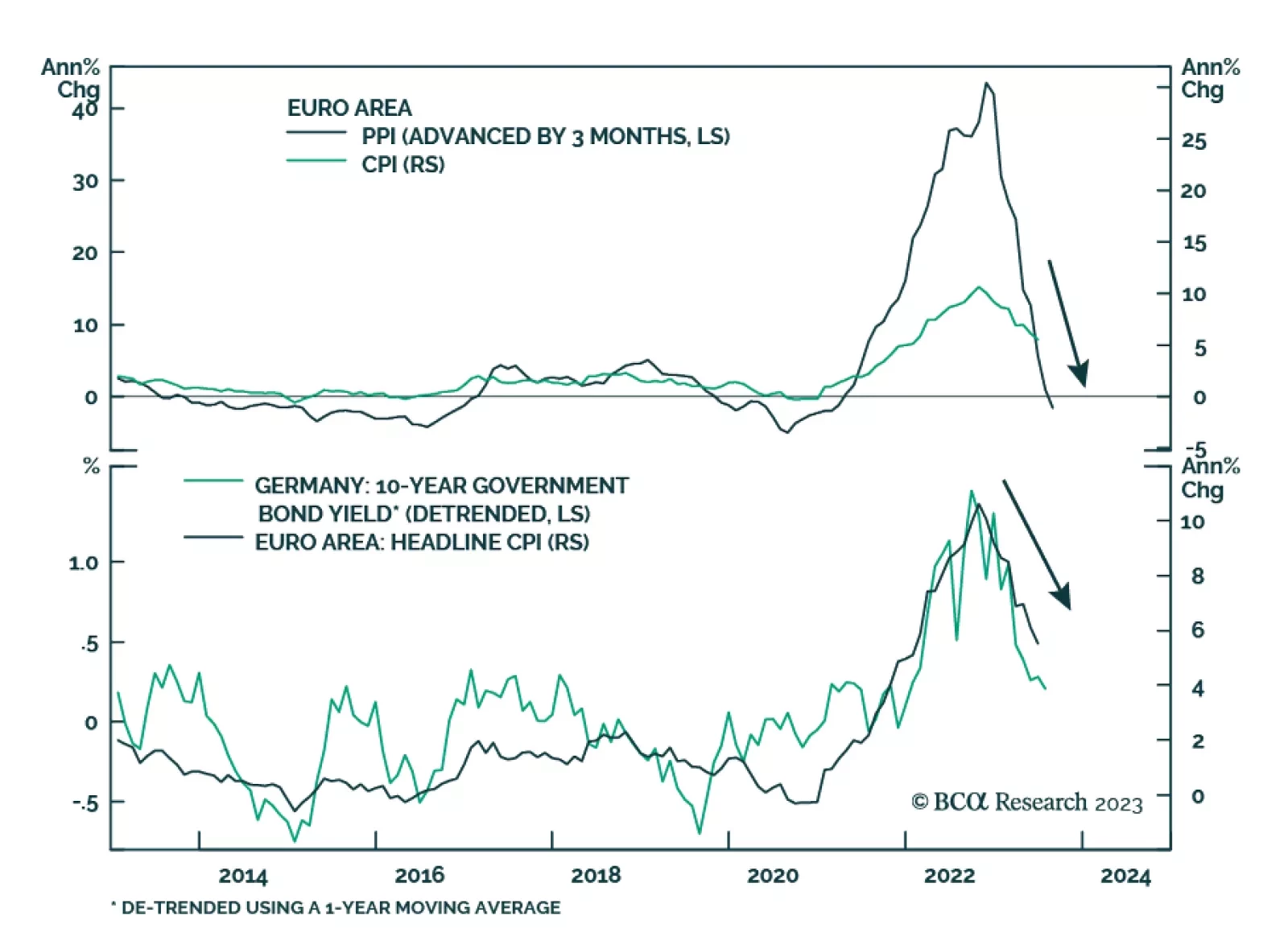

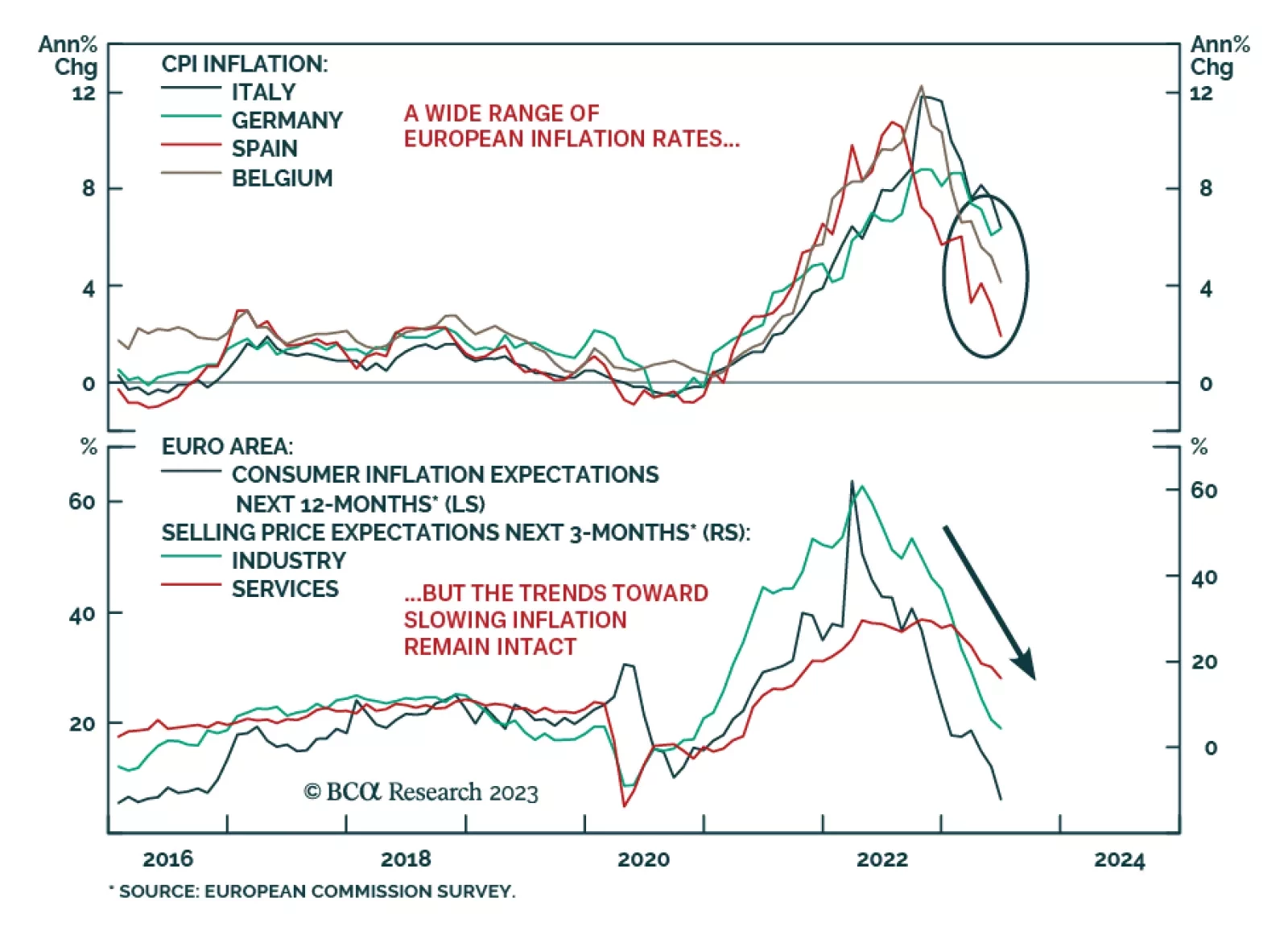

Eurozone producer prices fell by more than anticipated in May. The -1.5% y/y decrease – which marked the first annual drop since December 2020 – was more pronounced than expectations of a -1.3% y/y decline and…

