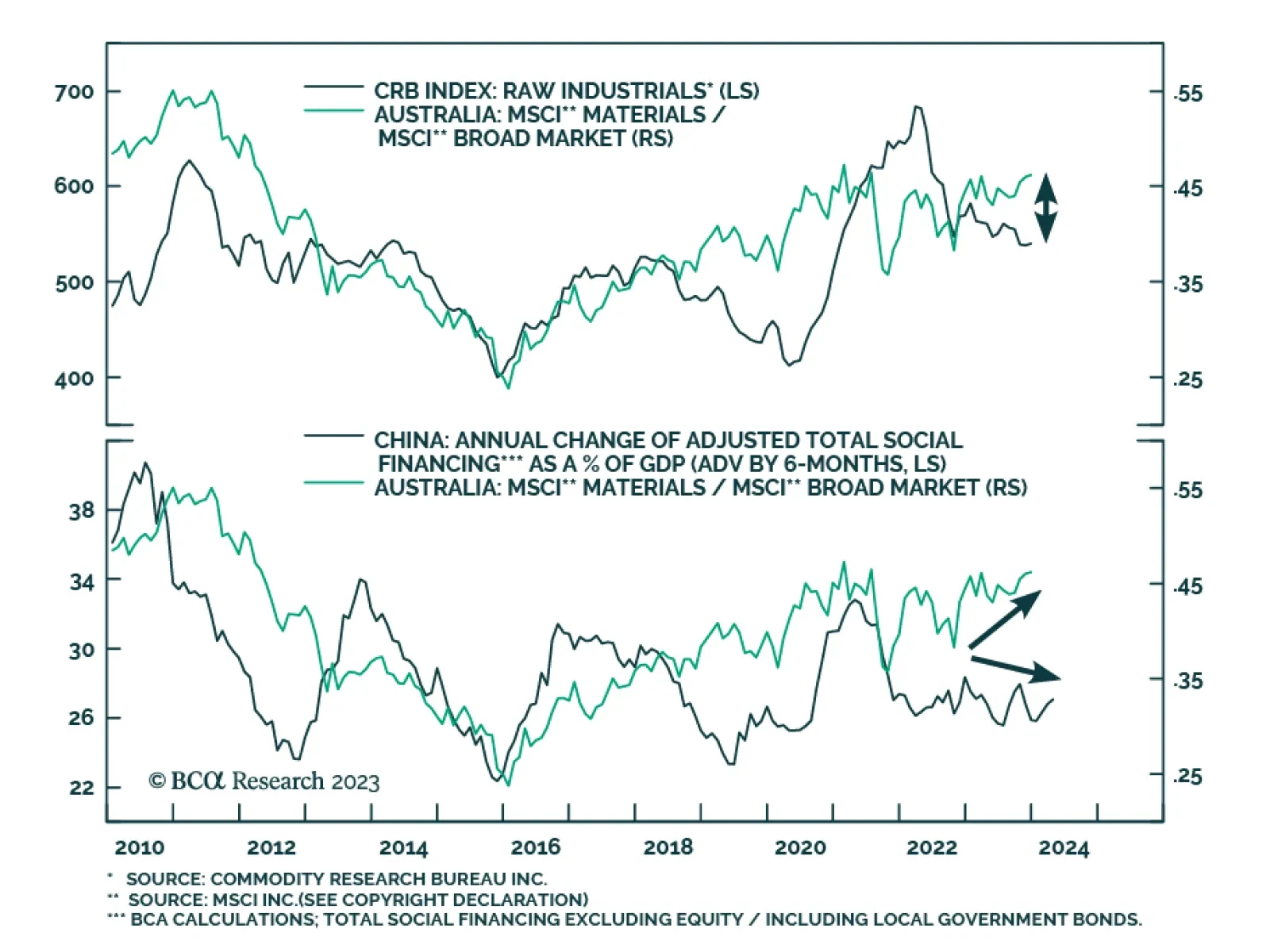

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

