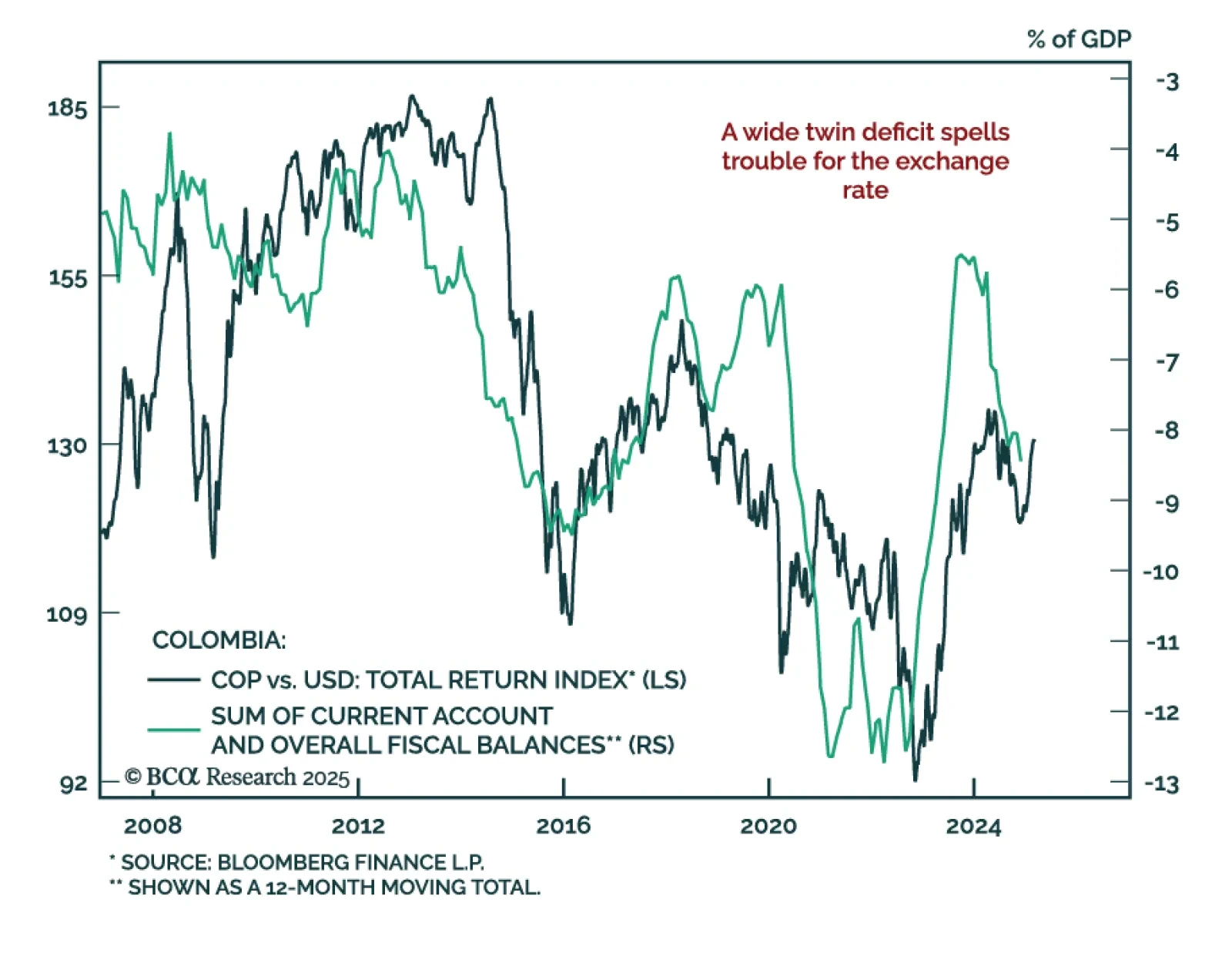

Our Emerging Markets strategists assessed Colombian assets after a significant rally. Colombia faces deep-rooted macroeconomic challenges that will not be easily reversed by a right-wing government in 2026. Public debt is on an…

