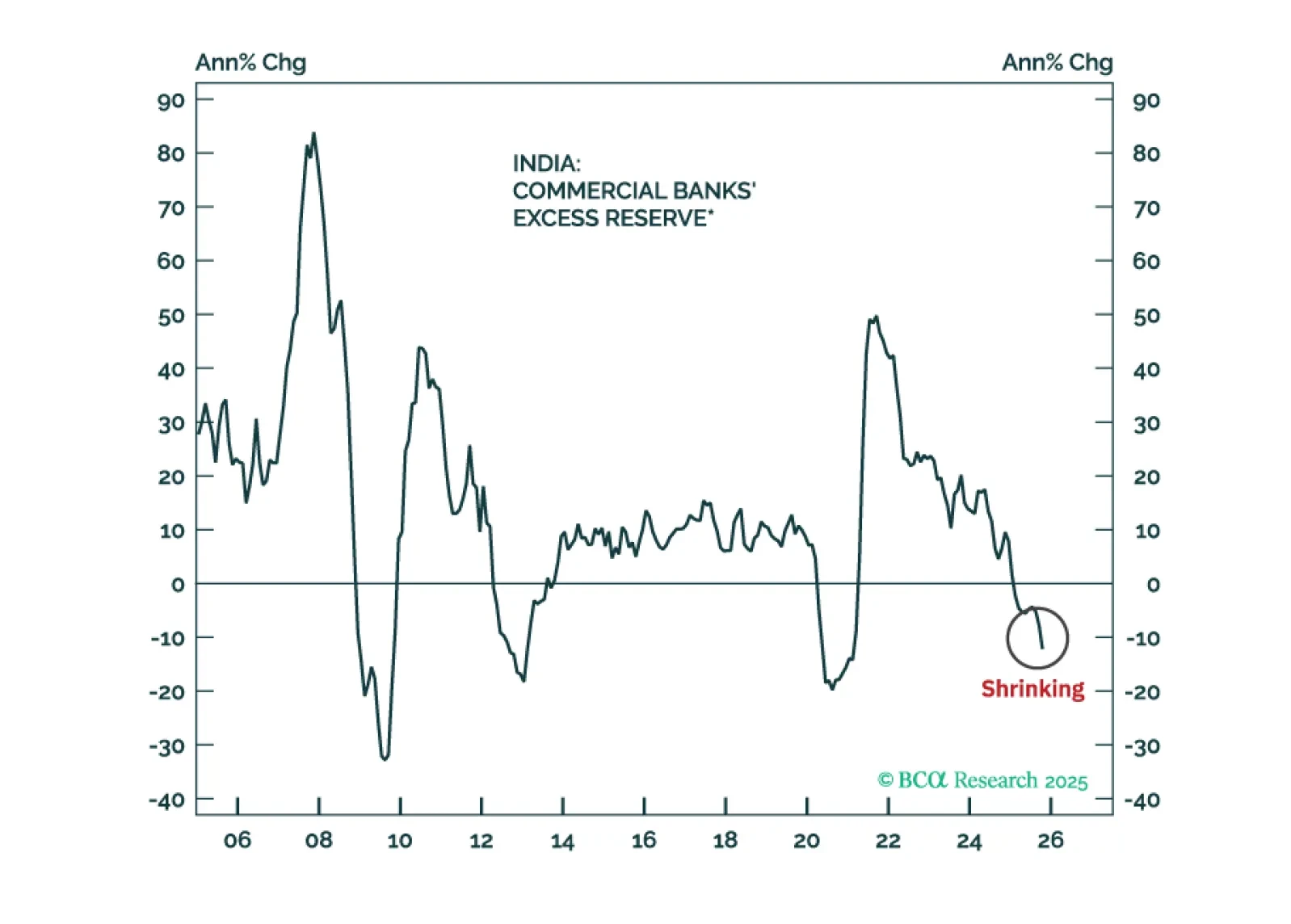

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

Our Portfolio Allocation Summary for November 2025.

