Time is running out on the Bank of England’s tightening cycle. UK economic growth is flirting with recession, unemployment is rising, house prices are contracting and inflation is decelerating. Markets are overestimating the eventual…

Collapsed complexity, plus the unwinding of favourable base effects and favourable seasonal adjustments to the inflation and jobs numbers, all pose a danger to the Goldilocks market.

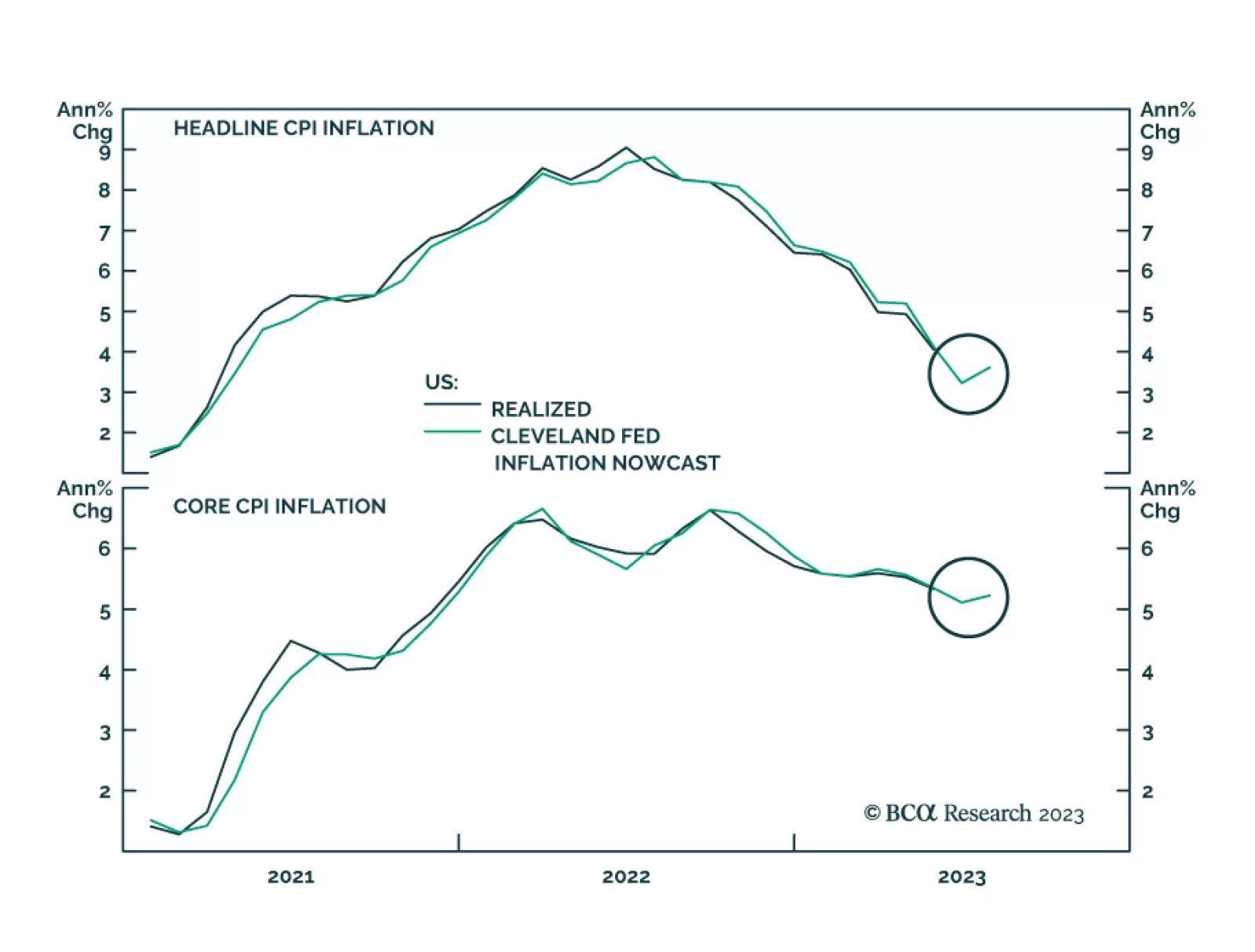

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

In this report, we dissect which markets have broken out and which ones have not, and reflect what this entails for our global macro view. Also, we analyze how the S&P 500 has been taking its cues from a change in the inflation…

An outlook for inflation and Fed policy following this morning’s CPI report.

