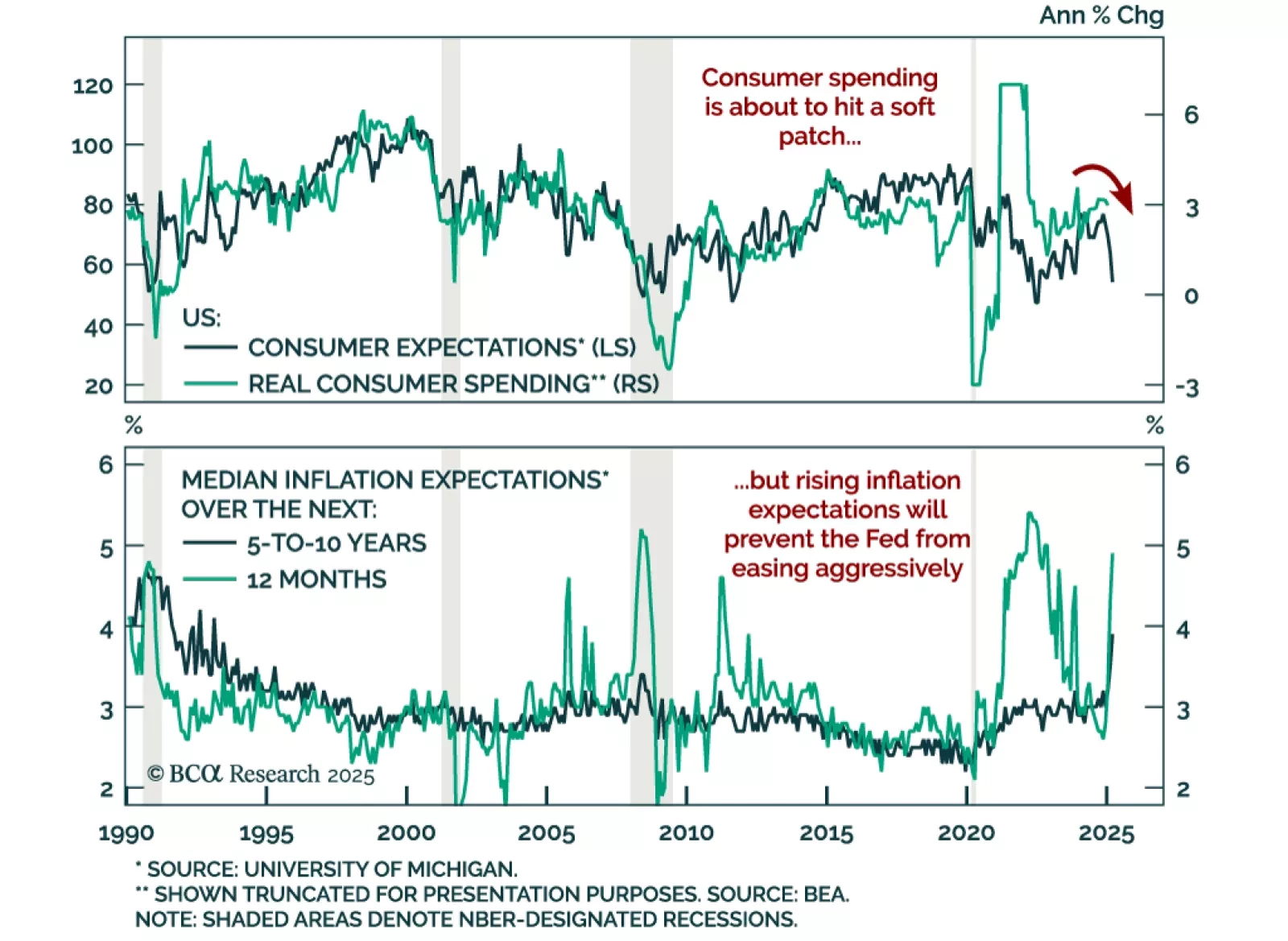

The preliminary March University of Michigan Consumer Sentiment Index missed estimates, falling to 57.9 from 64.7. The decrease came from both the assessment of current conditions and expectations, with the latter falling almost 10…

