Indian economic data releases delivered a positive signal on Monday. CPI inflation slowed from 5.7% y/y to 5.1% y/y in January – within the Reserve Bank of India’s (RBI) 2-6% target range. Meanwhile, industrial…

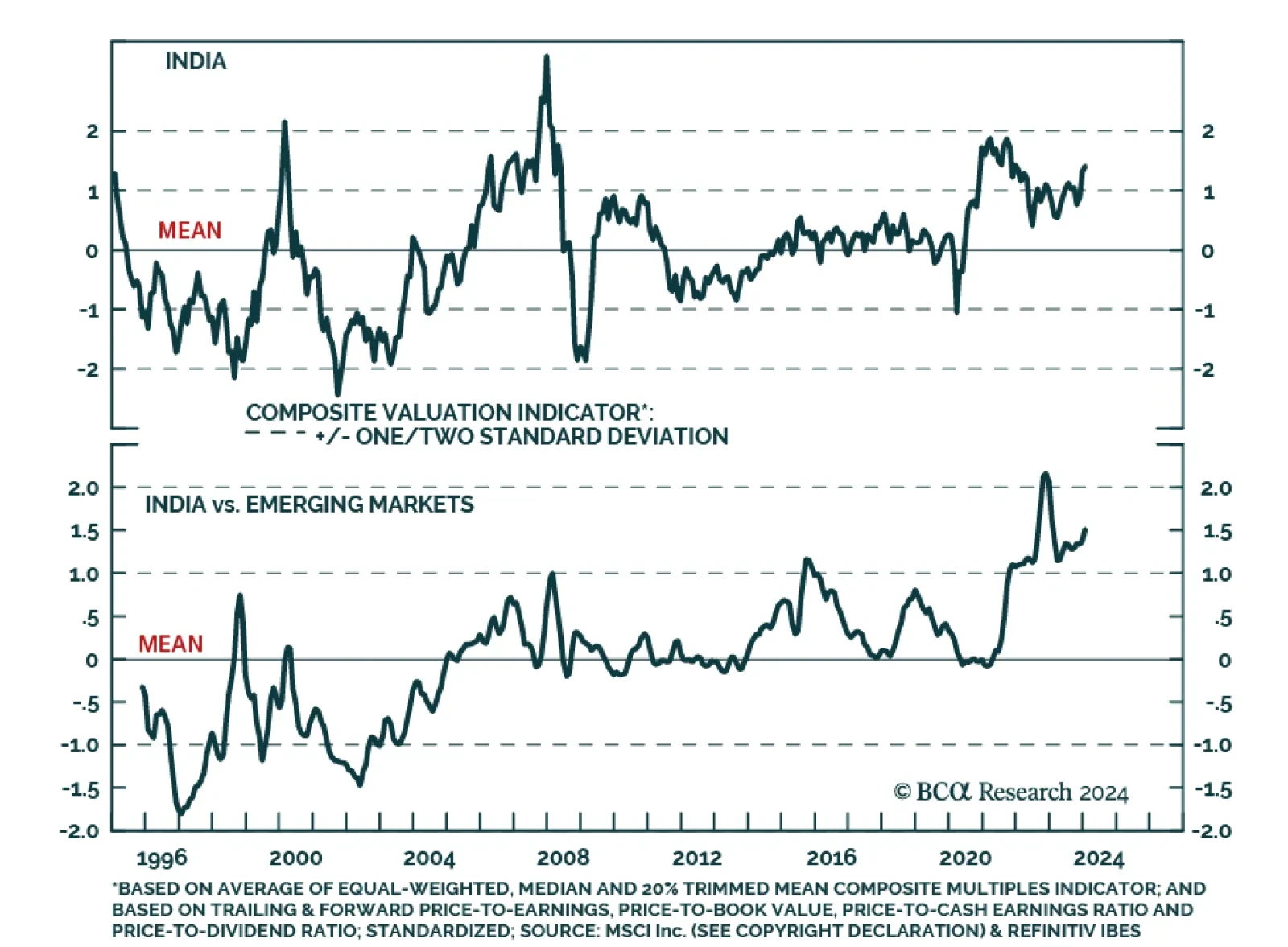

According to BCA Research’s Emerging Markets Strategy service, Indian stocks, which benefitted immensely from foreign portfolio inflows and are now very expensive, remain vulnerable to any global risk-off sentiment. The…

