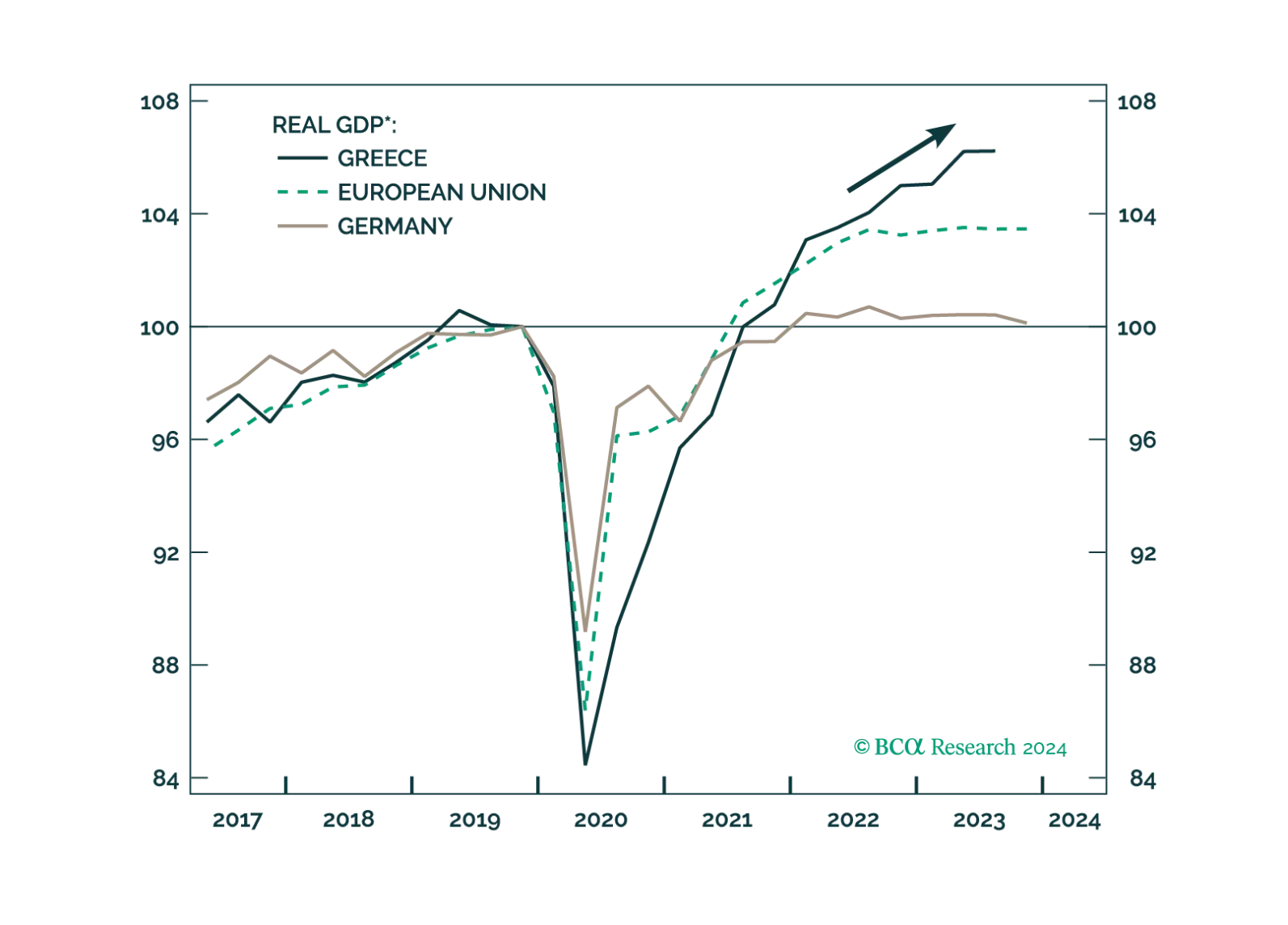

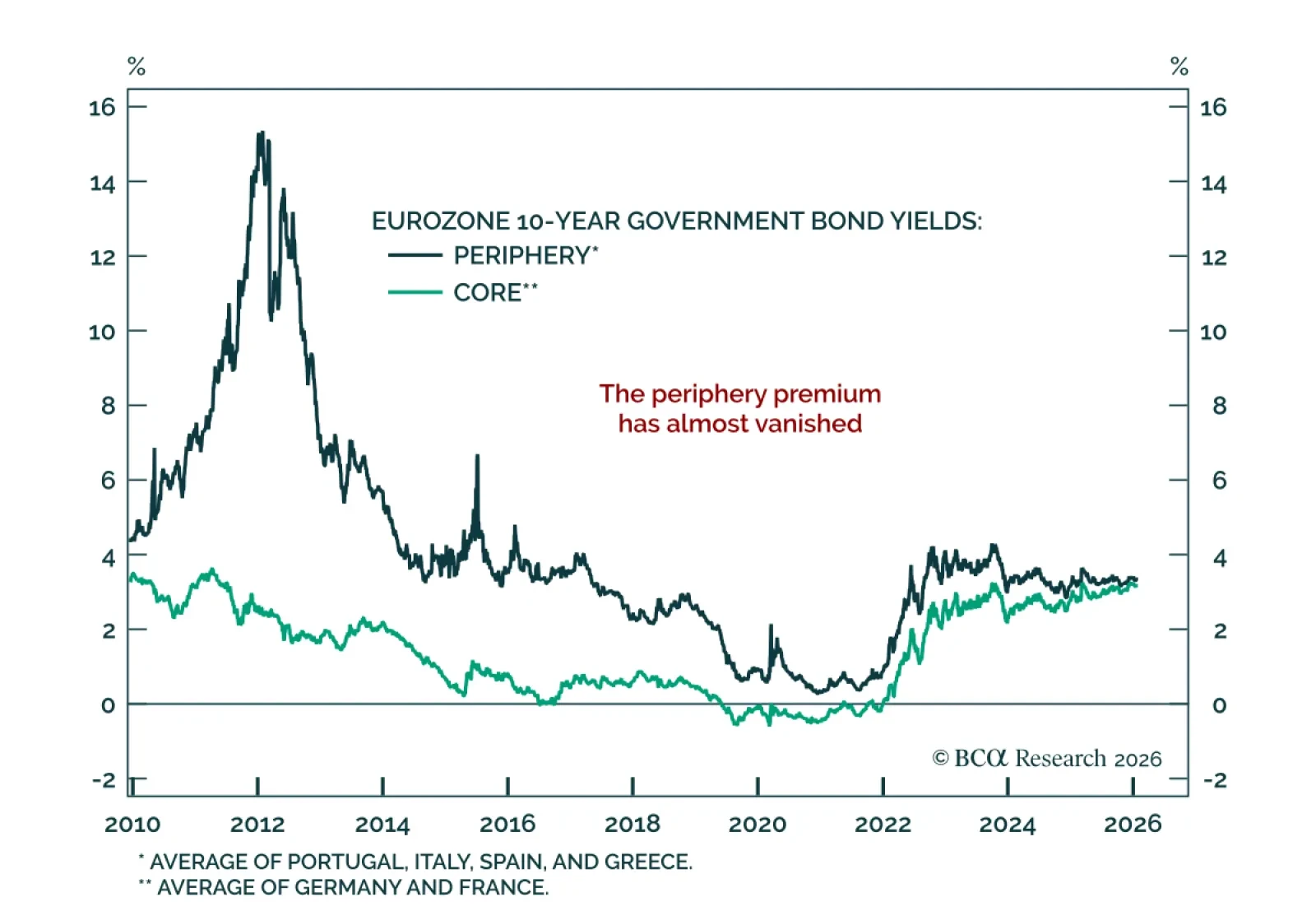

Peripheral Europe is driving the region’s resilience, and finally closing the gap with the core. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. The resilience of the European economy and strong…

