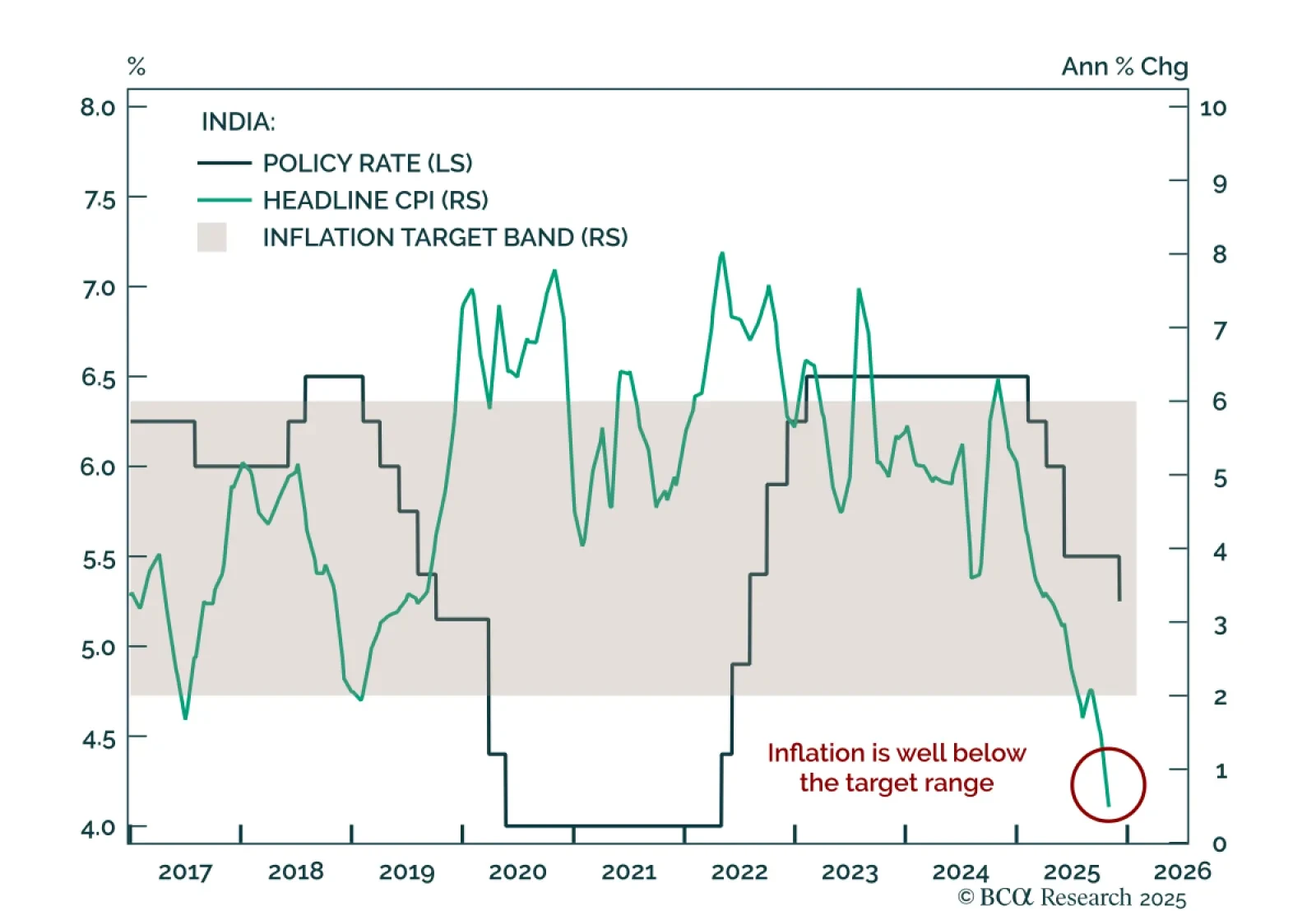

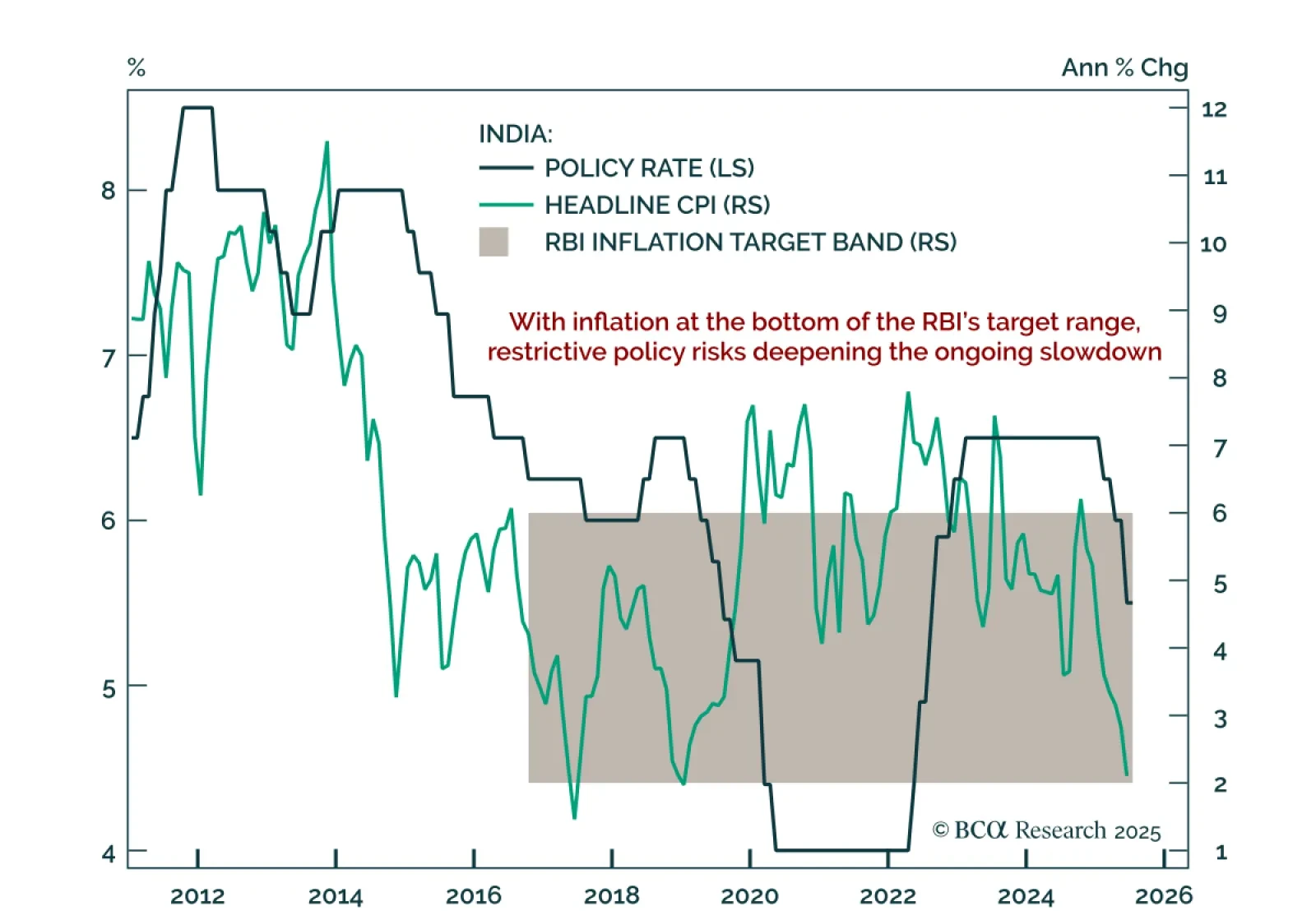

Easing, liquidity support, and subdued inflation favor India within an EM local currency bond portfolio. The RBI cut its key policy rate by 25 bps to 5.25% and signaled further easing, citing weakness in select economic indicators.…

