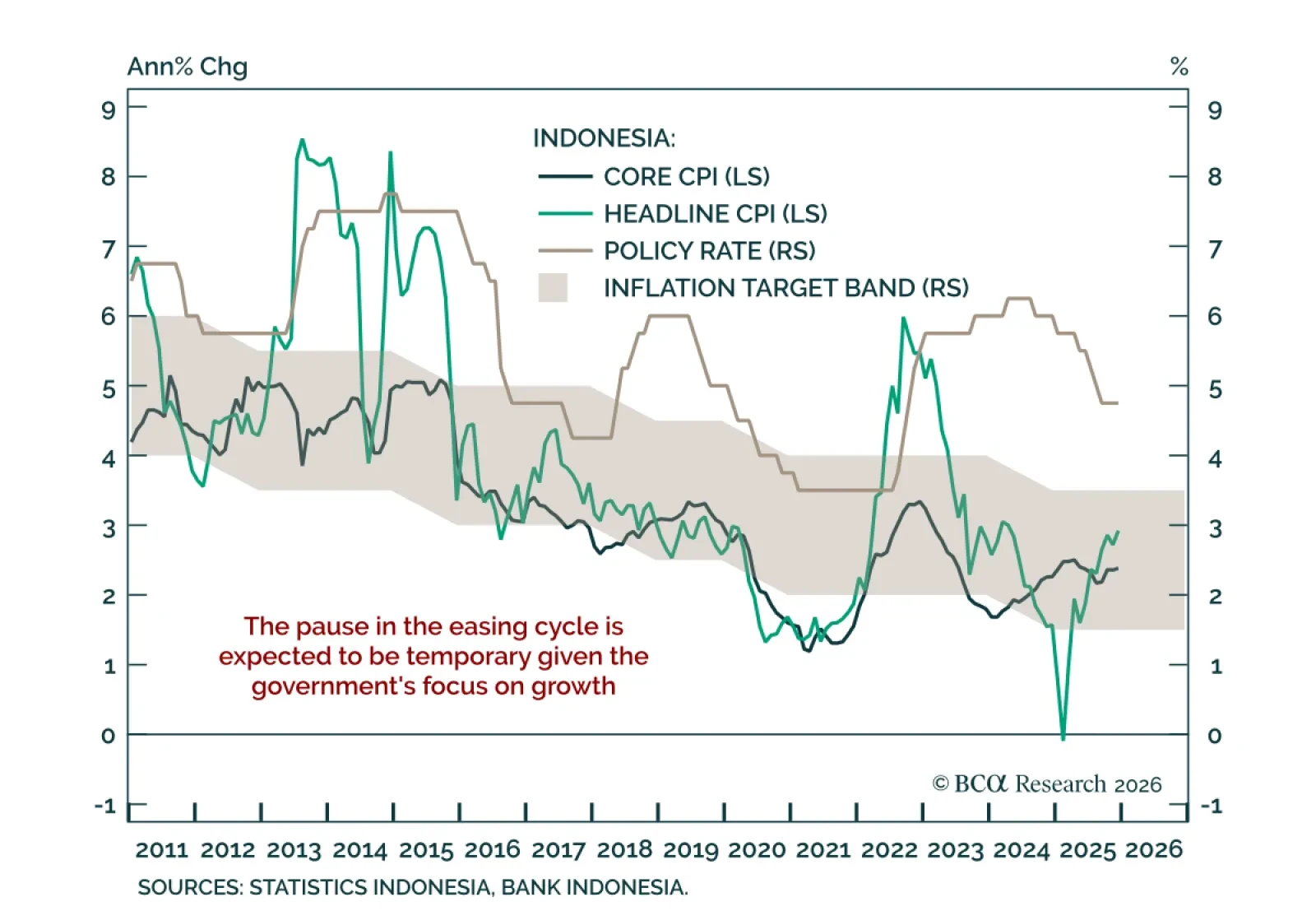

The Indonesian central bank kept its policy rate steady at 4.75%, in line with expectations. The decision comes as the rupiah has fallen to multi-year lows against the US dollar amid renewed foreign investor concerns over central…

