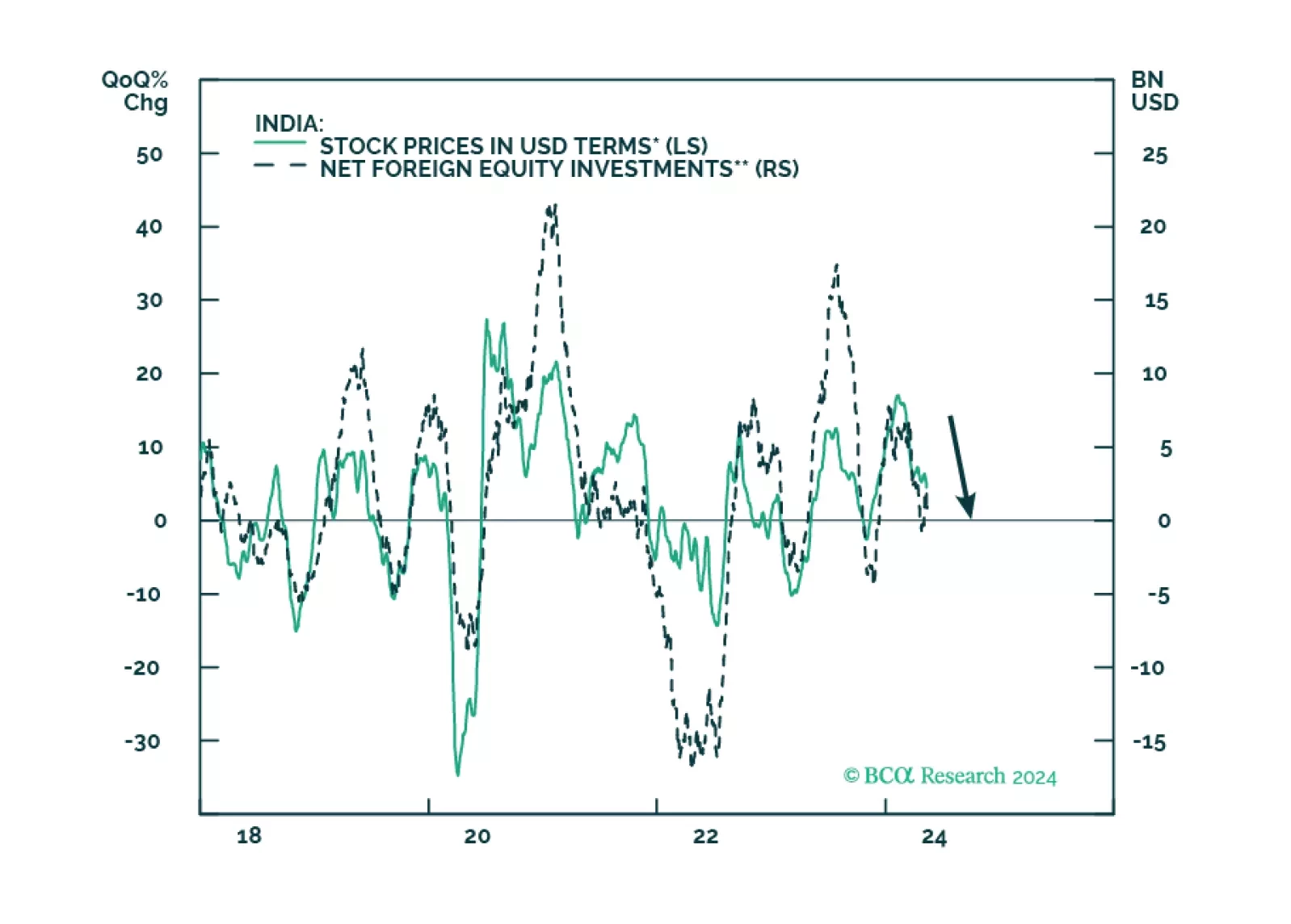

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

Our Emerging Markets and Foreign Exchange strategists recommend staying neutral-to-underweight on the Indian rupee versus EM Asia peers, as macro and policy pressures mount. US tariffs and possible sanctions on Russian oil imports…

