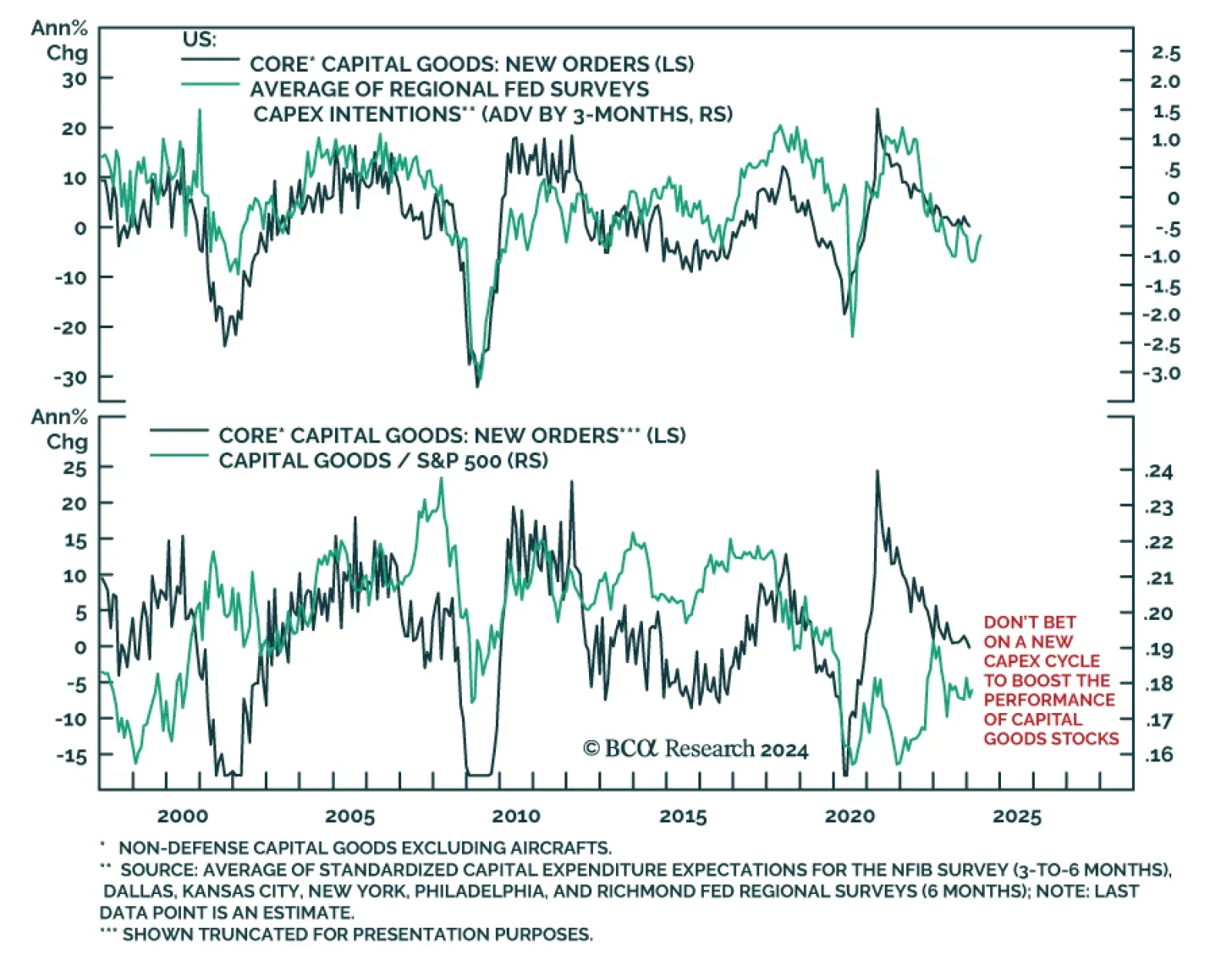

On the surface, the US durable goods report delivered a negative surprise on Tuesday. The 6.1% m/m drop in new orders in January fell below expectations and the December figure was revised down to 0.3% m/m from 0.0% m/m.…