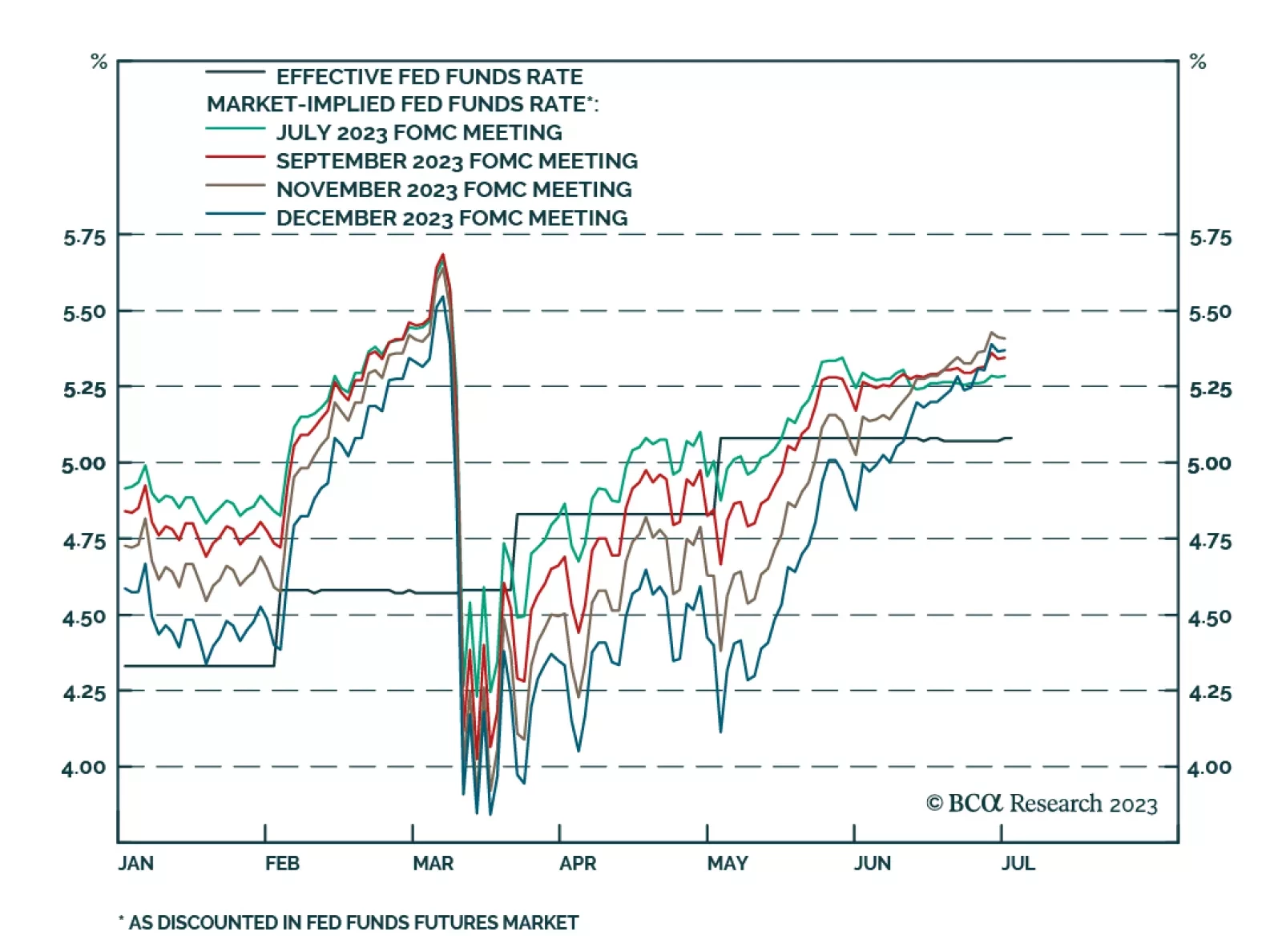

The minutes from the June FOMC meeting didn’t reveal anything that wasn’t already known. They did explicitly say that “some” participants would have preferred a 25 basis point rate hike instead of a pause…