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…

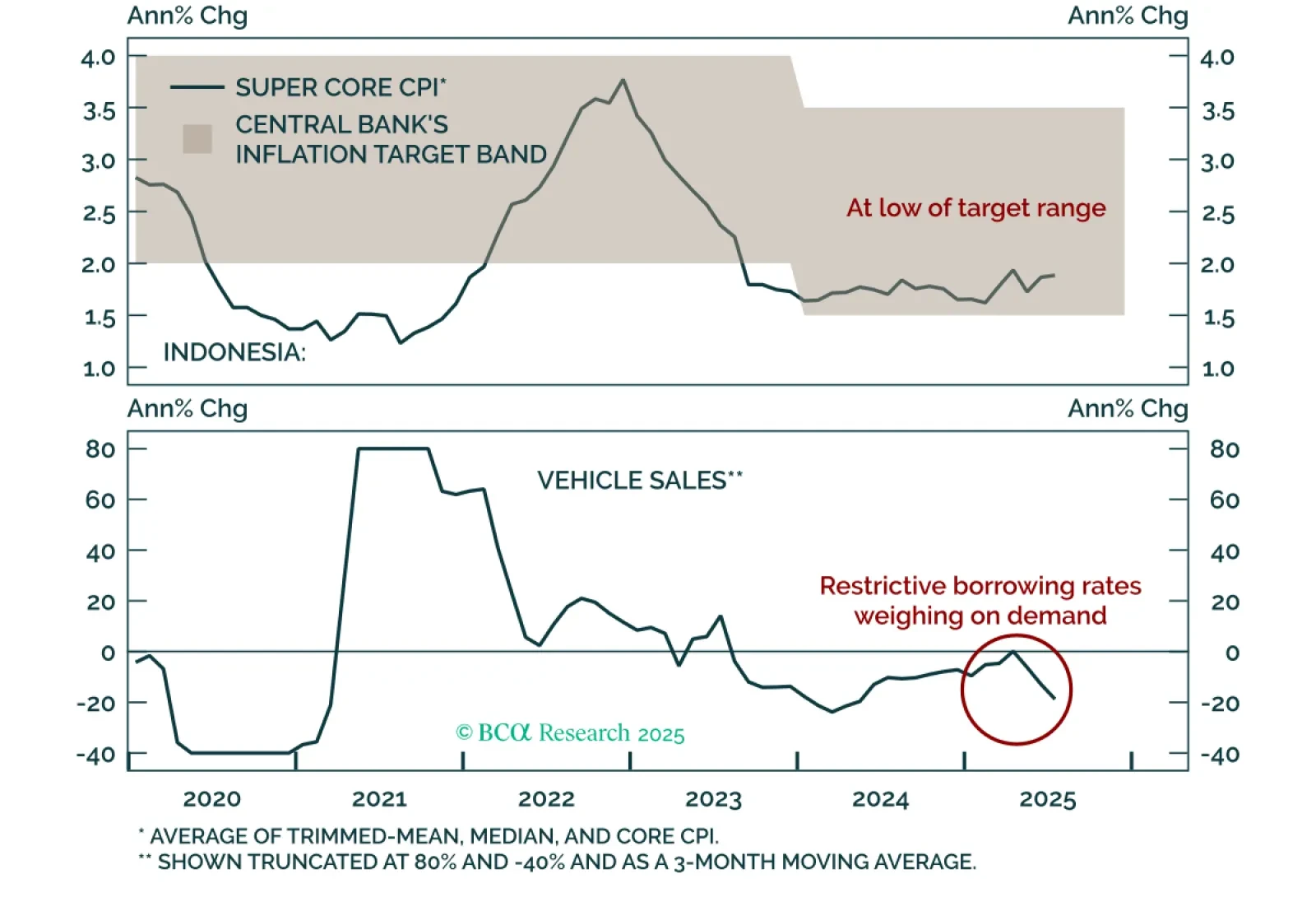

Indonesia’s surprise rate cut signals a dovish turn that will weigh on the rupiah. Bank Indonesia cut its policy rate by 25 bps to 5%, with low inflation and weak activity pointing to more easing ahead. Our Emerging Markets team…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

