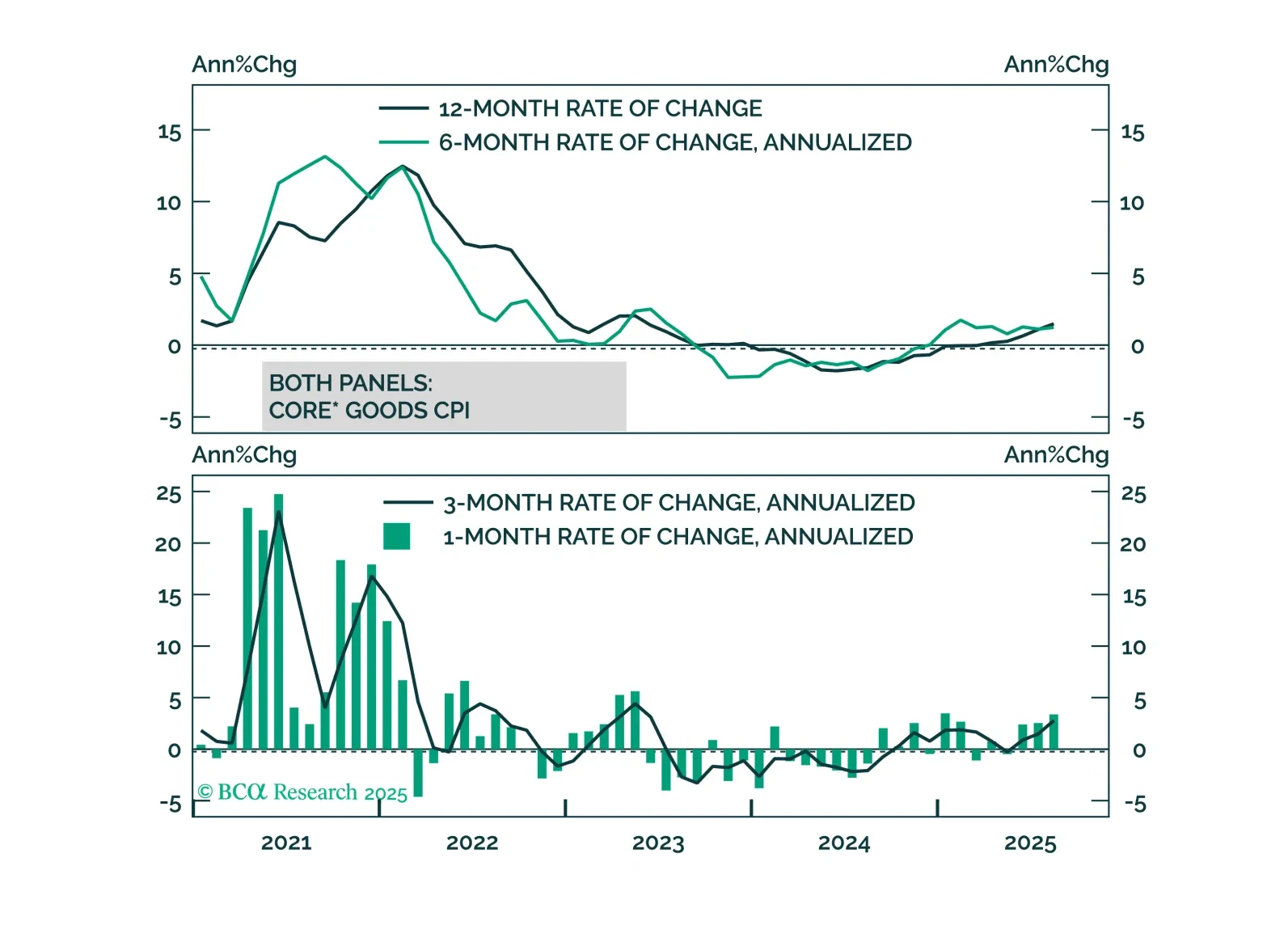

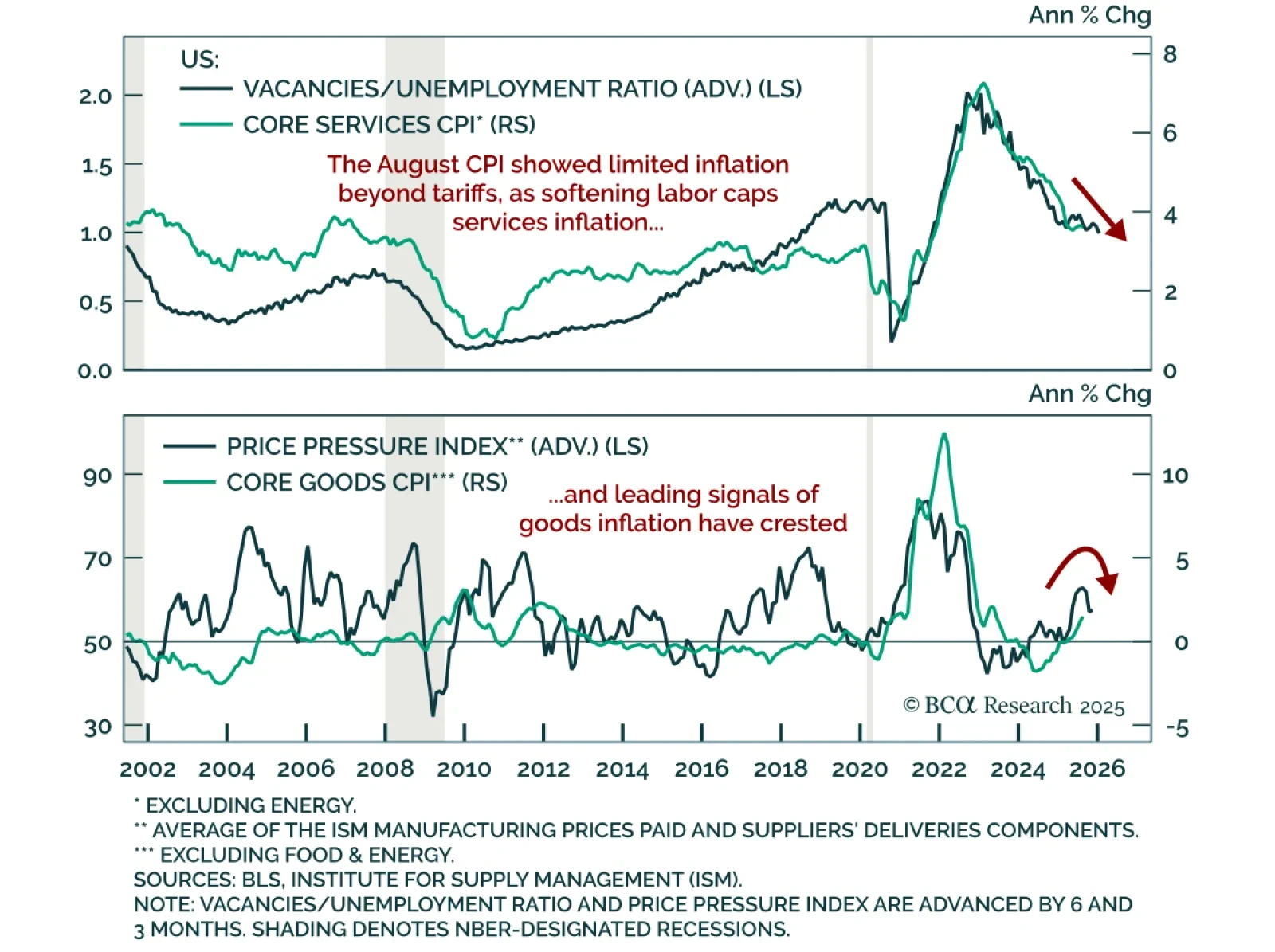

August US CPI was in line with expectations, reinforcing the case for Fed easing and a long-duration stance. Headline CPI rose 0.4% m/m (2.9% y/y), while core held at 0.3% m/m (3.1% y/y). Core goods inflation ticked up to 1.5% y/y…