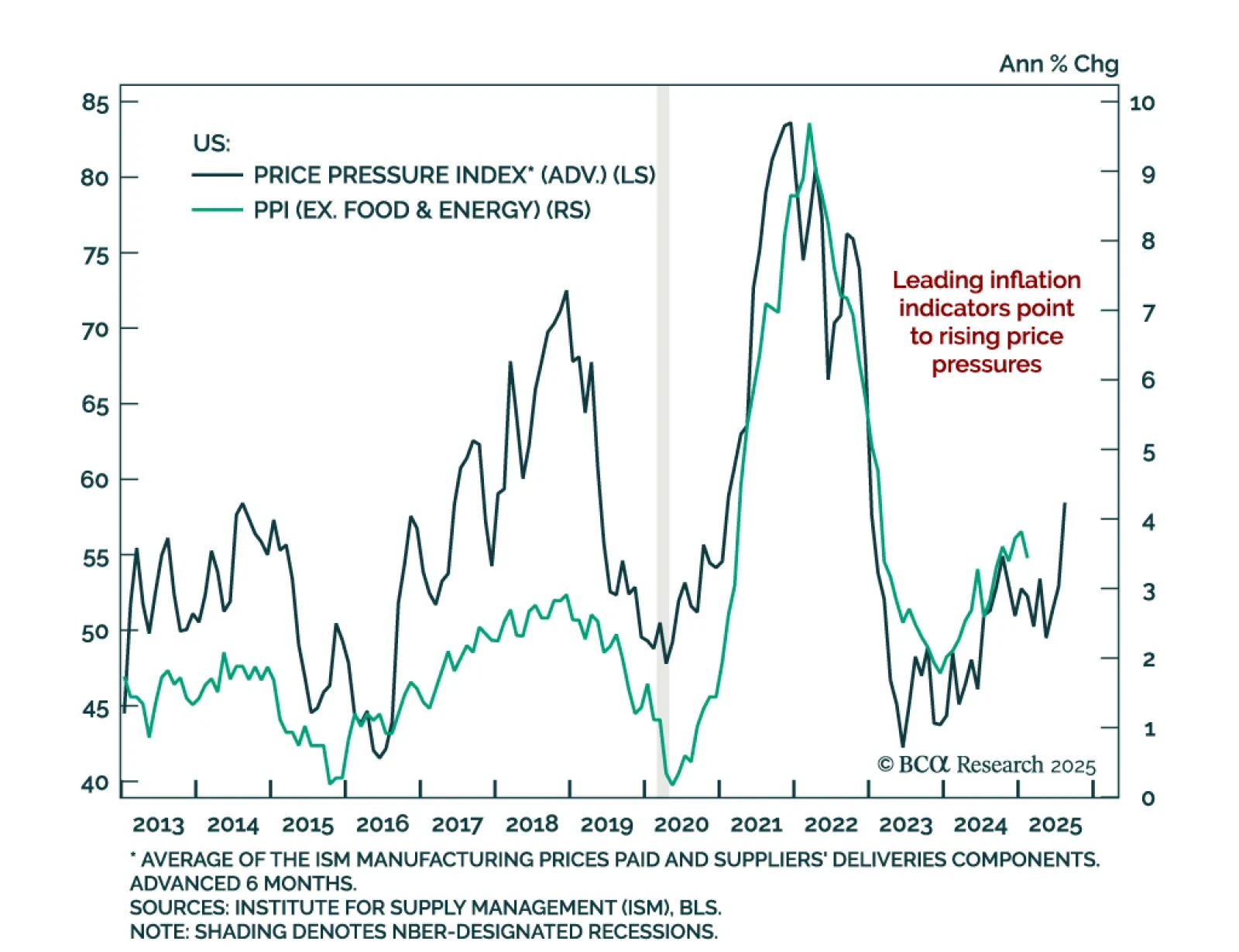

The February US Producer Price Index came in below estimates, with the headline measure showing no monthly change and standing at 3.2% y/y. Core PPI (excluding food, energy, and trade services) was also cooler than expected, coming…

