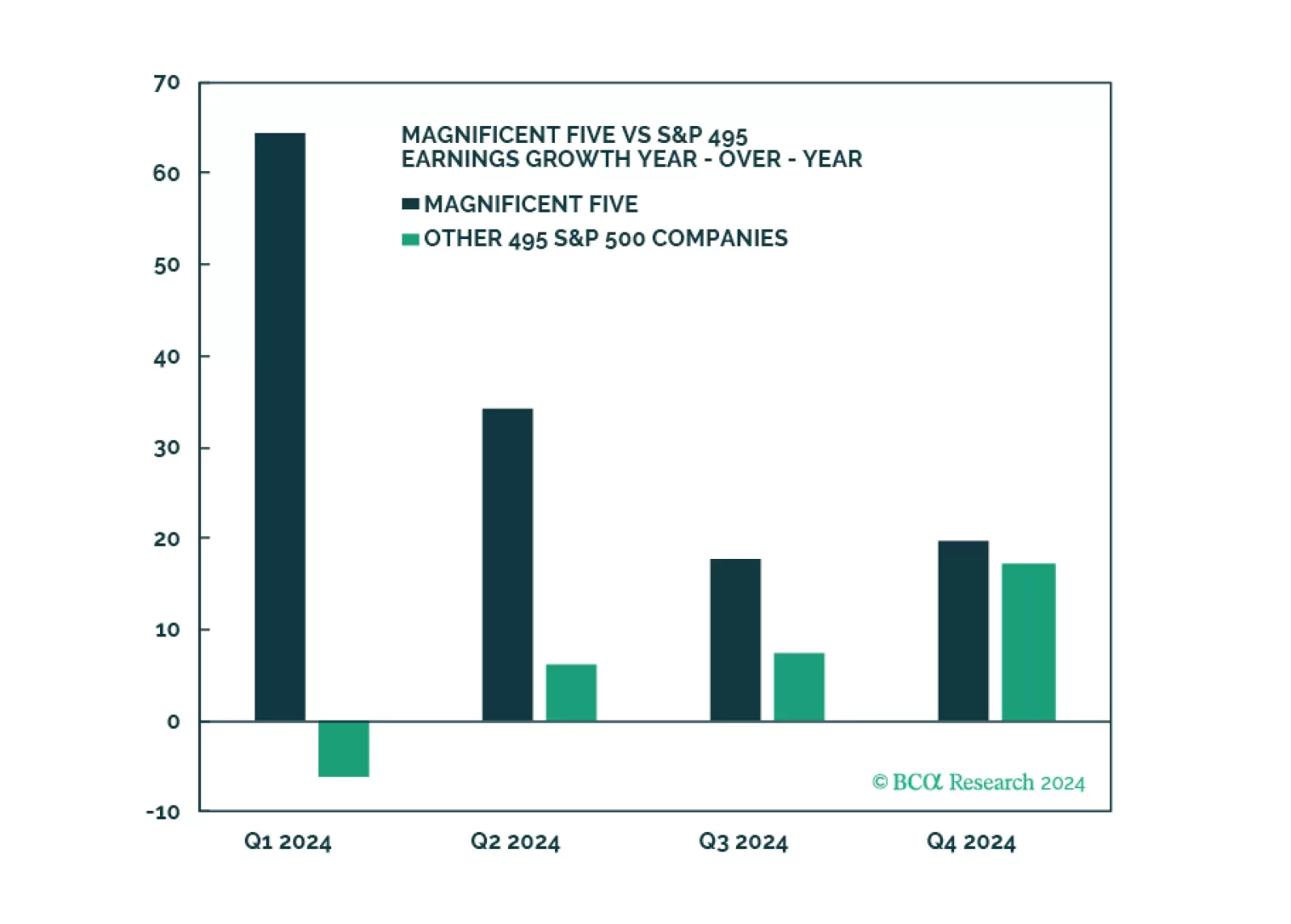

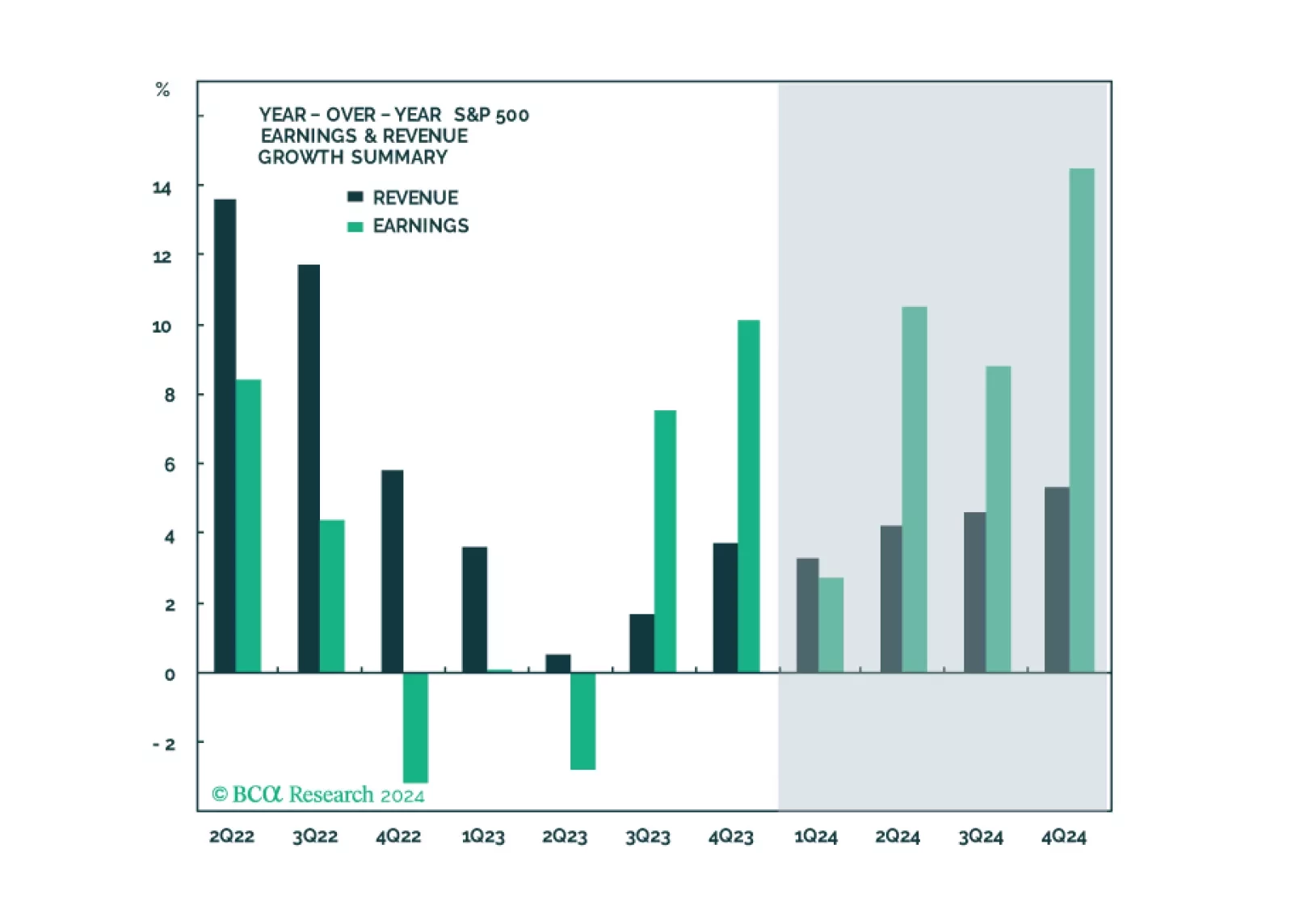