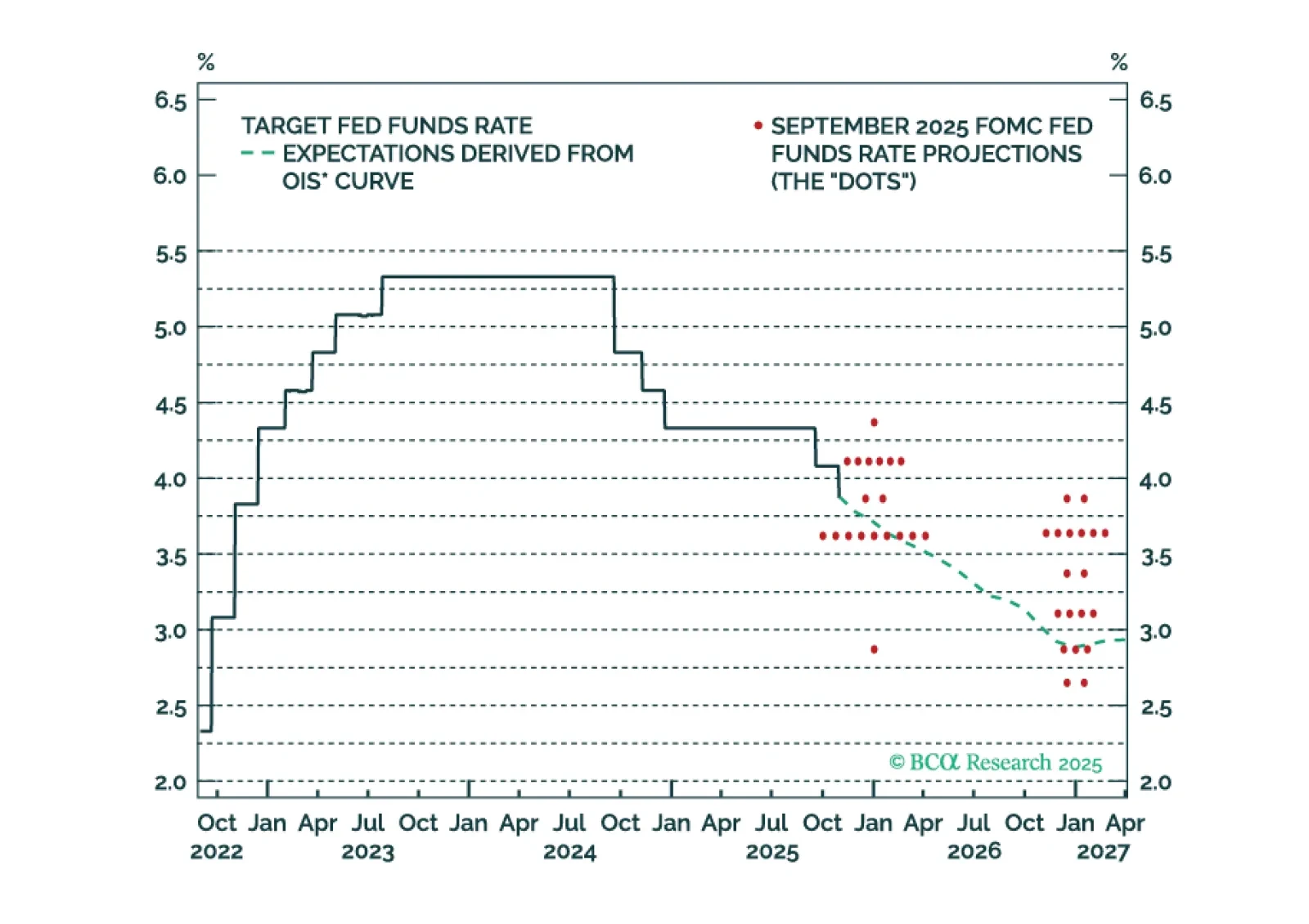

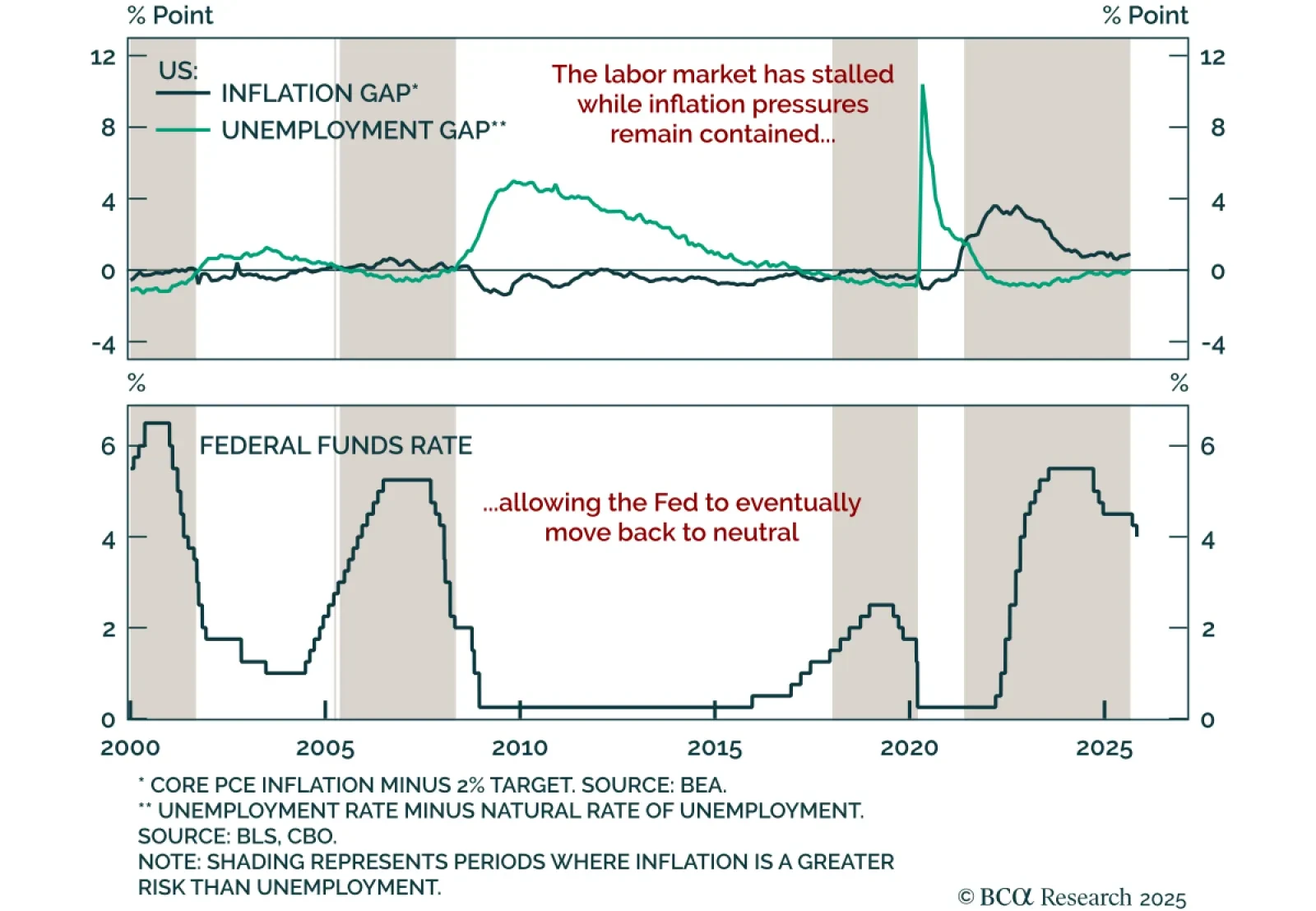

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.

The Fed cut rates by 25 bps to 3.75%–4.00% and announced QT will end December 1, signaling modest easing but no December cut commitment. The decision matched expectations, with dovish (Gov. Miran, for a 50 bps cut) and hawkish (Pres…

