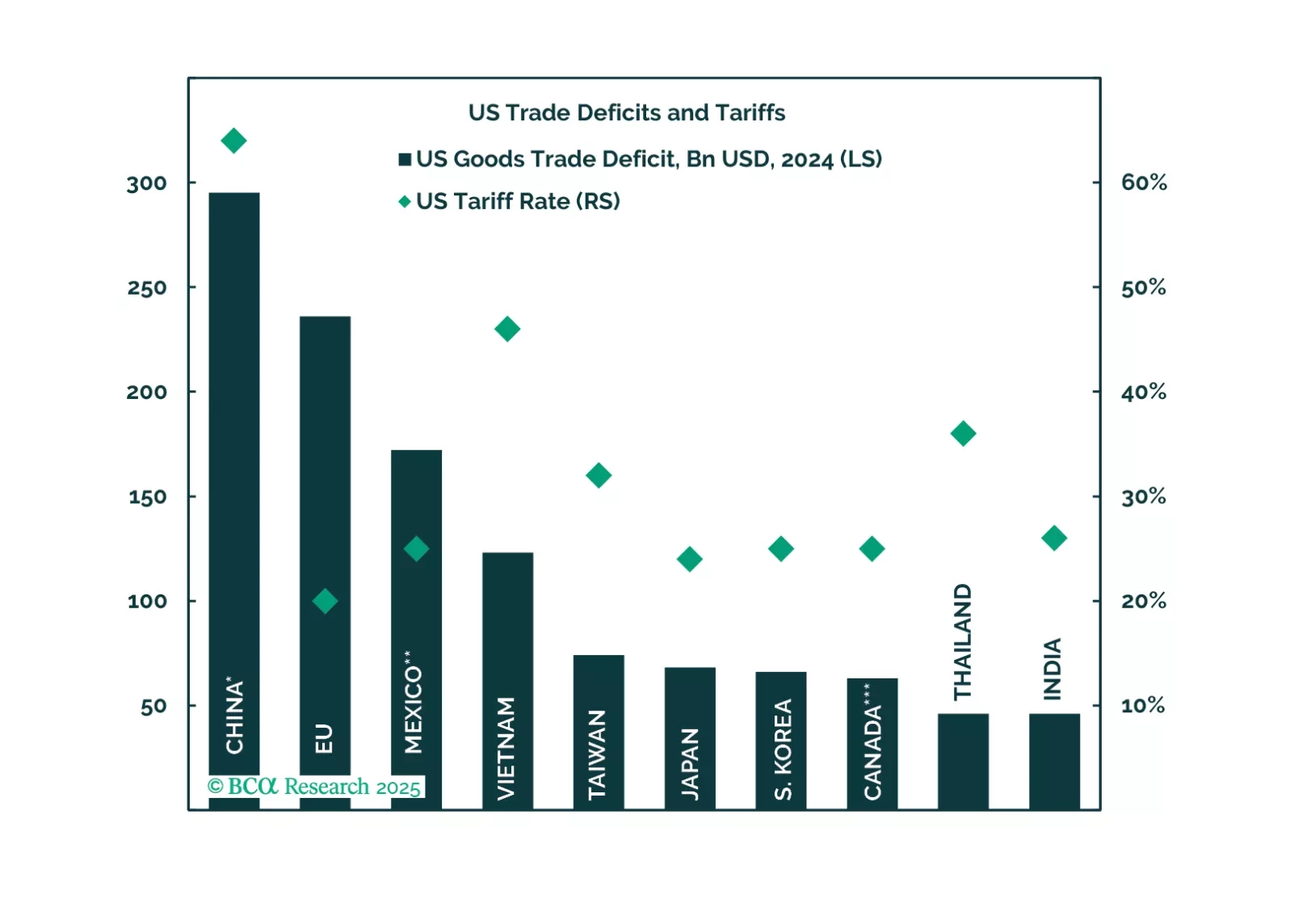

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

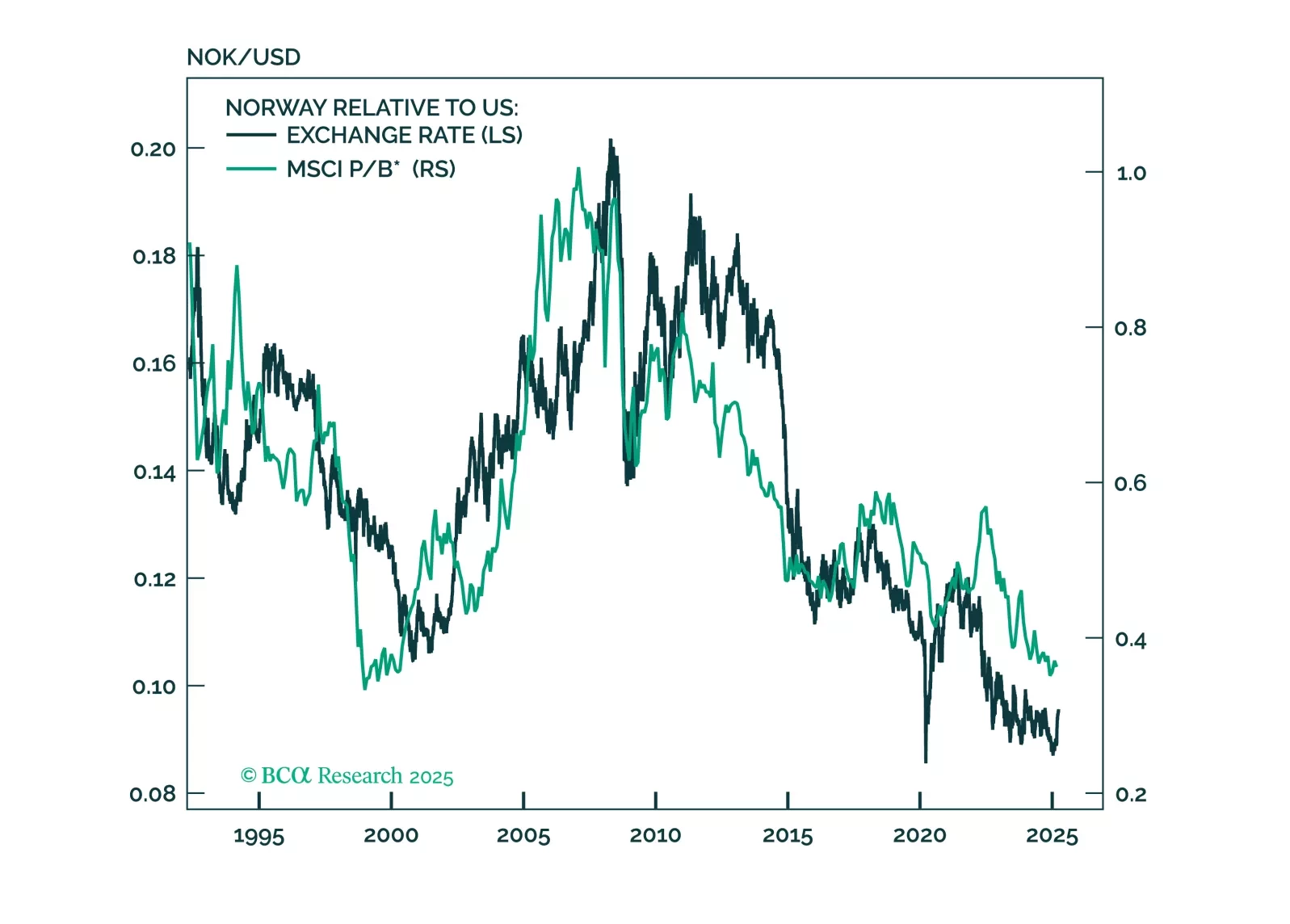