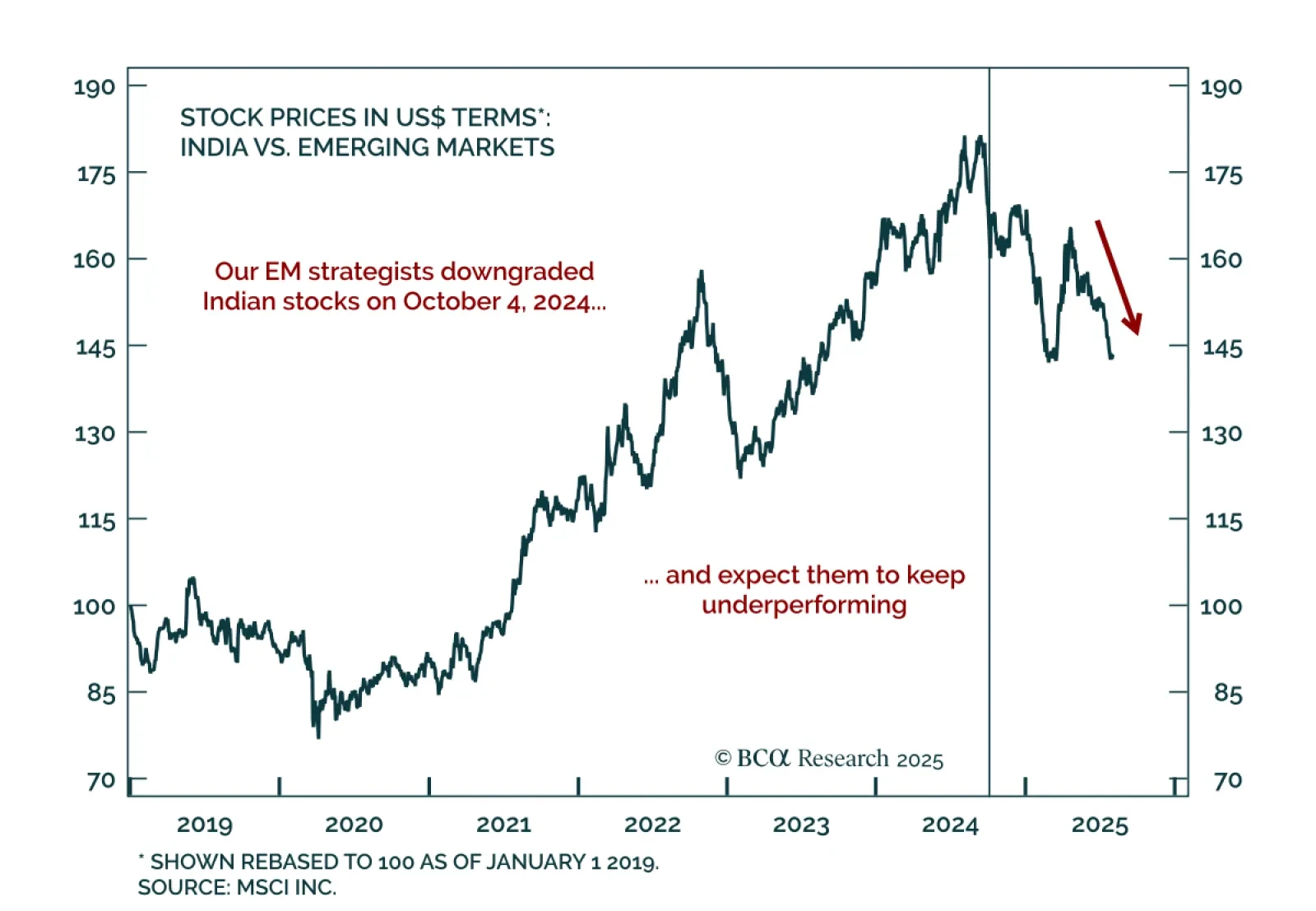

Our EM strategists advise absolute-return investors to avoid Indian equities, while dedicated EM and Emerging Asia portfolios should shift to a neutral allocation by closing their underweight. India’s growth outlook is deteriorating…