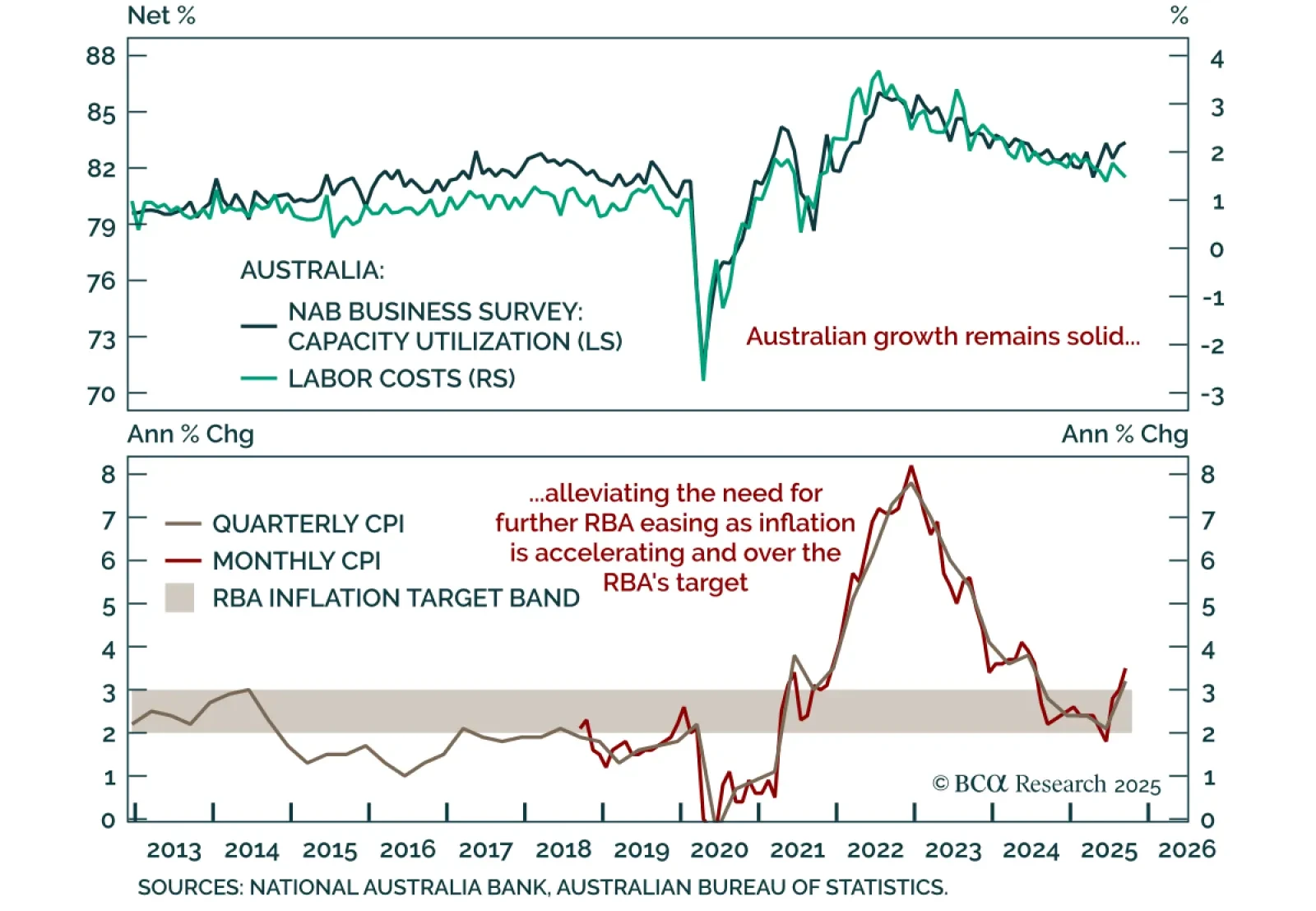

Australian September and Q3 inflation surprised to the upside, reinforcing the RBA’s cautious stance on easing. Headline CPI rose to 3.5% y/y from 3.0%, above the RBA’s 2–3% target range, while trimmed mean CPI increased to 2.8% from…