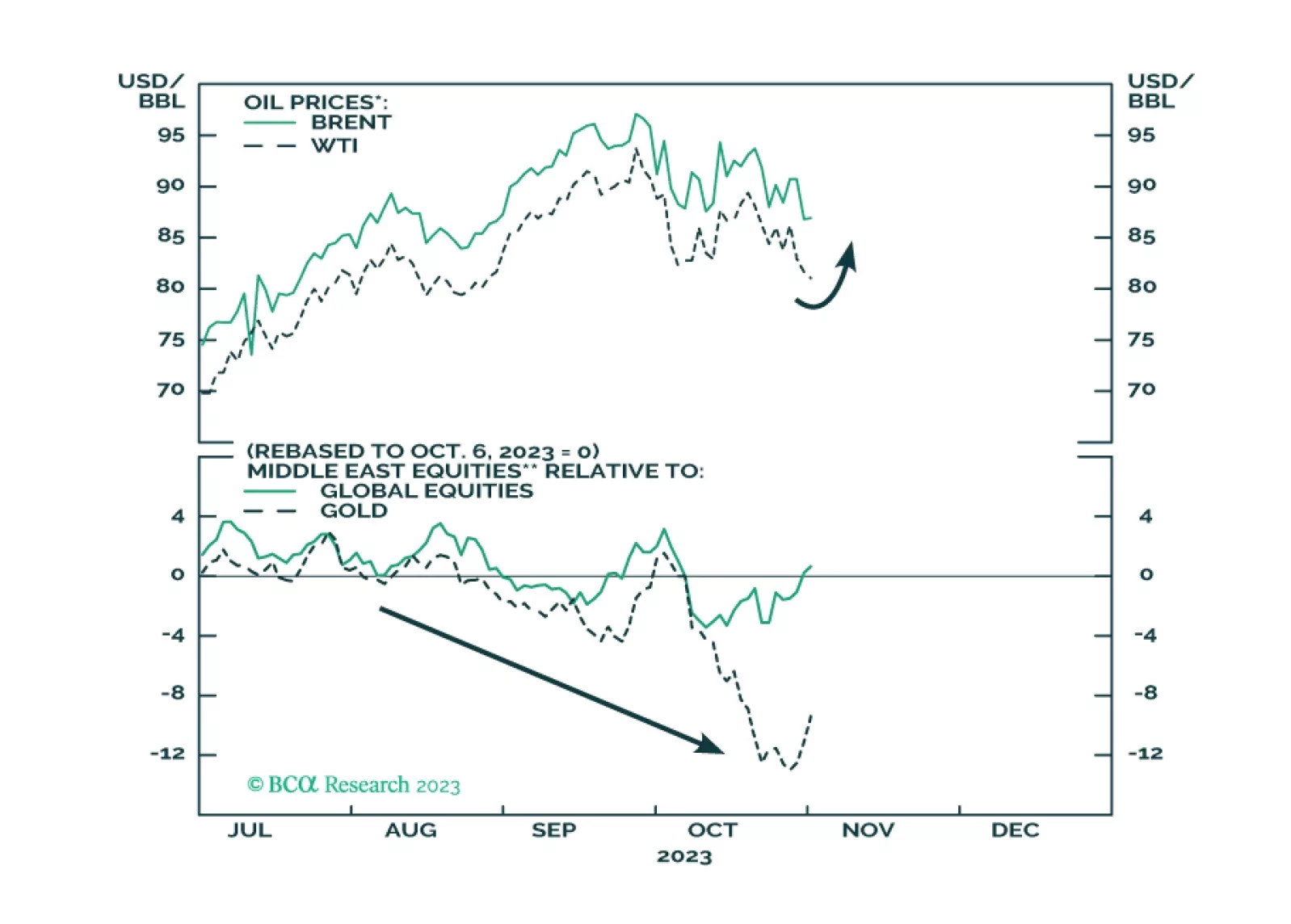

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

