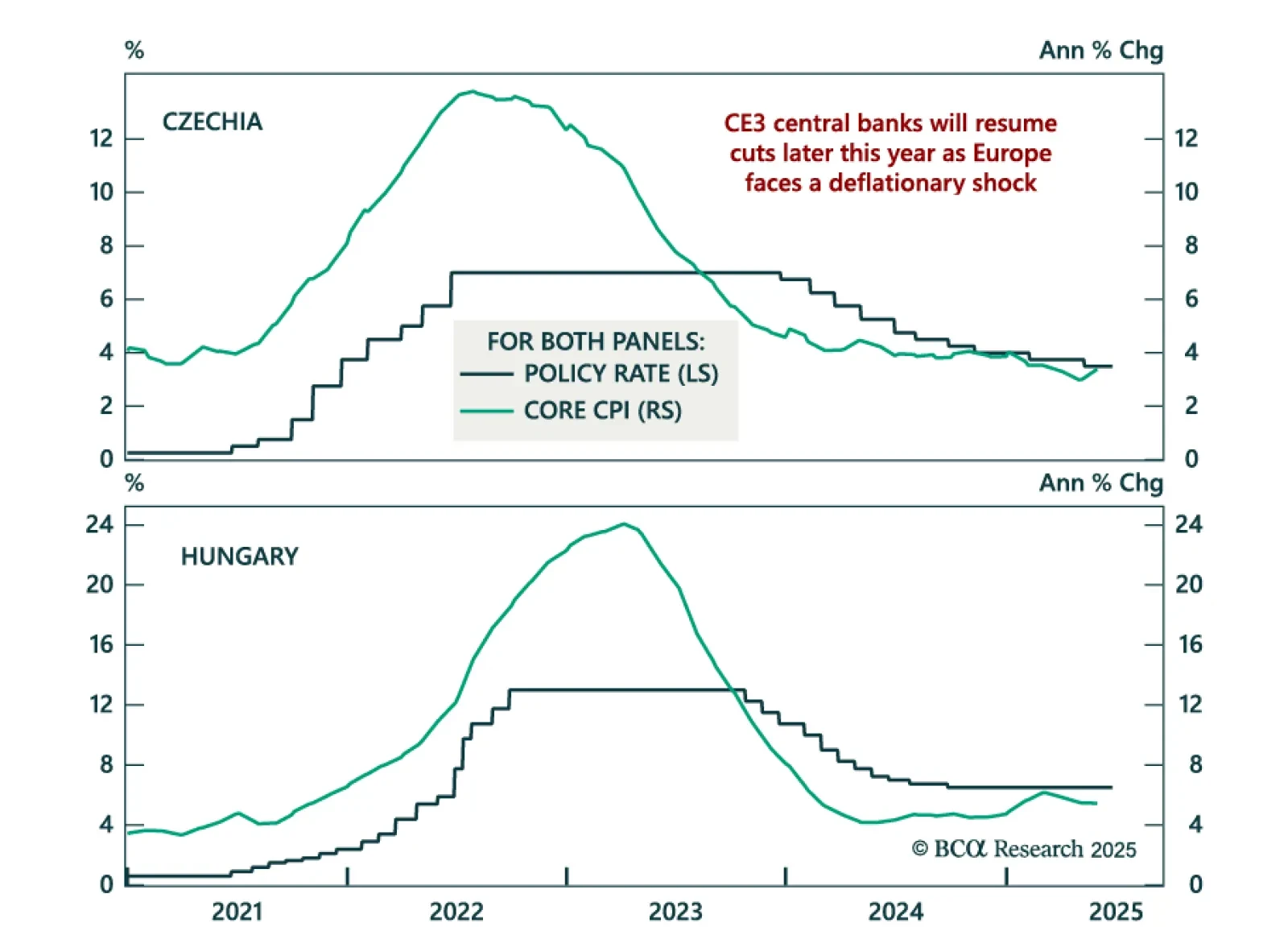

Deflationary pressures and weak core Europe growth support CE3 bond longs as rate cuts loom. The Czech and Hungarian central banks held rates steady at 3.5% and 6.5% this week, following Poland’s earlier decision to keep rates…