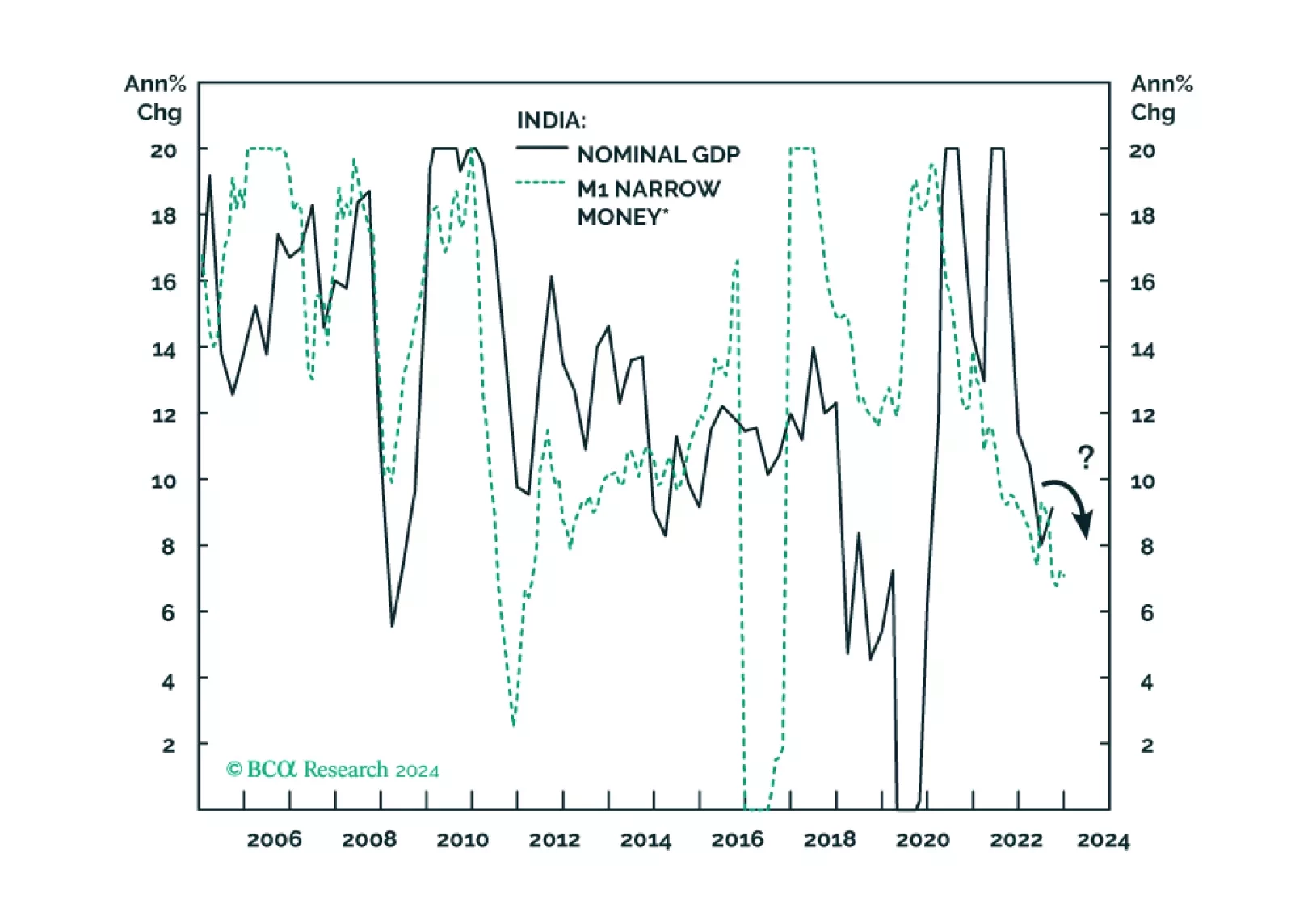

Decelerating nominal sales, a peaking credit cycle, and very high valuations - Indian stocks will not escape the carnage when risk assets globally begin to sell off.