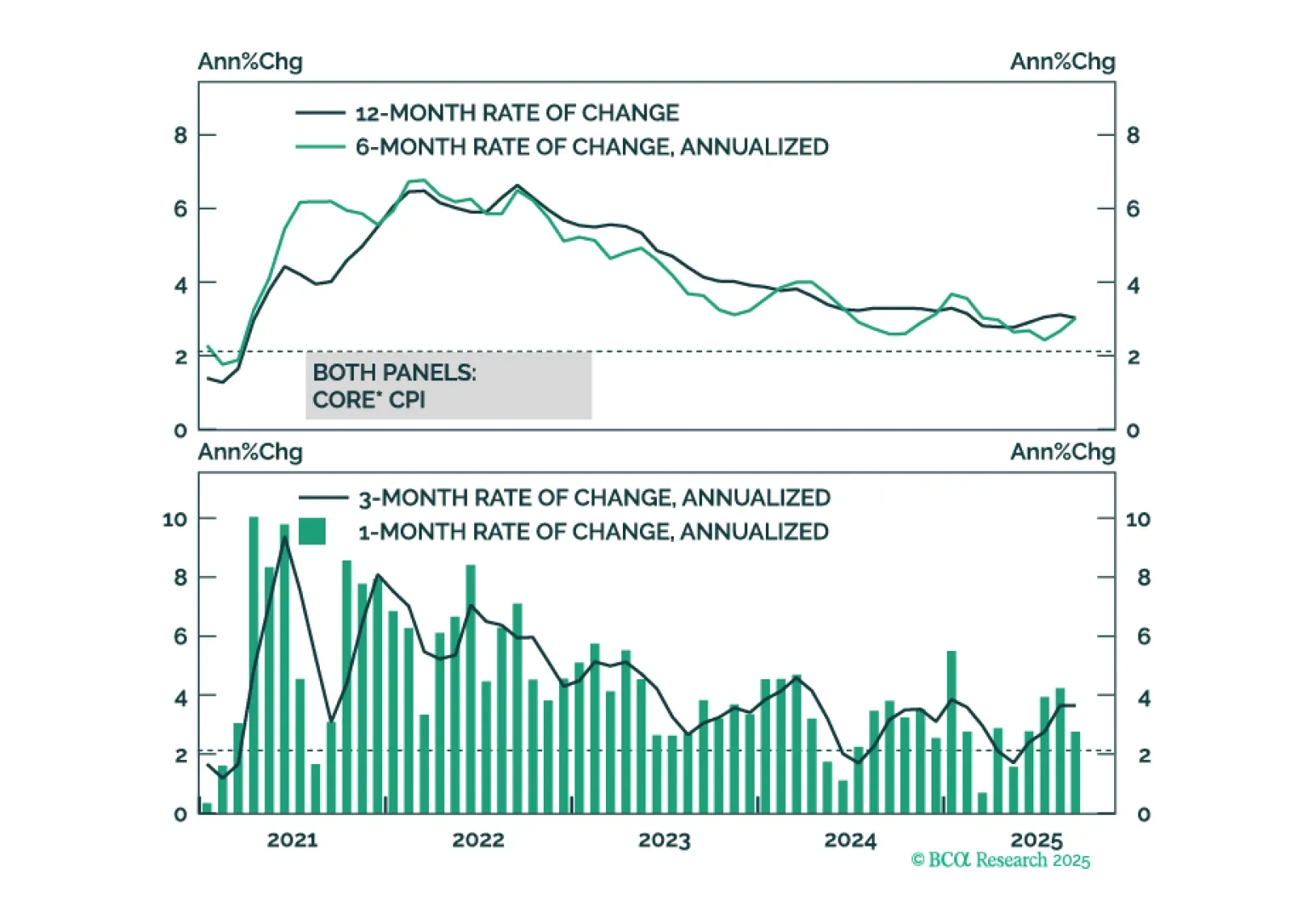

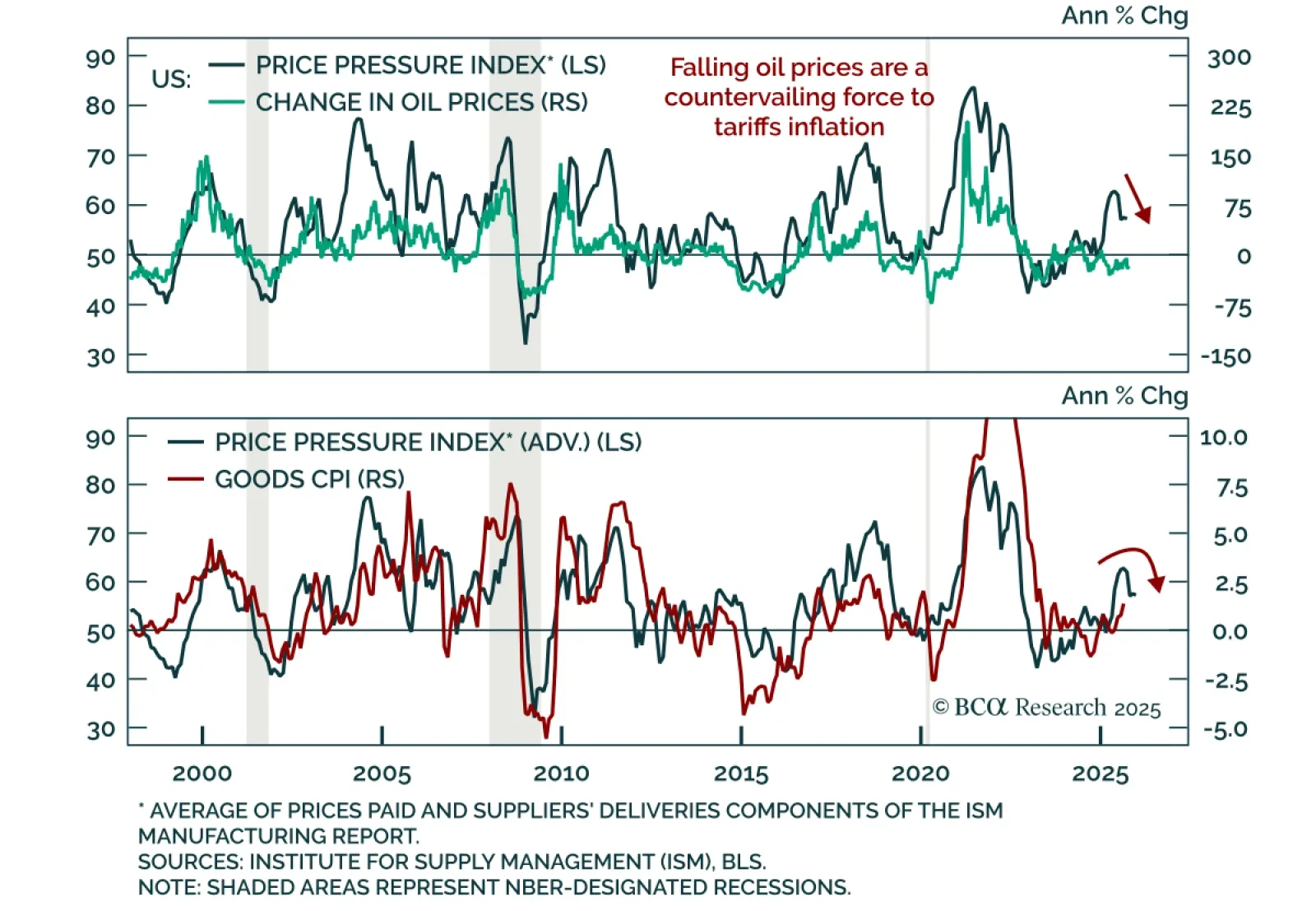

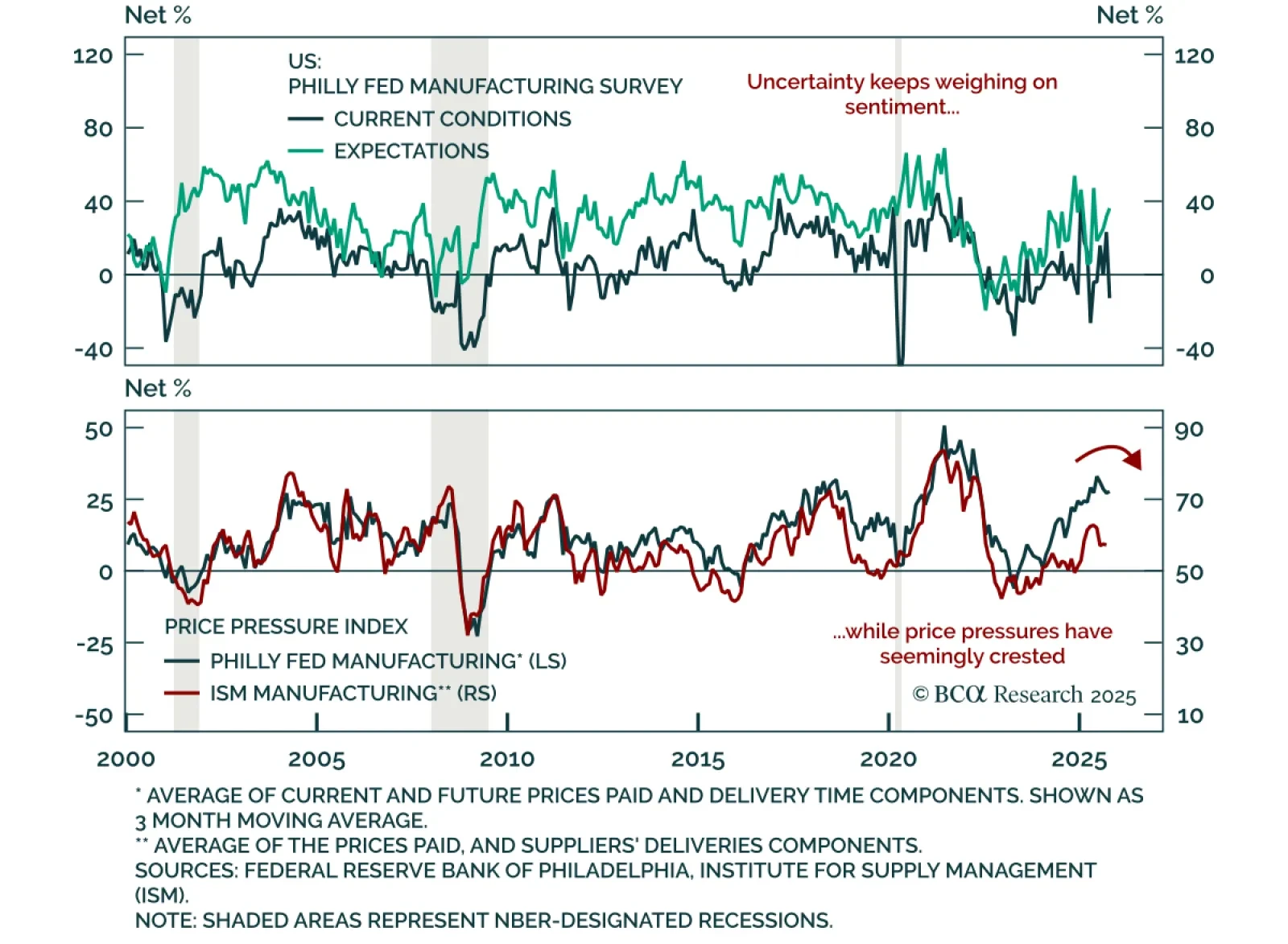

US inflation data continue to show no signs of price pressures beyond a near-term tariff effect.