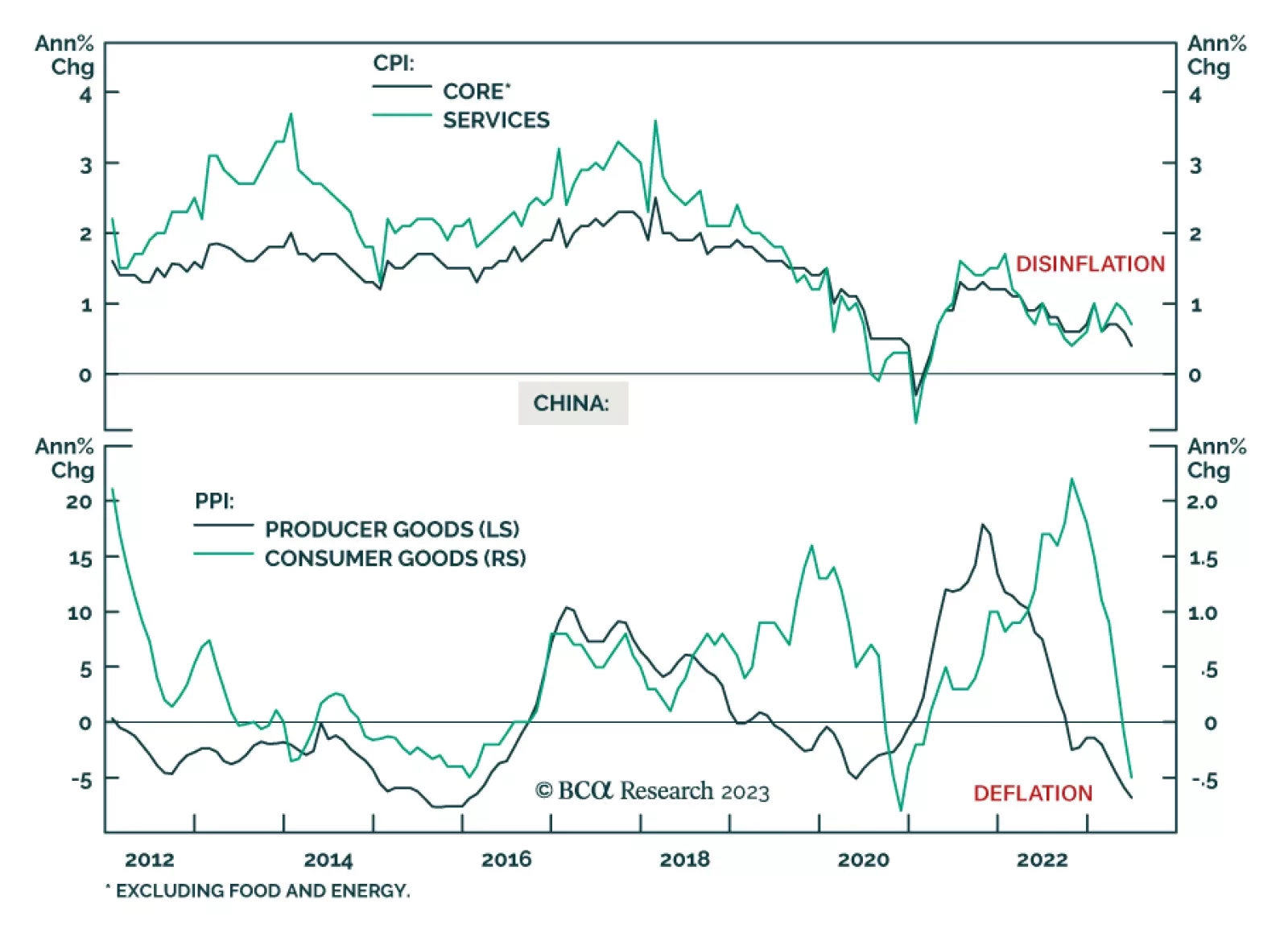

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

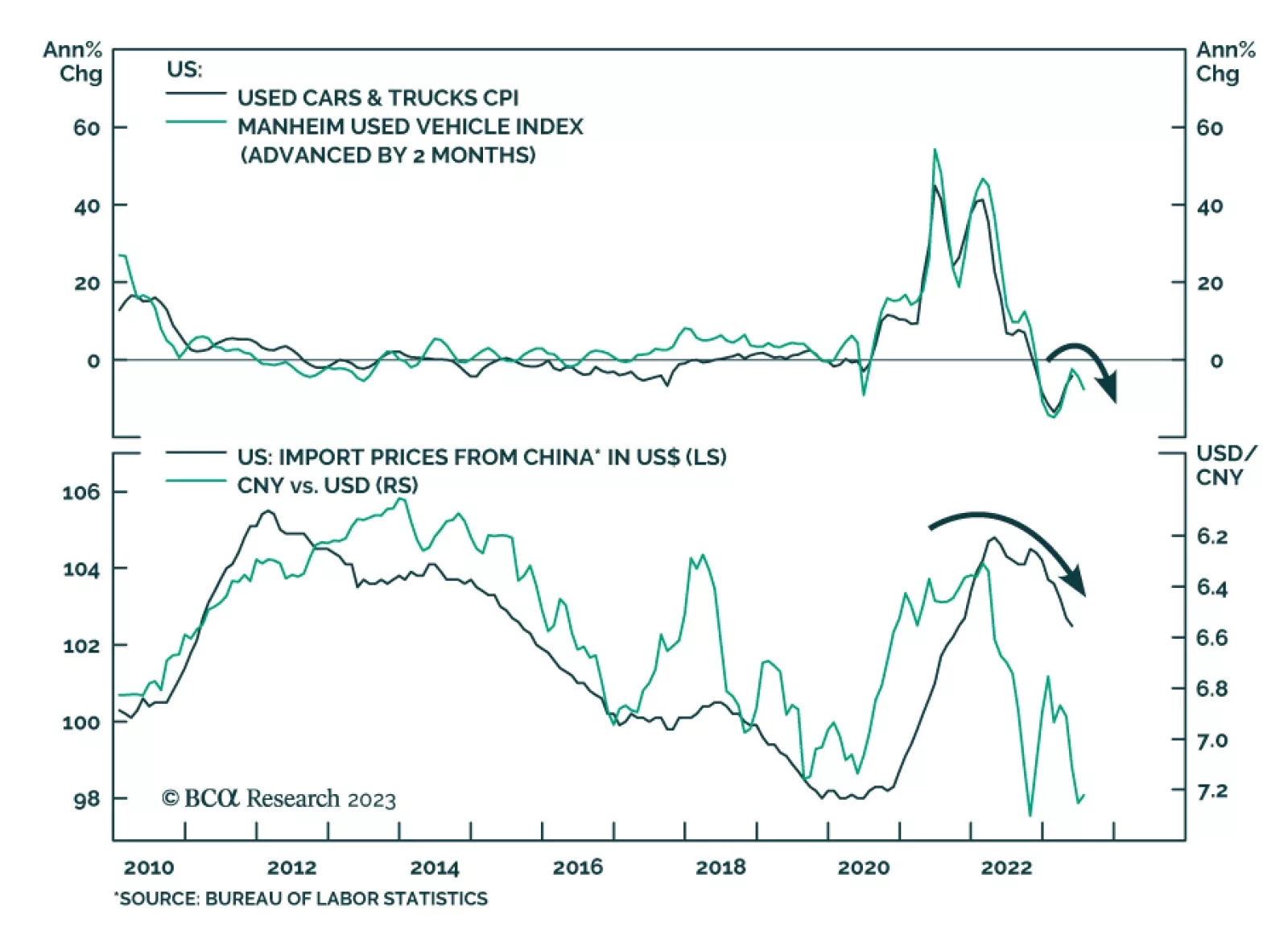

The latest update of the Manheim Used Vehicle Price Index provides a positive signal for US goods inflation. It shows used car prices fell by -4.2% m/m (-10.1% y/y) in June – its third consecutive monthly decline following…