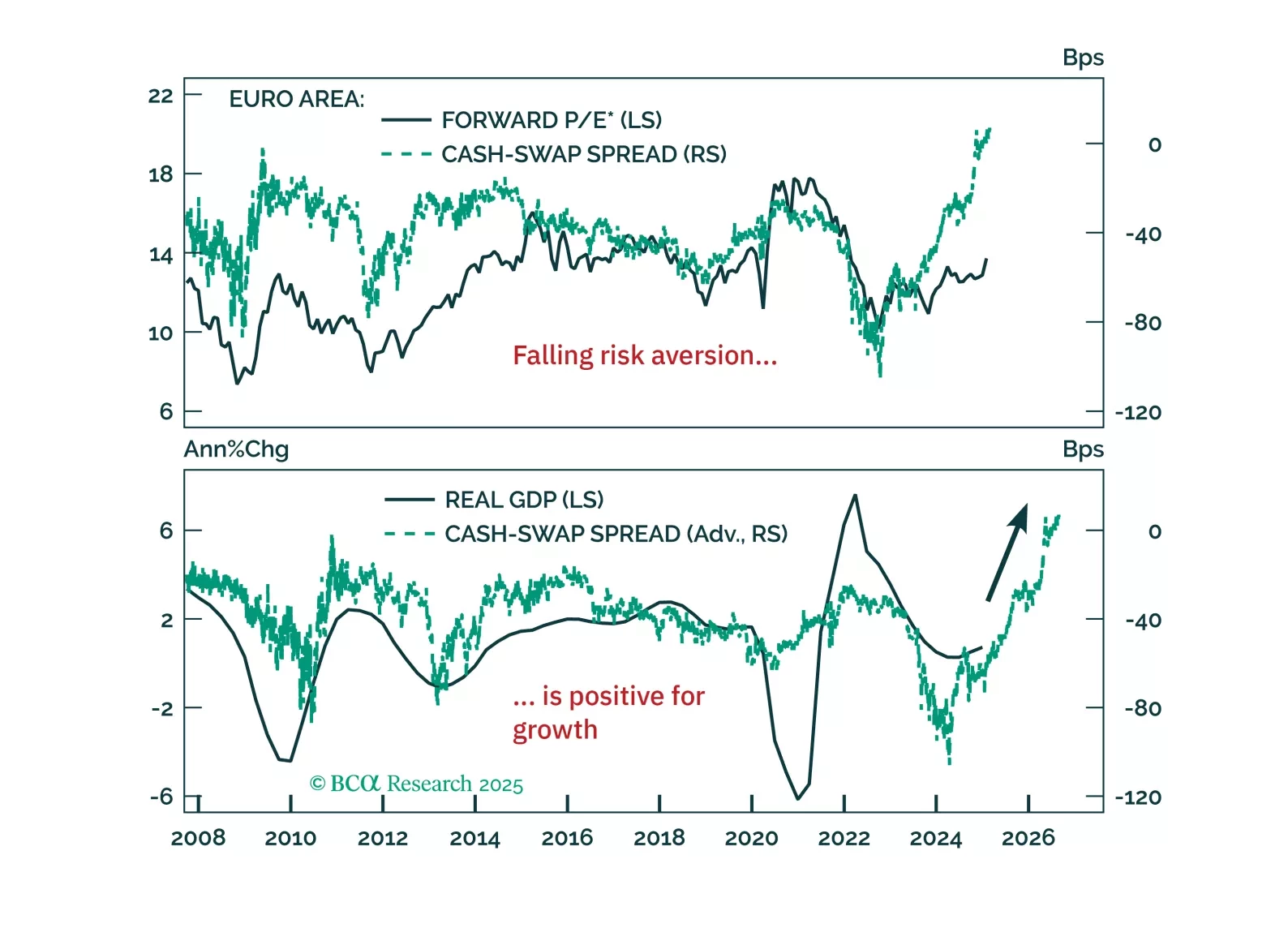

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

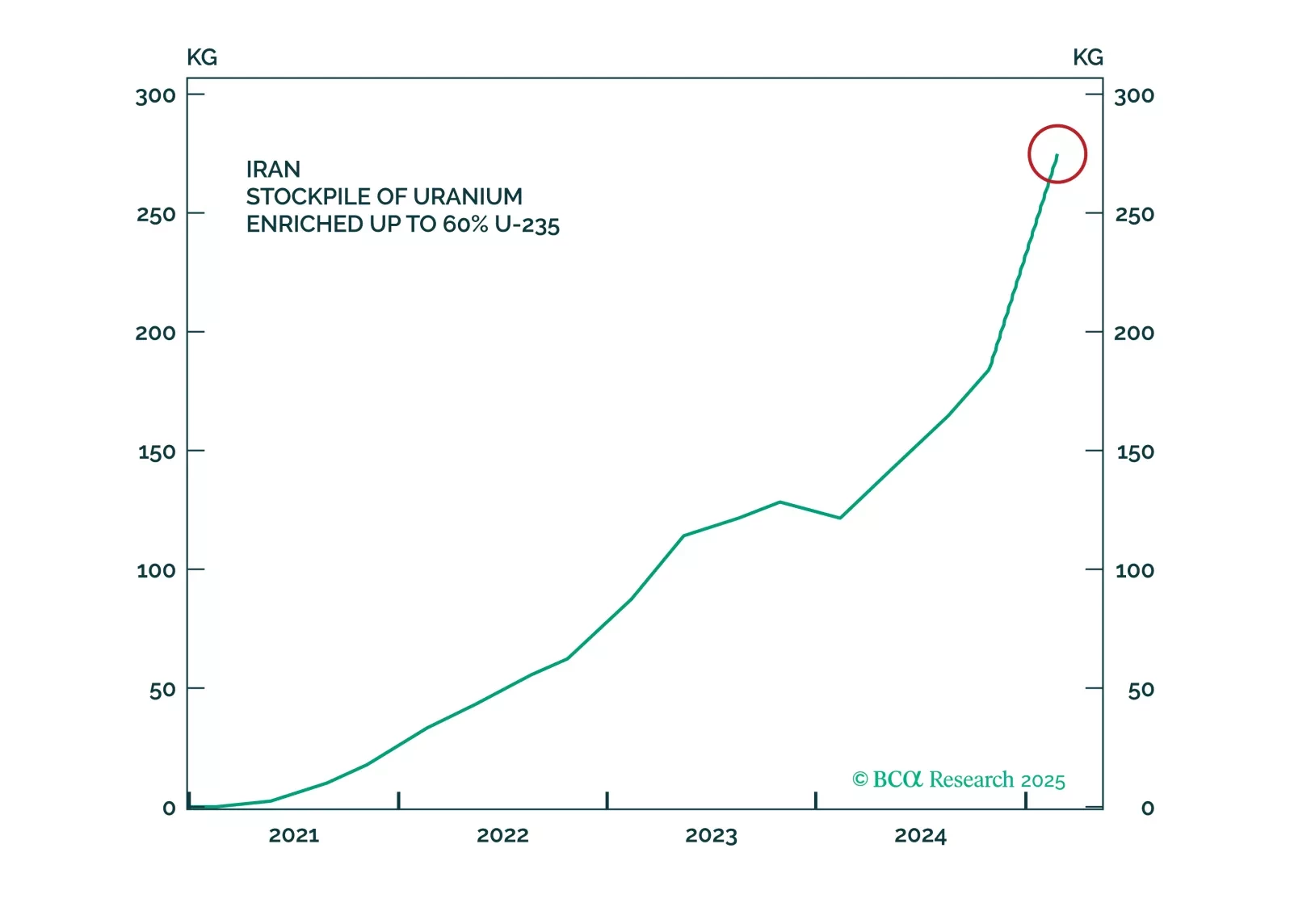

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