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

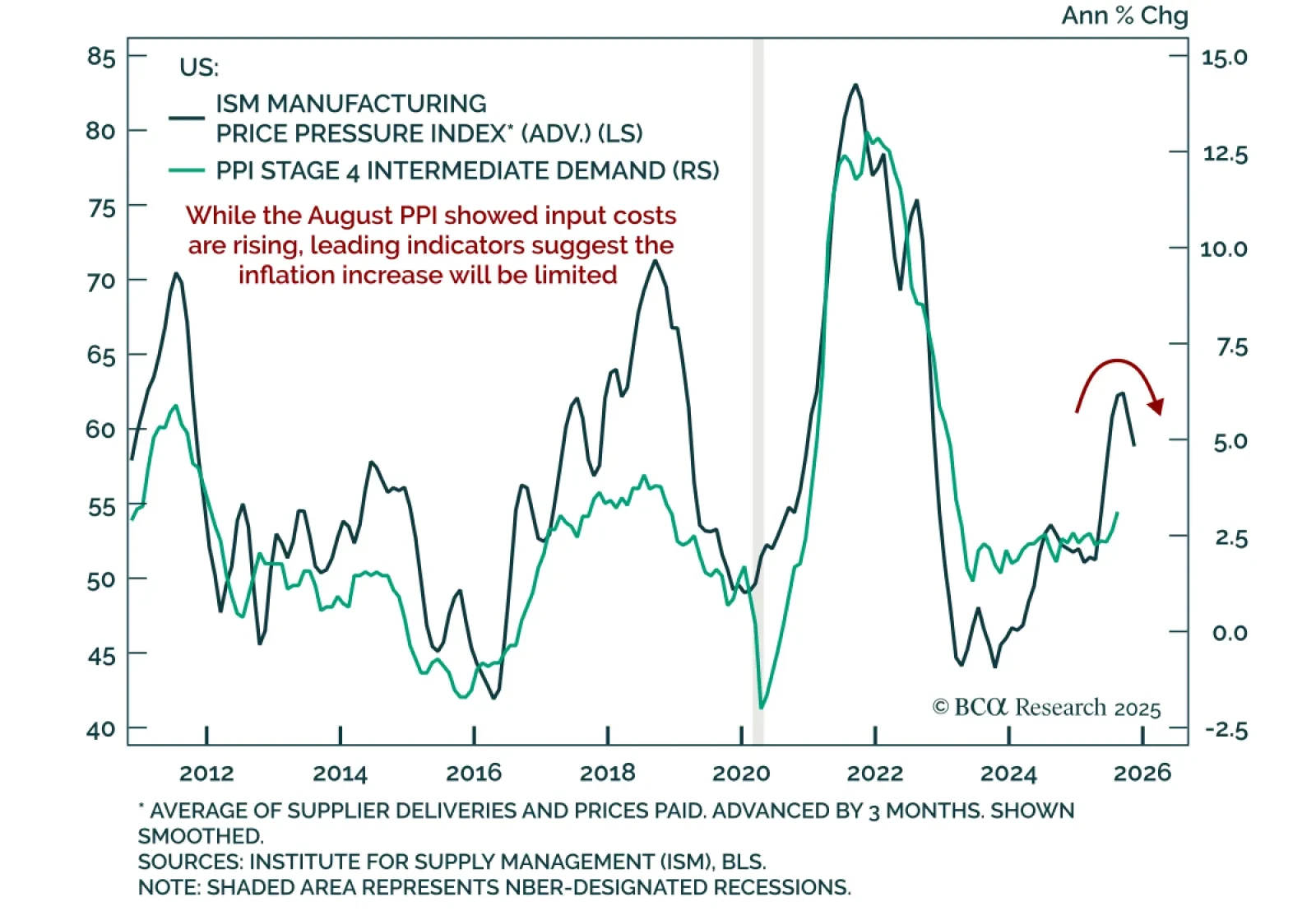

August PPI inflation cooled, reinforcing the case for Fed easing and long duration with steepeners. Headline PPI fell 0.1% m/m, bringing the annual rate down to 2.6% after July’s 0.7% gain. Core PPI (ex-food, energy, and trade)…

