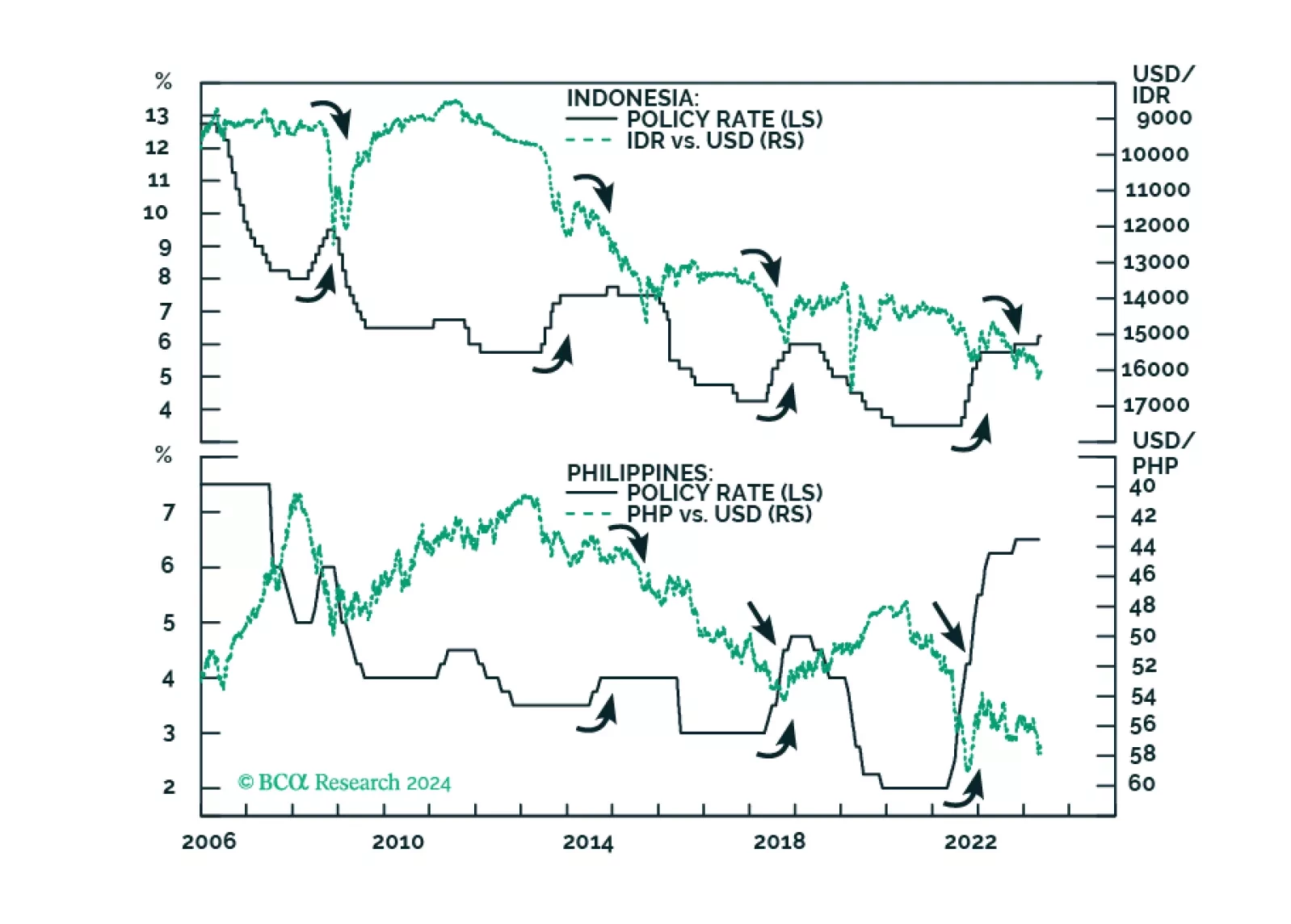

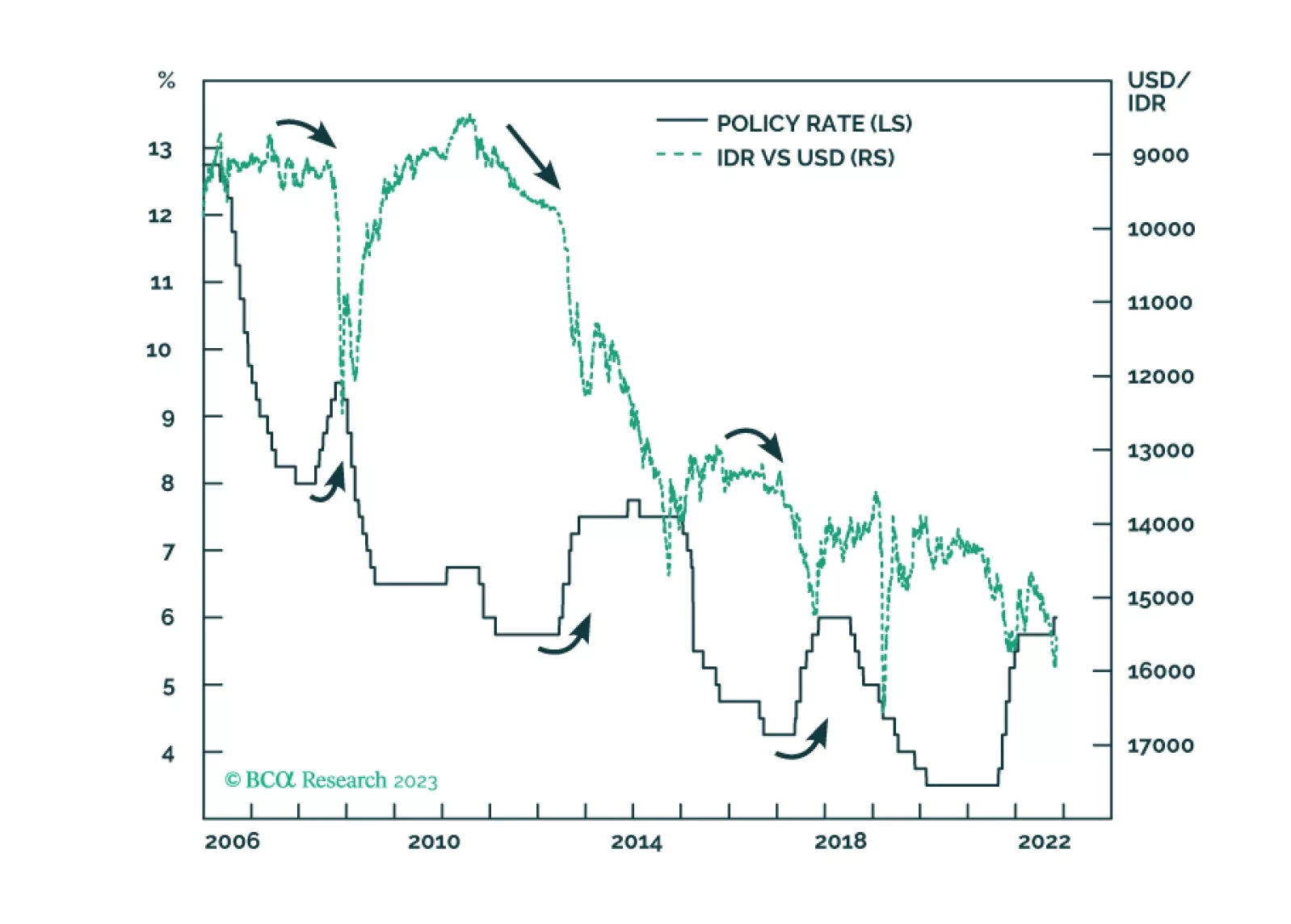

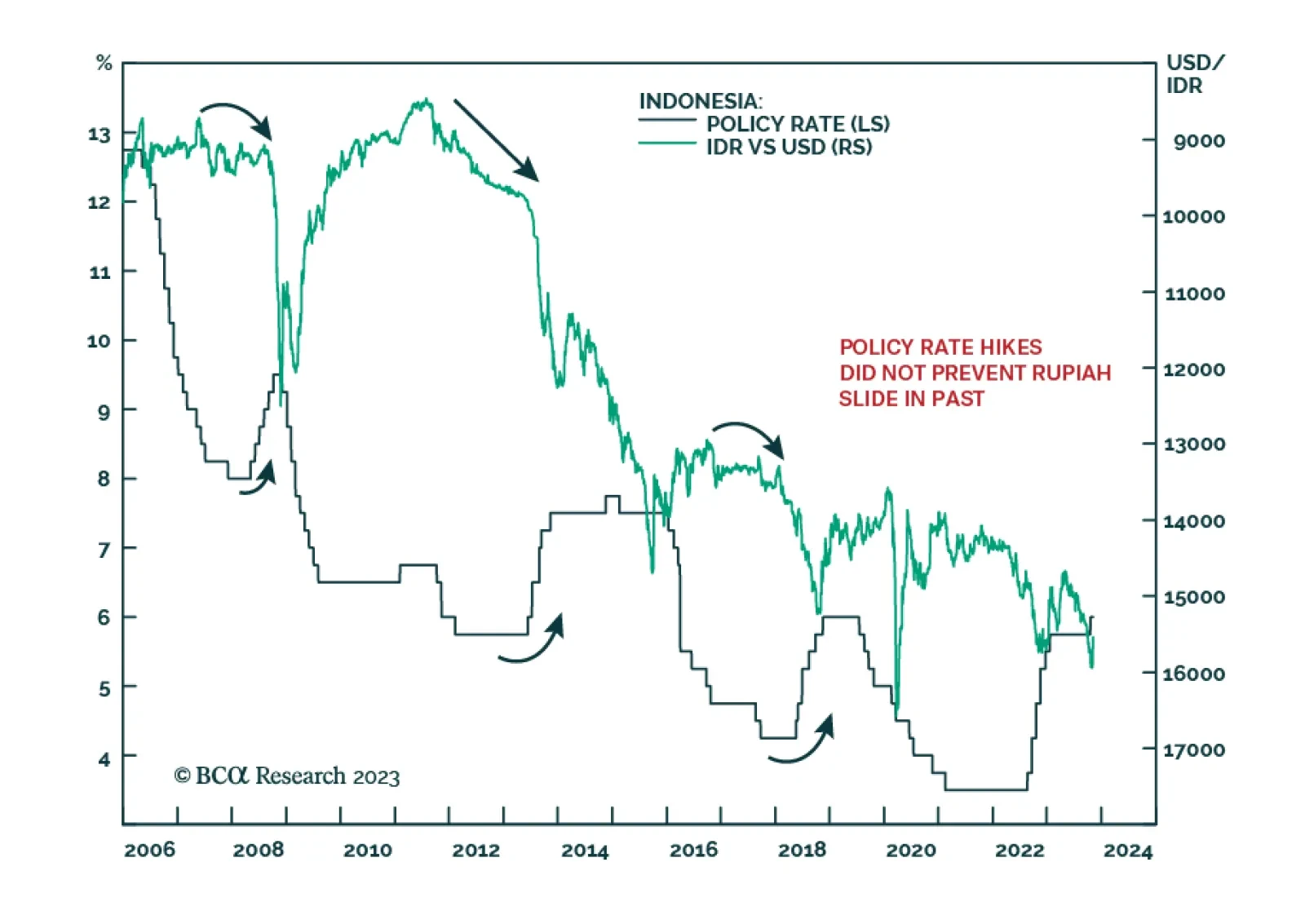

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

According to BCA Research’s Emerging Markets Strategy service, Indonesia's “window of opportunity” to transition to a lower real interest rate regime – without jeopardizing the currency stability…

Despite very low inflation, Bank Indonesia raised its policy rates last month to support the currency. The strategy did not work before and will not work now. Stay short the rupiah.