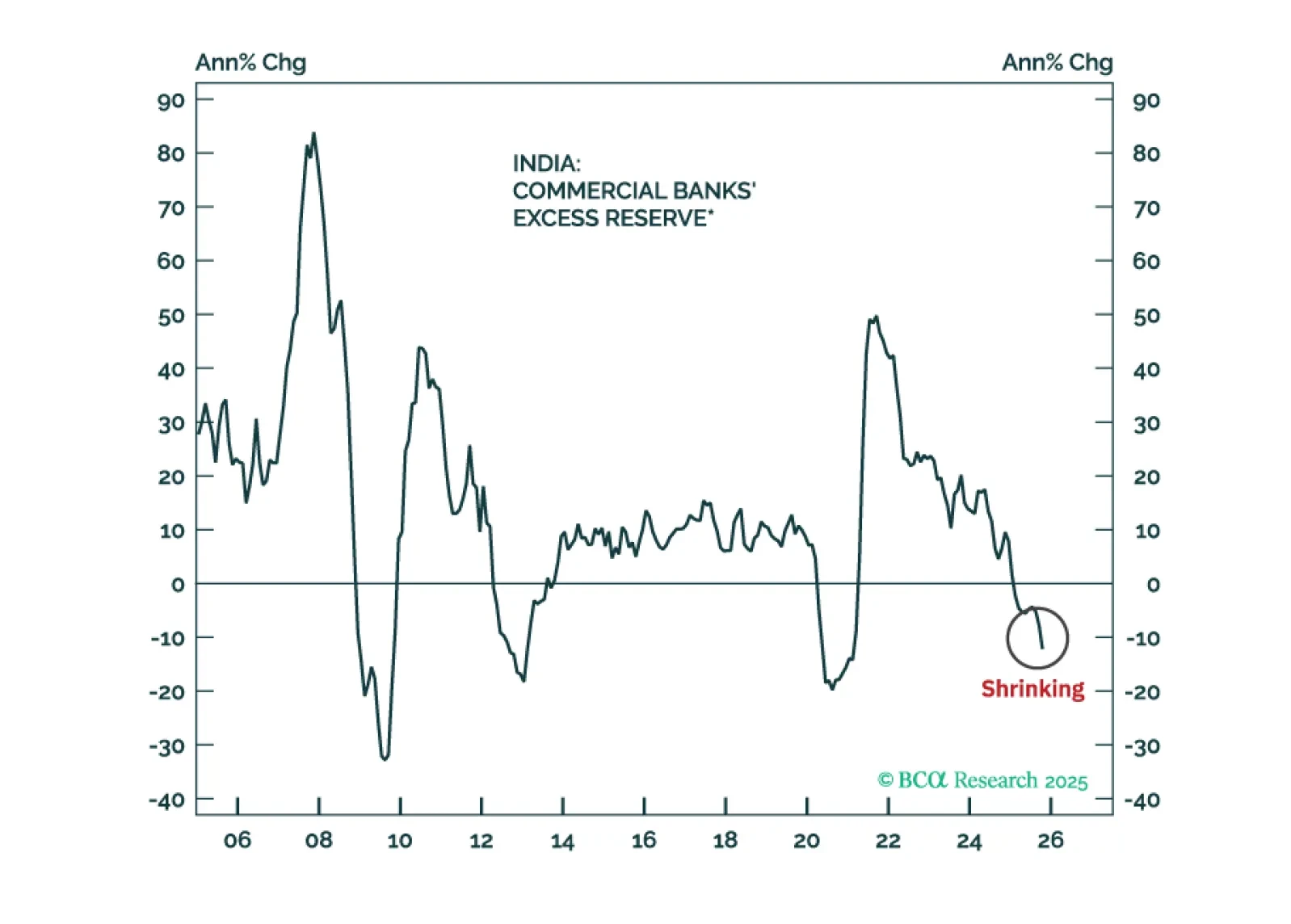

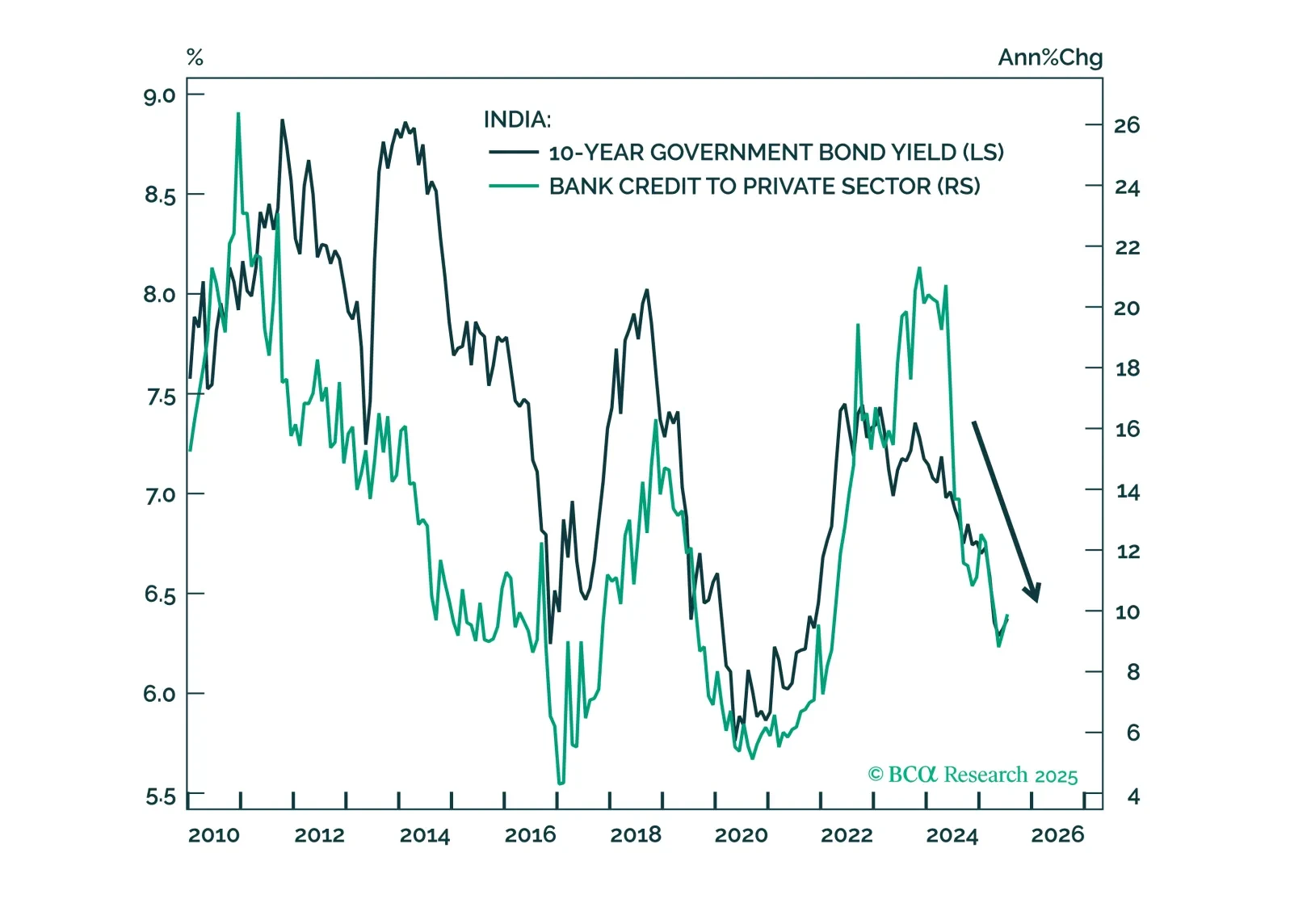

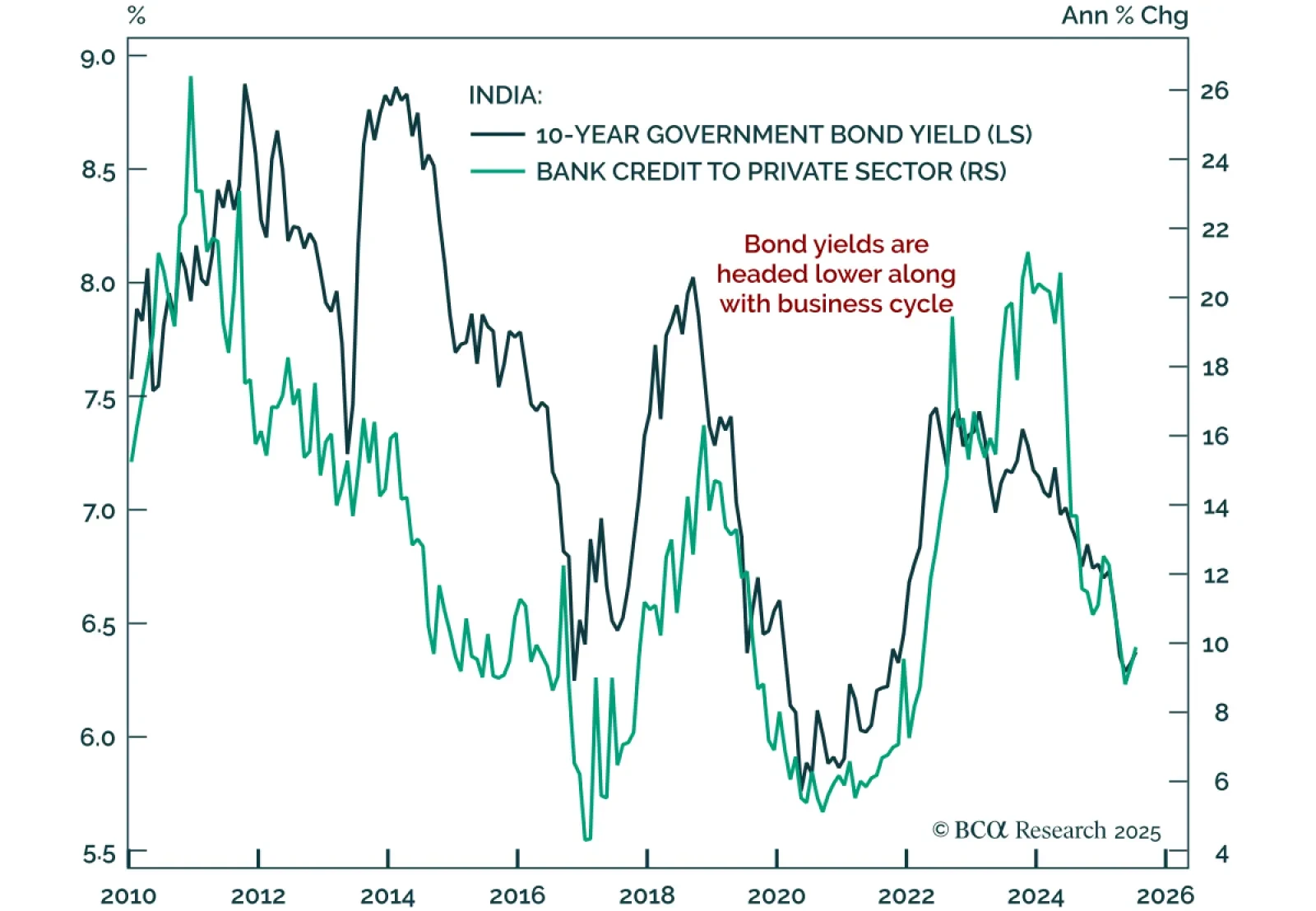