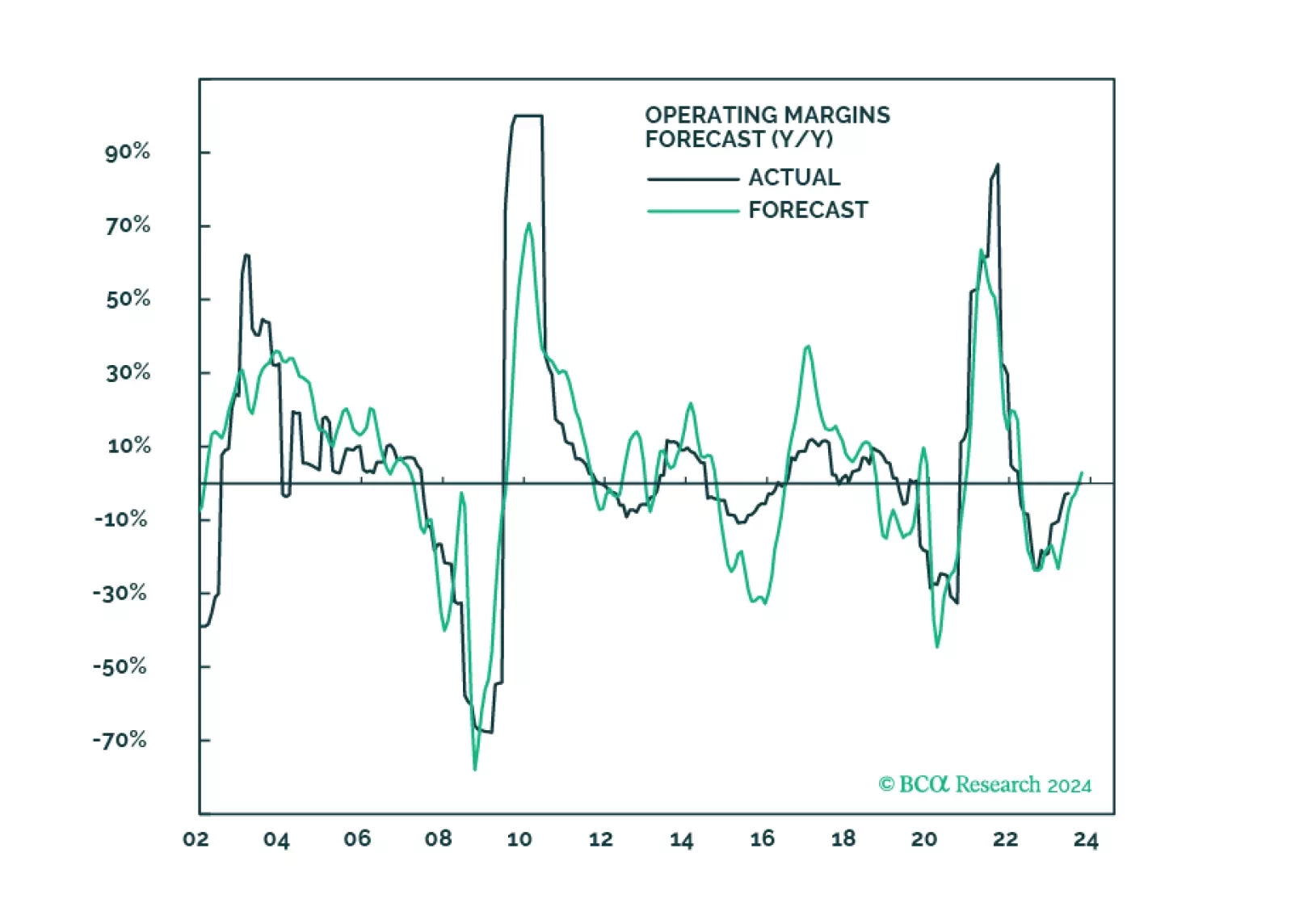

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

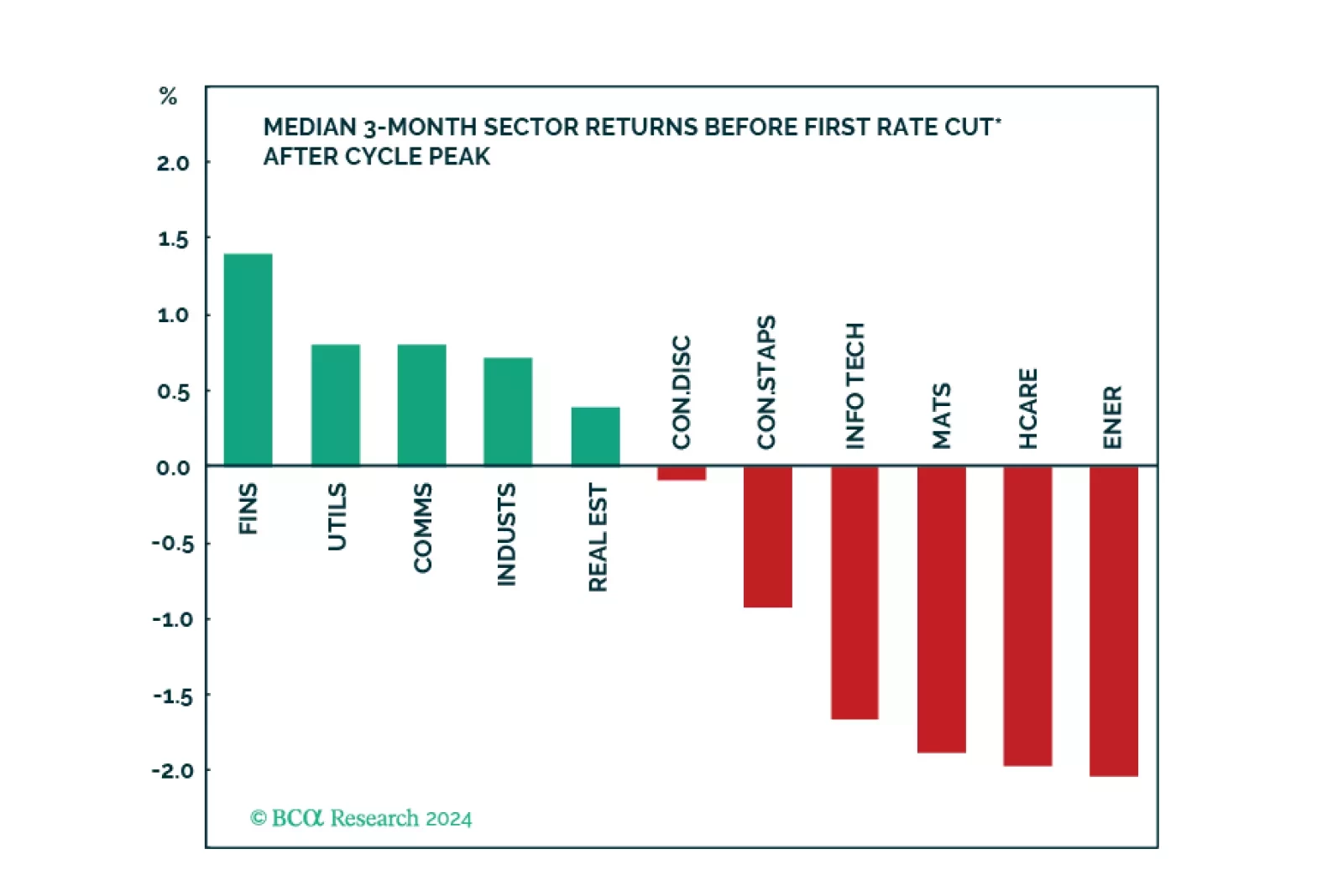