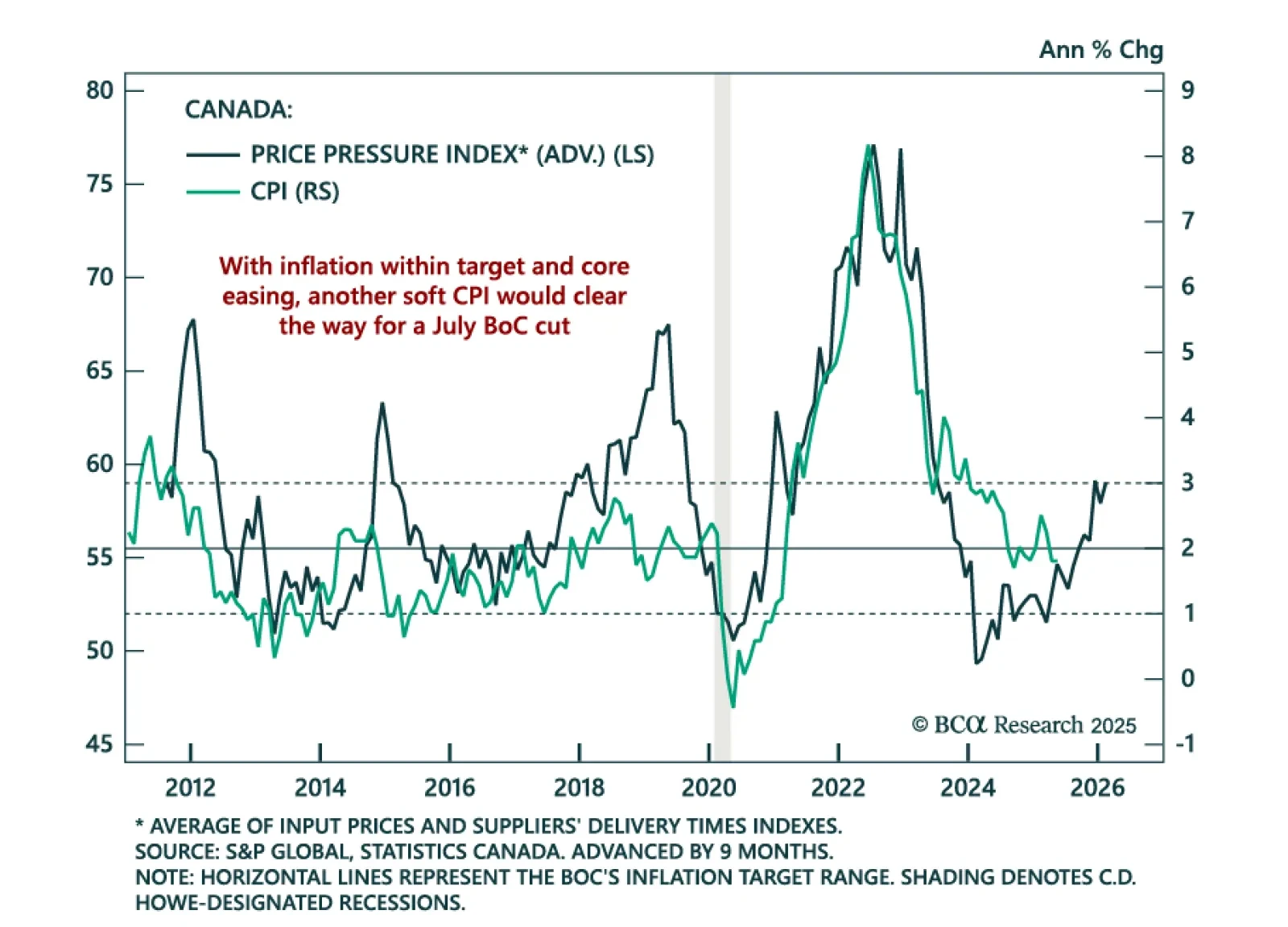

Contained Canadian inflation and soft macro conditions support our overweight on Canadian government bonds. May CPI was in line with expectations, with headline inflation holding at 1.7% y/y and core measures slowing to 3.0%, the…