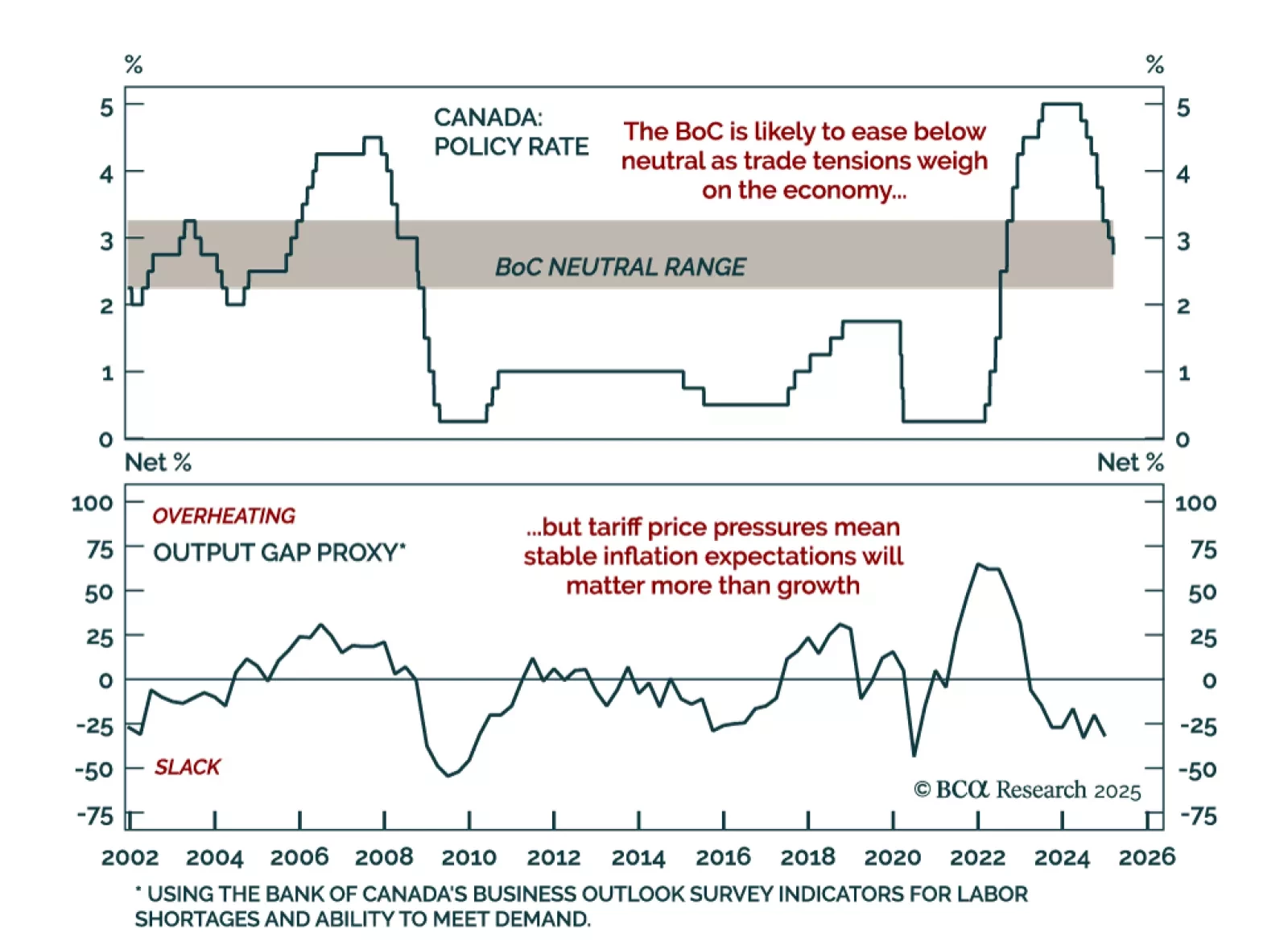

The Bank of Canada cut by 25 bps to 2.75% as expected. This seventh consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range. The BoC is in a tough place. The trade war…

