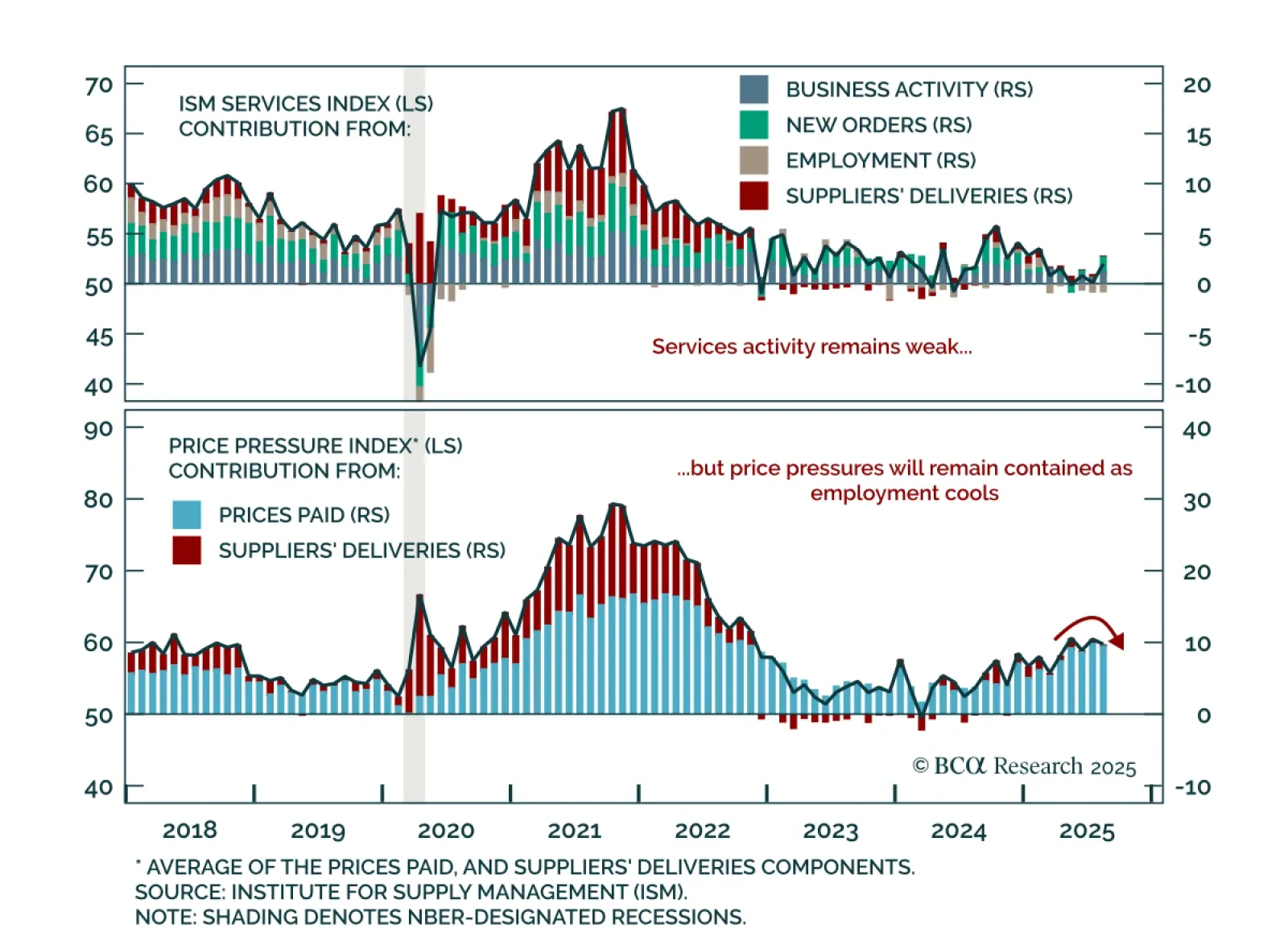

August ISM Services beat expectations, but employment weakness highlights fragile momentum. The index rose to 52.0 from 50.1, driven by business activity and new orders. However, the employment component stayed in contraction at 46.5…