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

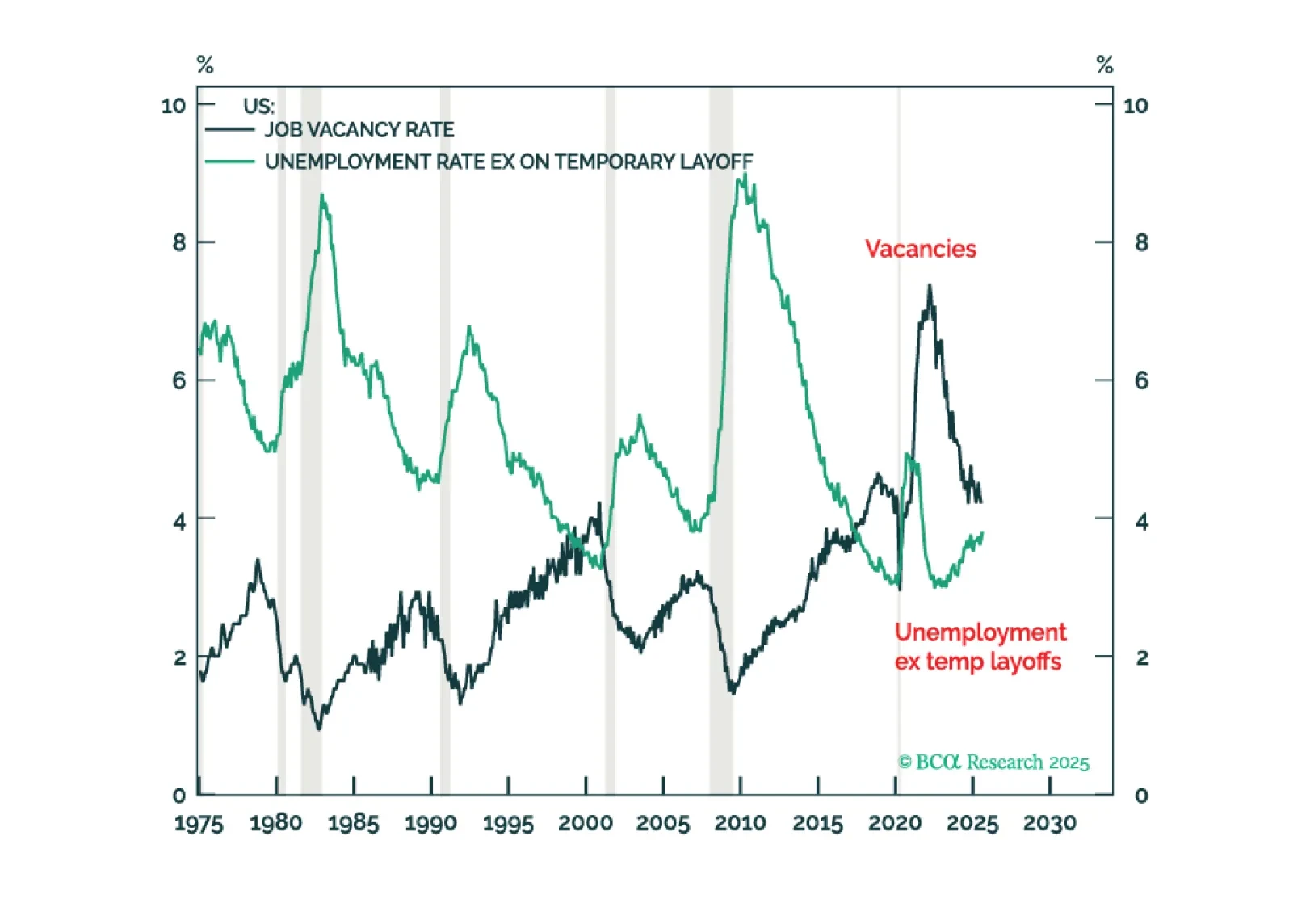

For the next few months at least, inflation risk trumps recession risk for both US markets and world markets. This because, correctly gauged, the US jobs market is still supply-constrained with ‘jobs looking for a worker’ exceeding ‘…

Our Emerging Markets and Foreign Exchange strategists recommend staying neutral-to-underweight on the Indian rupee versus EM Asia peers, as macro and policy pressures mount. US tariffs and possible sanctions on Russian oil imports…