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

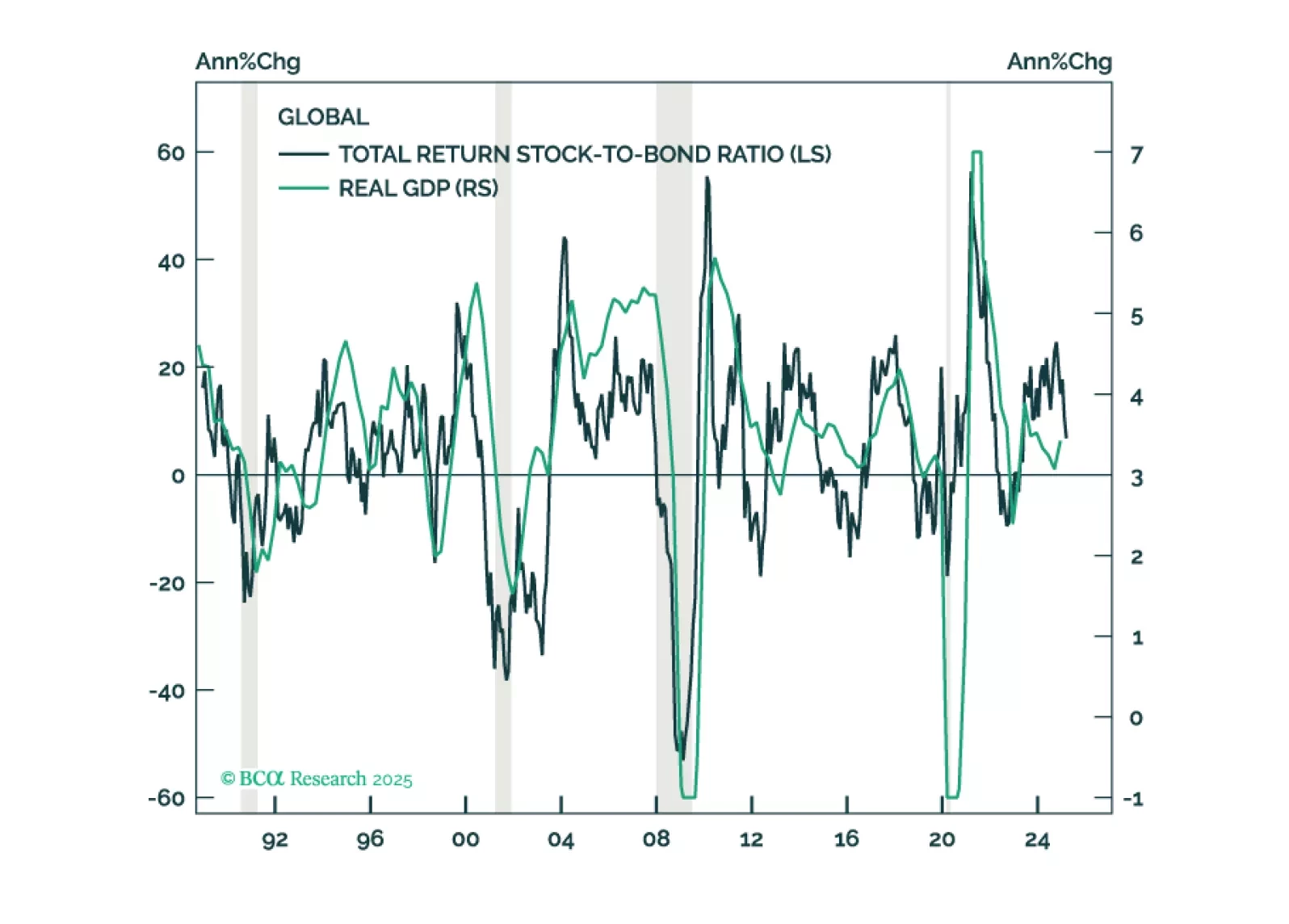

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

This report is a quick take on our views on UK bonds and FX, given the recent budget.

