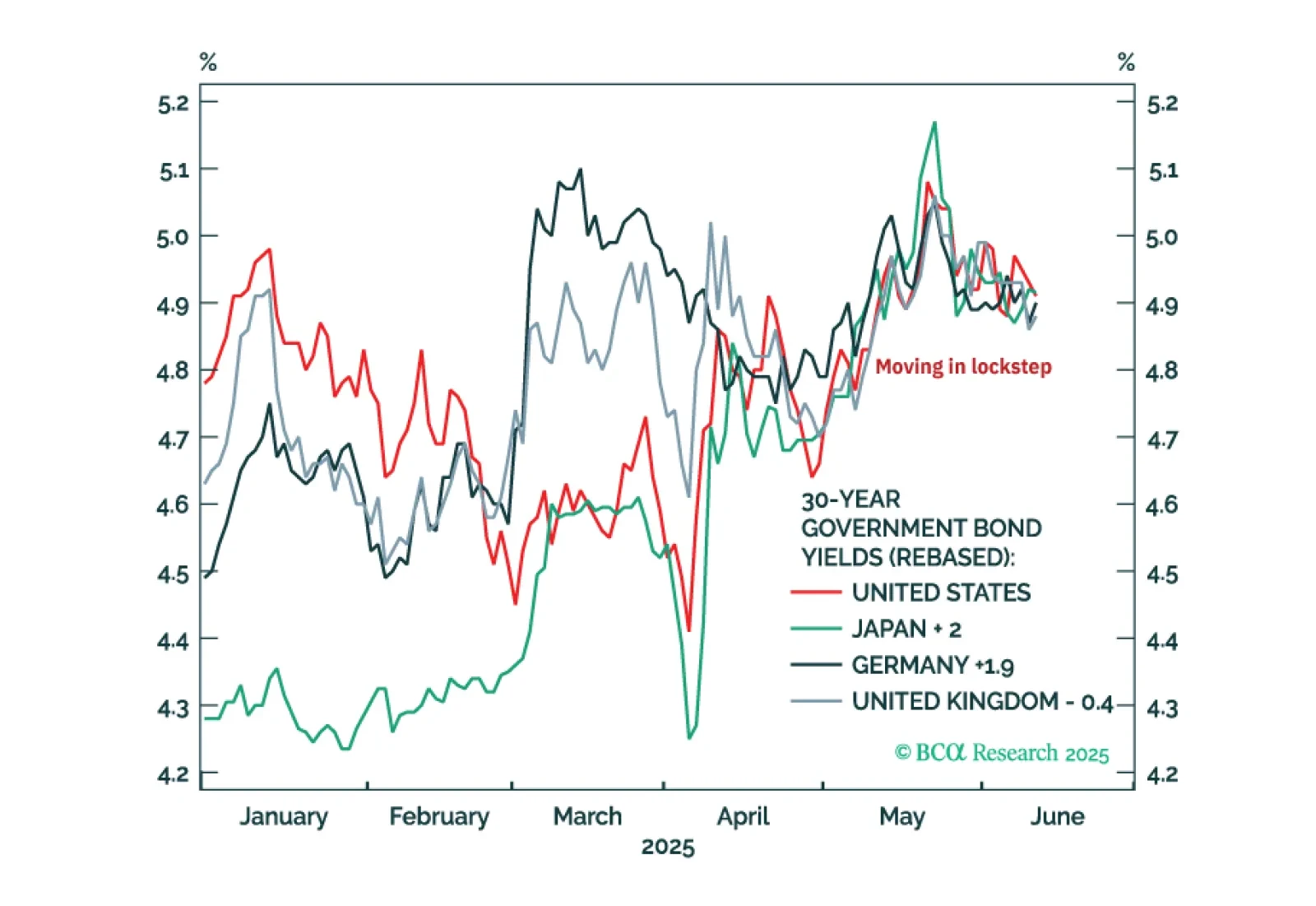

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

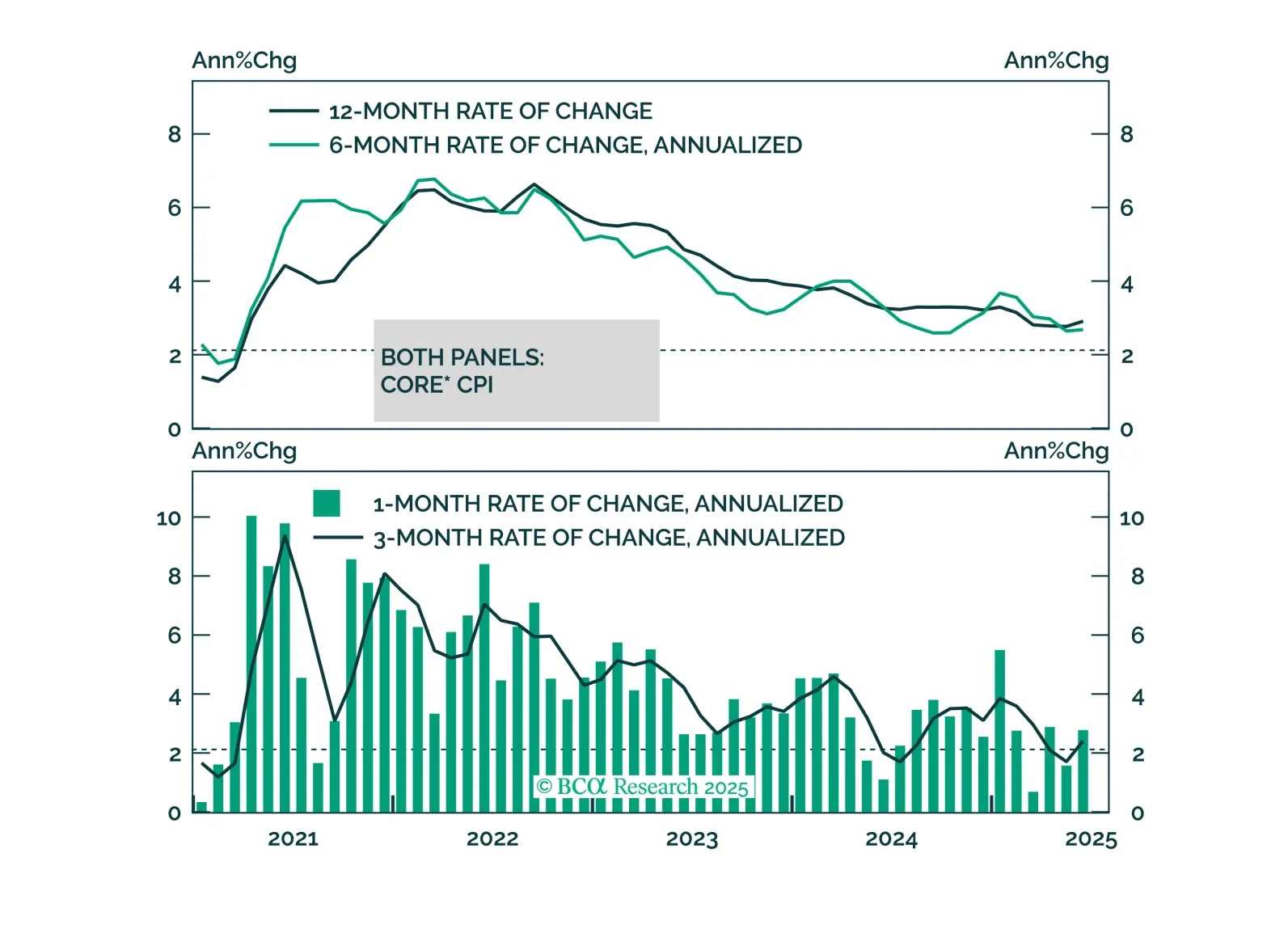

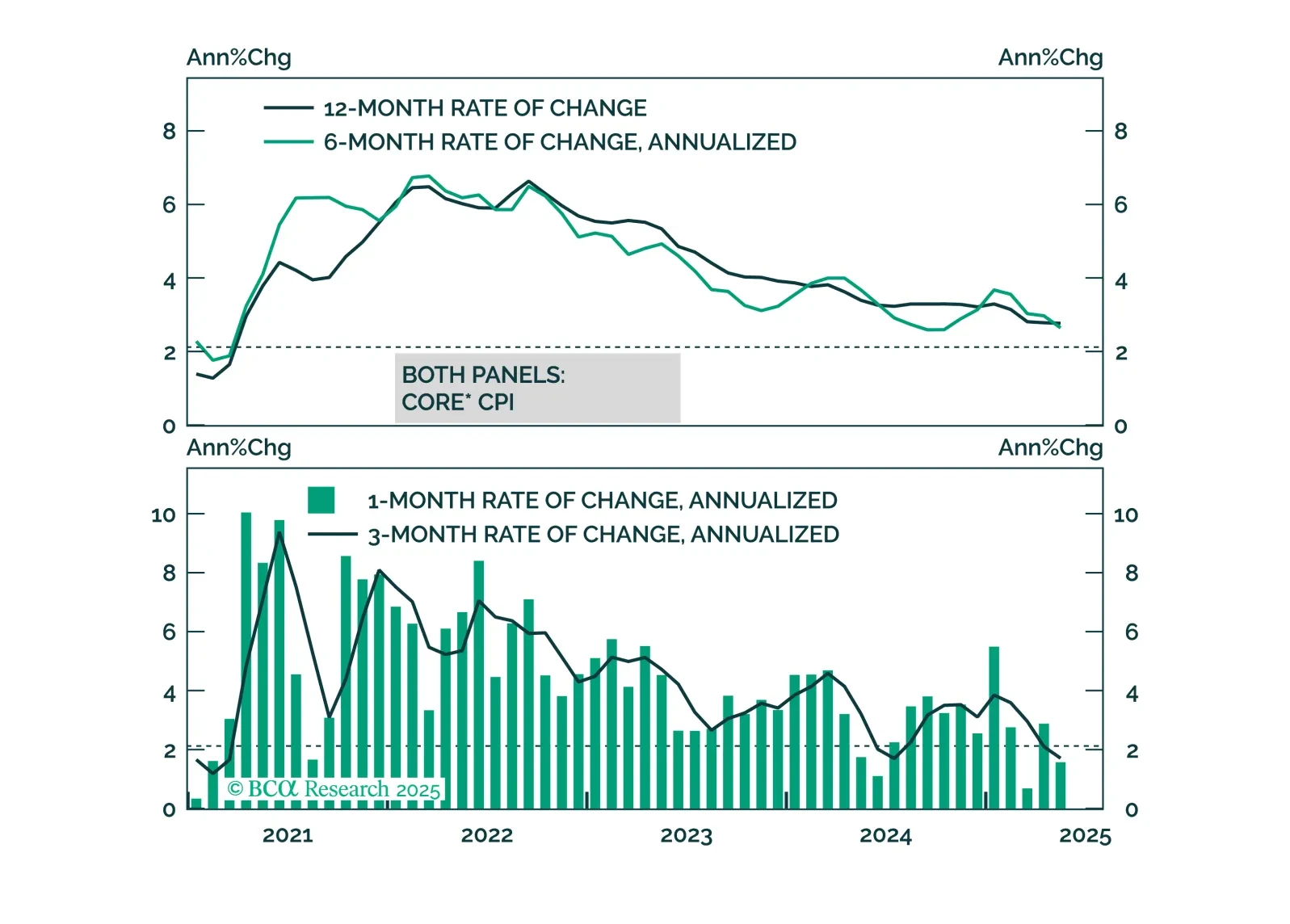

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