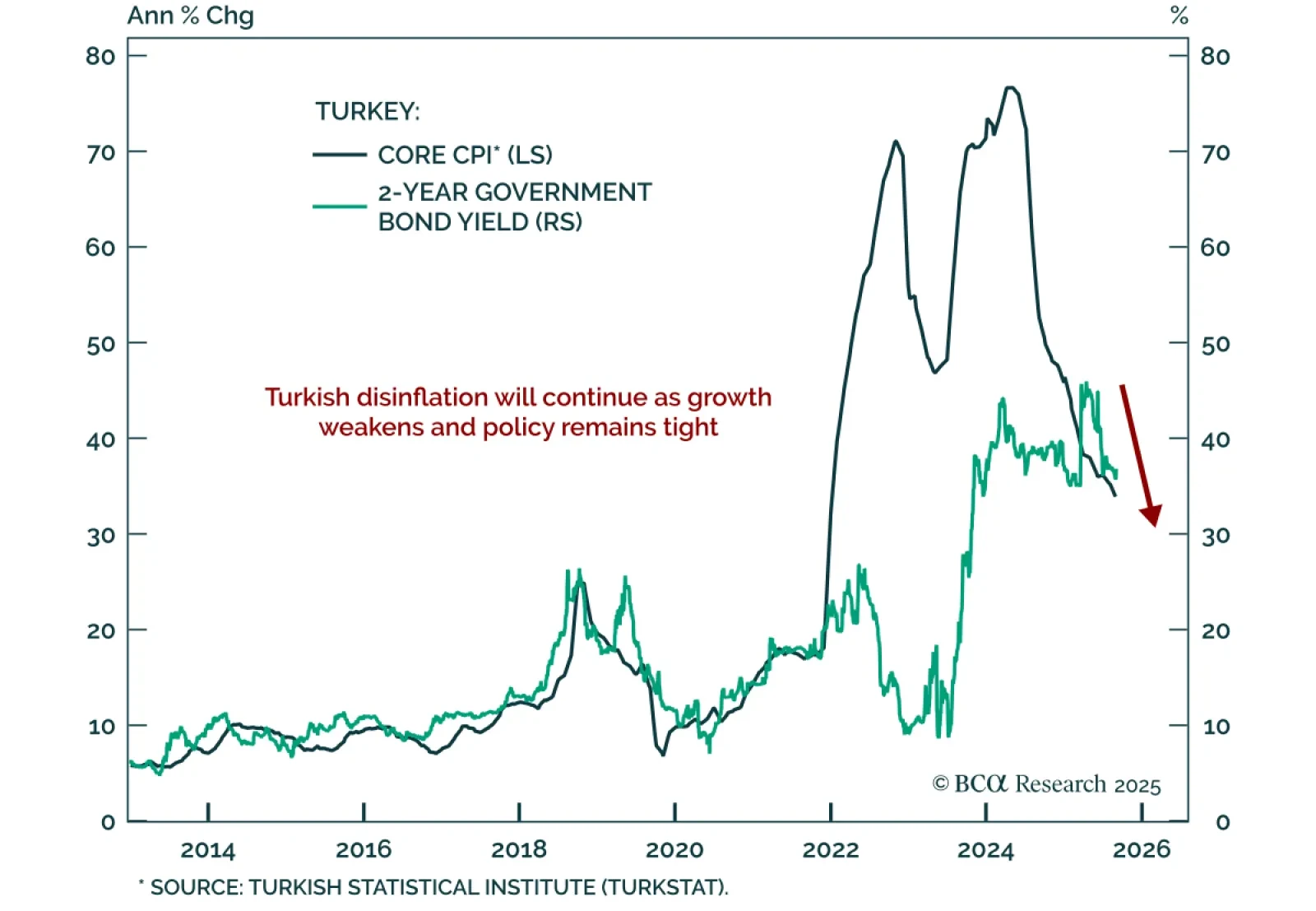

Turkey’s disinflation trend remains intact, supporting a bullish case for short-term bonds. Headline inflation eased to 33% y/y in August from 33.5% in July. Our Emerging Markets strategists expect further slowing as monetary and…

