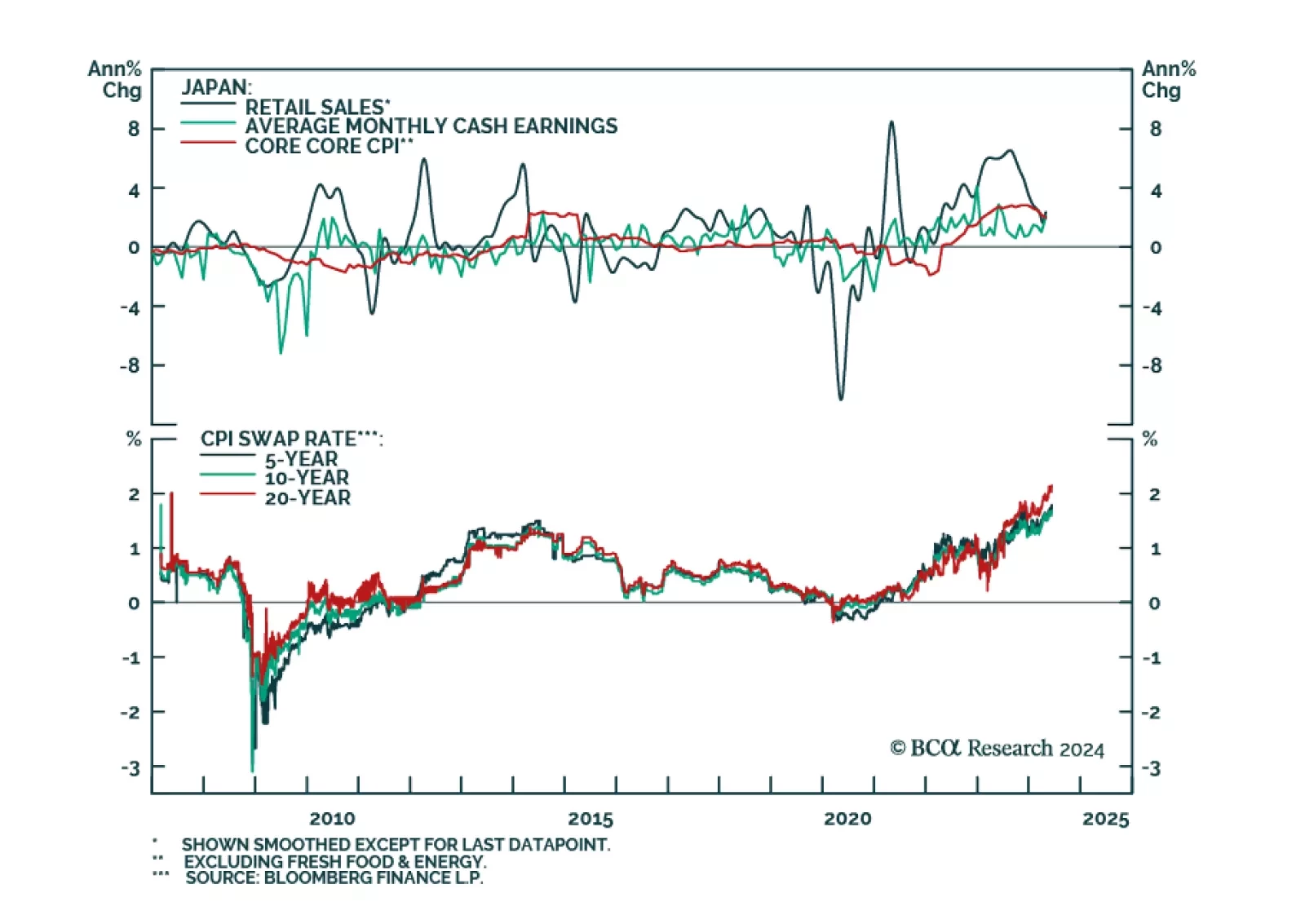

The Bank of Japan exited negative interest rate policy in March, but subsequent softer-than-expected CPI inflation prints have complicated its path towards tightening. The central bank is widely expected to stay put when it meets…