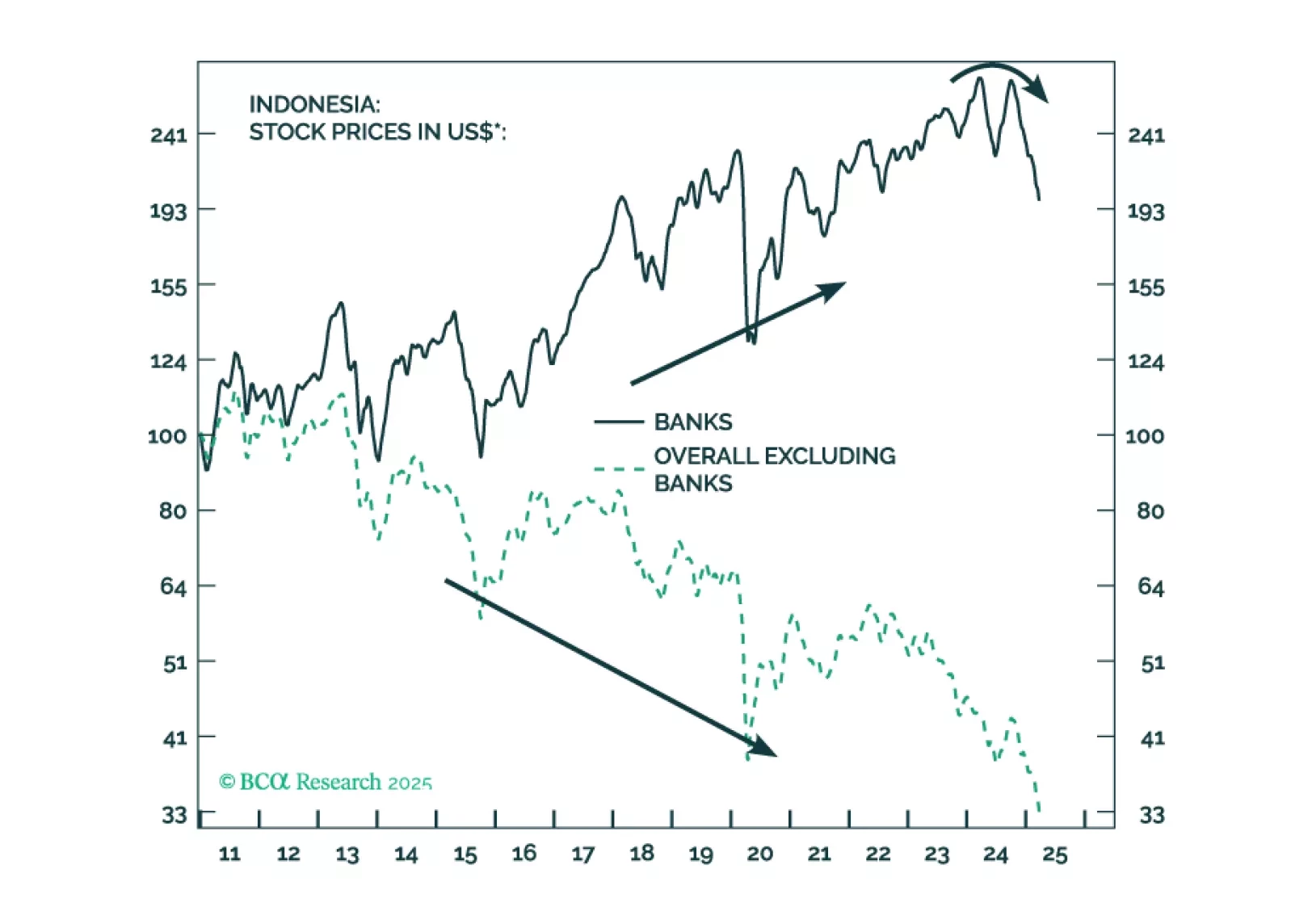

Our Emerging Markets strategists maintain a neutral view on Indonesia within EM equity and bond portfolios but continues to recommend shorting the rupiah versus the US dollar. They are closing their long Indonesian banks/short EM…

