This week we upgraded the S&P railroads index to neutral locking in 6.4% in relative gains since inception. The defensive nature of rails is most evident in industry pricing power (third panel). Railroad selling prices are holding…

Industrials continue to lag behind the S&P 500, having underperformed by an additional 4% since the March 23rd market bottom. The sub-par performance of this sector makes sense: the global industrial production is in tatters…

Highlights Portfolio Strategy The Fed’s unorthodox monetary policy is aimed at quashing volatility, lifting asset prices and debasing the currency, all of which are equity market bullish. Grim, but backward looking, macro data…

Highlights US Corporates: The Fed continues to expand the reach of its extraordinary monetary policies designed to combat the COVID-19 recession, now giving itself the ability to hold BB-rated US high-yield bonds within its corporate…

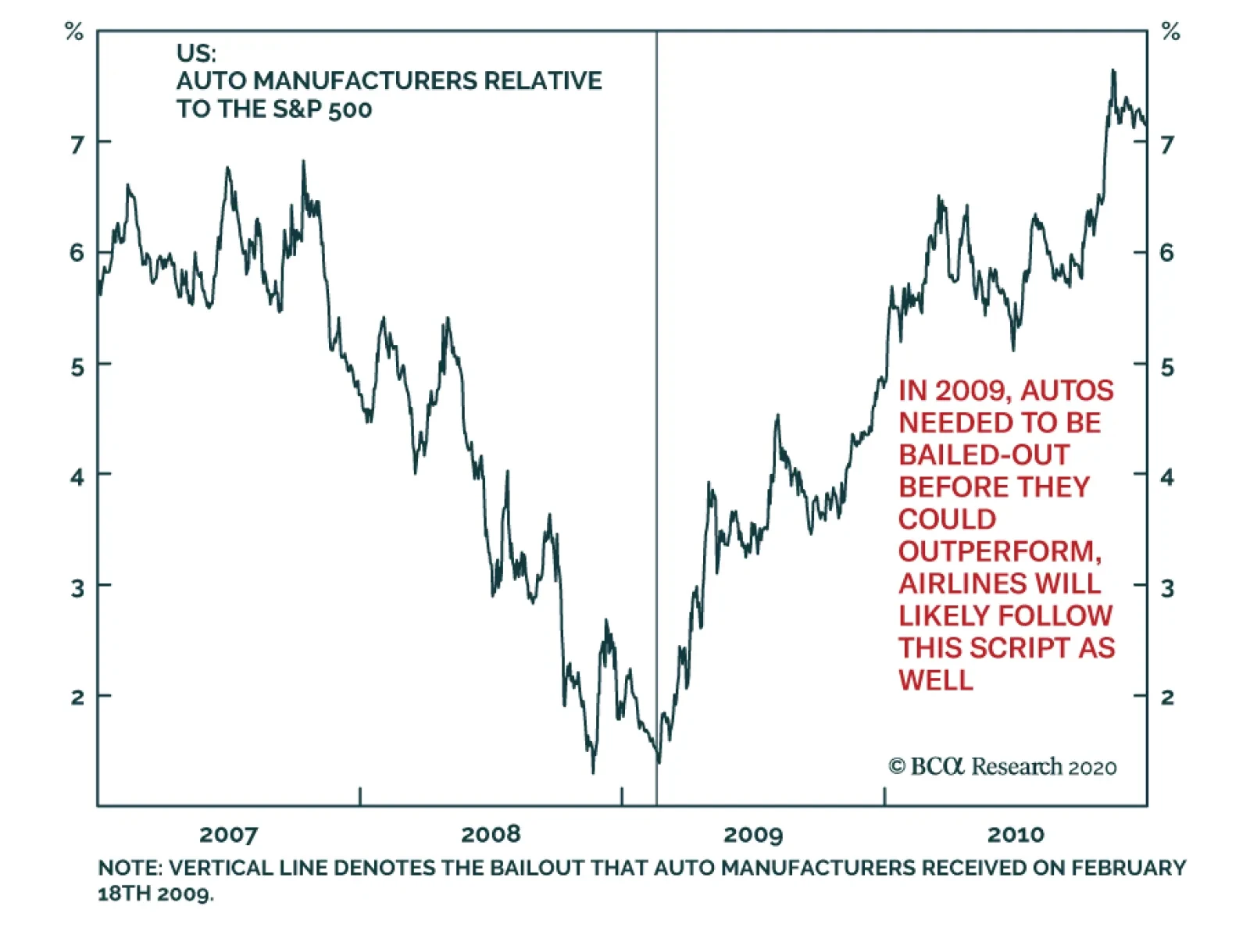