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

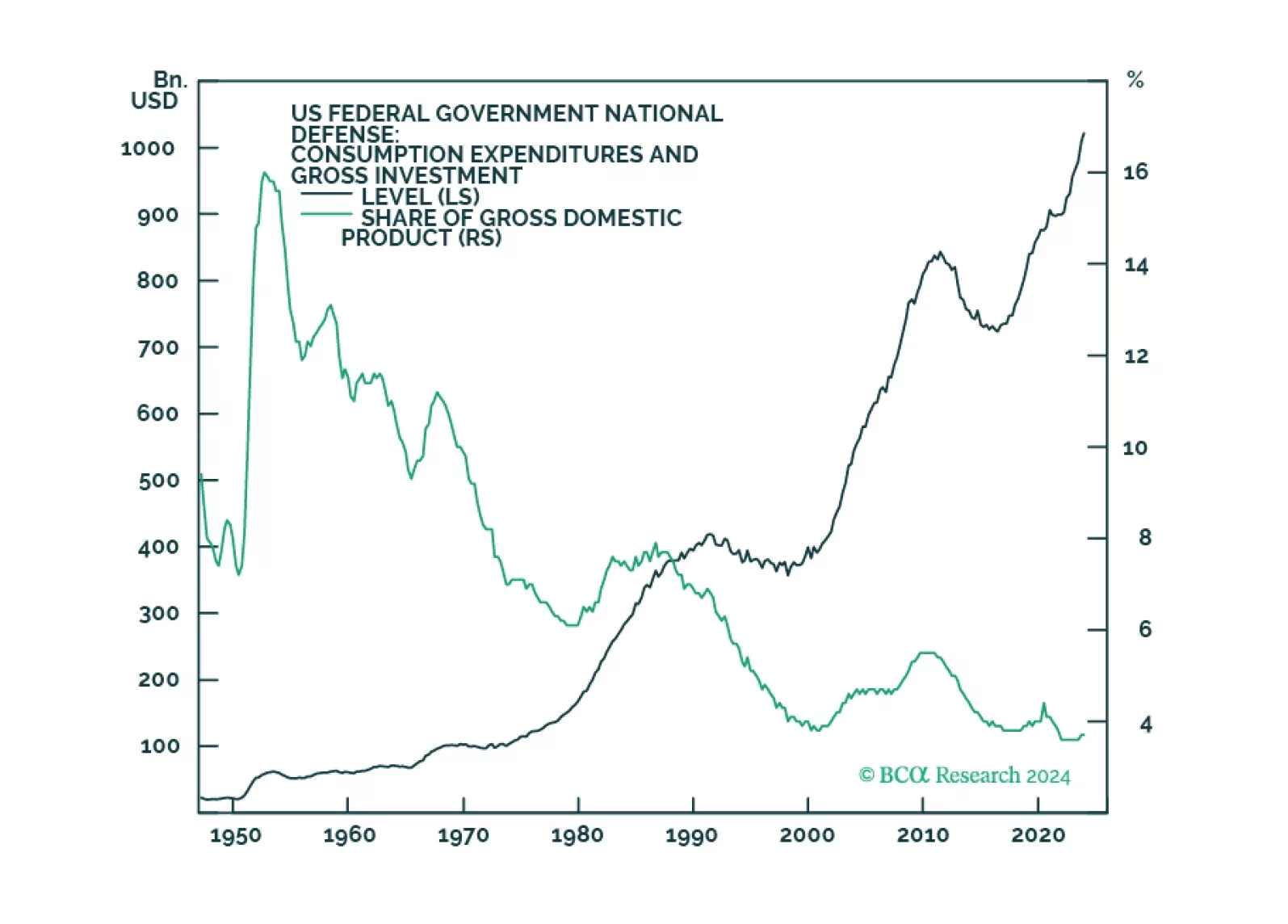

The US DoD rolled out its first-ever industrial policy designed to reverse decades of atrophy in its military-industrial complex. This left the US with diminished access to CMM commodities and supply chains, which are now dominated…