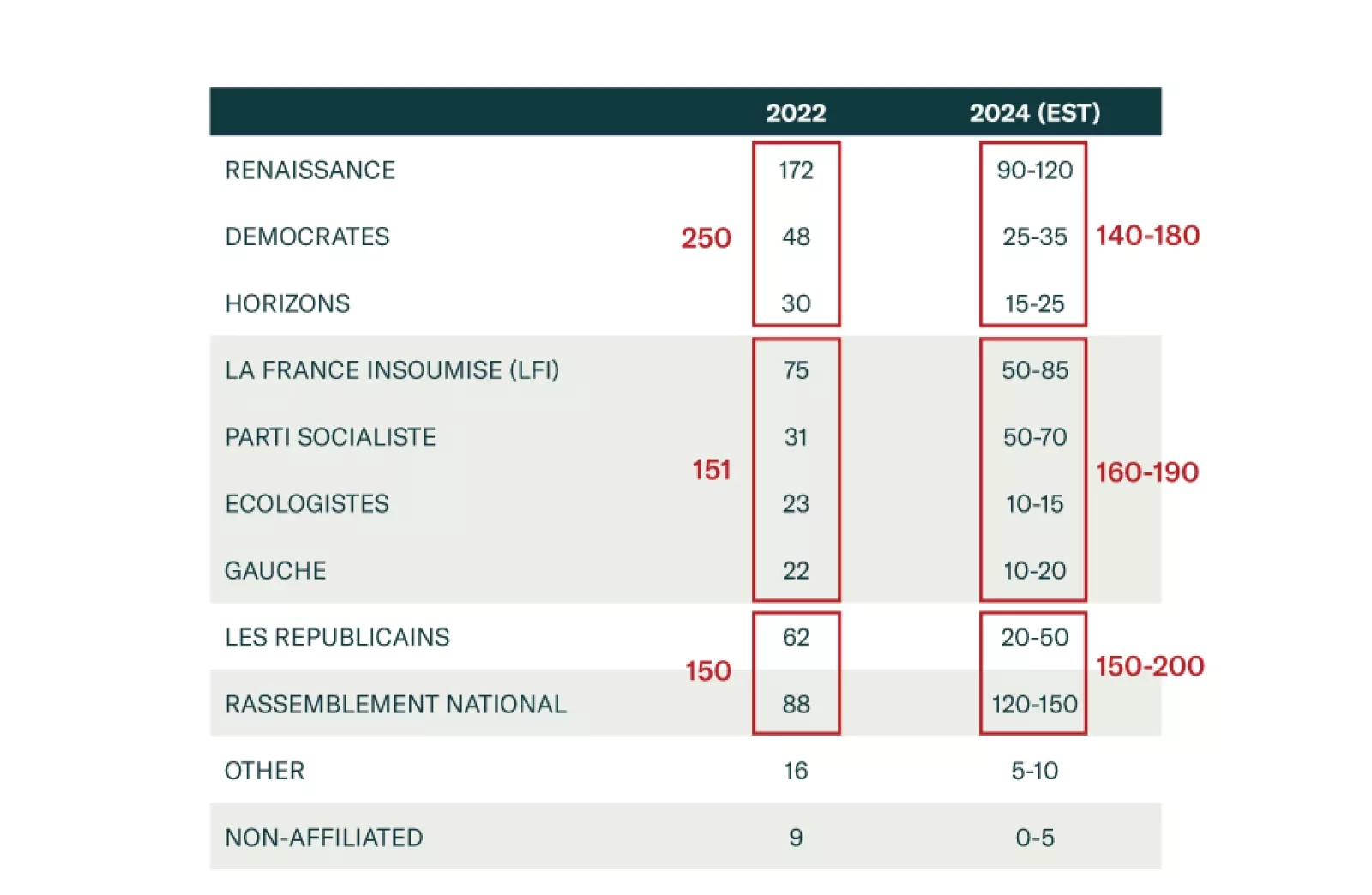

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

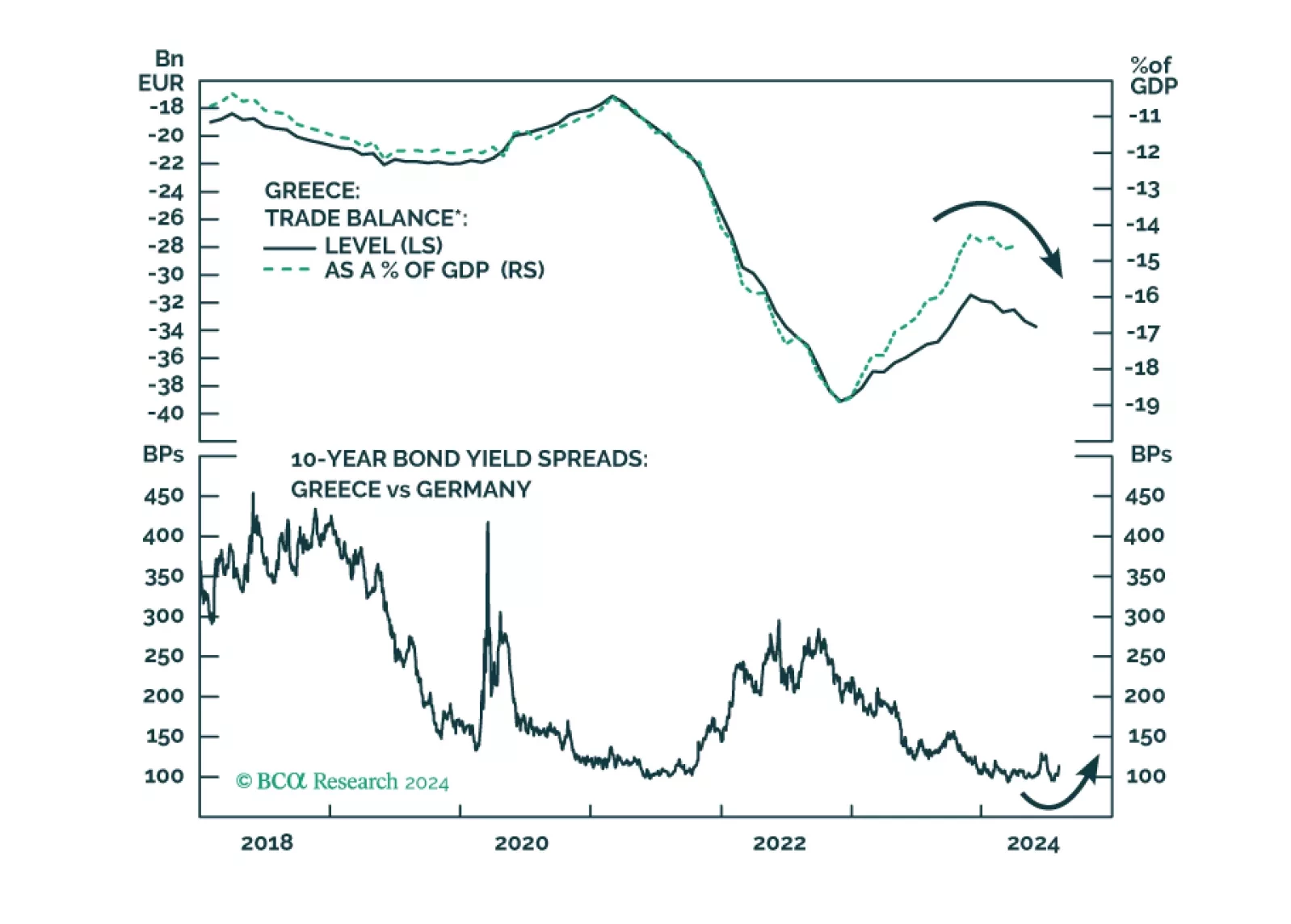