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

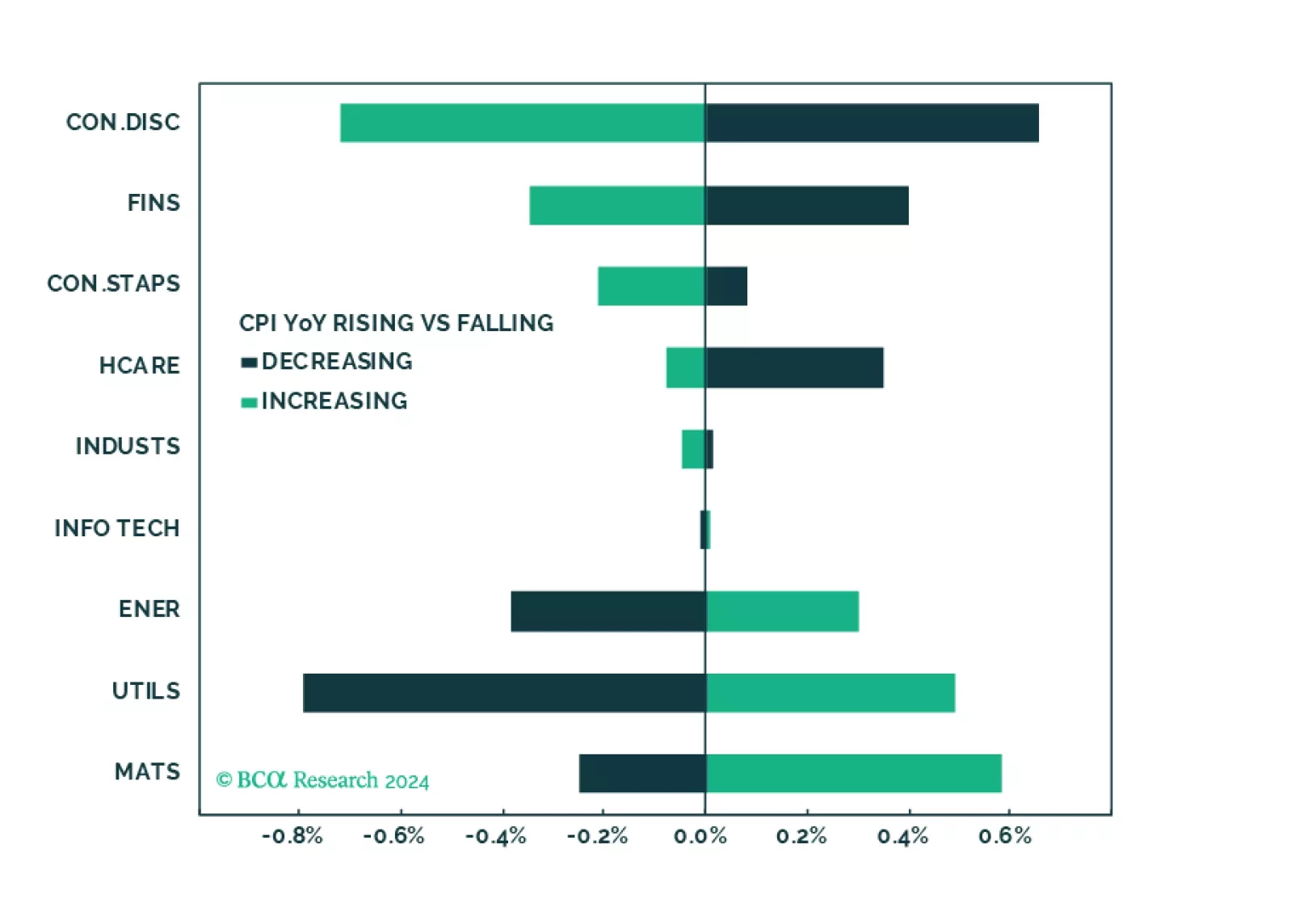