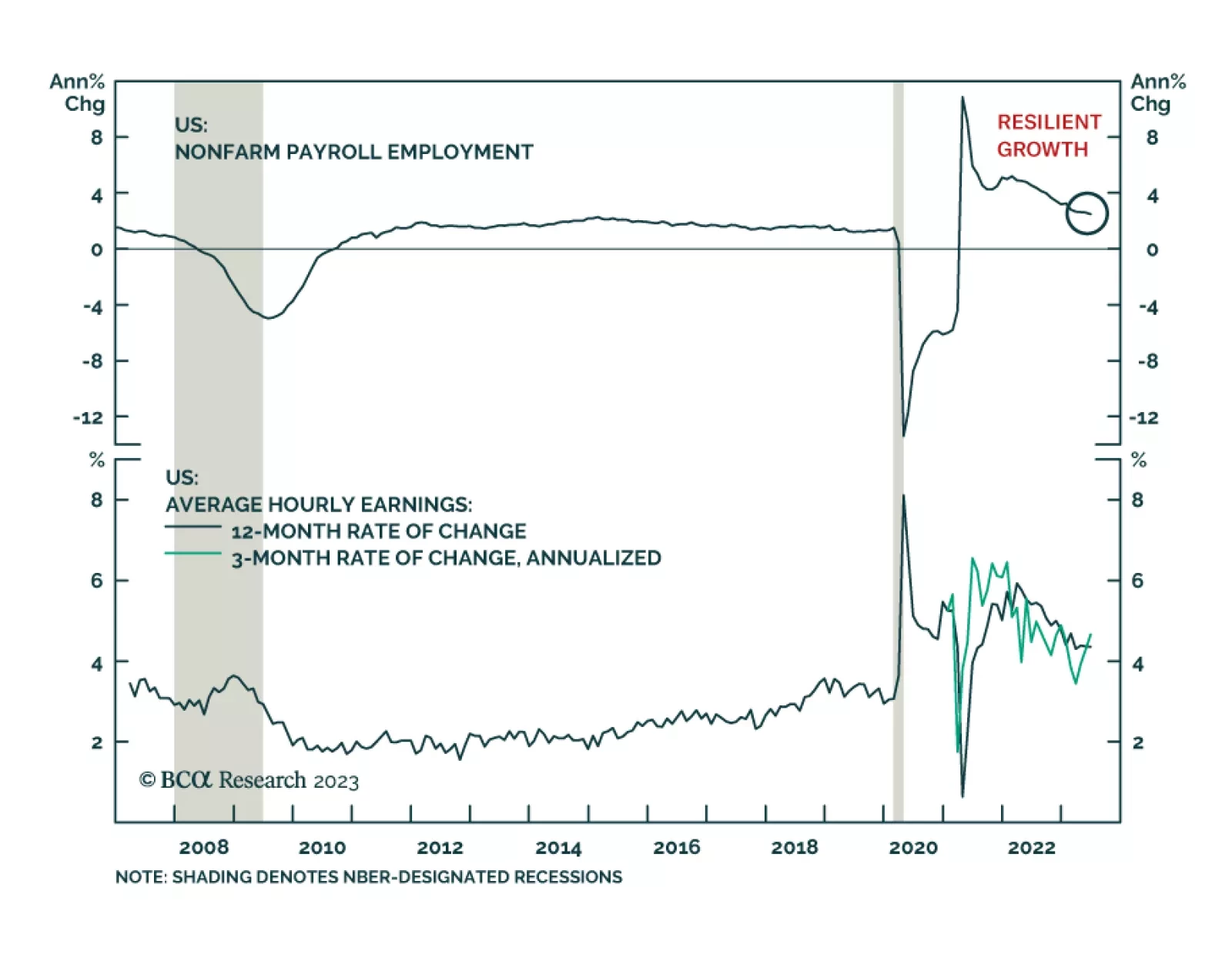

On the surface, the lower-than-anticipated job gains suggest that US labor market conditions softened last month. Friday’s jobs report revealed that the increase in nonfarm payrolls slowed from a downwardly revised 306…