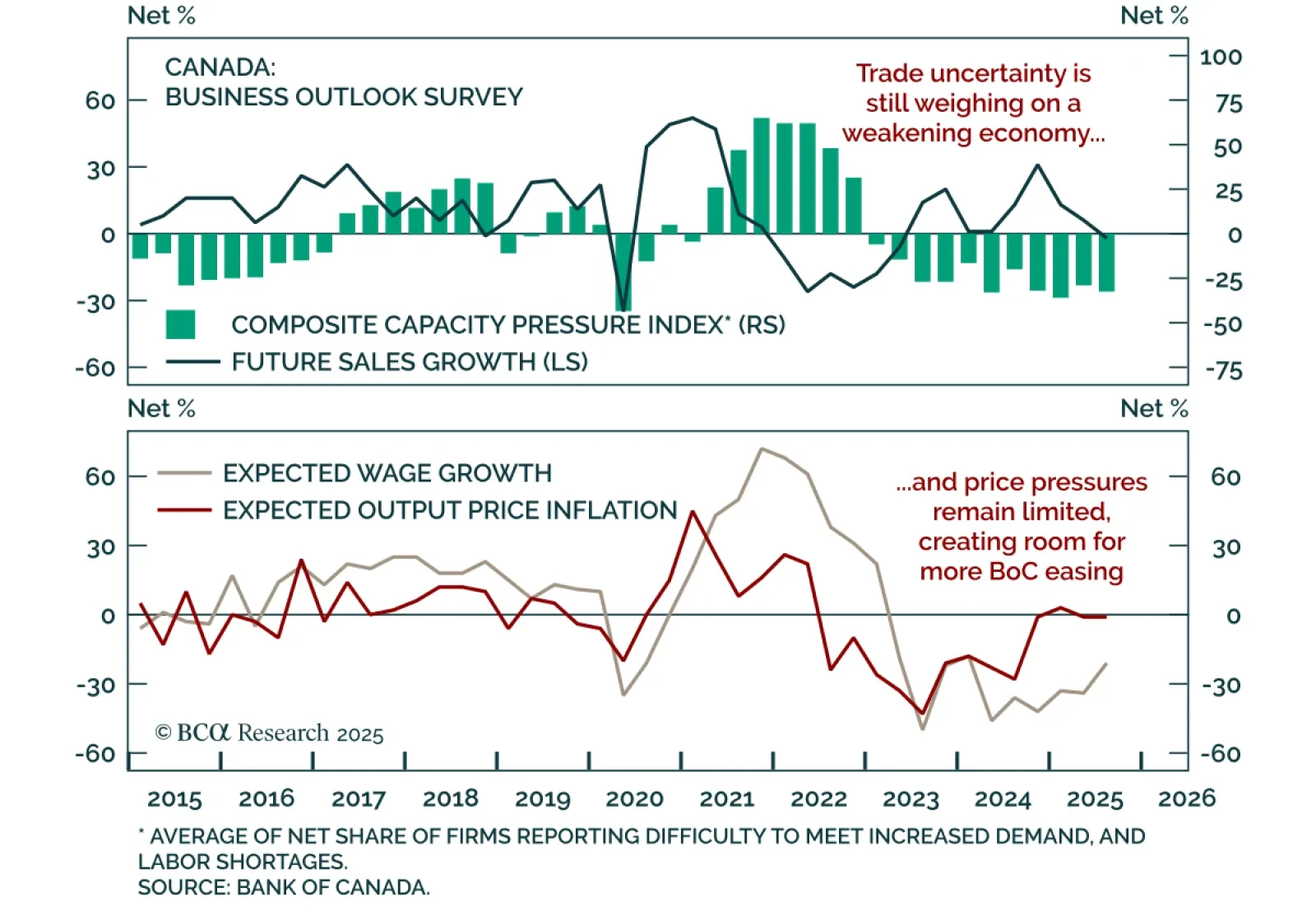

Canada’s Q3 Business Outlook Survey paints a weak macro picture with limited price pressures, supporting an overweight on CGBs and CAD 5s10s steepeners. The BOS Indicator ticked up marginally to -2.3 from -2.4, as low capacity…