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

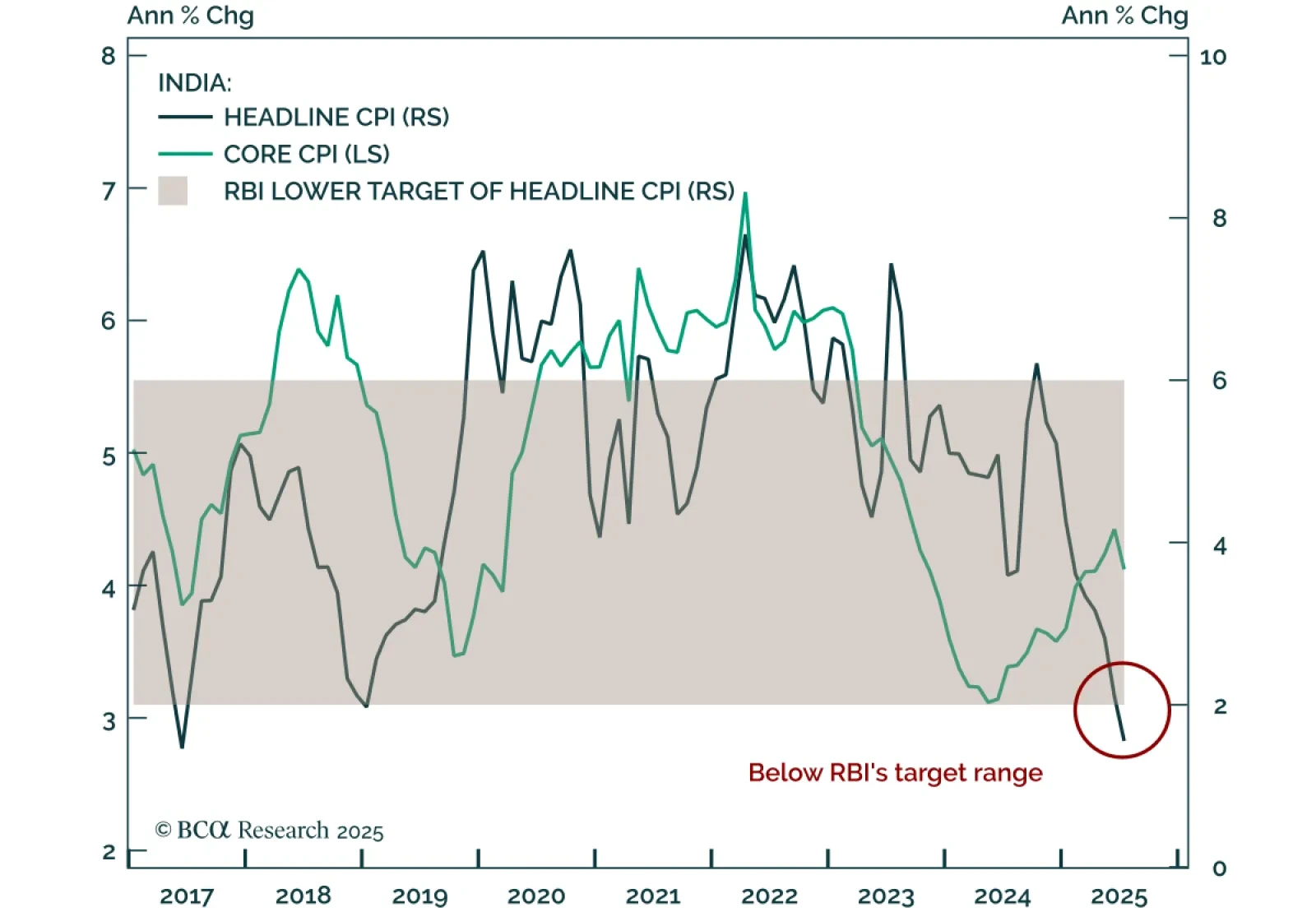

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

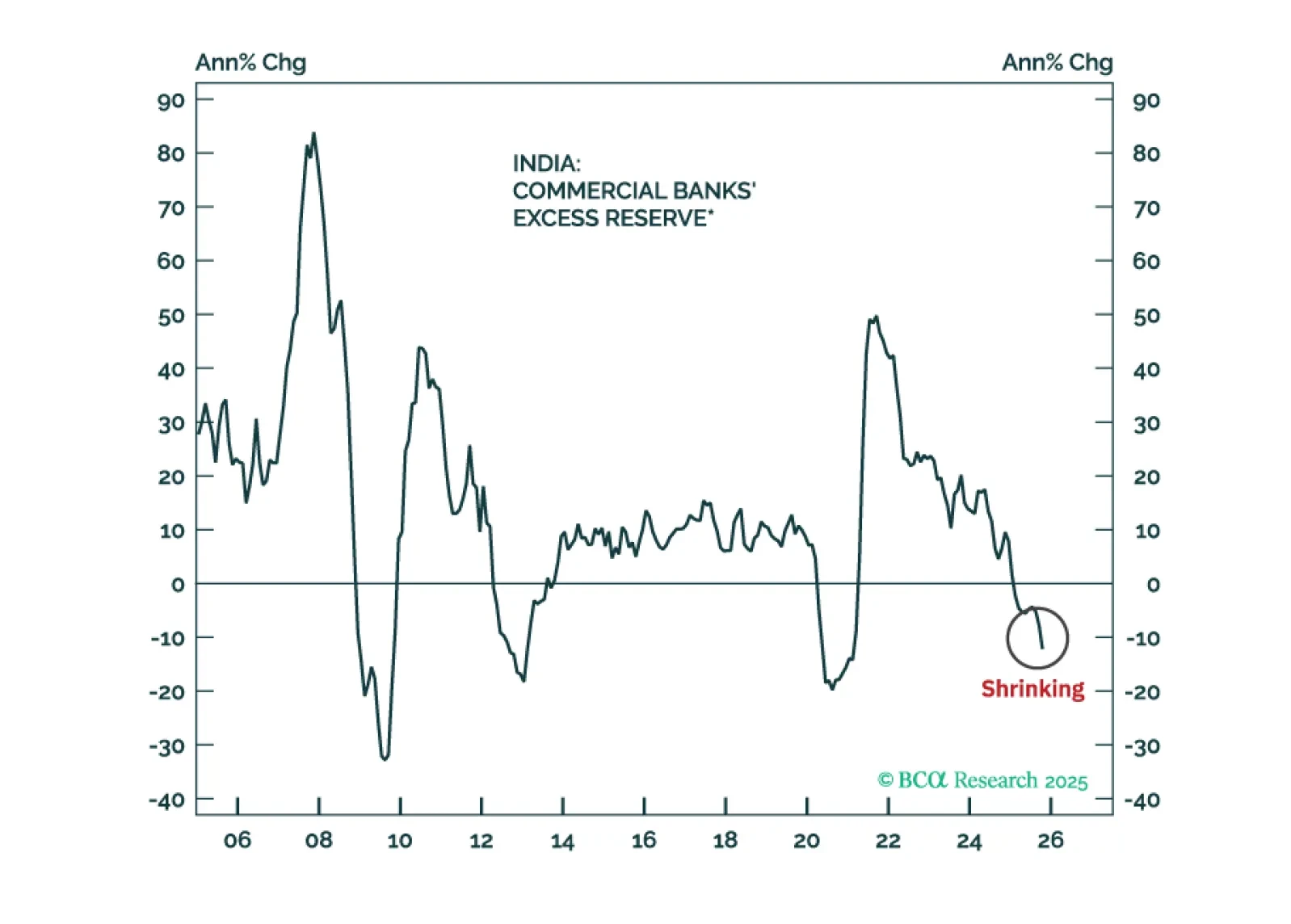

