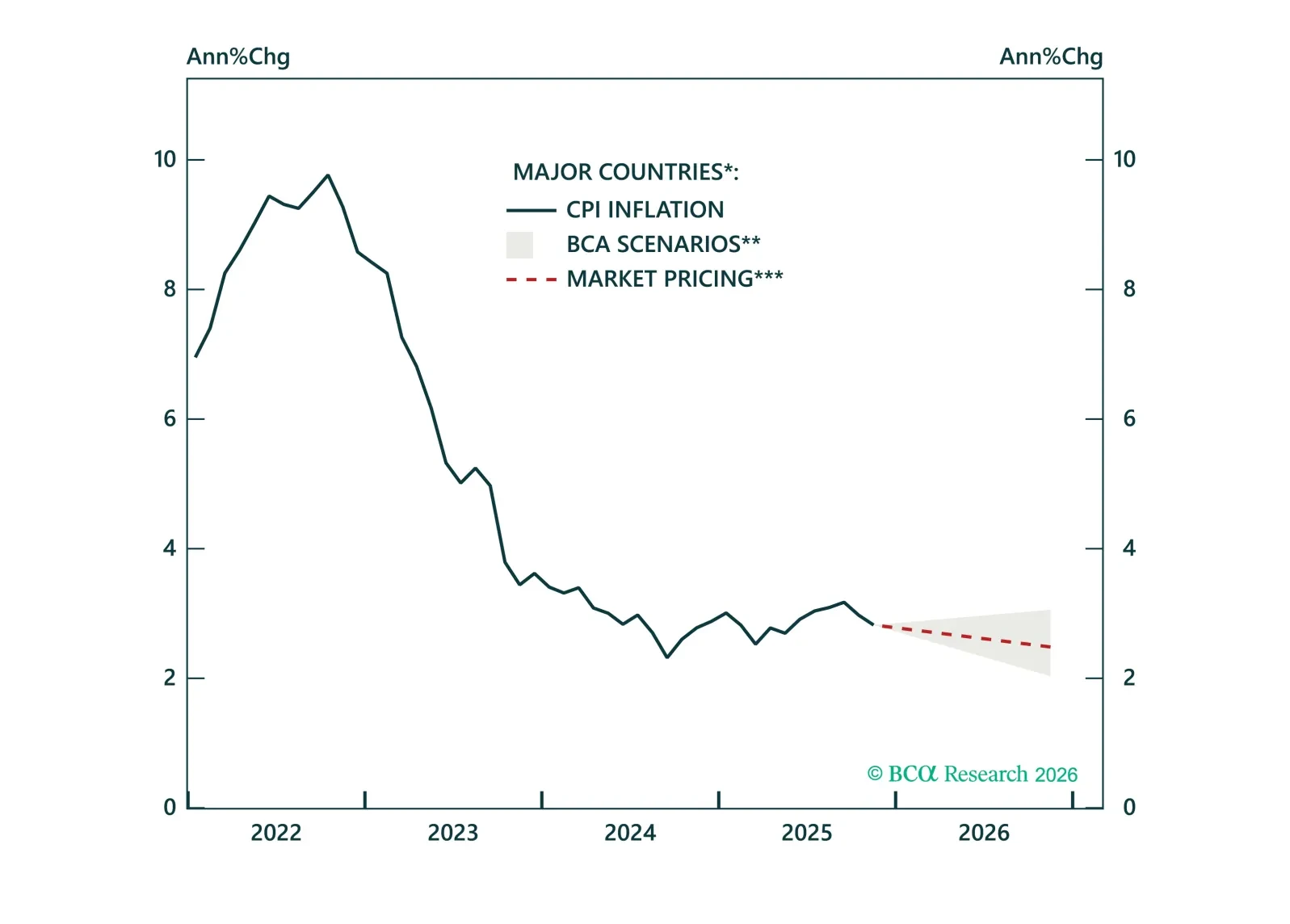

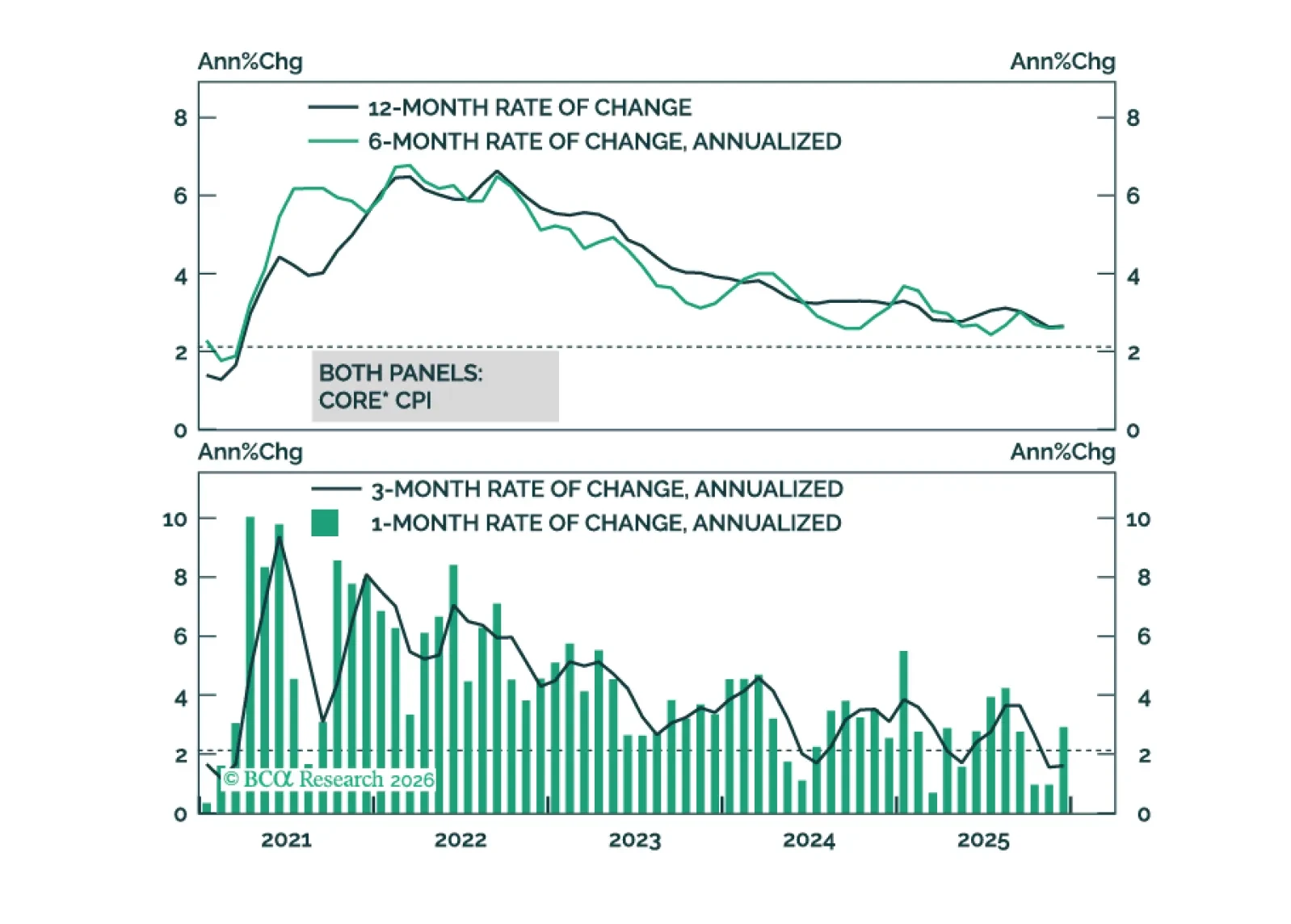

In our 2026 inflation outlook, we explain why 2026 will bring more disinflation, upside risks remain contained, and how to position in ILBs across major markets.

