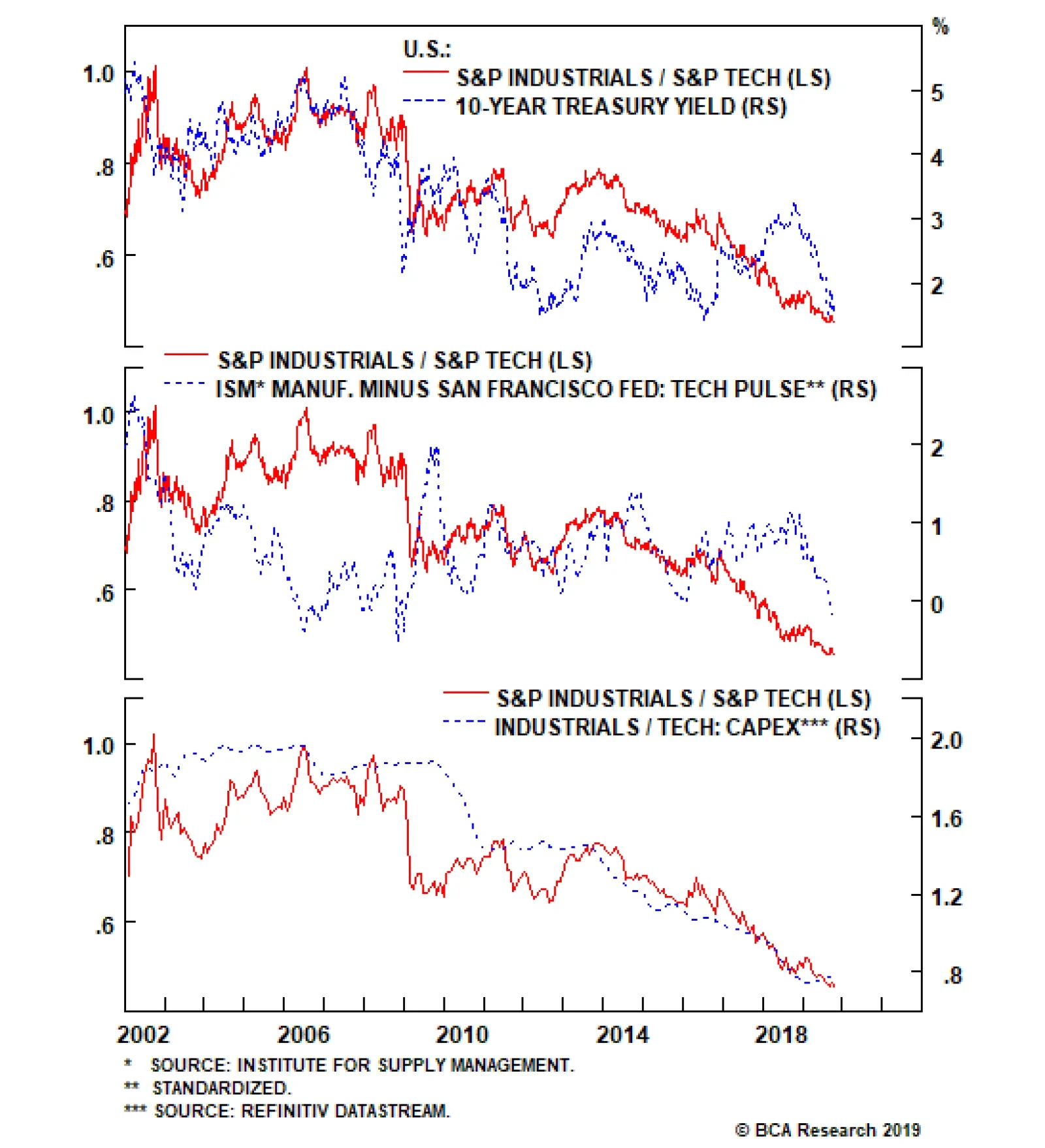

Ever since the Sino-American trade war started in March 2018, the market has punished industrials, but tech has escaped unscathed. The Fed’s tightening cycle and the Chinese policymakers’ brake slamming prompted…

Highlights Portfolio Strategy The trade-weighted U.S. dollar’s appreciation along with the still souring manufacturing data are weighing on SPX profit growth, at a time when heightened geopolitical uncertainty and a looming…

Underweight Transports have taken a beating recently with the heavyweight S&P railroads index leading the pack lower. Our underweight stance is paying handsome dividends and there are more gains in store in the coming…

The recent attacks on Saudi’s Aramco’s oil producing and refining assets caused a major disruption in the oil industry initially removing ~ 5.7mm b/d of KSA’s output. While energy stocks are the direct…

Neutral - Downgrade Alert The transportation industry is a bellwether for the economy as rising freight hauling services demand is synonymous with firming economic activity and vice versa. The recent FedEx earnings report…

Energy Stocks Are Heading North Banks Clamoring For Higher Rates And A More Hawkish Fed Homebuilding Stocks Are Catching Up To Housing Starts Will Global Trade Get “Fed-Exed”? Do Not Try To Bottom Fish……

Underweight BCA U.S. Equity Strategy’s electrical components & equipment (EC&E) three-factor earnings model did an excellent job in anticipating the recent breakdown in the S&P EC&E index (top &…

Highlights Portfolio Strategy The sustained global growth slowdown, widening junk spreads, along with the risk of a U.S. recession becoming a self-fulfilling prophecy suggest that caution is still warranted in the broad equity market…