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

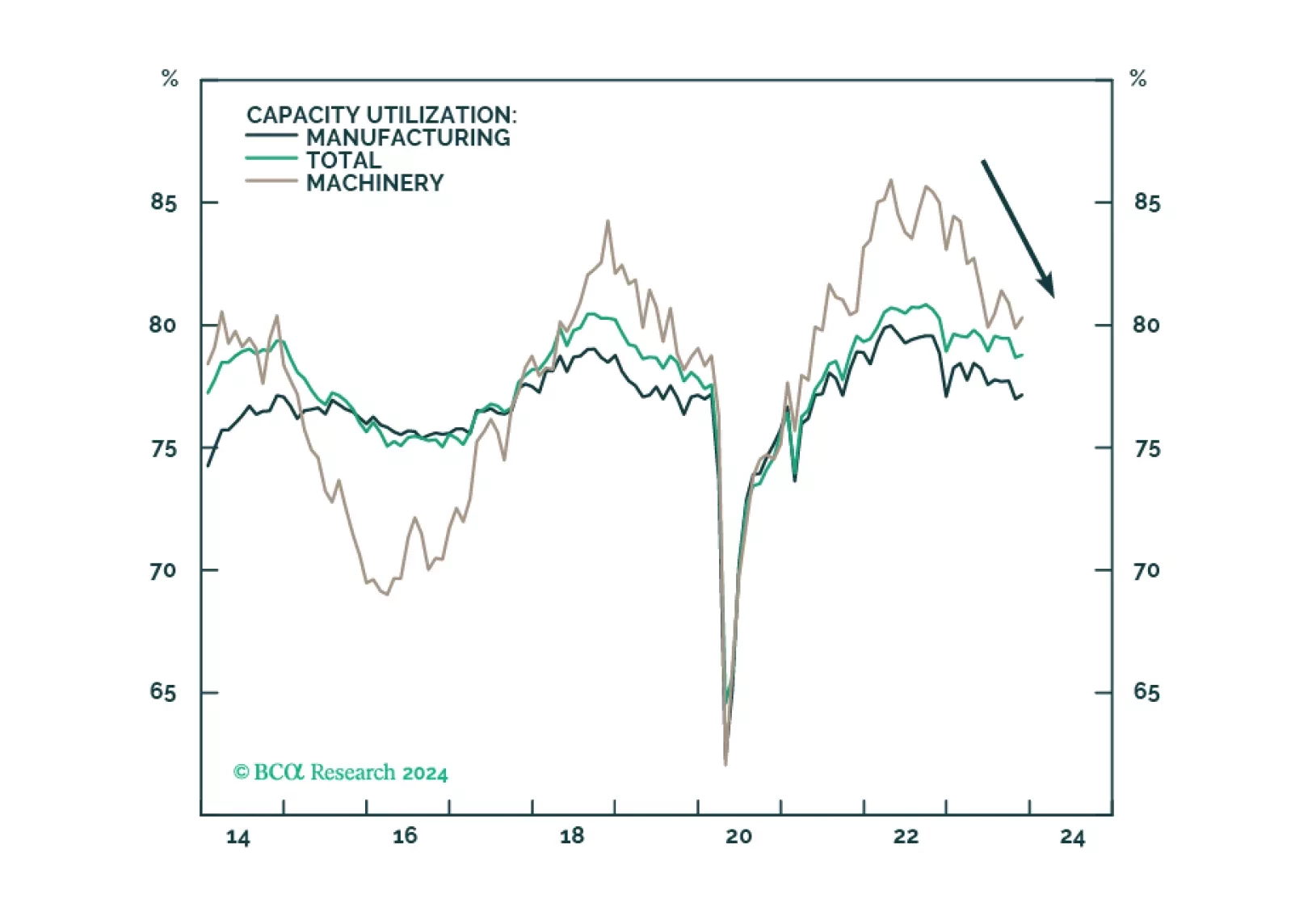

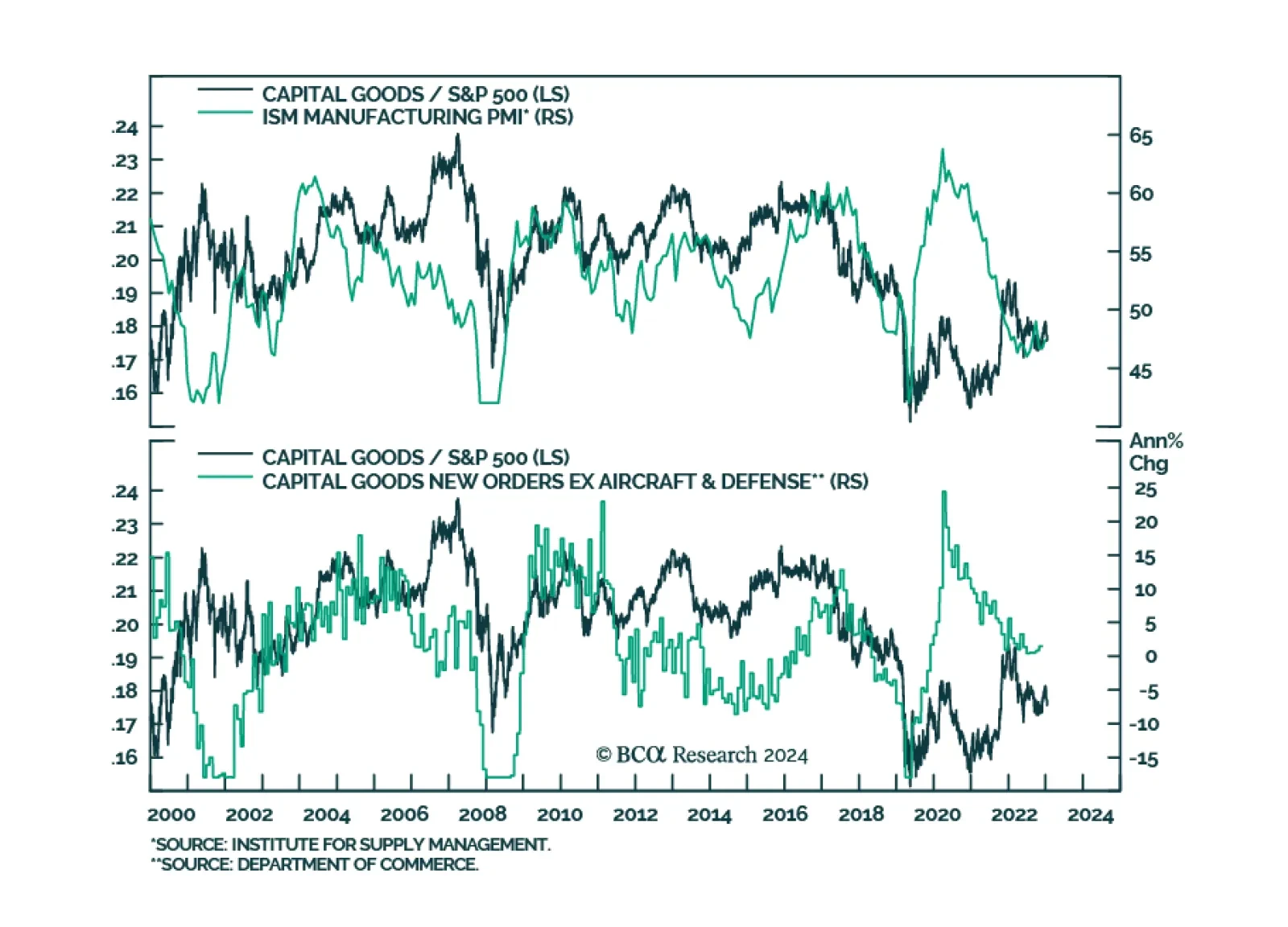

The performance of the Industrials sector tends to lag the business cycle, as companies invest in capex on the heels of economic expansion. But demand is not entirely cyclical, as the need to replace obsolete or aging equipment…

