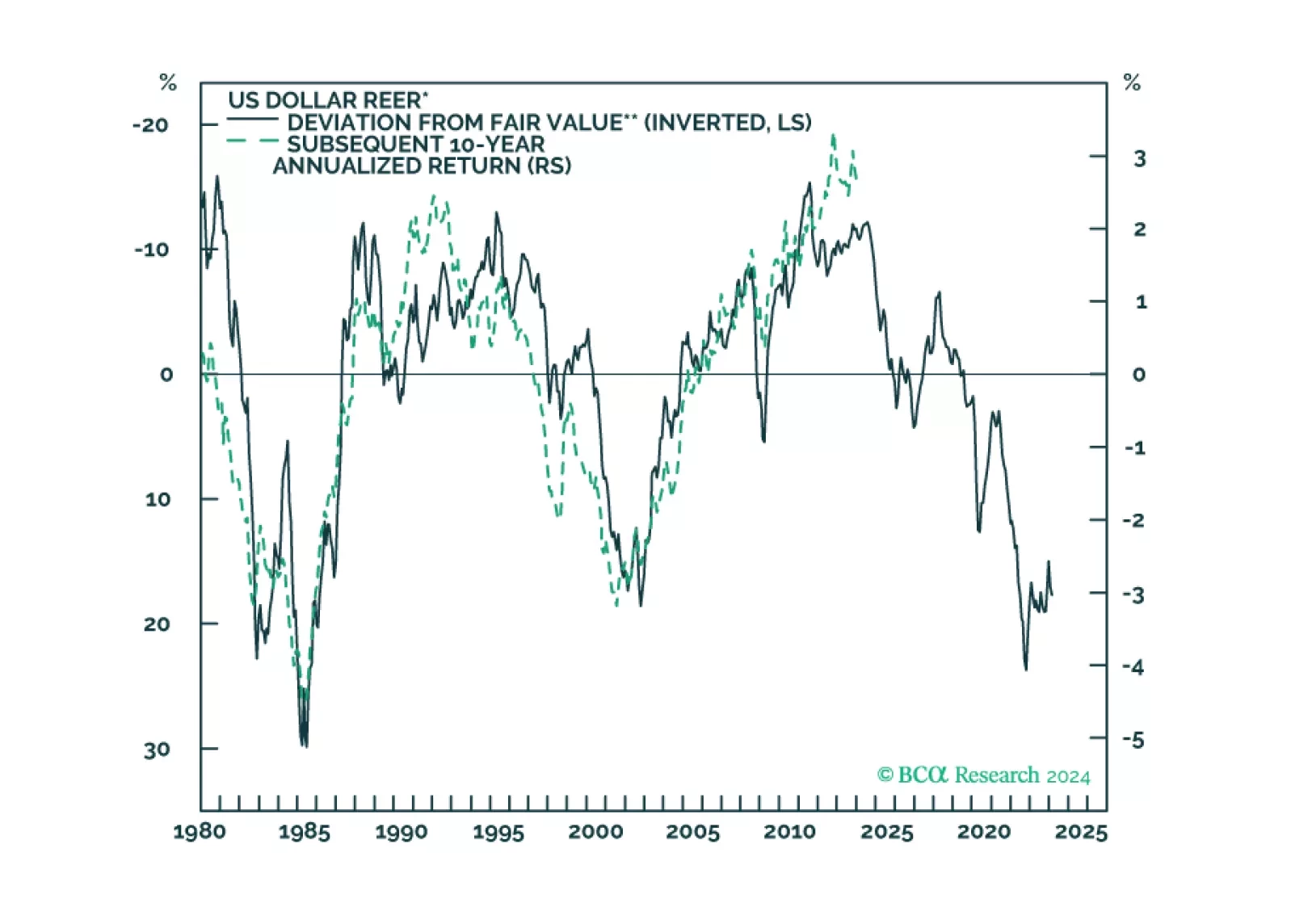

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

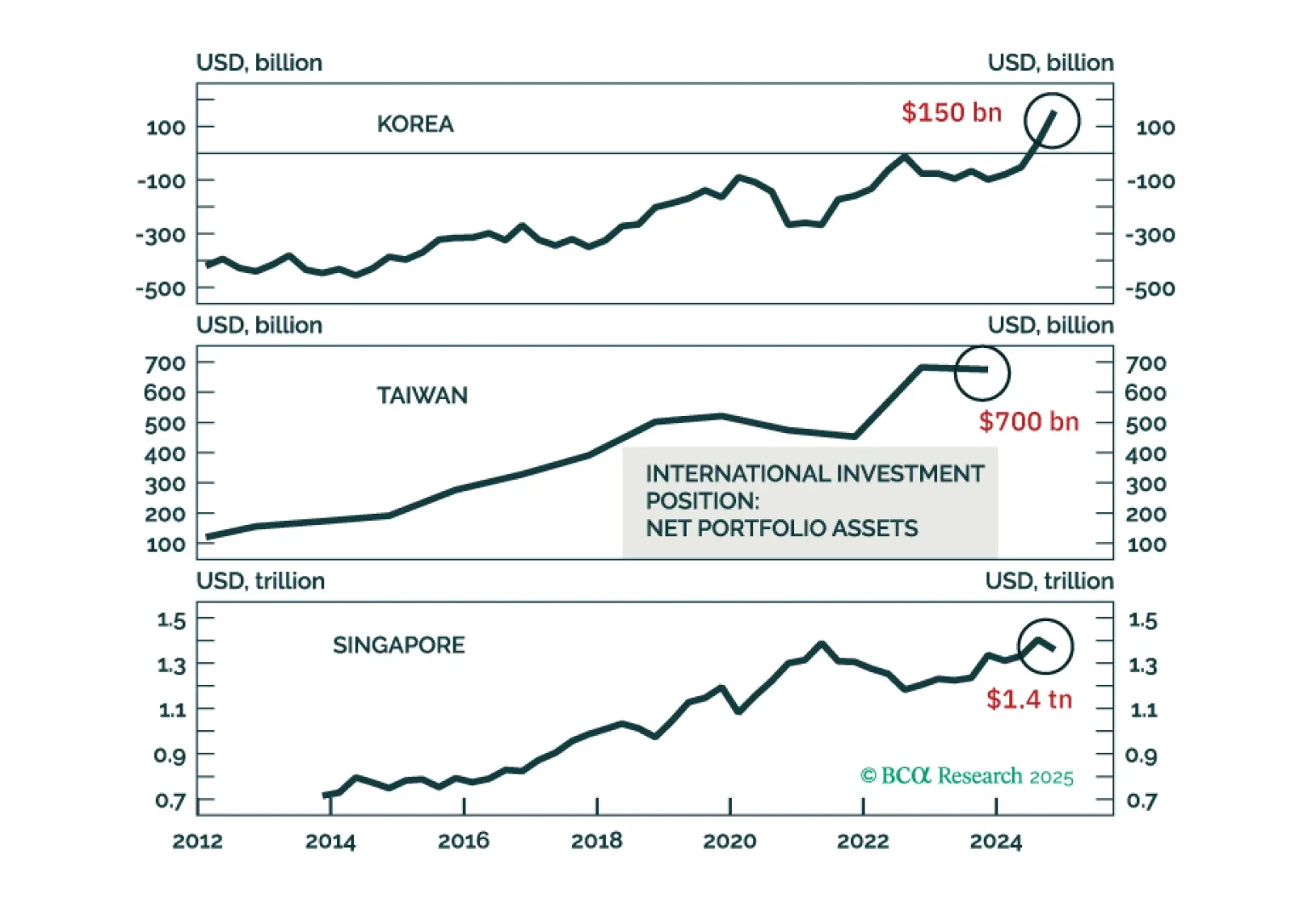