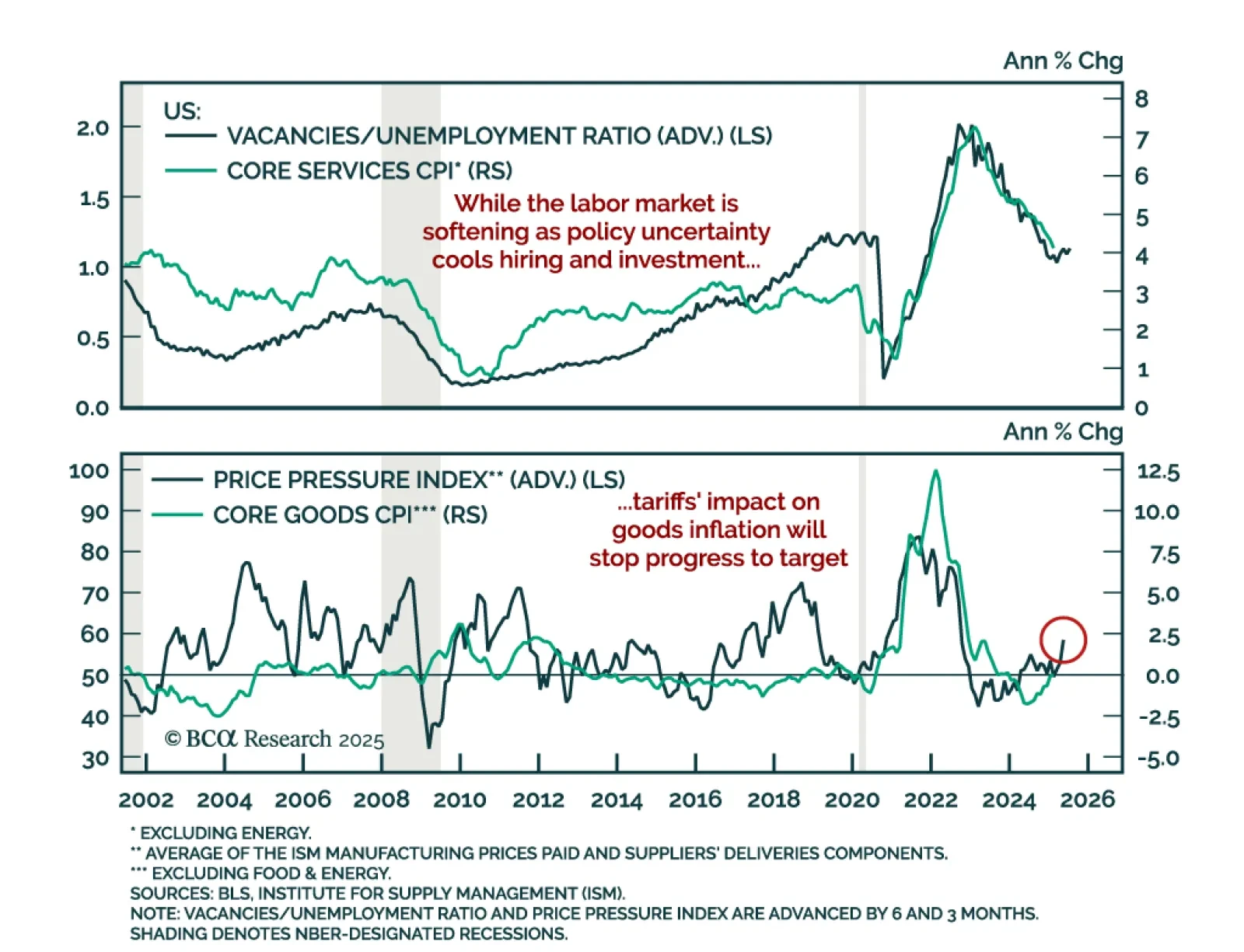

The February US CPI came in cooler than expected. Headline inflation decelerated to 0.2% m/m (2.8% y/y), as did core which now stands at 