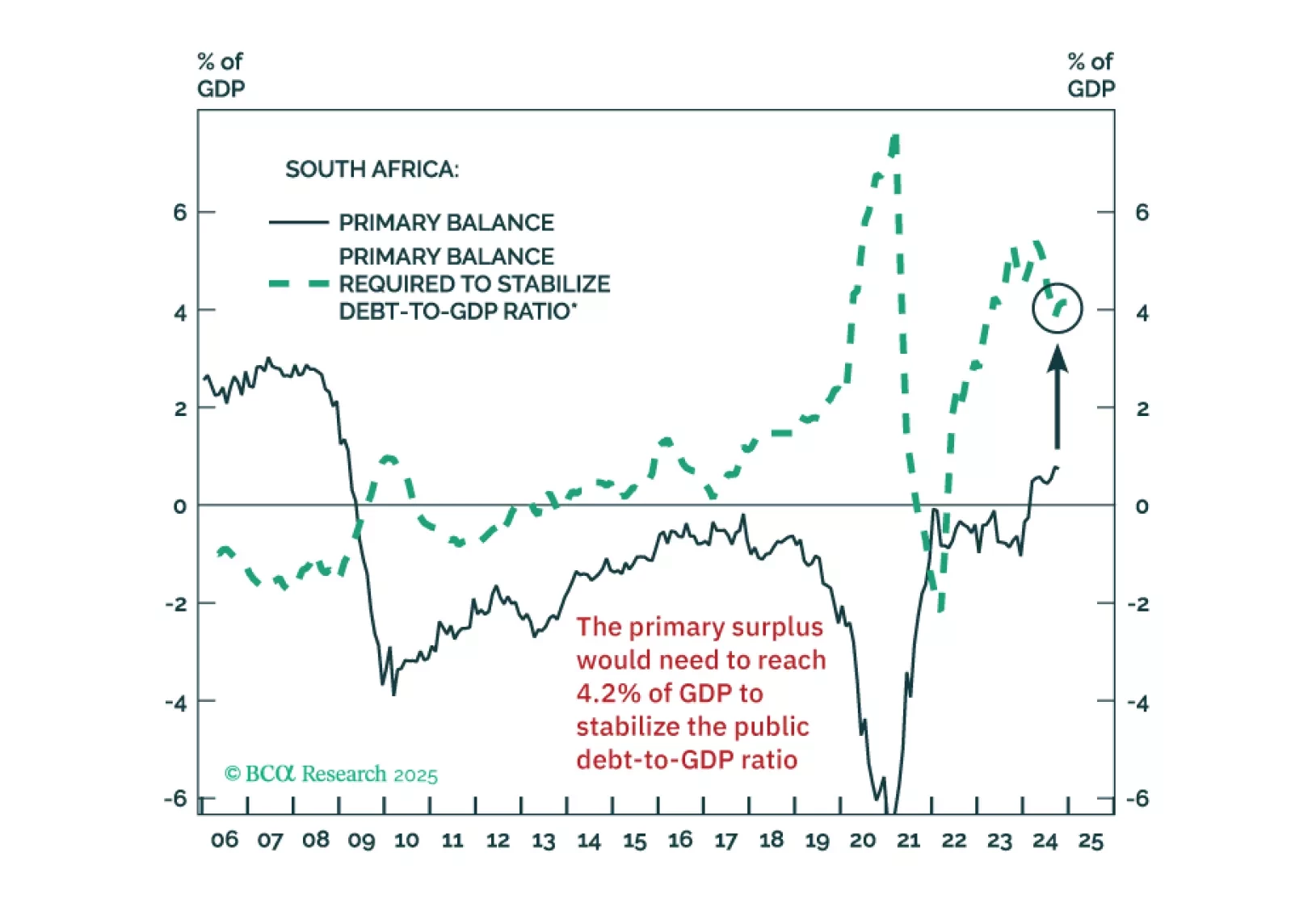

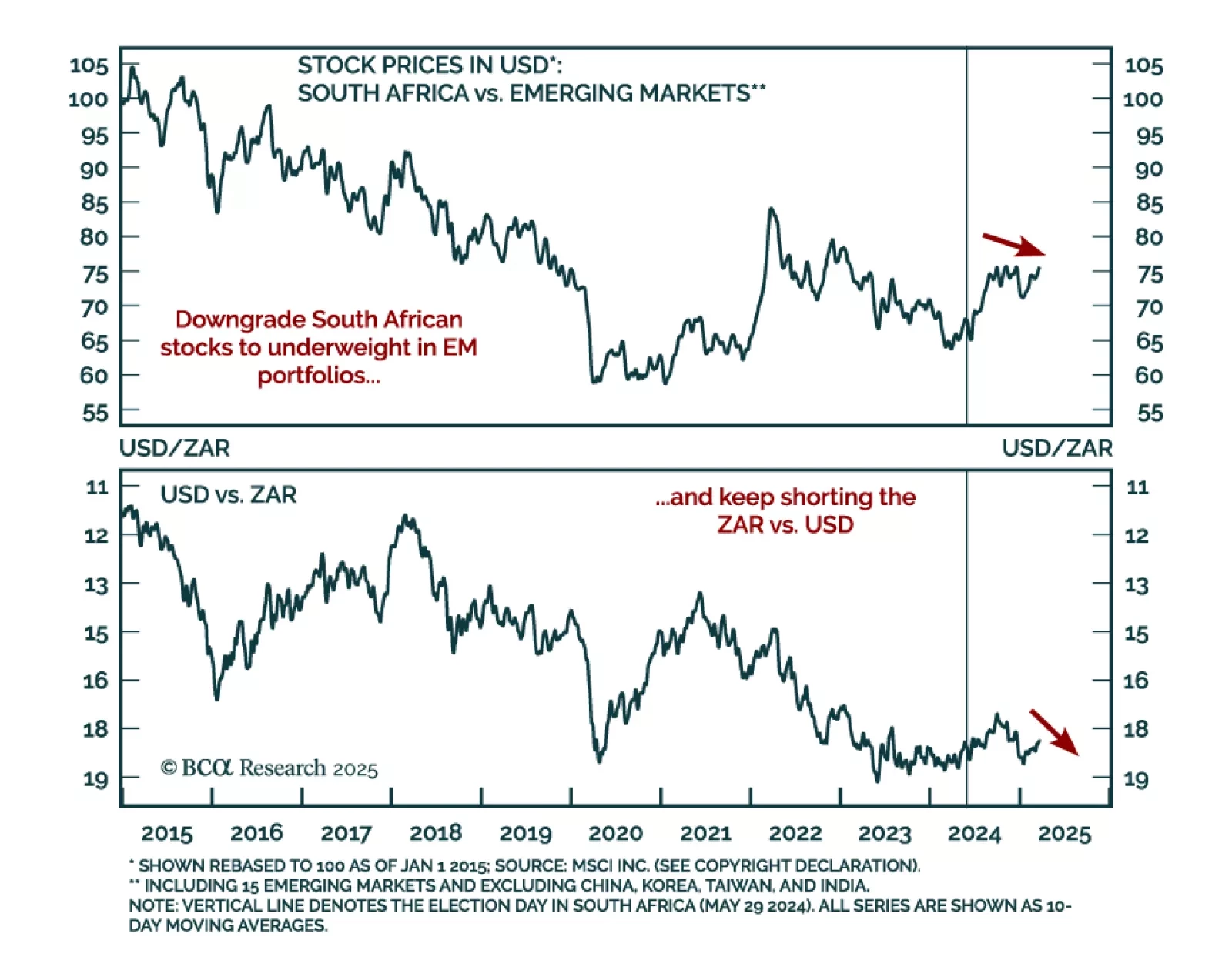

Our Emerging Market strategists reviewed their recommendations on South African assets as economic prospects start fading. South Africa’s fiscal tightening will suppress growth without achieving the necessary 4.2% primary…