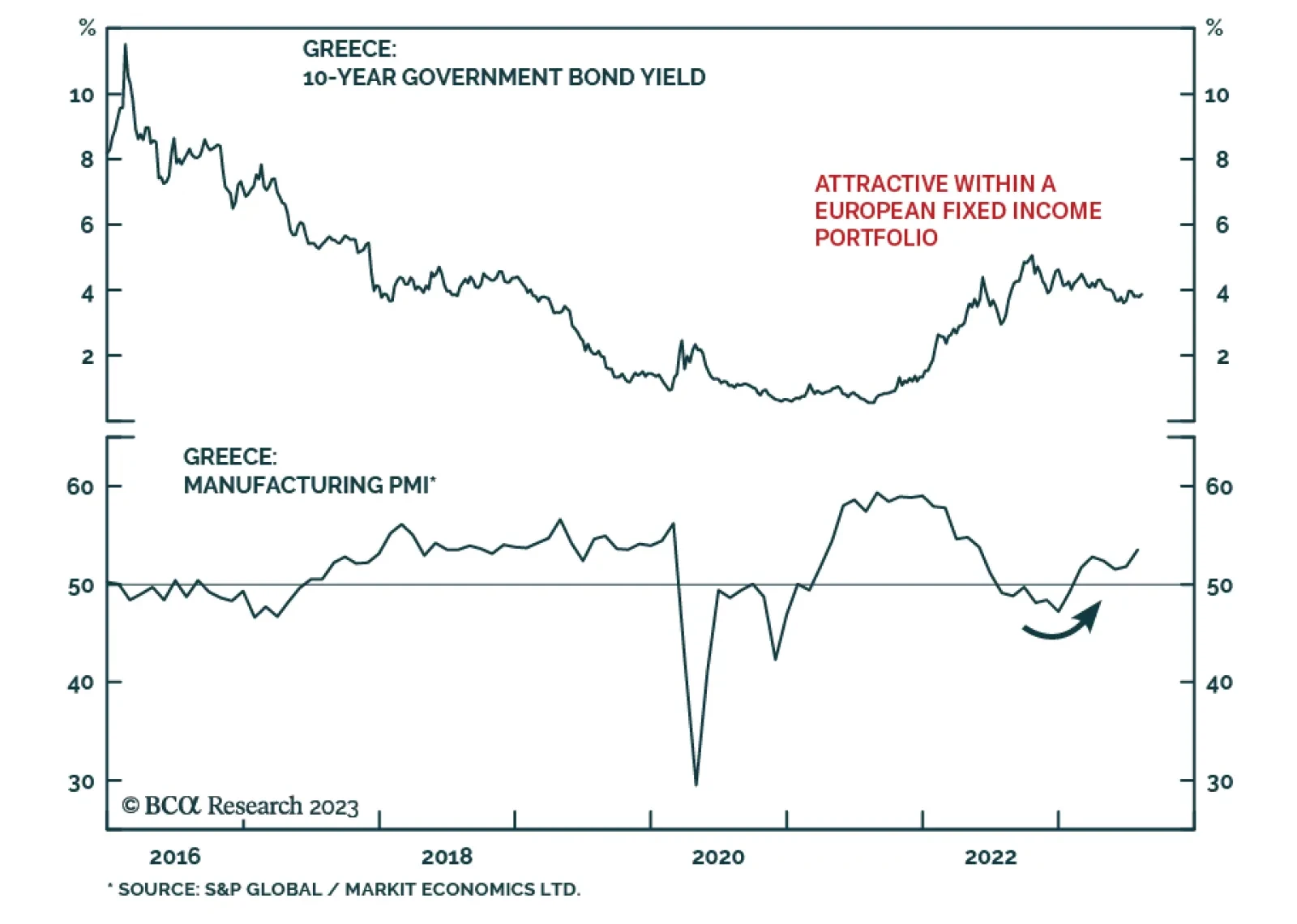

Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

Absolute return investors should be tactically cautious on Greek assets. Dedicated EM equity portfolios, however, should overweight Greek stocks.