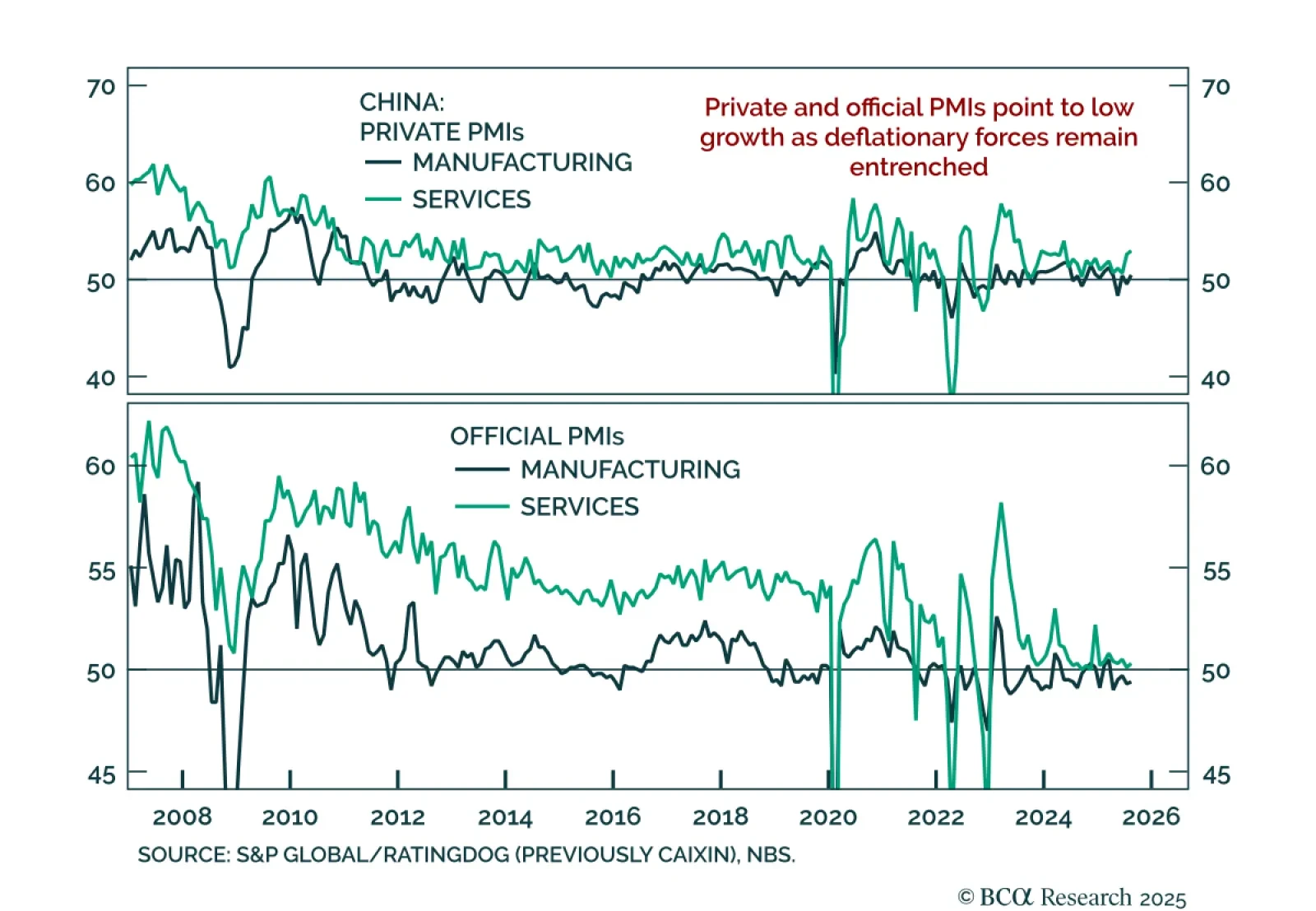

China’s August PMIs improved, but underlying data point to persistent weakness and limited momentum. The official NBS composite rose to 50.5 from 50.2, with manufacturing still in contraction at 49.4 and services edging higher to 50.…