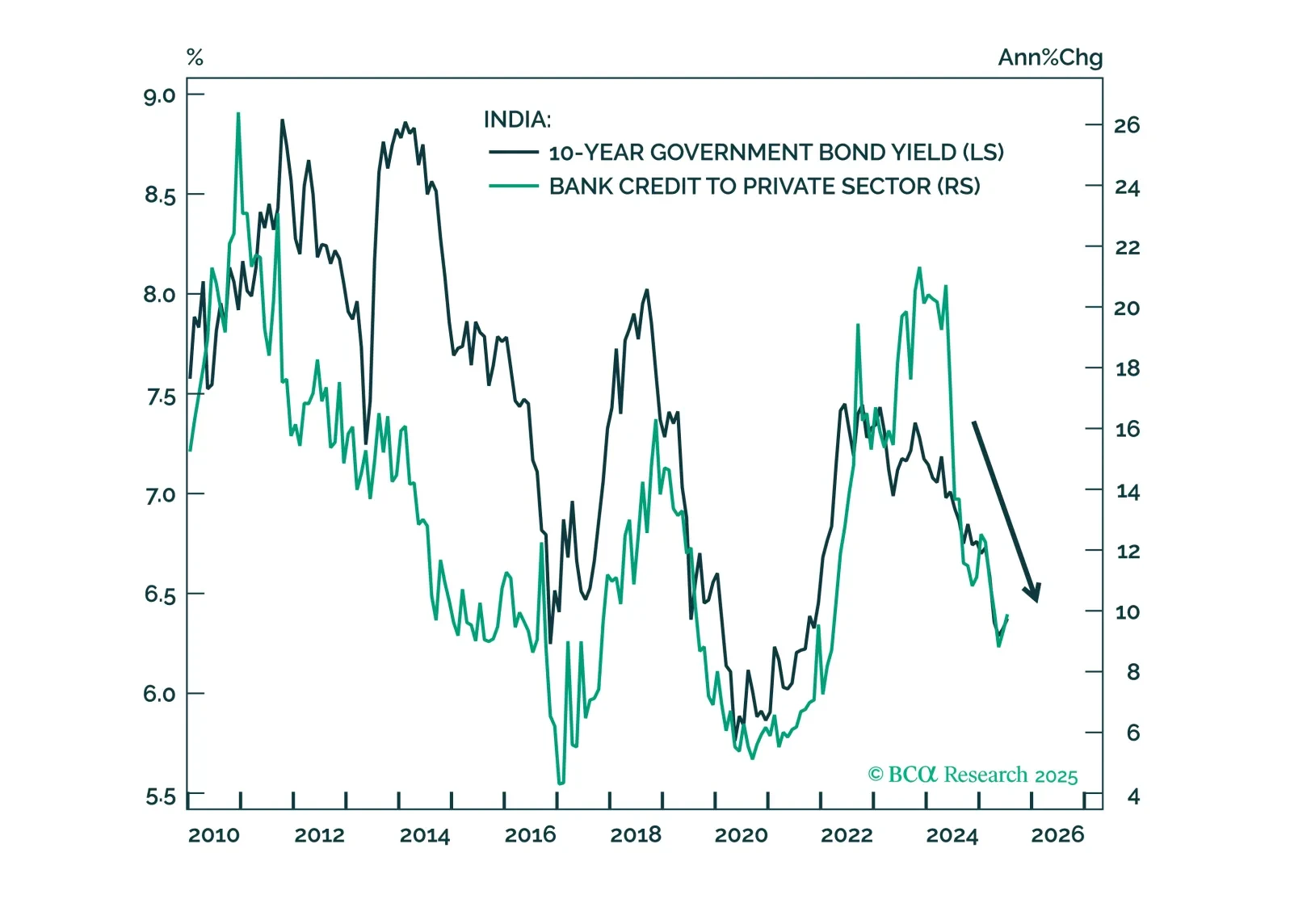

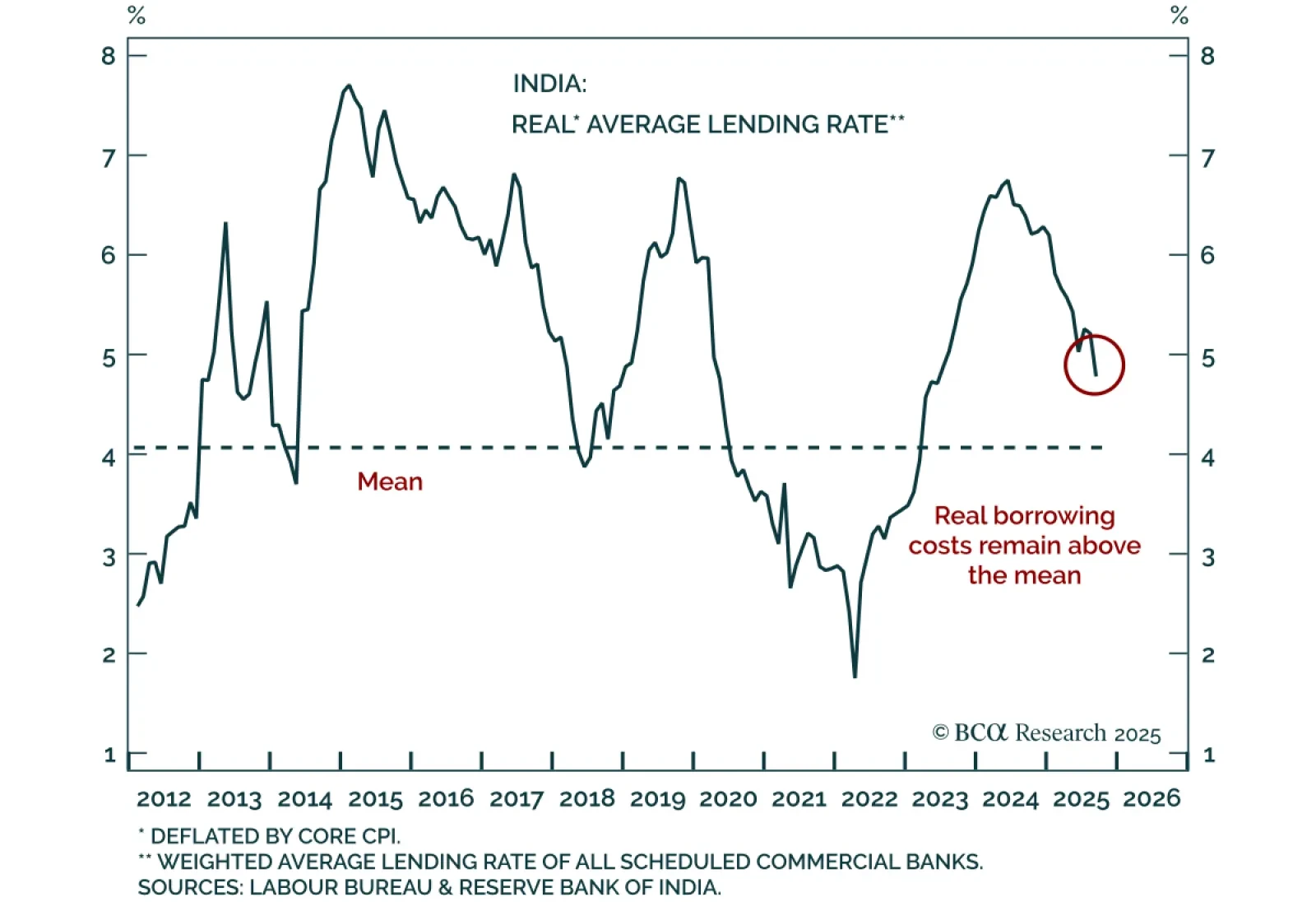

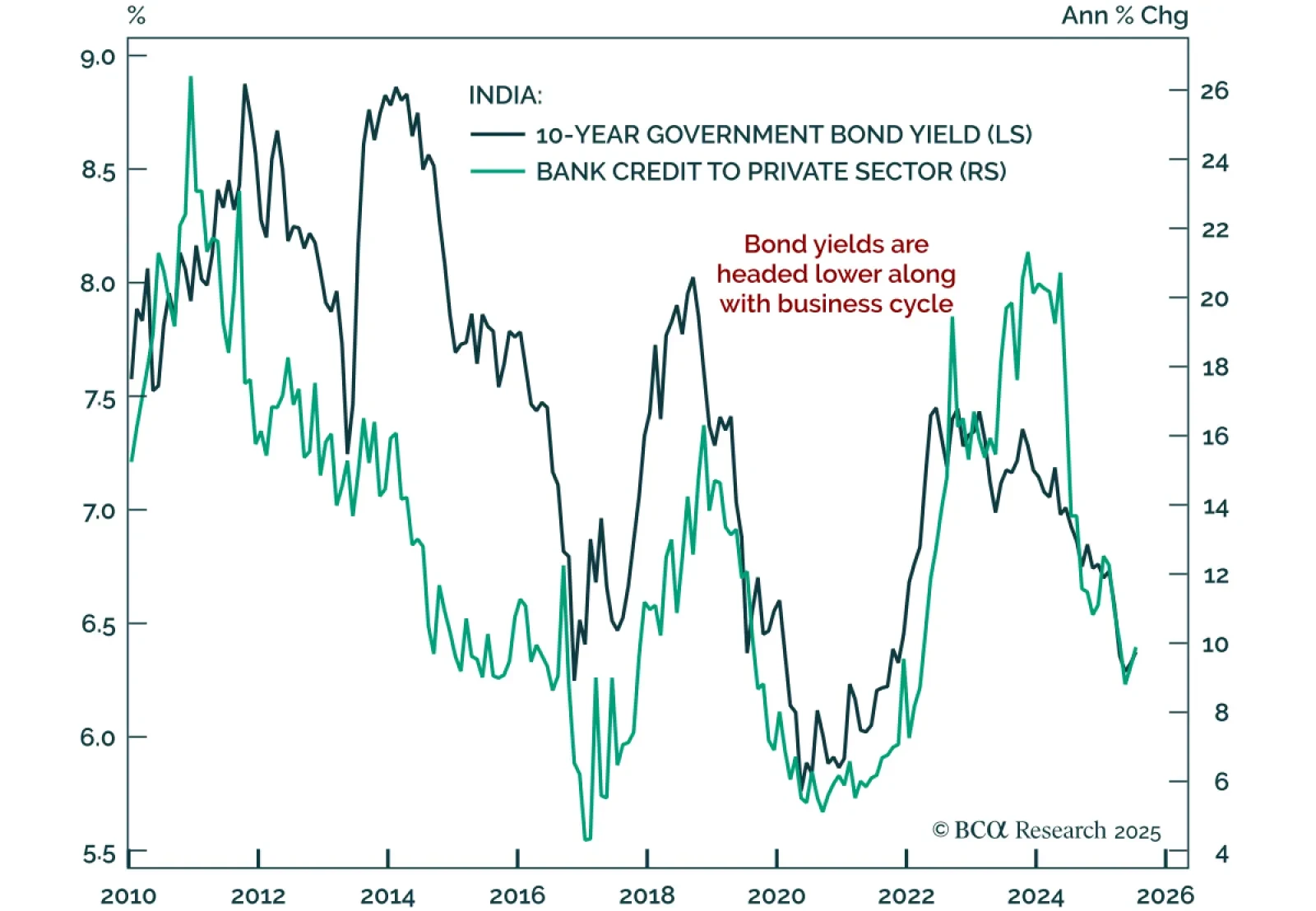

India’s central bank held rates at 5.5%, but restrictive policy, weak credit impulse, and rising external risks support further easing and a long bond position. Real lending rates remain near decade highs, and the negative…

Our Emerging Markets strategists recommend staying underweight India in EM equity and Asia portfolios, while maintaining an overweight in India within EM domestic bond allocations. A relatively higher US tariff rate and ongoing trade…