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

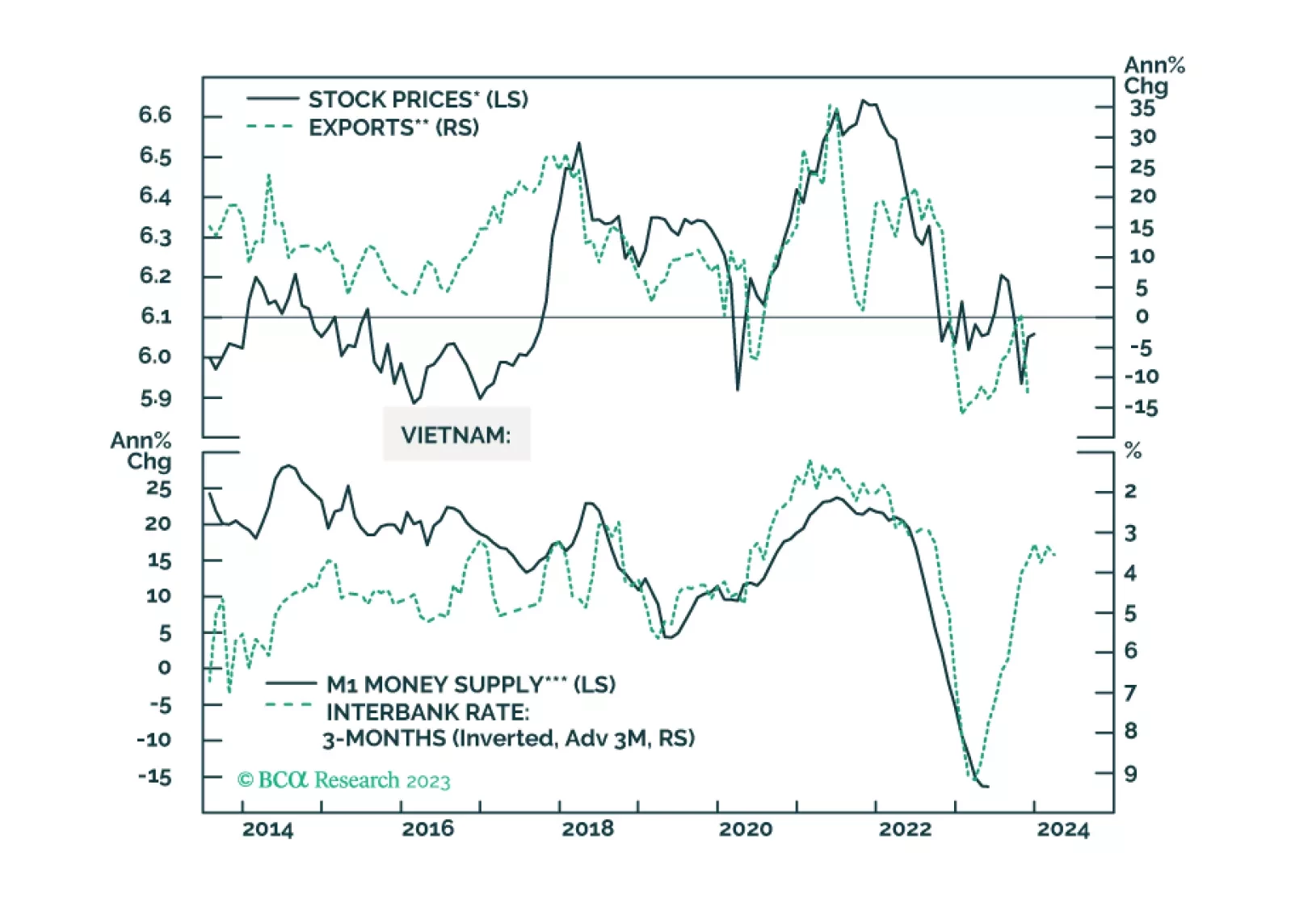

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.