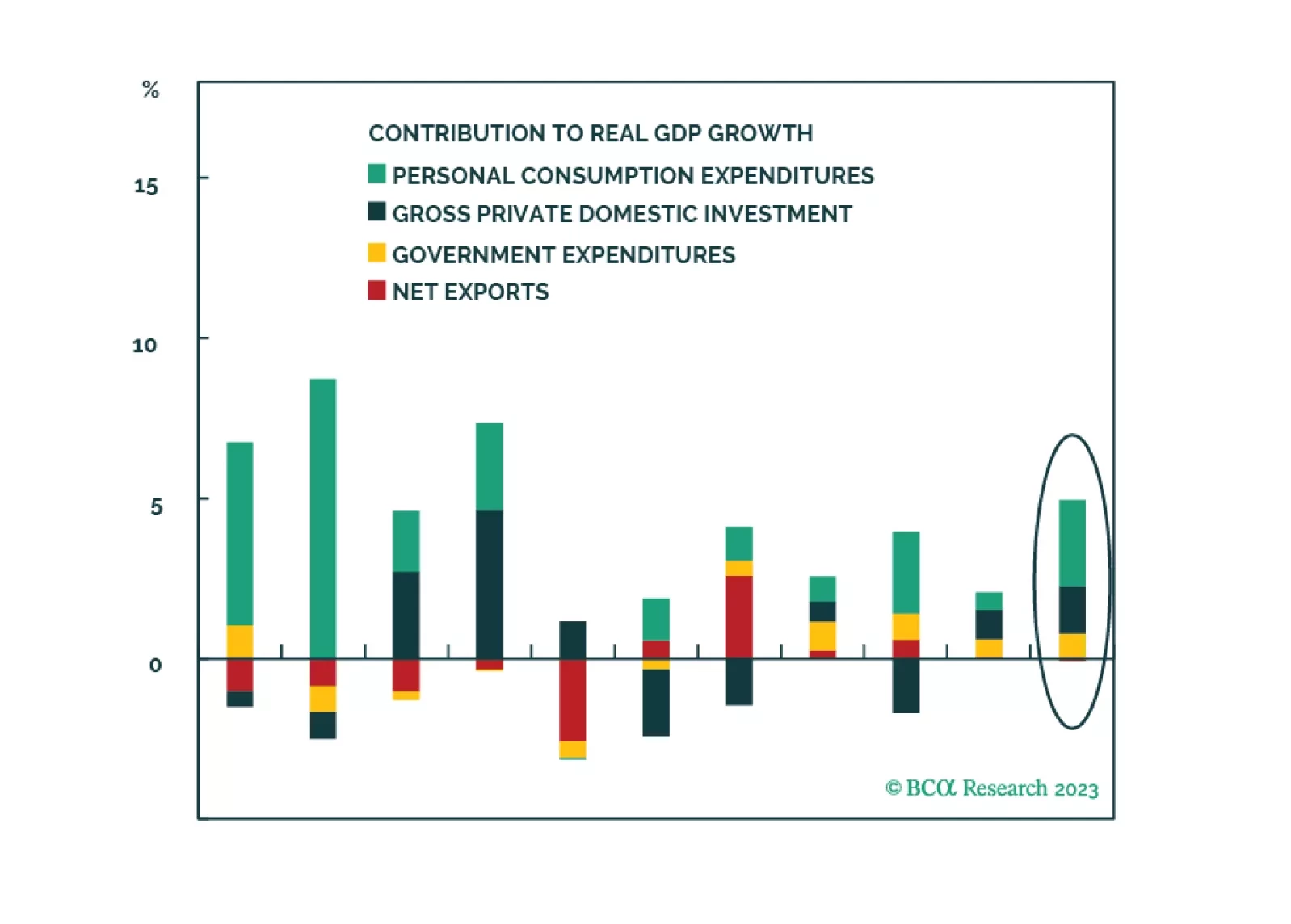

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