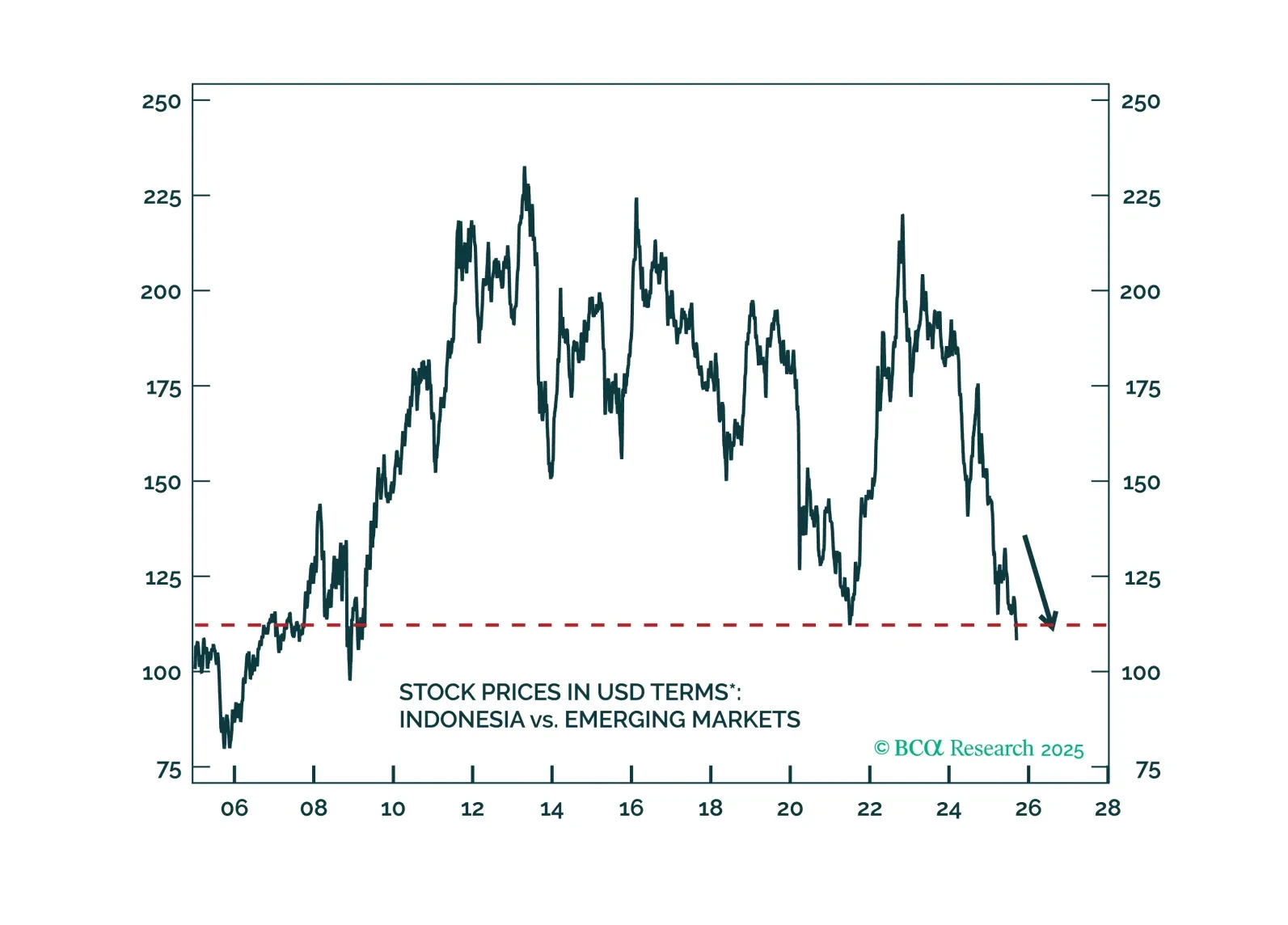

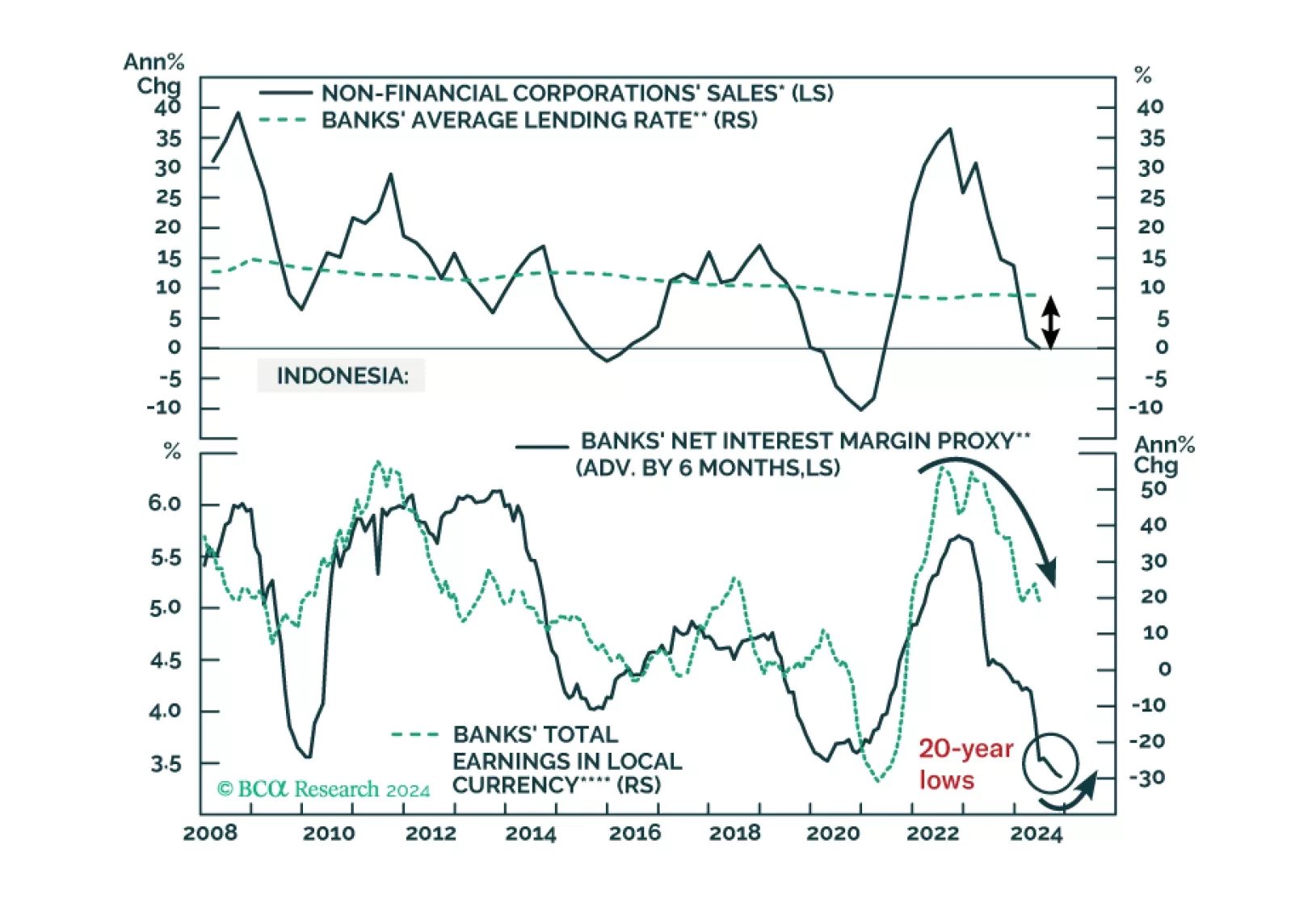

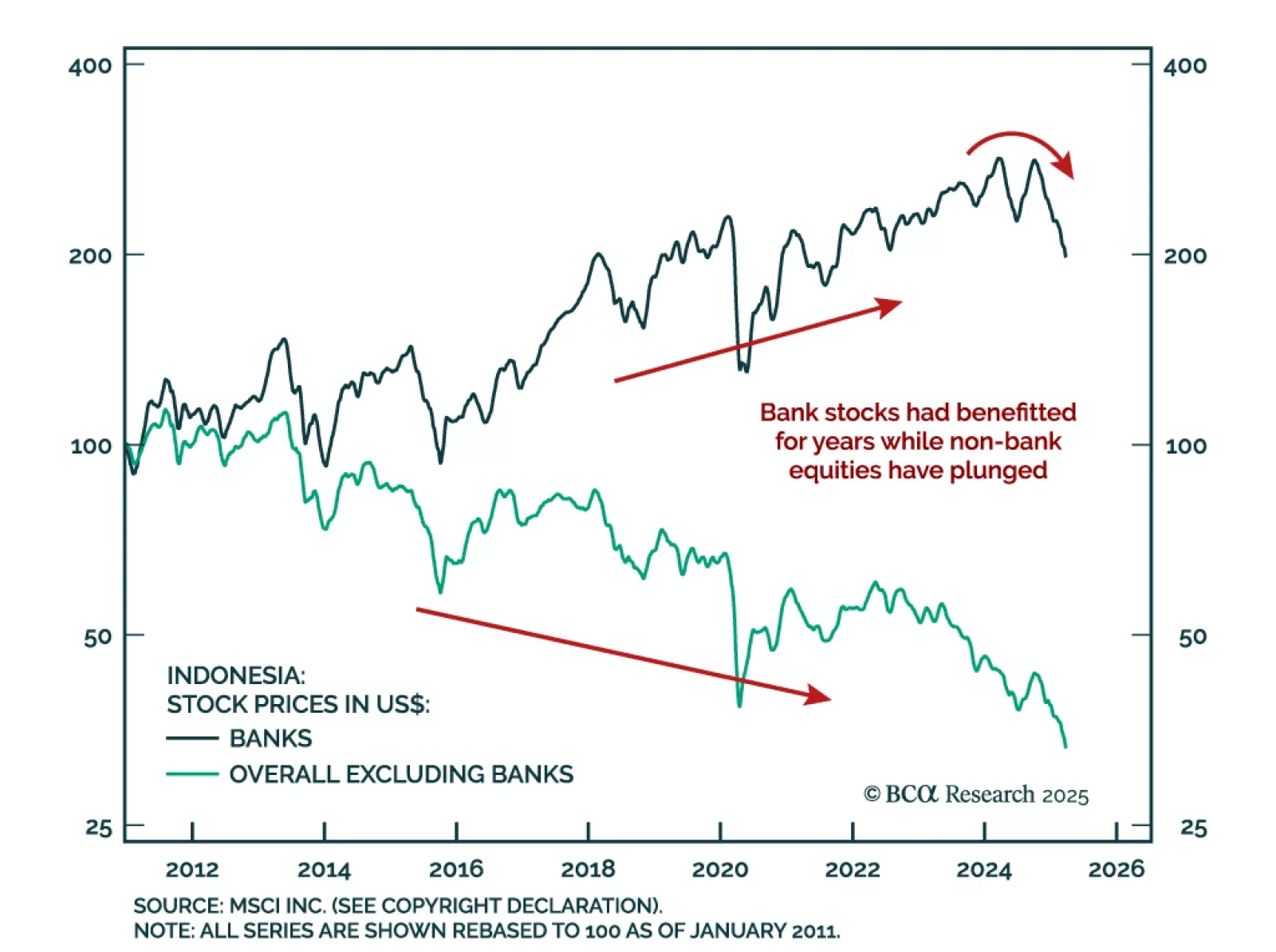

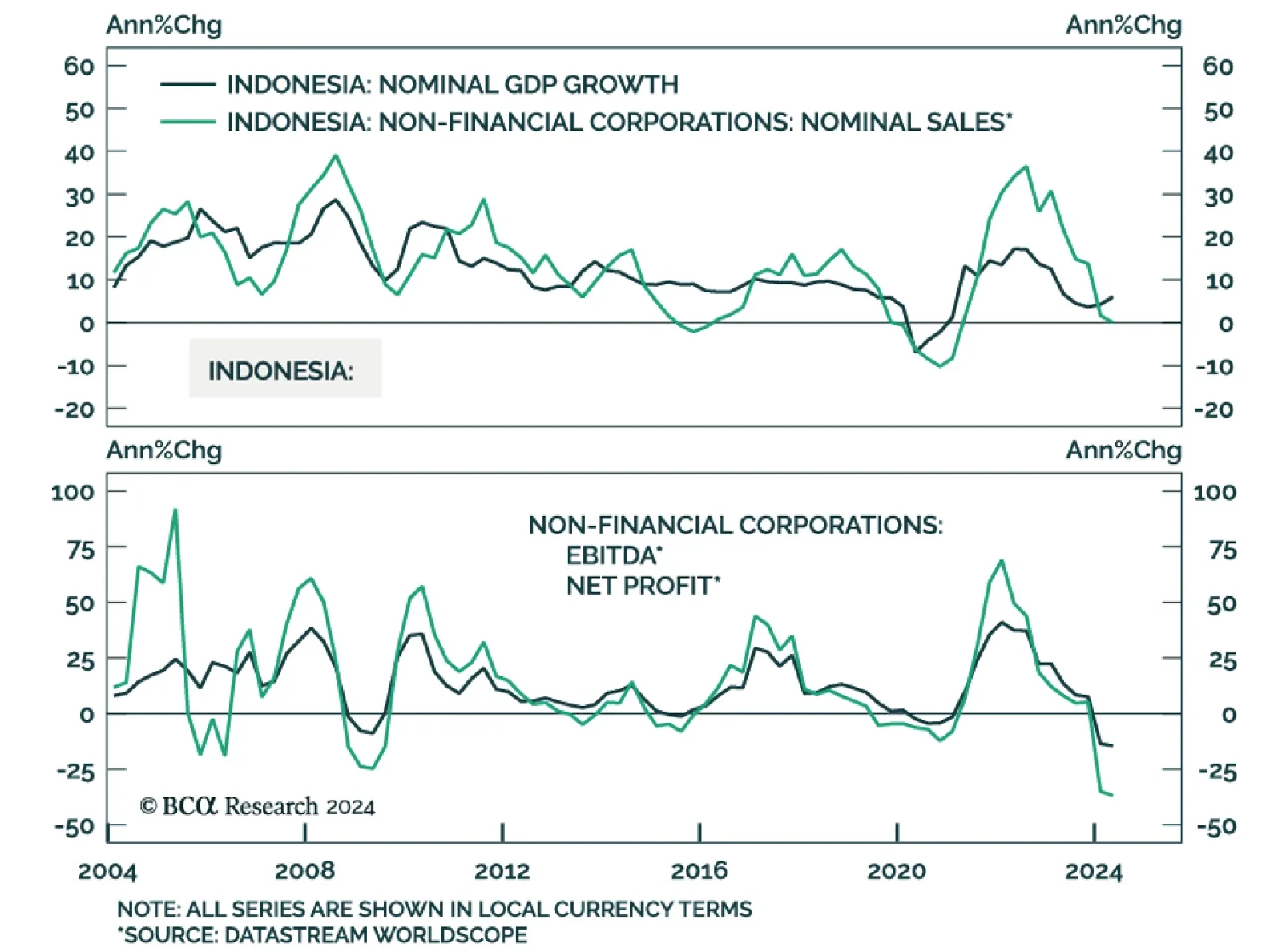