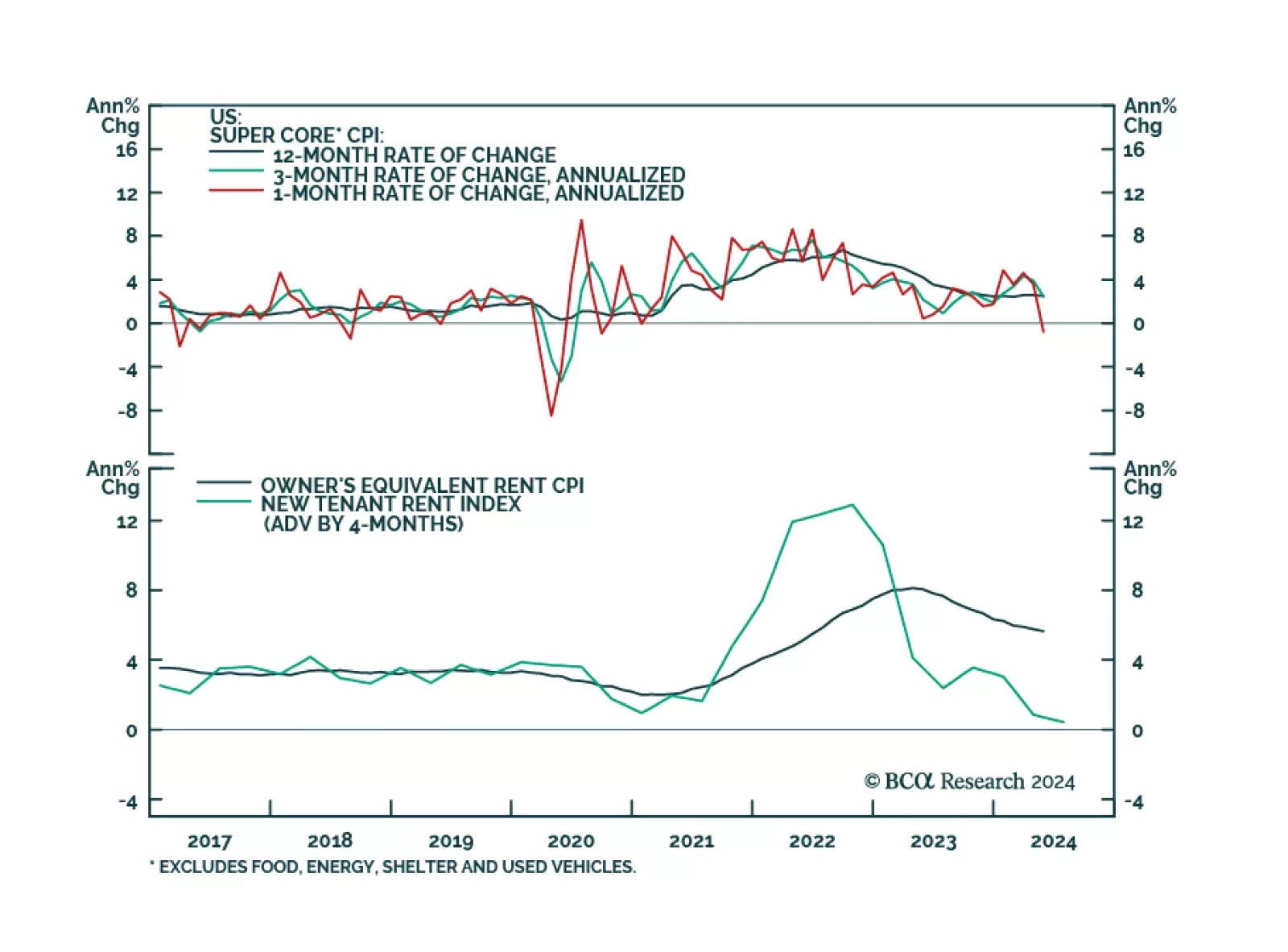

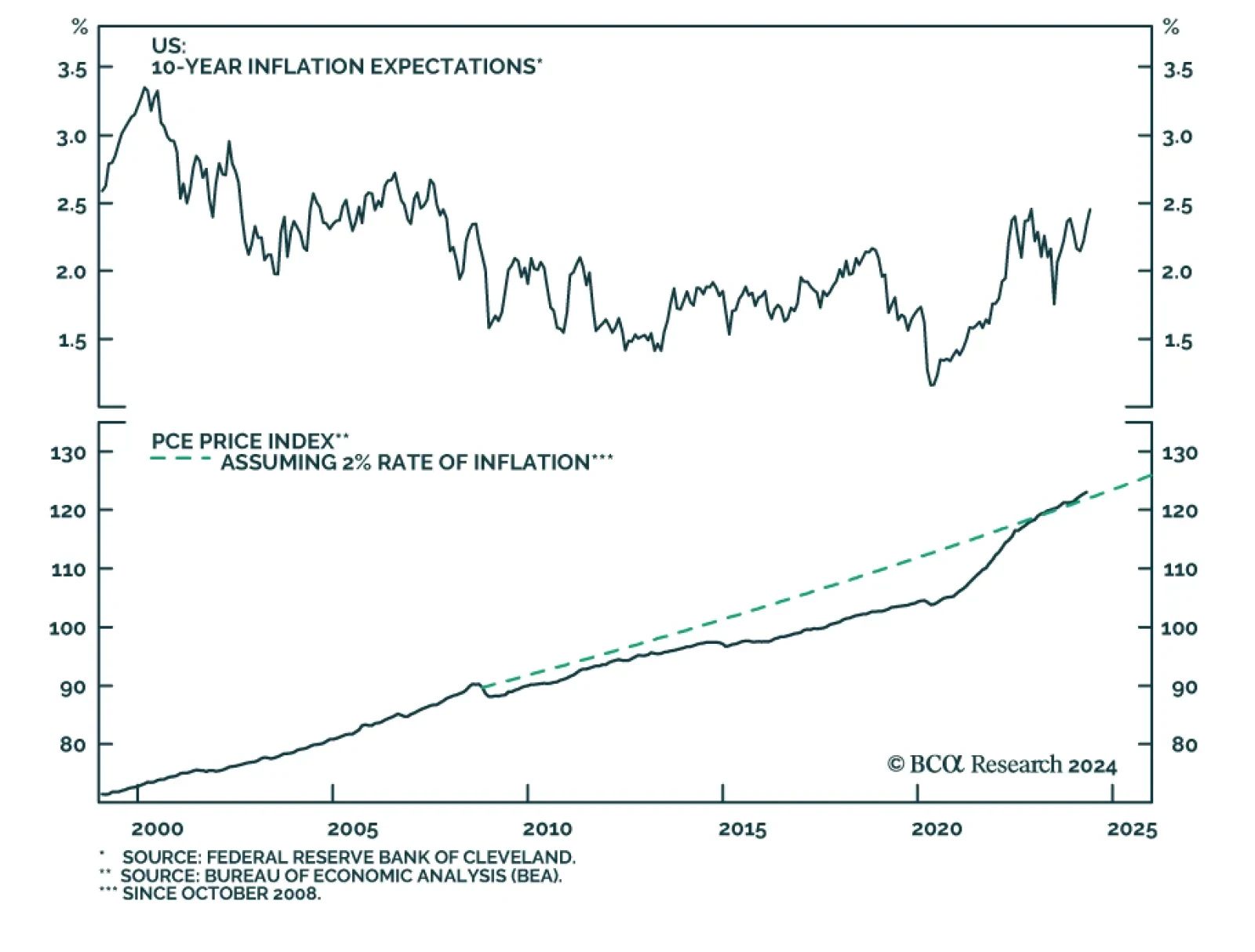

US CPI inflation continued to ease in May. Headline CPI stagnated on a month-on-month basis (3.3% y/y) in May, down from April’s 0.3% m/m (3.4% y/y), and below expectations of a more muted rate of growth. Core CPI also…