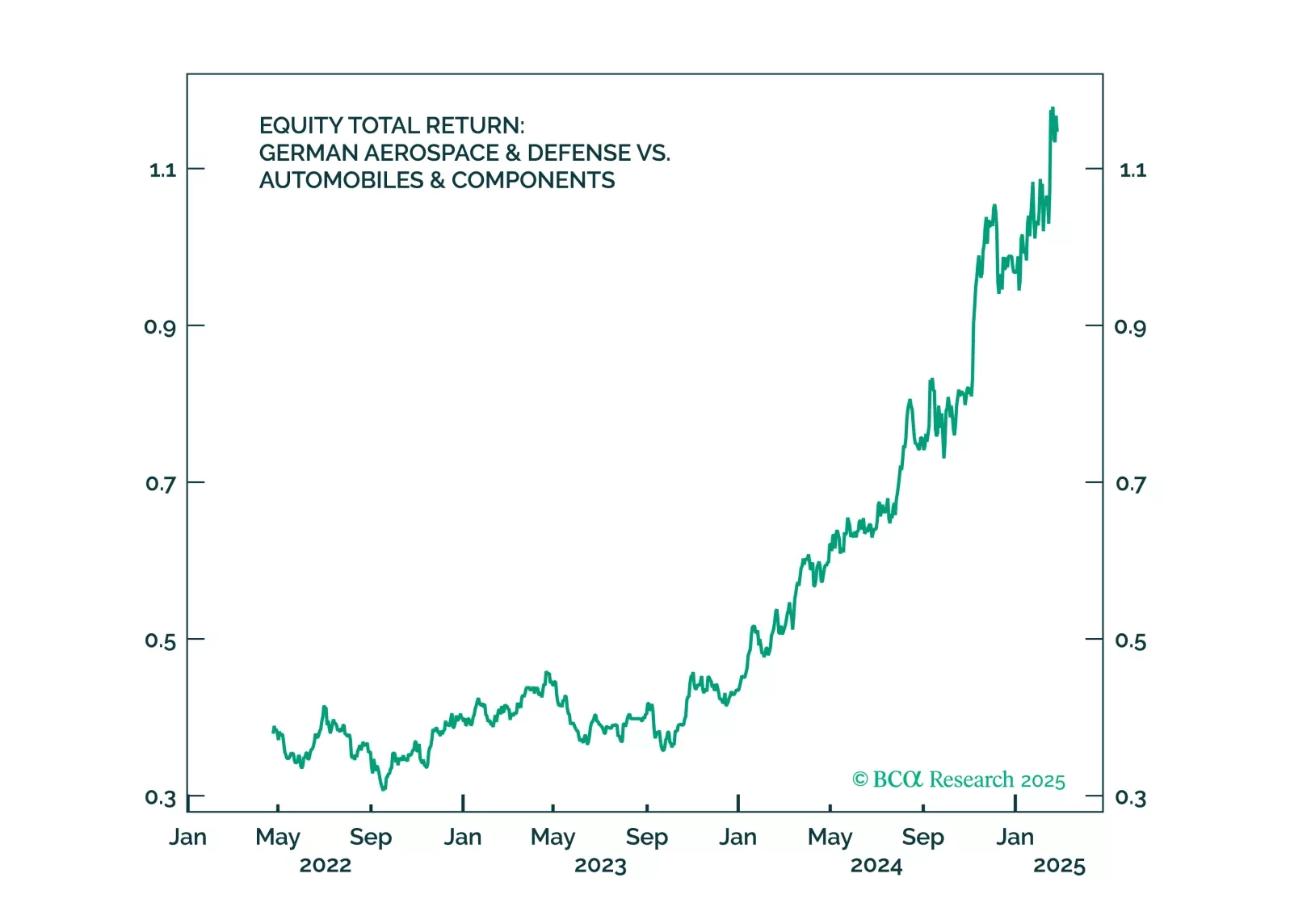

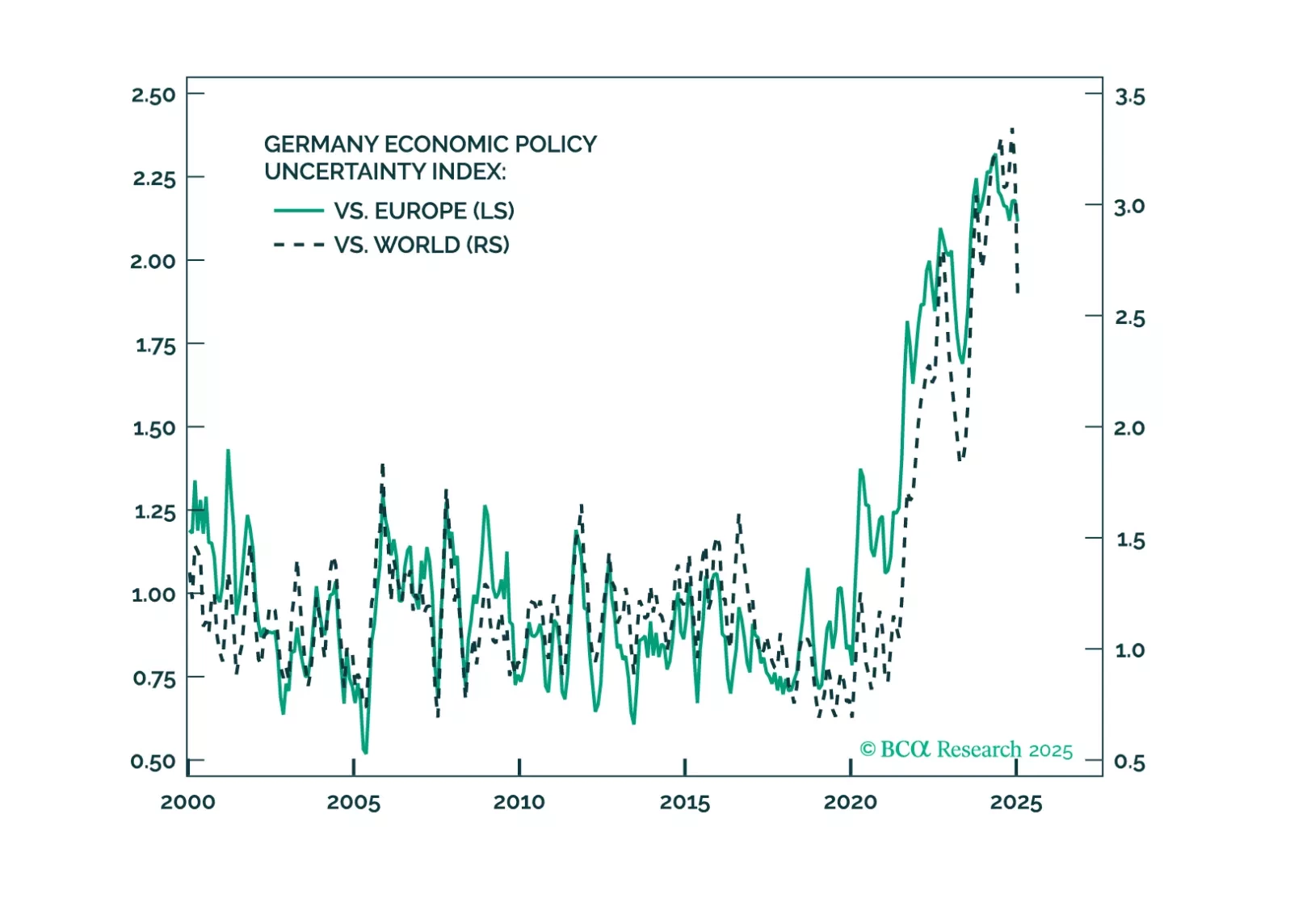

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

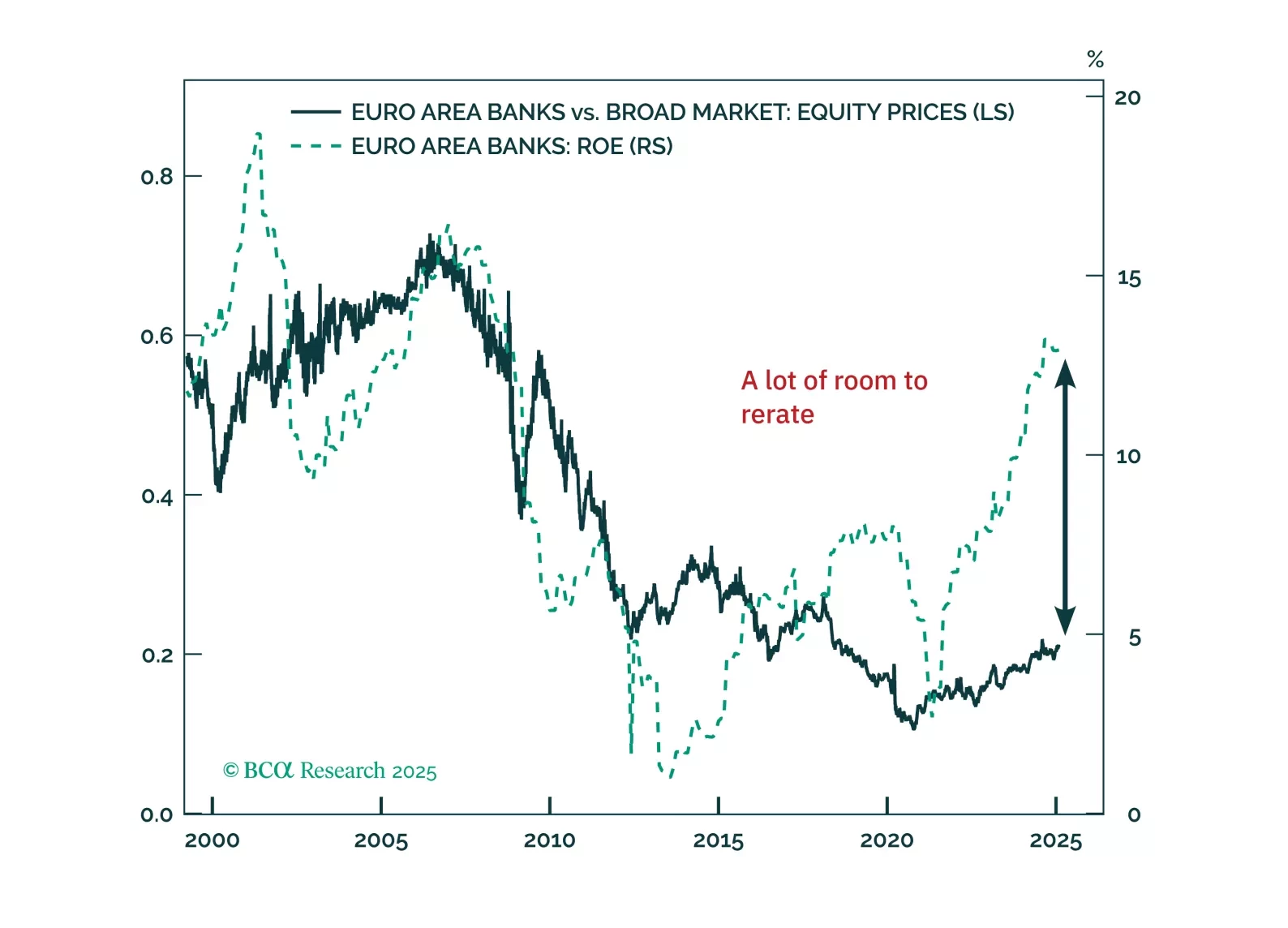

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