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

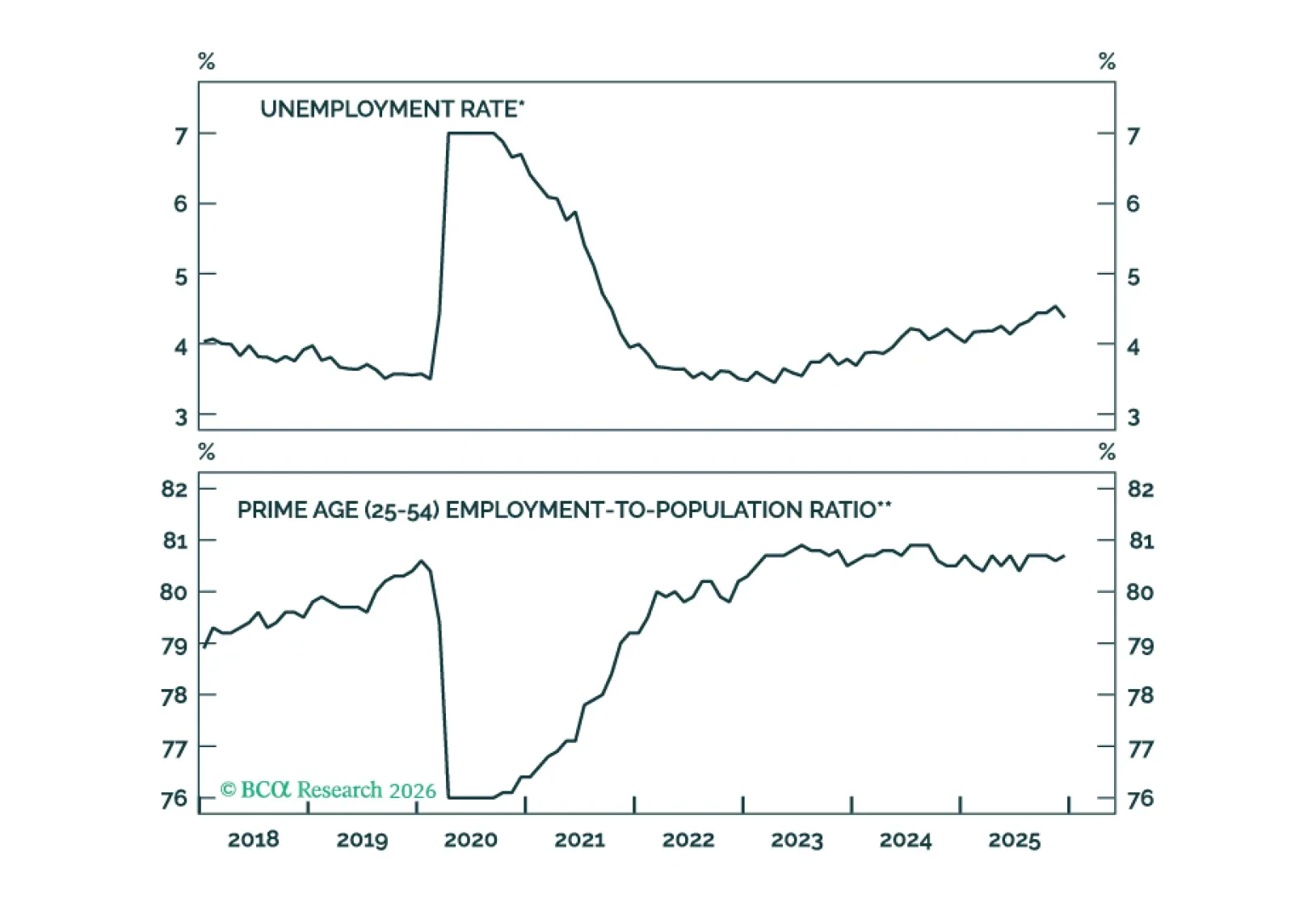

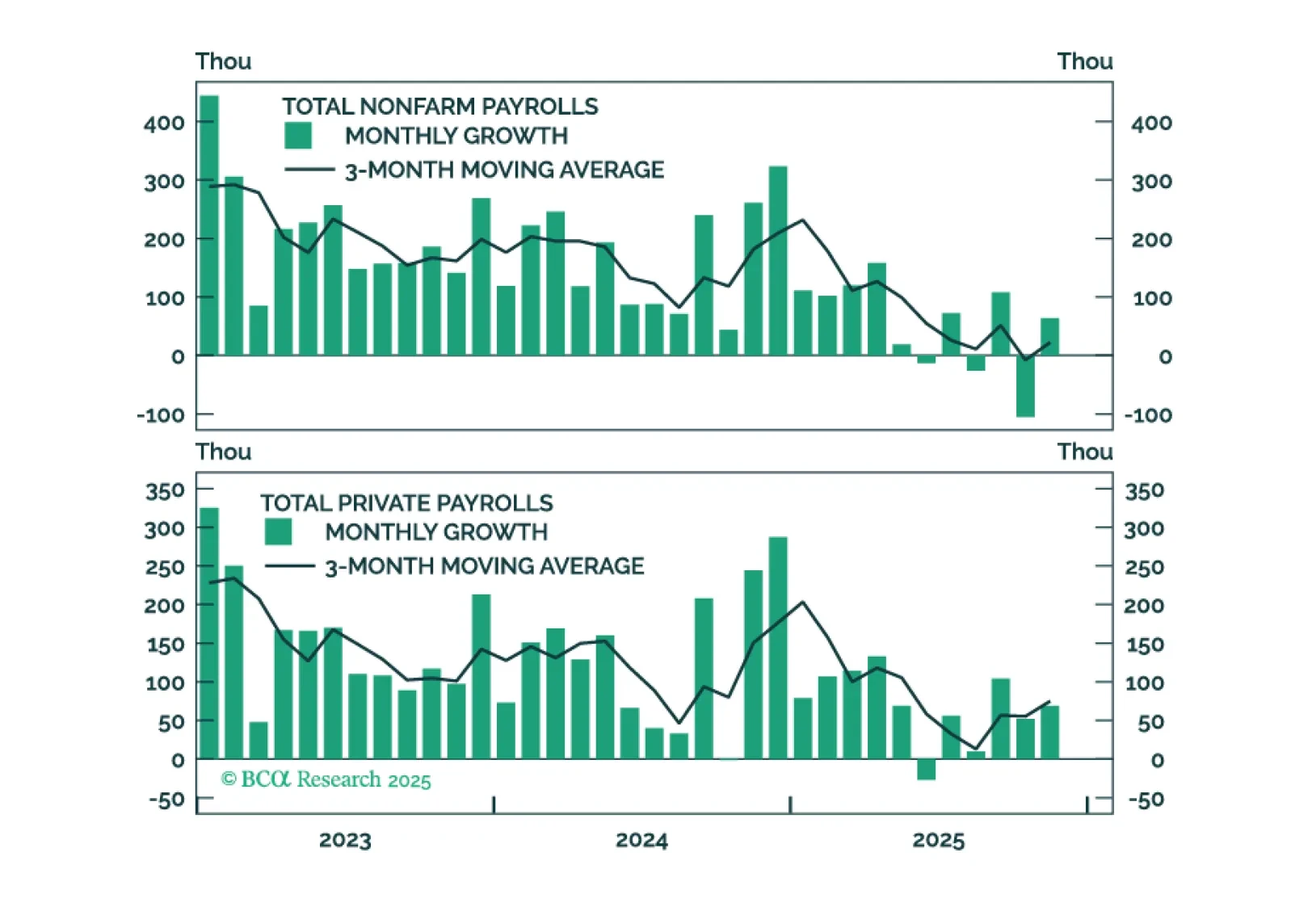

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

Our Portfolio Allocation Summary for January 2026.