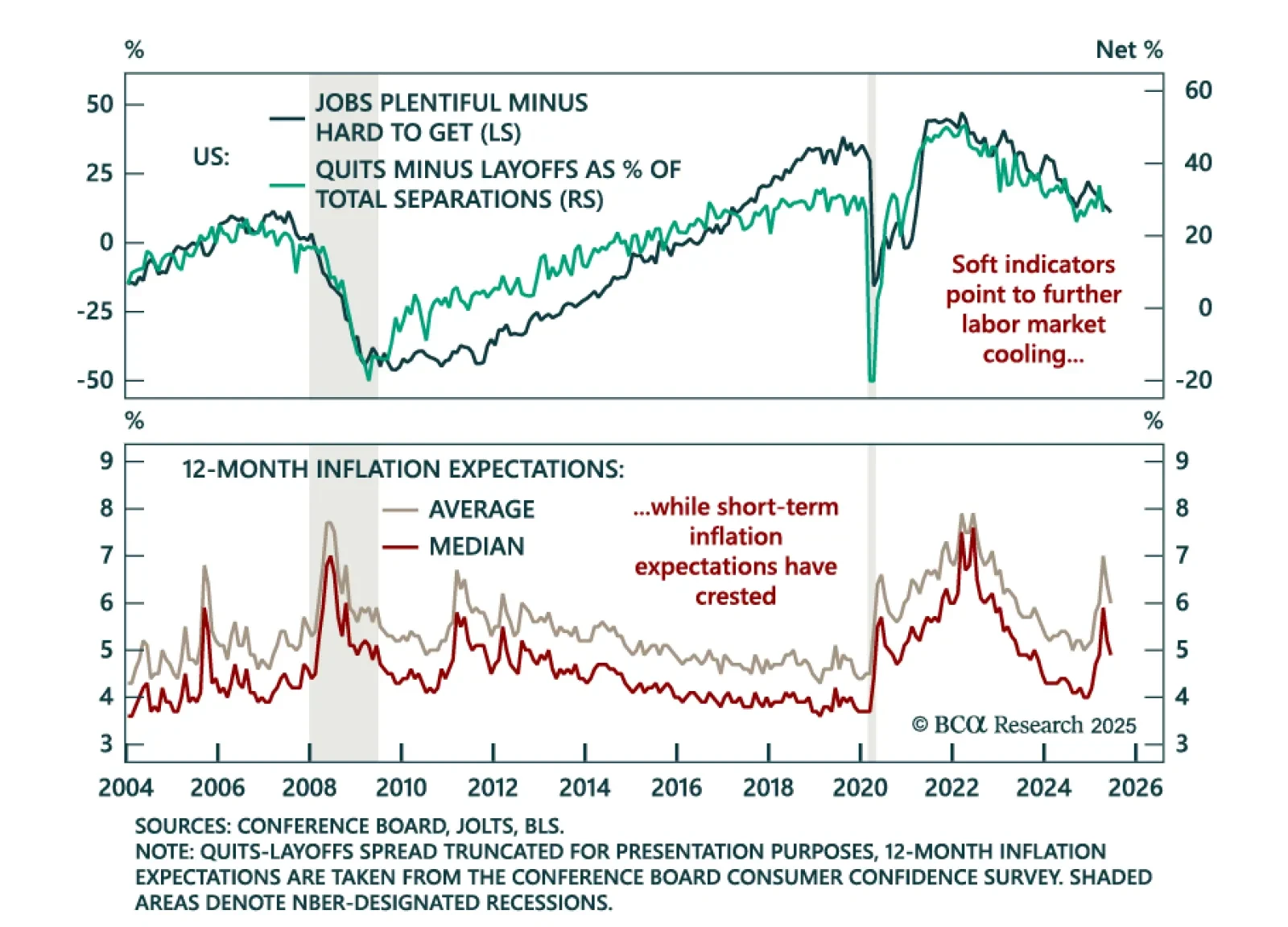

Weakening consumer confidence and fading labor momentum support a long duration stance as inflation fears recede. The June Conference Board Consumer Confidence index dropped 5 points to 93.0, missing expectations. Both present…