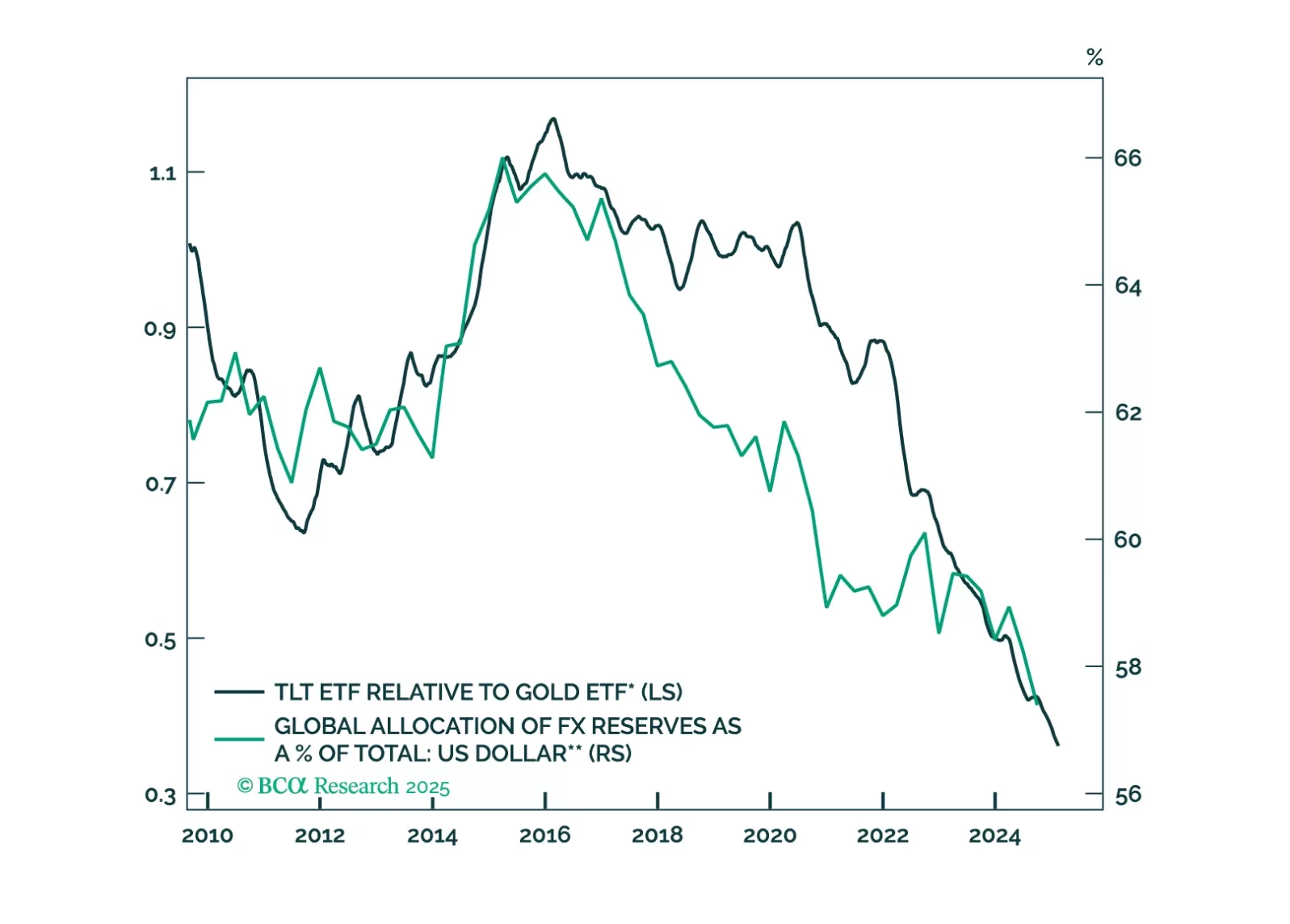

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

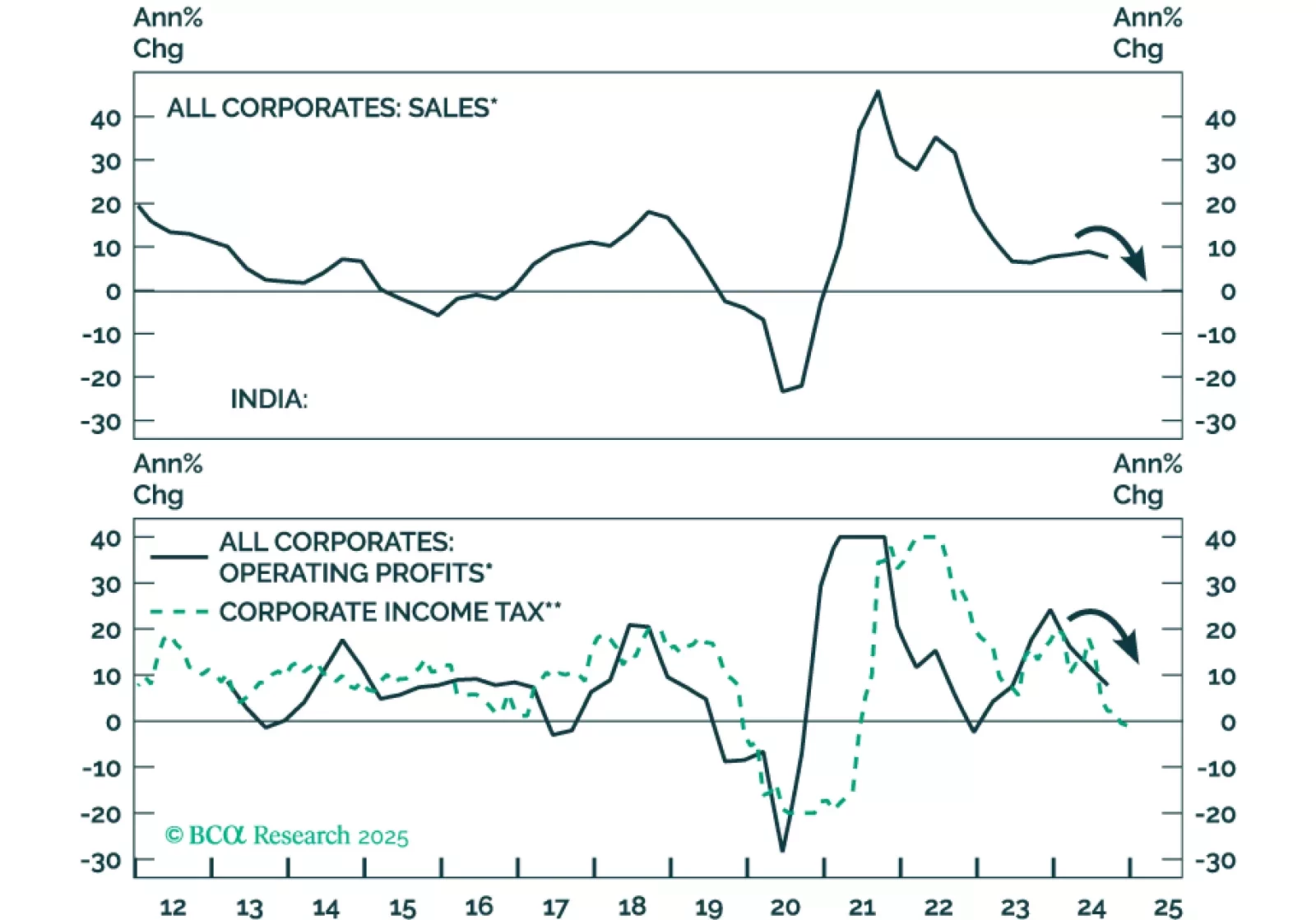

In its budget plans last week, the Indian fiscal authorities announced major tax cuts for households – the equivalent of about US$12 billion, 0.3% of GDP – to boost consumer spending. Soon thereafter, the central bank cut its policy rates…

Our Emerging Market strategists published a follow-up piece to their Bessenomics note where they assess the new Treasury Secretary plan’s impact on markets. Lower interest rates are central to Bessenomics. The Trump…