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

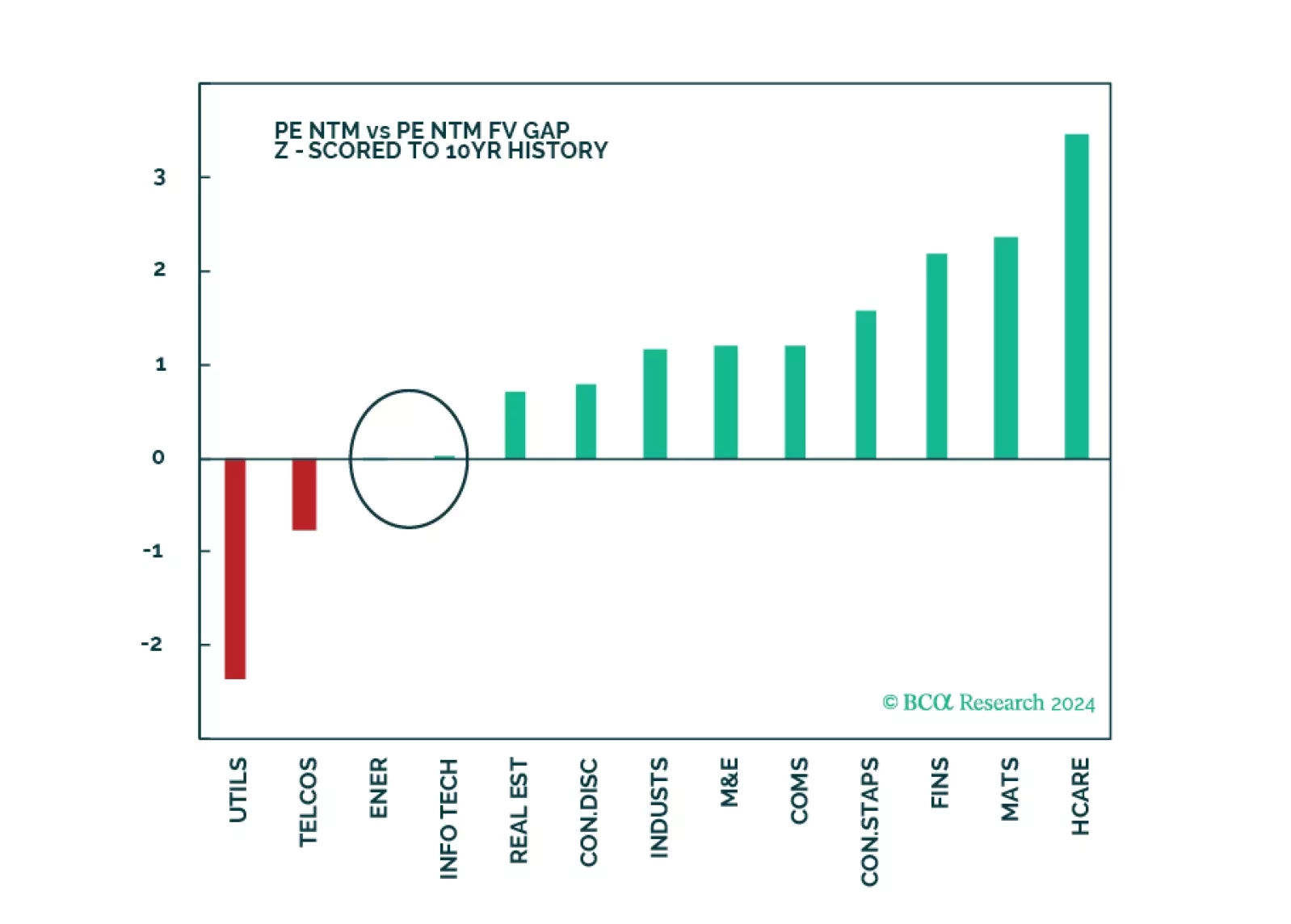

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