3.1% y/y. Core services inflation declined while core goods inflation was roughly unchanged.…

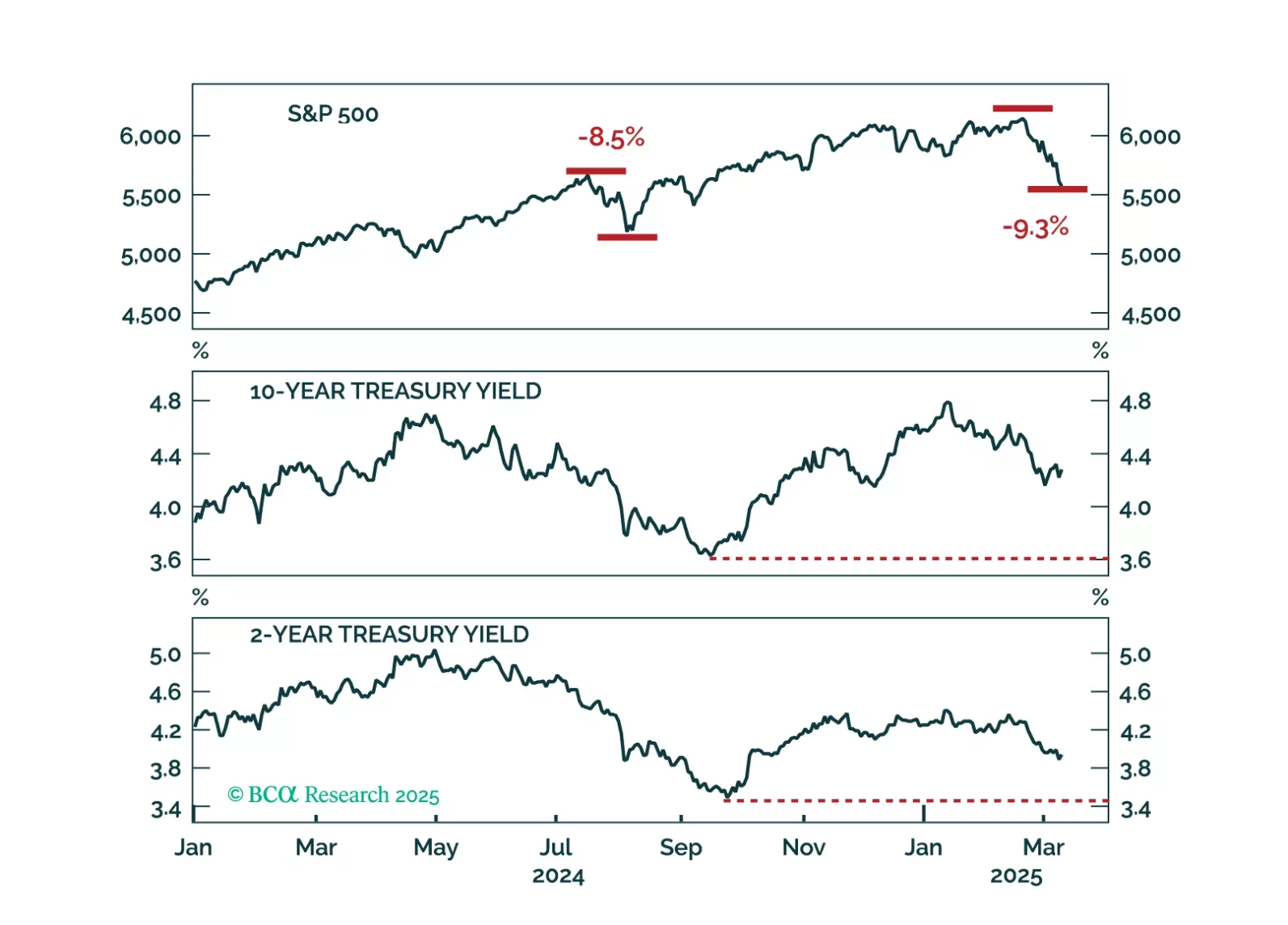

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.