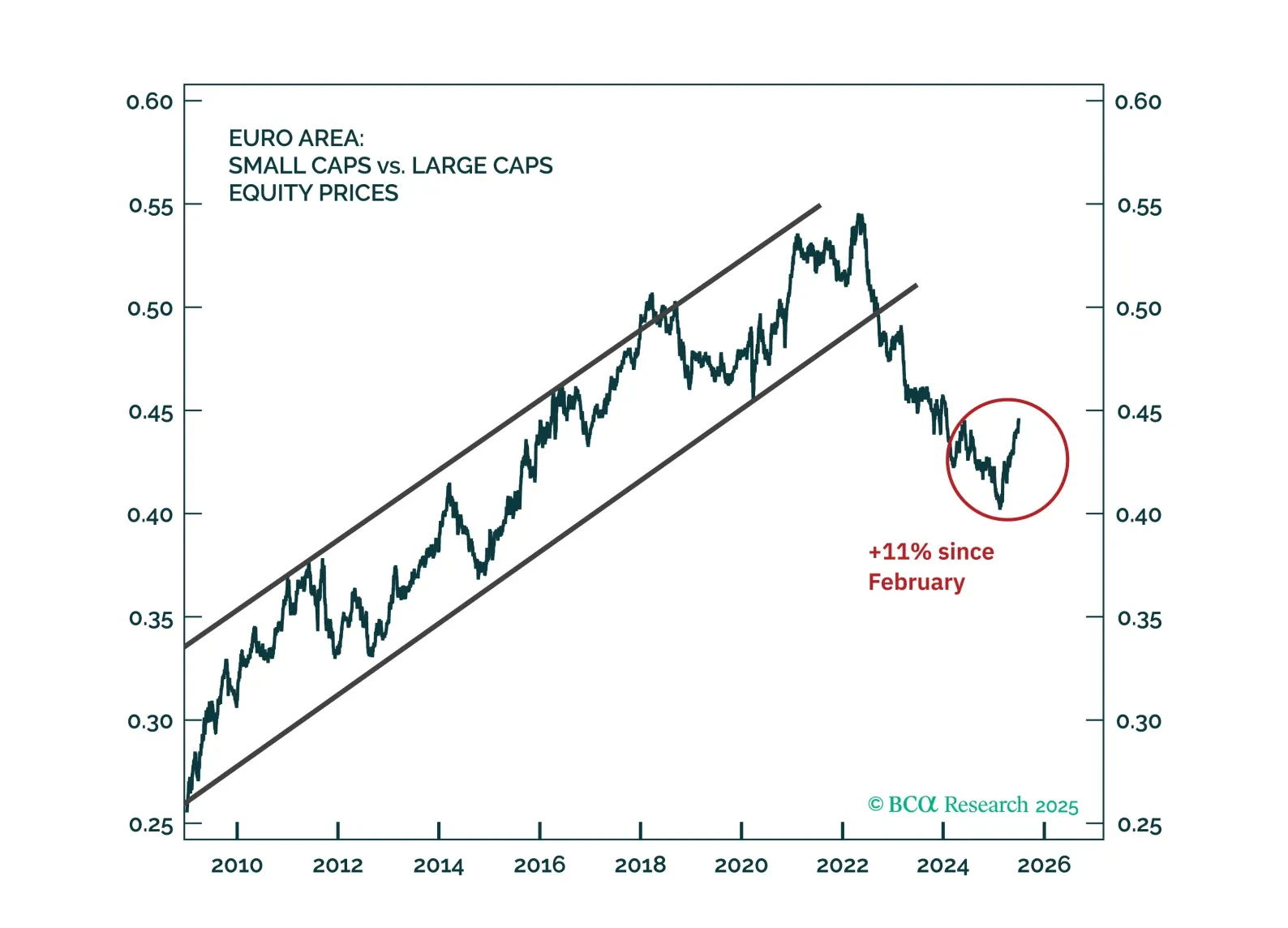

We upgrade European small caps to maximum overweight and double down on our existing recommendation to go long European small caps relative to US ones.

The perfectly synchronised moves in US, Japanese, German, and UK 30-year bond yields through the past two months are odd… and irrational. These irrational moves present compelling investment opportunities.