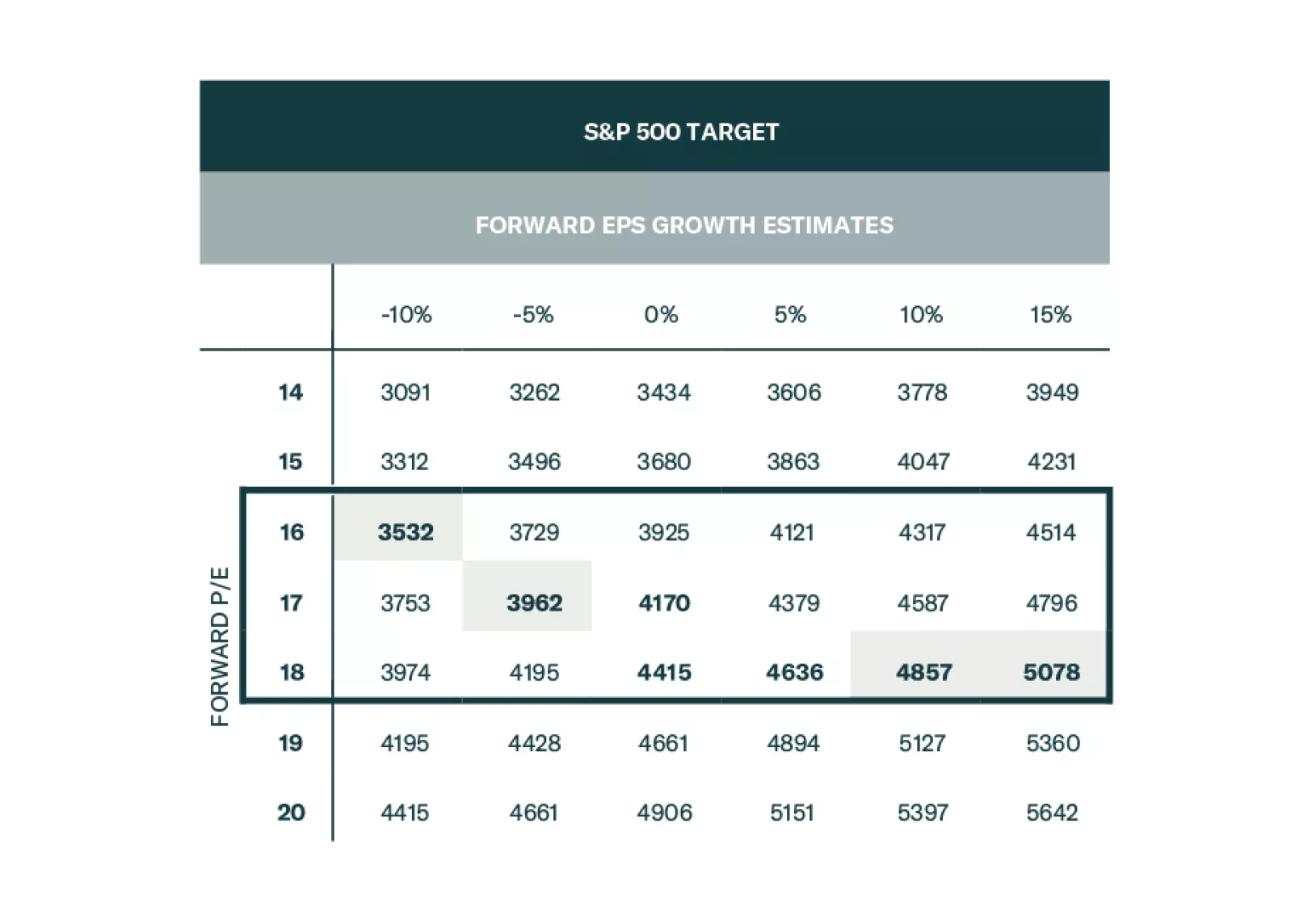

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