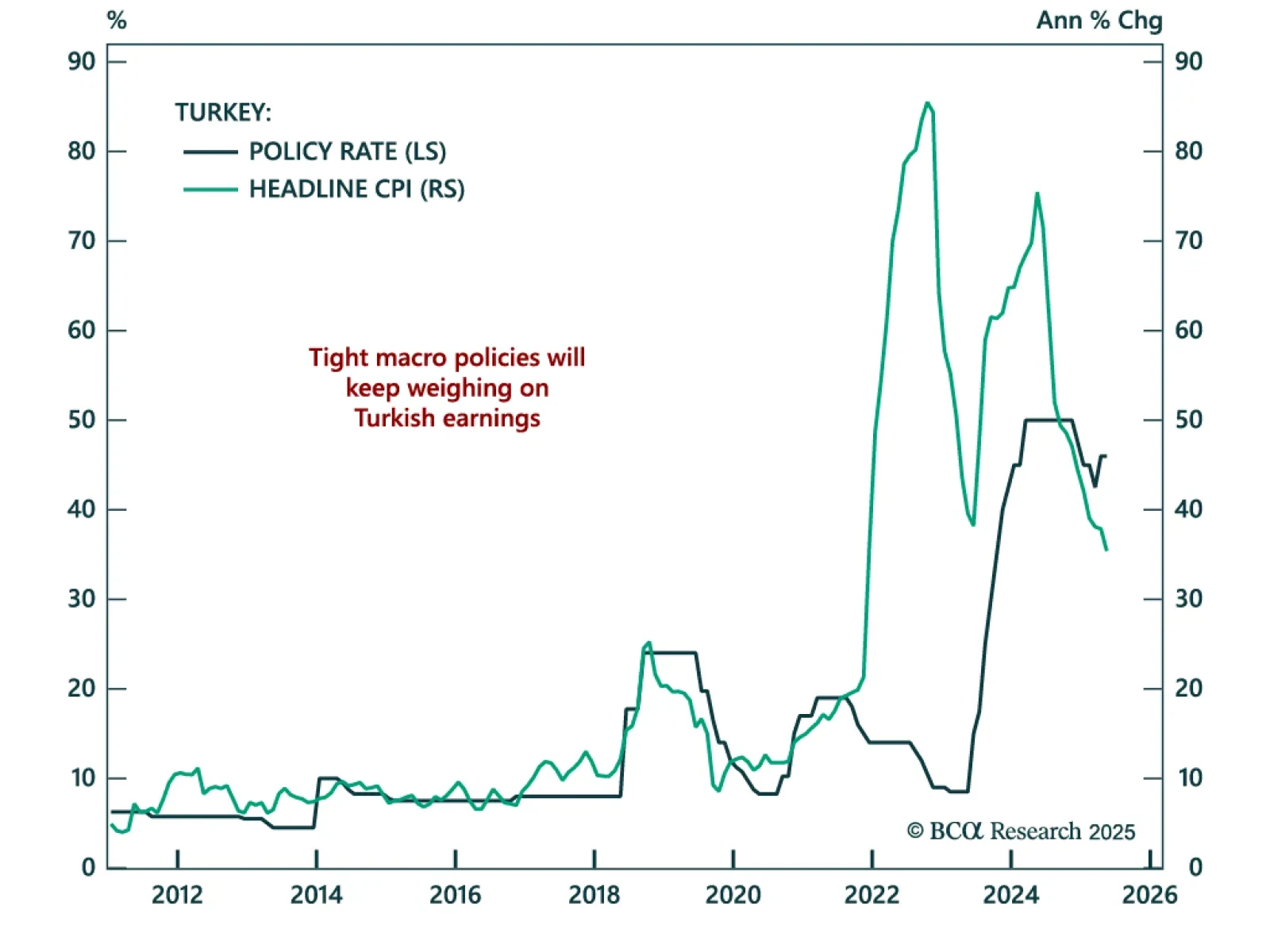

Turkey’s tight policy stance will weigh on growth and earnings, reinforcing our bearish view on Turkish equities. The central bank held rates at 46% and maintained a hawkish bias, consistent with efforts to bring inflation down from…