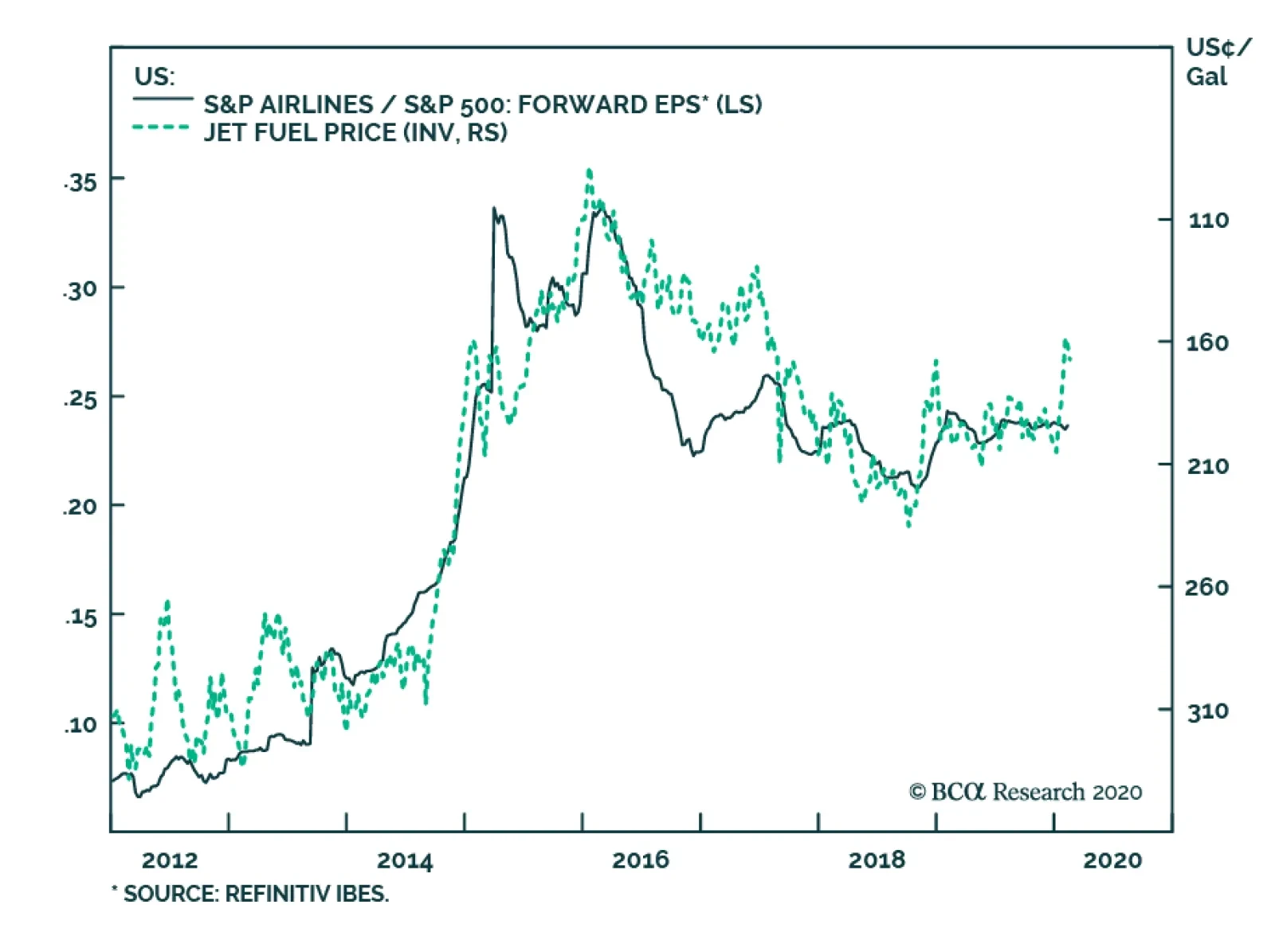

US airlines have encountered great turbulence due to COVID-19. They trade at a large discount to the S&P 500. Moreover, they have become massively oversold. While a short-term bounce is possible, it is unlikely to be more…

Highlights Portfolio Strategy Boeing’s 737 MAX grounding, China’s looming slowdown on the back of the coronavirus epidemic and weak industry operating metrics, all warrant a downgrade alert in the US aerospace index. Red…

Overweight Investors tend to overreact to events such as virus epidemics, but we deem that such fears typically create trading opportunities, especially in the hardest-hit sectors. Similar to hotels (that we upgraded to…

Yesterday, BCA Research's US Equity Strategy service reiterated its overweight stance on the S&P airlines index. Airline stocks have taken it on the chin lately on the back of COVID-19 demand destruction fears, but…