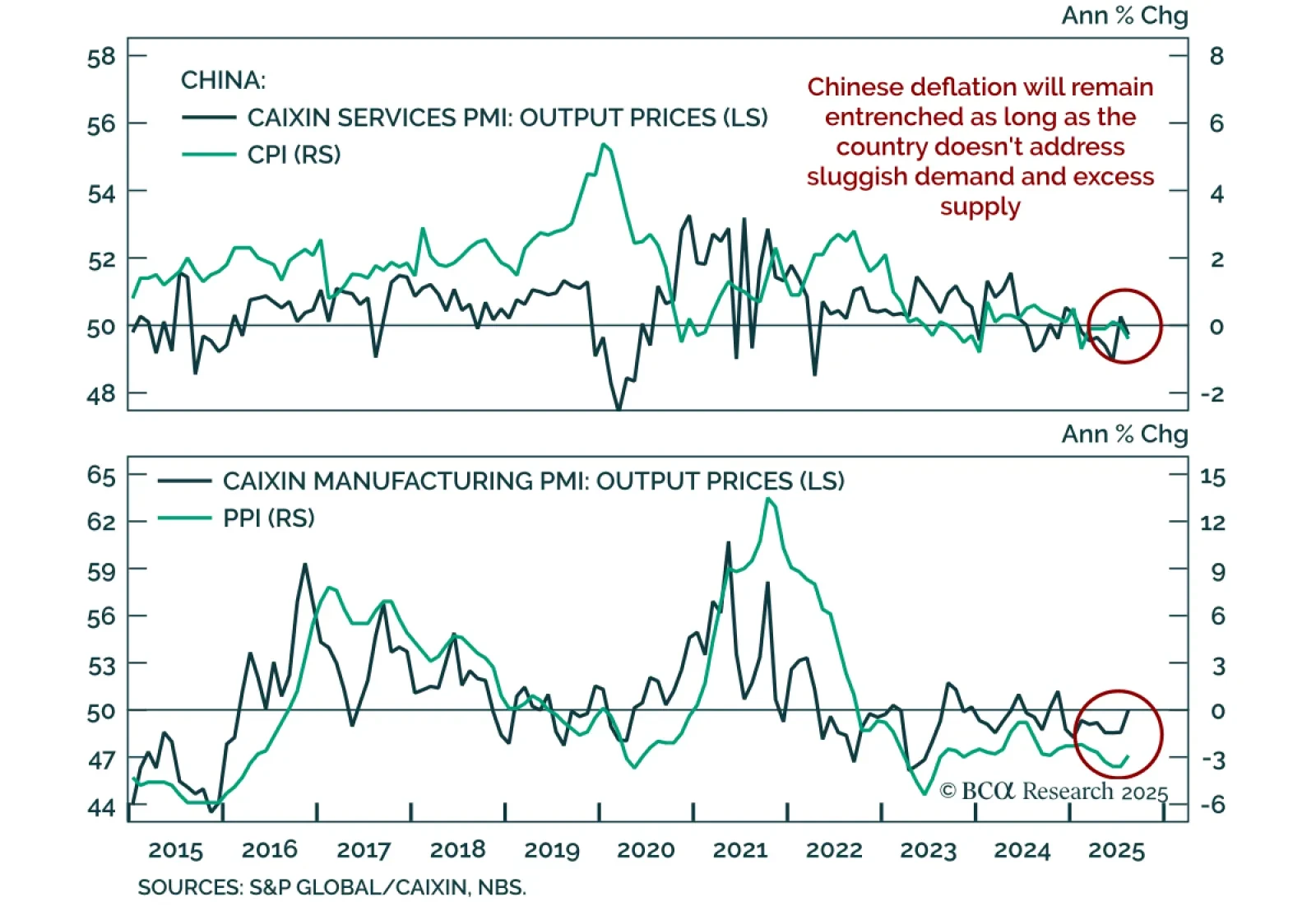

China’s August inflation data confirm entrenched deflation, reinforcing our overweight in onshore bonds and a tactical long in onshore small- and mid-caps versus large caps ahead of potential stimulus. Producer prices declined 2…