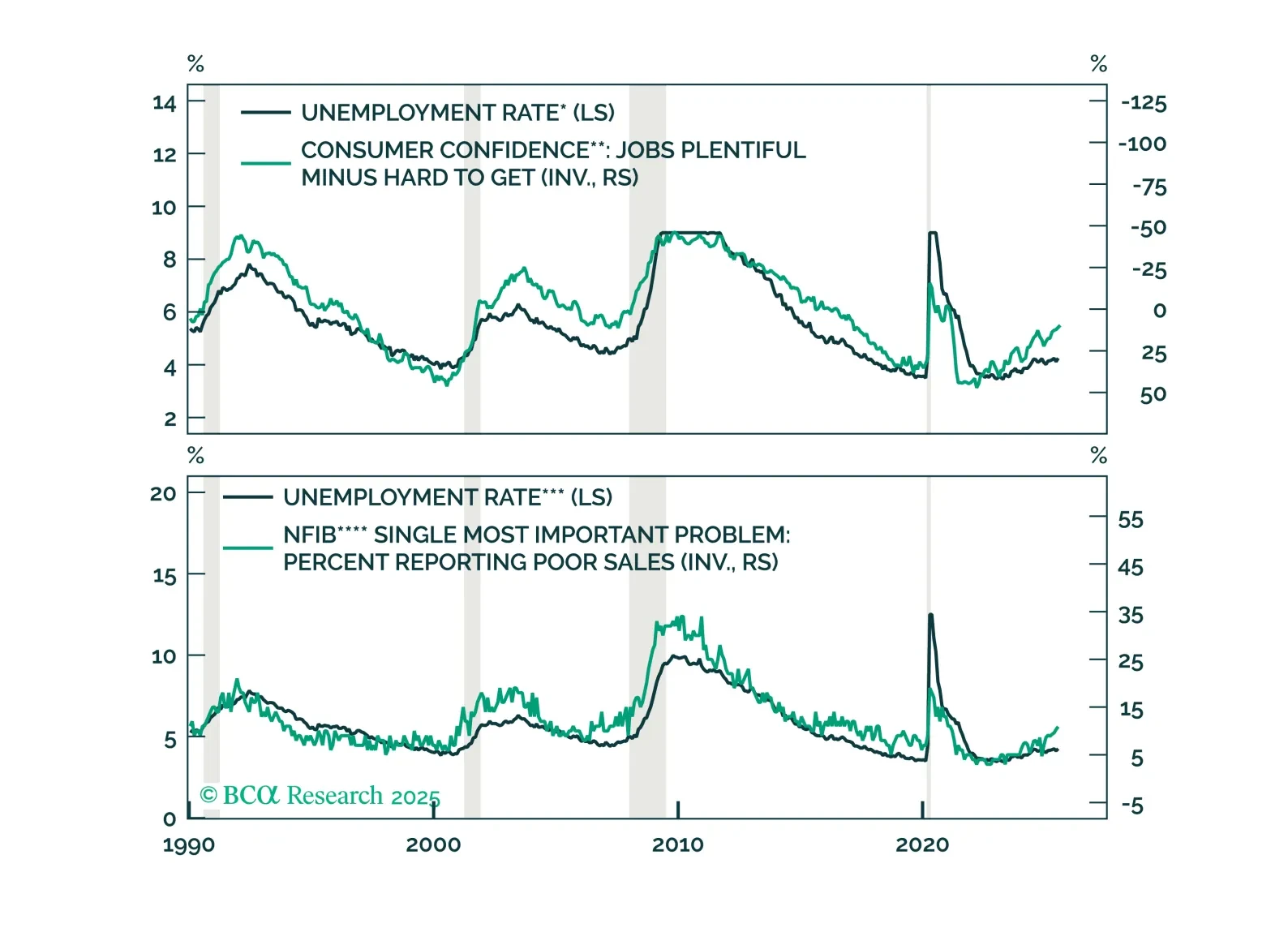

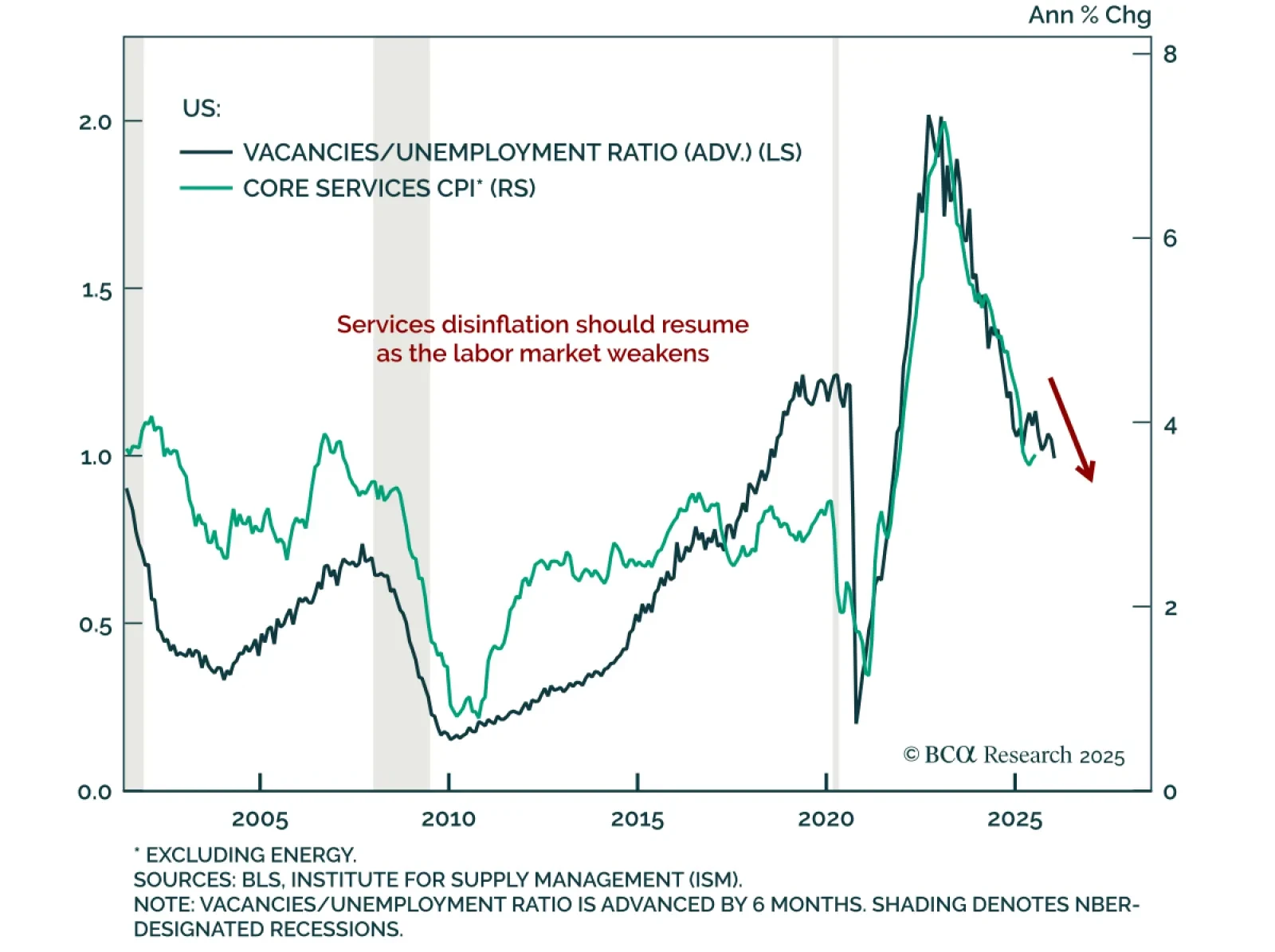

US job openings fell to a 10-month low in July, underscoring continued labor market weakening. Openings declined to 7.18m from 7.36m. The decline was led by non-cyclical sectors such as education and health services, which had…

Our Portfolio Allocation Summary for September 2025.