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

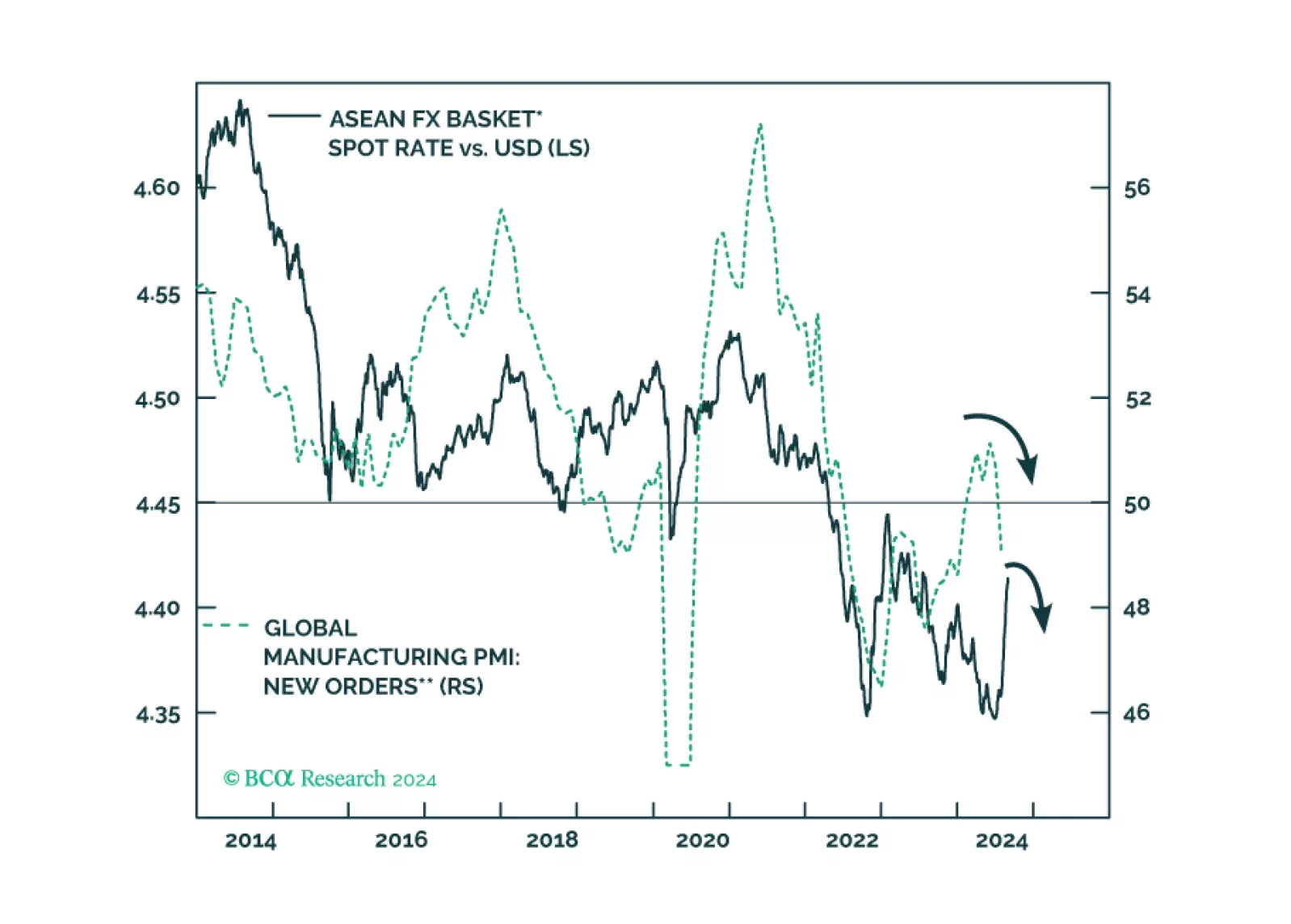

The ongoing rally in ASEAN currencies will fizzle sooner rather than later as they are not supported by fundamentals. The ringgit and the baht, however, will fare better than the peso and the rupiah during the coming global risk-off…

Indonesian stocks have sold off sharply and underperformed their EM and emerging Asian peers – both in local currency and in common currency terms – despite the nation’s 5.1% real GDP growth rate (the highest…

A major slowdown in nominal growth was behind Indonesia’s recent stock underperformance. Dedicated EM equity portfolios should upgrade Indonesian stocks from underweight to neutral. We also recommend a new relative trade: go long…