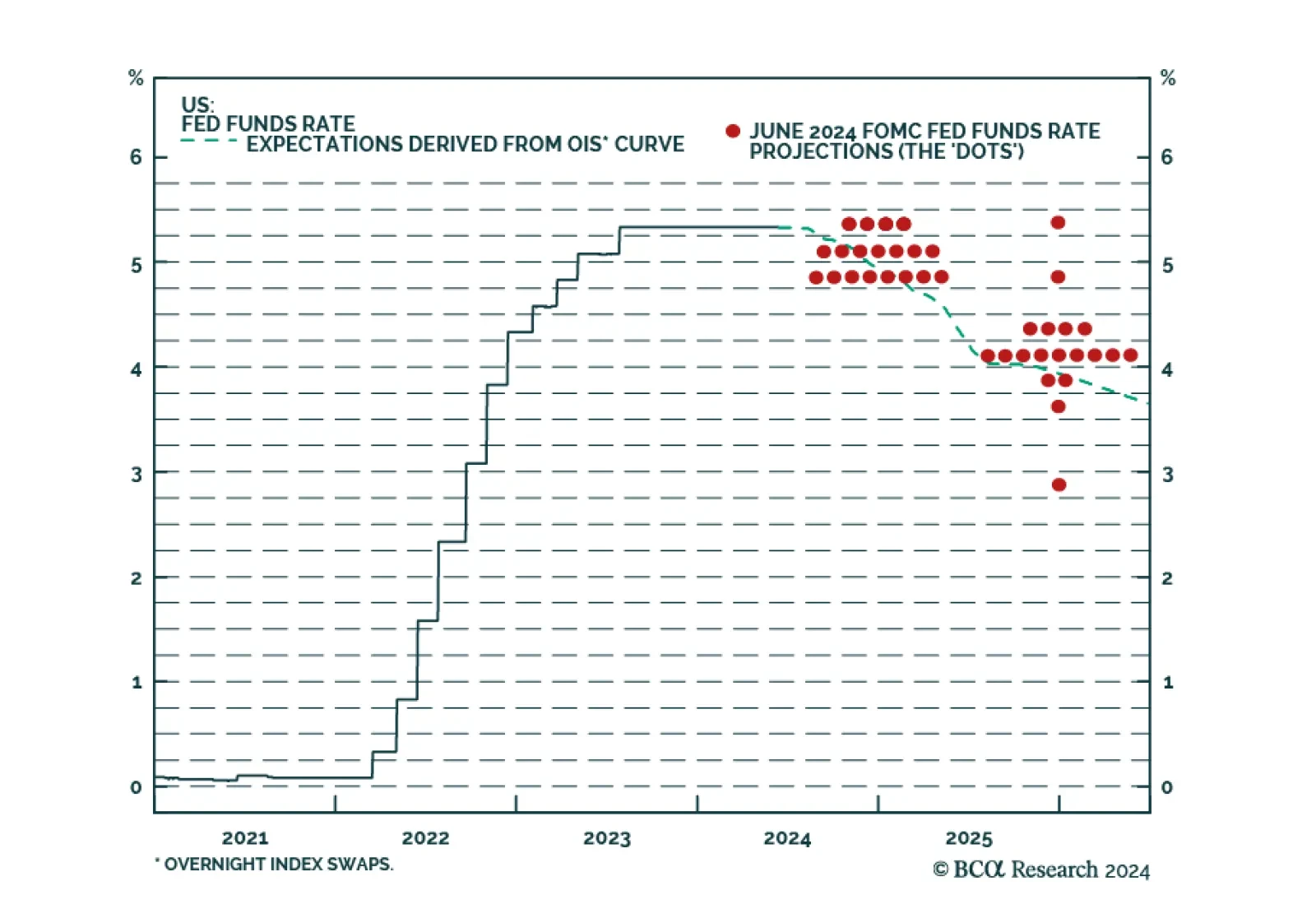

In a widely expected move, the Fed kept its policy rate unchanged within a 5.25%-5.5% range following its June 11-12 meeting. However, the median dots have moved higher for both 2024 and 2025. The median FOMC member now…