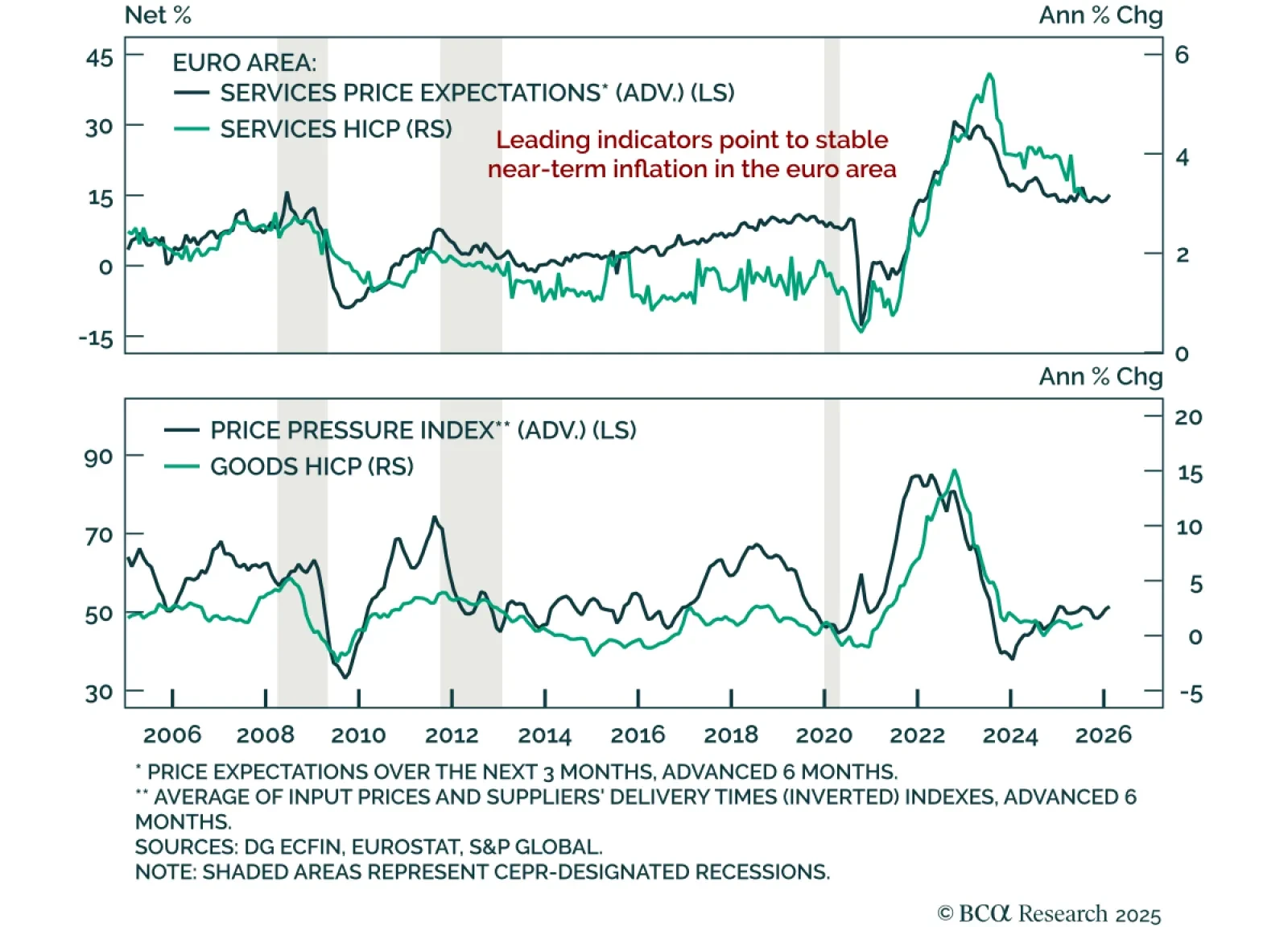

Euro area August flash HICP was slightly hotter than expected, reinforcing the case for the ECB to stay put in September. Headline inflation rose to 2.1% y/y from 2.0%, with the monthly print surprising at 0.2% m/m. Core inflation…