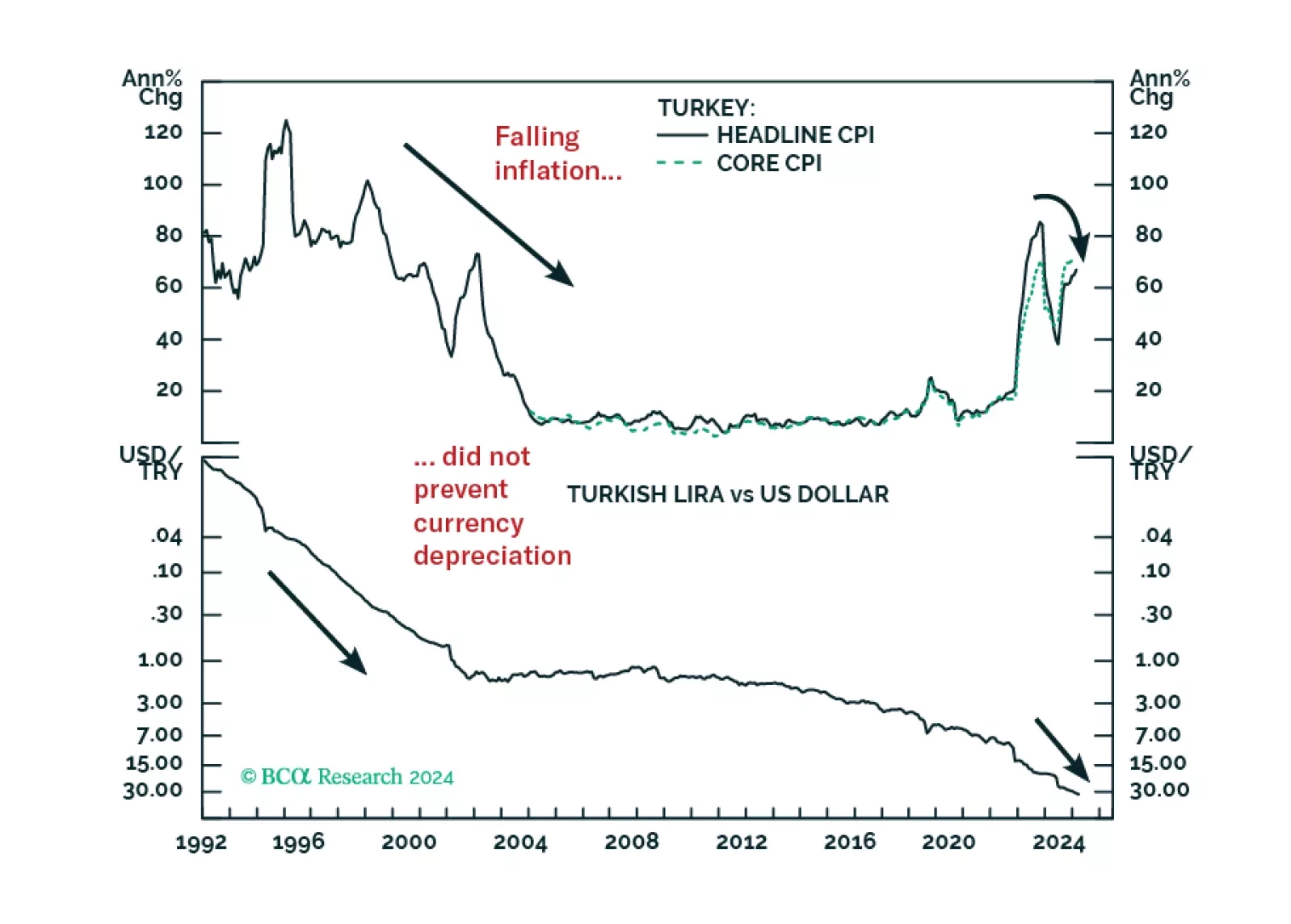

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