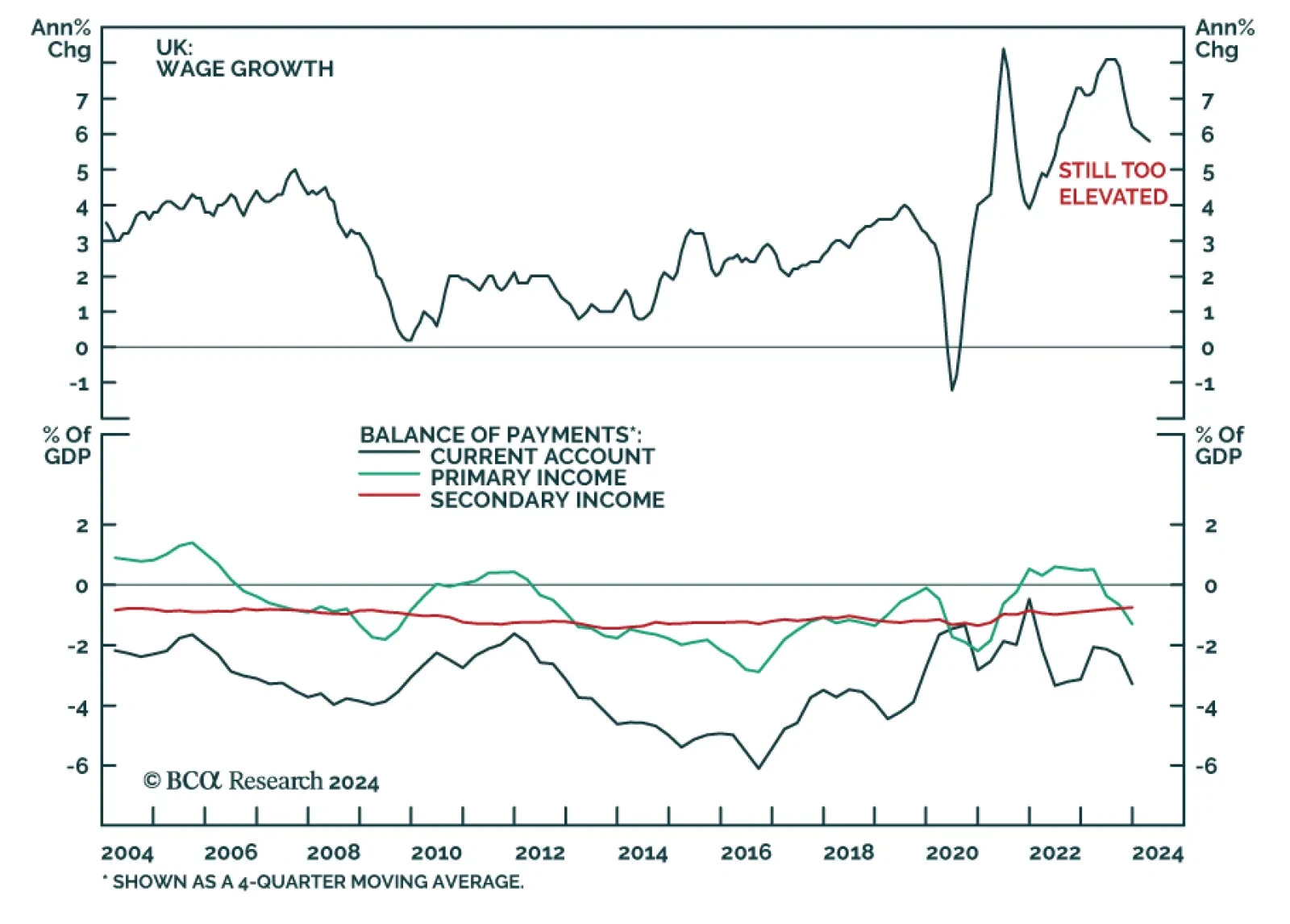

The UK unemployment rate surprised to the upside in the 3-month period ending in April, ticking up to 4.4% against expectations it would remain stable at March’s originally reported 4.3%. Concurrently, wage growth remains…