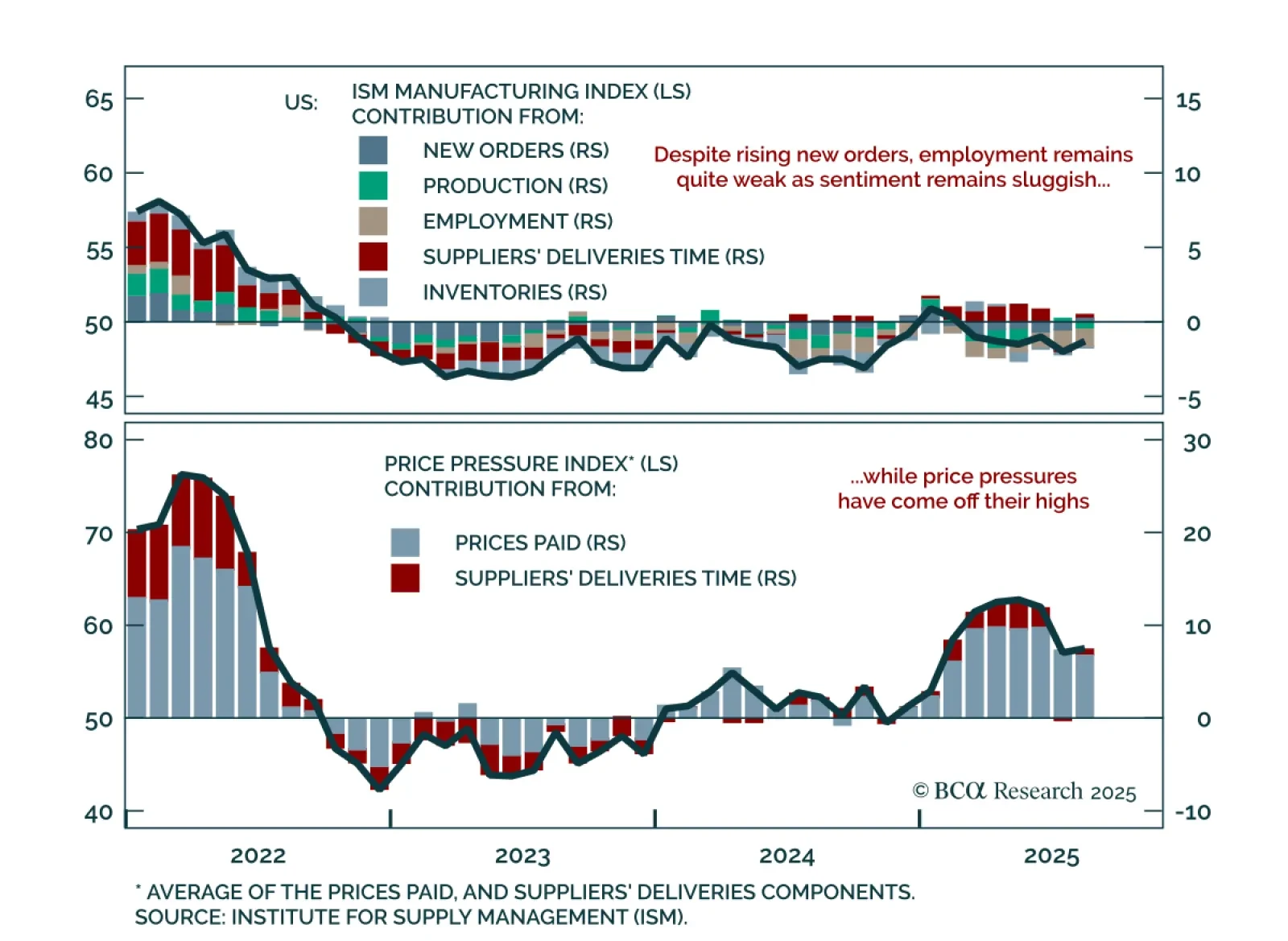

August ISM Manufacturing was mixed, with stronger orders offset by weak production and employment. The headline rose to 48.7 from 48.0, missing expectations. New orders beat estimates, rising into expansion at 51.4 and lifting…