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

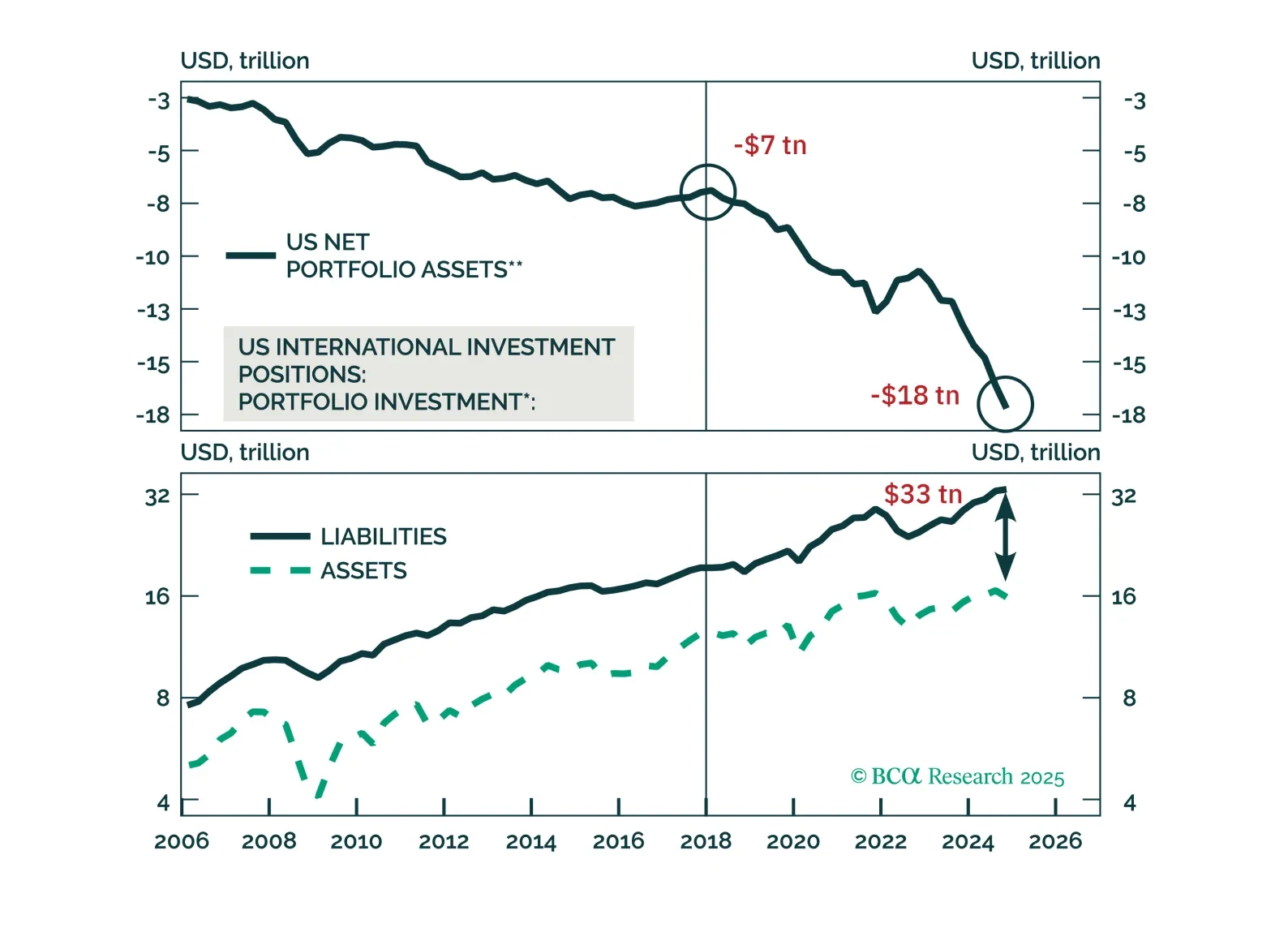