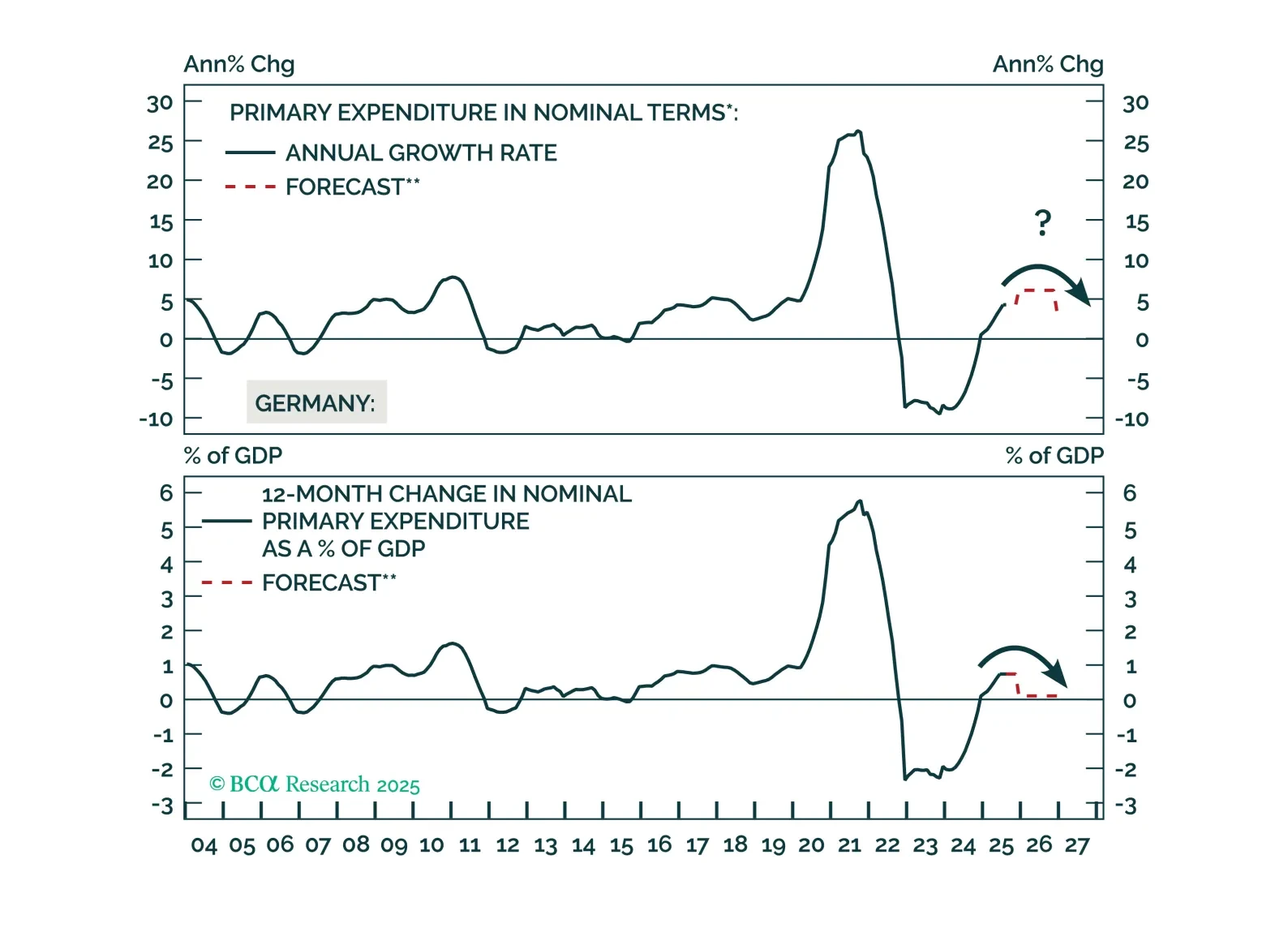

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

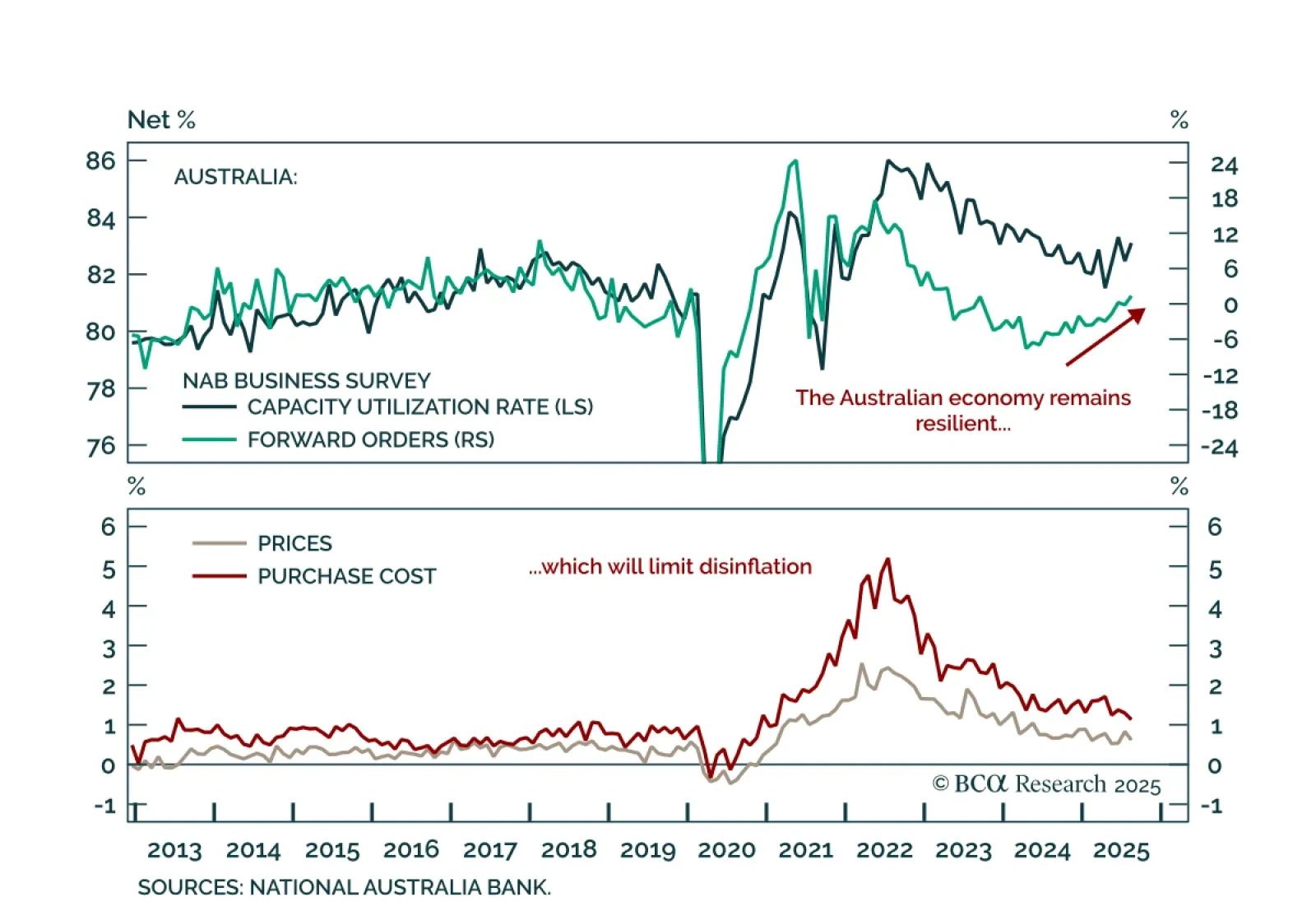

Australia’s NAB survey shows underlying resilience, reinforcing our underweight on ACGBs and the case for AUD flatteners vs. CAD steepeners. The August survey was mixed, with current conditions improving to 7 from 5, while business…