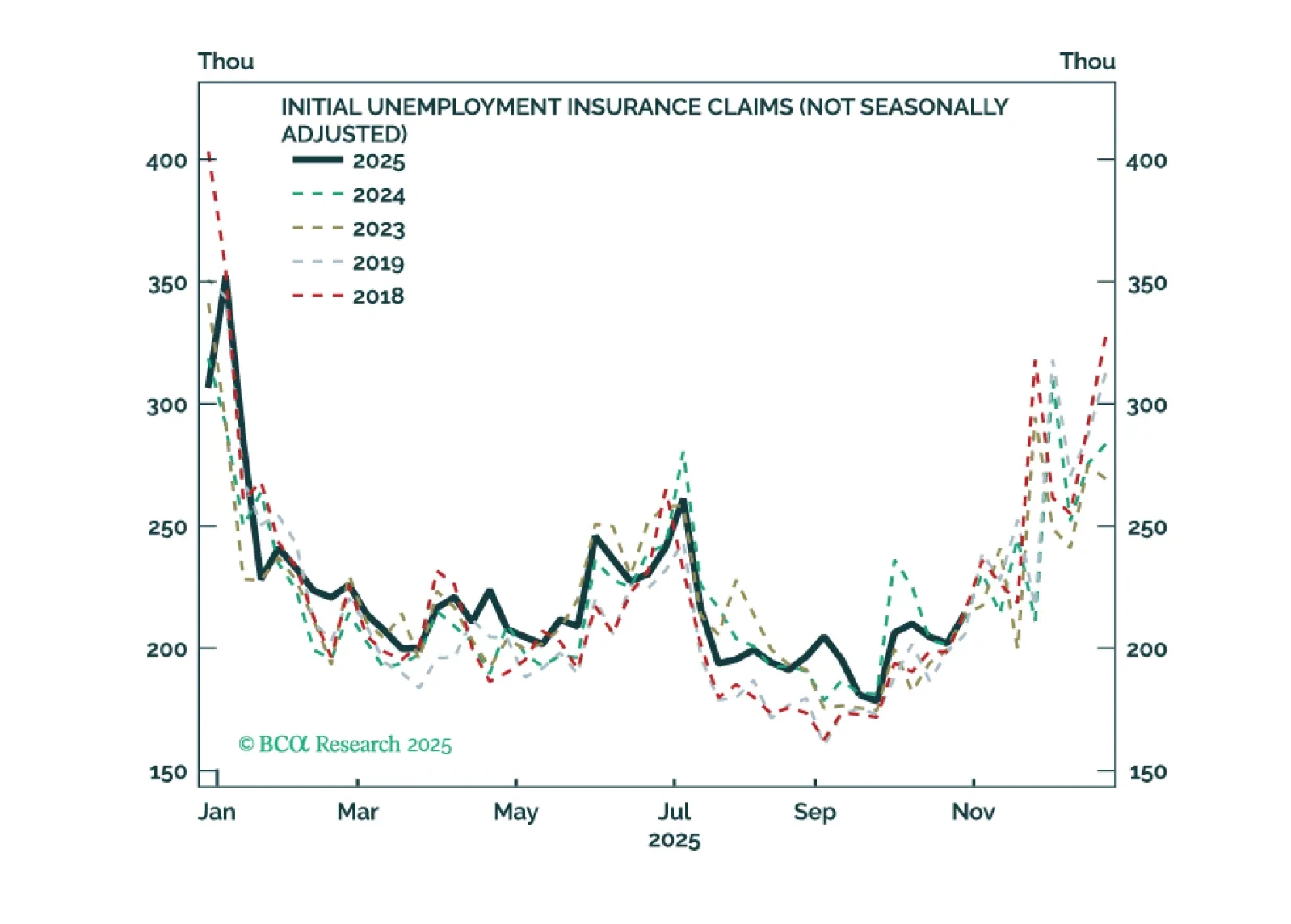

Falling oil prices are countering tariff-driven inflation which, along with a weakening labor market, is reinforcing a long duration stance. Brent crude broke below the $65/bbl support level held since June and WTI is now down 16%…

The October Philadelphia Fed manufacturing survey was mixed, showing weak headline data but steadier underlying