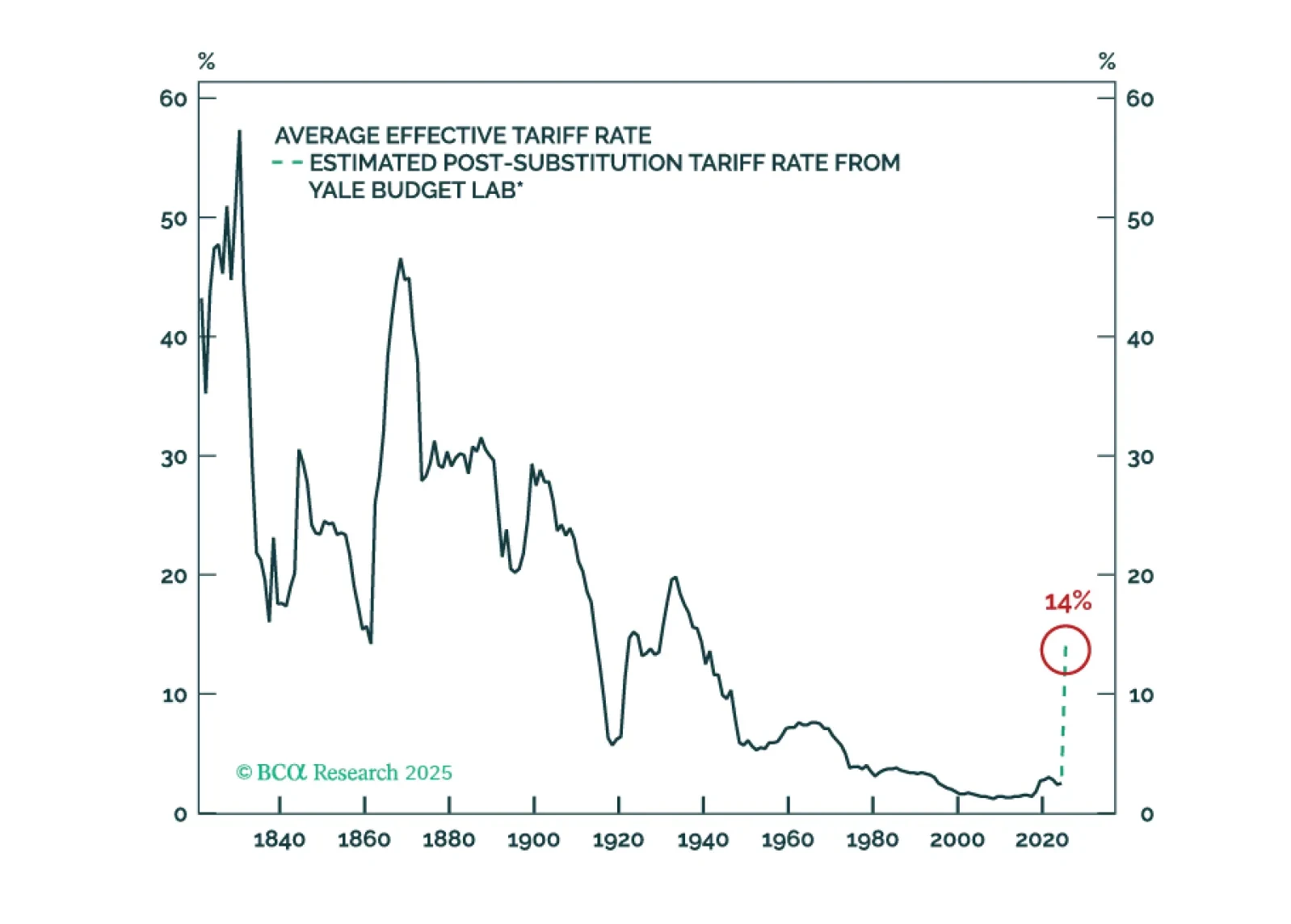

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

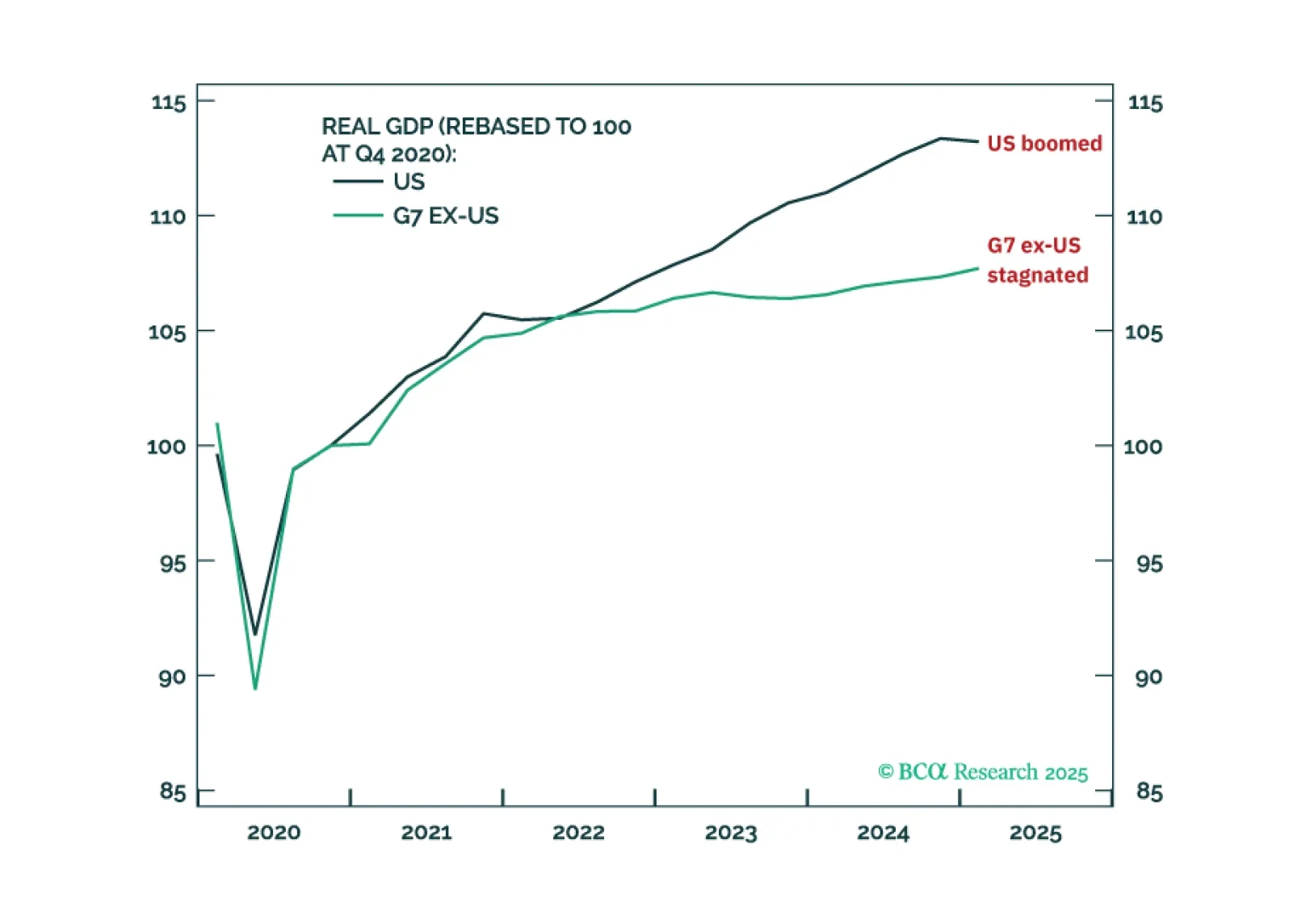