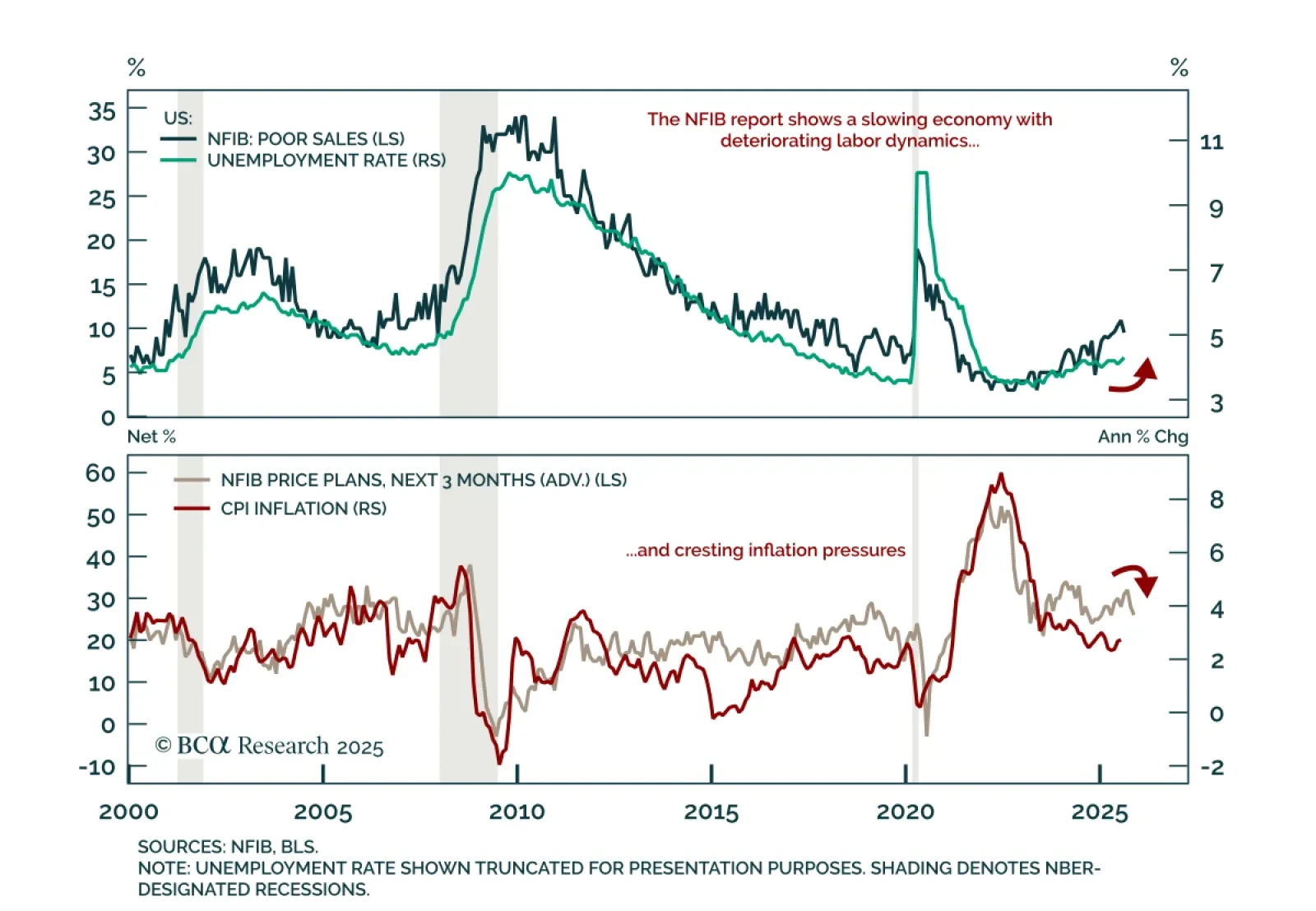

The August NFIB survey shows a fragile US economy with disinflationary signals and weak employment, supporting our defensive stance. The Small Business Optimism Index rose to 100.8 from 100.3, a six-month high, though still below…