Employment Data Point To Dovish Policy Surprises In 2026

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

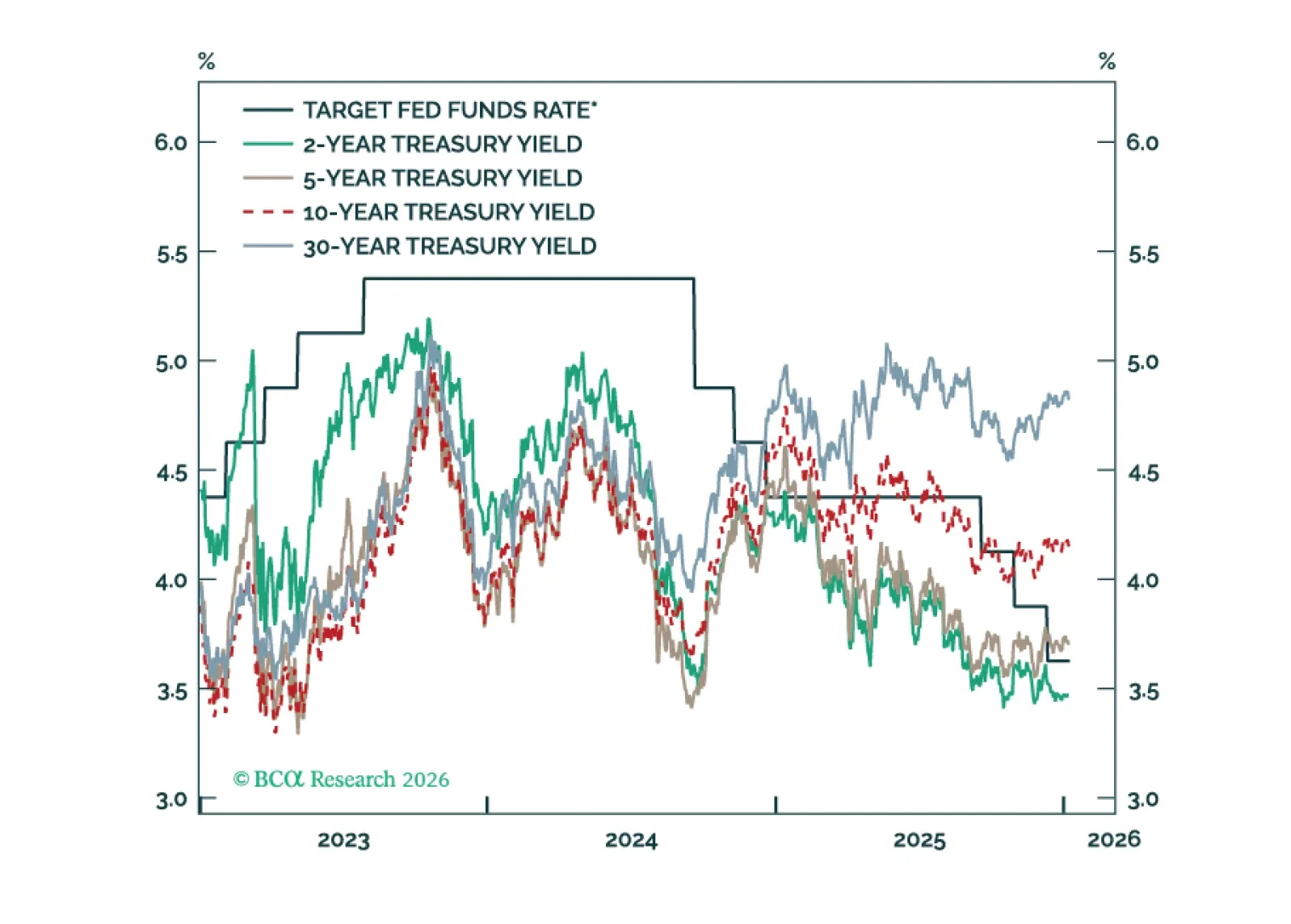

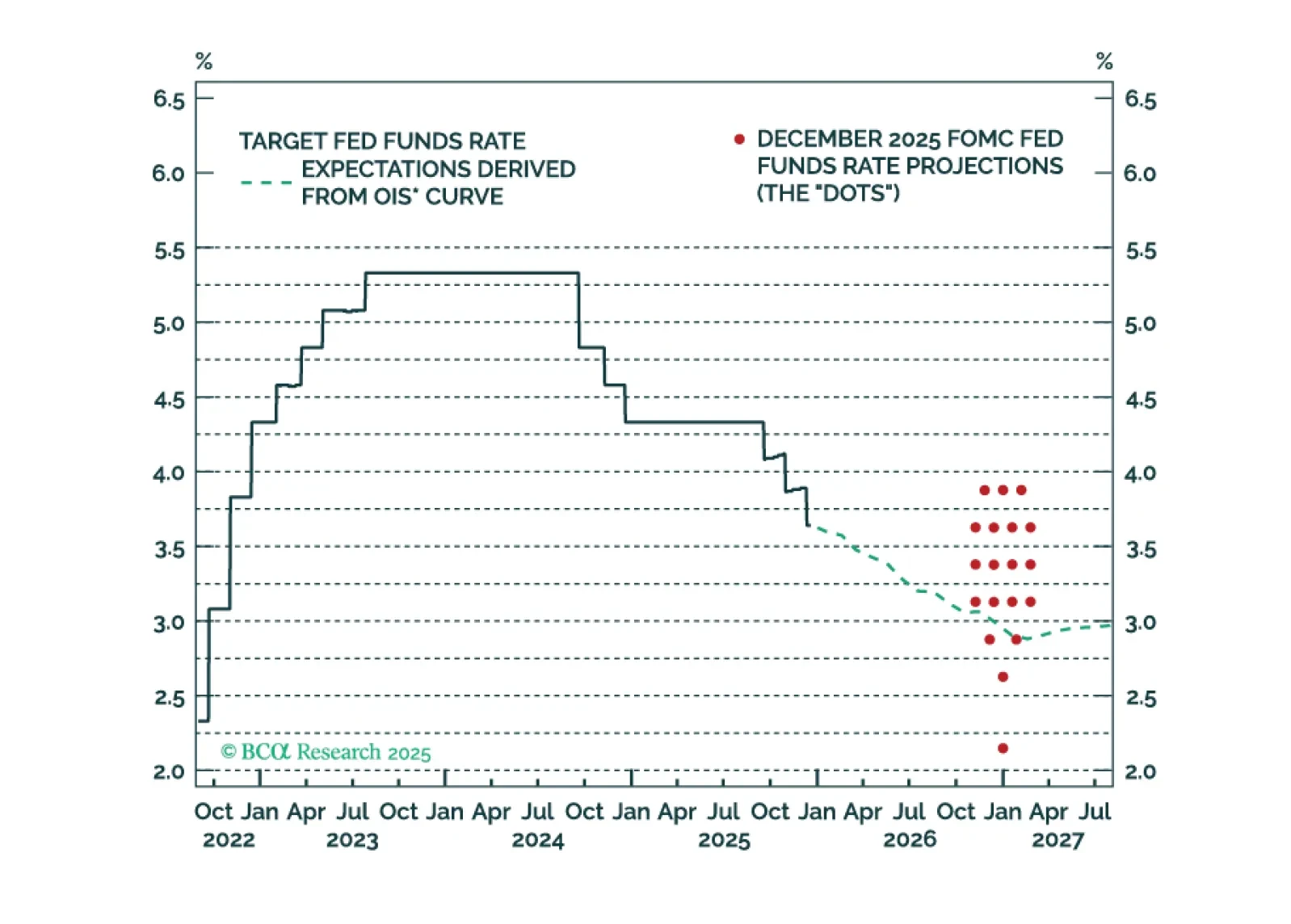