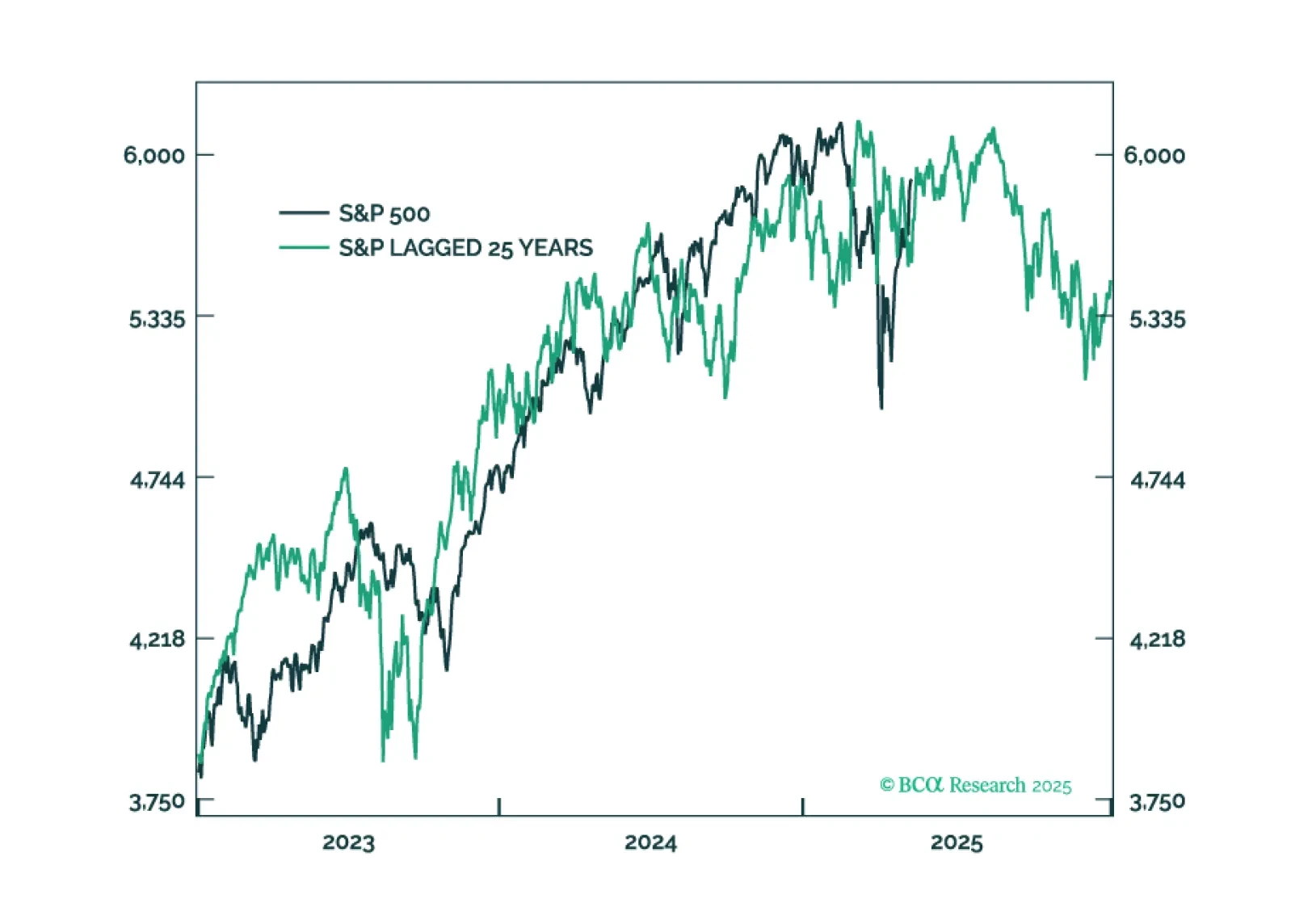

This year’s plunge in tech stocks followed by the recent strong countertrend rally is eerily reminiscent of 2000. But the market and economic parallels between 2025 and in 2000 run much deeper. This report lists 10 striking parallels…