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

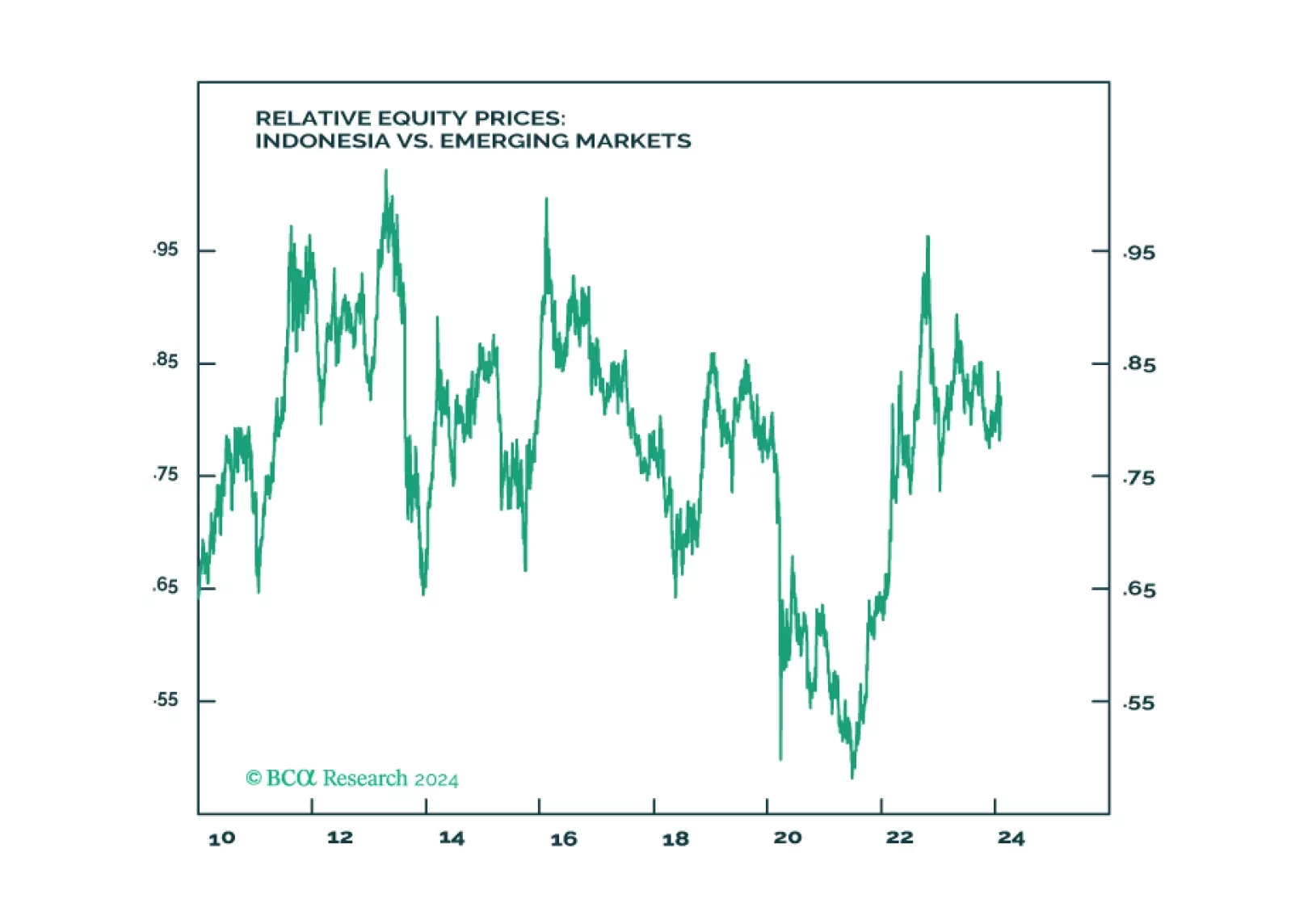

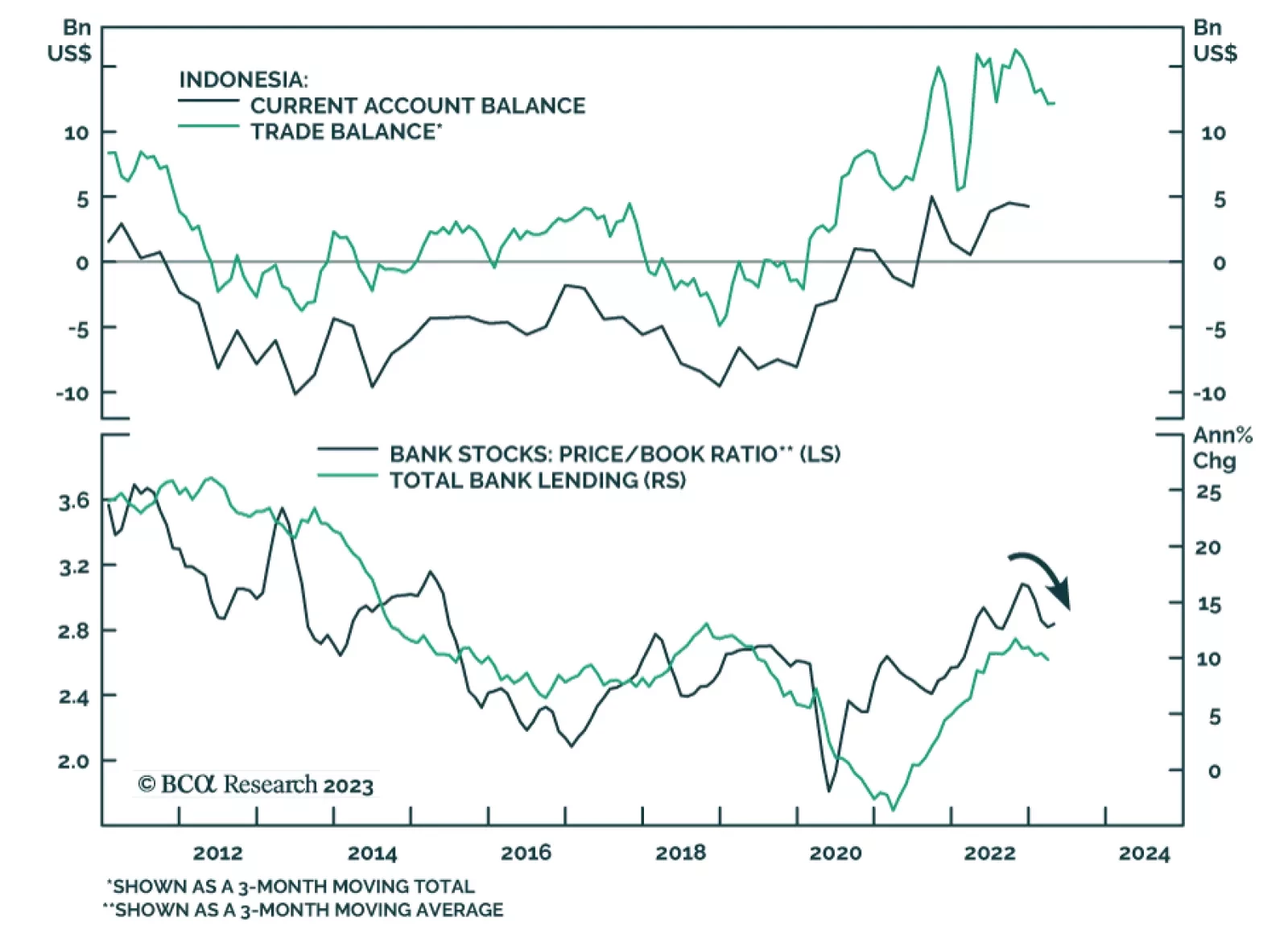

In a recent report, our Emerging Markets Strategy team recommended an underweight stance for Indonesian equities in EM portfolios. The team is also bearish on the rupiah. An unprecedented trade surplus recently gave Indonesia…