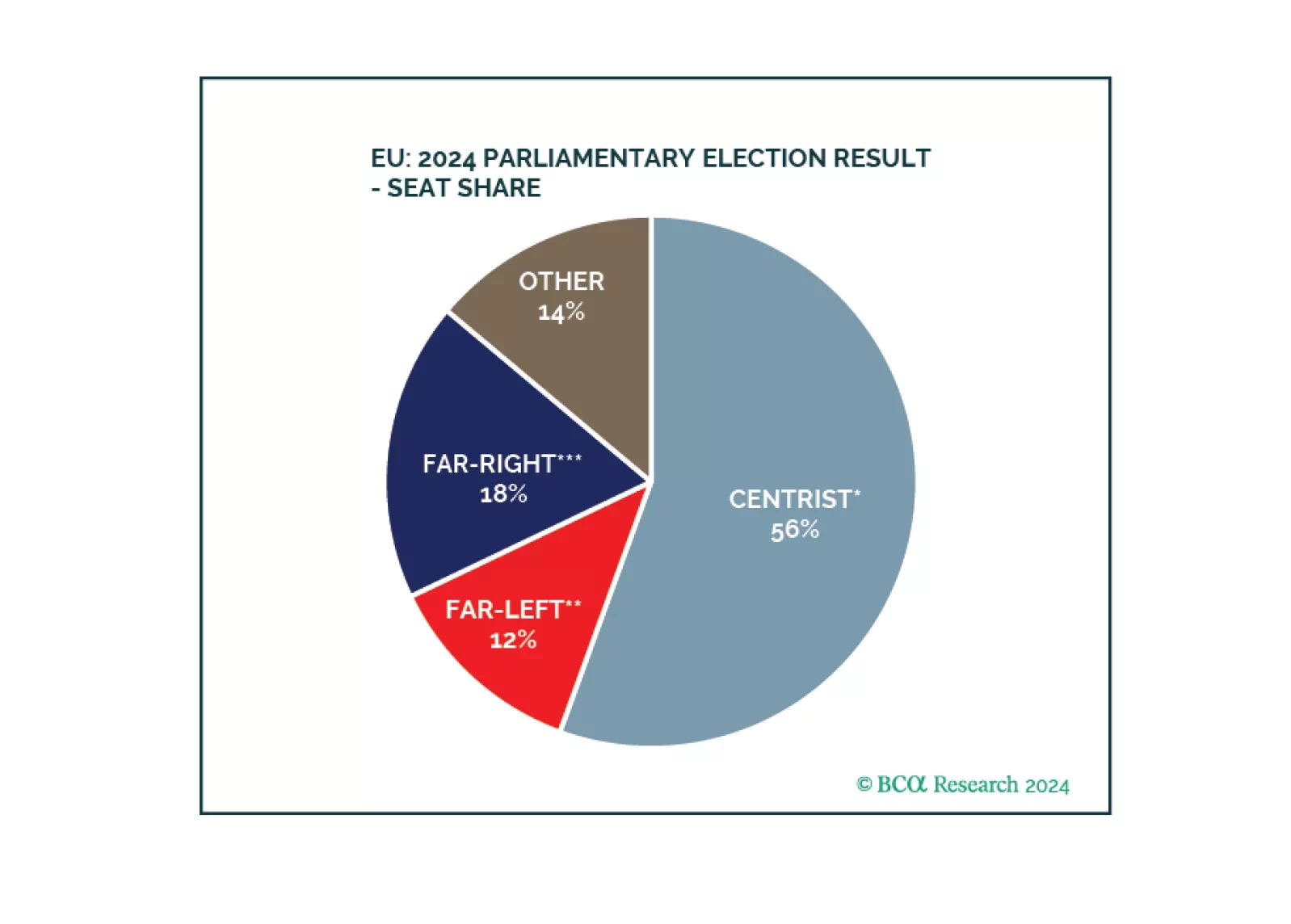

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

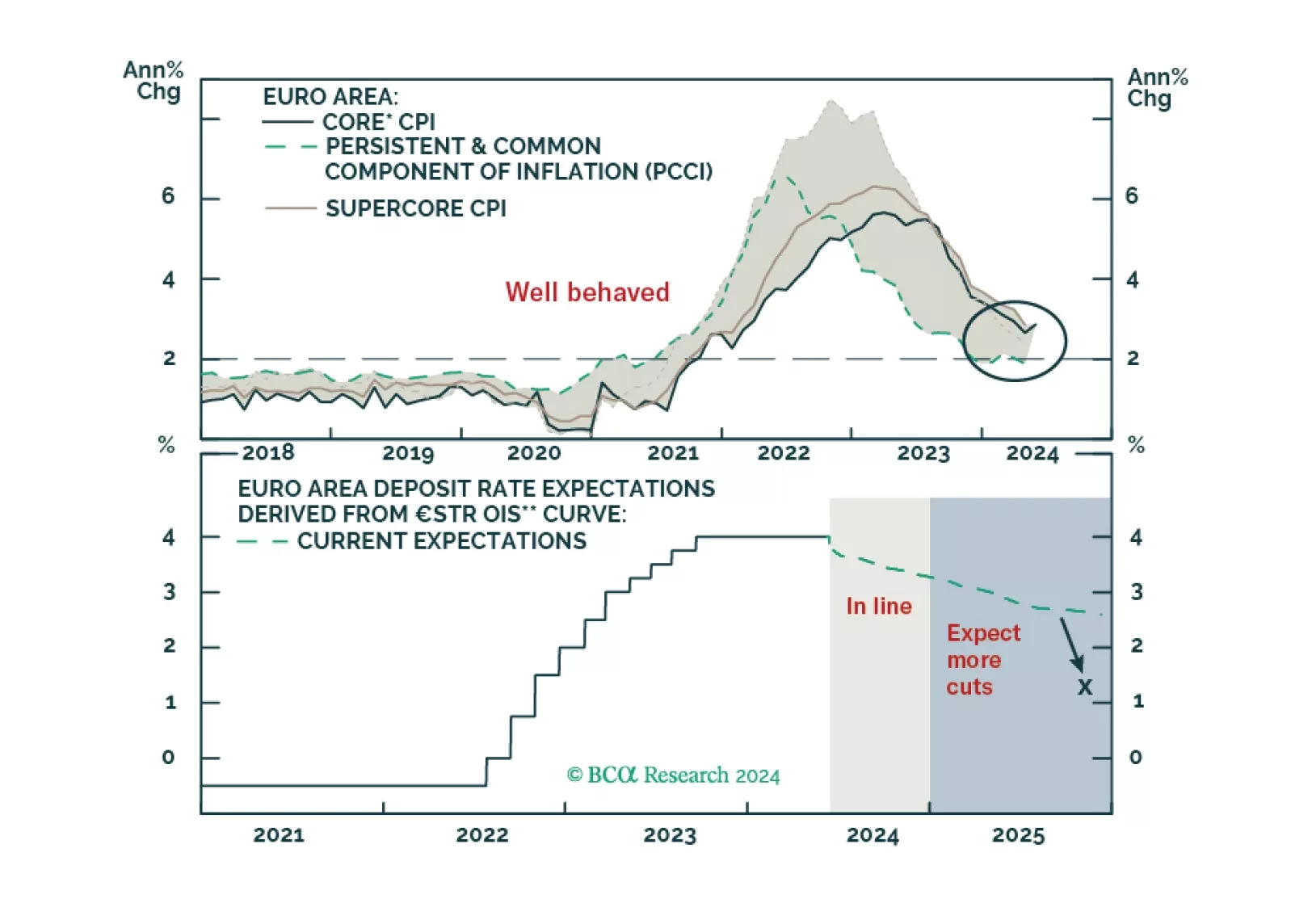

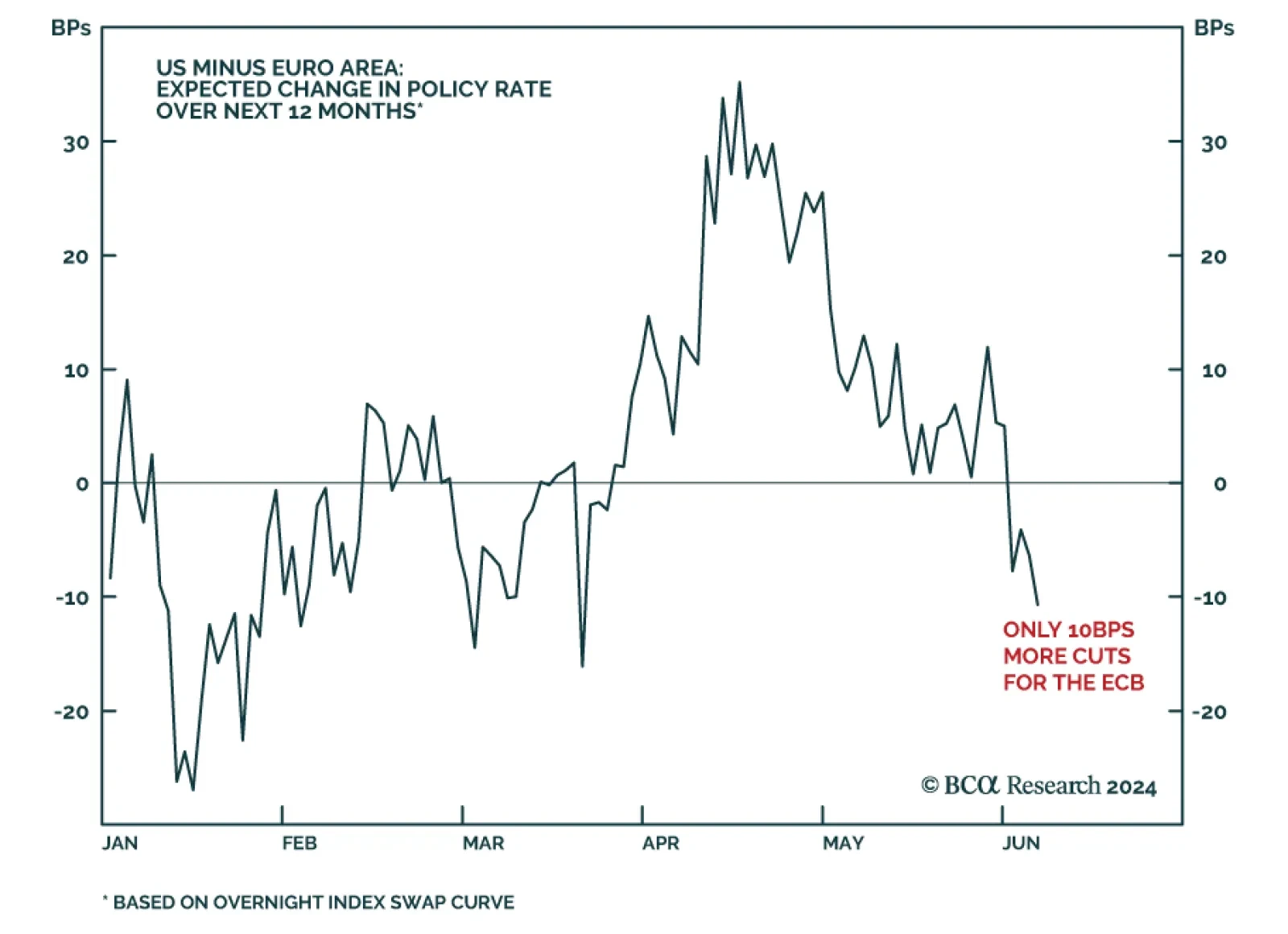

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

After holding rates steady over the past nine months, the ECB delivered on its widely expected rate cut on Thursday. The Governing Council lowered all three key ECB interest rates by 25 bps, bringing the refinancing, marginal…