components. The headline index fell to -12.8 from 23.2, the lowest level since April 2025. Underlying details were not as…

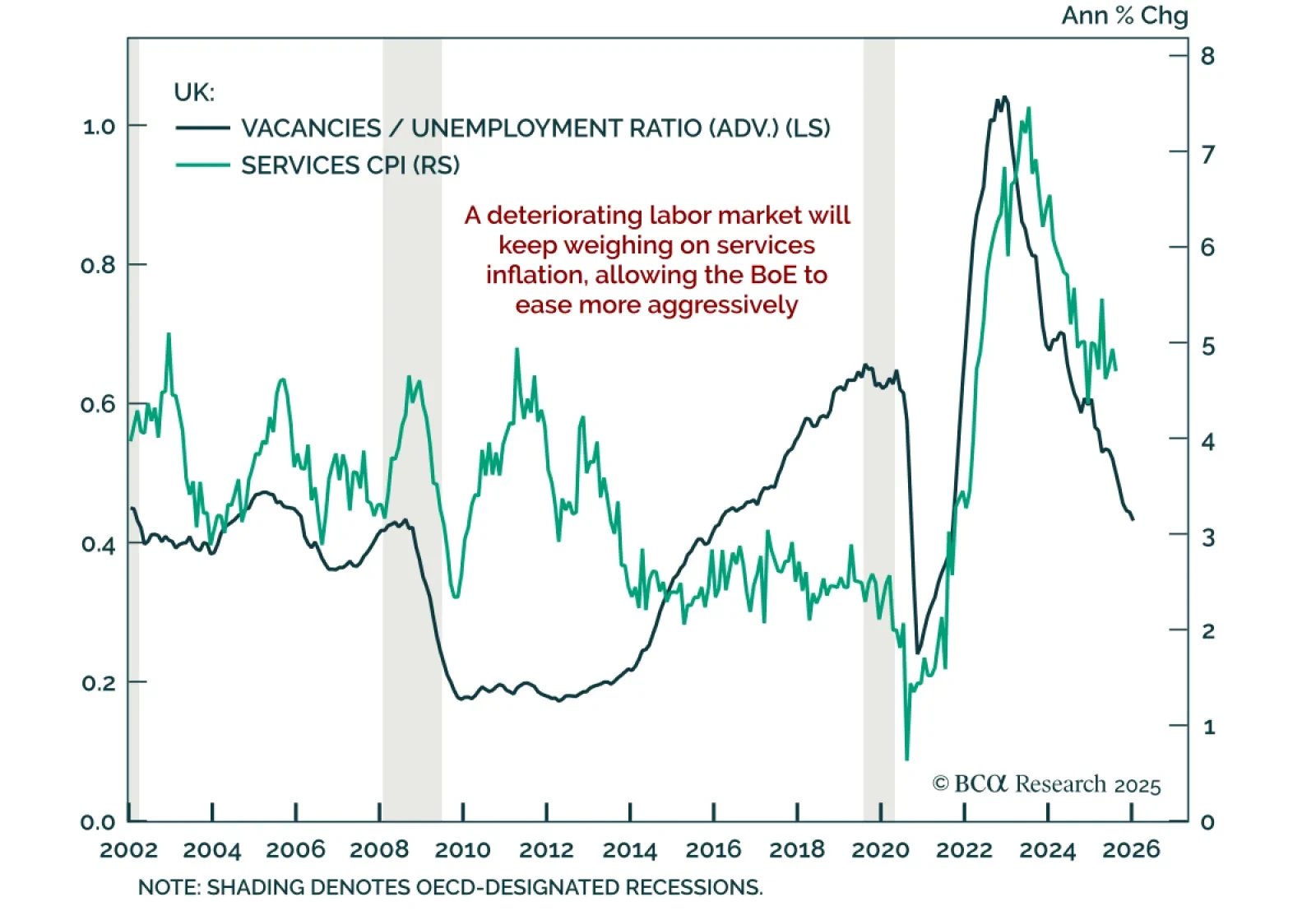

UK labor data weakened in August and September, reinforcing downside inflation risks and supporting overweight Gilts with 2s10s steepeners. Payrolls fell by 10k in September, while job vacancies continued to slide to cyclical lows as…