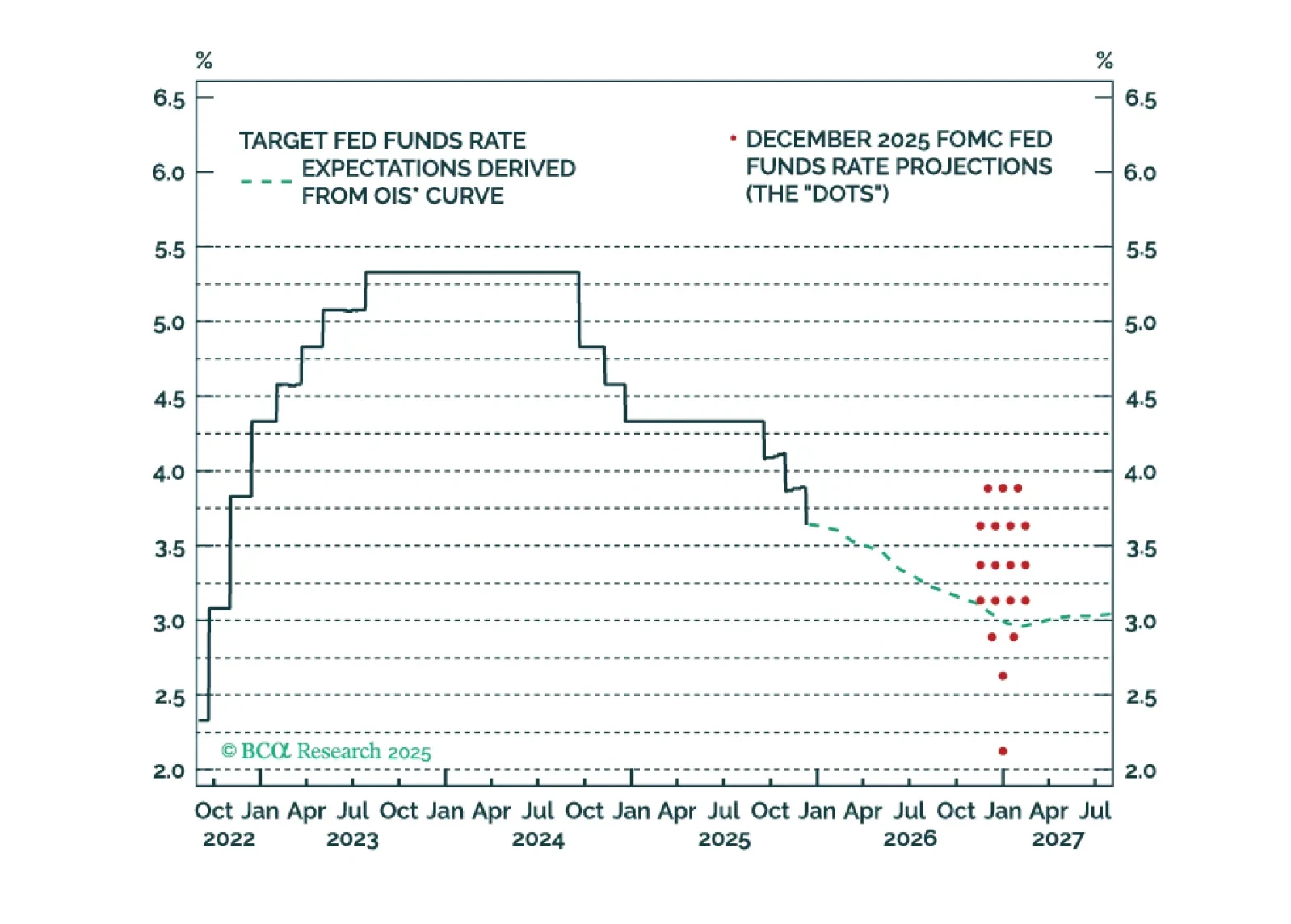

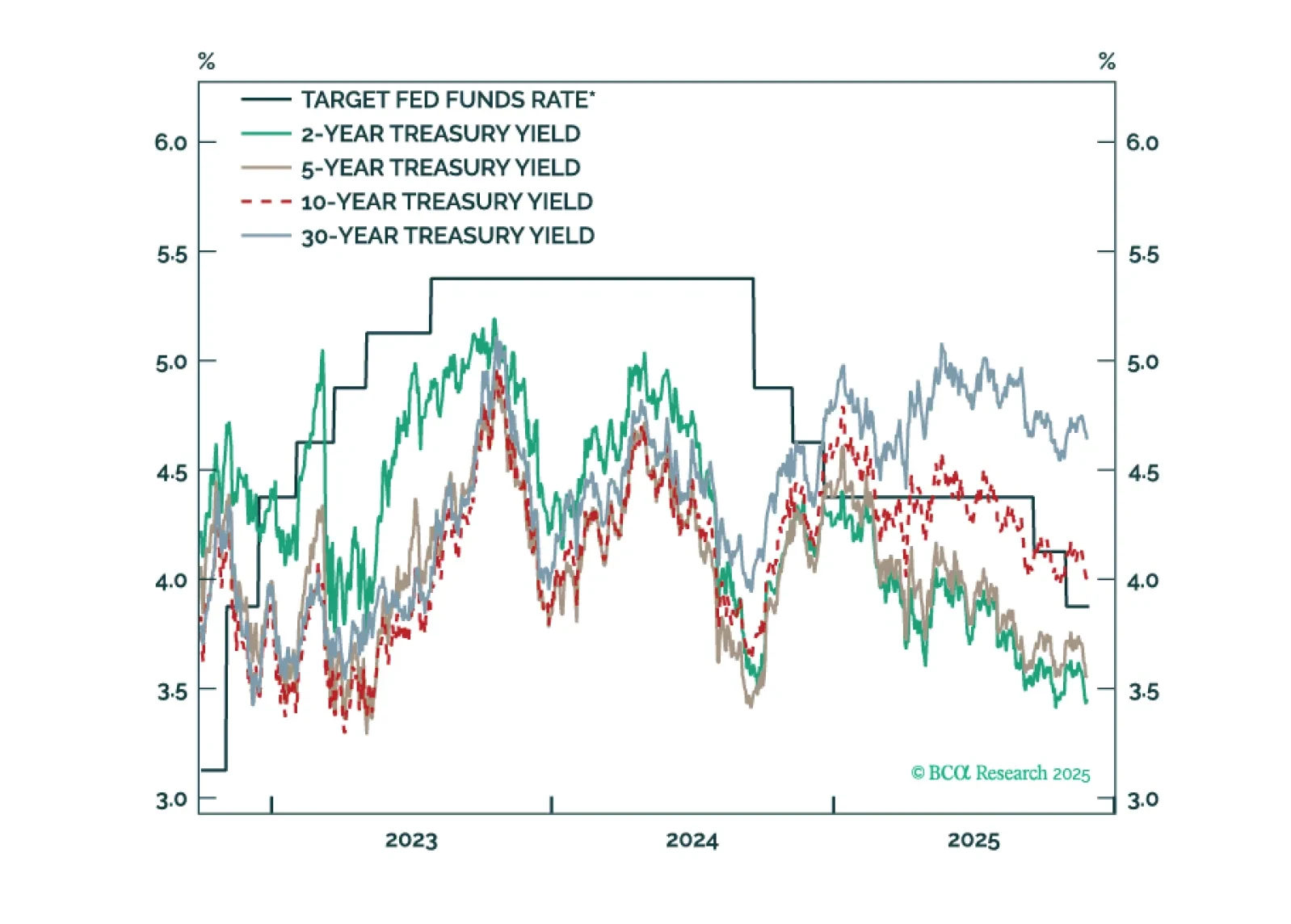

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

Our Portfolio Allocation Summary for December 2025.