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

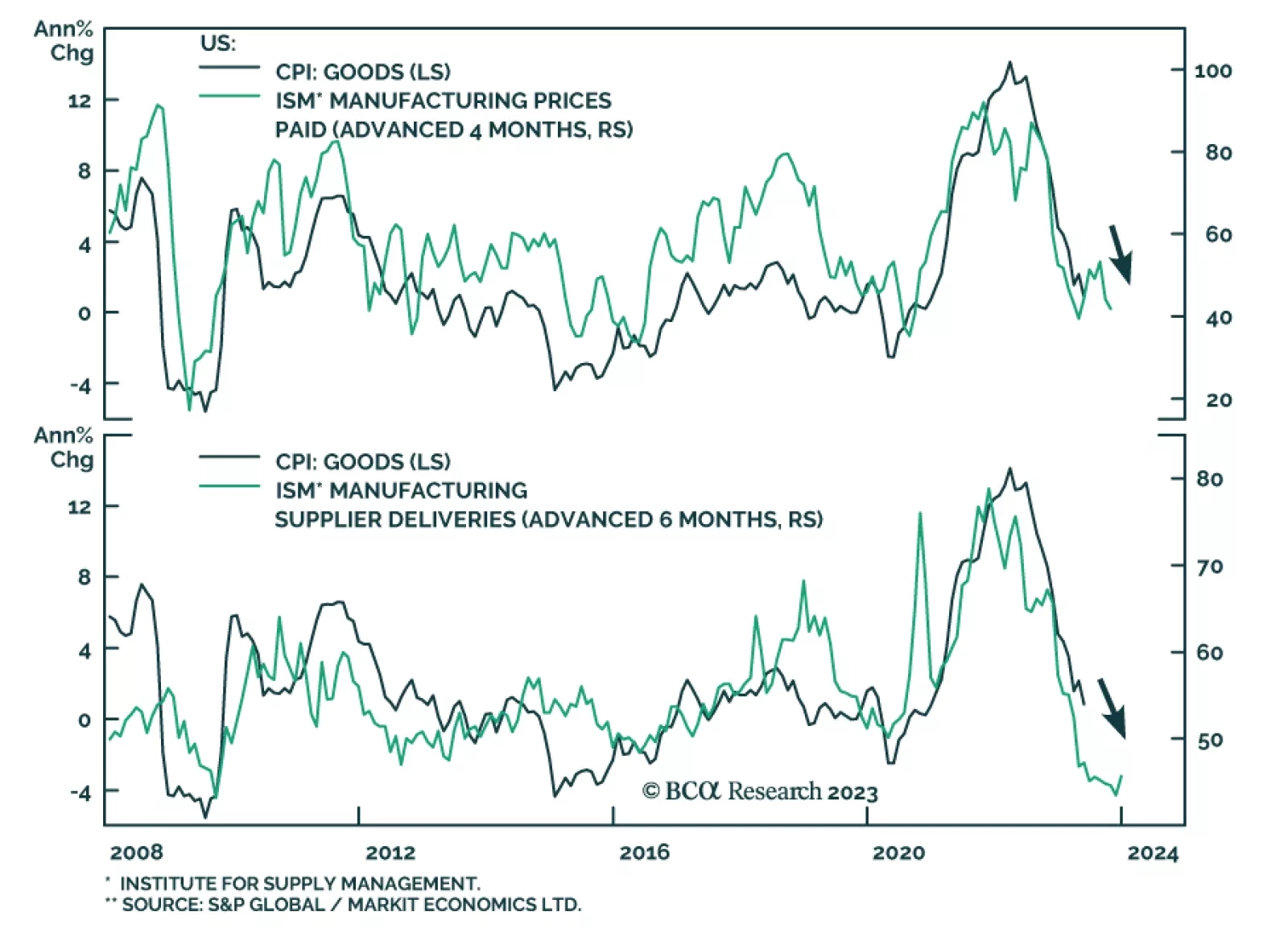

The ISM PMI sent a pessimistic signal about US manufacturing conditions in June. The headline index dropped 0.9 points to a 3-year low of 46.0 – it eighth consecutive month below the 50 boom-bust line. This is consistent…