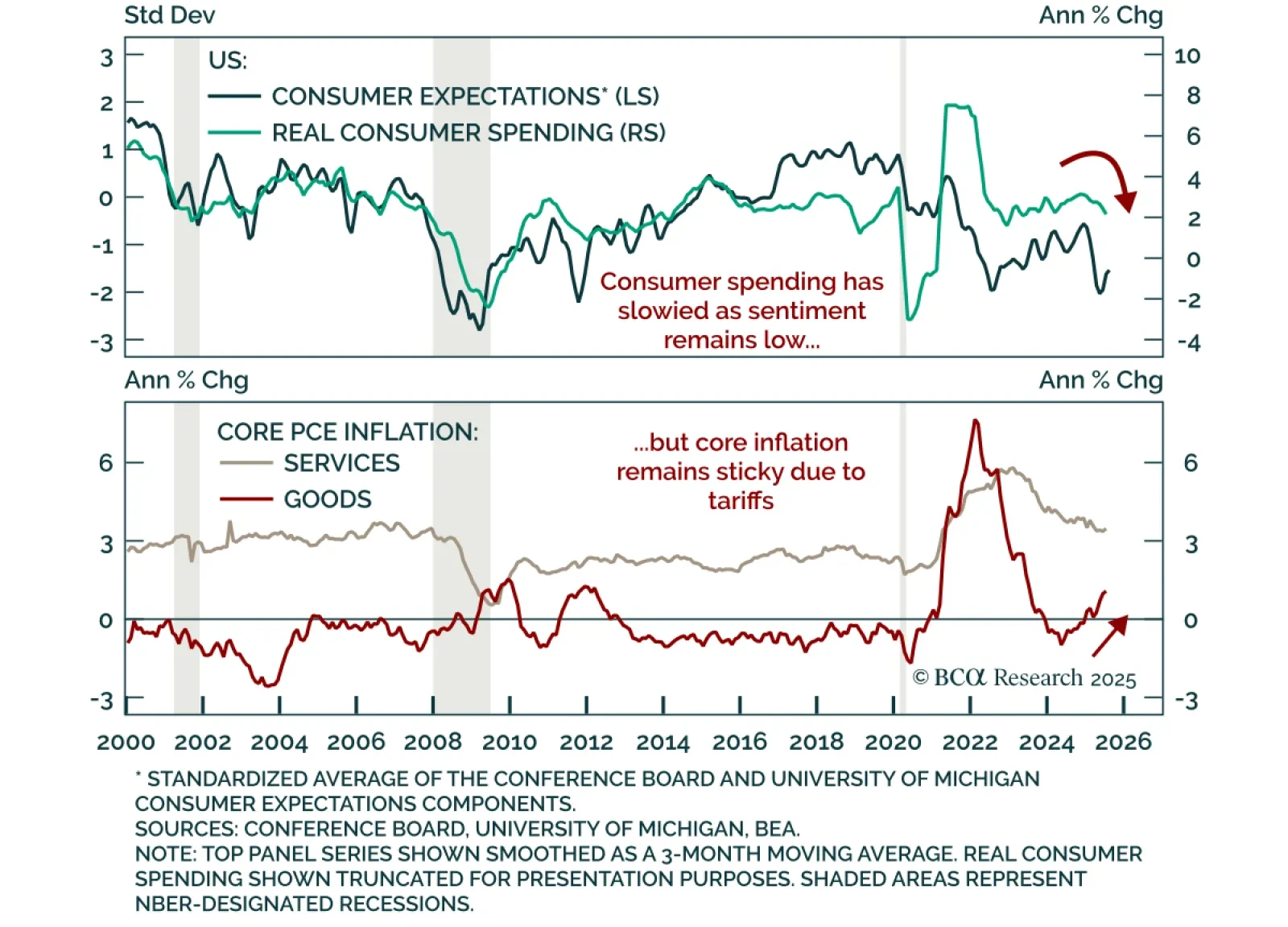

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

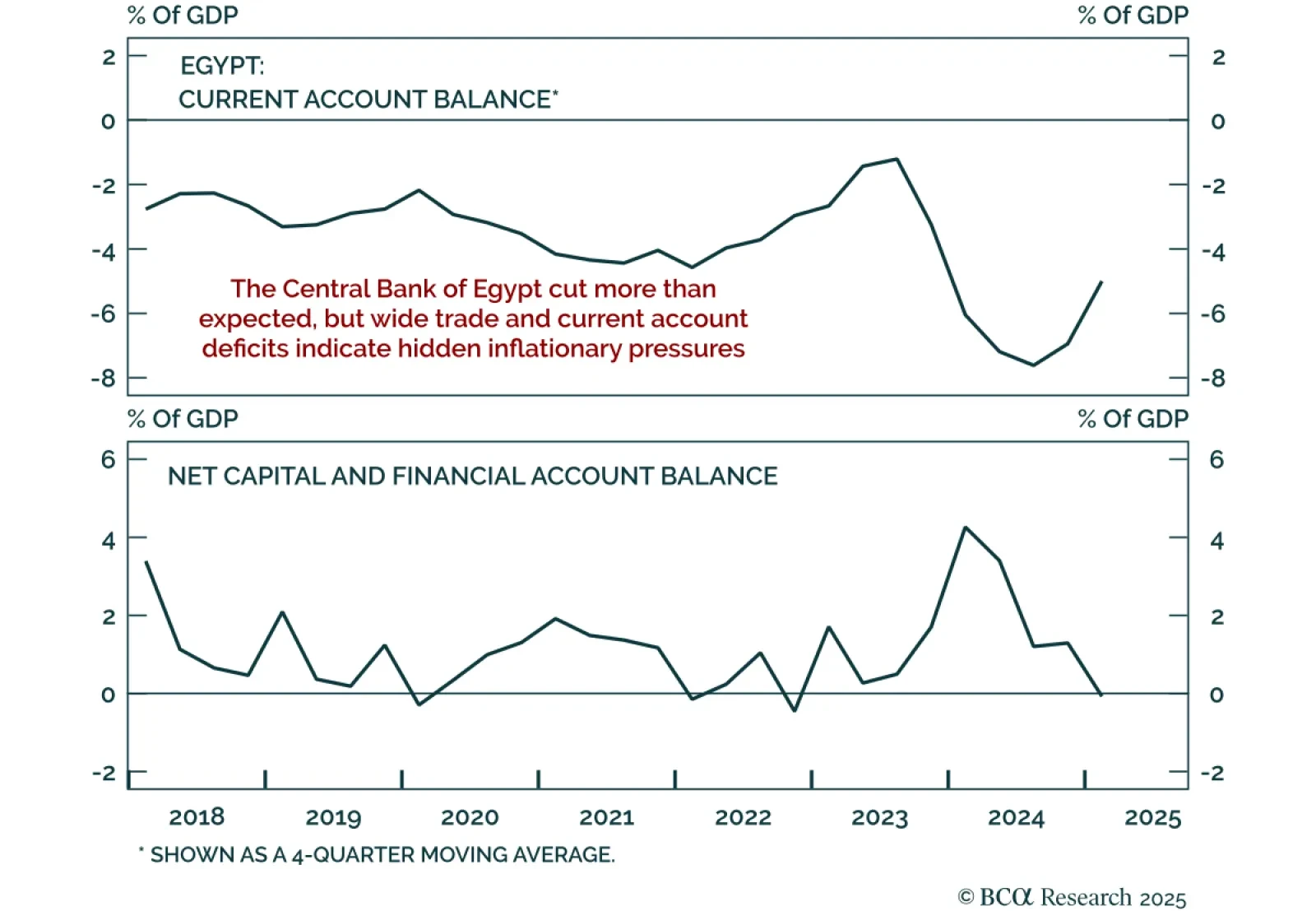

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…

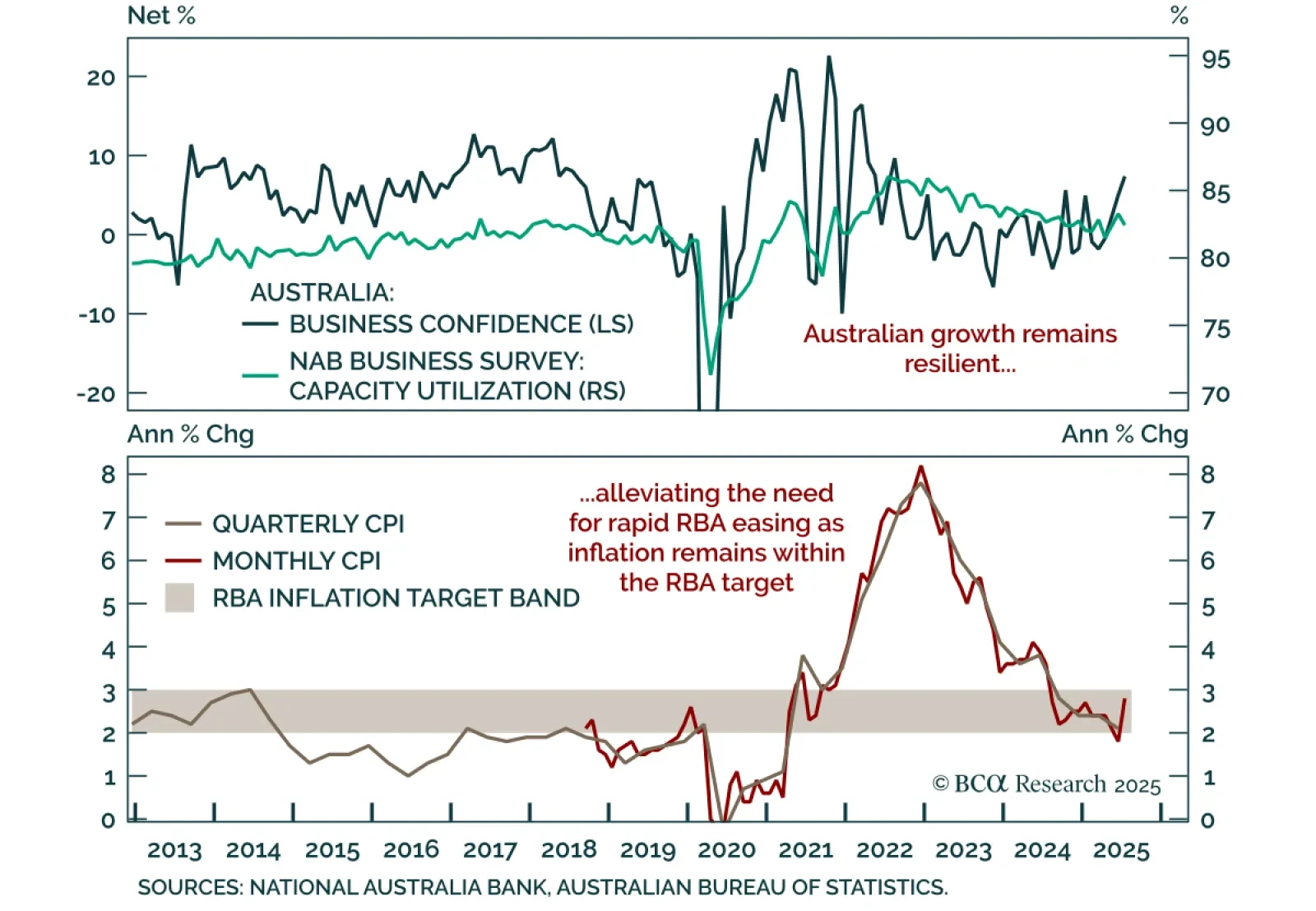

Australia’s July CPI surprise does not justify the aggressive easing priced, keeping us underweight ACGBs. Headline inflation accelerated to 2.8% y/y from 1.9% in June, with trimmed mean rising to 2.7% from 2.1%. Despite the…