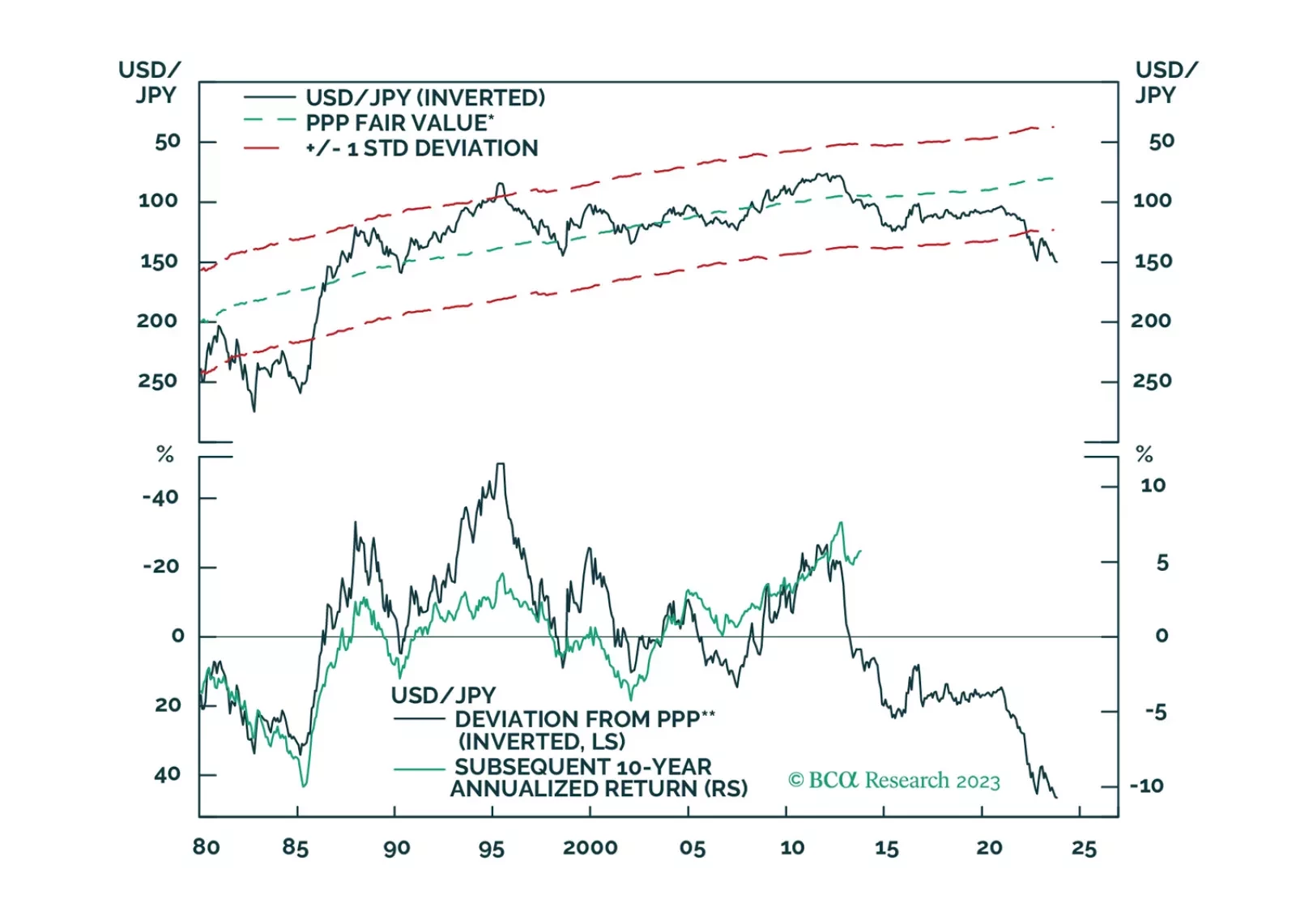

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

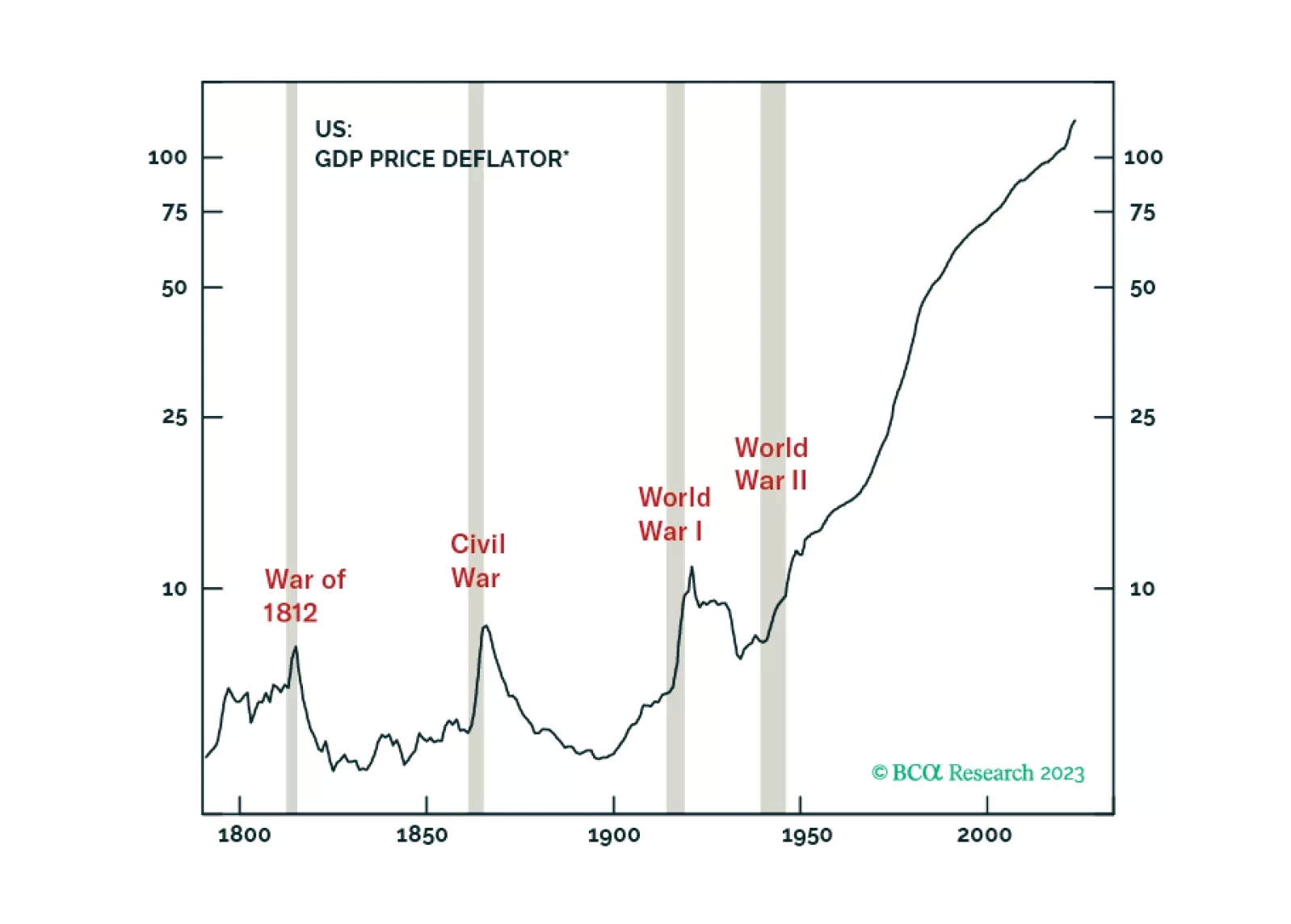

The Hamas attack against Israel, timed almost 50 years to the day after a similar surprise attack on Yom Kippur of 1973, has evoked parallels with the 1970s. Parallels not only with Middle Eastern geopolitics then and now, but also…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

The sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that implies a probable and playable rebound. More strategically, long-duration bonds yielding close to 5 percent are an excellent…

The bear market in US bonds will likely end with a bang rather than a whimper. Even during the secular US bond bull market of 1982-2021, cyclical bond bear markets ended only after an eruption of financial turmoil. It would be…

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

The biggest misunderstanding in the markets right now is that to keep expected inflation well-anchored at 2 percent, inflation must undershoot 2 percent for some time. This implies that interest rate futures curves are mispriced, and…

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…