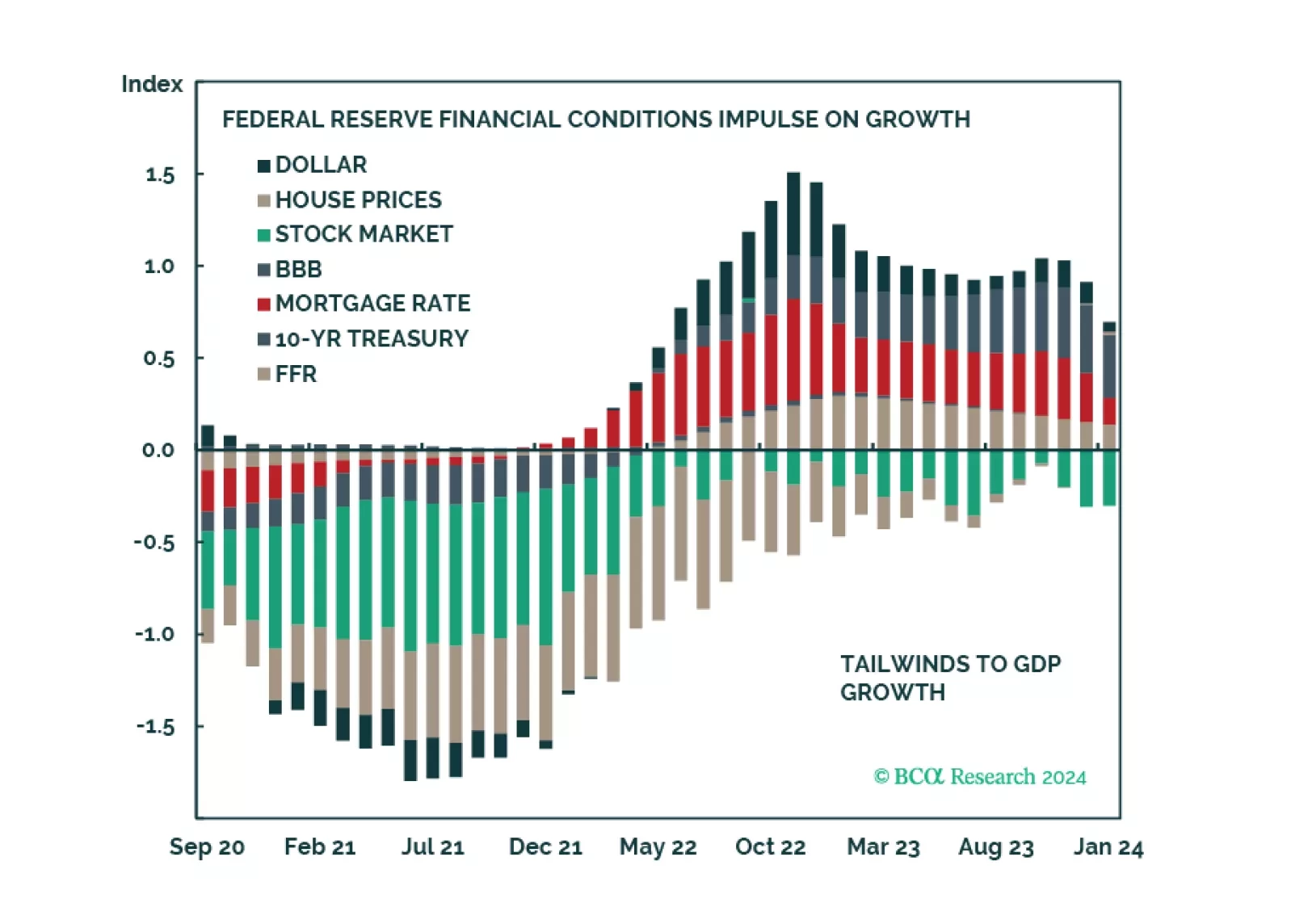

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