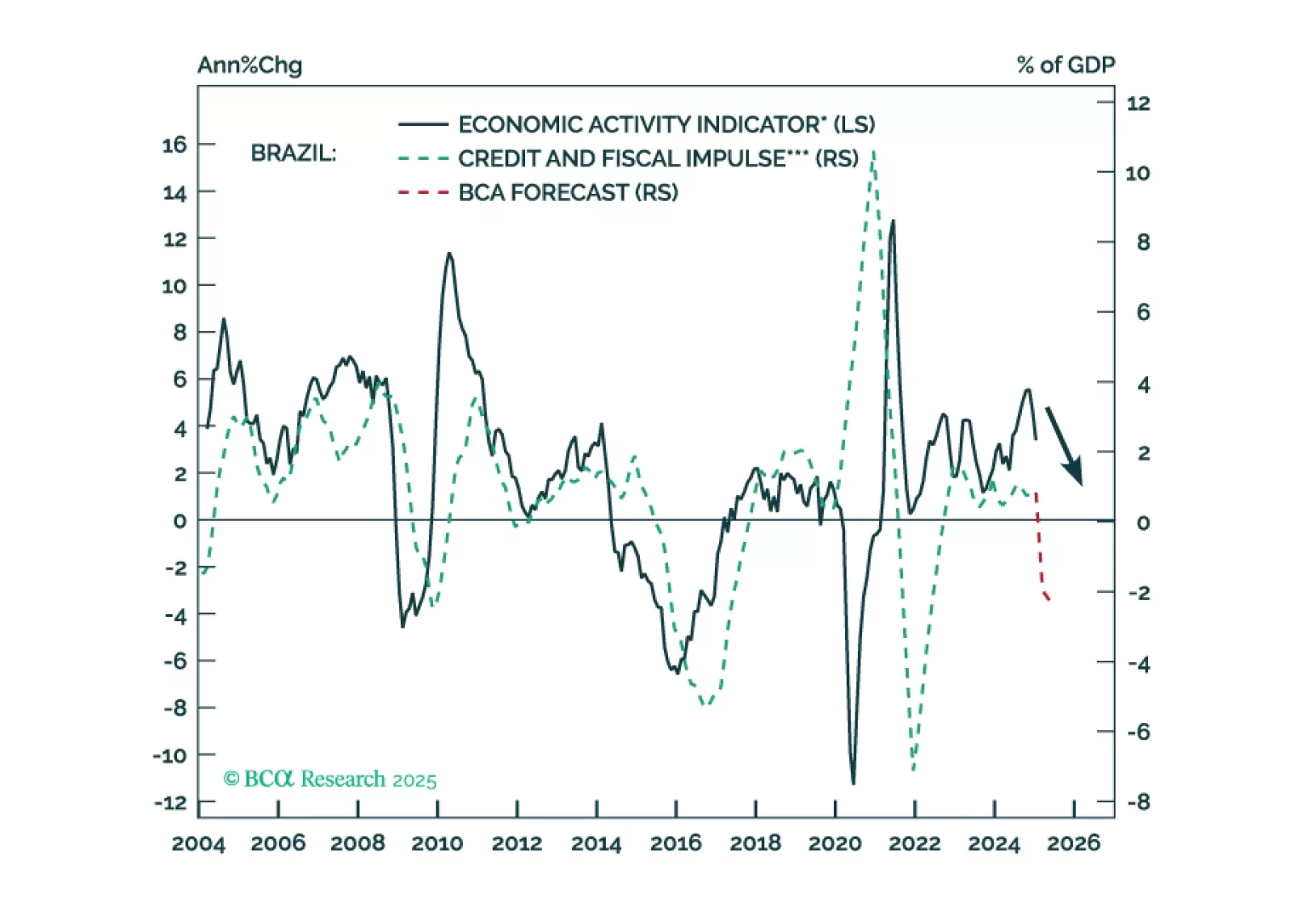

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