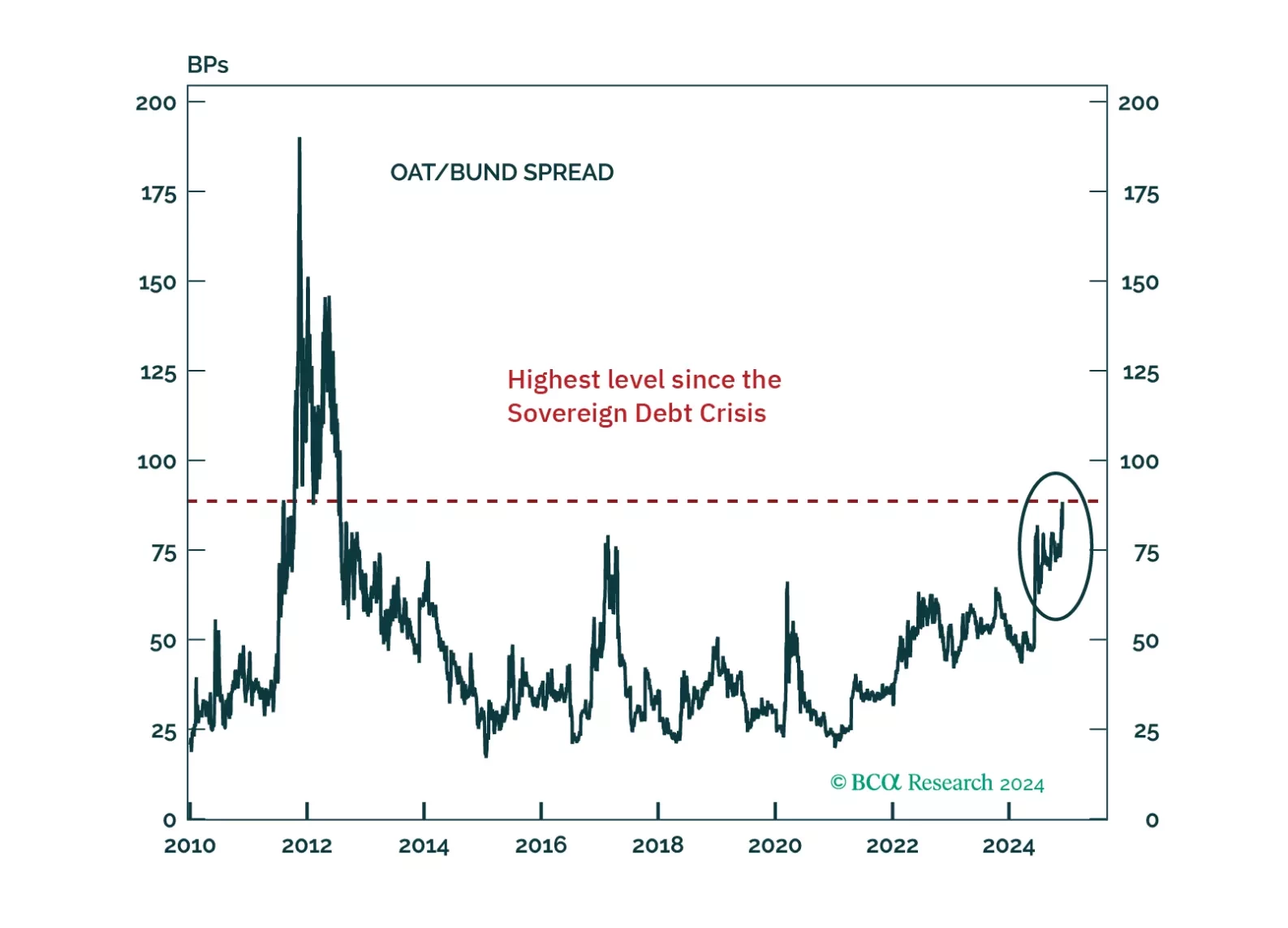

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?