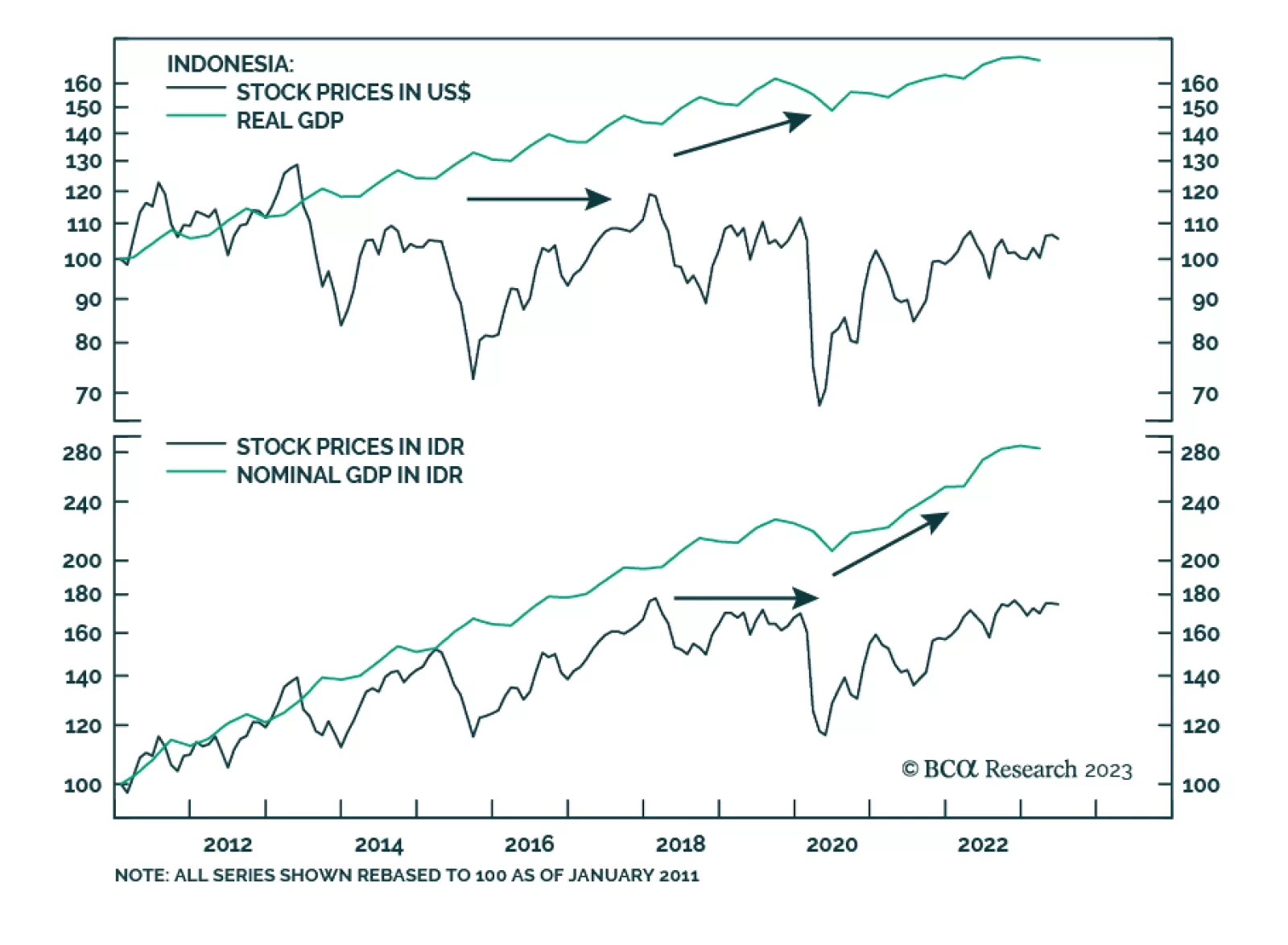

According to BCA Research’s Emerging Markets Strategy service, investors should stay underweight Indonesian equities within Emerging Market and Emerging Asian equity portfolios. Unprecedented export earnings have pushed…

An unprecedented trade surplus has given Indonesia a rare opportunity to transition into a lower real rates regime. The sustainability of Indonesian stocks outperformance is contingent upon whether the authorities can do so.

Indonesian equity outperformance was predicated on an unprecedented trade windfall, including coal exports. As that fades, both the stocks and the currency are highly vulnerable.