This report revisits China’s property market through both cyclical and structural lenses, assesses the likely policy responses, and evaluates their investment implications.

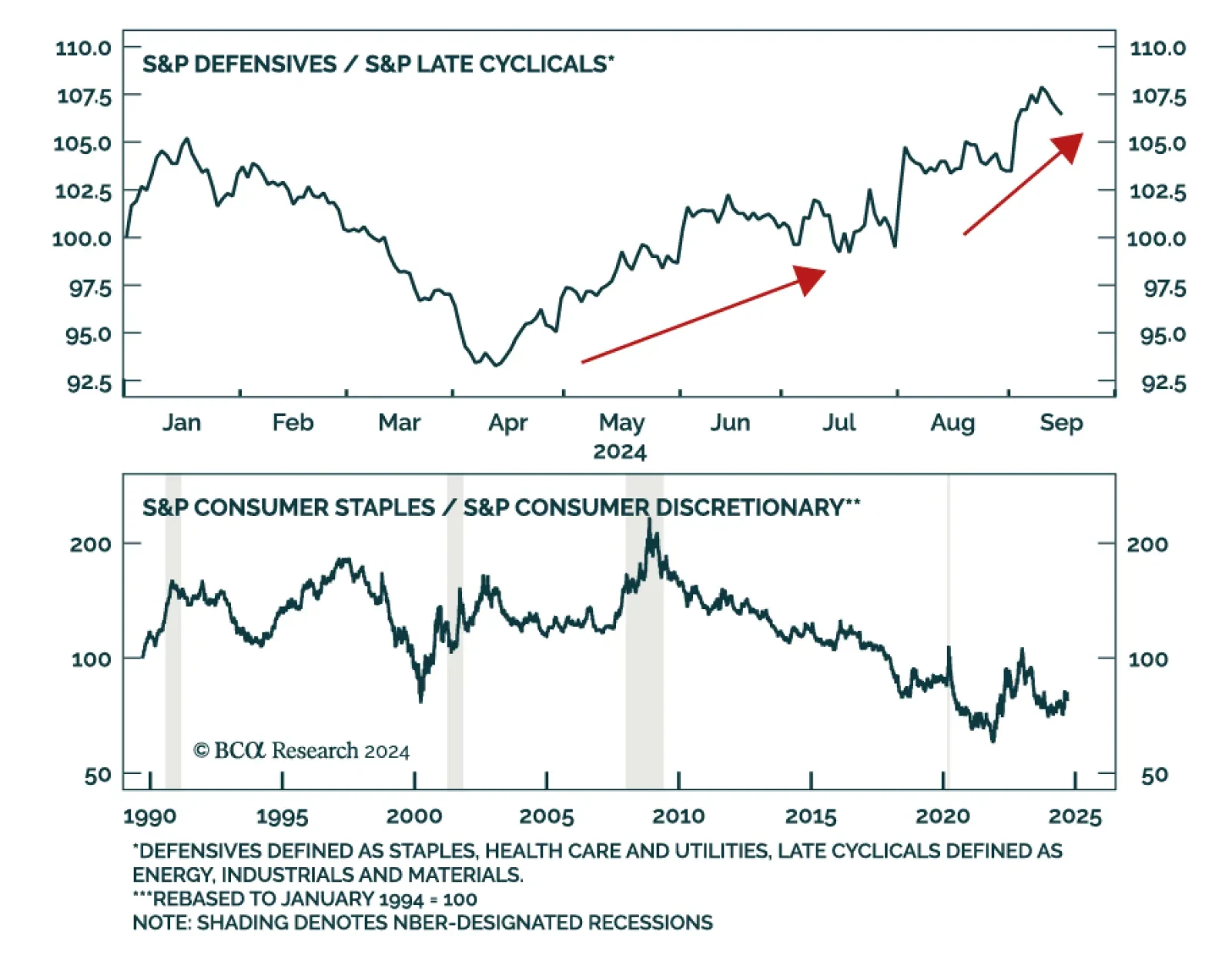

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

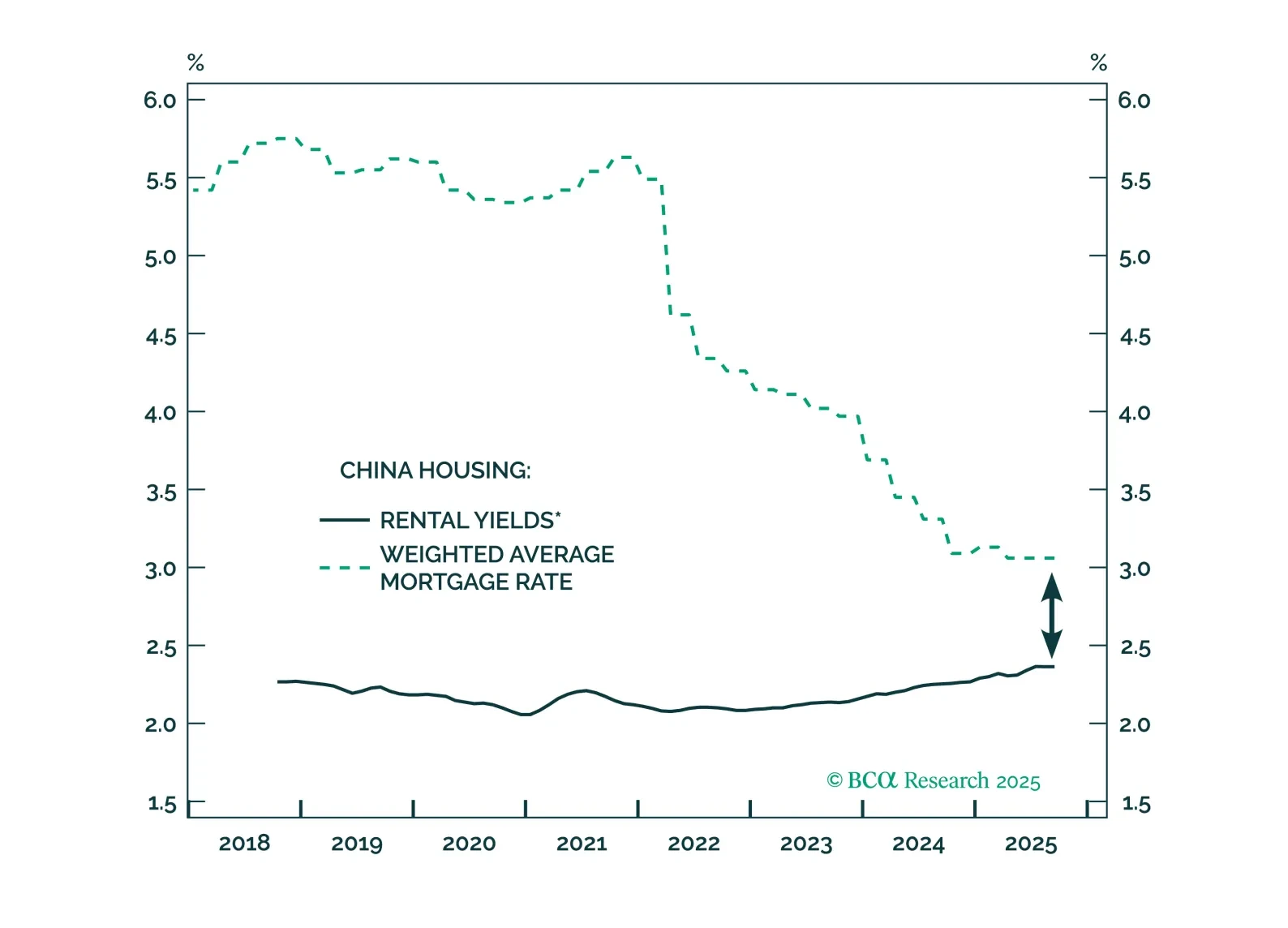

Executive Summary The structural downtrend in Chinese bond yields has a lot further to go, because it is helping to let the air out gently of stratospheric valuations in the real estate sector, and thereby preventing a hard landing for…

Underweight Housing stocks have been resilient to rising interest rates for the most part of the year, but now macro headwinds are taking over this consumer discretionary sub-sector and we recommend a below benchmark allocation. Rising…

Underweight High-Conviction While our underweight homebuilders call has been offside of late, we are sticking with it given the recent turn in some crucial data series. Interest and mortgage rates are a key determinant for…

Today we close two high-conviction trades and place a stop buy order for the June 2021 expiry VIX futures as a hedge to the remaining positions. Homebuilders have proven to be more resilient than we expected, especially…

In the January 19th Special Report we instituted a long S&P REITs / short S&P homebuilders pair trade with a 10% stop loss. Yesterday, our stop was triggered and we are obeying it and closing this pair trade. Among…

Underweight We deem that most, if not all, of the good news (low mortgage rates, low inventories, high demand, work-from-home reality, all-time highs on the overall NAHB housing sentiment survey) is already priced in…

Dear client, Next Monday December 14, 2020 we will be hosting our last webcasts for the year “From Alpha To Omega With Anastasios”, one at 10am EST for our US, European and Middle Eastern clients and one at 8pm EST for our…