India’s intake of industrial commodities is 10-to-20 times as small as China’s. Capital goods are five times as small. Hence, India is not in a position to offset any decline in Chinese demand for these commodities and goods.

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

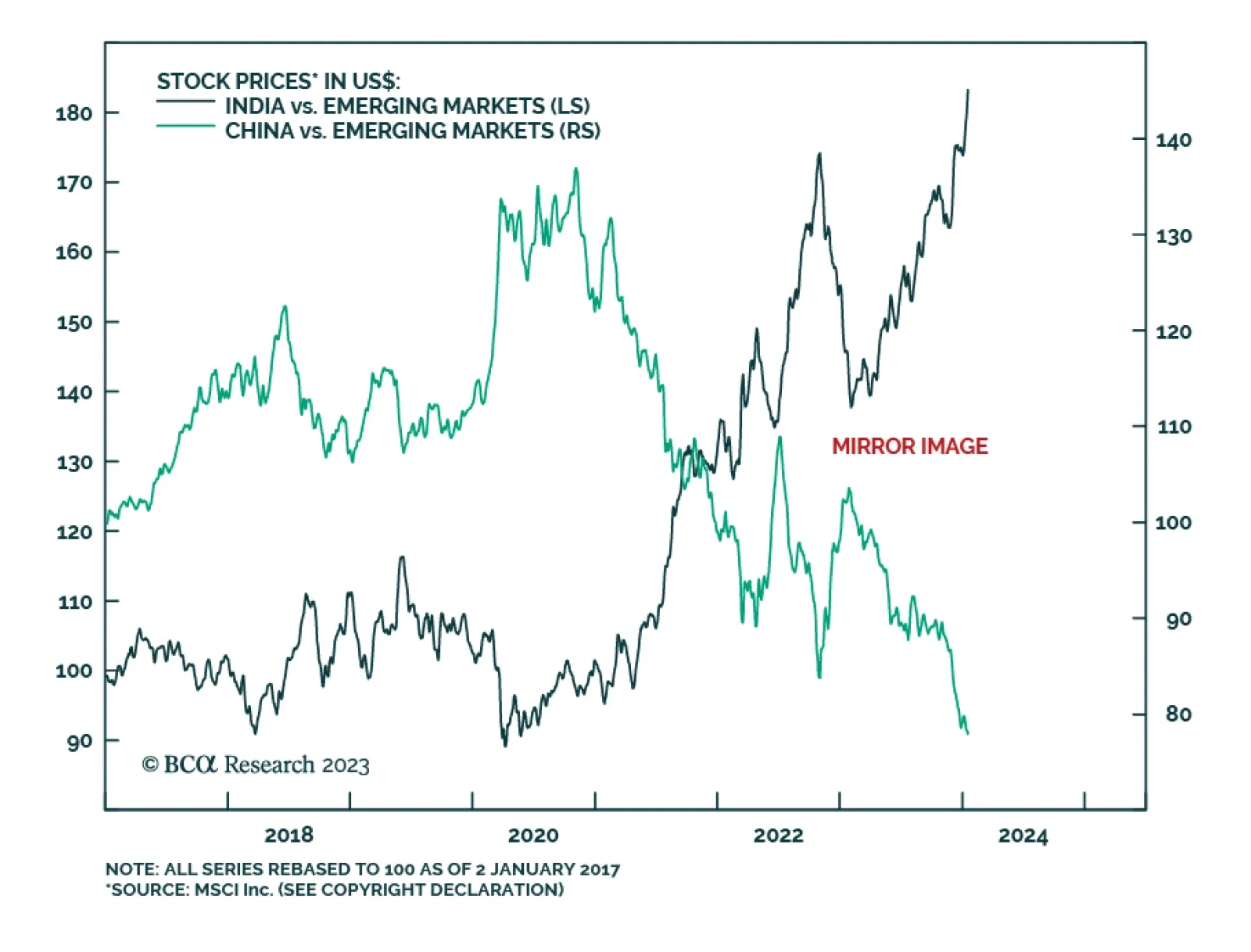

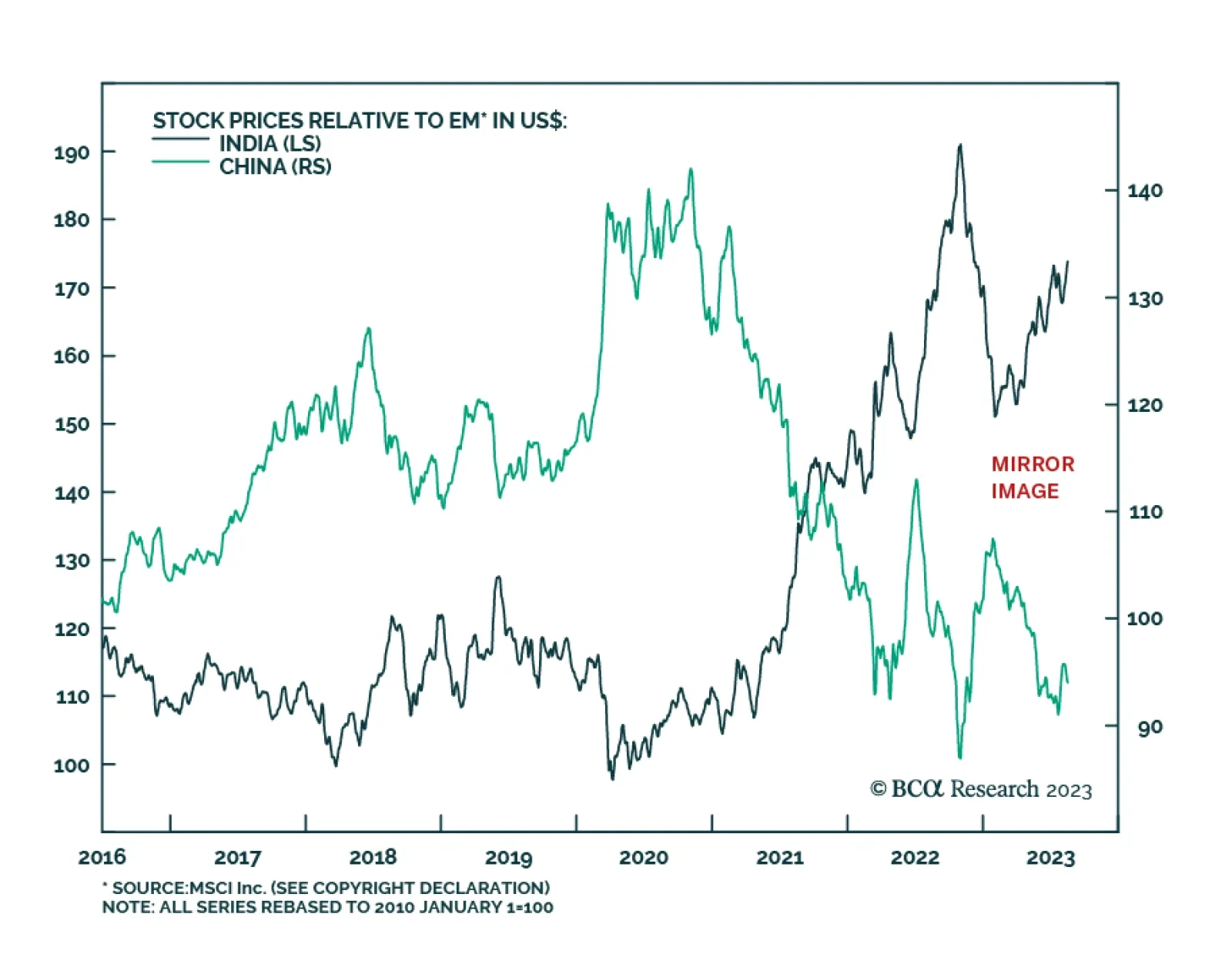

Indian stocks have gone up this year even as the broader EM markets have been falling. How long can Indian markets continue to rise?