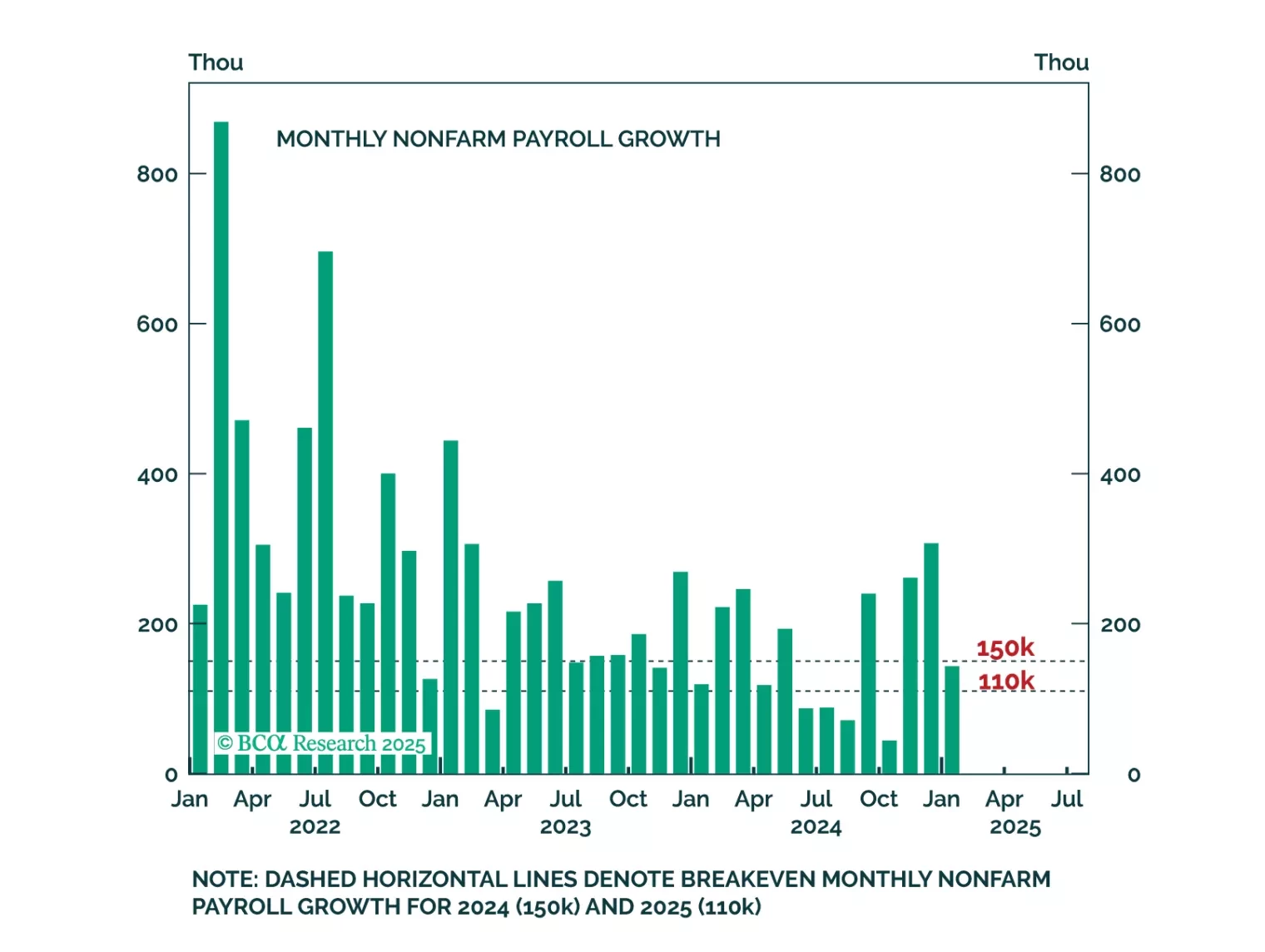

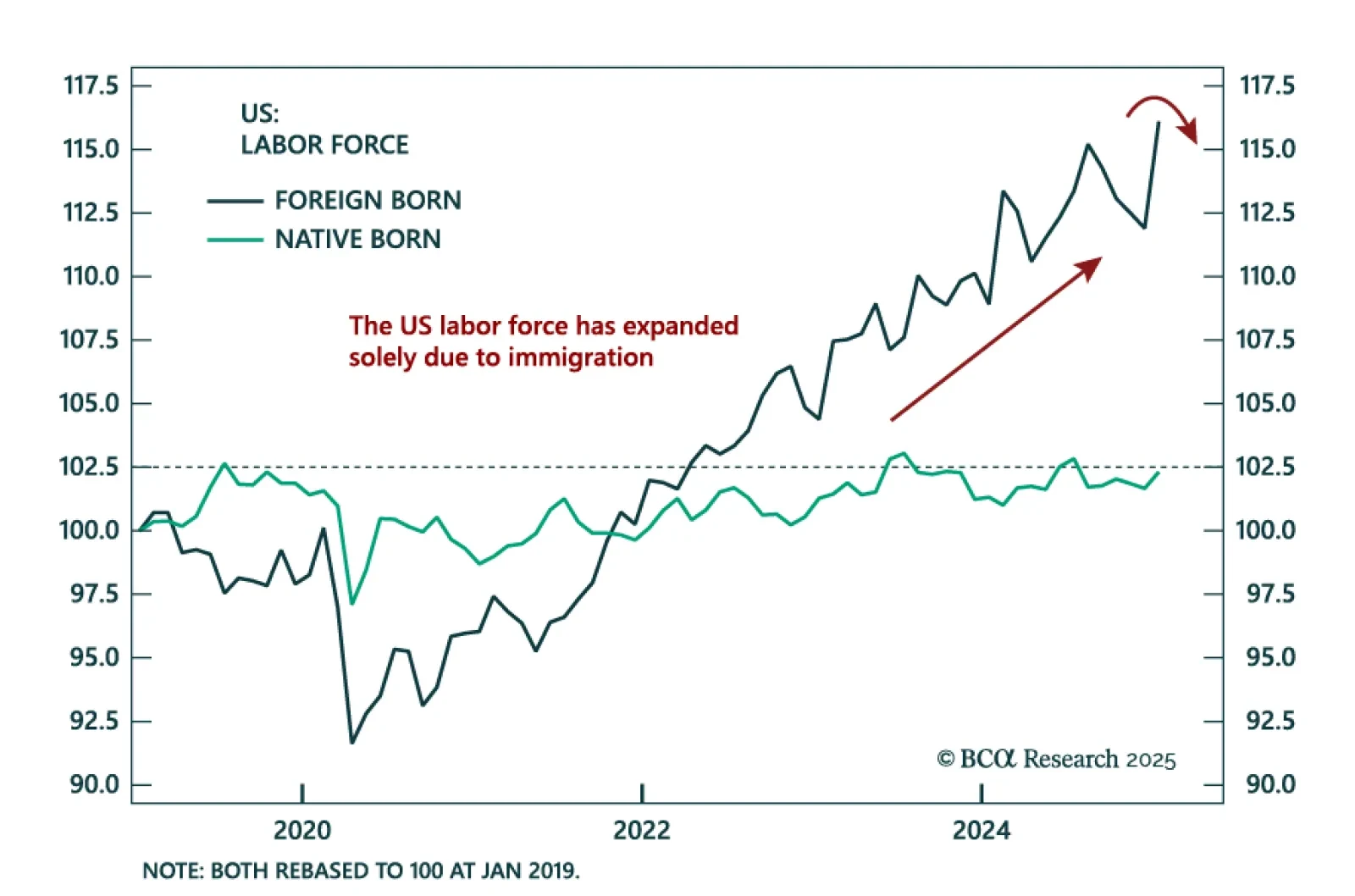

Some thoughts on this morning's employment data and Treasury Secretary Bessent's recent attempts to talk down the 10-year Treasury yield.