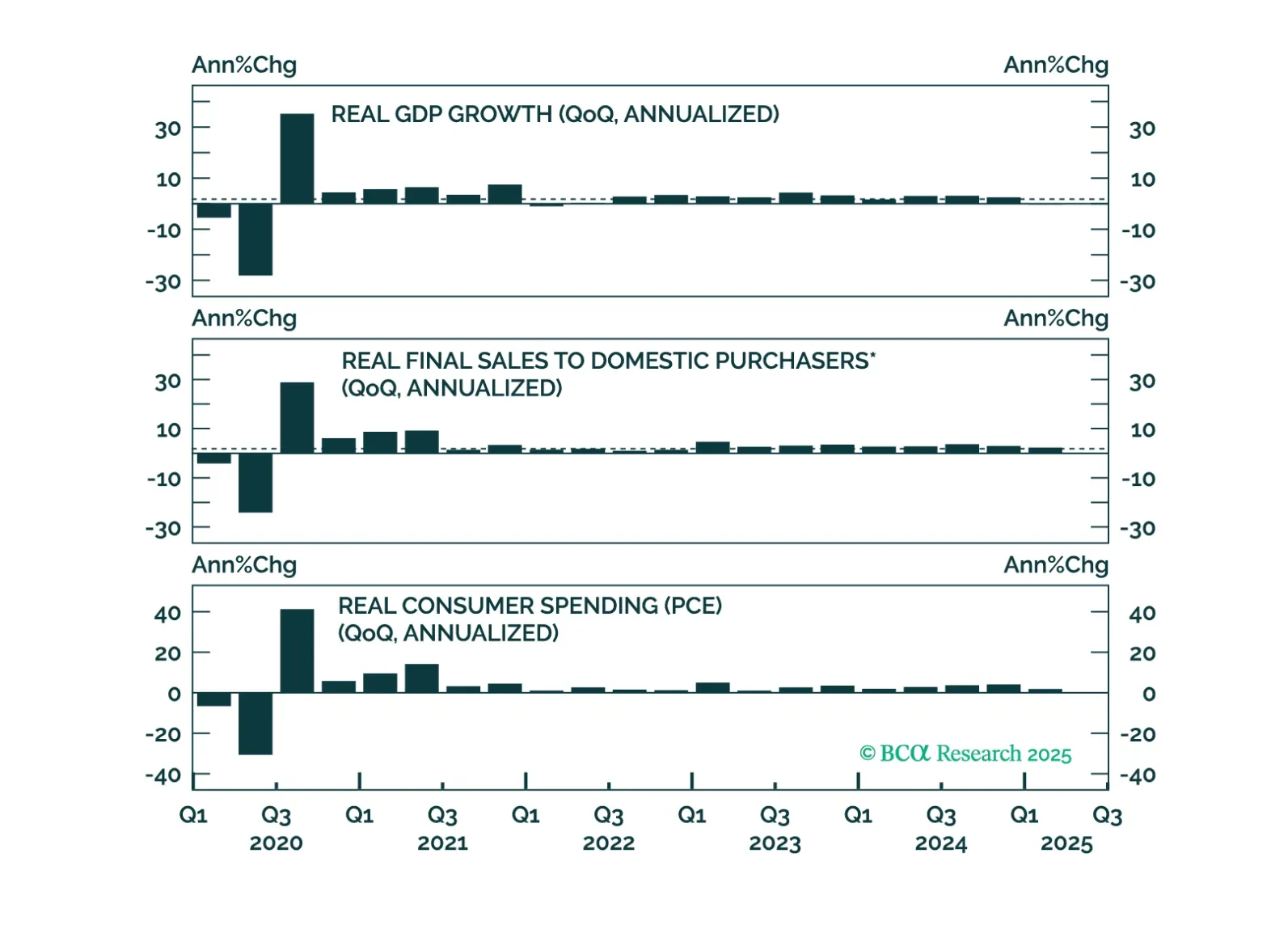

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

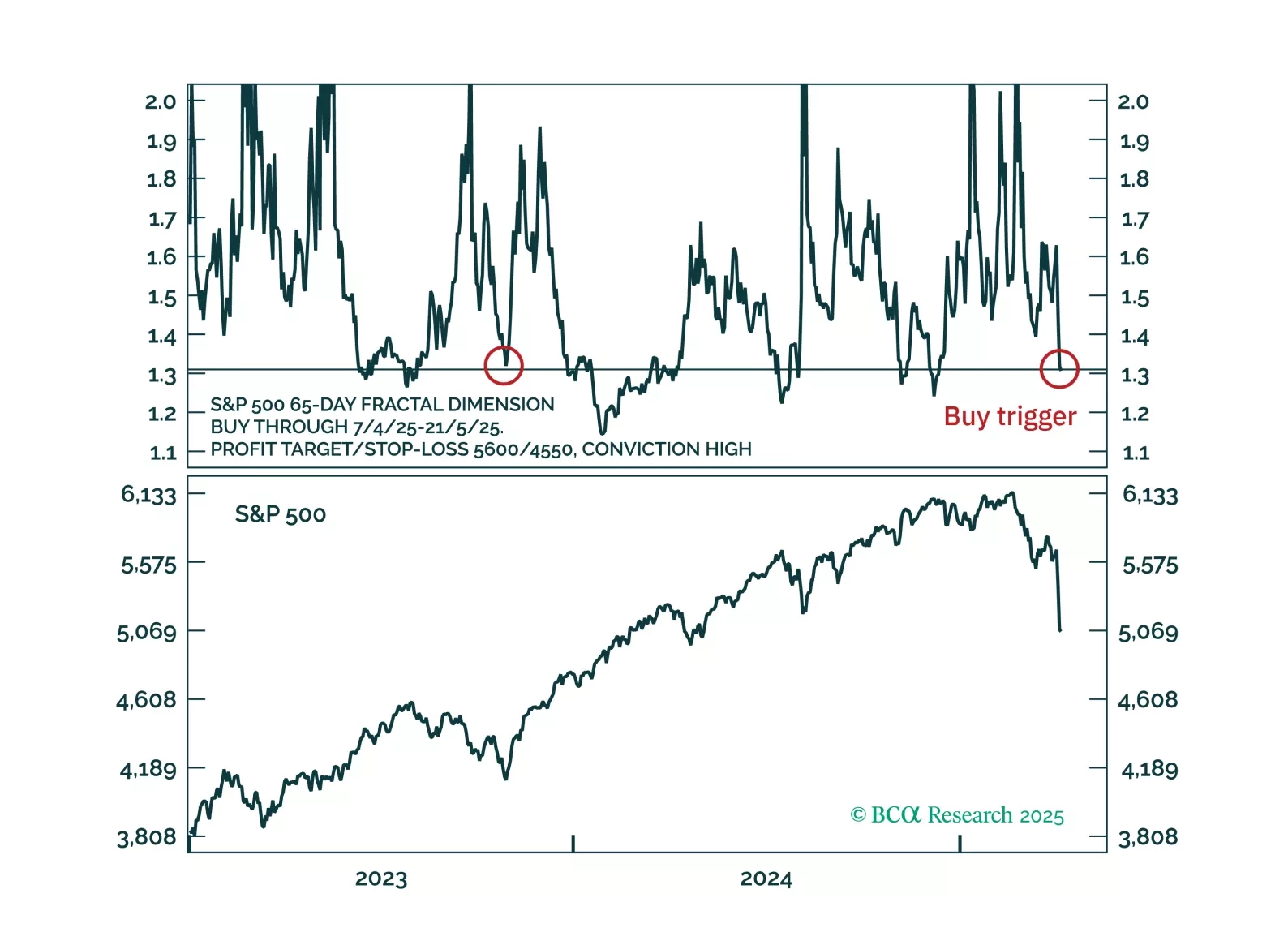

Countertrend buy triggers have been activated for the S&P 500, Nasdaq and Nasdaq versus 30-year T-bond.