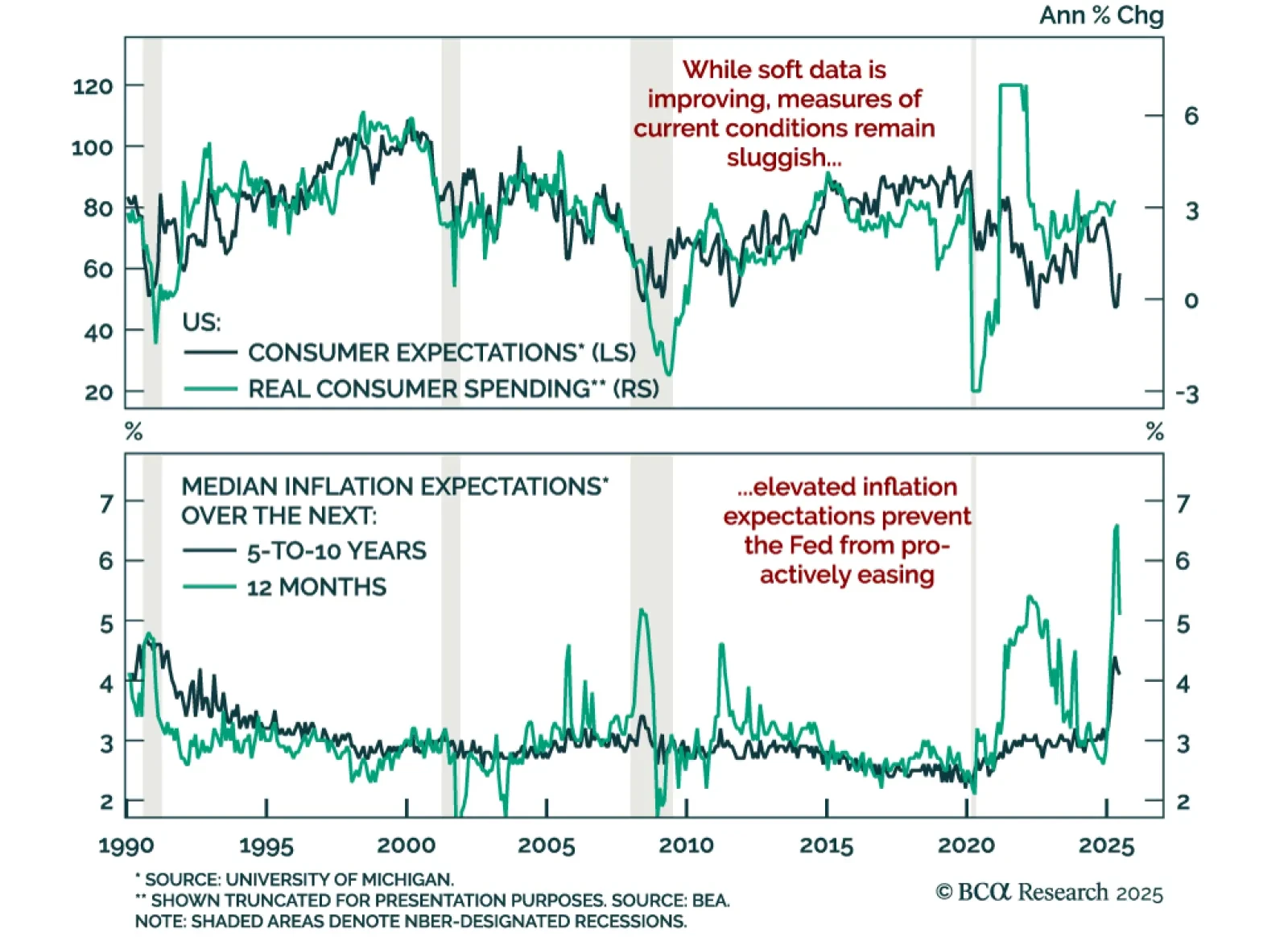

While consumer sentiment is rebounding, sticky inflation expectations and slowing growth warrant staying long duration and steepeners. The preliminary June University of Michigan Consumer Sentiment Index surprised to the upside,…