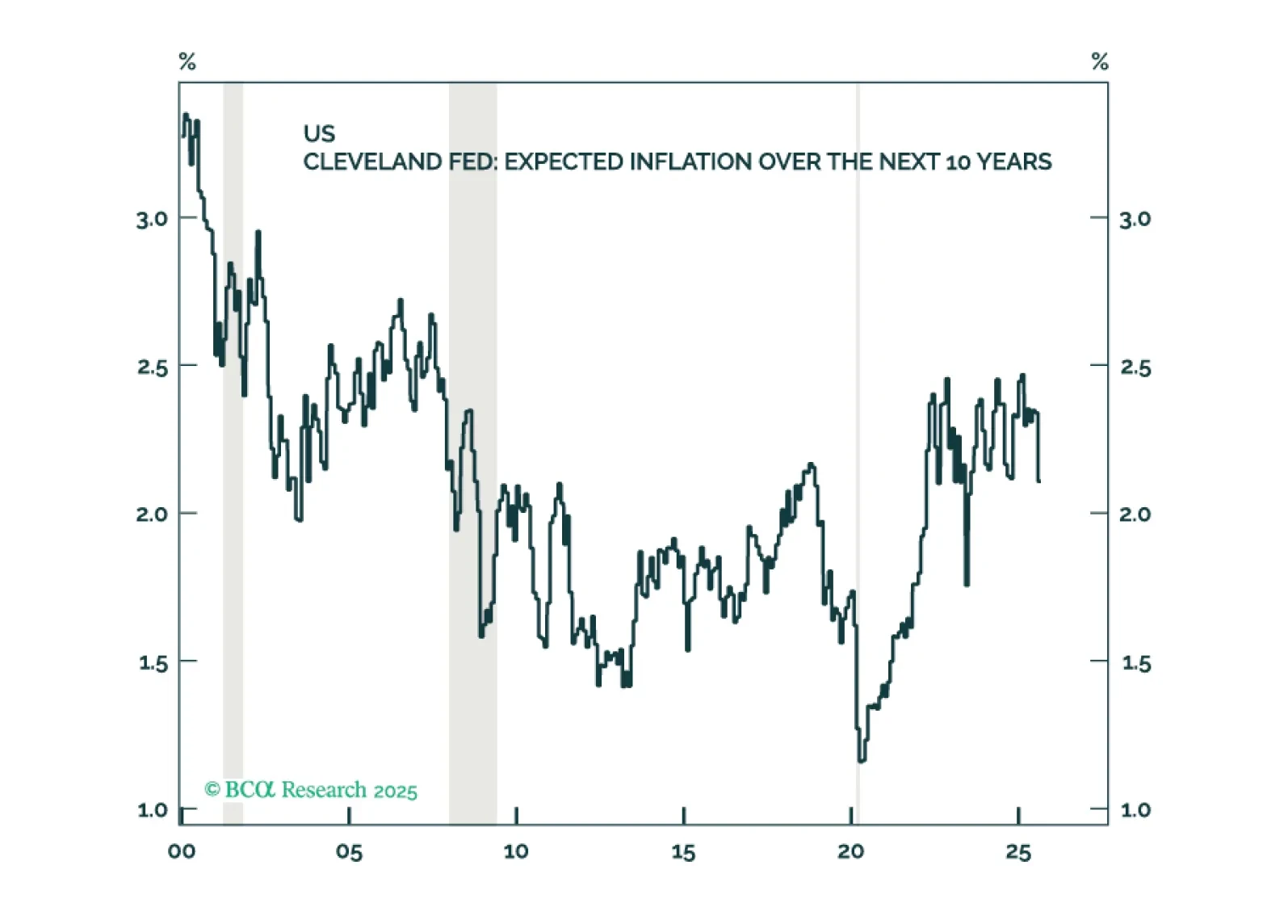

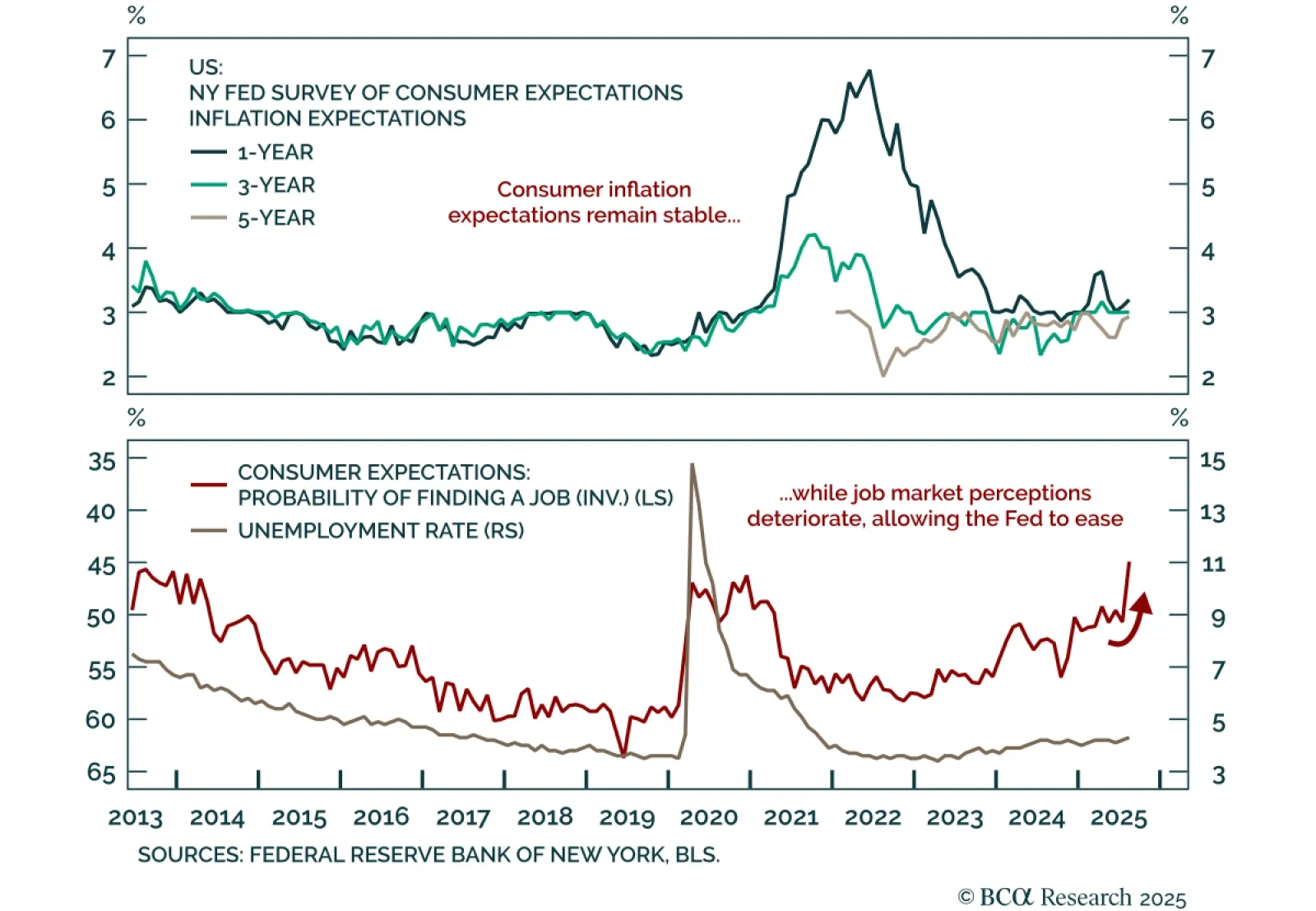

Stable long-term inflation expectations and weak labor perceptions support a defensive stance. The NY Fed Survey of Consumer Expectations showed 1-year inflation expectations ticking up to 3.2% in August, while the 3-year (3.0…