Our Emerging Markets Strategy team expects a further decline in Indian stocks. Foreign equity inflows have been instrumental in the recent rally, but they will likely reverse in the coming months as risk-off sentiments pervade…

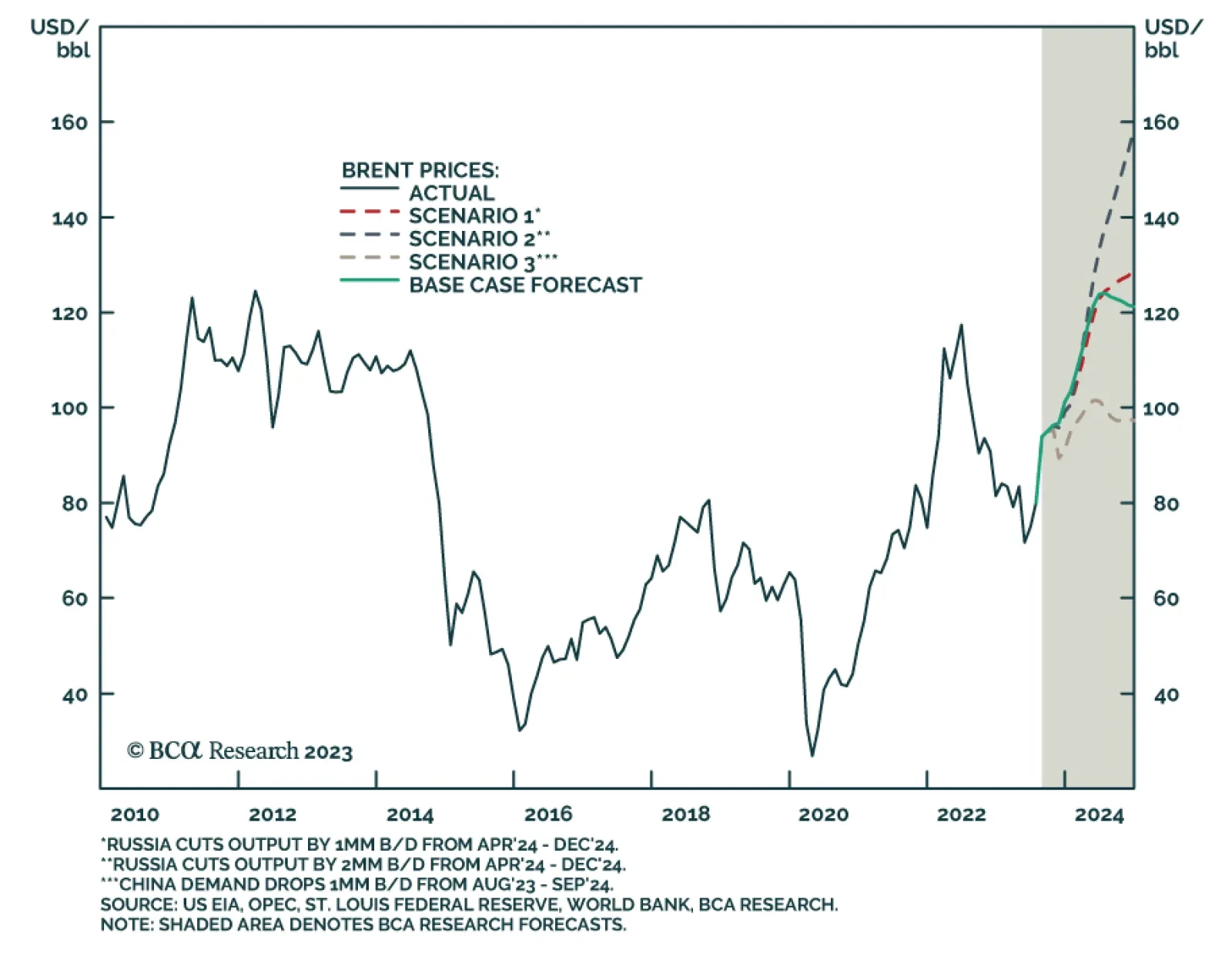

2023 is shaping up as a record-breaking year for global oil demand, according to our colleagues BCA's Commodity & Energy Strategy (CES). By year end, they expect the world will be consuming a record 103.5mm b/d, an…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.