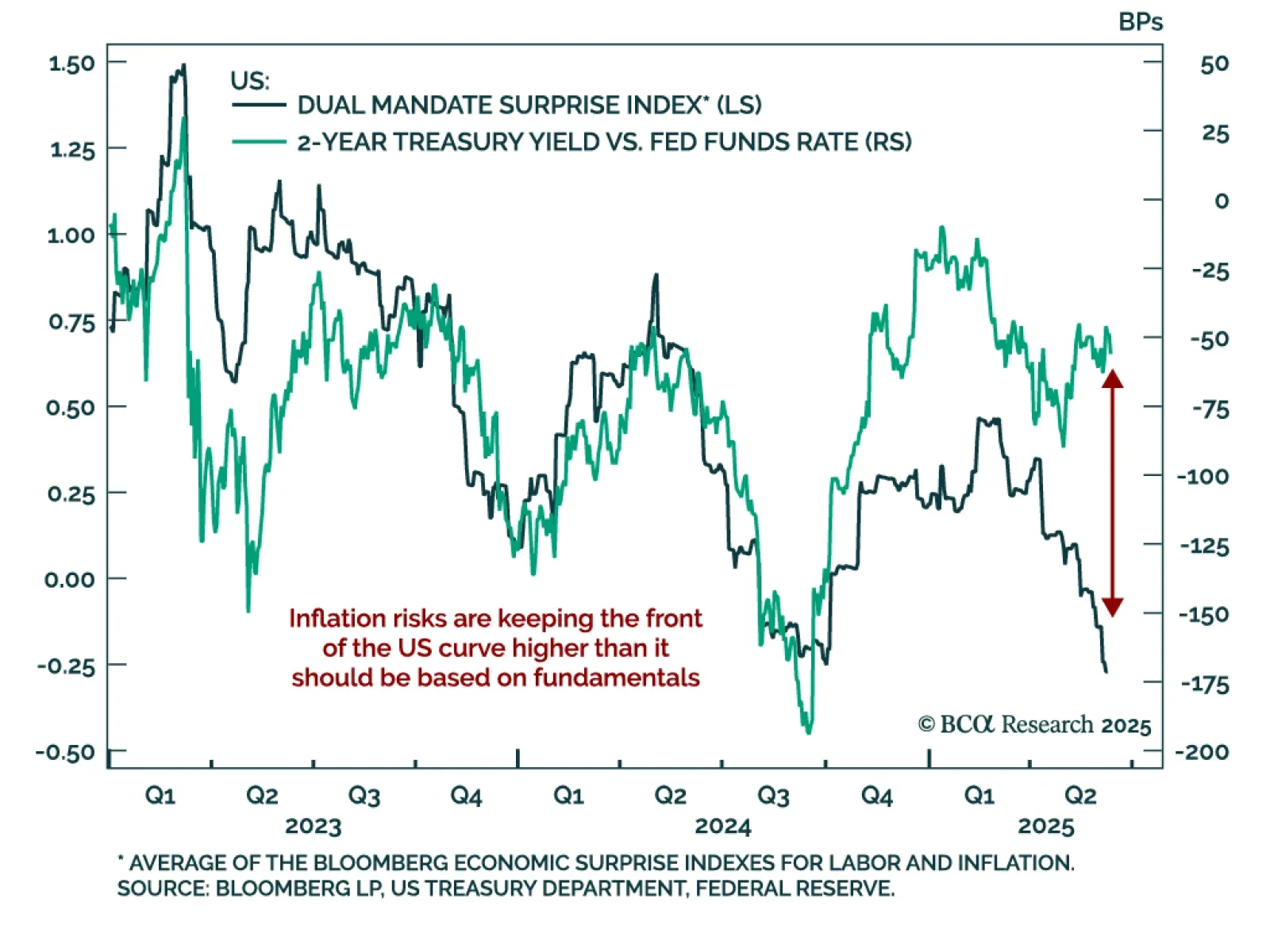

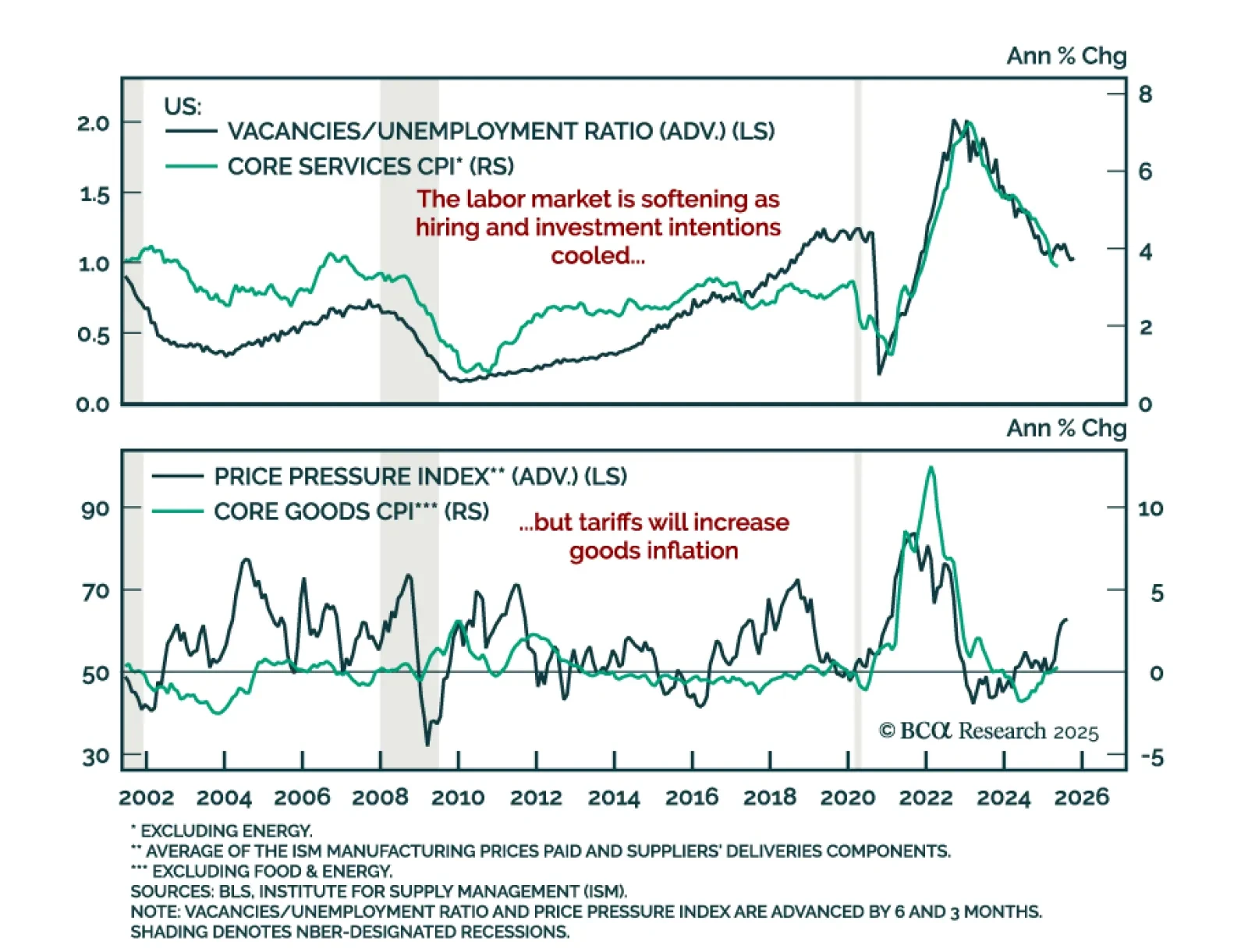

Elevated inflation expectations are keeping the Fed sidelined, reinforcing our long-duration and steepener bias in US rates. The US May CPI would have normally supported cuts, but the Fed cannot risk elevated short-term…