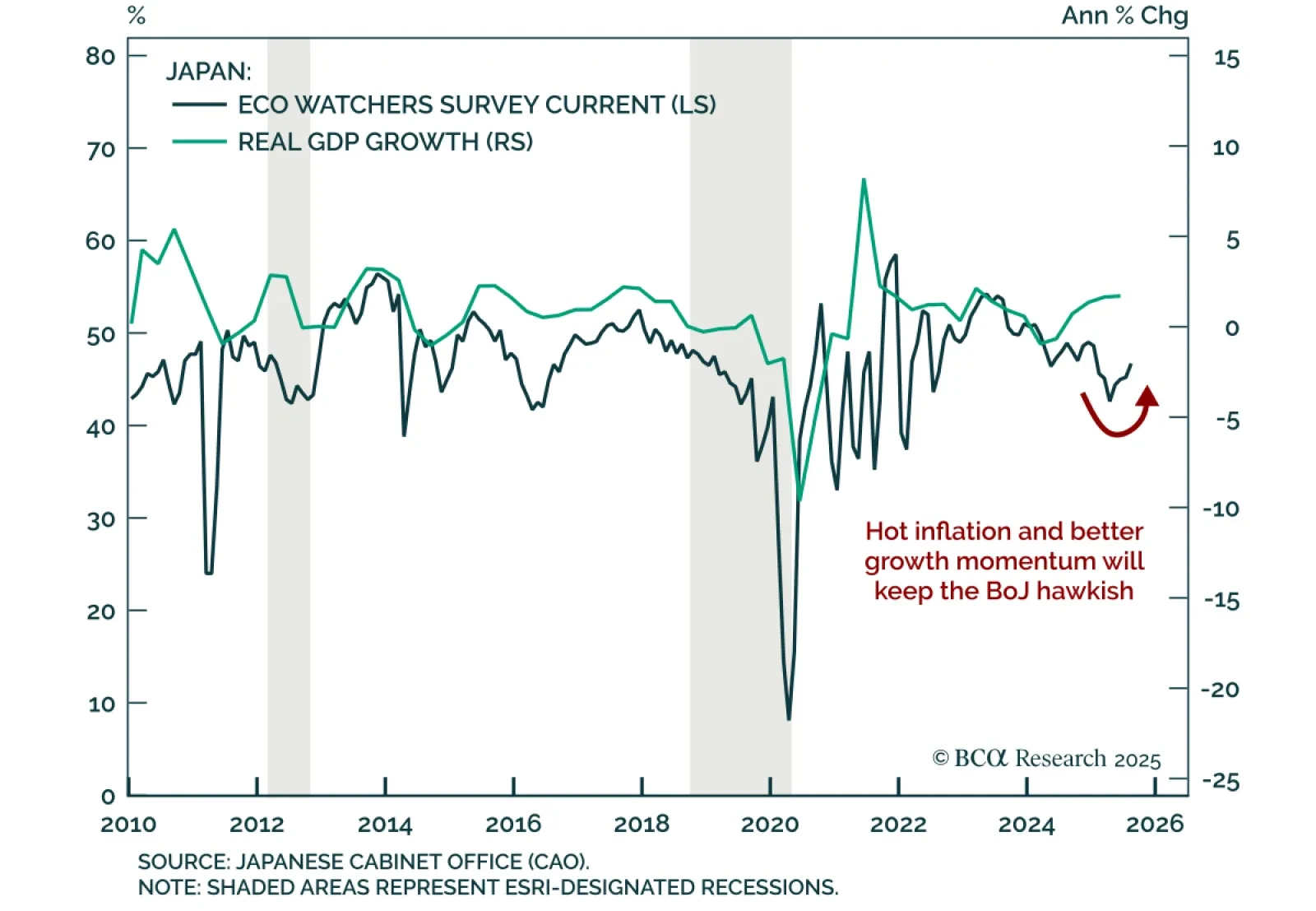

Japan’s Eco Watchers Survey points to stabilization; JGBs remain unattractive and the yen’s near-term setup is less favorable versus USD. The August survey modestly beat expectations, with the current component rising to 46.7…

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…