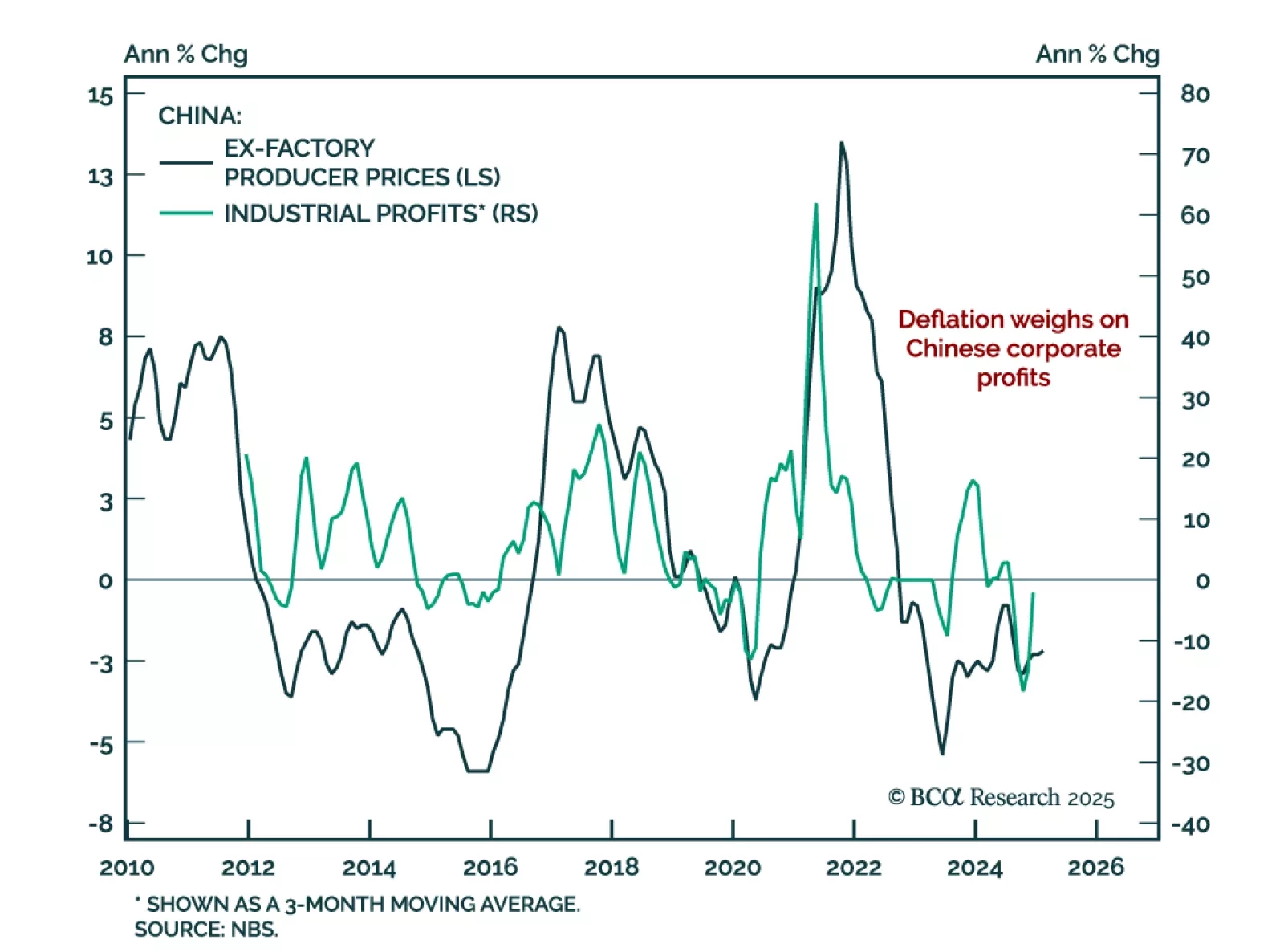

China’s February consumer prices fell 0.7% y/y after expanding on an annual basis in January. Producer price deflation stood at -2.2% y/y, roughly unchanged from a month prior. China’s first quarter data is heavily influenced by…