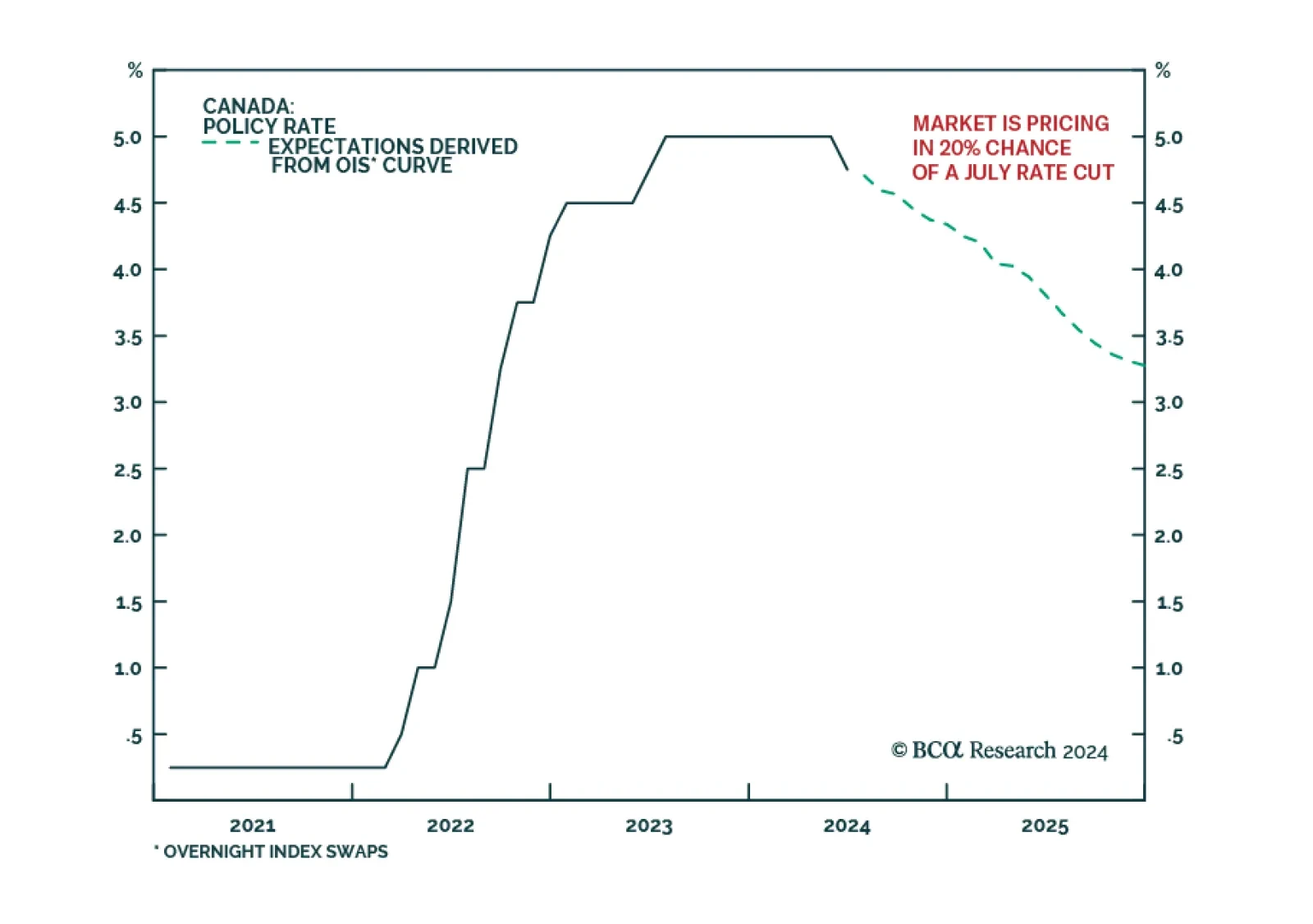

The Bank of Canada reduced its policy rate by 25 basis points from 5% to 4.75% on Wednesday, in line with the market consensus. Headline inflation and the BoC’s preferred measures of core inflation are within the BoC’…

