Domestic bond yields in the three major central European markets have recently inched up more than their German counterparts. This is despite economic growth staying quite weak in CE3. What should investors make of it (Chart 1)? Our…

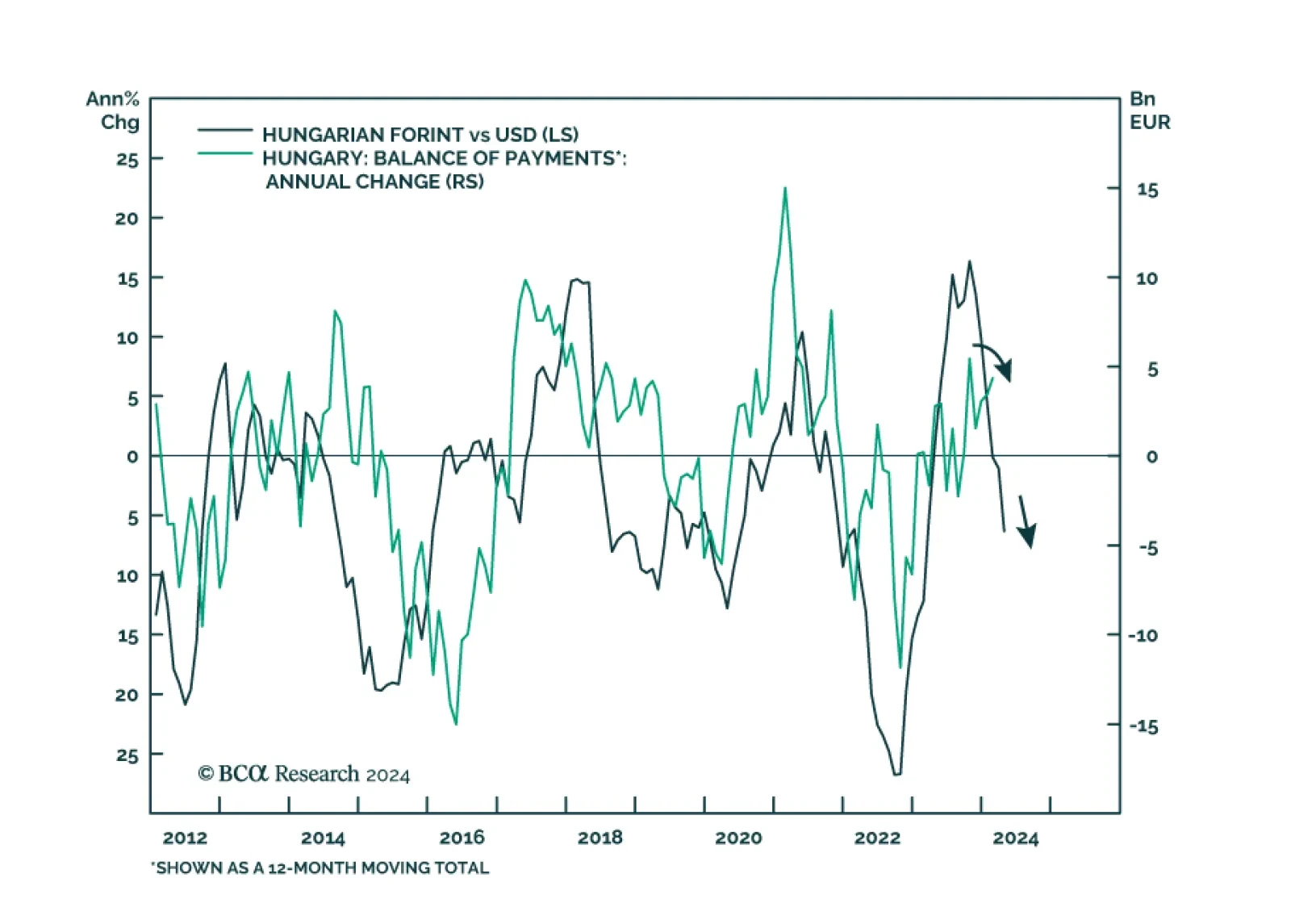

BCA Research’s Emerging Markets Strategy service concludes that among the CE3 currencies, the zloty and the koruna will be the relative winners, while the forint will likely be the worst performer of the three. That said,…