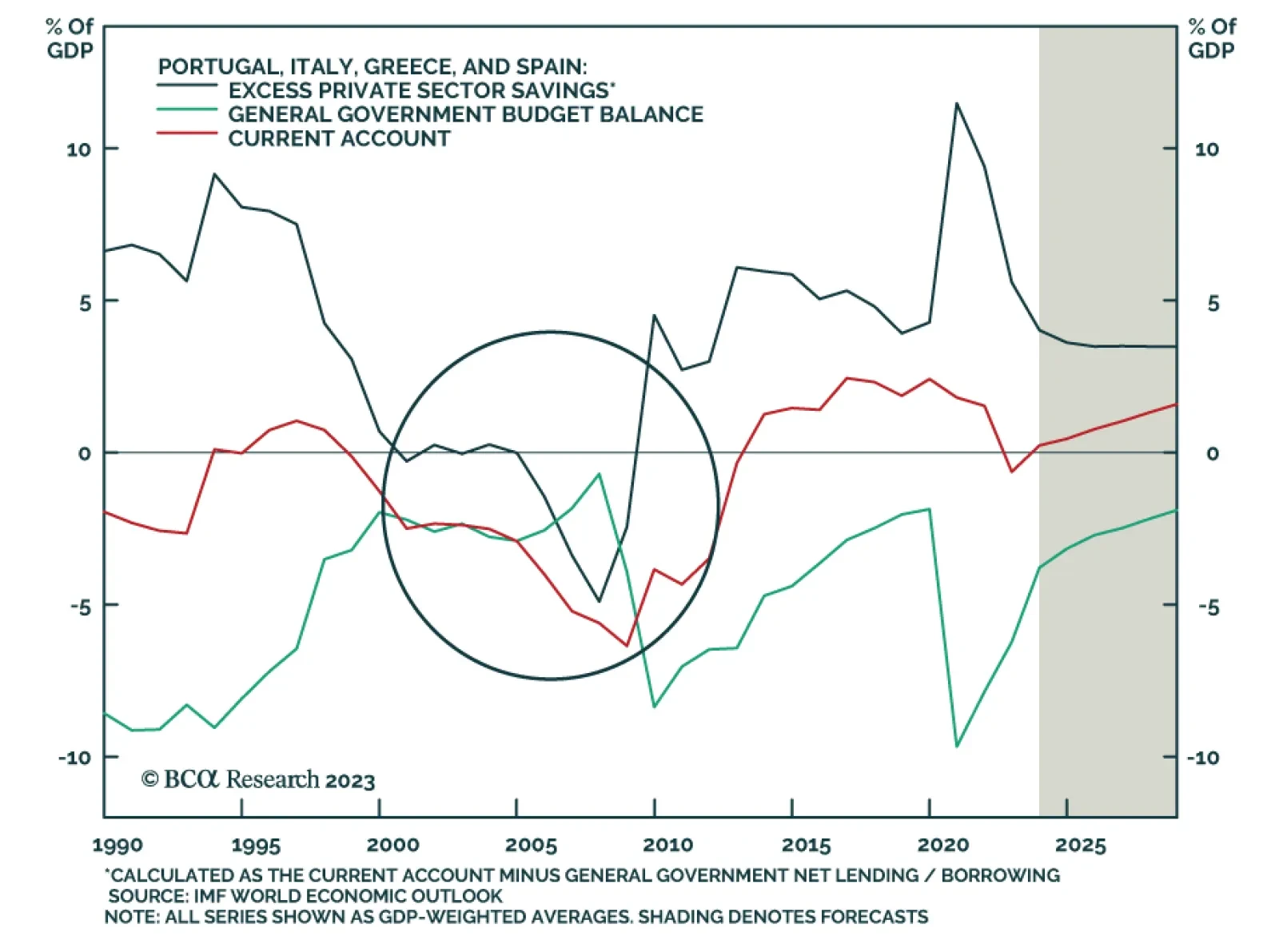

According to BCA Research’s European Investment Strategy service, the Mediterranean bloc’s move from current account deficit to current account surplus nations greatly limits the risk of a new sovereign debt crisis…

Greece is experiencing a strong economic revival from its lows of the Sovereign Debt Crisis. The Hellenic Republic has shown resilience, with an annual real GDP growth of 4.5%, outpacing the Euro Area’s growth by 2%. Greece…