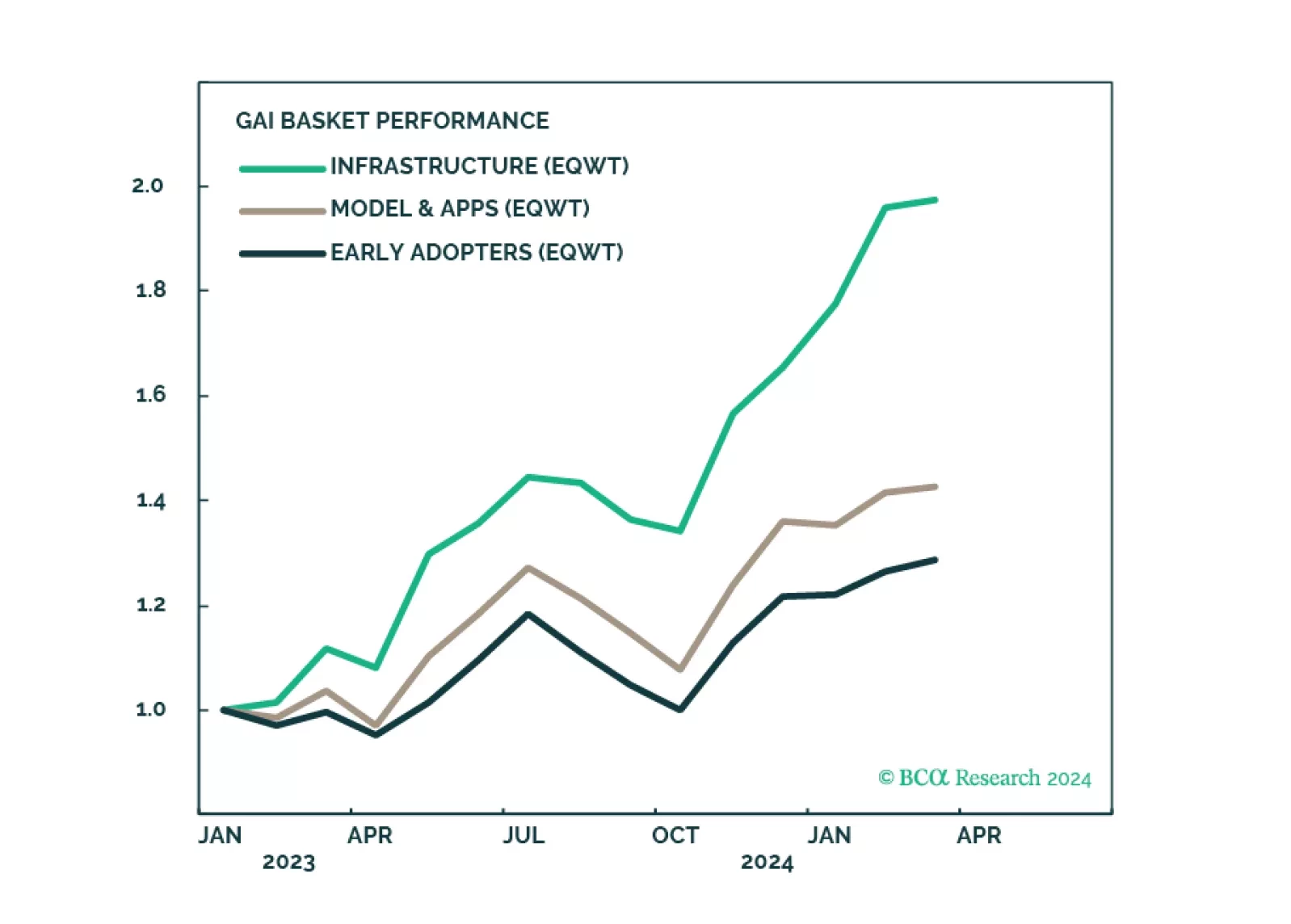