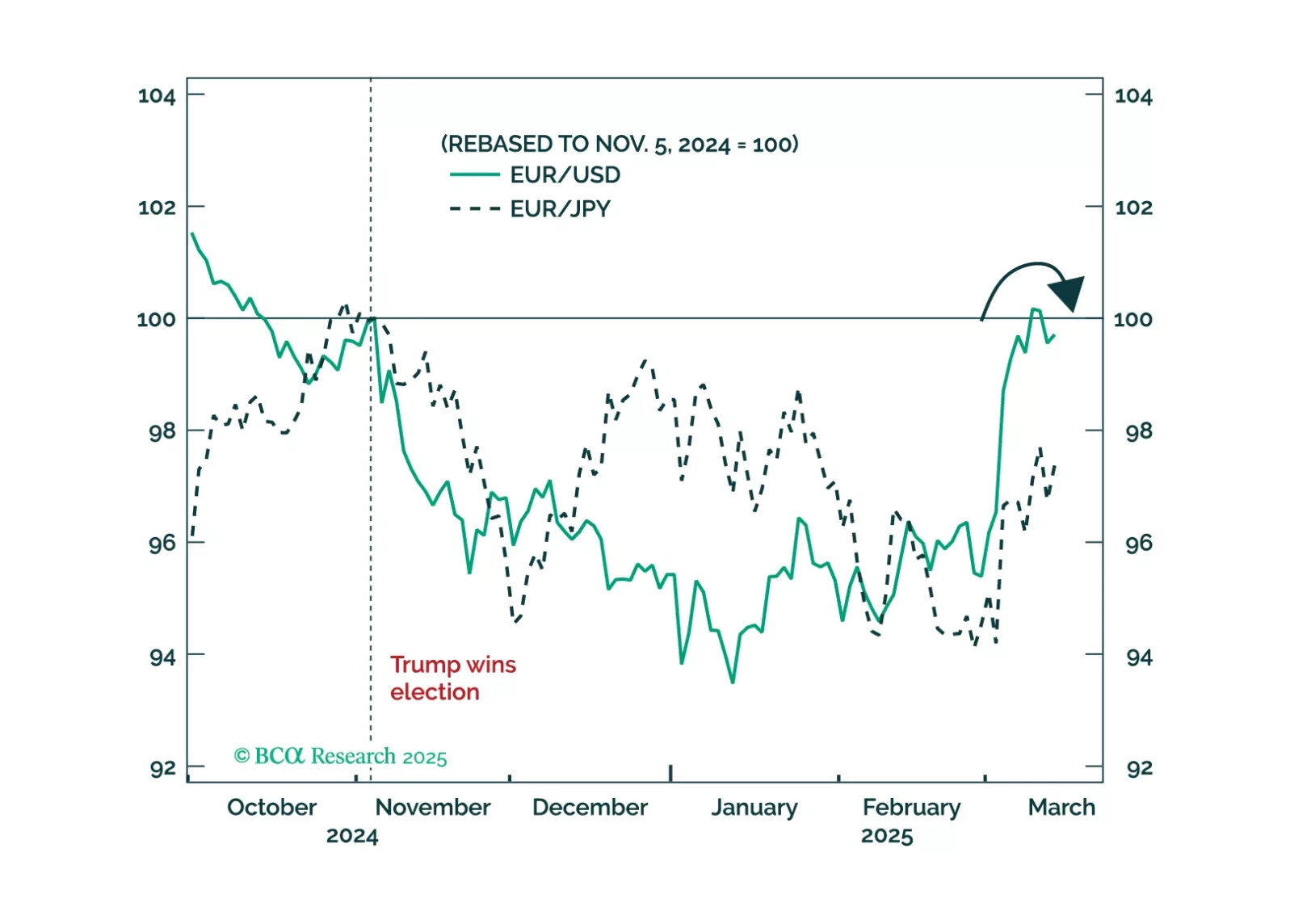

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