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…

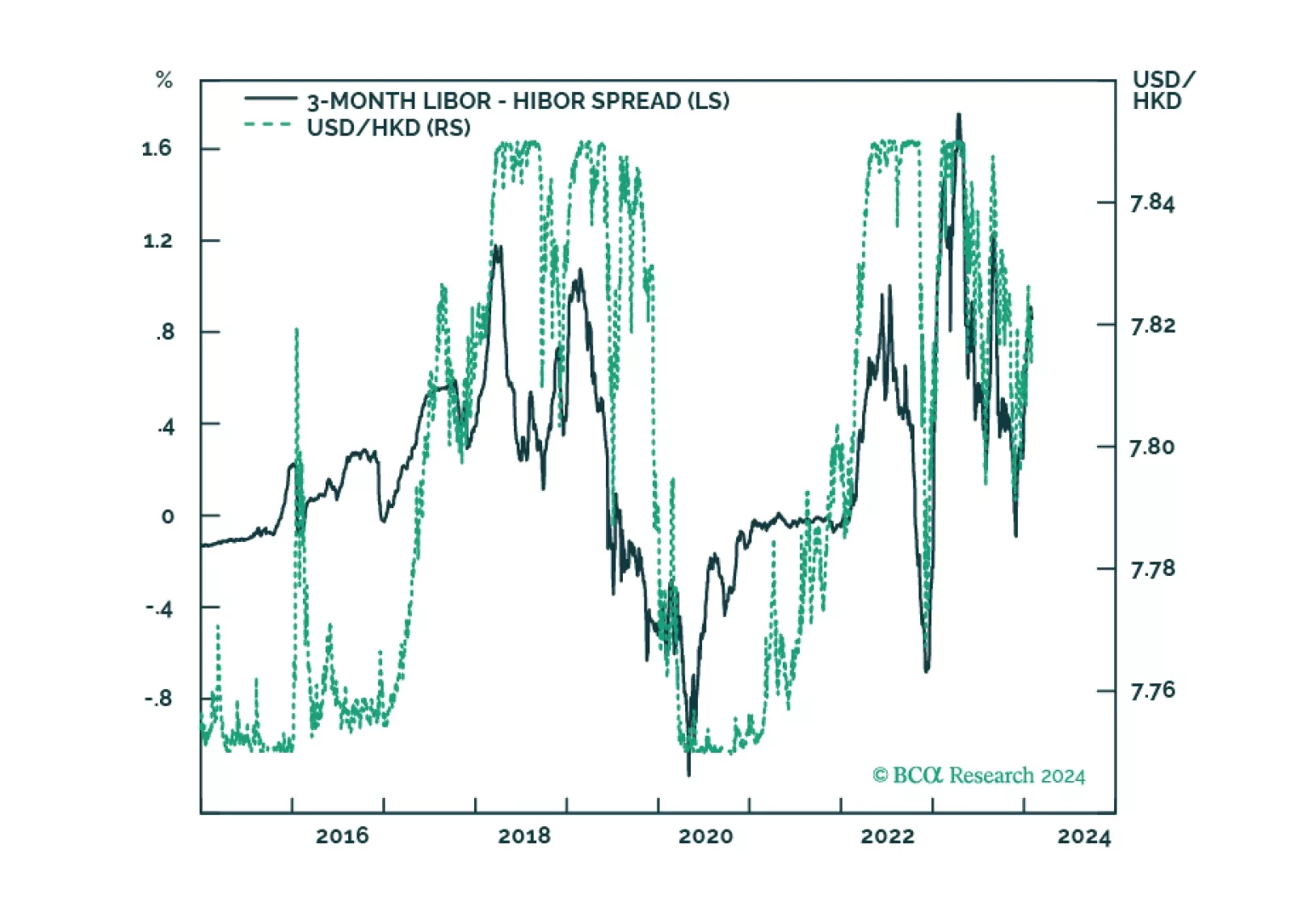

The HK dollar is under an assault from rising US interest rates and a weak economy. To defend the exchange rate peg, the HKMA will continue to tighten liquidity, which will boost HK interest rates above those in the US across the…