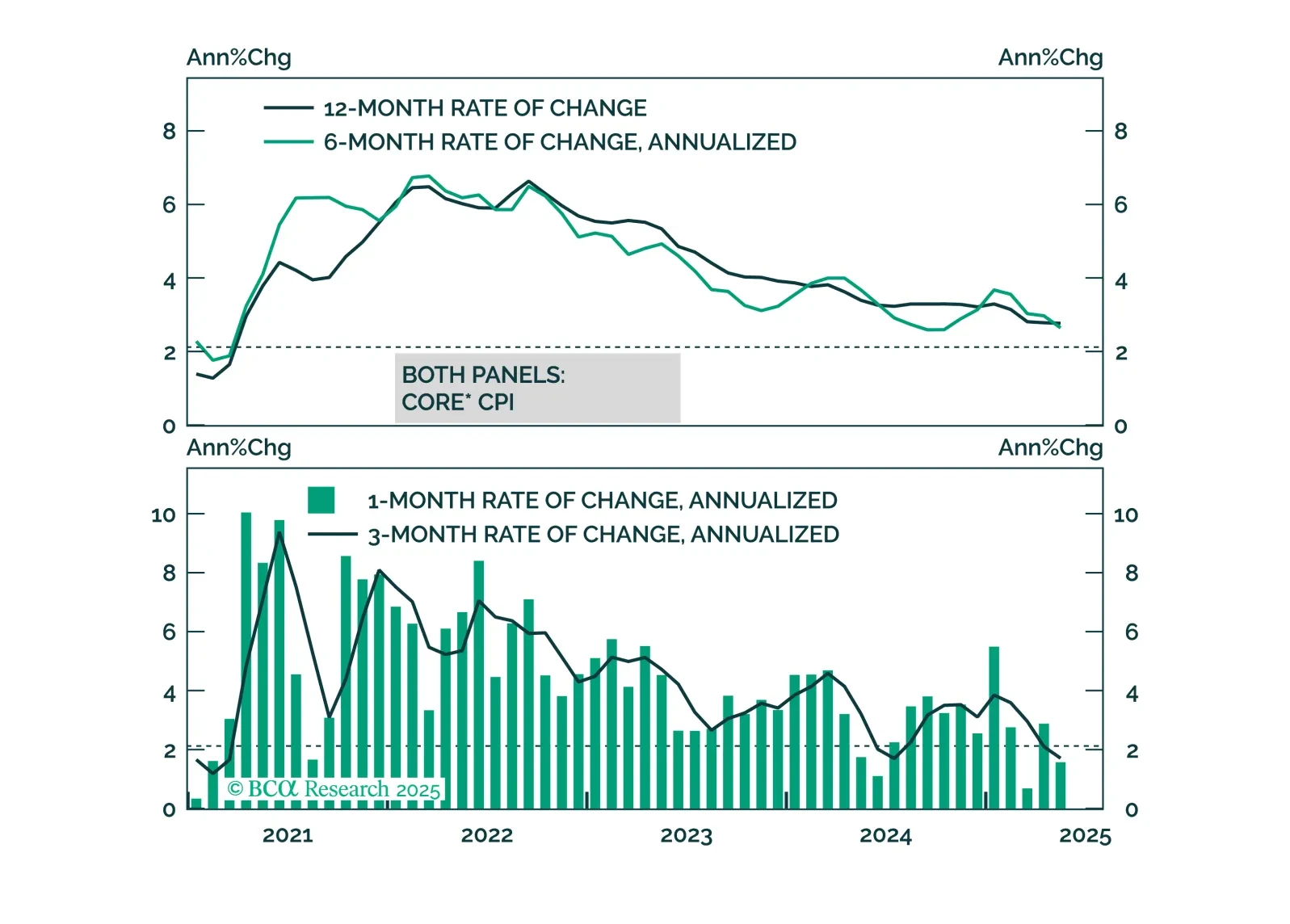

Colder May CPI reinforces our overweight in government bonds and tactical steepener trades as growth slows and the Fed stays cautious. Headline inflation rose 0.1% (2.4% y/y), below expectations, as did core CPI (2.8% y/y). Goods…