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

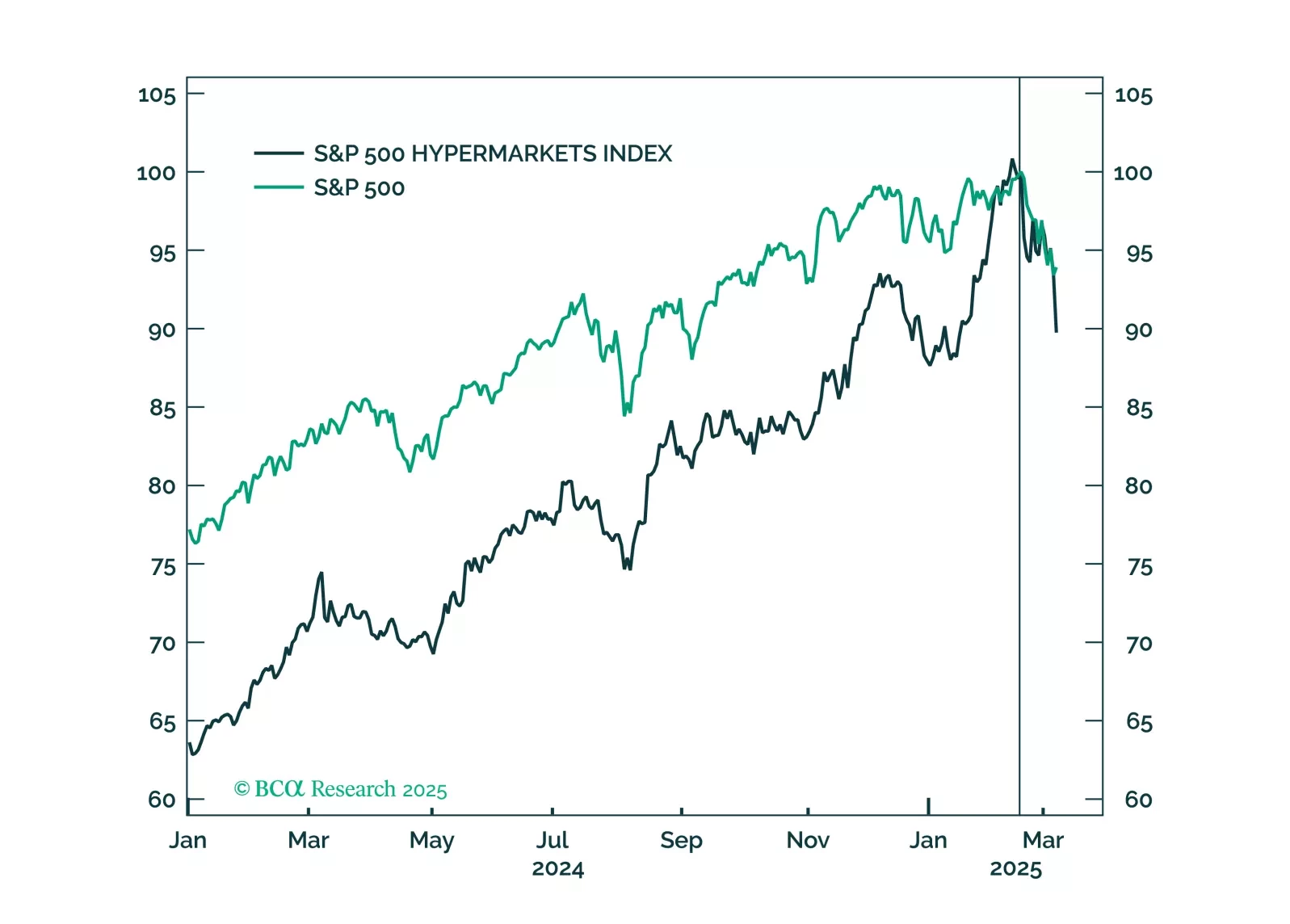

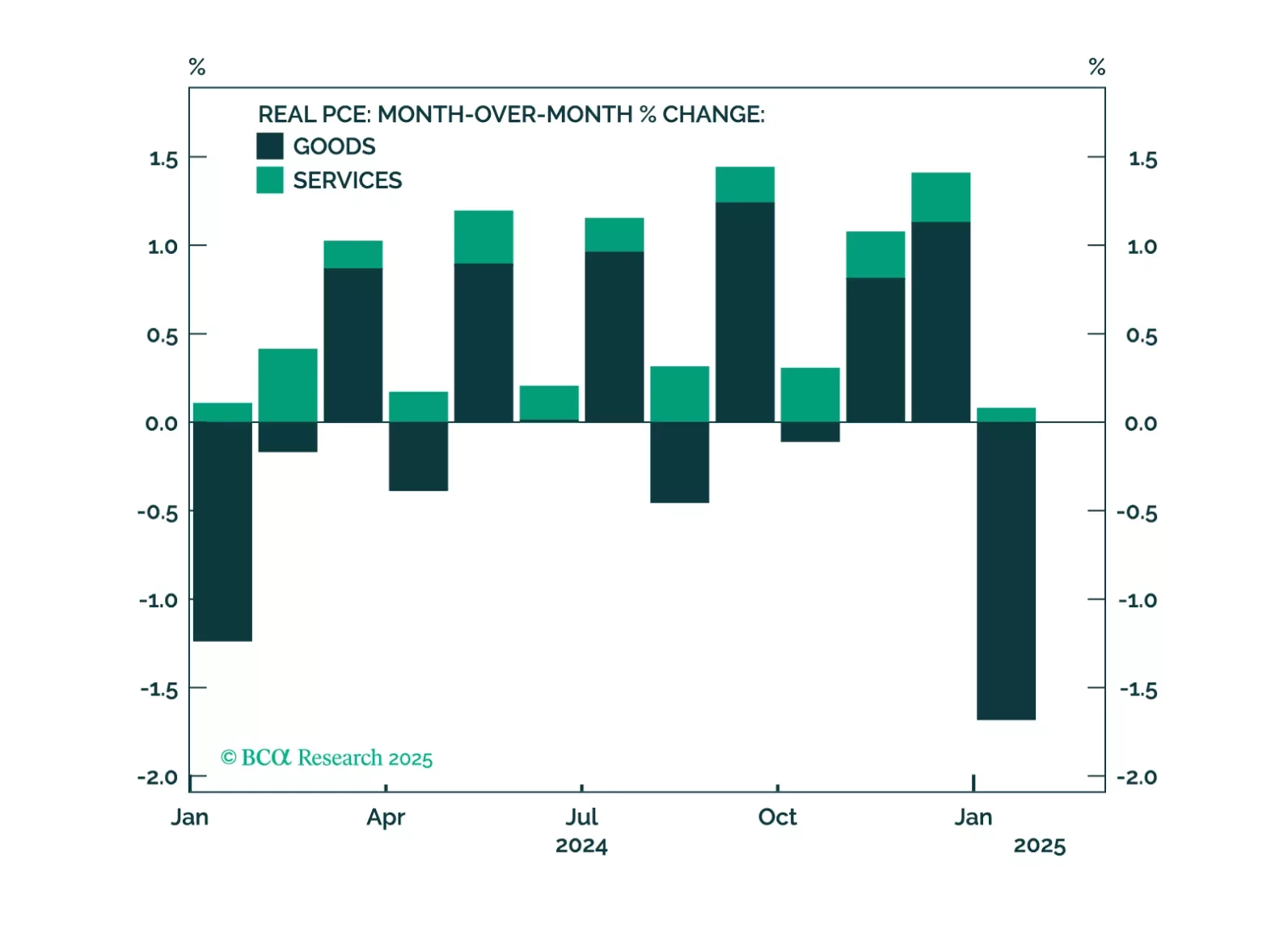

This morning’s employment report showed solid job growth, but recent consumer spending indicators are more concerning. The risk of recession starting within the next few months has increased. We suggest some important indicators for…