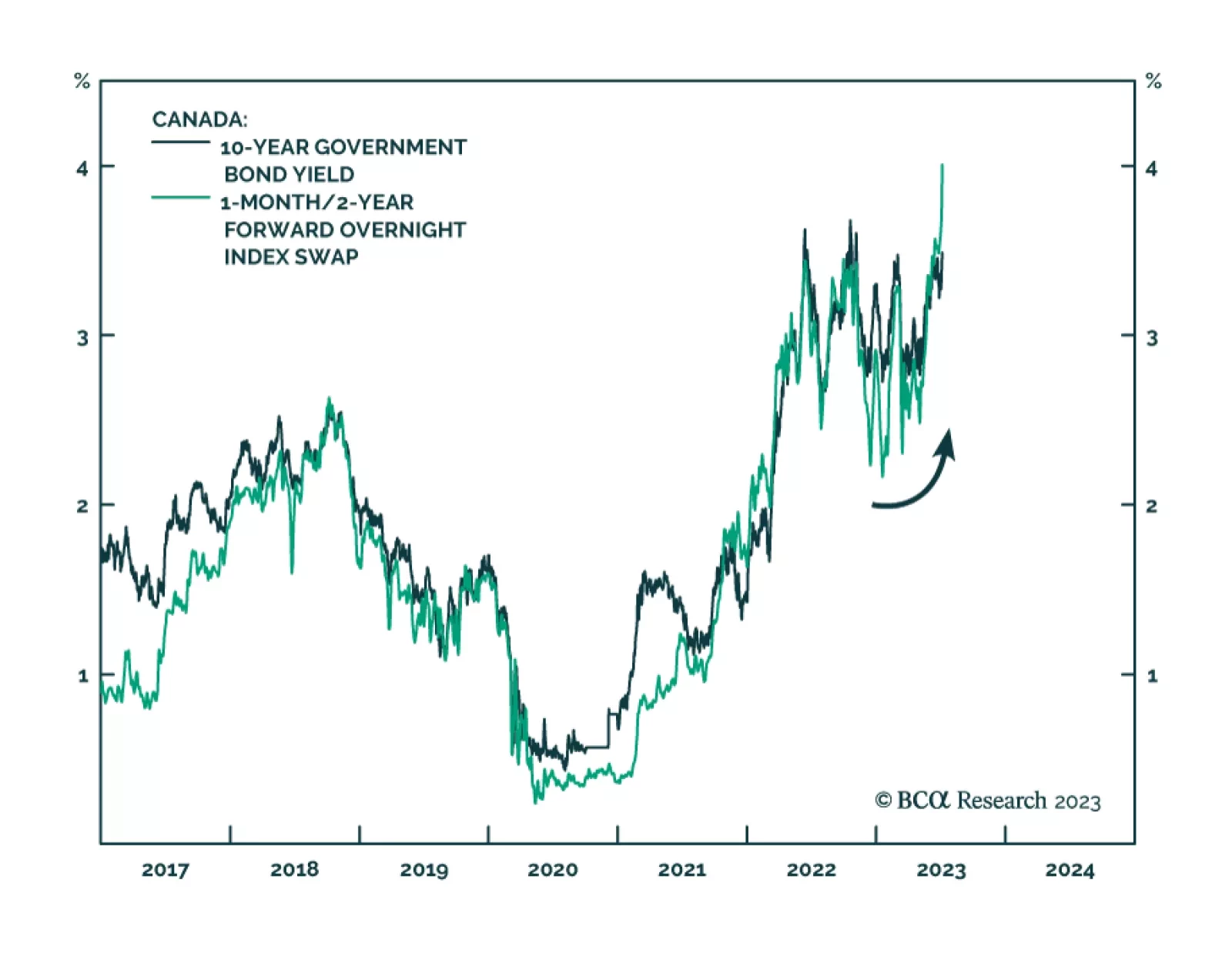

Canadian hiring surprised to the upside in June. The 60 thousand increase in employment last month – the highest since January – came in triple expectations of a 20 thousand rise and follows a 17 thousand decline in…

Last week’s labor market data signal that US employment conditions remain strong – solidifying the case for a 25 bps rate hike at the Fed’s next meeting later this month (see The Numbers). Yet in order for…