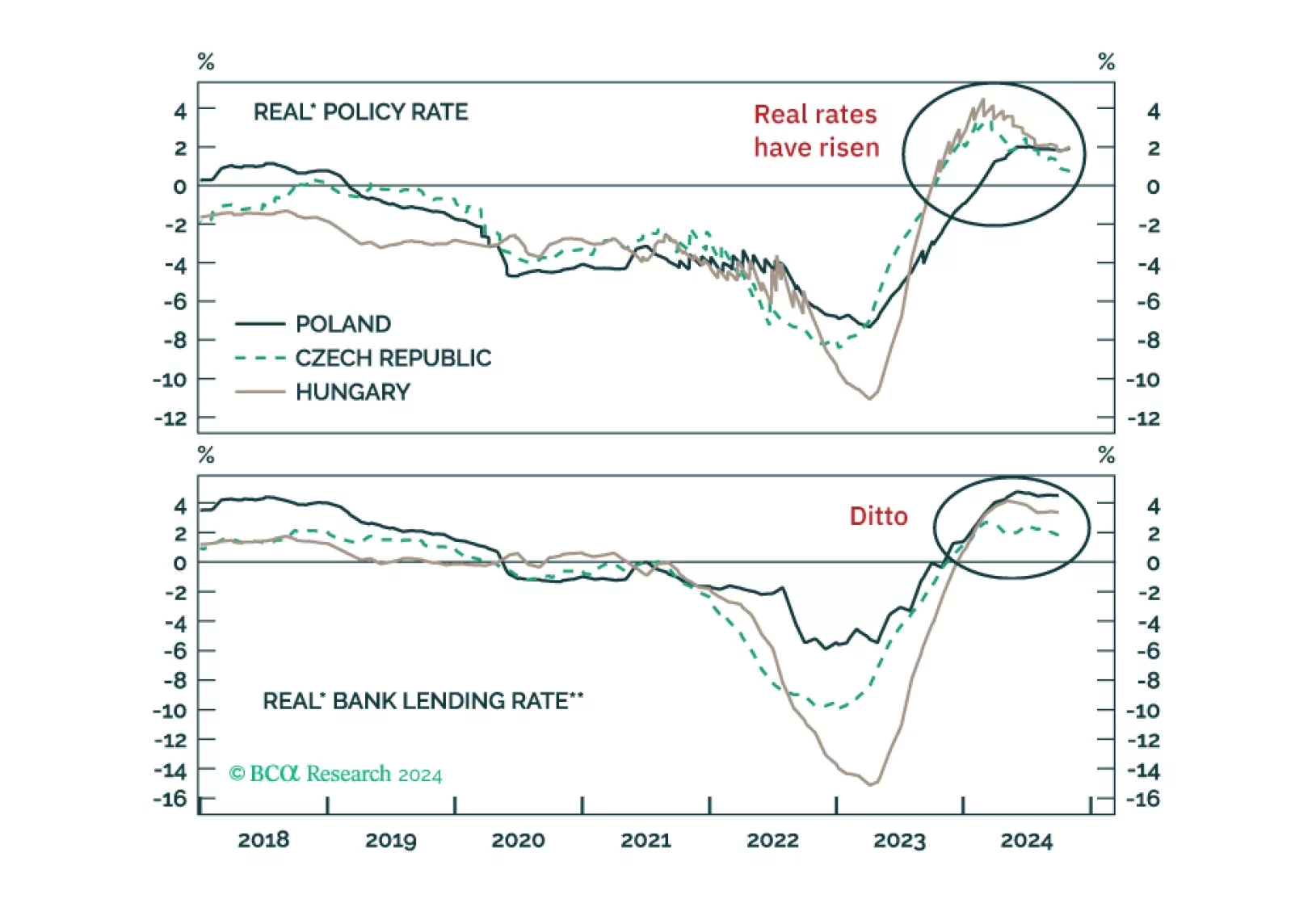

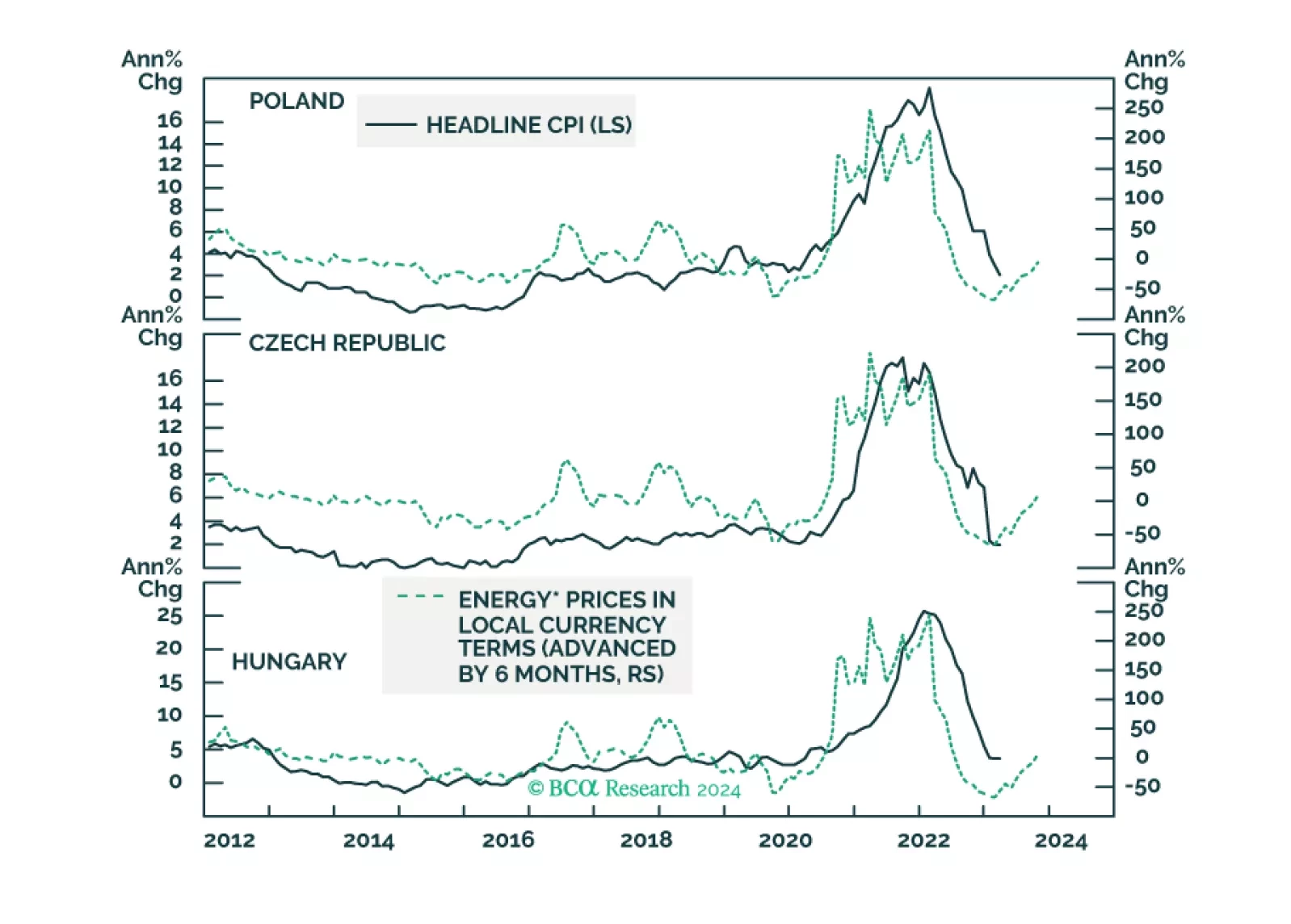

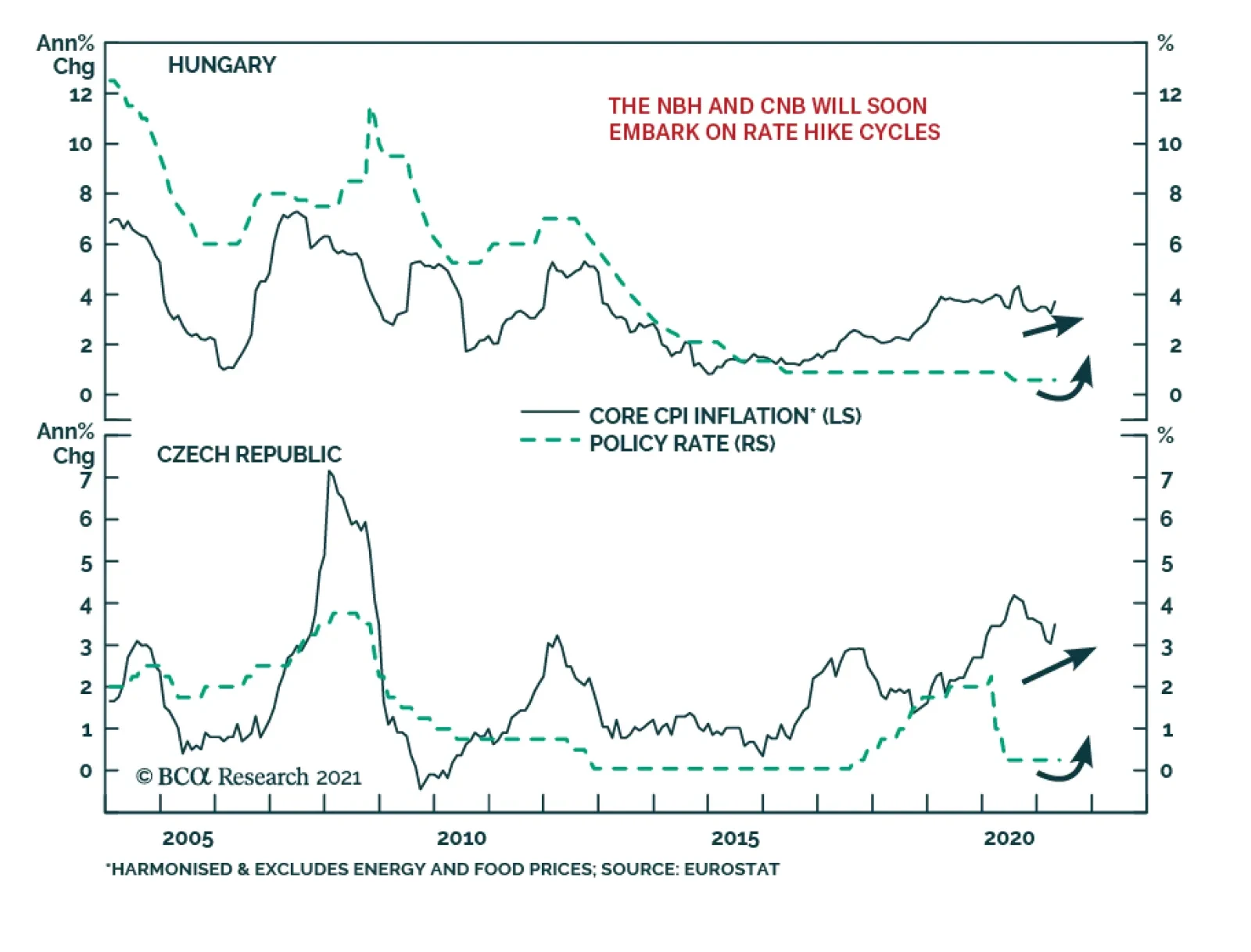

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…

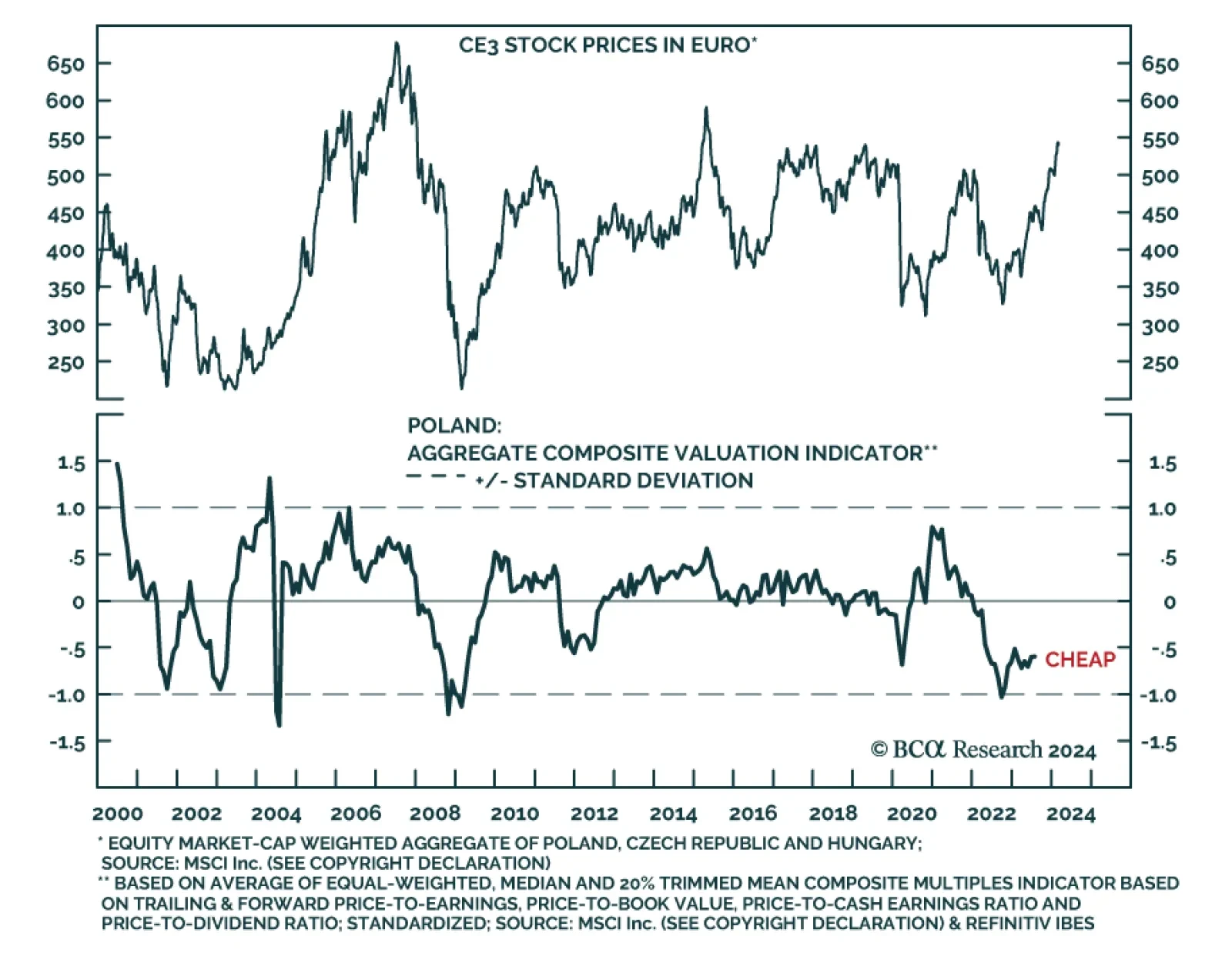

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

Real wages are set to rise in CE3 economies with implications for their asset markets and currencies. Of the three, Polish assets and the zloty are the most vulnerable.

The growth and inflation profiles of the three central European countries are set to diverge. The outlook for Polish and Hungarian Bonds are not attractive anymore. Book profits on them. Instead, initiate a new trade: pay Polish /…

It’s time to go overweight Hungarian domestic bonds in an EM and European core bond portfolios. Currency investors should book profits on our long CZK / short HUF trade, which has generated 29.4% gains since its inception in June…

Executive Summary Poland: Wages Are Surging Hungary is exhibiting classic signs of an overheating economy –as rising inflation coincides with very strong domestic demand. Yet, authorities are still pursuing very…

Executive Summary Loss Of Russian Production Will Lift Brent With German imports of Russian oil close to 10% of its total requirements – following an impressive decline from 35% pre-invasion – we expect the EU to…

BCA Research’s Emerging Markets Strategy service concludes that the Czech koruna will outperform the Hungarian forint. Conditions for central bank rate hike cycles are in place in Hungary and the Czech Republic. Yet…