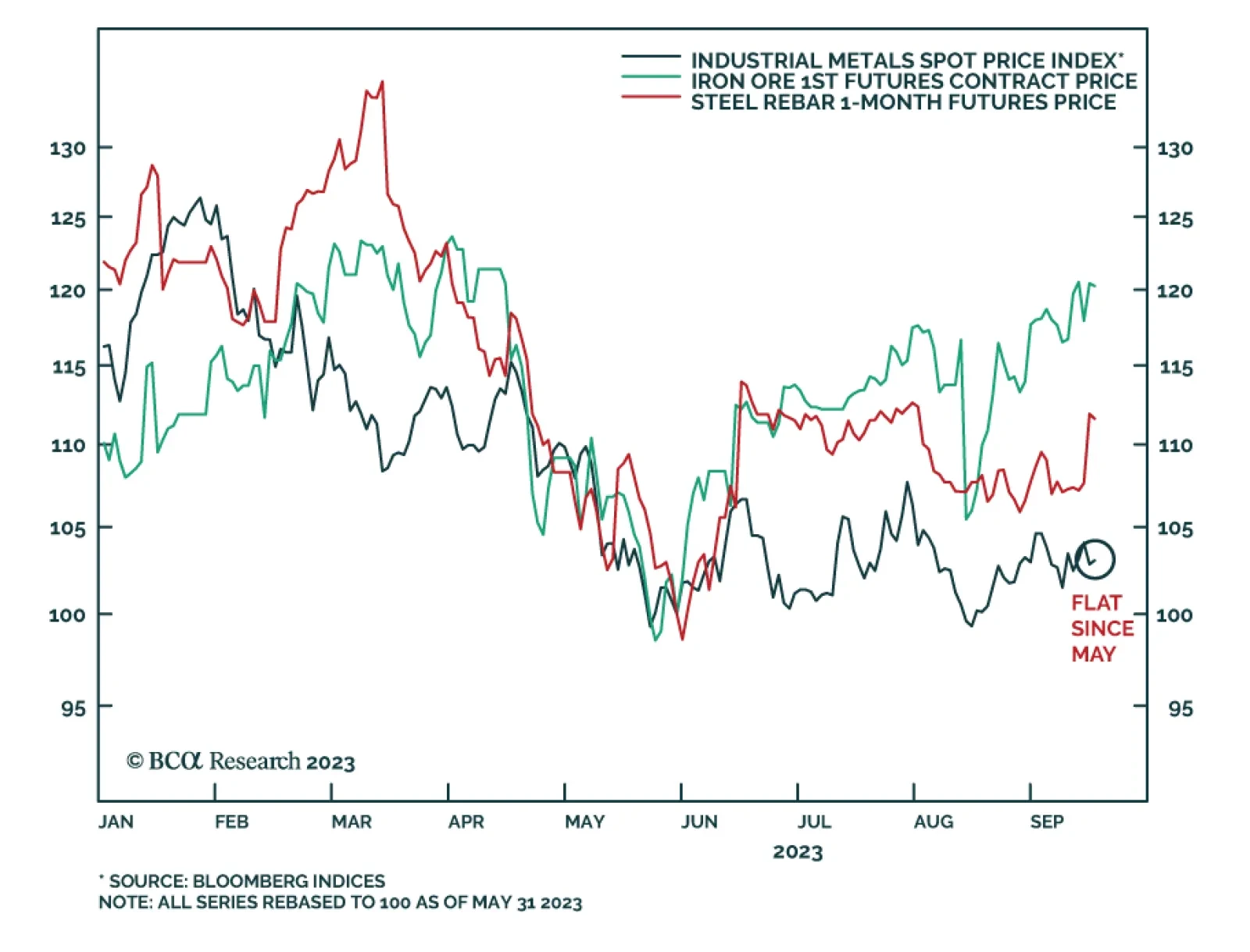

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…