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

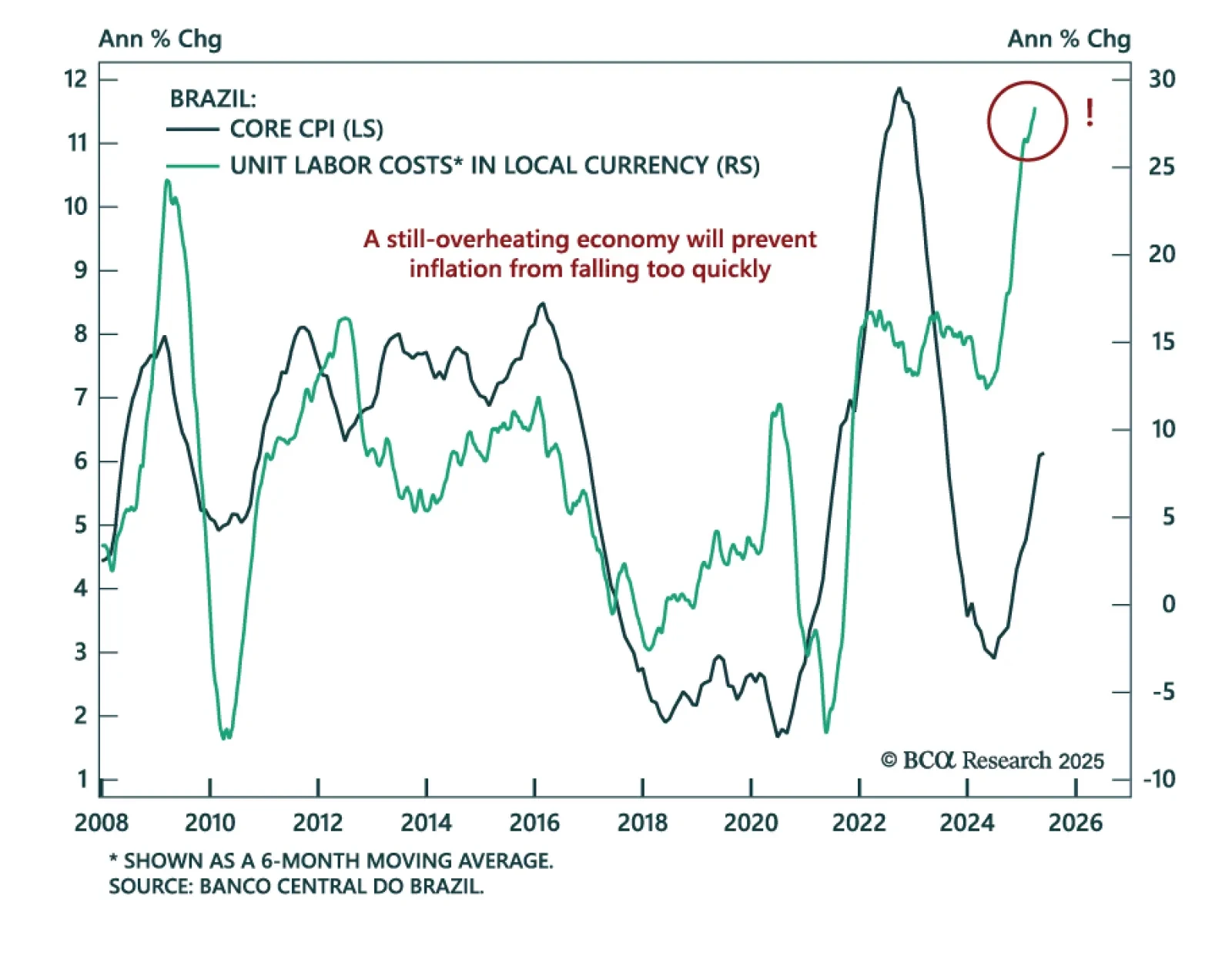

The May Brazilian CPI suggests that price pressures may have reached a peak, but do not expect immediate monetary easing to support fixed income markets. Headline CPI slowed to 5.3% y/y from 5.5% April, but core CPI remained flat at…