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

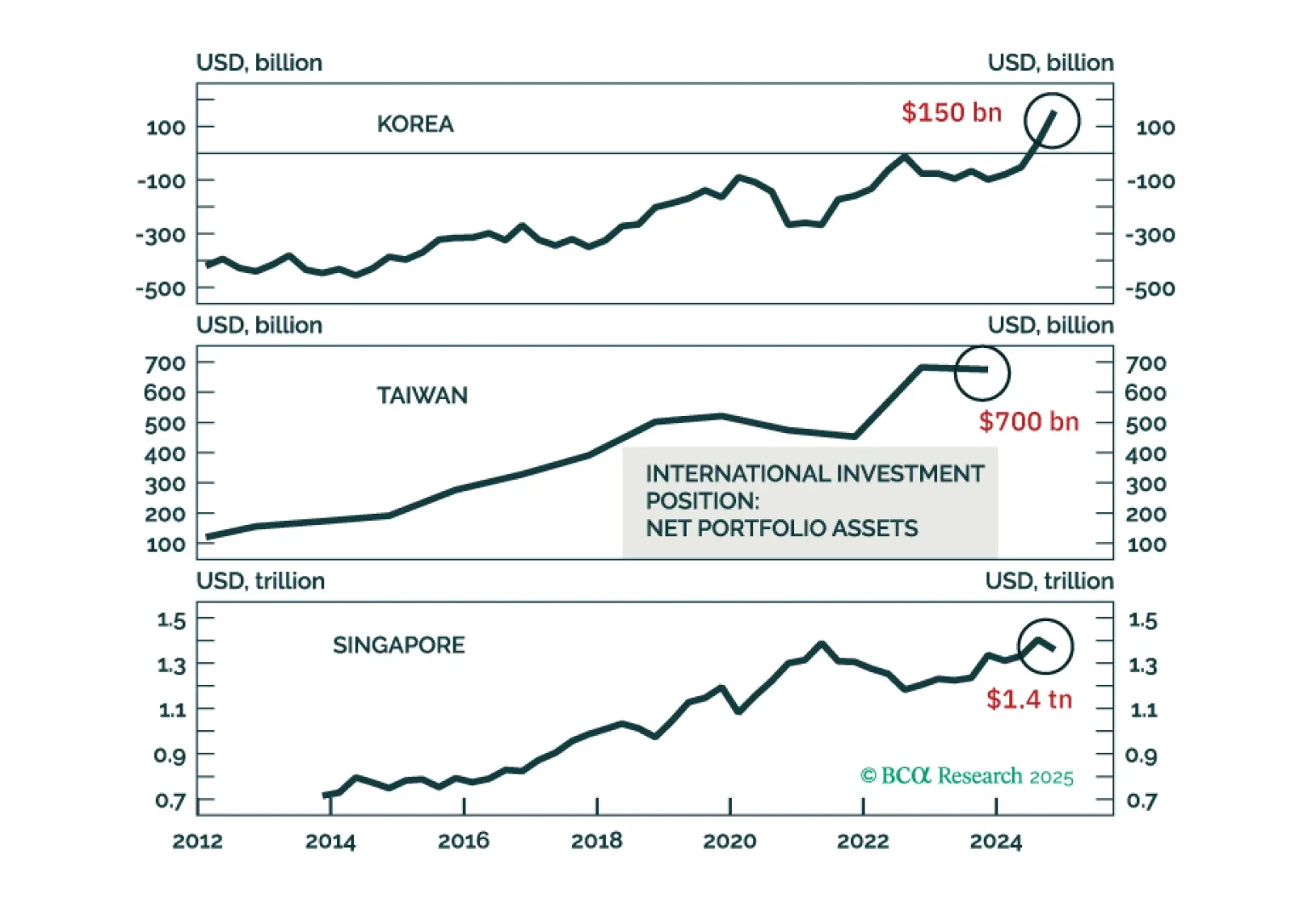

Global currency markets have entered a new era. This implies that the framework for analyzing exchange rates must also change. We introduce a new framework for analyzing EM currencies and classify them into…

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…