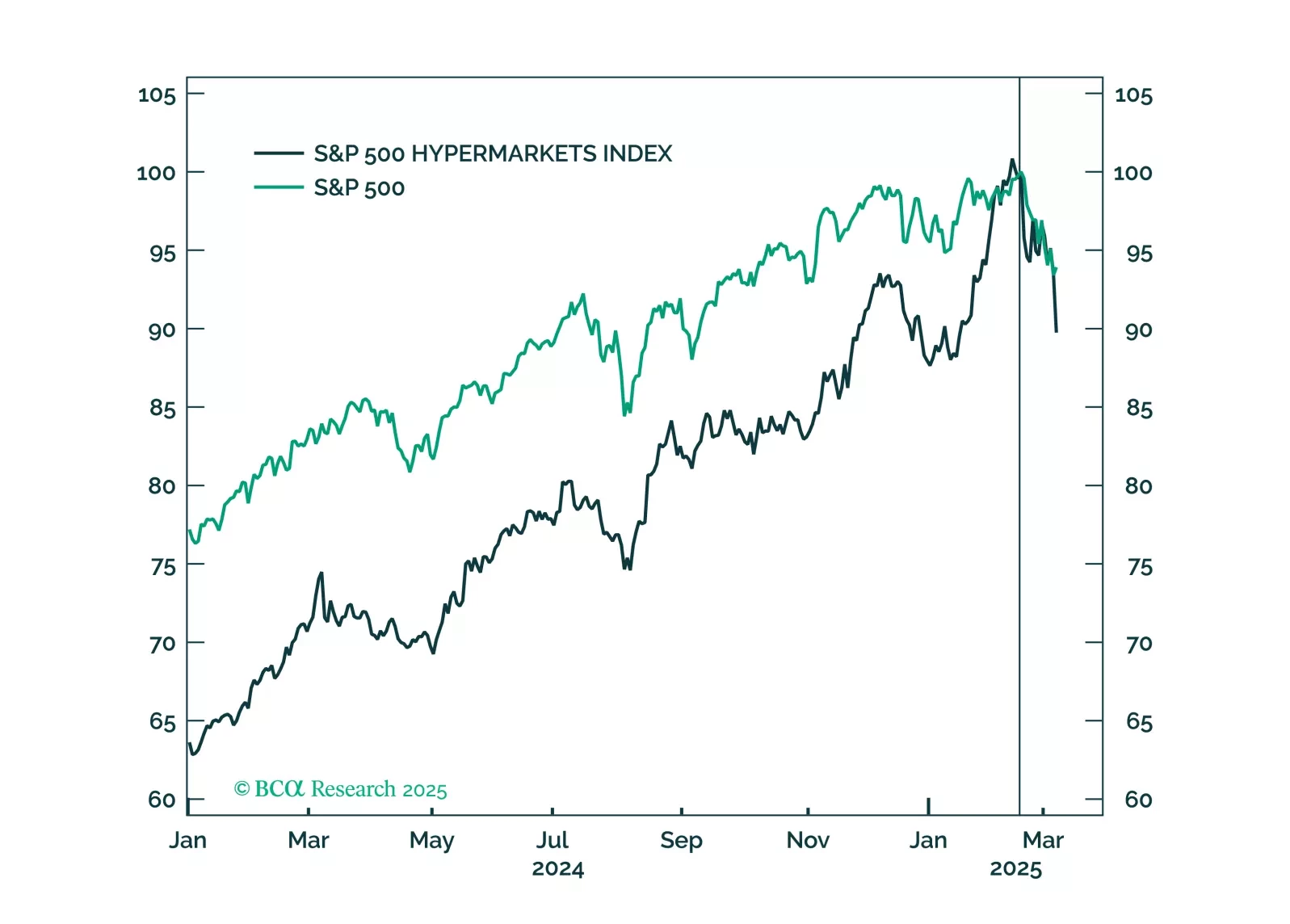

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…