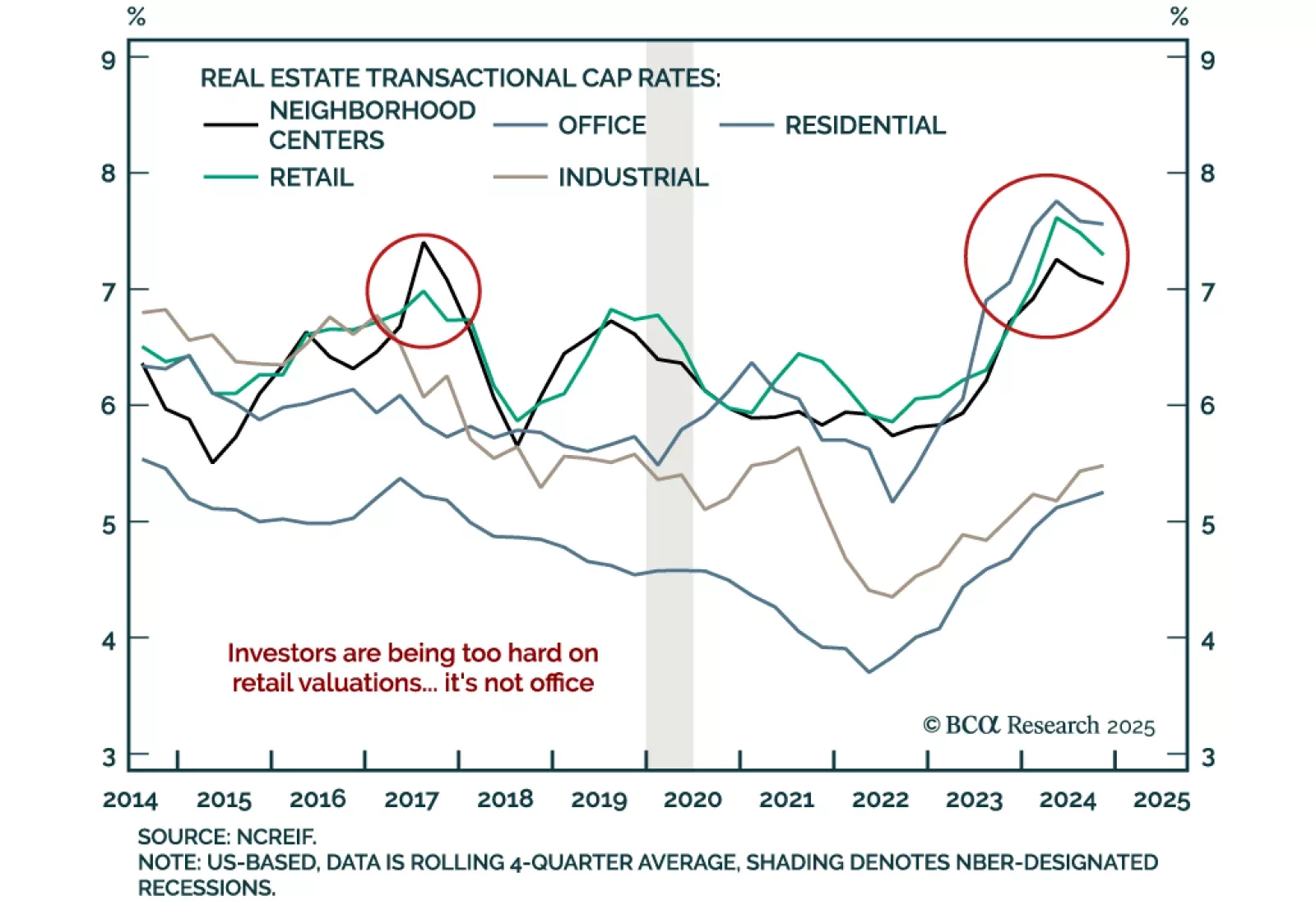

Our Private Markets & Alternatives strategists assessed retail real estate opportunities. Retail Real Estate is a contrarian opportunity, with investor sentiment at rock-bottom levels despite shifting consumption patterns.…

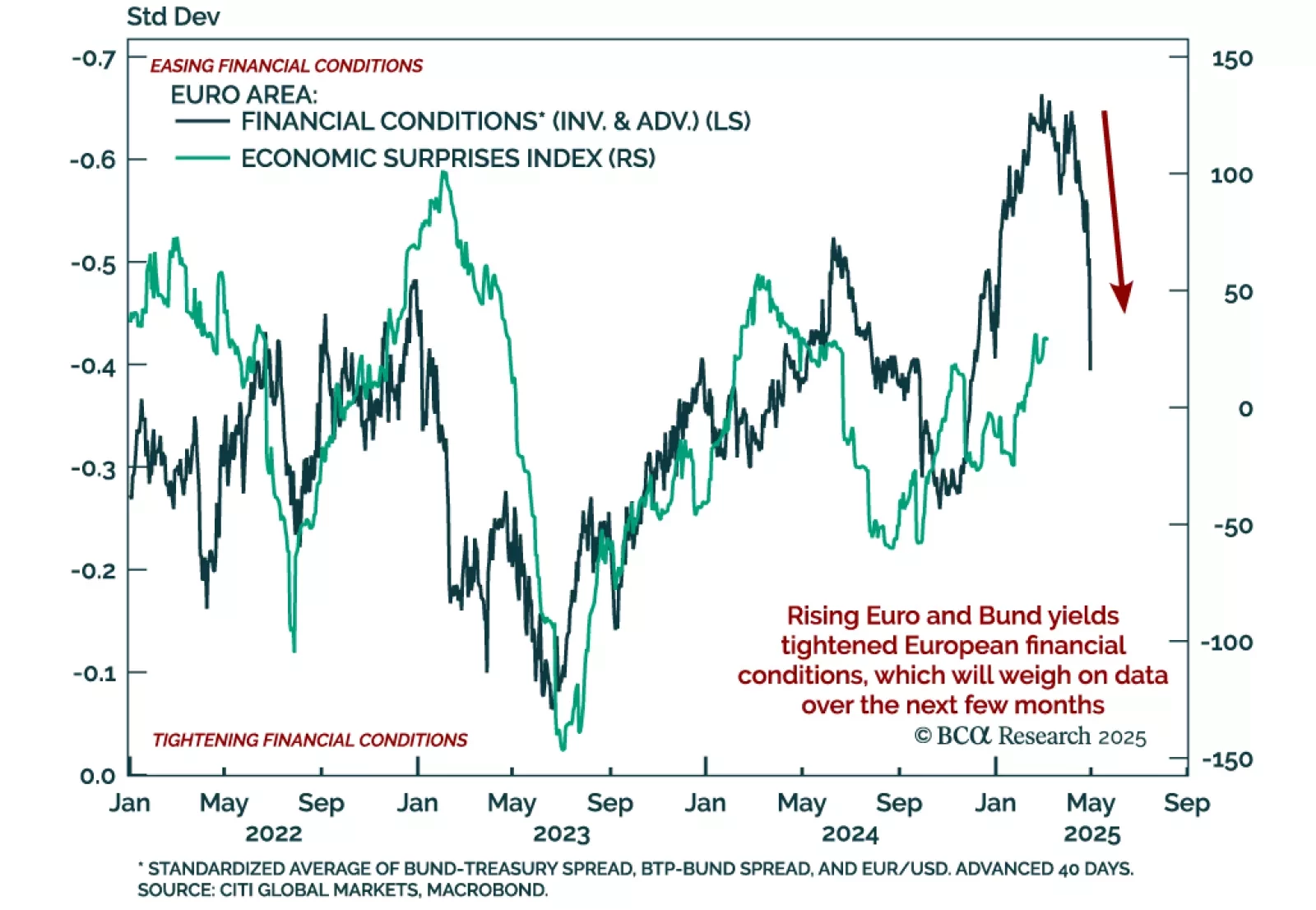

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…