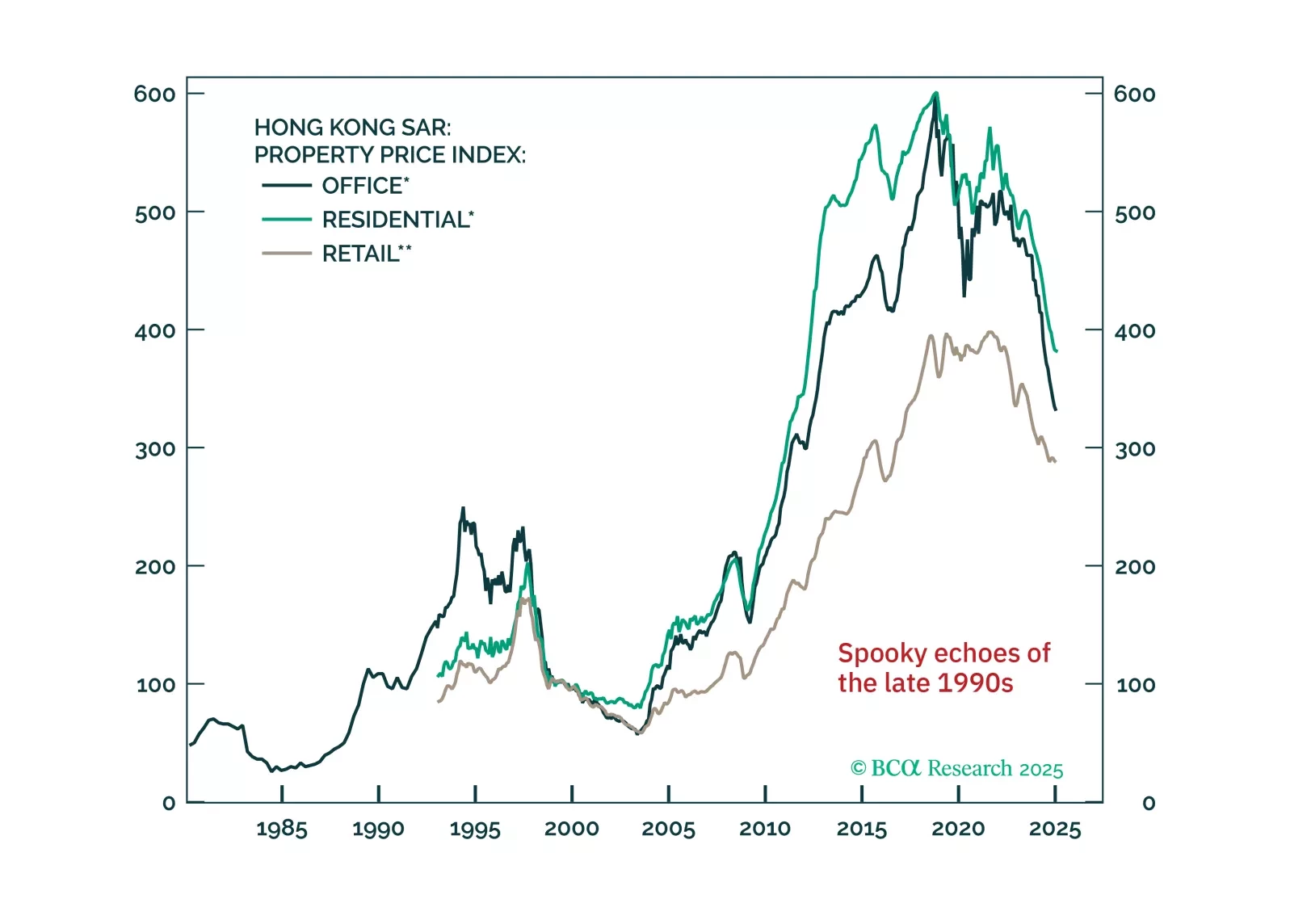

Executive Summary Liquidity Will Shrink Further In Hong Kong The HKD is facing its most critical test in several decades. While the peg is likely to survive (Feature Chart), the economic costs for Hong Kong SAR will be far…

Dear clients, The Foreign Exchange Strategy will take a summer break next week. We will resume our publication on September 4th. Best regards, Chester Ntonifor, Vice President Foreign Exchange Strategy Feature The economy of Hong…