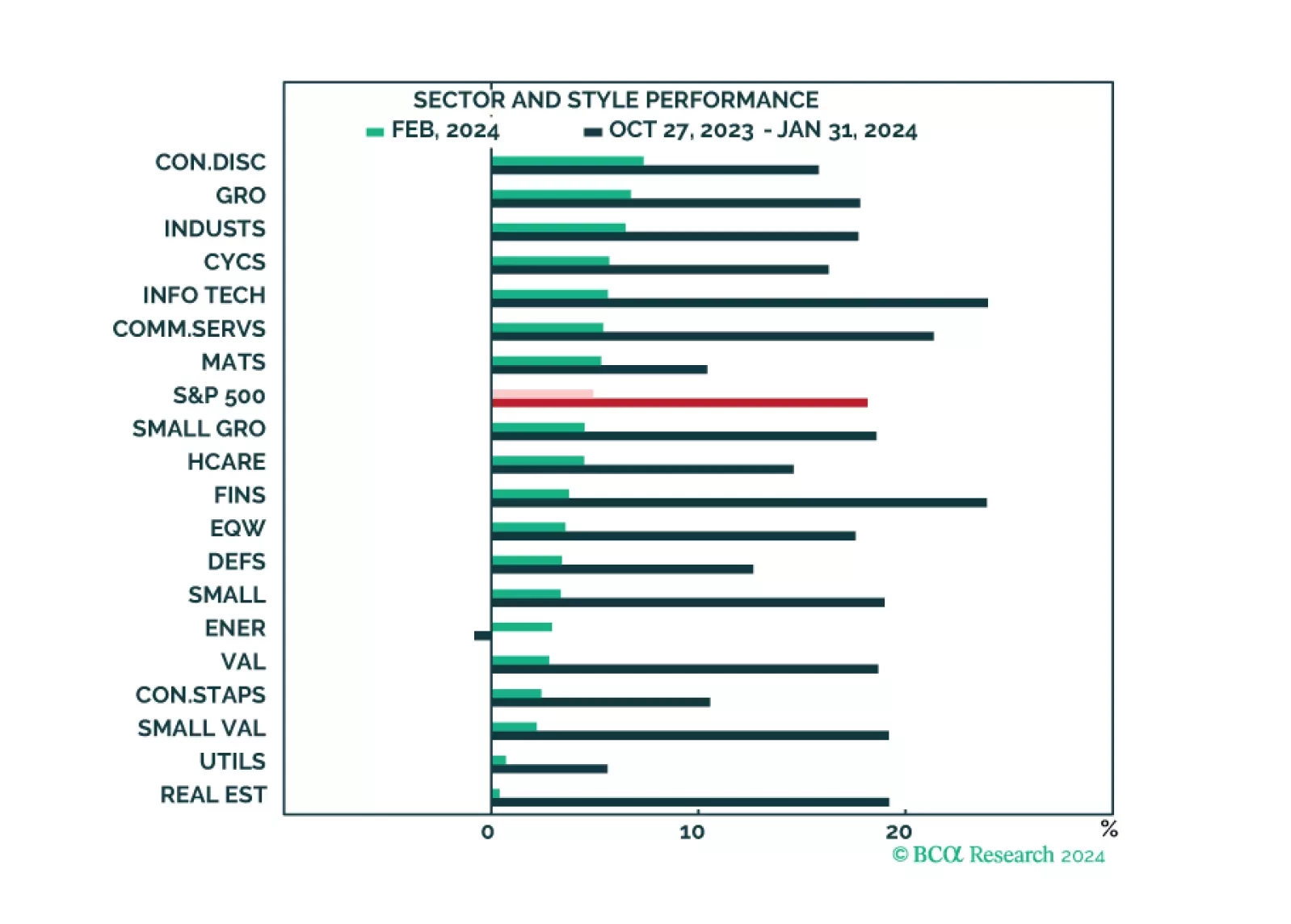

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…