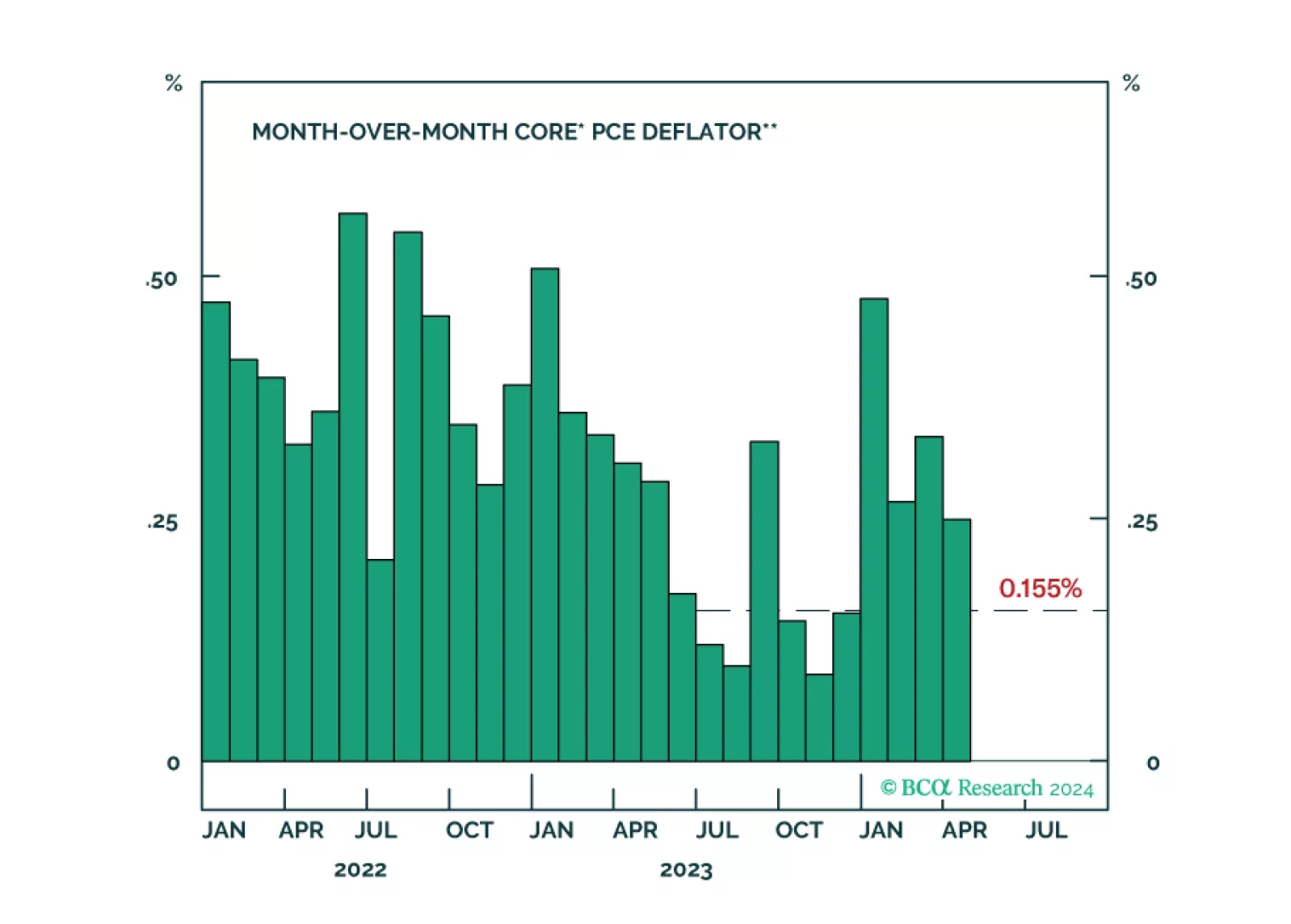

The moderation in core PCE in April was a step in the right direction towards a Fed easing. Our Global Investment Strategists also highlighted that outside of a few pandemic-related “catch-up” categories such as…

Our Portfolio Allocation Summary for June 2024.