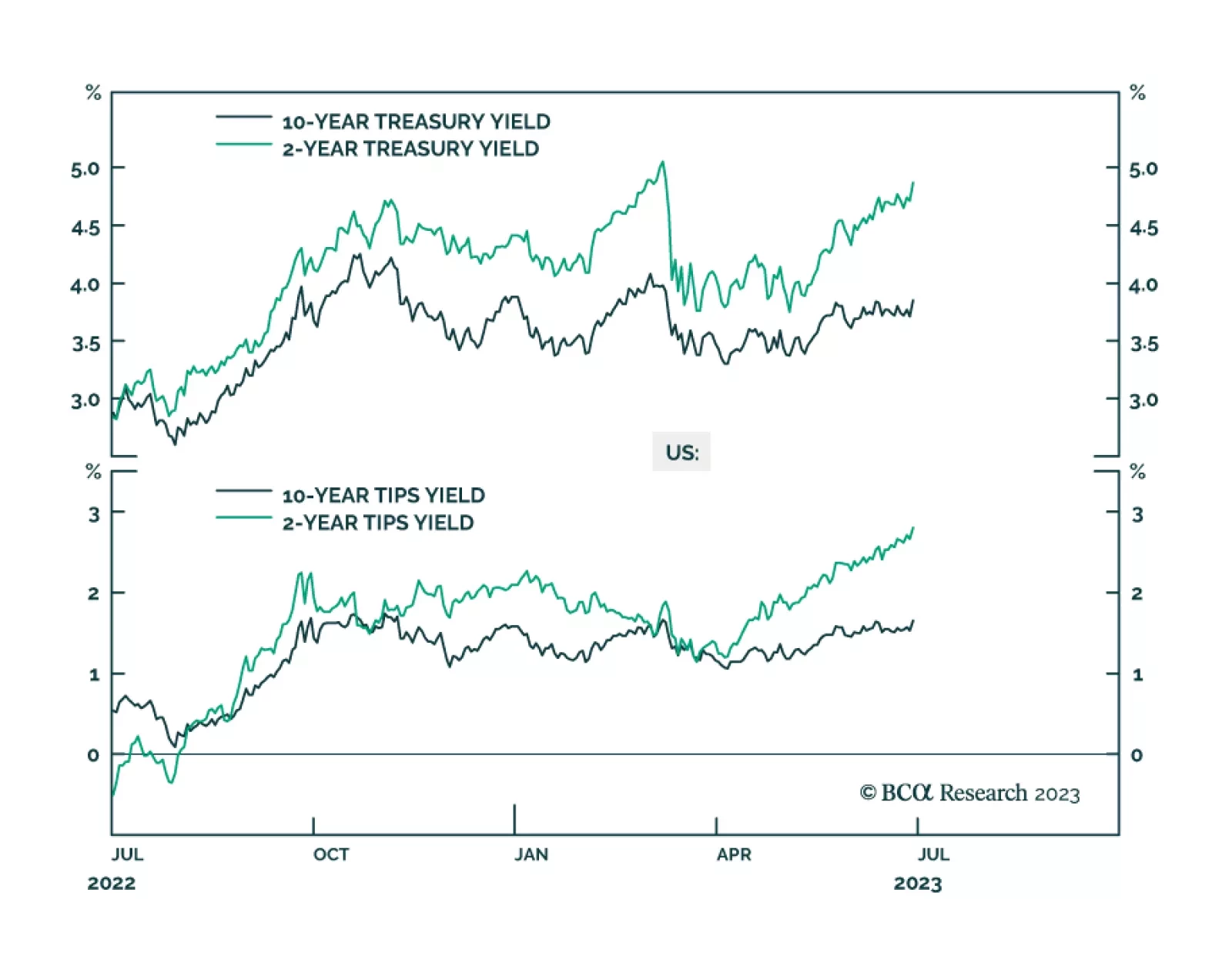

Our US Bond Strategy service responds to recent data releases which showed that real economic growth and the labor market are surprisingly resilient, while inflation pressures continued to decline. The 10-year Treasury yield…

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…